LegacyFX Review 2023

Table of Contents

ToggleConsidering trading with LegacyFX in 2023? Look no further! In this comprehensive LegacyFX review, we’ll delve into every aspect of their services, enabling you to make an informed choice. From examining their trading platform and fee structure to assessing customer support, we’ve got you covered.

LegacyFX, an established player since 2014, is based in Saint Vincent and the Grenadines. Its offshore location makes it a preferred option for traders seeking a trustworthy broker. Over the years, LegacyFX has built a stellar reputation, offering some of the tightest spreads in the industry and a strong commitment to top-notch customer service.

Discover whether LegacyFX is the ideal broker for your needs by reading on. We’ll provide you with all the essential information to help you make the right decision. Don’t miss out on this opportunity to make an informed choice when selecting your broker for 2023!

Related Post: DooPrime Review 2023: A Detailed Analysis of Trading Experience

Overview of LegacyFX

LegacyFX is an online trading platform that has been around since 2021. It offers traders access to the global financial markets and allows them to trade a wide range of assets, from stocks and commodities to currencies and cryptocurrencies. With its user-friendly interface, advanced trading tools, and multiple account types, it’s easy to see why LegacyFX has become one of the most popular online trading platforms. In this LegacyFX review 2023, we’ll take a closer look at some of the pros and cons of using this platform.

Unlock the full potential of LegacyFX with its extensive feature set, giving traders a competitive edge in 2023. Explore numerous technical indicators, automated trading strategies, and advanced charting tools, empowering you to analyze markets and identify lucrative trading opportunities. Tailor your trading experience to your unique needs with a diverse range of account types offering various leverage options and commission structures.

Rest easy knowing that LegacyFX is diligently regulated by multiple European authorities, providing a secure investment environment for peace of mind.

However, it’s essential to note some areas for improvement. Reports indicate room for enhancement in LegacyFX’s customer support service, with users expressing concerns about lengthy response times from support agents. Additionally, the relatively high minimum deposit requirement may pose a hurdle for newer or less experienced traders looking to kickstart their journey on the platform.

You May Also Like: ACY Securities Review 2023: A Detailed Look at Trading Services

Pros & Cons of LegacyFX

Pros

- Wide range of financial instruments

- Access to MetaTrader 5 (MT5) platform

- Multiple account types to choose from

- User-friendly trading platform

- Low minimum deposit requirement

Cons

- Not regulated by top-tier authorities

- Limited educational resources

- Limited deposit and withdrawal options

- Limited research tools

- Higher spreads and fees compared to some other brokers.

LegacyFX: Account Types

When delving into the world of LegacyFX trading, traders are presented with a diverse array of account types to cater to their unique needs and objectives. Let’s explore these account options in this segment to guide you in making the right choice.

Among the most favored choices is the Standard Account, known for its widespread appeal. With a modest minimum deposit requirement of $500, traders gain entry to a realm where fixed spreads, commencing from just 1.8 pips, facilitate trading efficiency. The Standard Account offers a generous leverage of up to 1:30 and stands out for its commission-free trading. Moreover, traders operating this account can access a vast selection of over 60 currency pairs, alongside commodities, indices, shares, and cryptocurrencies, broadening their trading horizons.

Elevate your trading experience with the exclusive VIP Account, designed for traders seeking advanced tools and premium advantages. Discover this elite account option, requiring a minimum deposit of $5,000, and unlock a world of possibilities that go beyond the standard features.

As a VIP Account holder, you’ll enjoy all the benefits available with the Standard Account, and more. Dive into trading with razor-thin spreads, starting from an impressive 0 pips, and harness higher leverage, reaching up to an impressive 1:400.

But that’s not all. VIP traders are in a league of their own, receiving priority support from seasoned brokers who offer personalized guidance and expertise when you need it most. Explore the VIP Account for a truly elevated trading journey.

Further Reading: Formax Prime Review: A Comprehensive Look at a Forex Broker

Trading Platforms Available At LegacyFX

LegacyFX offers a variety of trading platforms to its customers. There’s the popular MetaTrader 4 (MT4), MT5, and Web Trader. All these platforms offer an array of features, including customizable trading interfaces, access to real-time market data, and advanced charting capabilities.

