Table of Contents

ToggleOanda is a globally recognized forex broker that was established in 1996. The company offers a comprehensive range of trading instruments, including forex, indices, commodities, and bonds. Oanda has a presence in several countries, including the United States, United Kingdom, Canada, Japan, and Singapore. The broker has built a solid reputation in the industry, particularly for its reliable and efficient trading services.

One of the most significant advantages of Oanda is its user-friendly trading platforms. The broker offers two primary trading platforms, the proprietary Oanda Web Platform and the MetaTrader 4 platform. Both platforms are accessible via desktop and mobile devices, enabling traders to access their accounts and execute trades at any time and from any location. The platforms are also equipped with various advanced trading tools, including charting tools, risk management tools, and technical analysis indicators.

Oanda is also known for its competitive pricing structure. The broker offers competitive spreads and does not charge any commissions on trades. The broker also offers flexible leverage options, enabling traders to access higher trading volumes with smaller account balances. The broker also offers negative balance protection, ensuring that traders do not lose more than their account balances.

Another factor that contributes to Oanda’s reputation is its regulatory compliance. The broker is regulated by several regulatory bodies, including the Financial Conduct Authority (FCA) in the UK, the National Futures Association (NFA) in the US, the Investment Industry Regulatory Organization of Canada (IIROC), and the Monetary Authority of Singapore (MAS). The broker adheres to strict regulatory requirements, ensuring that traders’ funds are kept in segregated accounts and that the broker operates with transparency and integrity.

Oanda Pros & Cons

Oanda is a well-known online forex and CFD broker, established in 1996. It offers a wide range of trading instruments, including forex, commodities, indices, and cryptocurrencies. In this article, we will discuss the pros and cons of trading with Oanda.

Pros

- Regulated Broker: Oanda is a regulated broker in various jurisdictions such as the US, UK, Canada, and Australia. This makes it a trustworthy broker as it has to follow strict regulations and rules set by these authorities to protect traders’ interests.

- User-friendly Trading Platform: Oanda’s proprietary trading platform, Oanda fxTrade, is user-friendly and easy to navigate, making it ideal for both beginner and advanced traders. It also offers various technical analysis tools and customizable charting options, making it convenient for traders to analyze the markets.

- Low Spreads: Oanda offers competitive spreads, which is a significant advantage for traders. The broker’s spreads are some of the lowest in the industry, making it cost-effective to trade.

- Commission-free Trading: Oanda does not charge commissions on trades, making it an affordable option for traders who trade frequently.

- Range of Trading Instruments: Oanda offers a vast range of trading instruments, including forex, commodities, indices, and cryptocurrencies, providing traders with a variety of options to choose from.

- Customer Support: Oanda’s customer support is available 24/7, offering support in various languages. Traders can reach the support team via email, phone, or live chat.

- Demo Account: Oanda offers a demo account, allowing traders to test their trading strategies and get familiar with the platform before investing real money.

Cons

- Limited Leverage: Oanda offers limited leverage compared to other brokers. The maximum leverage offered by Oanda is 50:1, which may not be sufficient for some traders.

- Inactivity Fees: Oanda charges an inactivity fee of $10 per month if the account is inactive for more than 12 months. This fee may be inconvenient for traders who do not trade frequently.

- Limited Trading Platforms: While Oanda’s proprietary trading platform is user-friendly and efficient, it may not suit all traders’ preferences. Oanda does not offer the popular MetaTrader 4 or 5 platforms.

- Limited Education Resources: While Oanda offers a range of trading instruments and a user-friendly platform, it does not provide extensive educational resources for traders.

- No Bonuses or Promotions: Oanda does not offer any bonuses or promotions, which may be a disadvantage for traders who look for such incentives.

Is Oanda Safe?

Oanda is a well-established online broker that has been operating in the forex market since 1996. The company provides a range of financial products and services, including trading platforms, market analysis tools, and investment management services. One of the key concerns for anyone looking to trade or invest with Oanda is whether the platform is safe and secure. In this article, we’ll explore Oanda’s safety and security measures, regulatory compliance, and insurance coverage to provide a comprehensive answer to the question: is Oanda safe?

Overview of Oanda’s safety and security measures

Oanda takes the safety and security of its clients very seriously. The company uses a range of measures to protect its clients’ data and assets, including advanced encryption technologies and multi-factor authentication. All client data is stored securely in servers located in data centers that are monitored 24/7. Oanda’s trading platforms also use secure connections to ensure that all communications are encrypted and cannot be intercepted by third parties.

