Moneta Markets Review 2023

Table of Contents

ToggleAre you looking for a reliable broker? Are you asking yourself ‘Is Moneta Markets the right broker for me?’ With so many brokers out there, it can be hard to decide which one is right for you. In this review, we’ll take a closer look at Moneta Markets and see if they’re worth your time and money in 2023.

The online trading industry has grown exponentially in recent years. With so many choices, it’s important to find the broker that best suits your needs. That’s why our team of experts have taken a deep dive into Moneta Markets to help you make an informed decision on whether or not this is the right broker for you.

We’ll go over all the features and services offered by Moneta Markets, as well as any potential risks associated with using them. After reading this review, you’ll have a better idea of whether or not this particular broker is the best option for your needs. So without further ado, let’s get started!

Recommended: LegacyFX Review 2023: Uncovering the Pros and Cons of Trading

Overview of Moneta Markets

Moneta Markets is a CFD and Forex broker that has been operating since 2020. It offers a wide range of trading instruments, including forex, indices, stocks, commodities and cryptocurrencies. Moneta Markets is regulated by the Cyprus Securities and Exchange Commission (CySEC). The broker also holds an Australian Financial Services License (AFSL) from ASIC. This ensures that the broker adheres to the highest standards of financial regulation.

The platform is web-based, so there’s no need to download any software or apps. The user interface is intuitive and easy to use, making it ideal for beginner traders. Moneta Markets also provides a range of helpful educational resources such as webinars, tutorials and ebooks to help traders learn how to trade successfully.

The customer support team at Moneta Markets is available 24/7 via email, phone and live chat. They are knowledgeable and friendly, providing quick responses to any questions or queries you may have about the platform or your trading account.

Read Next: DooPrime Review 2023: A Detailed Analysis of Trading Experience

Moneta Markets: Services And Fees

Moneta Markets provides a variety of services and fees, making it an attractive option for many traders. Customers can choose from a wide range of trading tools, such as CFD trading, Forex and metals trading, cryptocurrencies and stock indices. These tools are all accessible through the secure Moneta Markets website. The platform also offers competitive spreads on major currency pairs and tight spreads on cryptocurrency pairs. Moreover, there is no commission on trades executed through the platform.

The fees associated with Moneta Markets are minimal compared to other brokers in the industry. The minimum deposit is only $250 USD for all accounts types. Leverage options range from 1:2 up to 1:500 depending on the type of account opened. There is no extra fee charged for deposits or withdrawals made by bank transfer, credit card or e-wallet payment methods. In addition, Moneta Markets offers its customers access to free market analysis and educational resources to help them make informed decisions about their investments.

| Trading Account Currency | Commission per 0.01 lots (1000 base currency) | Commission per 1 lot (100,000 base currency) |

|---|---|---|

| AUDAustralian Dollar | AUD $0 | AUD $0 |

| USDUS Dollar | USD $0 | USD $0 |

| GBPPound Sterling | GBP £0 | GBP £0 |

| EUREuro | EUR €0 | EUR €0 |

| SGDSingapore Dollar | SGD $0 | SGD $0 |

| JPYJapanese Yen | JPY ¥0 | JPY ¥0 |

| NZDNew Zealand Dollar | NZD $0 | NZD $0 |

| CADCanadian Dollar | CAD $0 | CAD $0 |

Overall, Moneta Markets has become a popular choice among traders due to its comprehensive selection of services, low fees and excellent customer service support. Its easy-to-use interface makes it suitable for both experienced and novice investors alike. With its user-friendly platform, efficient execution speeds and highly competitive spreads, Moneta Markets is well positioned to meet the needs of investors in today’s ever changing markets.

Take a Look: ACY Securities Review 2023: A Detailed Look at Trading Services

Pros And Cons Of Moneta Markets 2023

Moneta Markets 2023 is a reliable and secure online broker, offering quality financial services to its clients. It offers a range of trading platforms for Forex, CFDs, commodities and stocks. The broker is regulated by the Financial Conduct Authority (FCA) in the UK, making it a safe choice for traders. However, there are certain pros and cons that need to be considered before investing with Moneta Markets.

Pros

- Wide range of financial instruments

- Low spreads and fees

- Multiple account types to choose from

- User-friendly trading platform

- Access to educational resources

Cons

- Not regulated by top-tier authorities

- Limited deposit and withdrawal options

- Limited research tools

- No negative balance protection

- Limited customer support options.

