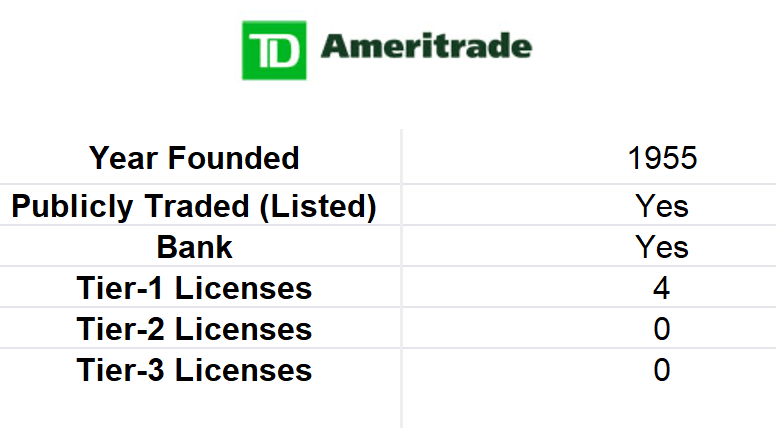

TD Ameritrade is one of the largest online brokerage firms in the United States. The company was founded in 1971 and is headquartered in Omaha, Nebraska. TD Ameritrade offers a wide range of investment products and services, including stocks, options, futures, mutual funds, and exchange-traded funds. The company has a reputation for its advanced trading tools and educational resources for investors.

TD Ameritrade is well-respected in the industry for its commitment to customer service and its innovative technology. The company has won numerous awards over the years, including “Best Online Broker” from Barron’s for six consecutive years. In addition, TD Ameritrade has been recognized for its mobile trading platform, which allows investors to manage their investments from their smartphones or tablets.

Choosing the right broker is important for investors who want to be successful in the stock market. The broker is responsible for executing trades on behalf of the investor, so it is important to choose a broker that is trustworthy and reliable. In addition, the broker should offer a wide range of investment products and services that meet the needs of the investor.

When choosing a broker, investors should consider several factors, including the fees and commissions charged by the broker, the quality of customer service, and the availability of research and educational resources. Investors should also consider the broker’s reputation in the industry and its track record of success.

TD Ameritrade Pros & Cons

TD Ameritrade is a popular brokerage firm that offers a wide range of investment services to clients. Founded in 1975, it has since grown to become one of the largest online brokers in the United States. Here are the pros and cons of trading with TD Ameritrade.

Pros

- User-friendly platform: TD Ameritrade offers a user-friendly platform that is easy to navigate, even for beginners. The company provides a range of research tools and educational resources to help clients make informed investment decisions.

- Wide range of investment options: TD Ameritrade offers a wide range of investment options, including stocks, ETFs, mutual funds, options, futures, and forex. This allows clients to build a diversified portfolio that meets their investment goals.

- Low fees: TD Ameritrade charges low fees for most of its services, making it an affordable option for investors. For example, it charges $0 commission for online stock, ETF, and options trades.

- Robust research tools: TD Ameritrade provides a range of research tools to help clients make informed investment decisions. These include analyst reports, news feeds, market data, and real-time quotes.

- Excellent customer support: TD Ameritrade provides excellent customer support, with 24/7 phone and email support. Clients can also access live chat support during trading hours.

- Educational resources: TD Ameritrade provides a range of educational resources to help clients improve their investment skills. These include articles, videos, webinars, and in-person events.

- Paper trading: TD Ameritrade allows clients to practice trading without risking real money through its paper trading feature. This can be a valuable tool for new investors who want to gain experience before investing real money.

Cons

- High margin rates: TD Ameritrade charges high margin rates compared to some of its competitors. This can be a drawback for investors who want to trade on margin.

- Limited forex trading: TD Ameritrade offers forex trading, but its selection of currency pairs is limited compared to some other brokers.

- No commission-free mutual funds: Unlike some other brokers, TD Ameritrade does not offer commission-free mutual funds. This can be a drawback for investors who want to invest in mutual funds.

