Table of Contents

ToggleIn recent times, eToro has emerged as a leading online trading platform, garnering a substantial global user base. This versatile platform boasts an array of trading functionalities, encompassing copy trading, social trading, and an extensive selection of asset categories such as stocks, forex, and cryptocurrencies. Within this comprehensive article, we will conduct a thorough exploration of eToro, delving into its advantages and disadvantages, safety protocols, fee structures, mobile applications, trading interfaces, market analysis tools, and educational offerings, all designed to enhance your trading experience.

eToro Pros & Cons

eToro is a popular trading platform that offers a range of assets and markets for traders to invest in. Like any platform, eToro has both pros and cons that users should be aware of before using the platform.

Pros

- User-Friendly Interface: eToro is known for its user-friendly interface, which makes it easy for traders of all levels to navigate and use the platform. The platform is designed to be intuitive and straightforward, with easy-to-use tools and features.

- Social and Copy Trading Features: eToro offers a unique social and copy trading feature that allows users to follow and copy the trades of successful traders on the platform. This can be a useful tool for new traders who are looking to learn from experienced traders and improve their trading strategies.

- Range of Assets and Markets: eToro offers a wide range of assets and markets for traders to invest in, including stocks, crypto trading, and forex. This can provide users with a diverse range of investment opportunities and the ability to trade in multiple markets.

- Mobile Trading Apps: eToro offers mobile trading apps for both iOS and Android devices, which allows users to trade on-the-go. The apps are well-designed and offer all of the same features as the desktop platform.

- Transparent Fee Structure: eToro’s fee structure is transparent, with no hidden fees or commissions. While the fees can be higher compared to some other trading platforms, users know exactly what they’re paying for and can easily calculate their costs.

Cons

- Limited Research and Analysis Tools: While eToro offers basic technical analysis tools, such as charts and indicators, more advanced research and analysis tools are not available on the platform. This can be a drawback for more experienced traders who rely heavily on these tools.

- Higher Fees for Certain Assets: While eToro’s fee structure is transparent, the fees for certain assets, such as crypto trading, can be higher compared to other platforms. This can be a concern for users who trade in these markets.

- Limited Deposit and Withdrawal Options: eToro only allows users to deposit and withdraw funds using a limited range of payment methods, such as bank transfer, credit/debit card, and PayPal. This can be a concern for users who prefer to use other payment methods.

- Limited Educational Resources: While eToro offers a range of educational resources, such as webinars and e-books, some users may find that the platform’s educational offerings are limited compared to other trading platforms.

Is eToro Safe?

Prioritizing safety and security is paramount in the world of investing and trading. In this SEO-friendly article, we will delve into eToro’s safety measures, investor protection, and user feedback, offering insights to aid your decision-making process when considering this platform for your trading requirements.

eToro’s Security Measures:

eToro places a strong emphasis on security, implementing a comprehensive suite of safeguards to shield user assets and personal data. Notable security features include:

Two-Factor Authentication (2FA): eToro employs the robust 2FA system to fortify user accounts and transactions, adding an extra layer of protection.

SSL Encryption: The platform deploys SSL encryption to ensure that data exchanged between users and the platform remains confidential and secure.

Segregated Accounts: eToro segregates user funds from its operational finances, a practice that shields user investments from potential financial mishaps.

Furthermore, eToro operates under the supervision of multiple regulatory bodies, including the prestigious Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC). These regulatory affiliations signify eToro’s commitment to adhering to stringent industry standards and guidelines, reinforcing the safety and security assurances provided to its users.