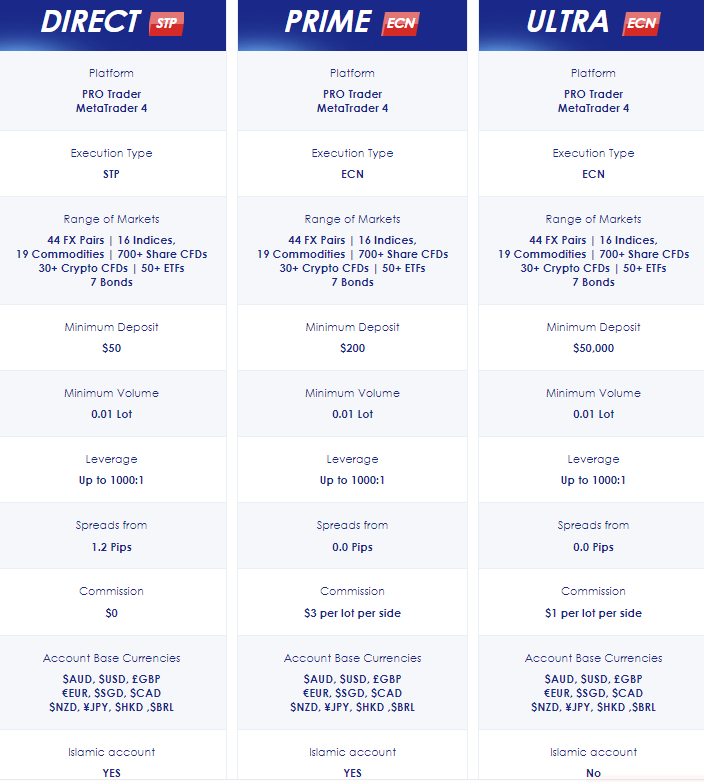

Accounts Types of Moneta Markets

Moneta Markets offers a range of account types to suit the needs of all traders. These include the Standard Account, Pro Account, and the VIP Account. The Standard Account has a minimum deposit of $250 and comes with no commission fees. It also provides access to leverage up to 1:500 and a wide selection of tradeable assets including commodities, currencies, indices and stocks. The Pro Account requires a minimum deposit of $2,500 and comes with reduced spreads as well as advanced charting tools. This account also includes access to leverage up to 1:400 and comes with no commission fees.

Finally, the VIP Account has a minimum deposit requirement of $20,000 and is ideal for experienced traders looking for more control over their trades. This account type provides access to higher leverage options (up to 1:200) as well as lower spreads than those offered on the Standard or Pro Accounts. All in all, Moneta Markets offers an impressive range of accounts that can meet the needs of any trader regardless of experience level or budget.

Continue Reading: Formax Prime Review: A Comprehensive Look at a Forex Broker

User-Friendliness Of Moneta Markets Platform

Moving on from the types of accounts available for trading with Moneta Markets, we will now take a look at how user-friendly their platforms are. It is important to know that the platform you use is easy to understand and navigate, as this can make or break your trading experience.

The platforms used by Moneta Markets are designed to be highly intuitive and user-friendly. They feature simple, easy-to-understand menus and tools that allow you to quickly access all of the features you need. All of the features are designed in such a way that they are easy to find and understand. Additionally, the platform offers live chat support so that if you ever have any questions or need help with something, you can easily get it sorted out.

Overall, Moneta Markets provides an excellent user experience when it comes to their platforms. The user interface is simple yet effective and allows traders to easily find what they need and quickly execute trades. This makes it an ideal choice for both experienced traders as well as those new to trading alike.