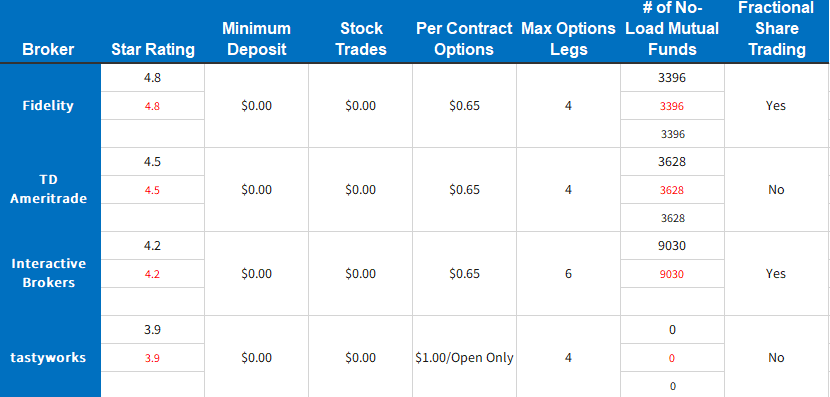

- No fractional shares: TD Ameritrade does not offer fractional shares, which can be a drawback for investors who want to invest in expensive stocks but cannot afford to buy a full share.

- No cryptocurrency trading: TD Ameritrade does not offer cryptocurrency trading, which can be a drawback for investors who want to invest in digital assets.

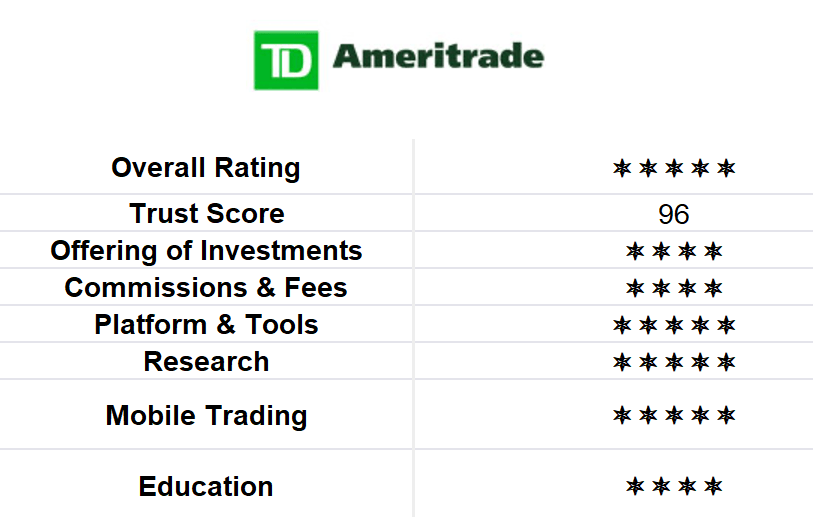

Is TD Ameritrade Safe?

TD Ameritrade is one of the most popular online brokerages in the United States, offering a wide range of investment options to its clients. However, before investing with any broker, it is crucial to determine if it is safe and trustworthy. In this article, we will answer the question “Is TD Ameritrade Safe?” and cover various aspects of the brokerage’s safety.

Regulation and Licensing

TD Ameritrade is a subsidiary of the Toronto-Dominion Bank, which is one of the largest banks in North America. The brokerage is regulated by several authorities, including the Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA), and the Commodity Futures Trading Commission (CFTC). Moreover, TD Ameritrade is a member of the Securities Investor Protection Corporation (SIPC), which protects customers’ securities and cash up to $500,000 in the event of the broker’s insolvency.

Insurance

In addition to SIPC protection, TD Ameritrade also provides additional insurance coverage for its clients. The brokerage has a policy with Lloyd’s of London, which covers clients’ assets up to an additional $149.5 million per account, including up to $2 million in cash. This additional coverage is available for a total of $152 million per client.

Cybersecurity

TD Ameritrade takes cybersecurity seriously and uses advanced security measures to protect its clients’ accounts. The brokerage provides two-factor authentication for logins and transfers, uses encryption to protect data in transit, and stores client data on secure servers. Moreover, TD Ameritrade’s website and mobile app undergo regular security audits and testing to identify and address any vulnerabilities.

Fees and Commissions

TD Ameritrade charges commissions for trades and fees for certain services, such as wire transfers and paper statements. However, the brokerage does not charge annual account fees, inactivity fees, or fees for account transfers. Additionally, TD Ameritrade offers a wide range of commission-free ETFs and mutual funds, which can help reduce investment costs.

