ACY Securities Review 2023

Table of Contents

ToggleAre you on the hunt for a comprehensive ACY Securities trading services review? Look no further! In this SEO-friendly article, we’ll provide an extensive exploration of what ACY Securities brings to the table. From the array of services they offer to the optimal strategies for leveraging their platforms, we’ll cover it all. If you’re contemplating trading with ACY Securities, this article is tailor-made for you!

ACY Securities, a prominent online trading services provider, has been in operation since 2023 and has cemented its reputation as one of the most dependable and forward-thinking financial services firms in the industry. With a diverse range of products and services, they are exceptionally well-equipped to cater to your needs, whether you’re a novice or a seasoned trader. You can rely on them for exceptional service and expert guidance at every stage of your trading journey.

This article delves deep into what sets ACY Securities apart from other trading companies. We will explore their unique features and advantages while also discussing any potential drawbacks. Our aim is to equip you with all the necessary insights to make an informed decision about whether to invest with them. By the conclusion of this review, you’ll have a clear understanding of why ACY Securities stands out as the preferred choice for online trading. Let’s embark on our ACY Securities review journey!

Related Post: Formax Prime Review: A Comprehensive Look at a Forex Broker

Overview Of ACY Securities

ACY Securities is an online brokerage firm that offers a wide range of trading services. It provides both retail and institutional investors with access to the global financial markets. The company was founded in 2021 and is headquartered in London, England.

ACY Securities offers a comprehensive suite of services for all types of traders, from novice to experienced. These include advanced charting tools, market analysis reports, educational materials, real-time news updates, and more. ACY’s platform also allows customers to trade directly from their computer or mobile device.

ACY Securities has earned a reputation for being reliable and secure. They have developed strong security measures to protect clients’ data and funds, as well as a 24/7 customer service team available to answer any questions or provide assistance when needed. Overall, ACY Securities provides an excellent platform for trading with competitive pricing and superior customer service.

You May Also Like: Interactive Brokers Review 2023: Features, Fees & User Feedback

Pros And Cons of ACY Securities

Pros

- Regulated by reputable authorities

- Access to MetaTrader 4 (MT4) platform

- Low spreads and fees

- User-friendly trading platform

- Multiple deposit and withdrawal options

Cons

- Limited range of financial instruments

- Limited educational resources

- Limited research tools

- No negative balance protection

- Limited customer support options.

Features And Benefits Offered By ACY Securities

ACY Securities offers a range of features and benefits to investors. With their advanced trading platform, traders have access to powerful charting and analysis tools that allow them to make informed decisions quickly. This platform also provides real-time market data, so traders can get up-to-date information on the markets they are trading in. Additionally, the platform has a wide variety of order types, enabling traders to execute trades with ease.

The company also provides excellent customer service, with knowledgeable staff who are always available to answer questions or provide guidance. ACY Securities also offers competitive fees and commissions for trading services, ensuring that customers get value for money. Furthermore, the company offers an array of educational resources such as webinars and live seminars which are designed to help investors understand the markets better and improve their trading skills.

Overall, ACY Securities is an excellent choice for traders looking for comprehensive trading services. The company’s features and benefits provide users with everything they need to start investing confidently in the markets. Their advanced platform, comprehensive customer service, low fees and commissions, and educational resources all combine to make them a great choice for investing success.

Further Reading: Plus500 Review 2023: Still a Top Broker for Investment?

