Table of Contents

ToggleSaxo Bank is a Danish investment bank that was established in 1992. The bank primarily provides online trading and investment services to retail and institutional clients. It operates in more than 100 countries and has offices in major financial centers around the world. Saxo Bank has earned a reputation as a reliable and innovative provider of trading solutions to individuals, banks, and financial institutions.

Saxo Bank has made a name for itself by leveraging technology to make trading and investing more accessible to a wider audience. It provides a range of trading instruments, including forex, CFDs, stocks, futures, and options. The bank’s proprietary trading platform, SaxoTraderGO, is user-friendly and provides access to over 40,000 financial instruments across multiple asset classes. The platform also offers a range of research tools and trading resources to help clients make informed investment decisions.

Saxo Bank is also known for its institutional services, which provide banks, brokers, and other financial institutions with access to its technology and liquidity. The bank’s white-label solutions enable institutions to offer their clients a customized trading experience under their own brand.

Saxo Bank has won several awards for its trading services, including the Best Multi-Asset Trading Platform at the 2020 Finance Magnates Awards. The bank has also been recognized for its commitment to innovation and its efforts to democratize access to financial markets.

Saxo Bank Pros & Cons

Saxo Bank is a Danish investment bank that provides online trading and investment services to clients worldwide. The bank has been in operation since 1992 and is known for its cutting-edge technology, competitive pricing, and exceptional customer service. While Saxo Bank has many advantages, it also has some disadvantages that potential clients should consider before trading with the bank.

Pros

- Competitive pricing: Saxo Bank’s fees and commissions are among the most competitive in the industry, making it an attractive option for traders who want to keep their costs low.

- Wide range of markets: Saxo Bank offers access to more than 40,000 instruments across various asset classes, including forex, stocks, options, futures, and bonds. This wide range of markets allows traders to diversify their portfolios and take advantage of market opportunities.

- Cutting-edge technology: Saxo Bank has developed its own trading platform, SaxoTraderGO, which is known for its user-friendly interface and advanced features. The platform can be accessed from desktop or mobile devices, making it convenient for traders on-the-go.

- Exceptional customer service: Saxo Bank’s customer service team is available 24/5 and is known for its responsiveness and expertise. The bank also provides a wide range of educational resources, including webinars, tutorials, and market insights, to help traders improve their trading skills.

Cons

- High minimum deposit: Saxo Bank’s minimum deposit requirement is $10,000, which may be prohibitive for some traders, especially beginners.

- Inactivity fees: Saxo Bank charges an inactivity fee of $100 per quarter if clients do not make at least one trade in three consecutive months. This fee can add up over time, especially for traders who are not very active.

- Limited customization: Saxo Bank’s trading platform, SaxoTraderGO, is highly advanced, but it may not be as customizable as some other platforms. This may be a disadvantage for traders who prefer to tailor their trading environment to their specific needs.

Is Saxo Bank Safe?

Saxo Bank is a Danish online investment bank founded in 1992. It offers a broad range of financial services, including trading platforms, investment advisory services, and asset management. Saxo Bank operates in several countries worldwide and is regulated by financial authorities in each jurisdiction where it operates.

Regulatory Oversight: Saxo Bank is a highly regulated financial institution. It is licensed by various financial regulatory authorities, including the Financial Conduct Authority (FCA) in the United Kingdom, the Swiss Financial Market Supervisory Authority (FINMA), and the Danish Financial Supervisory Authority (DFSA). The bank is also a member of various regulatory bodies, including the International Swaps and Derivatives Association (ISDA) and the Global Foreign Exchange Committee (GFXC).

Security Measures: Saxo Bank has implemented several security measures to ensure the safety of its clients’ data and transactions. The bank uses advanced encryption technologies and firewalls to protect its systems from cyber threats. Saxo Bank also offers two-factor authentication and a secure messaging system to enhance the security of clients’ accounts. Additionally, Saxo Bank has an incident response team in place to respond to any security breaches promptly.

Client Fund Protection: Saxo Bank takes client fund protection seriously. The bank segregates client funds from its operational funds and holds them in separate accounts. Saxo Bank is also a member of various compensation schemes, such as the Financial Services Compensation Scheme (FSCS) in the UK and the Swiss Investor Protection Scheme (SIPS) in Switzerland. These schemes provide additional protection to clients’ funds in case of the bank’s insolvency.