Customer Support

TD Ameritrade offers customer support via phone, email, and live chat. The brokerage’s customer service team is available 24/7 and can assist clients with account-related inquiries, technical issues, and investment advice. TD Ameritrade also has a robust knowledge base and educational resources, including webinars, articles, and videos, to help clients learn more about investing.

Related Post: Unbiased Oanda Review 2023: Pros/Cons, Fees & Features

TD Ameritrade: Offering of Investments

TD Ameritrade is a well-known online brokerage firm that offers a wide range of investment products and services to its customers. Founded in 1975, the company has grown to become one of the largest discount brokerages in the United States, with over 11 million customer accounts and more than $1 trillion in assets under management.

Range of Products Available for Trading:

TD Ameritrade offers a diverse range of investment products, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), options, futures, and foreign exchange (forex) trading. Customers have access to over 4,000 no-transaction-fee mutual funds, and over 550 commission-free ETFs, making it an attractive choice for investors who want to build a diversified portfolio without incurring high trading fees.

In addition, TD Ameritrade provides a range of educational resources and tools to help investors make informed decisions about their investments. These resources include webinars, online courses, market commentary, and research reports from leading analysts and investment firms.

Availability of Different Asset Classes:

TD Ameritrade offers customers access to a wide range of asset classes, including domestic and international stocks, bonds, and ETFs. Customers can also trade options on equities, ETFs, and indices, as well as futures and forex.

The company’s offerings in the fixed income space are particularly noteworthy, with access to a broad range of corporate bonds, municipal bonds, treasuries, and other fixed income securities. This makes it a good choice for investors who want to diversify their portfolios beyond stocks and other equity-based investments.

Options for Account Types:

TD Ameritrade offers several different types of accounts to suit the needs of different investors. These include individual brokerage accounts, joint accounts, custodial accounts for minors, and retirement accounts such as Traditional IRAs, Roth IRAs, SEP IRAs, and SIMPLE IRAs.

In addition, TD Ameritrade offers managed portfolios through its Essential Portfolios and Selective Portfolios services. These services provide investors with a professionally managed portfolio of ETFs that is tailored to their individual investment goals and risk tolerance.

You May Also Like: Roboforex Review 2023: Is it the Best Trading Platform Out There?

TD Ameritrade: Commissions and Fees

TD Ameritrade is a leading brokerage firm that offers a wide range of financial products and services to investors. As with any brokerage firm, TD Ameritrade charges fees and commissions for its services. In this article, we will provide a breakdown of TD Ameritrade’s fee structure, compare it with other brokers in the industry, and highlight any hidden fees or charges to watch out for.

Breakdown of TD Ameritrade’s fee structure

TD Ameritrade charges a variety of fees and commissions for its services. Here is a breakdown of some of the most important fees:

- Stock and ETF Trading Fees: TD Ameritrade charges $0 for online stock and ETF trades. This fee structure is very competitive compared to other brokers in the industry.

- Options Trading Fees: TD Ameritrade charges $0.65 per options contract. This fee is also very competitive compared to other brokers.

- Mutual Fund Trading Fees: TD Ameritrade charges $49.99 for no-load mutual fund transactions. This fee is on the higher end of the industry standard.

- Account Fees: TD Ameritrade charges no annual or inactivity fees for their brokerage accounts.

- Other Fees: TD Ameritrade charges fees for things like wire transfers ($25 outgoing, $0 incoming), paper statements ($2), and a few other services. These fees are typical of the industry.

Comparison with other brokers in the industry

TD Ameritrade’s fee structure is very competitive compared to other brokers in the industry. For example, Robinhood offers commission-free trading, but it doesn’t offer some of the advanced trading features that TD Ameritrade does. Other brokers like E*TRADE and Charles Schwab have similar fee structures, but TD Ameritrade often has lower fees for certain services like options trading.

It’s worth noting that some brokers, like Vanguard and Fidelity, offer their own mutual funds with no trading fees. This can be a significant cost savings for investors who primarily invest in those funds. However, TD Ameritrade has a larger selection of mutual funds available for purchase than many of its competitors.