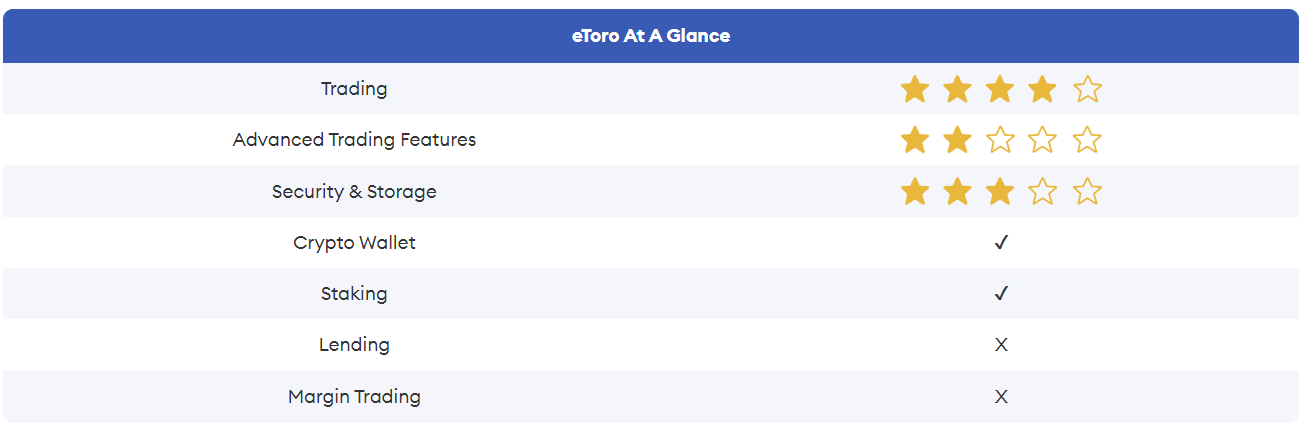

eToro Ratings

Investor Protection:

In addition to stringent security measures and regulatory compliance, eToro goes the extra mile to provide robust investor protection and insurance to its valued users. As part of its commitment to safeguarding investments, eToro is a proud member of the Financial Services Compensation Scheme (FSCS) in the UK. This affiliation offers substantial peace of mind by granting eligible investors access to compensation of up to £85,000 in the unlikely event of eToro facing insolvency or bankruptcy.

Moreover, eToro extends a protective shield through its provision of negative balance protection. This essential feature ensures that users cannot incur losses surpassing the amount they have deposited into their accounts. This serves as an additional layer of security, fortifying user confidence and mitigating the risk of significant financial setbacks.

User Reviews:

In the realm of online trading, user feedback serves as a valuable metric for evaluating a platform’s safety and reliability. eToro has garnered an array of positive reviews from its user base, with many lauding its intuitive interface and innovative social trading capabilities.

However, it’s important to acknowledge that, like any trading platform, eToro has encountered some negative reviews. These critiques often revolve around challenges related to deposits, withdrawals, customer support, and fee structures. It’s worth noting that such negative feedback is not uncommon in the industry. As prudent traders, it’s advisable to carefully assess these reviews while also considering the platform’s overall reputation, robust safety measures, and regulatory adherence when making an informed decision.

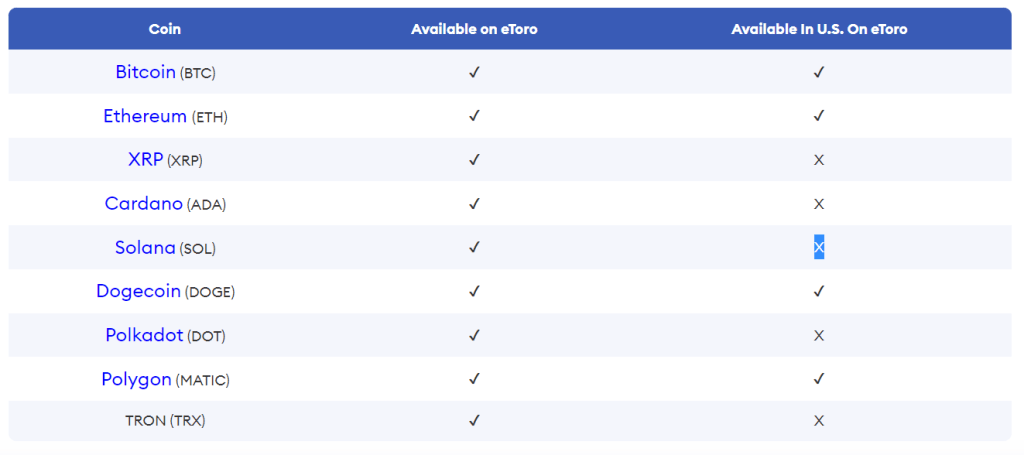

Here’s a list of more popular coins available on eToro

Related Post: City Index Review 2023: Is it the Best Online Trading Platform?

eToro: Offering of Investments

eToro stands as a versatile trading platform, presenting a wide array of investment opportunities to its users. From stocks and ETFs to crypto trading and forex, eToro offers a rich assortment of assets, making it an attractive choice for investors. In this SEO-friendly article, we’ll delve into the diverse investment options available on eToro, discussing trading choices, leverage, and margin trading features provided by the platform.

