Table of Contents

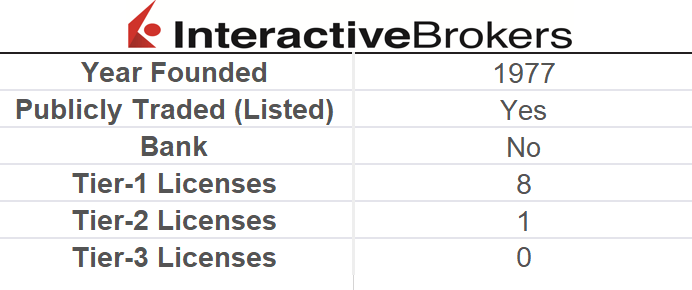

ToggleInteractive Brokers, founded in 1978 by Thomas Peterffy, stands as a venerable force in the world of online brokerage. With an extensive global presence, boasting a client base exceeding one million spanning over 220 countries and territories, Interactive Brokers has solidified its position as one of the largest brokerages globally. The firm offers an array of financial instruments for trading, encompassing stocks, options, futures, currencies, bonds, and mutual funds.

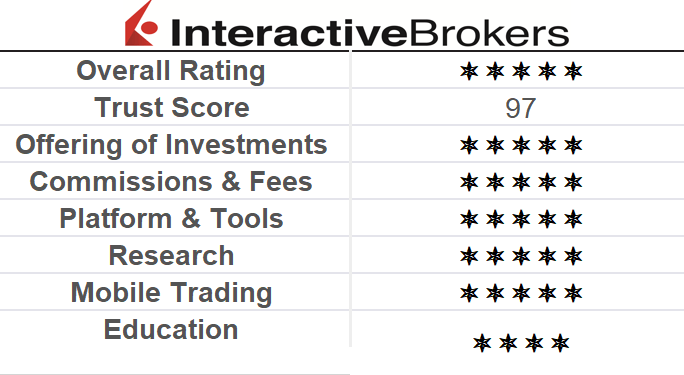

Interactive Brokers garners widespread acclaim within the industry, recognized for its cutting-edge trading technology, competitive pricing with low commissions, and an extensive product portfolio. It has earned accolades from numerous industry publications and institutions for its innovative tech solutions and pricing competitiveness. Notably, in 2021, Barron’s consecutively ranked Interactive Brokers as the #1 Online Broker for the seventh consecutive year.

The commitment to security is a hallmark of Interactive Brokers’ operations. The company adheres to stringent regulatory oversight from multiple financial authorities, including the US Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA), and the UK Financial Conduct Authority (FCA), among others. Furthermore, Interactive Brokers safeguards client assets through segregated accounts and offers insurance coverage for client funds, ensuring a robust safety net for investors.

Interactive Brokers Pros & Cons

Interactive Brokers is a popular and well-respected online brokerage firm that offers a range of trading products and services. As with any broker, there are both advantages and potential drawbacks to trading with Interactive Brokers.

Pros

- Advanced trading technology: Interactive Brokers is known for its advanced trading technology, including its Trader Workstation (TWS) platform, which provides a range of features and tools for traders.

- Wide range of products: Interactive Brokers offers a wide range of products for trading, including stocks, options, futures, currencies, bonds, and mutual funds, among others.

- Competitive pricing: Interactive Brokers offers low commissions and fees, particularly for high-volume traders. The company also offers tiered pricing based on trading volume, which can provide additional savings for active traders.

- Global reach: Interactive Brokers has a global presence, with clients in over 220 countries and territories. This provides traders with access to a diverse range of markets and trading opportunities.

- Safety and security measures: Interactive Brokers is regulated by multiple financial authorities and holds client assets in segregated accounts. The company also provides insurance coverage for clients’ funds.

Cons

- Complex platform: While the Trader Workstation platform offered by Interactive Brokers is advanced and feature-rich, it can also be complex and overwhelming for new traders. This can make it challenging to navigate and use effectively.

