Table of Contents

ToggleSearching for an online broker that offers comprehensive features and services to enhance your trading success? Look no further than our 2023 FXTM review. In this article, we delve into FXTM’s offerings, evaluating how they stack up against other brokers in terms of fees, customer service, security, account options, and more. Whether you’re a novice or a seasoned pro, FXTM caters to all, allowing traders to tailor their accounts to their unique needs and preferences.

With a legacy dating back to 2011, FXTM stands as one of the industry’s most enduring brokers. Throughout the years, they have consistently adapted to evolving industry standards and regulatory requirements. FXTM holds regulatory oversight from trusted institutions such as CySEC and FCA, guaranteeing clients a robust layer of protection while utilizing their services.

FXTM’s appeal is evident at first glance, attracting a substantial user base. However, don’t just take our word for it; dive into our comprehensive review to gain valuable insights into FXTM’s 2023 performance!

Recommended: Trader’s Way Review 2023: Is Trader’s Way A Good Broker?

Overview

Fxtm is an established trading company that provides access to global financial markets. It offers a wide range of services, from foreign exchange and CFDs to commodities and indices trading. This renowned broker has been in the business for over 10 years now, providing clients with reliable service and support. Their products are largely tailored towards new traders and those looking to diversify their portfolios.

This platform leverages cutting-edge technology and analytics tools to ensure secure transactions across all platforms. In addition, FXTM offers a wealth of educational resources designed to empower traders with market knowledge and insights. The responsive customer service team is available 24/7 via phone or online chat, ensuring swift resolution of any inquiries or concerns that may arise during your trading journey with FXTM.

In summary, FXTM creates a secure and user-friendly environment, enabling traders to approach the foreign exchange market with confidence. With competitive spreads, leverages up to 1:500, and an intuitive interface, it’s no surprise that many consider FXTM among the industry’s top brokers today.

Read Next: XTB Review 2023: Is XTB a Good Broker for Traders?

Pros & Cons

Pros

- FXTM is a trusted international broker, offering traders access to more than 250 assets across Forex, CFDs, and Cryptocurrency.

- It offers competitive spreads, low fees and commissions on trades, high leverage of up to 1:30 for major currency pairs, fast execution speeds and advanced trading platforms.

- The broker also provides educational resources such as seminars and webinars that can help new traders understand the markets better.

Cons

- Higher costs for certain types of accounts.

- Additionally, it does not offer any bonuses or promotions which may be off-putting for some potential traders.

- Customer service could be improved in terms of response times and availability; however this has been improving over recent years.

Features & Benefits

Moving on from the overview of FXTM, let’s take a closer look at some of the features and benefits that this online broker offers.

When trading with FXTM, you are presented with plenty of options to choose from in terms of financial instruments. Spread-trading is available on several currency pairs, with competitive spreads starting as low as 0 pips. You can also open positions across various global markets such as commodities, stocks, indices, cryptocurrency and more! It’s easy to diversify your portfolio thanks to the broad range of assets that this platform has to offer.

FXTM provides its traders with multiple ways to optimise their trades for maximum returns:

- Hedging opportunities – allowing traders to protect themselves against market movements by opening two opposite positions simultaneously;

- Automated Trading – helping traders make informed decisions quickly;

- Copy Trading – copying strategies created by experienced professionals or other successful investors;

- Advanced trading tools – including Expert Advisors (EAs) and trading signals so that you can analyze market conditions better in order to make smarter investment decisions faster than ever before.

The intuitive user interface makes it simple for beginners and experts alike to find what they’re looking for when navigating the site. Plus, the support team is always ready to assist if any questions arise during your journey through FXTM’s world of forex trading!

Take a Look: Axitrader Review 2023: Is Axitrader a Good Broker?

Trading Platforms

FXTM is widely known for its reliable and user-friendly trading platforms. The online brokerage offers a variety of different trading platforms, each tailored to the needs of traders with different experience levels and financial goals. Whether you’re a beginner or an experienced trader, FXTM has something for everyone.

The fxtm platform provides access to hundreds of markets across the globe, allowing users to trade in Forex, commodities, stocks and indices from one convenient interface. With advanced charting tools and automated trading capabilities, this platform makes it easy to monitor your portfolio and make informed decisions quickly. It also features multiple order types, including market orders, limit orders and stop loss orders. This gives users greater control over their trades by providing them with more options for entering and exiting positions.

FXTM’s versatile selection of trading platforms allows all kinds of traders to find what they need easily and effectively. From powerful technical analysis tools available on MetaTrader 4 (MT4) to the innovative mobile app that lets you take your trading wherever you go – no matter which platform you use, FXTM guarantees a secure environment where you can feel confident about your investments.