A Wealth of Assets on eToro:

eToro grants users access to an expansive selection of assets, encompassing stocks, ETFs, cryptocurrency trading, forex, and commodities. The platform’s stock offerings span renowned companies like Apple, Amazon, and Tesla, as well as promising emerging firms from various corners of the globe. For diversification, eToro offers a range of ETFs, providing users exposure to well-curated portfolios of assets.

Furthermore, eToro extends access to an extensive suite of cryptocurrency trading options, including Bitcoin, Ethereum, Ripple, and more. Forex enthusiasts can engage in a diverse spectrum of currency pairs, encompassing major, minor, and exotic pairs. Finally, eToro caters to those interested in commodities, featuring precious metals like gold and silver, as well as the energy market with oil trading.

Varied Trading Possibilities:

eToro caters to diverse trading preferences. Users can opt for a long-term investment strategy, holding assets over an extended period, or engage in short-term trading. Additionally, eToro offers an innovative social trading feature, allowing users to follow and replicate the trades of fellow platform users.

For those seeking a more hands-off approach, eToro introduces CopyPortfolios. These pre-constructed investment portfolios are professionally managed by eToro’s investment team, offering users exposure to a range of assets and markets.

Leverage and Margin Trading:

eToro enhances trading potential by offering leverage and margin trading options. This functionality empowers users to open positions larger than their account balance, amplifying both potential profits and potential losses. The extent of available leverage varies based on the asset being traded, with higher leverage typically accessible for assets with higher volatility, such as cryptocurrency and forex.

It’s crucial to exercise caution when using leverage and margin trading on eToro. While they can magnify gains, they also heighten the risk of losses. Users must thoroughly assess their risk tolerance and adopt a well-considered trading strategy before engaging in leverage and margin trading activities on the platform.

You May Also Like: BDSwiss Review 2023: Is it a Reliable Forex and CFD Broker?

eToro: Commissions

eToro is a popular trading platform that provides users with access to a range of investment options. While the platform offers a variety of features and benefits, it’s important to understand the cost structure and fees associated with trading on eToro. In this article, we’ll explore eToro’s commissions and fees and compare them to other trading platforms.

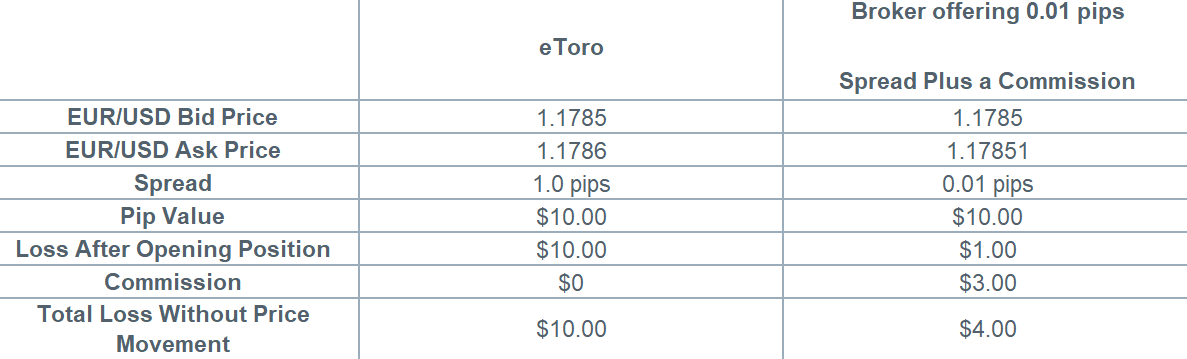

Here’s the eToro Direct Trading Cost Overview and Comparison

eToro’s Cost Structure: Unpacking Pricing and Fees

eToro employs a spread-based pricing model for most of its assets, a crucial aspect to consider when evaluating the cost of trading. In this SEO-friendly article, we’ll delve into how eToro’s cost structure functions, including spreads, transaction fees, markups, and their potential impact on your trading expenses.