- Minimum deposit requirements: Interactive Brokers requires a minimum deposit of $10,000 for most account types, which may be a barrier for some traders who are just starting out.

- Inactivity fees: Interactive Brokers charges an inactivity fee of $20 per month for accounts that do not meet minimum trading requirements. This can be a significant cost for traders who are not active on a regular basis.

- Limited customer support: Some traders have reported that customer support from Interactive Brokers can be slow or difficult to access, particularly during periods of high market volatility.

- Platform stability: While Interactive Brokers’ trading technology is generally reliable, there have been occasional reports of platform outages or other technical issues.

Overall Stats of Interactive Brokers

Is Interactive Brokers safe?

Safety and security are top priorities for any online brokerage firm, and Interactive Brokers is no exception. The company has implemented a range of measures to protect its clients’ assets and ensure that trading activities are conducted in a secure and regulated environment.

Overview of Interactive Brokers’ safety measures:

Interactive Brokers takes a comprehensive approach to safety and security, which includes:

- Multiple layers of protection: Interactive Brokers uses a multi-factor authentication system, which requires users to enter both a password and a security token in order to access their accounts. This helps to prevent unauthorized access to accounts.

- Secure data transmission: Interactive Brokers uses encryption technology to protect all data transmitted between its servers and clients’ devices. This helps to prevent data theft and other security breaches.

- Regular security updates: Interactive Brokers continually updates its security protocols and technology to ensure that it is up-to-date with the latest threats and vulnerabilities.

- Cybersecurity insurance: Interactive Brokers has a cybersecurity insurance policy that provides coverage for losses resulting from cyberattacks and data breaches.

Regulatory Compliance:

Interactive Brokers is regulated by multiple financial authorities, which provides additional oversight and protection for clients’ assets. The company is a member of the Securities Investor Protection Corporation (SIPC), which provides insurance coverage for clients’ funds in the event that Interactive Brokers becomes insolvent.

In addition to the SIPC, Interactive Brokers is also regulated by the Financial Industry Regulatory Authority (FINRA), the National Futures Association (NFA), and the Securities and Futures Commission of Hong Kong (SFC), among others. These regulatory bodies help to ensure that Interactive Brokers operates in compliance with applicable laws and regulations, and that it meets certain standards for safety and security.

Interactive Brokers’ Insurance Coverage:

Interactive Brokers provides insurance coverage for clients’ assets through a combination of SIPC coverage and excess insurance. The SIPC provides coverage of up to $500,000 per account for securities and cash, with a maximum of $250,000 for cash. Excess insurance provides additional coverage beyond the limits of the SIPC.

It is important to note that while insurance coverage provides a level of protection for clients’ assets, it is not a guarantee against loss. Trading involves risk, and losses can occur even in a secure and regulated environment.

Overall, Interactive Brokers takes safety and security seriously and has implemented a range of measures to protect its clients’ assets and ensure that trading activities are conducted in a secure and regulated environment. Traders can feel confident in the company’s commitment to safety and security, although it is important to carefully consider the risks involved in trading and to seek professional advice when needed.

Related Post: Plus500 Review 2023: Still a Top Broker for Investment?