In addition to these measures, Oanda has a dedicated team of security professionals who are responsible for monitoring the company’s systems for any suspicious activity. The team uses a range of tools and techniques to detect and respond to any potential security threats.

Regulatory compliance and oversight

Another important factor in determining whether Oanda is safe is the company’s regulatory compliance and oversight. Oanda is regulated by several top-tier financial regulatory bodies, including the Financial Conduct Authority (FCA) in the UK, the National Futures Association (NFA) in the US, and the Investment Industry Regulatory Organization of Canada (IIROC) in Canada.

These regulatory bodies set strict rules and standards that Oanda must adhere to in order to maintain its license to operate. This includes requirements for financial stability, client asset segregation, and risk management. Oanda is also required to submit regular reports and audits to these bodies to ensure that it is operating in compliance with their rules and regulations.

Insurance coverage for clients’ assets

Finally, one of the key ways that Oanda protects its clients’ assets is through insurance coverage. Oanda provides insurance coverage for client assets through a combination of regulatory requirements and voluntary coverage.

In the UK, for example, Oanda is required by the FCA to hold client funds in segregated accounts, which means that client assets are kept separate from the company’s own assets. This provides an additional layer of protection in the event that Oanda becomes insolvent.

Oanda also provides voluntary insurance coverage for its clients’ assets through a program called the Oanda Secure Program. This program provides an additional layer of protection for client funds in excess of the regulatory requirements. The program is underwritten by Lloyd’s of London, one of the world’s leading insurance providers.

Related Post: Roboforex Review 2023: Is it the Best Trading Platform Out There?

Oanda: Offering of Investments

Oanda is a global forex and CFD broker that offers a wide range of investment products to its clients. The company has been in the business for over 25 years and is known for its low fees, user-friendly platform, and excellent customer support. Oanda offers a range of products for trading, including forex, indices, commodities, bonds, and cryptocurrencies.

Range of Products Available for Trading:

Oanda offers a broad range of products for trading, including over 70 currency pairs, indices, commodities, bonds, and cryptocurrencies. The company’s forex offerings include all major currency pairs, as well as some minor and exotic pairs. Clients can trade these currencies through Oanda’s proprietary trading platform or through the popular MetaTrader 4 platform.

Oanda’s index offerings include the S&P 500, NASDAQ 100, FTSE 100, DAX 30, Nikkei 225, and many more. These indices offer traders the opportunity to invest in a diversified portfolio of stocks from some of the world’s largest companies. Oanda also offers commodity trading, including gold, silver, oil, and gas.

Availability of Different Asset Classes:

Oanda offers a diverse range of asset classes for trading, including currencies, indices, commodities, bonds, and cryptocurrencies. The company’s currency offerings are among the most extensive in the industry, with over 70 currency pairs available for trading.

Oanda’s indices cover major global indices, such as the S&P 500 and the FTSE 100, as well as lesser-known indices from around the world. The company’s commodity offerings include precious metals, such as gold and silver, as well as energy commodities like oil and gas. Oanda also offers trading in bonds, including US Treasuries and UK Gilts.

In addition to traditional asset classes, Oanda offers cryptocurrency trading. Clients can trade some of the most popular cryptocurrencies, such as Bitcoin, Ethereum, and Litecoin, through the company’s trading platform.

Options for Account Types:

Oanda offers a range of account types to suit different trader needs. The company offers a standard account, which is suitable for most traders, as well as a premium account, which offers additional features and benefits. Oanda also offers a demo account for traders who want to practice their trading strategies without risking real money.

The standard account offers competitive spreads and no commission fees. The account also offers negative balance protection, which means that clients will never lose more than their account balance. The standard account can be opened with a minimum deposit of $1.

The premium account offers all the features of the standard account, as well as additional benefits, such as lower spreads, priority customer support, and a dedicated account manager. The premium account requires a minimum deposit of $20,000.

The demo account is a simulated trading environment that allows traders to practice their trading strategies without risking real money. The demo account offers access to all of Oanda’s trading products and features, allowing traders to test their strategies in a risk-free environment.

You May Also Like: CMC Markets Review 2023: Ultimate Guide to Trading Success

Oanda: Commissions and Fees

Oanda is a reputable forex broker that offers competitive pricing and a wide range of trading instruments. As with any broker, understanding the fee structure is critical before opening an account. In this article, we will take a closer look at Oanda’s commissions and fees, compare them with other brokers in the industry, and highlight any hidden fees and charges to watch out for.

Breakdown of Oanda’s fee structure:

Oanda offers a transparent fee structure that is easy to understand. There are no hidden fees, and the broker provides detailed information on their website.