Spreads: The Variable Cost Component

eToro’s pricing model relies on spreads, which represent the difference between the bid and ask prices. These spreads fluctuate and can vary based on the asset being traded and prevailing market conditions. To illustrate, when trading Apple stock on eToro, you can typically expect a spread of approximately 0.09%.

Additional Transaction Fees:

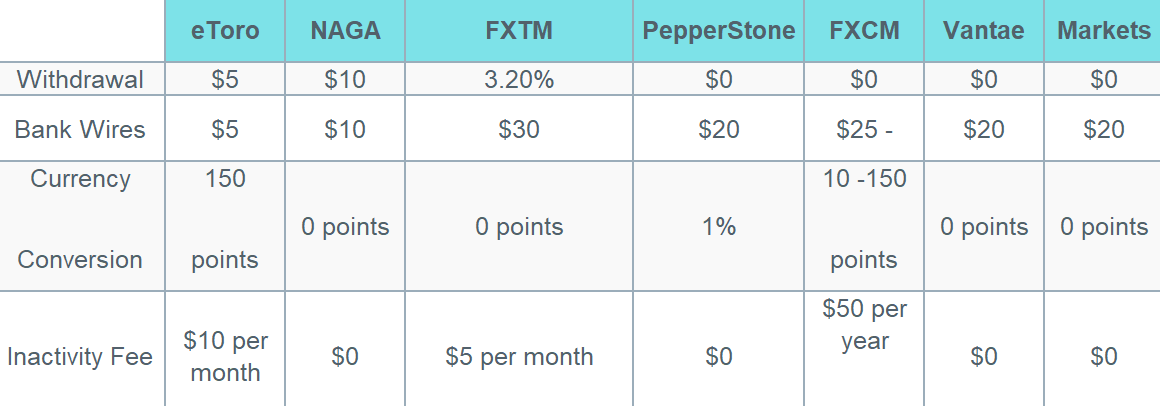

Beyond spreads, eToro imposes modest fees for specific transaction types. For instance, forex trades may incur overnight rollover fees. Additionally, eToro levies a withdrawal fee of $5 per transaction, a consideration when managing your funds.

Spreads, Markups, and Special Charges:

It’s worth noting that eToro may introduce markups or other charges on certain assets, impacting the overall cost of trading. For example, when engaging in crypto trading, eToro may apply a markup to the spread, potentially increasing your trading costs.

Commission-Free Trading, but Beware of Spreads:

eToro stands out by not charging commissions for trading stocks, ETFs, or cryptocurrencies. However, it’s imperative for users to remain vigilant about the potential impact of spreads, markups, and special charges on the cost of their trades. While commissions are absent, these factors play a role in determining the true expense of trading on the platform. Make informed decisions by considering the interplay of these elements within eToro’s cost structure.

Comparison to Other Trading Platforms:

When comparing eToro’s commissions and fees to other trading platforms, it’s important to consider the total cost of trading. While eToro does not charge commissions for trading, the cost of spreads and other fees can add up over time.

For example, when trading Apple stock on eToro usa securities inc, the spread is typically around 0.09%. In comparison, some other trading platforms may offer spreads as low as 0.01%. While this may seem like a small difference, it can add up over time, especially for active traders.

Additionally, eToro’s withdrawal fee of $5 per transaction may be higher than other trading platforms, which may offer free or lower-cost withdrawals.

Further Reading: Swissquote Review: Is This the Best Online Broker in 2023?