Related Post: Trade Smarter with Trading 212: Pros, Cons, and Features

Offering of Investments By Saxo Bank

Saxo Bank is a Danish investment bank that offers online trading and investment services to customers worldwide. It has gained a reputation for being a reliable and innovative trading platform that offers a diverse range of investment products and asset classes.

Product portfolio: Saxo Bank offers a comprehensive product portfolio that includes Forex, Stocks, CFDs, Options, Futures, ETFs, and Bonds. The bank offers trading in more than 40,000 instruments across 26 global exchanges. The platform offers a range of order types, including market, limit, stop, and trailing stop orders. Saxo Bank also offers a suite of tools and research, including trading signals, charting packages, and fundamental analysis.

Asset classes: Saxo Bank provides access to a wide range of asset classes, including currencies, equities, bonds, commodities, and indices. Customers can trade major and minor currency pairs, as well as exotic currency pairs. The bank offers access to more than 19,000 global stocks, including US and European stocks, and more than 5,000 ETFs.

Availability of tradeable markets: Saxo Bank offers access to more than 40,000 instruments across 26 global exchanges, making it one of the most comprehensive trading platforms available. Customers can trade in major markets such as the NYSE, NASDAQ, LSE, and HKEX, as well as smaller exchanges such as the OMX Nordic and Euronext.

Leverage and margin requirements: Saxo Bank offers competitive leverage and margin requirements, which vary depending on the asset class and instrument. For example, the bank offers up to 1:500 leverage on Forex trades and up to 1:20 leverage on stocks. The margin requirement also varies depending on the asset class and instrument, with margin rates as low as 1% for some trades.

You May Also Like: Libertex Review 2023: Pros & Cons, Safety, Fees, App & Education

Saxo Bank: Commissions & Fees

Saxo Bank is a Danish investment bank that provides online trading services in various financial instruments such as stocks, bonds, forex, and futures. The bank offers a competitive pricing structure with transparent fees and commissions.

| Assets | Fee level | Fee terms |

|---|---|---|

| US stock fee | Average | $0.02/share; min $10, but using VIP pricing the minimum can be as low as $3 |

| EURUSD fee | Low | Classic account: the fees are built into the spread, 0.7 pips is the average spread cost during peak trading hours. Using VIP pricing the spread can be as low as 0.4 pips. |

| US tech fund fee | Low | Mutual funds are available only in certain countries. The broker doesn’t charge any fee for mutual fund trading. |

| Inactivity fee | High | In the UK, £25 after one quarter of inactivity. SIPP and ISA accounts are exempt from this fee. In non-UK countries, up to $150 after 6 months of inactivity |

Pricing structure: Saxo Bank has a tiered pricing structure that depends on the trader’s trading volume. The more the trader trades, the lower the commissions they pay. The pricing structure is divided into three tiers, and each tier has different commission rates. The tiers are Classic, Platinum, and VIP. The Classic tier has the highest commission rates, while the VIP tier has the lowest commission rates.

Commission fees: Saxo Bank charges commission fees for each trade. The commission rates depend on the tier the trader falls into. For the Classic tier, the commission fee is 0.05% per trade, while for the Platinum tier, it is 0.04% per trade. For the VIP tier, the commission fee is negotiable and can be as low as 0.02% per trade.

Non-trading fees: Apart from the commission fees, Saxo Bank charges non-trading fees such as account inactivity fees, custody fees, and currency conversion fees. The account inactivity fee is charged if there is no trading activity on the account for six consecutive months. The custody fee is charged for holding certain assets, and the currency conversion fee is charged for converting currencies.

Deposit and withdrawal fees: Saxo Bank does not charge any deposit fees, but some withdrawal fees may apply. The bank charges a withdrawal fee of €10 for withdrawals less than €1,000. For withdrawals above €1,000, the bank does not charge any fees. However, there may be additional fees charged by the intermediary banks.

