Table of Contents

ToggleFounded in 2006, FxPro has established itself as a renowned, multi-award-winning online brokerage. Headquartered in London, UK, FxPro boasts a strong regulatory framework with oversight from prestigious financial authorities including the UK Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), the Financial Services Commission of the Bahamas (SCB), and the Dubai Financial Services Authority (DFSA).

FxPro’s global footprint extends to more than 170 countries, serving a diverse clientele. Our platform offers a diverse array of trading instruments encompassing forex, commodities, stocks, and cryptocurrencies.

In this comprehensive review, we aim to present a detailed overview of FxPro’s extensive services and offerings. We’ll delve into various aspects, including our cutting-edge trading platforms, competitive trading conditions, versatile account types, responsive customer support, and more. By the conclusion of this review, readers will gain valuable insights into what FxPro brings to the table, helping them make an informed decision about their choice of a brokerage partner.

FxPro Pros and Cons

FxPro is a global forex broker that offers trading services in more than 150 countries. The platform is renowned for its advanced trading tools, competitive pricing, and excellent customer support. However, like any other trading platform, it has its own advantages and disadvantages.

Pros

- Advanced trading platforms: FxPro offers its traders advanced trading platforms like MT4, MT5, cTrader, and Edge. These platforms provide traders with access to cutting-edge tools and features that help them make informed trading decisions.

- Tight spreads: FxPro offers competitive pricing on spreads, making it an attractive option for traders looking for low-cost trading.

- Multiple trading instruments: FxPro offers a wide range of trading instruments, including forex, commodities, indices, shares, and cryptocurrencies. This variety provides traders with numerous trading opportunities.

- Regulated broker: FxPro is regulated by top-tier financial regulators like the FCA, CySEC, and DFSA, which ensures that traders’ funds are safe and secure.

- Excellent customer support: FxPro provides traders with excellent customer support through various channels like email, live chat, and phone.

Cons

- Limited educational resources: FxPro does not provide a lot of educational resources for traders, which can be a disadvantage for beginners.

- No fixed spread accounts: FxPro does not offer fixed spread accounts, which may not be suitable for traders who prefer trading with a fixed spread.

- High minimum deposit: The minimum deposit required to open an account with FxPro is relatively high compared to other brokers, which may be a disadvantage for small traders.

- Limited payment options: FxPro offers limited payment options, which may be an inconvenience for traders who prefer using certain payment methods.

FxPro: Safety and Regulation

FxPro is a globally recognized forex and CFD broker that offers trading services to clients in over 170 countries. As a reputable financial services provider, FxPro prioritizes safety and regulation to ensure the protection of its clients’ interests. In this regard, the company operates under the oversight of various regulatory bodies, including:

Regulatory bodies overseeing FxPro

- Financial Conduct Authority (FCA) in the United Kingdom

- Cyprus Securities and Exchange Commission (CySEC) in Cyprus

- Dubai Financial Services Authority (DFSA) in the UAE

- Securities Commission of The Bahamas (SCB) in The Bahamas

- Financial Sector Conduct Authority (FSCA) in South Africa

- Securities Commission of The Republic of Vanuatu (SVF) in Vanuatu

These regulatory bodies are responsible for ensuring that FxPro adheres to strict regulatory standards and operating procedures.

Security measures for clients’ funds and personal information

FxPro takes the security of clients’ funds and personal information seriously. The company employs advanced security measures, such as two-factor authentication, SSL encryption, and segregated client accounts, to protect clients’ funds and personal data from unauthorized access or theft. Additionally, the company uses reputable banks to hold clients’ funds in segregated accounts, which ensures that clients’ funds are kept separate from the company’s operating funds.

Complaints and resolutions

FxPro has a dedicated customer support team that handles client complaints and inquiries. The company also has a complaints resolution process that is designed to resolve client complaints quickly and fairly. Clients can submit their complaints through various channels, including email, phone, or live chat. Once a complaint is received, FxPro investigates the issue and works to resolve it in a timely manner. If a client is not satisfied with the outcome, they can escalate their complaint to the relevant regulatory body.