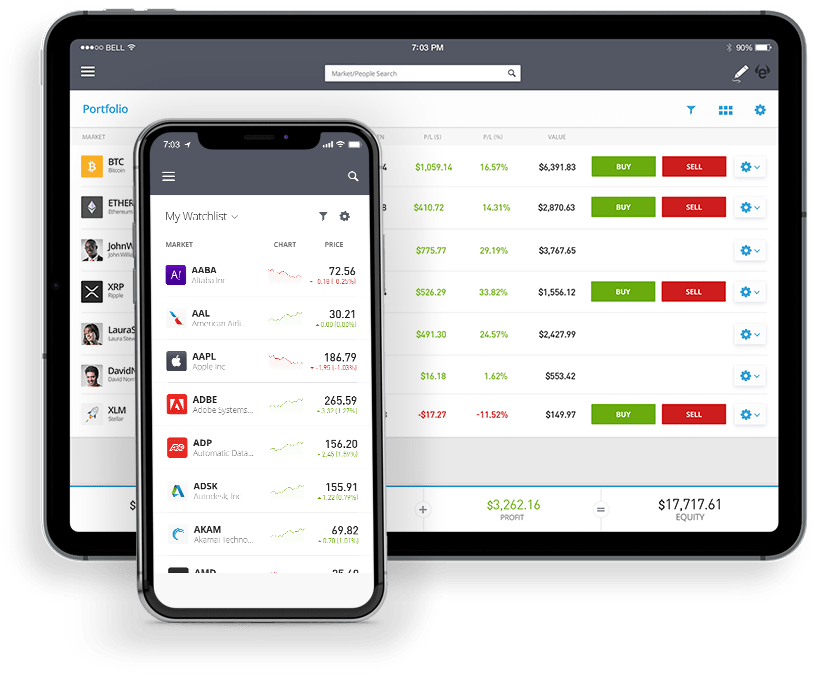

eToro’s Mobile Trading Apps

In today’s dynamic world, trading platforms must keep pace with the demands of mobile users. Recognizing this imperative, eToro USA Securities Inc. has crafted mobile trading apps that empower users to access the platform’s robust features and functionality while on the move. This article is your guide to exploring eToro’s mobile trading apps, covering their features, availability, user experience, and more, all designed with SEO in mind.

eToro’s Mobile App Features: Trading at Your Fingertips

eToro’s mobile trading apps are meticulously designed to provide users with comprehensive access to the platform’s core features, all within the convenience of their mobile devices. With these apps, users can effortlessly view their portfolios, monitor performance, and execute trades from anywhere, at any time. Furthermore, the apps embrace social trading, enabling users to track and replicate the trades of accomplished investors.

Real-time market data, news, and analysis are readily available through the mobile apps, ensuring users stay abreast of market developments, enabling well-informed trading decisions. Users can set up price alerts and notifications, enhancing their ability to monitor market movements and keep a vigilant eye on their investments.

Compatibility Across Devices: iOS and Android Compatibility

eToro’s mobile trading apps cater to both iOS and Android users, accessible for download from the App Store and Google Play Store. These apps harmonize seamlessly with most smartphones and tablets, delivering eToro’s feature-rich experience across a spectrum of devices.

Regular updates keep the mobile apps aligned with the latest operating systems and devices, reinforcing a smooth and dependable trading experience for users.

User Experience: Convenience Meets User-Friendliness

User feedback sings praises for eToro’s mobile trading apps, lauding their convenience and user-friendly interfaces. Navigating the platform and executing trades is an intuitive and straightforward process, enhancing the overall user experience.

The social trading features embedded in the apps have earned acclaim, fostering connections among traders and facilitating knowledge sharing. The ability to replicate the trades of successful investors has emerged as a favored feature among users.

While occasional reports of technical issues have surfaced, eToro’s responsive customer support team remains on hand to assist users in resolving any challenges they encounter.

Explore More: Markets.com Review: Is This the Best Broker for You in 2023?

Other Trading Platforms: eToro Forex Broker

eToro is committed to catering to the diverse needs and preferences of its users, offering a range of trading platforms. This article explores eToro’s alternative trading platforms, emphasizing their features, and their seamless integration with social trading networks, while adhering to SEO principles.

Diving into eToro’s Web Platform:

eToro’s web-based and desktop trading platforms serve as bastions of advanced trading capabilities. These platforms empower users with access to real-time market data, news, and analyses, providing a comprehensive view of market dynamics for well-informed trading decisions.

Charting aficionados will appreciate the advanced charting tools and technical indicators that enable in-depth analysis of market trends and patterns. Users can effortlessly execute trades and manage their portfolios directly through these platforms.

The web-based platform’s accessibility from any web browser, devoid of installation requirements, underscores its user-friendliness. Navigating the platform and utilizing its features is a breeze.