- Spreads: Oanda earns revenue from the bid-ask spread. The bid is the price at which the broker is willing to buy, and the ask is the price at which the broker is willing to sell. The difference between the bid and ask price is known as the spread. Oanda offers variable spreads, which means that the spread can fluctuate depending on market conditions. The spread can range from as low as 0.1 pips to as high as 3.0 pips, depending on the currency pair and market conditions.

- Commission: Oanda charges a commission of $5 per 100,000 units traded. This is in addition to the spread, so traders should factor in this cost when making trades. The commission is competitive compared to other brokers in the industry, and it can be reduced for high volume traders.

- Financing Fees: Oanda charges financing fees on overnight positions. This fee is based on the interest rate differential between the two currencies in the currency pair and is calculated daily. Traders can avoid financing fees by closing their positions before the end of the trading day.

Comparison with other brokers in the industry:

When comparing Oanda’s fees with other brokers in the industry, it is essential to consider the overall trading experience, including the quality of the trading platform, customer support, and range of trading instruments. However, here is a comparison of Oanda’s fees with two popular brokers in the industry:

- IG Markets: IG Markets is a popular broker that offers forex and other financial instruments. The broker’s spreads can be as low as 0.6 pips for major currency pairs, and they do not charge a commission. However, IG Markets does charge a financing fee, which can be higher than Oanda’s.

- eToro: eToro is a social trading platform that allows traders to follow and copy the trades of other successful traders. eToro does not charge a commission, but their spreads can be wider than Oanda’s, and they charge a withdrawal fee of $5.

Hidden fees and charges to watch out for:

Oanda is transparent about their fees, and there are no hidden fees. However, traders should be aware of the following charges:

- Inactivity fee: Oanda charges an inactivity fee of $10 per month if there are no trades or account activity for 12 months. This fee can be avoided by making at least one trade or maintaining a balance of $20.

- Currency conversion fee: If a trader deposits funds in a currency that is different from their trading account’s base currency, Oanda charges a currency conversion fee. The fee can be up to 1.0% of the deposit amount.

- Data fees: Oanda provides free access to real-time and historical forex data. However, traders who want to access data for other financial instruments may need to pay additional fees.

Further Reading: Forex.com Review 2023: Ultimate Trading Platform for Beginners

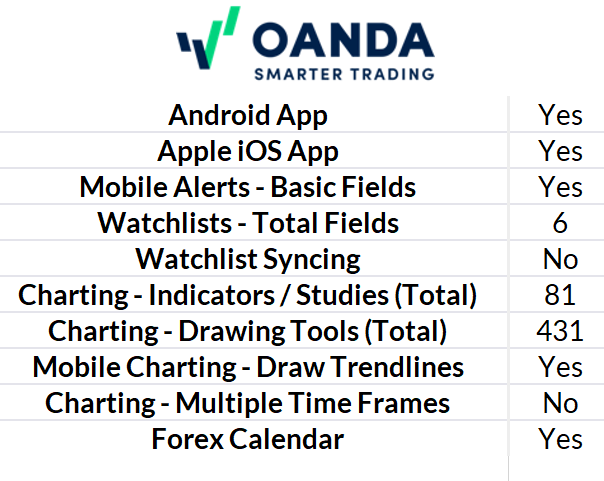

Oanda’s Mobile Trading Apps

Oanda is a popular online forex broker that offers various trading services to its clients. One of the primary features of Oanda is its mobile trading app, which allows traders to access their accounts and execute trades from their mobile devices.

Overview of Oanda’s mobile app:

The Oanda mobile app is available for both iOS and Android devices, and it can be downloaded for free from the App Store or Google Play Store. The app is designed to provide traders with a quick and easy way to access their trading accounts and execute trades on the go.

Features and functionalities:

The Oanda mobile app is packed with a range of features and functionalities that make trading easier and more convenient for its users. Some of the key features of the app include:

- Real-time quotes: The app provides traders with real-time quotes on currency pairs, as well as access to historical data and charts.

- Order management: The app allows traders to manage their orders, including setting stop-loss and take-profit levels, as well as adjusting their positions.

- Trading tools: The app comes with a range of trading tools, including technical indicators and drawing tools, which can help traders to analyze the markets and make informed trading decisions.

- Market news: The app provides traders with access to the latest market news and analysis, as well as economic calendar events that may impact the markets.

- Account management: Traders can use the app to manage their Oanda trading accounts, including funding their accounts, viewing their balances and transaction history, and changing their account settings.