Interactive Brokers: Offering of Investments

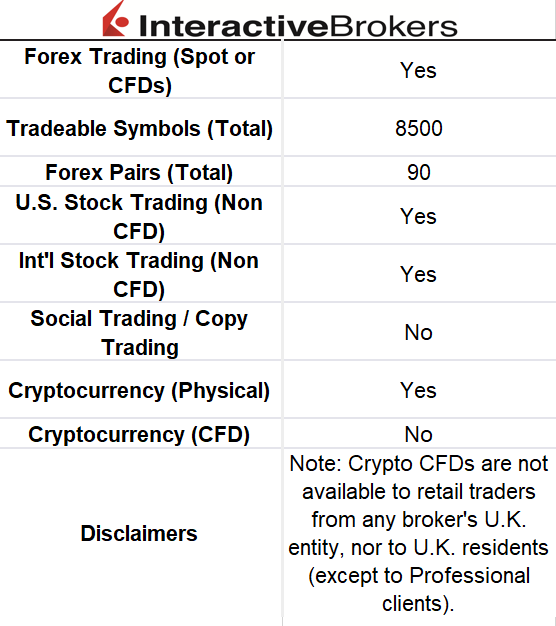

Interactive Brokers offers a wide range of products for trading, including stocks, options, futures, forex, bonds, and ETFs. The company provides access to over 135 markets in 33 countries, making it one of the most globally diversified brokers in the industry.

Range of products:

Interactive Brokers offers a broad range of products for traders to choose from, including:

- Stocks: Interactive Brokers provides access to stocks listed on over 135 exchanges worldwide, including major exchanges such as the NYSE, NASDAQ, and LSE.

- Options: The company offers options trading on stocks, indices, and futures, with competitive pricing and sophisticated trading tools.

- Futures: Interactive Brokers offers access to over 60 futures markets, including commodities, currencies, and stock indices.

- Forex: The company provides access to over 100 currency pairs, with low commissions and tight spreads.

- Bonds: Interactive Brokers offers access to over 40,000 bonds from 26 countries, with competitive pricing and advanced trading tools.

- ETFs: The company offers trading in over 8,000 ETFs from around the world, with low commissions and a wide range of investment options.

Availability of asset classes:

Interactive Brokers provides access to a broad range of asset classes, including:

- Equities: The company offers trading in equities from markets around the world, with a range of order types and execution options.

- Options: Interactive Brokers provides access to options trading on a range of underlying assets, including stocks, indices, and futures.

- Futures: The company offers access to a wide range of futures markets, including commodities, currencies, and stock indices.

- Forex: Interactive Brokers provides access to over 100 currency pairs, with low commissions and competitive pricing.

- Bonds: The company offers trading in a wide range of bonds, including government bonds, corporate bonds, and municipal bonds.

- ETFs: Interactive Brokers provides access to a broad range of ETFs, with low commissions and a range of investment options.

Interactive Brokers Account types:

Interactive Brokers offers a range of account types to suit the needs of different traders, including:

- Individual accounts: These accounts are designed for individual traders and investors, and offer a range of investment options and trading tools.

- Joint accounts: These accounts allow two or more individuals to trade and invest together, with the ability to customize the account to suit their needs.

- Corporate accounts: These accounts are designed for corporations and other entities, with a range of investment options and trading tools.

- Trust accounts: These accounts are designed for trusts and estates, with the ability to customize the account to meet the needs of the beneficiaries.

- Advisor accounts: These accounts are designed for investment advisors, with the ability to manage multiple client accounts from a single interface.

Interactive Brokers offers a wide range of products and asset classes for trading, with a range of account types to suit the needs of different traders. The company’s global reach and sophisticated trading tools make it a popular choice for traders looking for a comprehensive trading platform.

You May Also Like: TD Ameritrade Review: Is It the Right Brokerage for You?

Interactive Forex Brokers: Commissions and fees

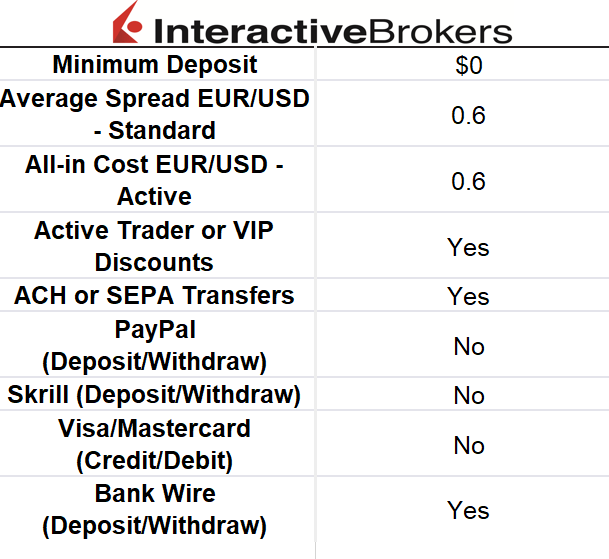

Interactive Brokers is known for its competitive fee structure, with low commissions and transparent pricing. In this section, we’ll take a closer look at Interactive Brokers’ fee structure, compare it with other brokers in the industry, and identify any hidden fees and charges that traders should be aware of.