Continue Reading: ActivTrades Review 2023: Is ActivTrades Trustworthy?

Account Types

Having discussed trading platforms, it’s now time to turn our attention to account types. FXTM offers several different options for traders who want to tailor their experience according to their individual needs. Depending on the type of trading you’re looking for – whether it be Forex, CFD or other trading options – there is an account that fits your requirements.

| Account type | Standard Account | Cent Account | Stock CFDs Account |

|---|---|---|---|

| URL | Live Demo | Live Demo | Live More |

| Trading Platforms | MT4 / MT5 | MetaTrader 4 | MetaTrader 4 |

| Account Currency | USD / EUR / GBP / NGN | US Cent / EU Cent / GBP Pence / NGN kobo | USD / EUR / GBP / NGN |

| Leverage / Margin requirements | Floating from 1:2000 | Fixed from 1:1000 – 1:25 (FX), 1:500 -1:25 (Spot Metals) | Fixed leverage 1:10 for US Shares and 1:3 for European Shares |

| Maximum deposit | No | No | No |

| Minimum deposit | $/€/£ 100, ₦40,000 | $/€/£ 10 / ₦2 000 | $/€/£ 100, ₦40,000 |

| Commission | No | Zero | No |

| Order execution | Instant Execution | Instant Execution | Instant Execution |

| Spread | From 1.3 | From 1.5 | From 0.1 |

| Margin Call | 40% | 60% | 40% |

| Stop Out | 20% | 40% | 20% |

| Swap-Free | MT4: Yes MT5: No | Yes | Yes |

| Limit & Stop Levels | 1 spread | 1 spread | 1 spread |

| Pricing | MT4:5 decimals for FX (3 on JPY pairs), Spot Metals: 2 decimals for XAUUSD and 3 decimals for XAGUSD MT5: 5 decimals for FX (3 on JPY pairs), Spot Metals: 2 decimals for XAUUSD and 3 decimals for XAGUSD | Zero commission & tight spreads | 2 decimals |

| Trading Instruments | MT4: Majors, Minors, Exotics – 59, Spot Metals – 5, Spot CFDs -14 , MT5: Majors, Minors, Exotics – 33, Spot Metals – 2 | FX Metals Commodities | 120+ US Shares 40+ European Shares |

| Contract specification | |||

| Minimum Volume in Lots per Trade | 0.01 | 0.01 | 0.01 |

| Step Lot | 0.01 | 0.01 | 0.01 |

| Maximum Volume in Lots per Trade | 30 | 1 | 10 |

| Maximum Number of Orders | 100 | 300 | 100 |

| Maximum Volume in Lots of Orders | 200 | 10 | 20 |

| Maximum Number of Pending Orders | 100 | 100 | 100 |

The first step in choosing an appropriate account type is deciding which asset class(es) best suit your investment goals and risk-profile. For example, if you are a beginner trader with limited capital but want to gain exposure to global markets, then the Cent Account may be ideal for you as it allows smaller trades with lower minimum deposits and spreads starting from 0 pips! Alternatively, if you have more significant funds available and wish to explore higher leverage levels, then the Standard Account might meet your needs better.

No matter what kind of trader you are, FXTM has multiple account types designed specifically for various trade styles and strategies. With each offering its own set of features such as low fees, tight spreads, negative balance protection and more – selecting an account can help take your trading journey even further by providing access to all the tools needed to become successful in this market!

Dig Deeper: Vantage Review 2023: Is Vantage a Safe Broker?

Fees & Commissions

FXTM is a reliable broker that offers competitive fees and commissions for its traders. It has a very straightforward pricing structure, which makes it easy to understand what you will be paying in trading costs.

| US stock charges on Advantage and Advantage Plus MT5 | ||

|---|---|---|

| Type | Commission | Charged by |

| US Stock commission | $0/trade | N/A |

| Platform usage | $0/trade | N/A |

| Collection of dividend tax | 30% X Dividend (automatic withholding on distribution) | IRS, USA |