Hidden fees and charges to watch out for

While TD Ameritrade’s fee structure is generally transparent and easy to understand, there are a few hidden fees and charges to watch out for. Here are a few examples:

- Margin Fees: If you use margin to trade, TD Ameritrade charges interest on the amount borrowed. The interest rates are competitive with industry standards, but it’s important to understand the costs before using margin.

- Broker-Assisted Trades: TD Ameritrade charges $25 for broker-assisted trades. While this fee is disclosed, it’s worth noting that some investors may need to use a broker’s assistance for more complex trades.

- ETF Expense Ratios: While TD Ameritrade doesn’t charge any fees for online ETF trades, the ETFs themselves may have expense ratios that can add up over time. Investors should research the expense ratios of the ETFs they plan to trade before making a purchase.

- Trading Platform Fees: TD Ameritrade offers several different trading platforms, some of which may have fees associated with them. For example, their thinkorswim platform has a $0.50 fee per options contract in addition to the standard options trading fee. These fees are disclosed, but it’s important to understand them before using the platform.

Further Reading: CMC Markets Review 2023: Ultimate Guide to Trading Success

TD Ameritrade Mobile Trading Apps

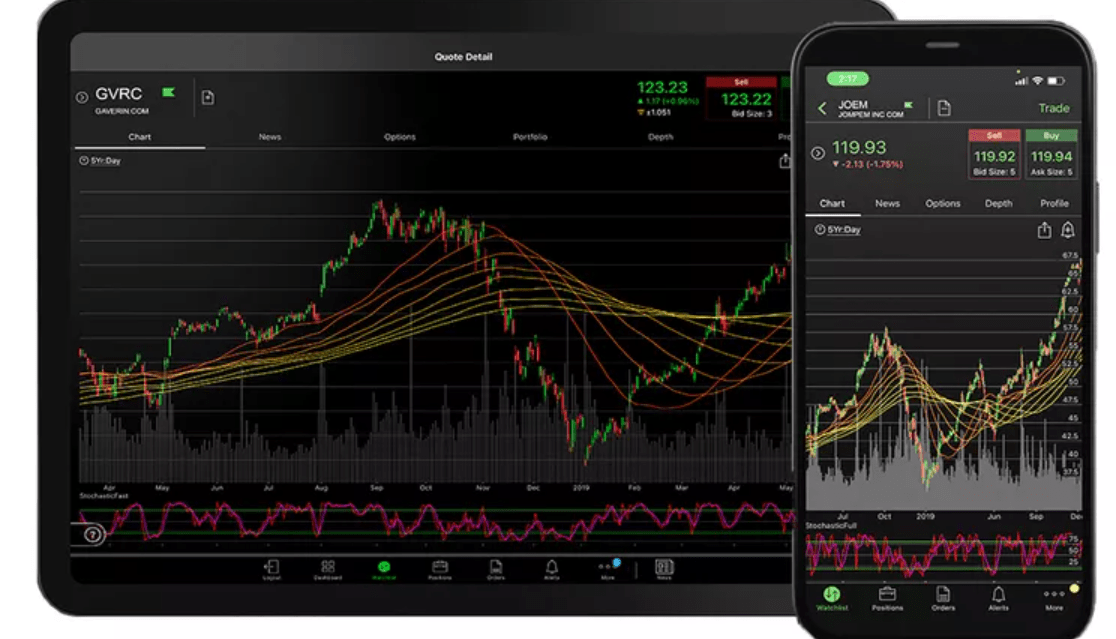

TD Ameritrade is a leading online broker that provides investment and trading services for individuals and institutions. The firm has a strong reputation for its advanced trading tools, excellent research resources, and top-notch customer service. In addition to its desktop platform, TD Ameritrade offers mobile apps for iOS and Android devices, enabling users to manage their investments on the go.

The TD Ameritrade Mobile app provides a comprehensive trading platform for investors, offering features and functionality designed to meet the needs of both novice and experienced traders. The app is free to download and available to anyone with a TD Ameritrade account.

Features and functionalities

TD Ameritrade’s mobile app offers a wide range of features and functionality, making it a powerful trading tool for investors. Some of the most notable features include:

- Trading: Users can buy and sell stocks, options, futures, and ETFs from their mobile device. The app also offers advanced order types, including conditional orders and complex options strategies.