Breakdown of Interactive Brokers’ fee structure:

Interactive Brokers’ fee structure is based on a tiered system, with fees decreasing as trading volume increases. Here’s a breakdown of the company’s fee structure:

- Stock trading: Interactive Brokers charges a commission of $0.005 per share, with a minimum commission of $1 per trade. For traders who trade in large volumes, the commission can be as low as $0.0005 per share.

- Options trading: Interactive Brokers charges a commission of $0.65 per contract, with a minimum commission of $1 per trade. For traders who trade in large volumes, the commission can be as low as $0.10 per contract.

- Futures trading: Interactive Brokers charges a commission of $0.85 per contract for most futures contracts, with discounts available for traders who trade in large volumes.

- Forex trading: Interactive Brokers charges a commission of $0.20 basis points on the notional value of the trade, with discounts available for traders who trade in large volumes.

- Bonds trading: Interactive Brokers charges a commission of $5 per bond, with a minimum commission of $1 per trade.

Comparison with other brokers:

Interactive Brokers’ fee structure is highly competitive compared to other brokers in the industry. For example, TD Ameritrade charges a commission of $6.95 per trade for stocks and options, while E*TRADE charges a commission of $6.95 for stocks and $6.95 plus $0.75 per contract for options. In contrast, Interactive Brokers’ commission for stocks is as low as $0.005 per share, and the commission for options is as low as $0.10 per contract.

Hidden Fees and Charges:

While Interactive Brokers’ fee structure is transparent and competitive, traders should be aware of certain fees and charges that can add up over time. For example, the company charges a monthly inactivity fee of $10 if traders do not generate at least $10 in commissions per month. Additionally, traders should be aware of currency conversion fees, which can range from 0.20% to 1.50% depending on the currency pair.

Overall, Interactive Brokers’ fee structure is highly competitive and transparent, with low commissions and a range of discounts available for traders who trade in large volumes. While traders should be aware of certain fees and charges, such as the monthly inactivity fee and currency conversion fees, the company’s overall pricing structure is one of its key advantages in the industry.

Further Reading: Unbiased Oanda Review 2023: Pros/Cons, Fees & Features

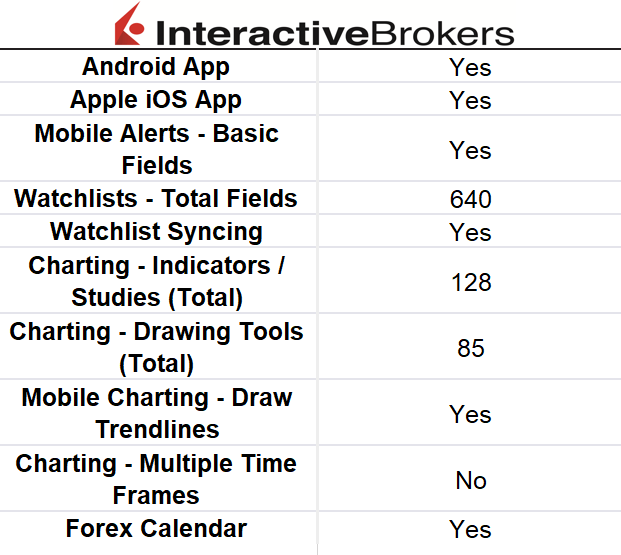

Interactive Brokers’ Mobile trading apps

Interactive Brokers offers mobile trading apps for both iOS and Android devices, which allow traders to access their accounts and trade on the go. In this section, we’ll take a closer look at Interactive Brokers’ mobile app, its features and functionalities, and its user experience and ease of use.