Dig Deeper: Interactive Brokers Review 2023: Features, Fees & User Feedback

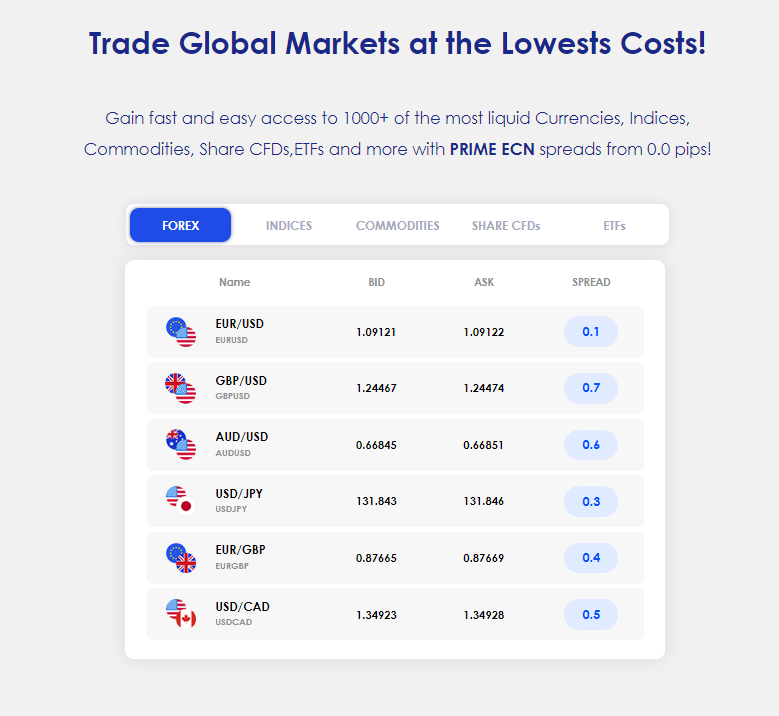

Moneta Markets: Financial Instruments

Moneta Markets offers a wide range of financial instruments, such as stocks, bonds, futures, options and CFDs. They provide access to a variety of markets, including forex, commodities, indices and cryptocurrencies. With the huge range of products available, traders can find something which suits their needs.

The trading platforms offered by Moneta Markets are user-friendly and easy to use. The platform provides in-depth market analysis and charting tools to help traders make informed decisions. There is also an extensive education center which provides tutorials on how to use the platform effectively. All these features make Moneta Markets a great choice for those looking for a reliable broker for their trading activities.

Overall, Moneta Markets is an excellent choice for both beginner and experienced traders alike. With its range of financial instruments and user-friendly trading platform, it is well suited to meet the needs of all types of investors. Its competitive fees structure makes it an attractive option for those looking to start trading in the markets.

Find Out: Plus500 Review 2023: Still a Top Broker for Investment?

Regulatory Compliance And Security Measures

Moneta Markets is a secure and reliable broker that takes regulatory compliance seriously. They are registered with the Financial Conduct Authority (FCA) in the United Kingdom and have licenses to provide their services in countries around the world. Here are three things you should know about Moneta Markets’ regulatory compliance:

- All funds deposited into your trading account are held fully segregated from the company’s own funds in accordance with FCA regulations.

- Moneta Markets employs sophisticated encryption technology to protect customer data at all times, both online and offline.

- All trades are conducted through a well-regulated market, ensuring that customers get real-time access to competitive prices on orders placed through the platform.

The company has also taken great strides to ensure its platform is safe and secure for all customers, with a number of security measures in place such as two-factor authentication and anti-phishing software. These measures help protect customer data from unauthorized access, while also providing an extra layer of security when trading online. In addition, Moneta Markets has implemented strict internal procedures for monitoring suspicious activity on its platform, which helps ensure customers are always protected from potential fraud or other malicious activities.

Moneta Markets is committed to providing a secure environment for its customers, and is constantly reviewing and updating its security measures to ensure it remains compliant with all relevant regulations and keeps clients safe from potential threats. With such rigorous standards for safety and security in place, this makes Moneta Markets an ideal choice for any investor looking for a trustworthy broker to manage their investments.

Learn More: TD Ameritrade Review: Is It the Right Brokerage for You?

Moneta Markets: Research And Education Resources

Moneta Markets is renowned for its research and education resources. It offers a wide range of options, including educational videos and webinars, market analysis and technical indicators, as well as detailed trading strategies. The broker also provides access to the latest news from across the world, ensuring that traders are always up-to-date on financial markets. The Moneta Markets platform also offers free eBooks and tutorials to help beginner traders understand the fundamentals of trading.

For more experienced traders, Moneta Markets has several advanced tools available. These include advanced charting capabilities and sophisticated risk management features such as automated trading systems and algorithmic trading signals. Additionally, the broker’s premium service includes exclusive access to proprietary trading indicators which can give traders an edge in their decisions.