ACY Securities: Account Types Offered

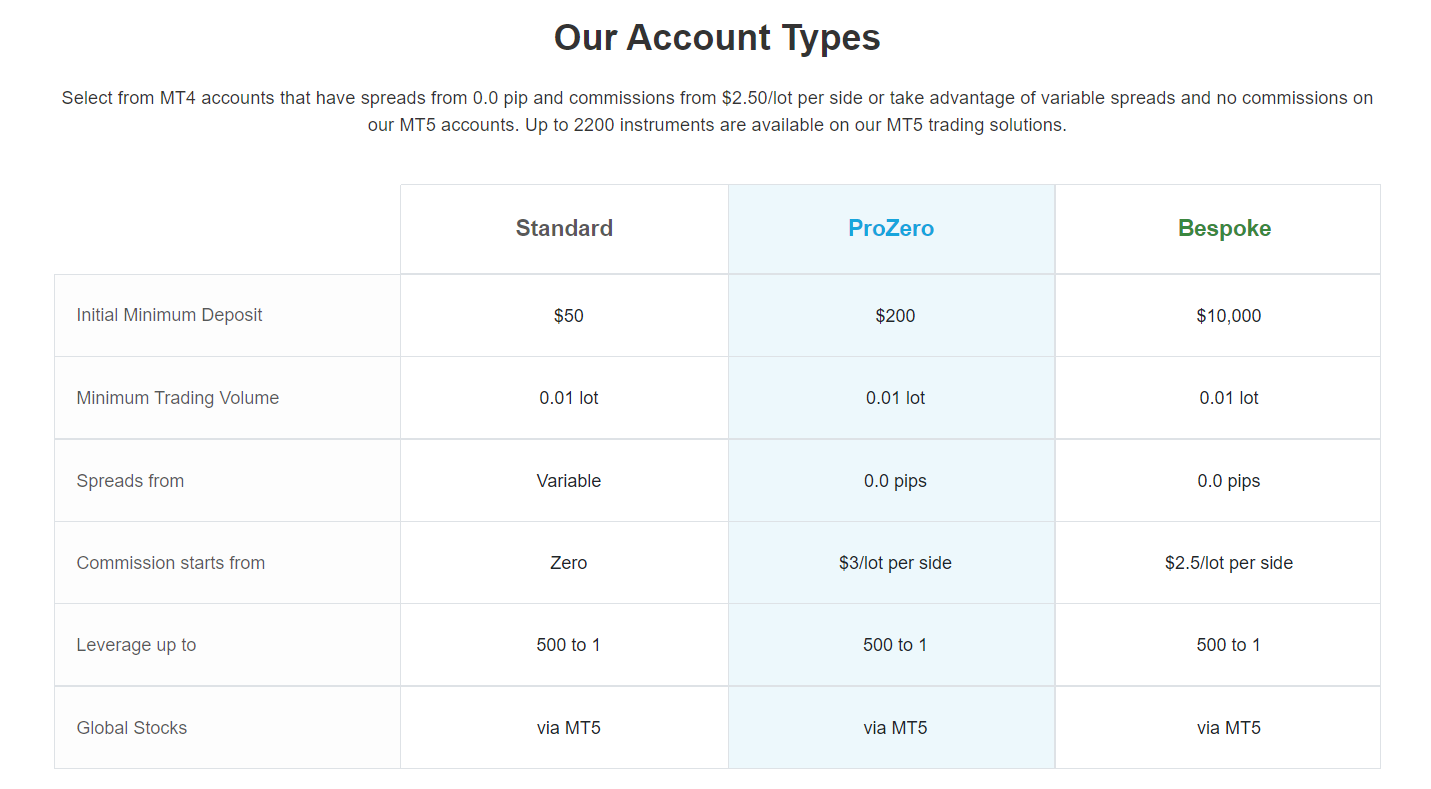

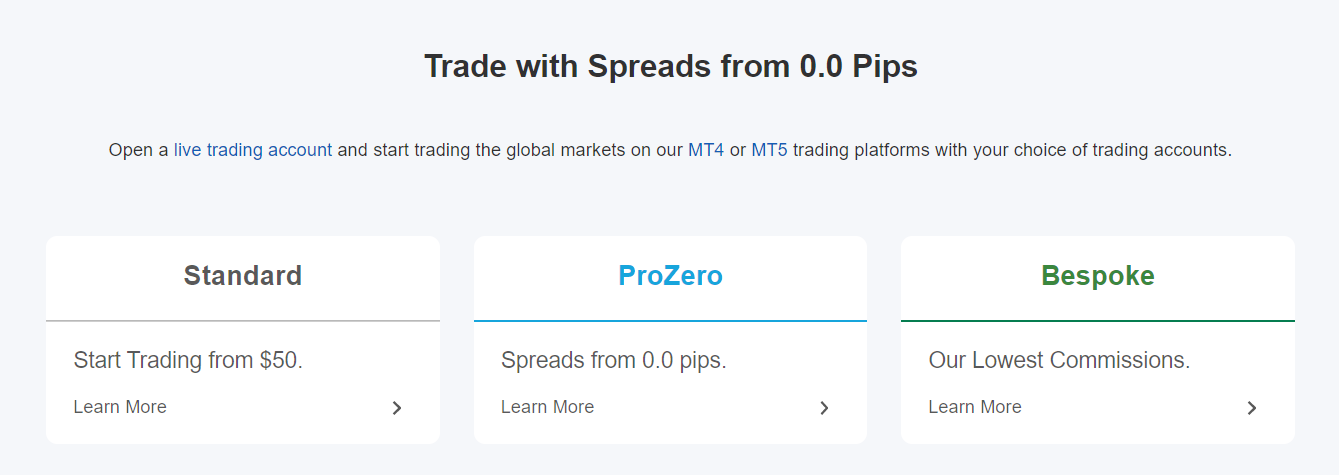

Having discussed the features and benefits of ACY Securities, it’s time to look at the account types they offer. In order to help traders find the best fit for their trading needs, ACY offers three different account types: Standard, Professional, and Prime.