Overview of Interactive Brokers’ mobile app:

Interactive Brokers’ mobile app is designed to provide traders with access to a range of features and functionalities, including the ability to trade stocks, options, futures, forex, and bonds, view account balances and positions, access market data and news, and more. The app is available for free download on both the App Store and Google Play.

Features:

Interactive Brokers’ mobile app offers a range of features and functionalities designed to help traders stay informed and execute trades quickly and easily. Some of the key features of the app include:

- Trading: Traders can trade a range of products, including stocks, options, futures, forex, and bonds, directly from the app.

- Market data: The app provides access to real-time market data, including quotes, charts, and news.

- Account management: Traders can view their account balances, positions, and transaction history, as well as make deposits and withdrawals.

- Watchlists: Traders can create custom watchlists to track their favorite stocks and other securities.

- Alerts: Traders can set up alerts to be notified when certain market conditions are met, such as when a stock reaches a certain price.

User experience:

Overall, Interactive Brokers’ mobile app is well-designed and user-friendly, with an intuitive interface and a range of helpful features. Traders can easily access their accounts and execute trades on the go, and the app provides real-time market data and news to help traders stay informed. However, some users may find the app to be somewhat complex, particularly if they are new to trading or have limited experience with mobile trading apps. Additionally, some users have reported experiencing occasional glitches or bugs with the app, although these issues are generally rare.

Explore More: Roboforex Review 2023: Is it the Best Trading Platform Out There?