Further Reading: Admiral Markets Review 2023: Platform, Fees & Customer Support

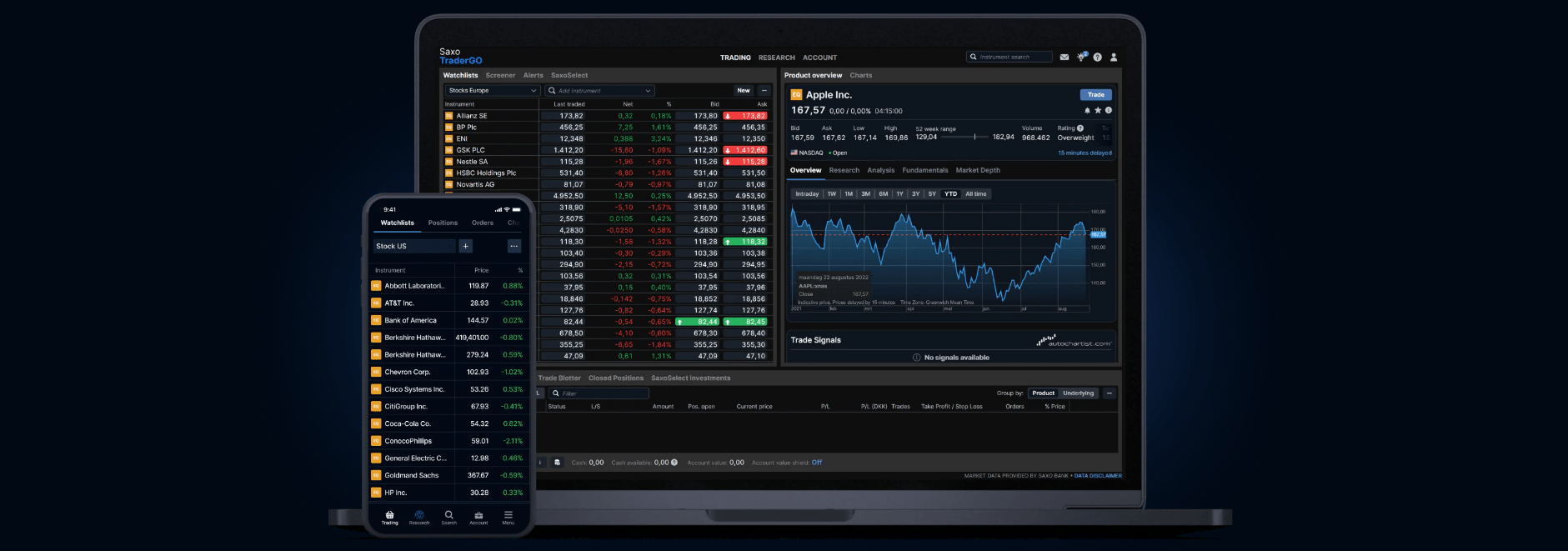

Saxo Bank: Mobile Trading Apps

Saxo Bank is a leading online investment bank that provides traders with a comprehensive range of financial services. Saxo Bank’s mobile trading apps, available for both iOS and Android, are designed to allow traders to manage their investments from anywhere in the world.

Overview of mobile apps: Saxo Bank’s mobile trading apps provide traders with an intuitive, user-friendly platform that allows them to monitor and trade a wide range of financial instruments, including stocks, forex, and commodities. The app is available in multiple languages, making it accessible to traders around the world.

Features and functionality: The Saxo Bank mobile app offers a range of features and functionality designed to help traders make informed investment decisions. These include real-time market data, customizable watchlists, advanced charting tools, and access to Saxo Bank’s proprietary trading algorithms.

The app also allows traders to place and manage trades directly from their mobile devices, as well as monitor their account balances and track their performance. Additionally, Saxo Bank’s mobile app offers a range of educational resources, including market analysis, research reports, and trading ideas.

Ease of use and navigation: Saxo Bank’s mobile app is designed with ease of use and navigation in mind. The app’s intuitive interface makes it easy for traders to find the information they need and execute trades quickly and efficiently.

The app also features customizable settings, allowing traders to personalize the platform to their specific needs and preferences. Furthermore, the app’s seamless integration with Saxo Bank’s web-based platform ensures that traders can access their accounts and trading history from anywhere, at any time.