- Research: TD Ameritrade’s research resources are available within the app, including access to real-time news, market data, and in-depth analysis from third-party providers.

- Account management: Users can view their account balances, positions, and transaction history from the app. The app also offers tools for managing account settings, such as enabling two-factor authentication and setting up alerts.

- Education: TD Ameritrade provides educational resources within the app, including articles, videos, and webinars, designed to help users improve their trading skills.

- Watchlists: Users can create and customize watchlists, enabling them to monitor the performance of specific stocks or securities.

- Charting: The app includes advanced charting tools, including technical indicators and drawing tools, allowing users to analyze market trends and make informed trading decisions.

- Customization: Users can customize their app experience by setting up personalized alerts and notifications, selecting preferred market data, and choosing their preferred theme.

User experience and ease of use

TD Ameritrade’s mobile app offers a user-friendly interface and intuitive navigation, making it easy for investors to manage their accounts and execute trades from their mobile device. The app’s design is clean and modern, with a layout that’s optimized for smaller screens. Users can quickly access key features and functionality, such as trading and research, from the app’s main menu.

The app’s trading features are especially user-friendly, with clear and concise order entry screens and intuitive order types. Users can quickly execute trades with just a few taps, making it easy to take advantage of market opportunities on the go.

In addition to its ease of use, the TD Ameritrade Mobile app also offers robust security features, including two-factor authentication and biometric login options, such as fingerprint or facial recognition. These features help ensure that users’ accounts are secure and protected from unauthorized access.

Explore More: Forex.com Review 2023: Ultimate Trading Platform for Beginners

TD Ameritrade Other Trading Platforms

TD Ameritrade is one of the most popular and widely-used online trading platforms for investors and traders in the United States. In addition to its flagship trading platform, TD Ameritrade offers a variety of other trading platforms that cater to different types of traders and investors.

Overview of other trading platforms offered by TD Ameritrade

- thinkorswim: thinkorswim is a professional-grade trading platform designed for active traders and investors. It offers advanced charting, real-time market data, and customizable trading tools to help traders make informed decisions. thinkorswim also includes a paper trading account, allowing users to practice trading strategies without risking real money.

- TD Ameritrade Mobile: TD Ameritrade Mobile is a mobile trading platform that allows investors to trade stocks, ETFs, options, and mutual funds from their smartphone or tablet. The app includes real-time quotes, customizable watchlists, and news and research from leading financial sources.

- Trade Architect: Trade Architect is a web-based trading platform designed for casual investors and traders. It offers an intuitive interface, customizable charts, and streaming news and analysis. Trade Architect also includes a paper trading account, allowing users to practice trading strategies without risking real money.

- StrategyDesk: StrategyDesk is a desktop-based trading platform designed for advanced traders. It offers customizable charts, advanced analytics, and real-time market data. StrategyDesk also includes a backtesting feature, allowing users to test trading strategies using historical data.

Availability of third-party platforms

TD Ameritrade also offers access to third-party trading platforms, including:

- NinjaTrader: NinjaTrader is a professional-grade trading platform that offers advanced charting, real-time market data, and customizable trading tools. It’s designed for active traders who require real-time data and advanced analytics to make informed decisions.

- TradingView: TradingView is a web-based trading platform that offers real-time market data, advanced charting, and social trading features. It’s designed for investors who want to collaborate with other traders and share trading ideas.

- Sterling Trader Pro: Sterling Trader Pro is a desktop-based trading platform designed for professional traders. It offers advanced order routing, real-time market data, and customizable trading tools.

TD Ameritrade Market Research

TD Ameritrade offers a variety of research tools to its clients, including fundamental and technical analysis, market news and commentary, and real-time data. Clients can access these tools through their online trading platform or by using the TD Ameritrade mobile app.

One of the key features of TD Ameritrade’s research tools is their ease of use. Clients can easily navigate through the platform to find the information they need, and the data is presented in a clear and concise format. This makes it easy for clients to make informed investment decisions based on the information provided.

Another important feature of TD Ameritrade’s research tools is their customization options. Clients can personalize their research experience by setting up alerts and notifications, creating custom watchlists, and filtering data based on their preferences. This allows clients to focus on the information that is most relevant to their investment strategy.