The MT4 platform stands out as a must-have for traders seeking automated trading tools and Expert Advisors (EAs). With support for multiple order types and comprehensive account management tools, it’s a versatile choice for optimizing your trading strategy. Meanwhile, the MT5 platform boasts its own unique features, including hedging capabilities and an extensive array of financial instruments to diversify your portfolio.

For those prioritizing user-friendliness, look no further than the Web Trader platform. This hassle-free option requires no downloads or installations, offering compatibility across all devices with an internet connection. Its intuitive interface ensures easy navigation, even for those new to trading. Rest assured, all LegacyFX platforms are built with robust security measures to safeguard your funds. Experience trading with confidence at LegacyFX.

Explore More: Interactive Brokers Review 2023: Features, Fees & User Feedback

LegacyFX: Fees And Commissions

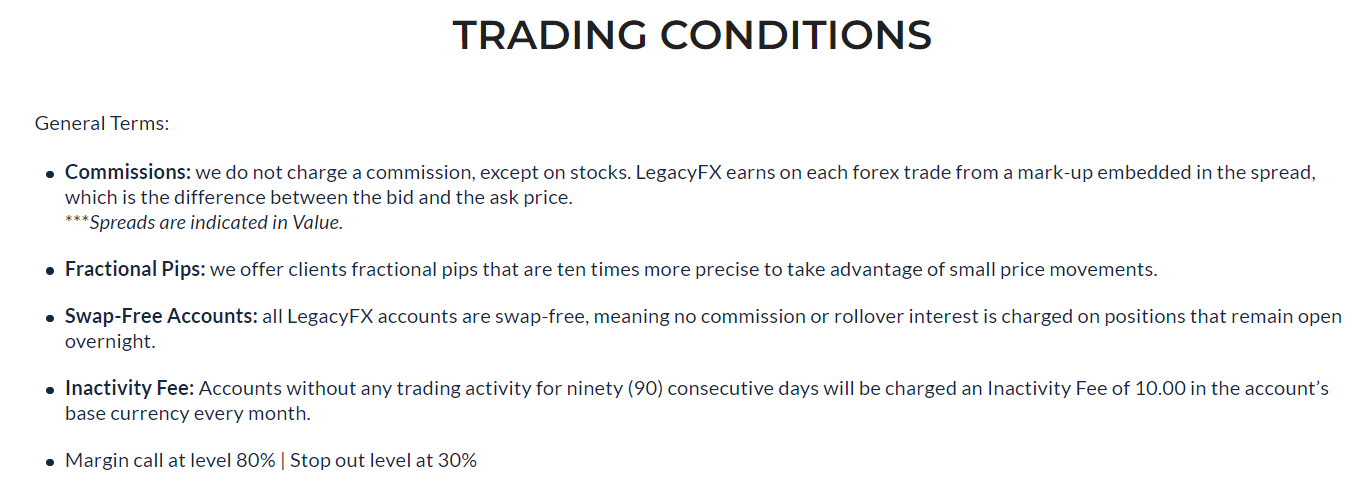

Turning our attention to the financial aspects of trading on LegacyFX, it’s crucial to delve into the fees and commissions entailed in your trading journey. A clear understanding of these costs plays a pivotal role in evaluating whether LegacyFX aligns with your trading goals.

LegacyFX stands out as a beacon of affordability within the industry, offering some of the most competitive fees and commissions. Their fee structure involves a fixed spread for all currency pairs, eliminating concerns about hidden fees or commissions. This commitment to transparency ensures that traders receive exceptional value for their trades, bolstering their confidence in the platform’s financial integrity.

| Minimum Deposit | $500 |

| Average Spread EUR/USD – Standard | N/A |

| All-in Cost EUR/USD – Active | N/A |

| Active Trader or VIP Discounts | Yes |

| ACH or SEPA Transfers | No |

| PayPal (Deposit/Withdraw) | No |

| Skrill (Deposit/Withdraw) | Yes |

| Visa/Mastercard (Credit/Debit) | Yes |

| Bank Wire (Deposit/Withdraw) | Yes |

In addition to these low costs, LegacyFX also offers free deposits and withdrawals through popular payment methods such as credit cards and e-wallets. Traders can also take advantage of promotional discounts that are offered from time to time, making their trading even more affordable. Here’s a quick breakdown of some of these key points:

- Fixed spreads on all currency pairs

- No commissions or hidden fees

- Free deposits and withdrawals through popular payment methods

- Promotional discounts offered from time to time

For those looking for an affordable trading experience with minimal costs, LegacyFX may be a good fit for them. It provides reliable trading services at competitive prices while offering an attractive selection of assets and tools to help traders succeed in their markets.