Explore More: IG Markets Review 2023: Platform, Trading, Commission & Support

Other Trading Platforms

Saxo Bank is a leading Danish investment bank that provides its clients with a variety of trading platforms for both institutional and retail investors. In addition to its award-winning SaxoTraderPRO platform, the company also offers SaxoTraderGO, a web-based platform that is easy to use and accessible from any device with an internet connection.

SaxoTraderGO: SaxoTraderGO is a web-based platform that is designed to be intuitive and easy to use. It provides access to over 40,000 financial instruments, including stocks, bonds, ETFs, futures, and options, and is available in 20 different languages. The platform allows clients to trade on multiple markets simultaneously, and to access real-time news and analysis.

SaxoTraderPRO: SaxoTraderPRO is a professional-grade trading platform that is designed for more advanced traders. It provides access to over 40,000 financial instruments, and includes advanced charting tools, customisable workspaces, and a range of order types. The platform is available as a desktop application for Windows and Mac, as well as on mobile devices.

Compatibility with third-party platforms: Saxo Bank’s trading platforms are compatible with a range of third-party platforms, including MetaTrader 4 and 5, NinjaTrader, and TradingView. This allows clients to use their preferred trading tools and strategies while still benefitting from Saxo Bank’s trading infrastructure and support.

Features and tools: Both SaxoTraderGO and SaxoTraderPRO offer a range of features and tools to help traders make informed decisions. These include real-time market data and news, customisable charting tools, a range of order types, and risk management tools such as stop-loss and take-profit orders. SaxoTraderPRO also includes advanced trading tools such as options chains and algorithmic trading capabilities.

Discover: FxPro Review 2023: Trading, Commission, Education & Pros/Cons

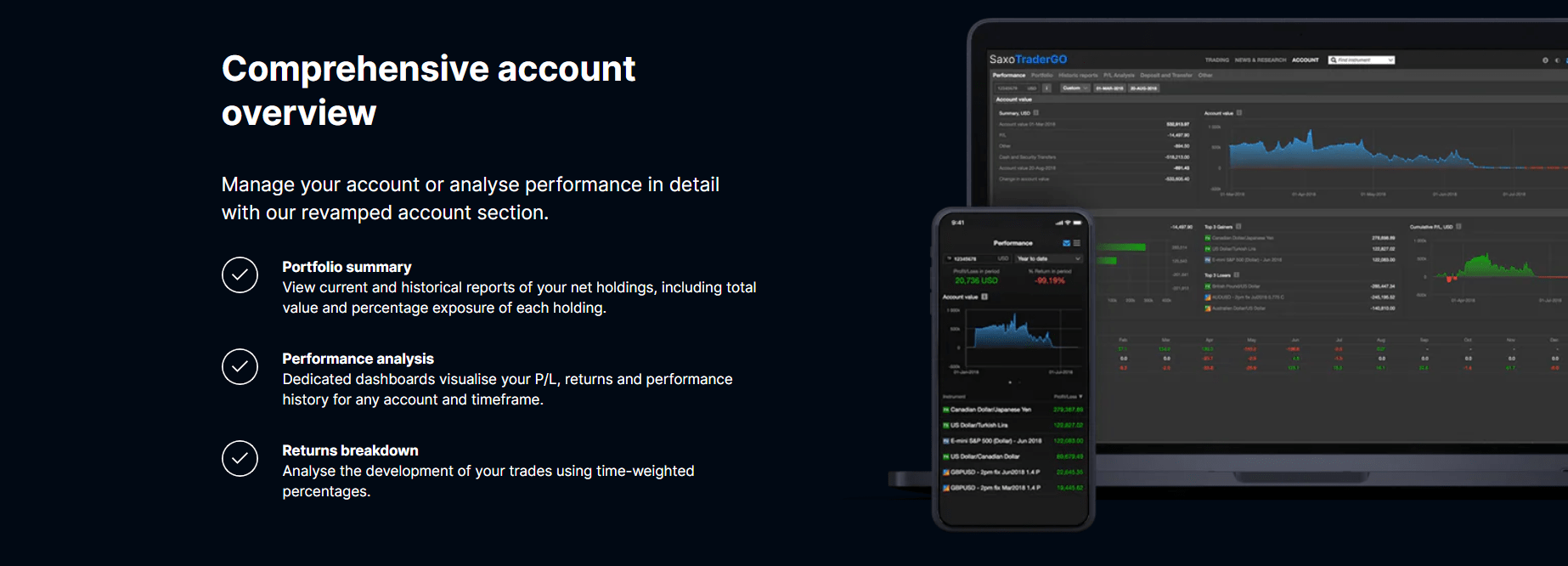

Saxo Bank: Market Research

Saxo Bank is a Danish investment bank that provides online trading and investment services. One of the bank’s strengths is its market research offering, which covers a range of asset classes and markets around the world.