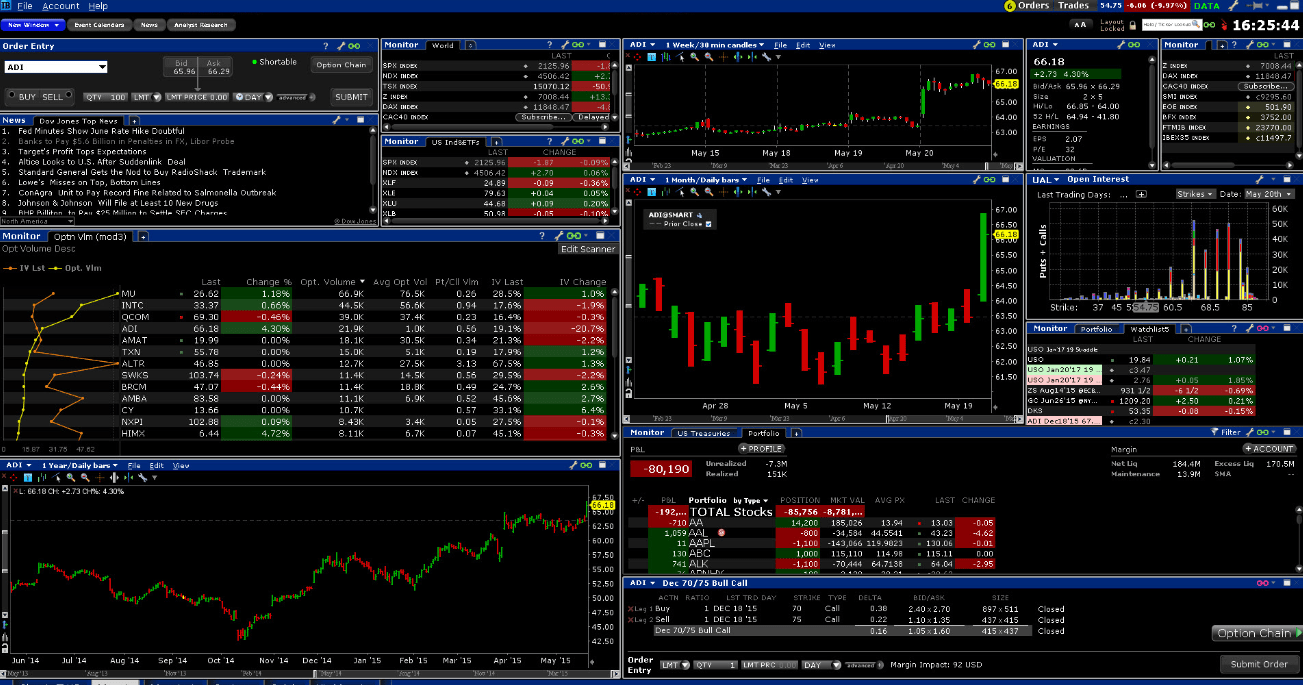

Other Trading Platforms

In addition to its mobile trading app, Interactive Brokers offers a range of other trading platforms designed to meet the needs of different types of traders. In this section, we’ll take a closer look at these platforms, compare their features and functionalities, and discuss the availability of third-party platforms.

Overview of other trading platforms offered by Interactive Brokers:

- Trader Workstation (TWS): TWS is Interactive Brokers’ flagship desktop trading platform, designed for advanced traders who require a range of powerful tools and customizable features. TWS offers a range of advanced trading tools, including real-time monitoring of market conditions, advanced order types, and customizable charts and technical indicators.

- IBKR WebTrader: IBKR WebTrader is a web-based trading platform that can be accessed from any device with an internet connection. It offers a simplified trading experience, with a clean and intuitive interface, real-time market data, and a range of order types and trading tools.

- IBKR Mobile: IBKR Mobile is a mobile trading app similar to the one discussed in the previous section. It offers many of the same features and functionalities as TWS and IBKR WebTrader, but in a mobile-optimized format.

Comparison of features and functionalities:

Each of Interactive Brokers’ trading platforms offers a range of unique features and functionalities designed to meet the needs of different types of traders. TWS is the most advanced platform, offering a range of powerful trading tools and customizable features. IBKR WebTrader is more simplified, with a clean and intuitive interface that is easy to navigate. IBKR Mobile offers many of the same features and functionalities as TWS and IBKR WebTrader, but in a mobile-optimized format. Overall, traders can choose the platform that best suits their needs and trading style.

Availability of third-party platforms:

Interactive Brokers also offers integration with a range of third-party trading platforms, including MetaTrader 4 and 5, NinjaTrader, and TradeStation. These platforms offer additional features and functionalities that are not available in Interactive Brokers’ native platforms, and can be used to trade a range of products, including stocks, options, futures, and forex. However, it’s worth noting that these platforms may come with additional fees or commissions, and may require some technical knowledge to set up and use.

Discover: CMC Markets Review 2023: Ultimate Guide to Trading Success

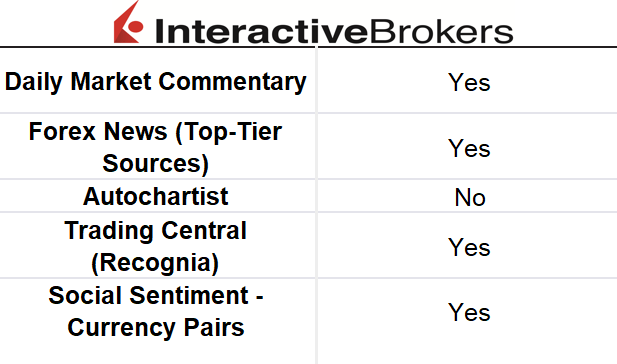

Interactive Brokers: Market research

Market research is an important aspect of trading, as it allows traders to stay informed about market conditions and make informed investment decisions. In this section, we’ll take a closer look at Interactive Brokers’ research tools and resources, as well as the analysis and insights provided by the broker.

Overview of Interactive Brokers’ research tools:

Interactive Brokers offers a range of research tools and resources designed to help traders stay informed about market conditions and make informed investment decisions. These tools include a range of market data, news, and analysis resources, as well as advanced charting tools and technical analysis indicators.