Discover: Plus500 Review 2023: Still a Top Broker for Investment?

Leverage & Margin Requirements

When it comes to trading with LegacyFX, one of the key features to consider is their leverage and margin requirements. Leverage allows traders to open larger positions with a lower initial investment, while margin requirements refer to the amount of funds needed in order to open and maintain a position. In general, LegacyFX offers high levels of leverage, ranging from 1:50 up to 1:500. This means that traders can open larger positions with a lower initial capital outlay. On top of this, they also offer extremely low margin requirements.

Navigating the realm of low margins at LegacyFX presents a dual-edged sword for traders. While it empowers them to initiate larger positions with minimal initial capital, it also exposes them to amplified potential losses in the event of unfavorable market movements. Thus, it becomes imperative for traders to grasp the intricacies of leverage and its inherent risks before venturing into positions.

For a secure trading journey, it’s essential to equip oneself with a robust understanding of leverage dynamics. Furthermore, traders should adopt prudent risk management practices, including the strategic use of stop-loss orders and meticulous position sizing when engaging in margin trading. By doing so, they can harness the benefits of low margins while mitigating potential downsides, ensuring a more controlled and informed approach to trading.

Check out: TD Ameritrade Review: Is It the Right Brokerage for You?

LegacyFX: Education Resources

Moving on from leverage and margin requirements, let’s look at the research and education resources available to traders through LegacyFX. One of the most beneficial aspects of this broker is the range of educational materials available. Whether you’re a beginner or an experienced trader, there are a wealth of resources for you to take advantage of. From webinars and tutorials to eBooks, there’s something for everyone.

The research tools provided by LegacyFX are also top-notch. These include market analysis reports, trading signals, economic calendars, and more. The broker also offers access to its own proprietary trading platform which includes charting tools and technical indicators that can help traders make informed decisions when trading in the markets.