Analysis and insights provided

TD Ameritrade’s research tools provide a range of analysis and insights that help clients understand market trends and make informed investment decisions. The platform provides both fundamental and technical analysis tools, which allow clients to analyze stocks based on various criteria such as financial ratios, earnings reports, and industry trends.

In addition to analysis tools, TD Ameritrade also offers market news and commentary from a variety of sources. Clients can access news articles, market summaries, and expert analysis from publications such as CNBC, Bloomberg, and Reuters. This allows clients to stay up-to-date on the latest market trends and news that may impact their investments.

TD Ameritrade’s research tools also provide clients with insights into investor sentiment. The platform includes tools that track stock and option activity, providing insights into how other investors are trading and what positions they are taking. This information can be valuable for clients who want to make investment decisions based on market trends and sentiment.

Availability of market data and news

TD Ameritrade’s research tools provide clients with access to a wealth of market data and news. Real-time data is available for stocks, options, and futures, allowing clients to monitor their investments and make informed decisions based on current market conditions.

In addition to real-time data, TD Ameritrade also offers historical data and charts. Clients can use this information to analyze trends and identify patterns that may impact future market movements. This data is available for a variety of asset classes, including stocks, options, futures, and forex.

TD Ameritrade’s platform also provides clients with access to a range of market news and commentary. Clients can access news articles, market summaries, and expert analysis from a variety of sources. This information is updated regularly, ensuring that clients always have access to the latest news and insights that may impact their investments.

Discover: Saxo Bank Review 2023: Best Broker for Your Trading Needs?

TD Ameritrade’s Educational Resources

TD Ameritrade is known for its extensive educational resources that are available to its clients. The broker has a dedicated section on its website that is entirely devoted to education. TD Ameritrade offers a range of resources to help clients improve their investing and trading skills, including articles, videos, webcasts, and courses.

Topics covered and level of depth

TD Ameritrade covers a broad range of topics in its educational resources, including investing, trading, retirement planning, and portfolio management. The broker offers educational content at different levels of depth, making it suitable for both novice and experienced investors. The educational resources cover a range of topics, including stocks, bonds, mutual funds, ETFs, options, futures, and forex trading.

For novice investors, TD Ameritrade offers a variety of introductory materials, including articles and videos on the basics of investing and trading. Intermediate and advanced investors can access more in-depth resources, such as webinars and courses on advanced trading strategies and risk management.

Availability of webinars and other learning resources

TD Ameritrade offers a wide range of learning resources to its clients, including webinars, live events, and courses. These resources are designed to help clients improve their skills and knowledge in trading and investing. The broker offers free live events and webinars for its clients, covering topics ranging from market analysis to trading strategies.

The TD Ameritrade website features a section called “Education Center,” where clients can access educational content at any time. The broker offers various courses, including online courses, in-person workshops, and live webinars. Clients can also participate in interactive quizzes and assessments to test their knowledge and skills.

TD Ameritrade also offers “Investools,” an advanced educational program that provides clients with personalized coaching, a comprehensive curriculum, and access to advanced trading tools. This program is designed for advanced investors who want to take their trading skills to the next level.

Check out: Trade Smarter with Trading 212: Pros, Cons, and Features

Final Thoughts About TD Ameritrade

TD Ameritrade is an online brokerage firm that was founded in 1975 and has since grown to become one of the largest brokerage firms in the United States. In November 2019, it was announced that Charles Schwab would be acquiring TD Ameritrade for $26 billion in an all-stock transaction. The deal was finally completed in October 2020, and since then, many investors and analysts have been evaluating the final verdict of this acquisition.

The acquisition of TD Ameritrade by Charles Schwab was a significant move in the brokerage industry. The merger created a behemoth in the industry, with the combined company having over $6 trillion in assets under management and servicing over 28 million brokerage accounts. The merger also brought together two of the largest discount brokers in the industry, with both companies offering similar services such as commission-free trading, extensive research, and educational resources.

Many investors were initially concerned about the impact of the merger on the brokerage industry. Some were worried that the consolidation of the two companies would lead to a decrease in competition and result in higher fees for customers. However, the verdict on the merger has been mostly positive, with many investors and analysts believing that the merger will result in lower fees and better services for customers.

More Resources: Libertex Review 2023: Pros & Cons, Safety, Fees, App & Education