One of the most popular research tools offered by Interactive Brokers is its Market Scanner. This tool allows traders to search for stocks, options, and futures contracts based on a range of criteria, including technical indicators, fundamental data, and news events. Traders can use this tool to quickly identify potential trading opportunities and make informed investment decisions.

Analysis and insights provided:

In addition to its research tools and resources, Interactive Brokers also provides a range of analysis and insights designed to help traders make informed investment decisions. These insights include daily market updates, commentary on significant events and trends, and in-depth analysis of specific stocks, sectors, and markets.

Interactive Brokers also offers a range of educational resources designed to help traders improve their knowledge and skills. These resources include webinars, videos, and articles on a range of topics, including trading strategies, risk management, and market analysis.

Availability of market data and news:

Interactive Brokers provides access to a range of market data and news sources, including real-time data from global exchanges, news feeds from major news providers, and customizable news filters that allow traders to stay informed about specific markets or sectors. This data is available in real-time, allowing traders to make informed investment decisions based on the most up-to-date information.

Interactive Brokers also provides access to a range of advanced charting tools and technical analysis indicators, allowing traders to analyze market trends and identify potential trading opportunities. These tools include customizable charts with a range of technical indicators, including moving averages, Bollinger Bands, and RSI.

Check out: Forex.com Review 2023: Ultimate Trading Platform for Beginners

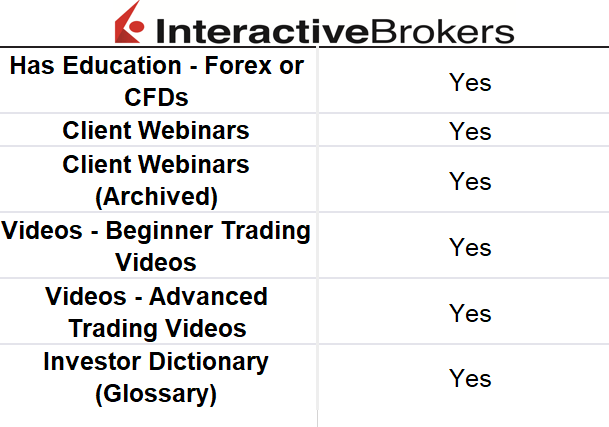

Education Resources By Interactive Brokers

Education is a crucial aspect of trading, as it can help traders improve their knowledge and skills, and ultimately make more informed investment decisions. In this section, we’ll take a closer look at Interactive Brokers’ educational resources, including the topics covered and level of depth, as well as the availability of webinars and other learning resources.

Overview of Interactive Brokers’ educational resources:

Interactive Brokers offers a range of educational resources designed to help traders improve their knowledge and skills. These resources include teachers resources, videos, webinars, and courses on a range of topics, including trading strategies, risk management, market analysis, and platform tutorials.

One of the most popular educational resources offered by Interactive Brokers is its Traders’ Academy. This online education center provides a range of courses and learning resources designed to help traders improve their skills and knowledge. The courses cover a range of topics, including trading strategies, technical analysis, options trading, and risk management.

Topics covered and level of depth:

Interactive Brokers’ educational resources cover a wide range of topics, from beginner-level tutorials to advanced trading strategies and techniques. The resources are designed to cater to traders of all skill levels, from novice traders just starting out to experienced professionals looking to improve their skills.

The level of depth of the educational resources varies depending on the topic and the target audience. For example, the beginner-level tutorials provide a basic introduction to trading concepts and terminology, while the more advanced courses cover more complex topics such as options trading strategies and quantitative analysis.

Availability of webinars and other learning resources:

Interactive Brokers offers a range of webinars and other learning resources designed to help traders improve their knowledge and skills. These resources include live and recorded webinars, video tutorials, and articles covering a wide range of topics.

The webinars are presented by experienced traders and market experts and cover a range of topics, including market analysis, trading strategies, and platform tutorials. The webinars are interactive and allow traders to ask questions and get feedback from the presenters.

