Table of Contents

ToggleTrading 212 is a UK-based online brokerage firm that offers access to a wide range of financial instruments, including stocks, ETFs, cryptocurrencies, forex, and CFDs. The company was founded in 2004 and is regulated by the Financial Conduct Authority (FCA) in the UK.

One of the main features that sets Trading 212 apart from other online brokers is its commission-free trading. This means that customers can buy and sell assets without having to pay any fees, which can make a significant difference to the overall cost of trading.

Trading 212 offers its services through a web platform and mobile app, which are both user-friendly and easy to navigate. The platform provides a range of useful tools and resources to help traders make informed decisions, including real-time market data, charts, and technical analysis indicators.

The purpose of this Trading 212 review is to provide an overview of Trading 212’s services and to evaluate its suitability for different types of traders and investors. We will look at the features and tools offered by the platform, the range of financial instruments available, and the level of customer support provided.

Overall, this Trading 212 review aims to provide a comprehensive and unbiased assessment of Trading 212, to help potential customers make an informed decision about whether it is the right online broker for them.

Check out: Libertex Review 2023: Pros & Cons, Safety, Fees, App & Education

Pros and Cons of Trading 212

Pros

- User-friendly and intuitive platform

- Offers a demo account for beginners to practice trading

- Low fees with commission-free trading for various financial instruments

- Competitive spreads

- Wide range of financial instruments available for trading

Cons

- Not available in all countries

- Limited research tools and resources compared to competitors

Trading 212 Fees & Commissions

Trading 212 is a popular online trading platform that allows investors to trade various financial instruments, such as stocks, ETFs, forex, and cryptocurrencies. One of the key considerations when choosing a trading platform is the fees charged, as these can significantly impact an investor’s returns. In this article, we will explore the different fees charged by Trading 212 and compare them with other popular trading platforms.

Trading fees and commissions: Trading 212 charges zero commission on most instruments, including stocks, ETFs, and forex. This means that investors can buy and sell these instruments without incurring any trading fees. However, there are a few exceptions, such as trading shares of UK-listed companies on the Invest account, where Trading 212 charges a small commission of 0.15%.

| Assets | Fee level | Fee terms |

|---|---|---|

| S&P 500 CFD | Low | The fees are built into the spread, 1.1 points is the average spread cost during peak trading hours. |

| Europe 50 CFD | Low | The fees are built into the spread, 2.4 points is the average spread cost during peak trading hours. |

| EURUSD | Low | The fees are built into the spread, 1.1 pips is the average spread cost during peak trading hours. |

| Inactivity fee | Low | No inactivity fee |

Account fees: Trading 212 offers two types of accounts: Invest and CFD. The Invest account allows investors to buy and sell shares, ETFs, and funds, while the CFD account offers access to a broader range of financial instruments, including forex, commodities, and cryptocurrencies.

Inactivity fees: Trading 212 does not charge any inactivity fees. This means that investors can hold positions for as long as they want without incurring any penalties. However, it is worth noting that Trading 212 reserves the right to close accounts that have been inactive for a prolonged period of time.

Deposit and withdrawal fees: Trading 212 does not charge any fees for deposits made by bank transfer or debit card. However, deposits made by credit card are subject to a fee of 0.7%. Withdrawals are also free, but Trading 212 requires a minimum withdrawal amount of £10. There may be additional fees charged by the investor’s bank for international transfers.

Comparison with other trading platforms: When compared to other popular trading platforms, Trading 212’s fees are highly competitive. For example, eToro charges a spread on each trade, which can be as high as 4.5% for certain stocks. Plus500 charges an inactivity fee of $10 per quarter if the account is inactive for more than three months. Trading 212’s zero commission policy on most instruments makes it an attractive option for investors looking to keep their trading costs low.

Related Post: Admiral Markets Review 2023: Platform, Fees & Customer Support

Is Trading 212 Safe?

Trading 212 is an online trading platform that allows traders to invest in a range of financial instruments such as stocks, ETFs, and forex. The platform has gained popularity among investors due to its user-friendly interface, low fees, and wide range of trading options. However, many potential investors may have concerns about the safety and security of using Trading 212. In this article, we will examine the safety of Trading 212 by analyzing various factors such as regulatory compliance, account security, investor protection schemes, company reputation, and customer support.