User experience and ease of use:

The Oanda mobile app is designed to be user-friendly and easy to navigate, with a clean and intuitive interface. The app is also highly customizable, allowing traders to set up their screens and layouts to suit their preferences.

Traders can quickly access their accounts and execute trades from the home screen, and the app also provides easy access to a range of trading tools and market analysis resources. The app is also designed to be fast and responsive, allowing traders to execute trades quickly and efficiently, even on slower mobile networks.

Explore More: Saxo Bank Review 2023: Best Broker for Your Trading Needs?

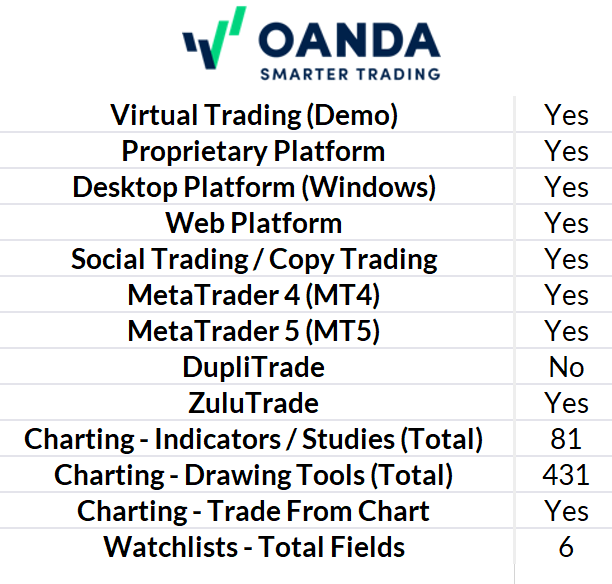

Other Trading Platforms

Oanda is a well-known online forex broker that offers a range of trading platforms to suit the needs of different types of traders. Apart from its proprietary platform, Oanda also offers other trading platforms to its clients, including the popular MetaTrader 4 (MT4) and 5 (MT5) platforms. In this article, we will provide an overview of these platforms and compare their features and functionalities.

Overview of other trading platforms offered by Oanda

MetaTrader 4 (MT4) MT4 is a popular trading platform that is widely used by forex traders worldwide. It offers a range of tools and features, including advanced charting, technical analysis tools, and automated trading capabilities. MT4 also supports multiple order types, such as market orders, limit orders, stop orders, and trailing stop orders. The platform is available for download on desktop and mobile devices, including iOS and Android.

MetaTrader 5 (MT5) MT5 is the successor to MT4 and offers more advanced features and functionality. It includes all the features of MT4 but also includes more advanced order types, including stop-limit orders, and support for more markets, including stocks and commodities. MT5 also includes an economic calendar and trading signals, making it a useful tool for traders looking to analyze the markets and make informed trading decisions.

Comparison of features and functionalities

While both platforms offer advanced tools and features, there are some key differences between MT4 and MT5. MT5 is more advanced than MT4 and offers more features and functionalities, including support for more markets and more advanced order types. MT5 also has a more modern and user-friendly interface than MT4. However, some traders may find MT4 more user-friendly due to its simplicity and ease of use.

Availability of third-party platforms

In addition to its proprietary platform and MT4 and MT5, Oanda also supports a range of third-party platforms. These include the TradingView platform, which offers advanced charting tools and technical analysis capabilities, and the NinjaTrader platform, which offers advanced trading automation tools and support for multiple markets. Oanda also offers an API that allows traders to integrate their trading strategies with other third-party platforms.

Discover: Trade Smarter with Trading 212: Pros, Cons, and Features

Oanda: Market Research

Oanda Market Research is a comprehensive platform that provides valuable insights and analysis to traders and investors. The platform is designed to help users stay ahead of market trends, identify potential trading opportunities, and make informed investment decisions.

Overview of Oanda’s research tools and resources

Oanda Market Research provides a wide range of tools and resources to traders and investors. The platform includes a variety of charts, graphs, and technical indicators to help users analyze market trends and identify potential trading opportunities. In addition, Oanda provides a range of educational resources, including webinars, videos, and tutorials, to help users improve their trading skills and stay up-to-date with the latest market developments.

Analysis and insights provided

Oanda Market Research provides users with a wealth of analysis and insights on a variety of financial instruments, including currencies, commodities, and indices. The platform includes daily and weekly market reports, which provide a comprehensive overview of market trends, key economic events, and potential trading opportunities.

In addition, Oanda provides in-depth technical analysis on a wide range of currency pairs, using a variety of indicators and charting tools. The platform also includes real-time news updates, which provide users with the latest developments and news that may impact the financial markets.