The Standard Account is designed for beginner traders or those with a limited budget. This account offers lower commission rates than the other two and does not require a minimum deposit. It also has access to all of ACY’s trading platforms and market analysis tools.

The Professional Account is geared towards more experienced traders who need advanced features such as algorithmic trading and an expanded portfolio of assets. This account comes with a minimum deposit requirement and higher commission fees than the Standard Account.

The Prime Account is tailored towards high-volume traders who want access to dedicated customer service, premium market research tools, and margin trading capabilities. This account also has a minimum deposit requirement in addition to higher commission fees than the other two accounts.

ACY Securities caters to all levels of investors by offering these three different accounts with varying levels of features and fees. With one of these accounts, any trader can find an option that fits their individual needs and budget.

Explore More: TD Ameritrade Review: Is It the Right Brokerage for You?

ACY Securities: Trading Platforms And Tools

Trading platforms and tools are the backbone of successful trading in today’s markets. Acy Securities provide traders with a wide range of trading platforms and tools to help them make the most of their investments. The platforms provide access to real-time market data, analysis, and trading opportunities across multiple asset classes.

The web-based platform is easy to use and designed for both novice and experienced traders. It offers advanced charting capabilities, real-time news feeds, customizable watchlists, access to research reports, and an integrated order management system. Acy Securities also offers a mobile app for traders on the go. Traders can monitor their portfolios on the go and place orders directly from their smartphones or tablets.

ACY Securities also provides educational resources to help traders learn how to effectively use all of its trading platforms and tools. These resources include webinars, tutorials, interactive courses, video updates, ebooks, and more. Traders can use these resources to get up-to-date information on current market trends as well as strategies they can use to optimize their trades. With these comprehensive services available at Acy Securities, traders have everything they need to get started trading successfully in 2023.

Discover: Unbiased Oanda Review 2023: Pros/Cons, Fees & Features

Research And Education Resources Offered By ACY Securities

At ACY Securities, we understand that knowledge is power. That’s why we provide our customers with a wide range of research and education resources to help them stay ahead of the market. Here’s what we offer:

- Comprehensive market analysis and data: Our research team provides detailed information on key indicators, industry trends and developments in the global markets. We also offer technical analysis tools to help you identify opportunities and make better trading decisions.

- Live training sessions: Our live training sessions are designed to give traders an in-depth understanding of the markets and how best to take advantage of them. From beginner to advanced traders, we cover all topics from risk management strategies to technical analysis techniques.

- Educational materials: We provide comprehensive educational materials for traders at all levels, including white papers, webinars, course recordings and more. Whether you’re just getting started or looking to brush up on your skills, our educational materials have everything you need to become a successful trader.

- 24/7 customer support: ACY Securities offers round-the-clock customer support through online chat and telephone so you can get all your queries answered quickly whenever you need it most.

We believe that arming yourself with knowledge is essential for success in any trading journey. With our research and education resources, we can help you become a more informed trader and make smarter investment decisions along the way.

Check out: Roboforex Review 2023: Is it the Best Trading Platform Out There?

ACY Securities: Fees And Commissions

Turning now to fees and commissions, it’s important to consider the cost of trading services when selecting an online broker. Fortunately, acy securities offers competitive rates for any type of trader. Their basic commission structure is $4.95 per stock trade, with options priced at $0.65 per contract. They also offer discounts for high-volume traders who conduct more than 30 trades per quarter or have a combined account balance above $25,000.

In addition to their standard commissions, acy securities also offers other fee structures such as per share pricing and tiered commission rates. For example, they offer volume-based discounts that start at 10% off the base rate for customers who make more than 500 trades per month or have a total account balance of over $50,000. This allows active traders to lower their costs even further while taking advantage of acy securities’ comprehensive range of features and tools.

ACY securities also offers free access to their research platform which contains real-time market data and news stories from trusted sources like CNBC and Bloomberg. Plus, they provide educational resources such as webinars and eBooks that can help traders stay up-to-date on the latest market trends and strategies. Altogether, these features make ACY securities an attractive option for both beginner investors looking to learn the ropes as well as experienced traders who want access to low fees and cutting edge technology.

More Resources: CMC Markets Review 2023: Ultimate Guide to Trading Success

Customer Support Services of ACY Securities

At ACY Securities, customer support services are a priority. They offer multiple ways to contact their team, with 24/7 email and phone assistance. Their website also has an extensive help center with lots of resources, including webinars, tutorials, and FAQs. Customers can even open a live chat window with one of the customer service reps.