| Live pricing data fee | Free live pricing | N/A |

| HK stock charges on Advantage and Advantage Plus MT5 | ||

|---|---|---|

| Type | Fees | Charged by |

| HK Stock commission | 0.05%/national trade* | FXTM |

| Platform usage | $ 0/trade | N/A |

| Stamp duty | 0.1%/national trade | HK Government |

| HKSFC Trade Levy | 0.0027%/national trade | HK SFC |

| HKEX Trading Fees | 0.005%/national trade | HKEX |

| Settlement fee | 0.002%/national trade | HK Clearing house |

| Exchange fee | 0.008%/national trade | HKEX |

| Collection of dividend tax | $ 0/trade | N/A |

| Live pricing fee | $120/month live pricing subscription | |

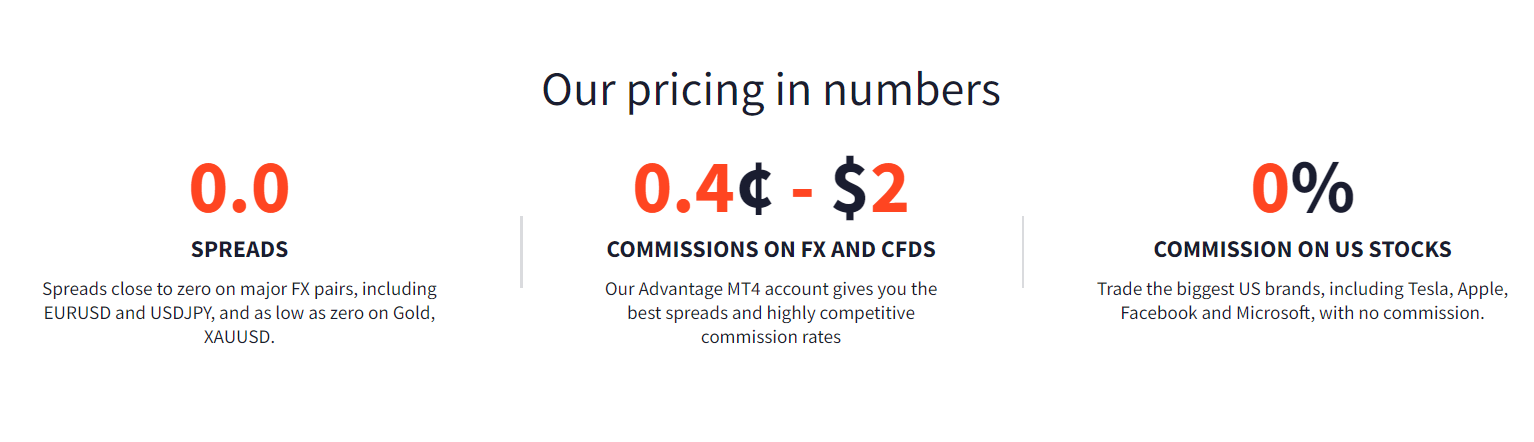

The commission fees at FXTM are quite low compared to other brokers in the industry. The spread starts from 0 pips on major currency pairs, and goes up depending on your account type. For deposits, there are no fees charged by FXTM as long as you use one of their accepted payment methods. Withdrawal fees are also reasonable; they start from $5 per transaction.

Overall, FXTM provides an affordable option when it comes to fees and commissions:

Commission Fees: Low

Trading Costs: Starting From 0 Pips

Withdrawal Fees: Starting From $5 Per Transaction

Deposit Fees: No Fees Charged By FXTM

We can conclude that FXTM presents an attractive proposition for traders looking for competitive fee structures without any hidden charges or surprises.

Find Out: XM Review 2023: Is XM a Good Broker for Beginners?

Customer Support Services

FXTM boasts top-tier customer support services, setting industry standards. Their 24/7 help desk operates in over 12 languages, ensuring clients receive prompt and accurate assistance, breaking through time and language barriers effortlessly. Furthermore, FXTM offers easily comprehensible training materials and accessible educational webinars, making them an ideal choice even for novice traders.

At FXTM, customer service extends beyond simple query resolution; they provide tailored account management services for seasoned traders seeking a personalized trading experience. Their adept team is well-equipped to address a wide spectrum of forex trading concerns, from technical glitches to prudent risk management guidance.

FXTM’s customer support team takes pride in their swift response times and dependable answers, reaffirming their commitment to prioritizing clients’ needs. Clearly, this broker prioritizes the creation of a secure and welcoming trading environment for traders of all backgrounds.

Learn More: In-Depth Analysis of IC Markets | Is IC Markets a Good Broker?

Security & Regulation

When it comes to trading in the Forex markets, security and regulation are paramount. FXTM has long been a leader in this regard, ensuring that its clients’ funds remain protected at all costs. FXTM is regulated by several of the world’s leading financial authorities, including:

CySEC – Cyprus Securities & Exchange Commission

FCA – Financial Conduct Authority (UK)

ASIC – Australian Securities & Investments Commission

IFSC – International Financial Services Commission (Belize)

These regulators impose strict standards on brokers such as FXTM which must be upheld in order for them to retain their licenses. This ensures that trader funds are always kept safe and secure. As part of its commitment to providing customers with a fully compliant service, FXTM provides segregated accounts for client funds, so money can never become commingled with company finances. What’s more, any money deposited into an account is held securely in tier-1 banks or EU-regulated payment processors – further enhancing their trustworthiness and safety credentials.