More Resources: Unbiased Oanda Review 2023: Pros/Cons, Fees & Features

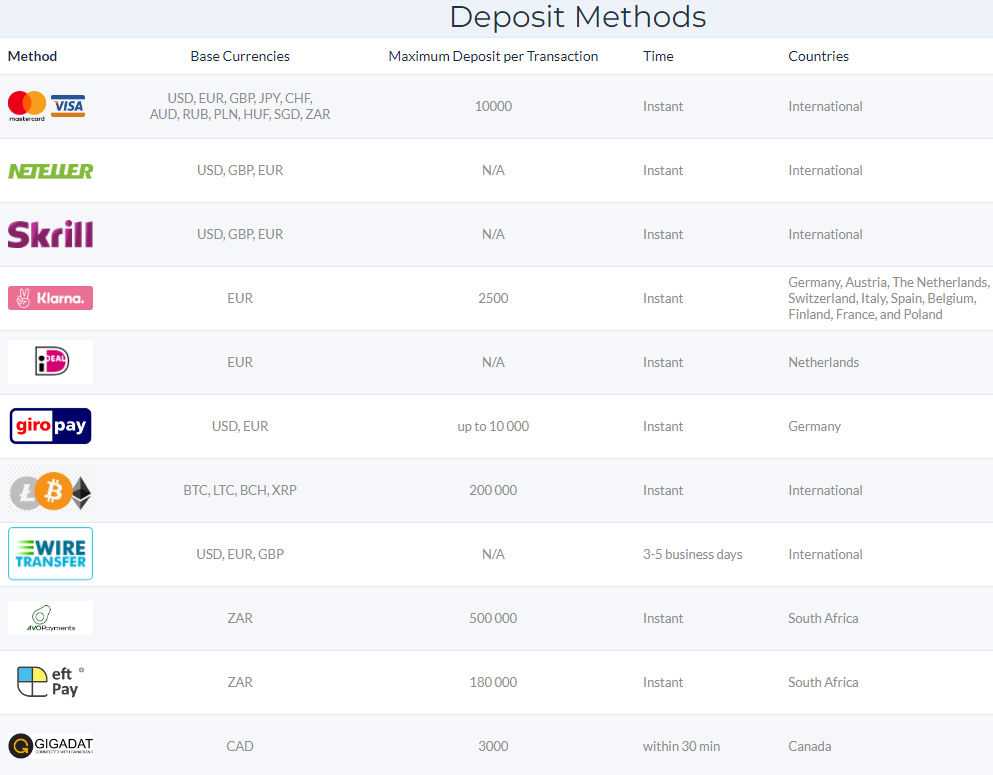

Deposits & Withdrawals At LegacyFX

LegacyFX offers several methods for deposits and withdrawals. Credit/debit cards, e-wallets, bank transfers, and cryptocurrency are all accepted forms of payment. Traders can use these options to quickly fund their accounts in a secure manner. When it comes to withdrawals, LegacyFX allows traders to access their funds within 24 hours after they make the request. There are no fees associated with deposits or withdrawals, however, customers should be aware that there may be fees imposed by their bank or payment processor.

The customer support team at LegacyFX is also available to help customers with any deposit or withdrawal issues they may encounter. They provide prompt and helpful responses to inquiries regarding deposits and withdrawals so that customers can get back to trading as soon as possible.

Overall, the range of deposit and withdrawal options provided by LegacyFX makes it easy for traders to move funds between their account and other financial institutions. This allows them to take advantage of various trading opportunities without having to worry about delays in processing payments or high fees charged by intermediaries.

Learn More: Roboforex Review 2023: Is it the Best Trading Platform Out There?

Customer Service of LegacyFX Broker

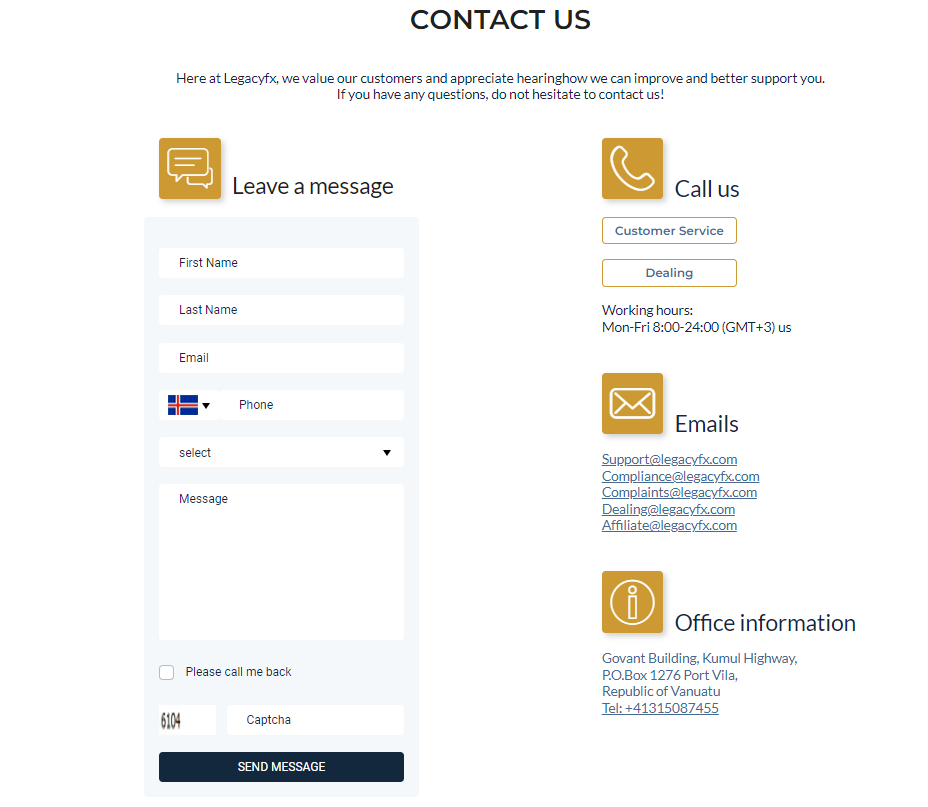

Moving on from deposits and withdrawals, let’s take a look at customer service when it comes to legacyfx. They offer a great range of support options, including live chat, email and telephone. This means they are always on hand to answer any questions or help with any issues you may have.