Interactive Brokers also offers a range of video tutorials covering platform features and trading strategies. These tutorials are designed to help traders get the most out of the platform and improve their trading skills.

More Resources: Saxo Bank Review 2023: Best Broker for Your Trading Needs?

Final thoughts About Interactive Brokers

In summary, Interactive Brokers emerges as a trusted and dependable brokerage option, replete with numerous advantages tailored to traders and investors. Its attractive low commissions and fees, diverse spectrum of investment opportunities, and cutting-edge trading platform have propelled it into a favored choice among global traders.

While the platform’s sophistication might pose a challenge to some traders, Interactive Brokers steps in with a wealth of educational resources to empower traders in maximizing their trading endeavors. Furthermore, the brokerage’s unwavering commitment to technological advancement and innovation ensures a continual evolution of its platform, ensuring it remains at the forefront of industry trends.

All in all, Interactive Brokers serves as a robust option for traders seeking competitive pricing, an extensive array of investment avenues, and advanced trading tools and capabilities. It’s worth noting, however, that beginners or those with limited trading experience may find the platform’s complexity and higher account minimums less accommodating. Nevertheless, Interactive Brokers continues to hold its position as one of the foremost online brokers in the field, a favored choice for traders seeking a dependable and trustworthy brokerage partner.

Frequently Asked Questions

What is Interactive Brokers Forex?

Interactive Brokers Forex refers to the foreign exchange trading services offered by Interactive Brokers, a reputable brokerage firm known for its extensive range of investment opportunities, including Forex trading.

How do I open an Interactive Brokers Forex account?

To open an Interactive Brokers Forex account, visit their website, complete the application, provide required documents, and fund your account with the specified minimum deposit.

What are the fees associated with Interactive Brokers Forex?

Interactive Brokers offers competitive Forex trading fees, including low spreads and commissions. The specific fee structure depends on your account type and trading activity.

What is the minimum deposit for an Interactive Brokers Forex account?

The minimum deposit required for an Interactive Brokers Forex account varies by account type but typically starts at a reasonable amount.

What Forex trading platforms does Interactive Brokers offer?

Interactive Brokers provides access to advanced trading platforms, including the Trader Workstation (TWS) and the web-based Client Portal, suitable for Forex trading.

Is there a demo account available for Interactive Brokers Forex?

Yes, Interactive Brokers offers a Forex demo account that allows traders to practice and familiarize themselves with the platform before trading with real funds.

What is the leverage offered by Interactive Brokers for Forex trading?

Interactive Brokers provides competitive leverage options for Forex trading, subject to regulatory requirements.

Does Interactive Brokers offer Forex market analysis tools?

Yes, Interactive Brokers offers a suite of Forex market analysis tools, including charts, technical indicators, and research resources.

Is Interactive Brokers Forex regulated?

Yes, Interactive Brokers is regulated by multiple financial authorities, ensuring a high level of security and compliance.

What educational resources are available for Forex traders on Interactive Brokers?

Interactive Brokers offers educational materials, webinars, and tutorials to help traders improve their Forex trading skills.

Can I trade other financial instruments besides Forex with Interactive Brokers?

Yes, Interactive Brokers provides access to various financial instruments, including stocks, options, futures, bonds, and mutual funds.

How can I contact Interactive Brokers customer support for Forex-related queries?

You can reach Interactive Brokers’ customer support through various channels, including phone, email, and live chat, available on their website.

Are there different types of Forex accounts available at Interactive Brokers?

Yes, Interactive Brokers offers different types of Forex accounts, catering to various trading preferences and experience levels.

Does Interactive Brokers offer mobile apps for Forex trading?

Yes, Interactive Brokers provides mobile apps for Forex trading, allowing you to trade on-the-go from your smartphone or tablet.

Does Interactive Brokers offer analytics and research for Forex traders?

Yes, Interactive Brokers offers comprehensive analytics and research tools to assist Forex traders in making informed decisions.