The Desktop Platform: Elevated Functionality

For enhanced features and functionality, eToro’s desktop platform caters to both Windows and Mac OS users. It boasts faster execution speeds and enriched charting capabilities, making it a preferred choice among seasoned traders seeking heightened performance.

Third-Party Platforms: MetaTrader 4 (MT4)

In addition to its proprietary platforms, eToro extends support to third-party trading platforms like MetaTrader 4 (MT4). MT4 is a renowned choice among traders, celebrated for its advanced charting tools, technical indicators, and automated trading capabilities.

eToro’s integration with MT4 allows users to harness its features while enjoying the benefits of eToro’s social trading network. This amalgamation facilitates the replication of successful traders’ strategies and the sharing of personal trading approaches within the eToro community.

Seamless Social Trading Network Integration:

Integral to eToro’s identity, the social trading network empowers users to connect with fellow traders, share insights, strategies, and mutually learn from each other’s experiences. eToro’s web-based and desktop trading platforms harmoniously integrate with this social trading network, offering users direct access to its vibrant features.

Users can readily scrutinize the performance of other traders and, with a few clicks, emulate their trades. Furthermore, users can disseminate their own trades and strategies, fostering a following and potentially augmenting their income via eToro’s Popular Investor program.

Discover: FP Markets Review 2023: Is This Broker Worth Your Investment?

eToro: Market Research

eToro extends a robust suite of tools and resources, poised to empower users with the knowledge needed to make well-informed trading decisions. This SEO-friendly article delves into the wealth of resources eToro offers, including market analysis and research tools, charting and technical analysis features, and insights from industry experts.

Market Analysis and Research Tools: Insights at Your Fingertips

eToro’s arsenal includes a diverse range of tools and resources tailored for market analysis and research. Among these are economic calendars, earnings reports calendars, and a steady stream of market news. The economic calendar stands as a vital resource, furnishing users with insights into upcoming economic events and their potential ramifications on financial markets. The earnings reports calendar, on the other hand, aids traders in monitoring earnings announcements by companies and their influence on stock prices. The platform also keeps users well-informed with comprehensive market news coverage, encompassing general market trends as well as company-specific updates.

Charting Features: A Visual Perspective for Traders

eToro’s charting and technical analysis features transcend platforms, available on both web-based and mobile interfaces. These robust charting tools empower users to explore different time frames and chart types, overlay technical indicators, and create essential annotations like trend lines. Technical analysis enthusiasts will find a treasure trove of indicators, including moving averages, Bollinger Bands, and MACD, along with chart patterns such as head and shoulders, triangles, and flags.

Insights from Industry Experts: Expertise at Your Fingertips

To further enhance trading acumen, eToro presents news and commentary from esteemed industry experts, including market analysts and seasoned traders. These insights serve as a compass, guiding users through the dynamic landscape of market trends and potential trading opportunities. Users can effortlessly access these expert perspectives directly from the platform or subscribe to eToro’s newsletter for a steady stream of valuable updates.

Check out: GWtrade Review 2023: Is This Broker Worth Your Investment?

Educational Resources By eToro

eToro goes the extra mile in fostering trading proficiency among its users by offering a diverse array of educational resources. This SEO-friendly article explores eToro’s commitment to user education, encompassing trading courses, webinars, tutorials, and essential tools, including demo accounts.

Abundant Learning Resources and Materials: E-books, Blogs, and Articles

eToro equips users with a rich reservoir of learning materials, encompassing e-books, blogs, and articles. This treasure trove covers a wide spectrum of topics, spanning trading strategies, market analysis techniques, and risk management principles. Users can readily access these valuable resources directly through the eToro platform or by visiting the eToro Academy website.

Structured Learning: Trading Courses, Webinars, and Tutorials

For those seeking a more structured educational path, eToro offers trading courses, webinars, and tutorials. These resources cater to traders at various skill levels. Beginner-level courses delve into trading fundamentals, while advanced offerings explore specific trading strategies and sophisticated market analysis techniques. Experienced traders and industry experts lead webinars and tutorials, facilitating interactive discussions and Q&A sessions to enrich the learning experience.