Overall, Oanda’s research tools and resources are designed to help traders and investors make informed decisions and stay ahead of market trends.

Availability of market data and news

Oanda Market Research provides users with access to a wide range of market data and news. The platform includes real-time quotes and charts for a variety of financial instruments, including currencies, commodities, and indices. In addition, Oanda provides users with historical data, allowing them to analyze past market trends and identify potential trading opportunities.

The platform also includes a range of news sources, including Reuters and MarketWatch, providing users with the latest developments and news that may impact the financial markets. This helps users stay informed about key economic events and announcements, allowing them to make informed decisions about their trading strategies.

Check out: Libertex Review 2023: Pros & Cons, Safety, Fees, App & Education

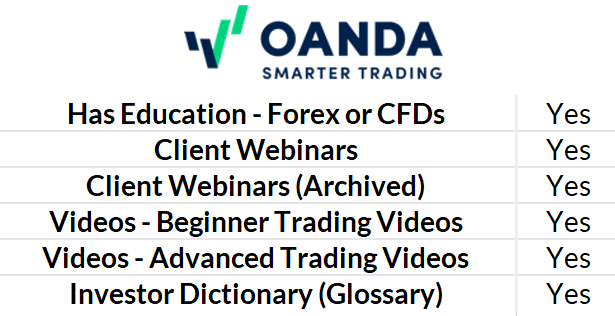

Educational Resources By Oanda Broker

Oanda is a well-known forex broker that offers an extensive range of educational resources to help traders enhance their knowledge and skills. The Oanda Education section on its website provides a variety of resources such as video tutorials, webinars, articles, and a comprehensive forex glossary. The educational resources are available to both new and experienced traders, allowing them to learn at their own pace and level of expertise.

Overview of Oanda’s educational resources

Oanda’s educational resources are designed to cater to the needs of traders of all levels, from novice to experienced. The resources are user-friendly and easily accessible, enabling traders to learn the fundamentals of forex trading and develop their trading strategies. The resources are designed to help traders understand the complexities of forex trading and make informed decisions when trading.

Topics covered and level of depth

Oanda’s educational resources cover a wide range of topics related to forex trading, including technical analysis, fundamental analysis, risk management, and trading strategies. The topics covered are comprehensive and provide traders with a solid understanding of the forex market. The level of depth varies from introductory to advanced, allowing traders to learn at their own pace and level of expertise.

For novice traders, Oanda offers an extensive range of resources that cover the basics of forex trading, such as the forex market, currency pairs, and trading terminology. The resources also cover the essential trading tools and how to use them, such as charts and indicators. Additionally, Oanda provides video tutorials that demonstrate how to place trades on the Oanda trading platform, making it easier for novice traders to get started.

For experienced traders, Oanda provides more advanced educational resources, such as webinars that cover technical analysis, risk management, and trading strategies. The webinars are conducted by experienced traders and provide traders with an opportunity to learn from their expertise. Oanda also provides in-depth articles on various forex-related topics, such as market analysis, trading psychology, and news trading. The articles are designed to help traders develop their skills and stay up to date with the latest market trends.

Availability of webinars and other learning resources

Oanda offers a variety of webinars that cover different aspects of forex trading. The webinars are conducted by experienced traders and are available to both new and experienced traders. The webinars cover topics such as technical analysis, trading strategies, and risk management. The webinars are interactive, allowing traders to ask questions and get real-time answers from the presenters.

Oanda also provides a comprehensive forex glossary that covers trading terminology and concepts. The glossary is user-friendly and easy to navigate, making it a valuable resource for novice traders. Additionally, Oanda provides a range of video tutorials that cover different aspects of forex trading, such as placing trades, using charts and indicators, and risk management.

More Resources: Admiral Markets Review 2023: Platform, Fees & Customer Support

Final Verdict About Oanda

Oanda is a popular forex broker that has been operating for over 20 years. In this time, they have garnered a reputation as a reliable and trustworthy broker. However, as with any broker, there are pros and cons to using their services. After evaluating their features, benefits, and overall customer feedback, we can make a final verdict on Oanda.

Firstly, Oanda’s trading platform is user-friendly and offers a wide range of tools and resources. They offer a competitive pricing structure and do not charge commission fees, making it an attractive option for traders who want to keep their costs low. Additionally, they have a broad range of financial instruments to trade, including Forex, CFDs, commodities, and indices.

In terms of customer support, Oanda offers excellent service, with 24/7 support available through live chat, email, and phone. They also provide educational resources and market analysis, which can be beneficial for new traders.