More Resources: Eightcap Review 2023: Pros and Cons, Trading, Fees & Mobile App

Offering of Investments: FxPro

FxPro is a global online forex and CFD broker that offers a wide range of financial instruments for trading. Clients can choose from over 260 financial instruments, including forex pairs, commodities, indices, shares, and futures. With FxPro, clients can access some of the most liquid and popular markets in the world.

Range of financial instruments available for trading

FxPro provides its clients with access to a broad range of financial instruments. These include forex currency pairs from major, minor, and exotic markets, indices from around the world, and commodities like gold, silver, and crude oil. FxPro also offers trading in individual shares, including some of the most popular stocks from major global exchanges.

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 2249 |

| Forex Pairs (Total) | 70 |

| U.S. Stock Trading (Non CFD) | No |

| Int’l Stock Trading (Non CFD) | Yes |

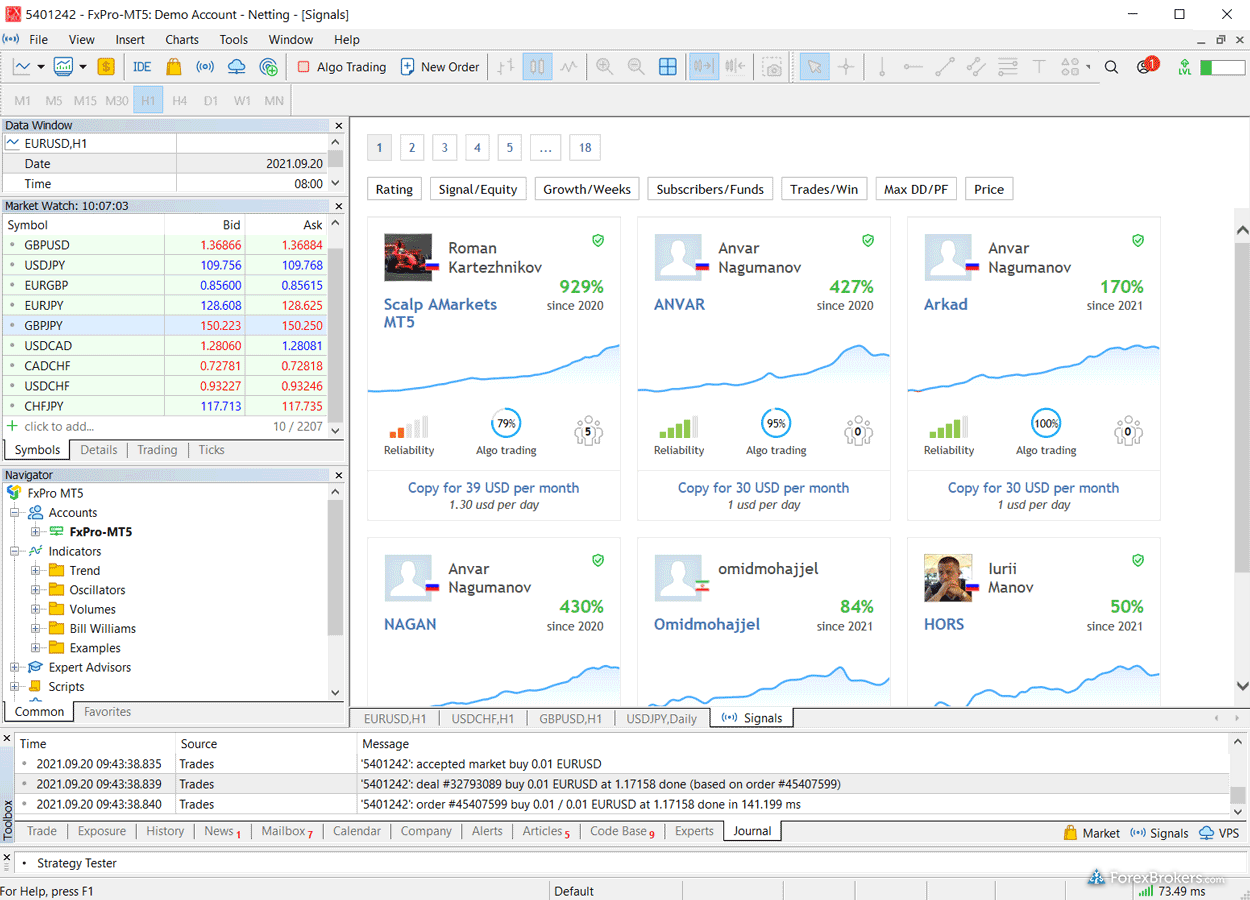

| Social Trading / Copy Trading | Yes |

| Cryptocurrency (Physical) | No |

| Cryptocurrency (CFD) | Yes |

Trading conditions for different account types

FxPro offers three different account types – the MT4, MT5, and cTrader accounts. The trading conditions vary for each account type, with the MT4 and MT5 accounts offering fixed and floating spreads, while the cTrader account provides market execution with no requotes. Clients can choose the account type that best suits their trading strategy and preferences.

Leverage and margin requirements

Leverage and margin requirements vary based on the financial instrument being traded and the account type. For forex trading, the maximum leverage is 1:500, while for share trading, the maximum leverage is 1:5. FxPro offers margin calls at 50%, meaning that when the margin level falls below this level, clients will be notified to either deposit more funds or close positions to maintain adequate margin levels.

Overall, FxPro provides a range of financial instruments, trading conditions, and leverages for its clients, making it a suitable choice for traders of all levels.

Check out: eToro Reviews 2023: Features, Platform, and User Feedback

FxPro: Commissions and Fees

FxPro is a well-established forex and CFD broker that offers competitive trading conditions to its clients. The broker offers various types of trading accounts, each with different commission and fee structures. In this article, we will discuss FxPro’s commissions and fees, spread and commission models, non-trading fees, and how they compare with other brokers in the market.