Empowering Your Skills: Trading Tools and Demo Accounts

eToro bolsters users’ skills by providing a suite of trading tools and invaluable demo accounts. These tools facilitate the practice of trading skills and the exploration of diverse strategies. Demo accounts, in particular, offer users the opportunity to engage in risk-free trading with virtual funds, emulating real-world trading conditions without financial exposure. This serves as a valuable resource for novice traders embarking on their trading journey.

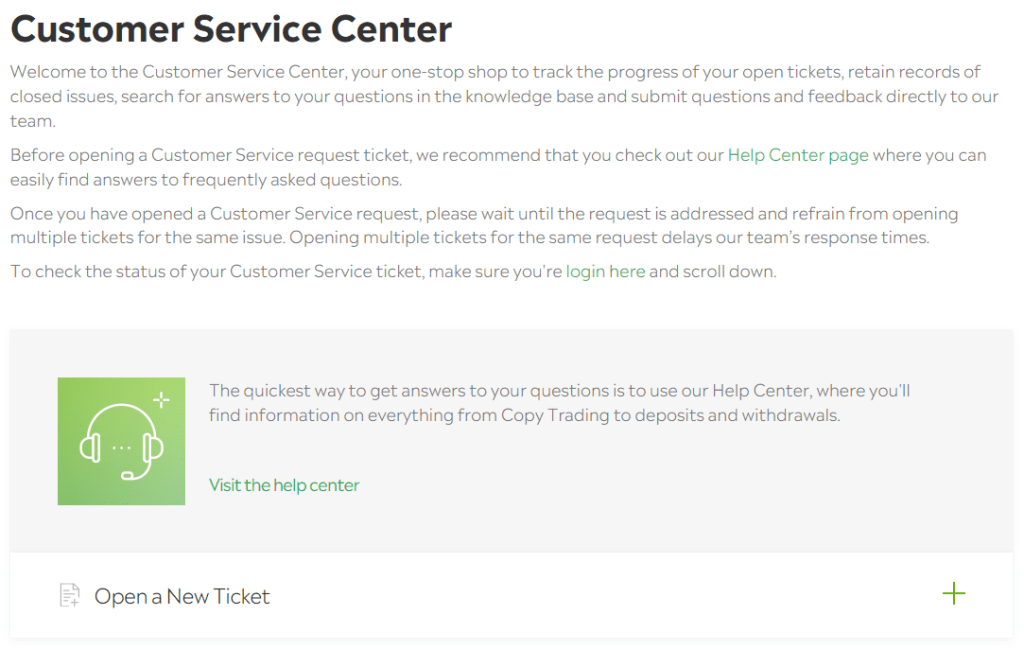

eToro account has a dedicated link for their customer support and support related articles can also be found on their website

More Resources: IronFX Review 2023: Pros, Cons and Everything You Need to Know

eToro Broker: Customer Support

eToro places paramount importance on delivering exceptional customer support through a multitude of accessible channels. This SEO-friendly article explores eToro’s commitment to providing responsive and user-centric customer service, with a track record of positive feedback from its valued customers.

Accessibility at Your Service: eToro’s Support Team

eToro’s customer service team stands ready to assist users 24/5, from Monday to Friday. This unwavering commitment to availability is a testament to the company’s dedication to providing prompt and efficient support. Users can reach out through diverse channels, including email, phone, and live chat, ensuring a hassle-free experience when seeking assistance or answers to inquiries.

Contact Methods: Multiple Avenues to Assistance

Navigating eToro’s customer support is a seamless process. The live chat feature is seamlessly integrated into the eToro platform, providing immediate access for users who may require real-time assistance during their trading endeavors. The phone support service, available in multiple languages, further enriches the user experience. For added convenience, users can also submit support tickets directly through their eToro accounts. Additionally, eToro extends a comprehensive FAQ section on its website, offering quick solutions to common queries.

User Satisfaction: A Testament to Excellence

eToro’s customer support team has earned acclaim from users who have experienced its responsiveness and professionalism firsthand. The positive feedback underscores eToro’s commitment to delivering top-tier support. Users also appreciate the company’s multilingual support efforts, ensuring accessibility for a diverse global audience.