Legacyfx also offer a comprehensive FAQ section which covers all the most common queries related to trading. This is a great way to get advice quickly without needing to contact customer service directly. It can also save time if you are having difficulty understanding something in the platform or want more information about specific features.

Find Out: CMC Markets Review 2023: Ultimate Guide to Trading Success

LegacyFX: Regulatory Compliance

Experience peace of mind with LegacyFX, your trusted partner in the world of trading, where safety and security take center stage. Regulated by the esteemed Financial Services Authority in the UK, LegacyFX adheres rigorously to the highest standards, ensuring the utmost protection for your investments.

In full compliance with MiFID regulations and European laws, LegacyFX upholds stringent financial resource requirements and safeguards customer funds. Your capital remains shielded, held in segregated bank accounts exclusively for trading purposes. The commitment extends to maintaining ample capital reserves to cover any potential trading losses, reinforcing the platform’s unwavering dedication to your financial well-being.

Navigating diverse trading options, including Forex, CFDs, Stocks, Cryptocurrencies, Commodities, and Indices, LegacyFX remains firmly committed to regulatory compliance across each market. Rigorous adherence to industry-specific regulations ensures the safeguarding of your assets.

Dig Deeper: Forex.com Review 2023: Ultimate Trading Platform for Beginners

Overall Performance of LegacyFX Forex Broker

LegacyFX, established in 2023, has emerged as a beacon of trust and security in the world of online trading. Our commitment to providing a safe and dependable trading environment is unwavering, making us a top choice for traders in search of excellence.

Our platform boasts a robust order execution system, empowering traders with lightning-fast and precise order fulfillment, accompanied by minimal slippage. Explore advanced charting capabilities that have garnered praise from users, simplifying market trend analysis.

Continue Reading: Saxo Bank Review 2023: Best Broker for Your Trading Needs?

Take a Look: Trade Smarter with Trading 212: Pros, Cons, and Features

Frequently Asked Questions

What is LegacyFX Forex Broker?

LegacyFX is a reputable online Forex Broker that provides a platform for trading various financial instruments, including currencies, cryptocurrencies, stocks, and commodities.

Is LegacyFX a regulated broker?

Yes, LegacyFX is regulated by the Financial Services Authority in the UK, ensuring compliance with stringent safety and security standards.

How do I open an account with LegacyFX?

To open an account, visit the LegacyFX website, complete the registration process, submit required documents for verification, and fund your account.

What types of accounts does LegacyFX offer?

LegacyFX offers different account types, including Standard and VIP, catering to traders with varying needs and preferences.

What are the minimum deposit requirements for LegacyFX accounts?

The minimum deposit for a Standard Account is $500, while the VIP Account requires a minimum deposit of $5,000.

Does LegacyFX offer a demo account?

Yes, LegacyFX provides a demo account option for traders to practice their strategies without risking real money.

What trading platforms are available at LegacyFX?

LegacyFX offers the popular MetaTrader 4 (MT4) platform, known for its advanced charting tools and automated trading capabilities.

What trading instruments can I access with LegacyFX?

LegacyFX provides access to a wide range of assets, including Forex, CFDs, stocks, cryptocurrencies, commodities, and indices.

How does LegacyFX handle spreads and commissions?

LegacyFX offers competitive fixed spreads, starting as low as 1.8 pips, with no hidden commissions.

What is the maximum leverage offered by LegacyFX?

Traders can access leverage of up to 1:400, depending on the account type and instrument.

What risk management tools are available at LegacyFX?

LegacyFX offers features like stop-loss orders and price alerts to help traders manage risk effectively.

Is LegacyFX suitable for both novice and experienced traders?

Yes, LegacyFX caters to traders of all levels, offering a user-friendly interface and advanced tools for both beginners and experts.

How can I contact LegacyFX customer support?

You can reach LegacyFX’s responsive customer support team through various channels, including live chat, email, and phone.

Does LegacyFX provide educational resources for traders?

Yes, LegacyFX offers educational materials, including market analysis and trading guides, to help traders improve their skills.

Is my money safe with LegacyFX?

Yes, LegacyFX prioritizes the safety of client funds, with strict regulatory compliance and segregated bank accounts for client deposits, ensuring maximum security.