In summary, Moneta Markets provides comprehensive research and education resources for both novice and experienced traders alike. With a broad range of webinars, videos, tutorials, eBooks and market analysis tools at their disposal, traders can have confidence in making informed decisions when it comes to their investments.

More Resources: Unbiased Oanda Review 2023: Pros/Cons, Fees & Features

Customer Service Options Offered By Moneta Markets

Moneta Markets provides customers with plenty of options when it comes to customer service. They have 24/7 live chat support, email support, and telephone support in multiple languages. Additionally, they offer FAQs and other resources on their website to help customers find answers quickly and easily.

Here are some of the features you can expect when dealing with Moneta Markets’ customer service:

- 24/7 Live Chat Support

- Email Support

- Telephone Support in Multiple Languages

- FAQs and Other Resources on Website

- Social Media Channels for Engagement

Overall, Moneta Markets has put a lot of effort into providing their customers with excellent customer service options. Their commitment to offering fast response times and helpful resources make them a great broker for those who need assistance quickly. This is especially important for traders who are new to the market or require more specialized advice.

Check out: Roboforex Review 2023: Is it the Best Trading Platform Out There?

Is Moneta Markets Right For You?

Moneta Markets is an online broker that has been around since 2023. It offers a wide range of trading services and products for both experienced traders and beginners alike. The platform also boasts high levels of security, which is essential when engaging in any type of financial activity. But is Moneta Markets the right choice for you?

To start, Moneta Markets provides access to a variety of instruments and markets, including stocks, options, ETFs, commodities, futures and currencies. This makes it suitable for almost any investor looking to diversify their portfolio. In addition, they offer competitive spreads on various instrument types, which can help you save money in the long run. Furthermore, the innovative trading tools and platforms available make it easy to stay on top of your investments. Finally, their customer service team is always available to answer questions or provide assistance if needed.

Overall, Moneta Markets offers an impressive suite of features and services that are sure to meet most investors’ needs. Their fees are competitively priced and the range of markets they offer should provide plenty of opportunities for those looking to grow their portfolios. With high levels of security and a strong customer service team in place as well, there’s no doubt that this broker is worth considering if you’re looking for an online trading partner.

Discover: CMC Markets Review 2023: Ultimate Guide to Trading Success

Conclusion

In conclusion, it’s clear that Moneta Markets is a reliable broker and a great choice for traders in 2023. They offer a demo account, so you can test out the platform before investing real money. Additionally, they don’t have any additional fees and offer margin trading. Trading with Moneta Markets also requires a relatively low minimum deposit requirement, which is great for those looking to start trading with smaller amounts of capital. Finally, the withdrawal limits at Moneta Markets are quite generous and make it easy to access your profits when you’re ready.

Overall, I think Moneta Markets is an excellent choice for traders in 2023. They have all the features a trader needs and their fees are very reasonable. Withdrawing funds from the platform is also easy and hassle-free. If you’re looking for a reliable broker to use in 2023, then Moneta Markets should be at the top of your list!

So if you’re considering using Moneta Markets as your broker in 2023, I’d recommend giving them a try. With their competitive fees and features, it’s sure to be a great experience!

Explore More: Forex.com Review 2023: Ultimate Trading Platform for Beginners

Frequently Asked Questions

Does Moneta Markets Offer A Demo Account?

When considering a potential broker, one of the key questions to ask is whether they offer a demo account. This allows traders to test and practice their strategies before using real money.

Demo accounts can be incredibly beneficial for traders as they allow users to:

- Gain experience: Trading on a demo account will give users the opportunity to get comfortable with the platform, develop their own strategies, and become more familiar with the markets.

- Test strategies: Users can try out different trading styles and see which ones work best for them. They can also use the demo account to backtest their strategies, allowing them to see how successful they would have been in past market conditions.

- Minimise risk: By testing out trades on a demo account first, users can reduce their risk when investing real money. It also allows them to make mistakes without worrying about losing money so they can learn from them and become better traders over time.

Therefore, it’s important for investors to find a broker that offers a good quality demo account so that they can take advantage of these benefits. It’s an essential component of successful trading and should not be overlooked when researching brokers.