Here’s the link to eToro’s customer support page: https://www.etoro.com/customer-service/

Final Thoughts About eToro

Unlocking eToro: A User-Friendly Trading Platform

eToro stands out as a user-friendly trading platform that opens doors to a diverse world of assets and markets. This SEO-friendly review explores eToro’s unique offerings, including stocks, cryptocurrencies, and forex, along with its distinctive social and copy trading features.

A Multifaceted Trading Experience: Assets Galore

eToro distinguishes itself by offering a comprehensive array of assets and markets, spanning stocks, cryptocurrencies, and forex. This diverse portfolio appeals to traders seeking a broad spectrum of investment opportunities. Notably, eToro’s social and copy trading features add a distinctive layer, making it an enticing choice for those eager to follow and replicate the strategies of successful traders.

Fees and Transparency: An Attractive Proposition

While eToro’s fee structure may appear higher compared to some competitors, its transparency and the absence of commission fees for stock trading render it an appealing choice for stock traders. This transparency instills confidence, allowing traders to better manage their trading costs.

On-the-Go Trading: Seamless Mobile Experience

eToro’s well-designed mobile apps mirror the desktop platform’s full suite of features, simplifying on-the-go trading. This mobile accessibility caters to traders’ dynamic lifestyles, providing convenience and flexibility.

Empowering New Traders: Education and Demo Accounts

eToro’s educational resources and demo accounts create a nurturing environment for novice traders. These resources facilitate learning and experimentation, empowering new traders to delve deeper into the world of trading.

Considerations for Seasoned Traders: Research and Support

Seasoned traders may find eToro’s research and analysis tools relatively limited, potentially posing a challenge for those heavily reliant on these resources. Additionally, the platform’s customer support options, though accessible, may warrant consideration for users with specific support needs.

Conclusion: eToro’s Versatility and Safety

In conclusion, eToro earns its reputation as a reputable and secure trading platform, catering to traders of all levels. Nonetheless, choosing the right platform hinges on aligning your trading needs and goals. Before you embark on your trading journey, carefully evaluate whether eToro’s versatile offerings resonate with your objectives.

Frequently Asked Questions

What is eToro, and how does it work?

eToro is an online trading platform that allows users to invest in a wide range of assets, including stocks, cryptocurrencies, and forex. It stands out for its unique features like social trading and copy trading, enabling users to follow and replicate the trades of experienced traders.

Is eToro a safe platform for trading and investing?

Yes, eToro is considered a safe and reputable platform. It’s regulated by various financial authorities and employs security measures such as encryption and segregated user funds to protect users’ assets.

What assets can I trade on eToro?

eToro offers a diverse range of assets, including stocks, cryptocurrencies like Bitcoin and Ethereum, and forex currency pairs. You can access various investment options within these categories.

How are eToro’s trading fees structured?

eToro uses a spread-based pricing model for most assets, meaning the difference between the buy and sell prices (the spread) is the primary cost. While eToro doesn’t charge commissions for stock trading, it’s essential to consider spreads when evaluating trading costs.

Does eToro offer a mobile app for trading on-the-go?

Yes, eToro provides well-designed mobile apps that offer the same features as the desktop platform. This mobile accessibility enables users to trade and manage their portfolios conveniently from their smartphones or tablets.

Can I practice trading on eToro before using real funds?

Absolutely. eToro offers demo accounts that allow you to trade with virtual money. This feature is invaluable for new traders looking to gain experience and test strategies without risking real capital.

What educational resources does eToro provide for traders?

eToro offers a range of educational resources, including trading courses, webinars, e-books, blogs, and articles. These materials cover various topics, from trading basics to advanced strategies, fostering continuous learning.

How does social trading work on eToro?

Social trading on eToro allows you to connect with other traders, follow their trades, and even copy their trading strategies automatically. It’s an excellent way to learn from experienced traders and diversify your portfolio.

What are the advantages of using eToro’s copy trading feature?

The primary benefit of eToro’s copy trading is the ability to replicate the trading strategies of successful investors, even if you’re a beginner. It offers a passive way to potentially earn returns by following the strategies of experienced traders.

Is customer support readily available on eToro?

eToro offers customer support through various channels, including email, phone, and live chat. While it’s accessible during trading hours, users have reported positive experiences with the platform’s support team in terms of responsiveness and professionalism.