Research Offerings: Saxo Bank’s market research offering includes daily market updates, weekly macroeconomic reports, and in-depth research on individual companies, industries, and trends. The bank also publishes quarterly outlooks for different asset classes, including equities, fixed income, and commodities. Additionally, Saxo Bank provides clients with access to live webinars, expert insights, and market analysis tools.

Quality and Depth of Research: Saxo Bank’s research is widely respected for its quality and depth. The bank employs a team of experienced analysts who use a combination of quantitative and qualitative methods to analyze market trends and identify investment opportunities. The research team is well-versed in macroeconomic trends, political events, and technological advancements that could impact the markets. Saxo Bank’s research reports are detailed and informative, providing clients with valuable insights and actionable investment ideas.

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | Yes |

| Trading Central (Recognia) | No |

| Social Sentiment – Currency Pairs | Yes |

Tools and Resources: Saxo Bank provides clients with a range of tools and resources to help them make informed investment decisions. These include the bank’s proprietary trading platform, which allows clients to access real-time market data, execute trades, and manage their portfolios from a single interface. The platform also features advanced charting and analysis tools, as well as customizable watchlists and alerts. Additionally, Saxo Bank offers a range of educational resources, including online courses, webinars, and expert insights, to help clients improve their investing skills.

Check out: Eightcap Review 2023: Pros and Cons, Trading, Fees & Mobile App

Education: Saxo Bank

Saxo Bank is a Denmark-based online investment bank that provides a range of services to its clients, including trading in forex, stocks, futures, options, and other instruments. Saxo Bank Education is an initiative by Saxo Bank to provide educational resources to traders and investors of all levels.

Educational Offerings: Saxo Bank Education offers a range of educational resources to its clients, including webinars, videos, articles, and e-books. The educational offerings cover a variety of topics, such as trading strategies, risk management, technical analysis, and macroeconomics. Additionally, Saxo Bank Education offers a range of courses for traders and investors of all levels, including beginners, intermediate traders, and advanced traders.

Quality and Comprehensiveness of Educational Materials: The educational materials provided by Saxo Bank Education are of high quality and are comprehensive. The materials are designed to be easily understandable by traders and investors of all levels. The courses offered by Saxo Bank Education are also well-structured, and each course has a clear learning objective.

Availability of Support and Guidance: Saxo Bank Education provides support and guidance to its clients through its team of expert trainers and instructors. The team is available to answer any questions that clients may have about the educational materials or trading strategies. Additionally, Saxo Bank Education offers a range of tools and resources, such as trading platforms and market analysis tools, to help traders and investors make informed decisions.

More Resources: eToro Reviews 2023: Features, Platform, and User Feedback

Final Thoughts About Saxo Bank

Saxo Bank is a Danish investment bank that offers online trading and investment services to clients in over 170 countries. The bank has a strong reputation for its cutting-edge technology and innovative trading platforms, which have earned it numerous awards over the years.

One of the bank’s key strengths is its commitment to transparency and education. Saxo Bank provides clients with a wealth of resources and tools to help them make informed investment decisions, including market analysis, trading ideas, and educational materials.

In addition, Saxo Bank offers a wide range of financial products and services, including stocks, bonds, options, futures, and forex. Clients can trade these products through the bank’s proprietary trading platform, SaxoTraderGO, which is known for its intuitive interface and advanced features.

Overall, Saxo Bank is a well-respected player in the online trading and investment space, with a strong reputation for innovation, transparency, and customer service. Whether you’re a seasoned trader or a beginner, the bank’s robust platform and educational resources make it a solid choice for anyone looking to invest in the global markets.