Are There Any Additional Fees For Trading With Moneta Markets?

When it comes to trading with a broker, one of the most important things to consider is what fees you’ll be responsible for. Moneta Markets may offer a great platform, but if there are additional fees, this could make the cost of trading too high. So, it’s important to know whether or not there are any additional fees associated with trading with Moneta Markets.

It’s good practice to check what kind of fees a broker charges before you commit to trading with them. At Moneta Markets, they don’t charge any additional fees on top of their commission rate and spreads. They do, however, have some account inactivity fees that apply after 90 days of inactivity on an account. This fee is charged per month until the account is reactivated or closed.

It’s also important to note that while Moneta Markets doesn’t charge additional fees on trades, they do require a minimum deposit when opening an account. The amount varies depending on which type of account you choose and can range from $200-$5,000 USD/EUR/GBP/AUD/CAD. Additionally, some payment methods may come with processing fees – so make sure you read up on these before making your first deposit at Moneta Markets!

Overall, knowing about any extra costs associated with trading at Moneta Markets can help you decide if it’s the right broker for you. Make sure you research all the fees involved before committing to an account and remember that even though there aren’t any extra charges for trades at Moneta Markets, there may still be other costs like minimum deposits and processing fees associated with certain payment methods.

Does Moneta Markets Offer Margin Trading?

Margin trading can be an attractive option for experienced traders who want to take advantage of more opportunities in the market. It’s important to know if a broker offers this type of trading before you invest. That’s why it’s worth asking, does Moneta Markets offer margin trading?

The answer is yes. Moneta Markets provides highly competitive margins that enable traders to leverage their positions and increase their potential returns. They also offer a wide range of margin products, including CFDs, futures, and spot FX. Plus, they provide support through their customer service team.

In addition to margin trading, Moneta Markets offers other features that can help you make informed decisions when investing in the markets. These include advanced charting tools, real-time news feeds, and educational resources to help you stay up-to-date with the latest market insights. All of these features can give you an edge when trading with Moneta Markets.

With great customer service and a wide range of margin products, Moneta Markets is well-equipped to help traders maximize their returns in the markets. If you’re looking for a broker that offers competitive margins and advanced features for successful trading strategies, then Moneta Markets is definitely worth considering.

Is There A Minimum Deposit Requirement For Moneta Markets?

When it comes to investing and trading, one of the most important questions to ask is whether a broker has a minimum deposit requirement. Moneta Markets is no different. To help investors decide if this is the right broker for them, here’s what potential customers need to know about the minimum deposit requirement.

Firstly, Moneta Markets does require a minimum deposit before trading can begin. This amount can vary depending on what type of account you are opening with Moneta Markets and may change based on market conditions or other factors. Generally speaking, the current minimum deposit for a Moneta Markets account is $500.

Secondly, as long as this initial deposit has been made, investors are able to start trading without any additional deposits required. That being said, certain investments may require additional funds to be deposited in order to pay fees or taxes associated with that particular investment.

Finally, while most brokers allow customers to make deposits via credit cards or bank transfers, Moneta Markets only accepts deposits via bank transfer at this time; credit card deposits are not currently accepted by Moneta Markets. As such, it’s important for potential customers to consider how they plan on making their initial deposit when deciding if this is the right broker for them.

What Are The Withdrawal Limits With Moneta Markets?

When it comes to trading, one of the most important things to consider is the withdrawal limits associated with a broker. With Moneta Markets, understanding the withdrawal limits is key in determining whether they are the right broker for your needs.

It’s important to note that there are different types of withdrawal limits with Moneta Markets. For example, one type of limit is related to the amount you can withdraw from your account per day. Depending on your account type, your daily withdrawal limit may be higher or lower than other traders’. It’s also important to understand any fees associated with withdrawals and whether or not these fees are dependent on the amount withdrawn.

Another type of limit relates to transactions which may be limited by currency or by type. For instance, some currencies may only allow a certain number of transactions per day while other currencies may have no such limitation. Similarly, there could be restrictions on certain types of trades such as options trading or margin trading which could affect how much you can withdraw at any given time.

Understanding all these aspects of withdrawal limits is essential in deciding whether Moneta Markets is right for you and your trading needs. It’s worth taking the time to research and compare different brokers before making a decision so that you can find one that best suits your requirements.