Spread and commission models: FxPro offers two types of spread models: fixed and variable. The fixed spread model is ideal for traders who want to know their trading costs upfront, while the variable spread model offers tighter spreads during market volatility. The broker also offers commission-based accounts, which are suitable for high-volume traders.

| Minimum Deposit | $100 |

| Average Spread EUR/USD – Standard | 1.51 |

| All-in Cost EUR/USD – Active | 1.27 |

| Active Trader or VIP Discounts | Yes |

| ACH or SEPA Transfers | Yes |

| PayPal (Deposit/Withdraw) | Yes |

| Skrill (Deposit/Withdraw) | Yes |

| Visa/Mastercard (Credit/Debit) | Yes |

| Bank Wire (Deposit/Withdraw) | Yes |

Non-trading fees: FxPro does not charge any deposit or withdrawal fees, except for bank wire transfers, which incur a small fee. However, the broker charges an inactivity fee of $15 per month after six months of account inactivity.

Comparison with other brokers in the market: When compared with other brokers in the market, FxPro’s commissions and fees are competitive. The broker’s spreads are relatively low, and the commission charges are reasonable, making it an attractive choice for traders looking for a reliable and cost-effective trading platform. However, traders should note that FxPro’s inactivity fee is higher than some other brokers in the market, which could be a disadvantage for inactive traders. Overall, FxPro’s commission and fee structures are competitive, and the broker provides traders with a range of trading accounts to suit their individual needs.

Discover: City Index Review 2023: Is it the Best Online Trading Platform?

Trading Platforms of FxPro

FxPro is a leading online forex and CFD broker that offers its clients a range of trading platforms to suit their needs. Among these platforms are the MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, which are popular in the forex and CFD trading communities.

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms

MT4 and MT5 are among the most widely used trading platforms in the world, with a huge user base that includes both novice and experienced traders. MT4 is known for its user-friendly interface and intuitive charting tools, while MT5 offers additional features such as more advanced technical analysis tools, more order types, and more timeframes. Both platforms offer access to a wide range of financial instruments, including forex, stocks, indices, and commodities.

cTrader platform

cTrader is a popular trading platform that is known for its advanced charting capabilities and high-speed order execution. It is particularly popular among algorithmic traders who rely on the platform’s advanced charting tools and custom indicators. cTrader also offers a range of order types and the ability to trade directly from the charts.