FXTM also operates under strict anti-money laundering regulations; meaning your identity will have to be verified before you can make any withdrawals from your account. All these measures ensure that traders can rest easy knowing that their personal data and finances are being managed responsibly by a highly reliable broker.

More Resources: Tickmill Review 2023 | Is Tickmill a Safe Broker?

Education Resources

Having discussed the security and regulations of FXTM, it is now time to explore their education resources. FXTM offers a comprehensive range of educational tools for traders looking to improve their forex trading skills. From interactive tutorials and videos, to webinars and seminars, they have an array of learning materials available to help both beginner and experienced traders gain greater insight into the markets.

In addition, FXTM’s library contains various trading resources such as eBooks and Trading Guides that provide in-depth analysis on key topics like risk management strategies, technical indicators, chart patterns, market psychology and more. These educational guides are designed to be easily accessible by all levels of traders so they can take full advantage of these valuable insights.

For those who want even more hands-on experience with FXTM’s platforms and products, the broker also provides personalized one-on-one support from expert advisors who offer tailored guidance based on individual needs. This personal touch helps ensure each trader has the necessary knowledge to make informed decisions when engaging in online currency trading.

Check out: Honest and In-Depth Analysis of FXCM | Is FXCM a Good Broker?

Final Thoughts

Discover: Pepperstone Review 2023 | Is Pepperstone a Reliable Broker

Frequently Asked Questions

After conducting a comprehensive FXTM review, it’s evident that this online broker has ascended to the forefront of the FX trading and investment landscape. FXTM empowers traders with cutting-edge technology, competitive pricing, and outstanding customer support, solidifying their reputation as one of today’s most trusted online brokers.

In summary, we confidently endorse FXTM as a dependable and high-quality provider of forex trading services. Whether you’re a seasoned trader or a newcomer to the world of forex, FXTM caters to all. With a rich array of features tailored to both beginners and advanced traders, FXTM equips you with everything required for success in the financial arena.

FXTM offers a plethora of benefits and opportunities for its clients, underpinned by their unwavering commitment to transparency and exceptional customer support. If you’re in search of a reliable partner to nurture your financial portfolio, we highly recommend giving FXTM a try.

Frequently Asked Questions

What is FXTM Forex Broker?

FXTM, short for ForexTime, is a reputable online forex broker that offers a platform for individuals to trade various currency pairs and other financial instruments. Established in 2011, it has become a leading name in the industry, known for its advanced technology and comprehensive services.

How can I access FXTM’s trading platform?

To access FXTM’s trading platform, simply visit their official website and sign up for an account. Once registered, you can log in to the platform using your credentials and begin trading immediately.

What types of accounts does FXTM offer?

FXTM offers various account types to cater to different trader preferences, including Standard, Cent, Stock, ECN, and more. Each account type comes with its own set of features and trading conditions, allowing you to choose the one that suits your needs.

Can I try FXTM’s platform before opening a live account?

Yes, FXTM provides the option to open a demo account, which allows you to practice trading with virtual funds. It’s an excellent way for both beginners and experienced traders to get familiar with the platform and test their strategies risk-free.

What is the minimum deposit required to start trading with FXTM?

The minimum deposit requirement varies depending on the type of account you choose. Typically, it starts as low as $10 for Cent accounts and may be higher for other account types. Be sure to check the specific account details for accurate information.

How competitive are FXTM’s spreads and fees?

FXTM offers competitive spreads and fees, making it an attractive choice for traders. The exact spreads and fees can vary based on the account type and trading conditions, so it’s advisable to review the details on their website.

Does FXTM provide educational resources for traders?

Yes, FXTM offers a range of educational resources, including webinars, tutorials, articles, and market analysis. These resources are designed to help traders enhance their knowledge and make informed trading decisions.

Is customer support available around the clock at FXTM?

Absolutely. FXTM’s customer support team is available 24/7, ensuring that you can get assistance whenever you need it. You can reach them through phone or online chat for quick responses to your inquiries.

How secure is my personal and financial information with FXTM?

FXTM takes security seriously and employs advanced encryption technology to safeguard your personal and financial information. They are also regulated by reputable authorities like CySEC and FCA, which adds an extra layer of protection.

Can I use FXTM’s platform on my mobile device?

Yes, FXTM offers a mobile trading app that is compatible with both iOS and Android devices. This allows you to trade on the go, monitor your positions, and stay updated with market developments from anywhere with an internet connection.