Regulatory Compliance: One of the most important factors to consider when assessing the safety of an online trading platform is regulatory compliance. Trading 212 is a UK-based company and is authorized and regulated by the Financial Conduct Authority (FCA). The FCA is one of the most respected regulatory bodies in the financial industry and has strict guidelines and standards that financial institutions must adhere to. Therefore, Trading 212’s compliance with FCA regulations provides a high level of safety and assurance to investors.

| Country of clients | Protection amount | Regulator | Legal entity |

|---|---|---|---|

| United Kingdom | £85,000 | Financial Conduct Authority (FCA) | Trading 212 UK Ltd. |

| EEA countries | 90% of your funds, max €20,000 | Cyprus Securities and Exchange Commission (CySEC) | Trading 212 Markets Ltd. |

| Other countries | 90% of your funds, max €20,000 | Bulgarian Financial Supervision Commission (FSC) | Trading 212 Ltd. |

Account Security: Account security is another critical factor in determining the safety of an online trading platform. Trading 212 utilizes advanced security measures to ensure that its users’ accounts are protected. The platform employs two-factor authentication, encryption technology, and firewalls to safeguard users’ accounts and personal information. Additionally, Trading 212’s website uses Secure Socket Layer (SSL) encryption, which means that all data transmitted between the user’s device and the platform’s server is encrypted and secure.

Investor Protection Scheme: Investor protection schemes are established to provide additional protection to investors in the event of financial loss due to an authorized firm’s insolvency. Trading 212 is a member of the Financial Services Compensation Scheme (FSCS), which is a UK government-backed scheme that provides protection up to £85,000 per individual. This means that in the unlikely event of Trading 212 going bankrupt, investors’ funds are protected, up to the stated amount.

Company Reputation: Company reputation is an essential factor in determining the safety of an online trading platform. Trading 212 has been operating since 2006, and over the years, it has built a positive reputation in the financial industry. The platform has received numerous awards for its services, including the 2016 and 2017 Best Trading Platform awards by Online Personal Wealth Awards. Additionally, Trading 212 has a 4.5-star rating on Trustpilot, with over 50,000 reviews, which indicates a high level of customer satisfaction.

Customer Support: Customer support is crucial when it comes to using an online trading platform. Trading 212 offers excellent customer support through various channels, including email, phone, and live chat. The platform also has an extensive knowledge base that provides answers to frequently asked questions. Additionally, Trading 212 has an active social media presence, where users can interact with the platform and other traders to get insights and help.

You May Also Like: IG Markets Review 2023: Platform, Trading, Commission & Support