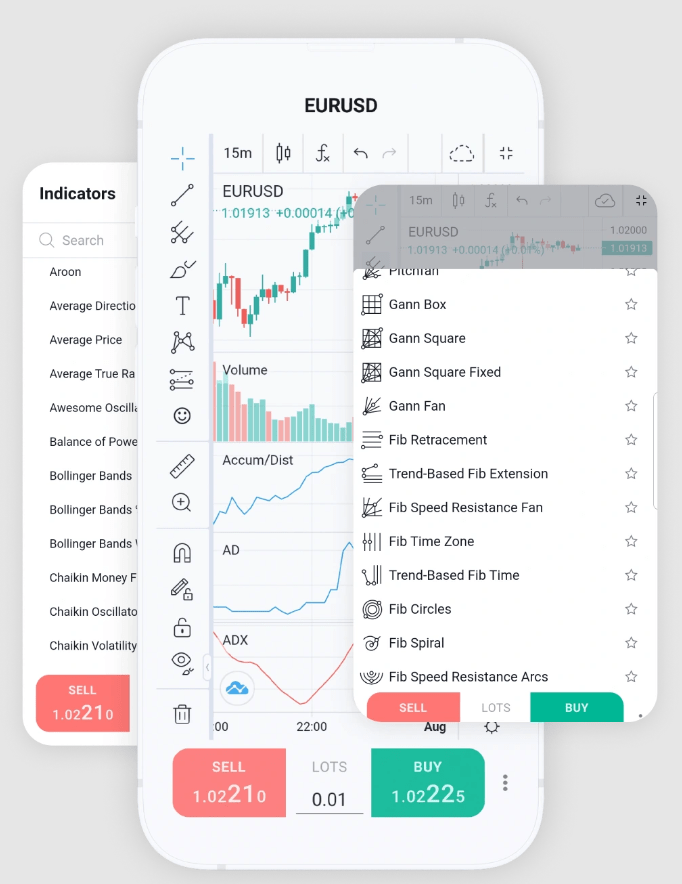

Mobile trading apps

In addition to its desktop trading platforms, FxPro also offers mobile trading apps that allow traders to access their accounts and trade on-the-go. The mobile apps are available for both iOS and Android devices and offer all the features and tools available on the desktop platforms, including real-time quotes, interactive charts, and a range of order types.

Explore More: BDSwiss Review 2023: Is it a Reliable Forex and CFD Broker?

FxPro: Market Research and Analysis

FxPro is a well-known forex and CFD trading platform that offers a wide range of trading instruments to its clients. One of the key features of the platform is its market research and analysis tools, which provide traders with valuable insights into the global financial markets.

Daily market commentary and analysis: FxPro offers daily market commentary and analysis, which covers a range of financial instruments such as forex, commodities, and indices. The analysis includes a detailed overview of the current market trends, key support and resistance levels, and potential trading opportunities. The commentary is written by experienced analysts who use a combination of fundamental and technical analysis to provide traders with a comprehensive view of the market.

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | No |

| Trading Central (Recognia) | Yes |

| Social Sentiment – Currency Pairs | Yes |

Economic calendar and news feeds: FxPro also provides its clients with an economic calendar and news feeds that keep them updated on the latest economic events and market-moving news. The economic calendar includes important indicators such as GDP, CPI, and employment data, while the news feeds cover a range of topics including politics, central bank policy, and corporate earnings.

Technical analysis tools: FxPro offers a range of technical analysis tools to help traders make informed trading decisions. The platform includes advanced charting features, indicators, and drawing tools that allow traders to analyze market trends and identify potential entry and exit points. FxPro also provides access to trading signals, which are generated by a team of professional traders using technical and fundamental analysis.

Further Reading: Swissquote Review: Is This the Best Online Broker in 2023?