ACY Securities’ customer service reps are knowledgeable and friendly. They make it easy for customers to get answers to their questions and resolve any issues quickly. Customers can expect timely replies from the support team, usually within 24 hours or less. Additionally, the website is easy to navigate and provides helpful information about trading services.

Overall, ACY Securities offers excellent customer support services for traders of all levels. The staff is highly knowledgeable and always willing to help customers with any problems they may have. From emailing questions to opening a live chat window, customers can count on getting reliable answers in a timely manner.

Learn More: Forex.com Review 2023: Ultimate Trading Platform for Beginners

Security Of Funds

Moving on, the security of funds is an important consideration when choosing a brokerage firm. Acy Securities takes this aspect very seriously, providing its customers with multiple layers of protection. They use a system of segregated accounts, meaning that customer funds are stored separately from the company’s own funds. This ensures that clients’ money can never be used for any purpose other than making trades or withdrawing profits. Additionally, all deposits and withdrawals are secured by the latest encryption technology, ensuring that no one can access clients’ financial information without authorization.

To further enhance security, ACY Securities has implemented a multi-stage verification process. This involves verifying clients’ identity and ensuring that their location matches the one associated with their account. They also use two-factor authentication to protect against unauthorized access to accounts. This helps ensure that only authorized users can complete transactions or view sensitive information about their accounts.

ACY Securities has gone to great lengths to ensure the safety of its customers’ funds and personal data. Their commitment to secure trading practices makes them a reliable choice for traders looking for a safe and secure brokerage firm.

Find Out: Saxo Bank Review 2023: Best Broker for Your Trading Needs?

Final Verdict About ACY Securities

Overall, ACY Securities is a reliable and reputable trading platform with plenty of features to offer. Their user interface is easy to use, their fees are competitive, and they provide great customer service. They also have a wide array of assets available for traders to choose from. Here’s a quick overview of the key points:

- Competitive fee structure

- High quality customer service

- Wide range of asset classes

- Intuitive user interface

In sum, ACY Securities is an excellent option for both beginner and experienced traders alike. Whether you’re looking for a simple trading platform or one with more complex features, ACY has something to offer everyone. With its low fees and wide variety of assets, it’s definitely worth considering when deciding on your next brokerage provider.

In conclusion, ACY Securities is an excellent choice for traders looking to open a trading account in 2023. With a minimum deposit requirement of just $100, they make it easy to get started. In addition, they offer mobile trading and access to international markets, giving customers the ability to trade on their own schedule. Finally, ACY Securities provides reliable customer support, so you can be sure that any issues you experience will be responded to quickly. All in all, if you’re looking for an online broker with great features and reliability, ACY Securities is certainly worth considering.

Dig Deeper: Trade Smarter with Trading 212: Pros, Cons, and Features

Frequently Asked Questions

What is ACY Securities, and when was it established?

ACY Securities is a reputable online trading services provider that has been in operation since 2023. It boasts a strong track record and a commitment to innovation in the financial services sector.

What types of trading services does ACY Securities offer?

ACY Securities offers a wide range of trading services, including forex trading, commodities trading, and CFD trading. They cater to both novice and experienced traders.

Can I trust ACY Securities with my investments?

Yes, ACY Securities has earned a reputation for reliability and trustworthiness. They provide top-notch service and expert advice to ensure the security of your investments.

What sets ACY Securities apart from other trading companies?

ACY Securities differentiates itself through its innovative approach, diverse product offerings, and commitment to customer satisfaction. Their platform features and educational resources are also standout attributes.

Are there any drawbacks to trading with ACY Securities?

While ACY Securities has many advantages, some traders might find their fees slightly higher compared to other brokers. However, this cost is often justified by their excellent service and resources.

Is ACY Securities suitable for beginners in trading?

Yes, ACY Securities welcomes beginners and provides educational materials and support to help them get started. Their user-friendly platform also makes it accessible for those new to trading.

How can I access ACY Securities’ trading platforms?

You can access ACY Securities’ trading platforms via desktop applications, web-based platforms, and mobile apps. This flexibility allows you to trade from anywhere with an internet connection.

What are some popular trading strategies that work well with ACY Securities?

ACY Securities accommodates various trading strategies, including day trading, swing trading, and long-term investing. They provide tools and resources to assist traders in implementing their preferred strategies effectively.

What customer support options does ACY Securities offer?

ACY Securities provides customer support through multiple channels, including live chat, email, and phone support. Their team is responsive and knowledgeable, ensuring quick assistance for any queries or issues.

Can I open a demo account with ACY Securities to practice trading?

Yes, ACY Securities offers demo accounts for traders to practice without risking real capital. It’s an excellent way to familiarize yourself with their platform and trading instruments before committing to live trading.