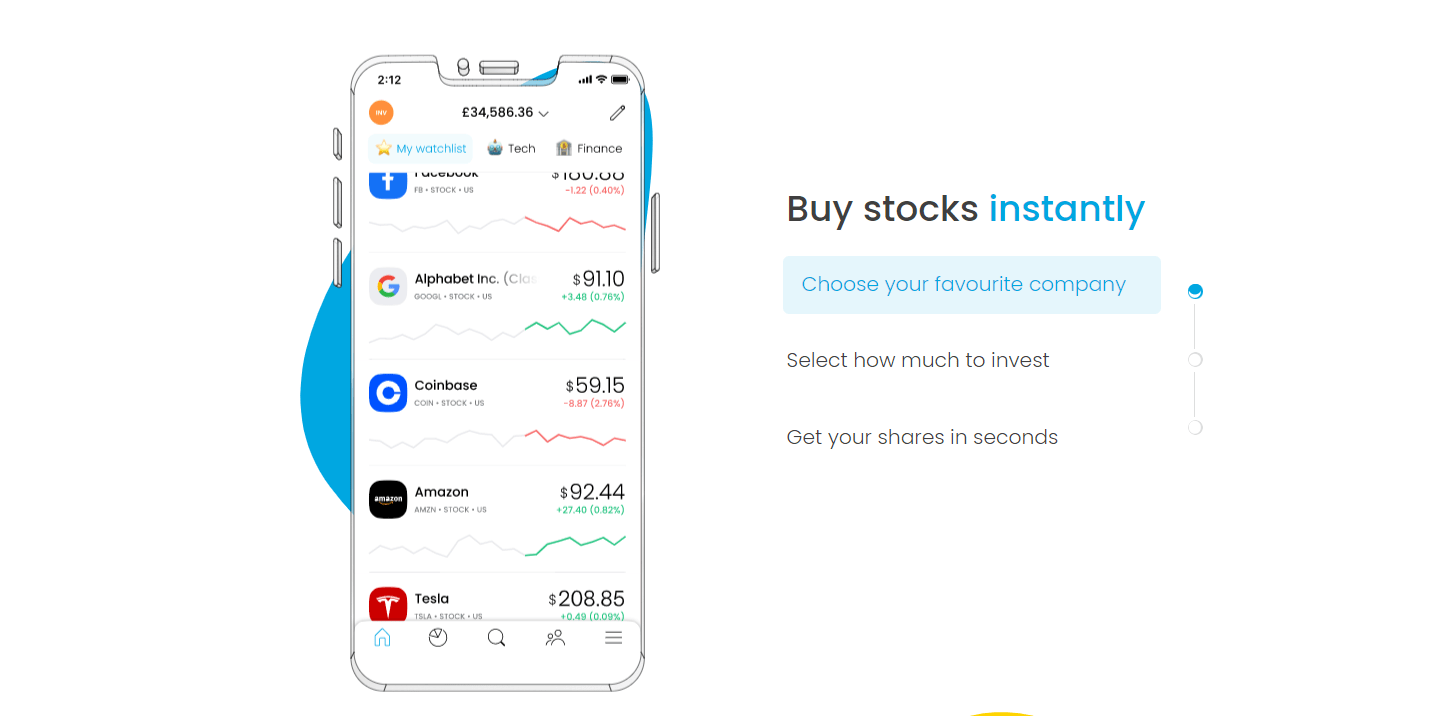

Trading 212 App & Platform

Trading 212 is an online brokerage platform that offers trading services to individuals interested in investing in financial instruments such as stocks, currencies, and commodities. The Trading 212 app was launched in 2016 and has since gained popularity among traders due to its user-friendly interface and a wide range of trading tools.

The app allows users to trade in real-time, view charts and market data, and manage their investment portfolios from their mobile devices. The app is available on both Android and iOS devices and is free to download.

User interface and design: The Trading 212 app has a clean and intuitive user interface that is easy to navigate. The app is designed with a modern look and feel, with a white background and black and grey text. The app also features colorful charts and graphs that make it easy for users to visualize their trading activity.

The app’s design is optimized for mobile devices, with all the essential features accessible from the main screen. Users can easily switch between trading instruments and view detailed information about each asset class, including live quotes and historical data.

Trading features and tools: The Trading 212 app offers a range of trading features and tools that help traders make informed investment decisions. The app provides real-time quotes for over 10,000 financial instruments, including stocks, indices, currencies, and commodities. The app also offers technical analysis tools such as moving averages, RSI, and MACD, allowing traders to analyze market trends and patterns.

The app has a user-friendly order management system that allows users to execute trades quickly and easily. Users can place market orders, limit orders, and stop-loss orders directly from the app. The app also provides real-time news feeds and economic calendars, helping traders stay up-to-date with the latest market news and events.

Trading 212 demo account: The Trading 212 app offers a demo account feature that allows users to practice trading without risking real money. The demo account comes with a virtual balance of $10,000, allowing traders to experiment with different trading strategies and test the app’s features before investing real money.

The demo account feature is a valuable tool for beginners who are just starting in trading. It allows users to gain experience in trading without worrying about losing money. The demo account feature is also beneficial for experienced traders who want to test new trading strategies without risking real money.

More Resources: FxPro Review 2023: Trading, Commission, Education & Pros/Cons

Advantages of the App:

- User-friendly interface: The Trading 212 app has a clean and intuitive user interface that is easy to navigate, making it accessible for traders of all levels.

- A wide range of trading tools: The app provides a range of trading tools such as real-time quotes, technical analysis tools, and economic calendars, helping traders make informed investment decisions.

- Demo account feature: The demo account feature allows users to practice trading without risking real money, making it a valuable tool for beginners and experienced traders alike.