FxPro’s Education and Resources

FxPro is a globally recognized online broker that provides a wide range of educational resources and tools for its traders. The company has a robust trading academy that offers comprehensive courses on trading, investment strategies, risk management, and more. Traders can access a variety of educational resources, including video tutorials, e-books, and webinars, which are designed to help them enhance their trading skills and knowledge.

Trading Academy and Educational Resources: FxPro’s Trading Academy is an extensive resource for traders of all levels. It covers a range of topics from basic concepts to advanced trading strategies, providing a solid foundation for traders to build on. The Academy offers educational materials in the form of videos, articles, and webinars, and the content is updated regularly to ensure that traders are always up-to-date with the latest market trends.

Webinars and Seminars: FxPro regularly hosts webinars and seminars featuring expert speakers from the industry. These events cover a range of topics, from fundamental analysis to advanced trading strategies, and provide an opportunity for traders to interact with experts and gain valuable insights into the market.

Customer Support and Assistance: FxPro’s customer support team is available 24/5 to assist traders with any questions or issues they may have. The team is multilingual and can be reached via email, phone, or live chat. Additionally, the broker provides a range of tools and resources to help traders manage their accounts and trades, including real-time market analysis, trading calculators, and more.

You May Also Like: Markets.com Review: Is This the Best Broker for You in 2023?

Final Thoughts About FxPro

FxPro, a well-respected online trading platform, opens doors to a vast array of financial instruments, including forex, shares, futures, metals, and more. With over 15 years of industry expertise, FxPro has earned its stripes as a go-to broker for traders worldwide.

Key Highlights of FxPro:

Advanced Trading Platforms: FxPro stands out with its sophisticated trading platforms, featuring the likes of MT4, MT5, and cTrader. These platforms offer an array of invaluable trading tools and functionalities, from real-time market data to customizable charts and automated trading strategies.

Tailored Account Types: FxPro caters to diverse trader needs with a range of account options, including demo accounts, micro accounts, and premium accounts. Our commitment to trader success extends to educational resources such as webinars and tutorials, empowering traders to enhance their knowledge and skills.

Robust Regulation: Your safety matters. FxPro operates under the regulatory purview of the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, and the Financial Sector Conduct Authority (FSCA) in South Africa. This ensures stringent adherence to regulatory standards, creating a secure trading environment.

Related Post: FP Markets Review 2023: Is This Broker Worth Your Investment?

Frequently Asked Questions

What is FxPro and what services does it offer?

FxPro is a reputable forex broker that provides access to a wide range of financial instruments, including forex, shares, futures, metals, and more. They offer advanced trading platforms, educational resources, and various account types to cater to different trader needs.

How long has FxPro been in the industry?

FxPro has been serving traders for over 15 years, making it a well-established and experienced broker.

What are the key trading platforms available on FxPro?

FxPro offers advanced trading platforms like MT4, MT5, and cTrader. These platforms come equipped with real-time market data, customizable charts, and automated trading strategies.

Can I practice trading with FxPro before investing real money?

Yes, FxPro offers demo accounts, allowing you to practice trading with virtual funds to gain experience without financial risk.

What types of trading accounts does FxPro provide?

FxPro caters to various traders with demo accounts, micro accounts for beginners, and premium accounts for experienced traders.

Does FxPro offer educational resources for traders?

Yes, FxPro provides educational materials such as webinars and tutorials to help traders enhance their knowledge and skills.

How is FxPro regulated and is it safe for trading?

FxPro is authorized and regulated by reputable bodies like the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, and the Financial Sector Conduct Authority (FSCA) in South Africa. This ensures a secure trading environment.

Can I trade on FxPro from outside the UK?

Absolutely. FxPro has a global presence and serves traders from over 170 countries, making it accessible to traders worldwide.

Are there any fees or commissions when trading with FxPro?

FxPro’s fee structure varies depending on the account type and financial instruments you trade. It’s essential to review their fee schedule to understand the costs associated with your specific trading activities.

Why should I choose FxPro as my forex broker?

FxPro stands out due to its extensive experience, robust regulatory compliance, diverse trading instruments, advanced platforms, and educational support. It’s a reliable choice for traders at all levels seeking a secure and comprehensive trading experience.