- Commission-free trading: Trading 212 offers commission-free trading, making it an affordable option for traders looking to keep their trading costs low.

Disadvantages of the App:

- Limited investment options: While the app offers a wide range of trading instruments, it is limited to stocks, currencies, and commodities, with no options for trading in futures or options.

- Limited research tools: The app lacks advanced research tools, making it difficult for traders to conduct in-depth research on the assets they are interested in trading.

- Limited customer support: The app’s customer support is limited to email and chat support, with no phone support available.

Further Reading: Eightcap Review 2023: Pros and Cons, Trading, Fees & Mobile App

Other Apps Like Trading 212

Trading 212 is a popular trading app that allows users to invest in stocks, cryptocurrencies, and other financial instruments. While it has gained popularity among investors, it’s essential to compare it with other trading apps and understand the features and tools offered by them.

Comparison with other popular trading apps: When compared to other popular trading apps, Trading 212 stands out due to its user-friendly interface and low fees. Apps like Robinhood, Webull, and eToro are popular among investors, and they offer similar features to Trading 212. However, Robinhood and Webull are only available to US-based investors, while Trading 212 and eToro cater to a global audience.

Features and tools offered by other trading apps: Robinhood, Webull, and eToro offer features such as commission-free trades, fractional shares, and social trading. Robinhood and Webull are known for their real-time market data and research tools, while eToro has a CopyTrader feature that allows users to mimic the trading strategies of successful investors.

In contrast, Trading 212 offers a diverse range of investment options, including stocks, ETFs, forex, and cryptocurrencies. It also provides a free demo account, which enables users to practice trading without risking their funds. Additionally, Trading 212 offers tools such as stop-loss orders, limit orders, and trailing stops, which allow users to manage their trades effectively.

| Trading 212 | eToro | XTB | IG | Capital.com | |

| Overall score | 4.6stars | 4.9stars | 4.8stars | 4.6stars | 4.6stars |

| Fees score | 4.0stars | 4.2stars | 4.3stars | 3.5stars | 4.3stars |

| Account opening score | 4.5stars | 5.0stars | 5.0stars | 4.2stars | 5.0stars |

| Deposit and withdrawal score | 4.3stars | 3.8stars | 4.5stars | 4.5stars | 4.5stars |

| Web platform score | 4.4stars | 4.4stars | 4.4stars | 5.0stars | 4.4stars |

| Markets and products score | 4.1stars | 4.7stars | 3.9stars | 4.7stars | 2.5 |

Pros and cons of using other trading apps: Robinhood and Webull are popular among investors due to their commission-free trades and real-time market data. However, they have received criticism for their customer support and lack of investment options.

eToro is a popular trading app due to its social trading feature and diverse range of investment options. However, it has higher fees compared to other trading apps and a more complex user interface.

On the other hand, Trading 212 has a user-friendly interface and low fees, making it an attractive option for beginner investors. However, some users have reported issues with customer support and the limited availability of some investment options.

Explore More: eToro Reviews 2023: Features, Platform, and User Feedback

Final Verdict of Trading 212

Trading 212 is a UK-based online brokerage platform that offers a range of financial instruments, including stocks, forex, and cryptocurrencies. It has become a popular platform among traders due to its user-friendly interface, low fees, and extensive range of tradable assets. In this article, we will provide a recap of key points and a final recommendation for Trading 212.

One of the most significant advantages of Trading 212 is its low fees. The platform charges no commission on stock trades, and forex and cryptocurrency trades have competitive spreads. Additionally, the platform has no account minimums, making it accessible to traders of all levels.

Trading 212 offers a user-friendly interface that is easy to navigate, even for beginners. The platform provides a range of educational resources, including articles and video tutorials, to help traders improve their skills and knowledge. The platform also offers a wide range of tradable assets, including over 3,000 stocks, 100 forex pairs, and 30 cryptocurrencies. This extensive range of assets allows traders to diversify their portfolios and take advantage of different market conditions.

However, it’s important to note that Trading 212 is not the best option for everyone. If you’re looking to invest in mutual funds or bonds, you’ll need to look elsewhere. Additionally, if you require extensive customer support, you may want to consider a different platform.

Discover: City Index Review 2023: Is it the Best Online Trading Platform?