“Buy low, sell high” is a timeless adage in the world of trading. Day traders are constantly on the lookout for reliable patterns that can help them identify optimal entry and exit points. One such pattern is the three-bar reversal pattern, a technique that has gained popularity among day traders. This pattern involves analyzing price charts to spot specific formations that indicate a potential reversal in the market.

Alton Hill, a renowned trading expert, has introduced an enhanced version of this pattern, which considers the closing prices of the first two bars in relation to the third bar. By incorporating this enhanced pattern into their trading strategy, day traders can increase their chances of finding high probability trade setups.

However, it is crucial to approach this pattern with caution and consider the potential risks involved, such as unpredictable price action. By managing these risks through adjustments in trade size and stop loss, day traders can effectively utilize the three-bar reversal pattern to enhance their trading performance.

Key Takeaways

- The three-bar reversal pattern can be adapted for day trading and is used as an entry point when combined with other analysis.

- In a long setup, the first bar closes down, the low of the second bar is below the low of the first bar and the third bar, and the third bar closes above the high of the first bar and the second bar.

- In a short setup, the first bar closes up, the high of the second bar is above the high of the first bar and the third bar, and the third bar closes below the low of the first bar and the second bar.

- The three-bar reversal pattern can be enhanced by blending the third and fourth bars using the candle blending technique, and it can be combined with other indicators or price patterns for high probability trade setups.

What is Three Bar Reversal Pattern?

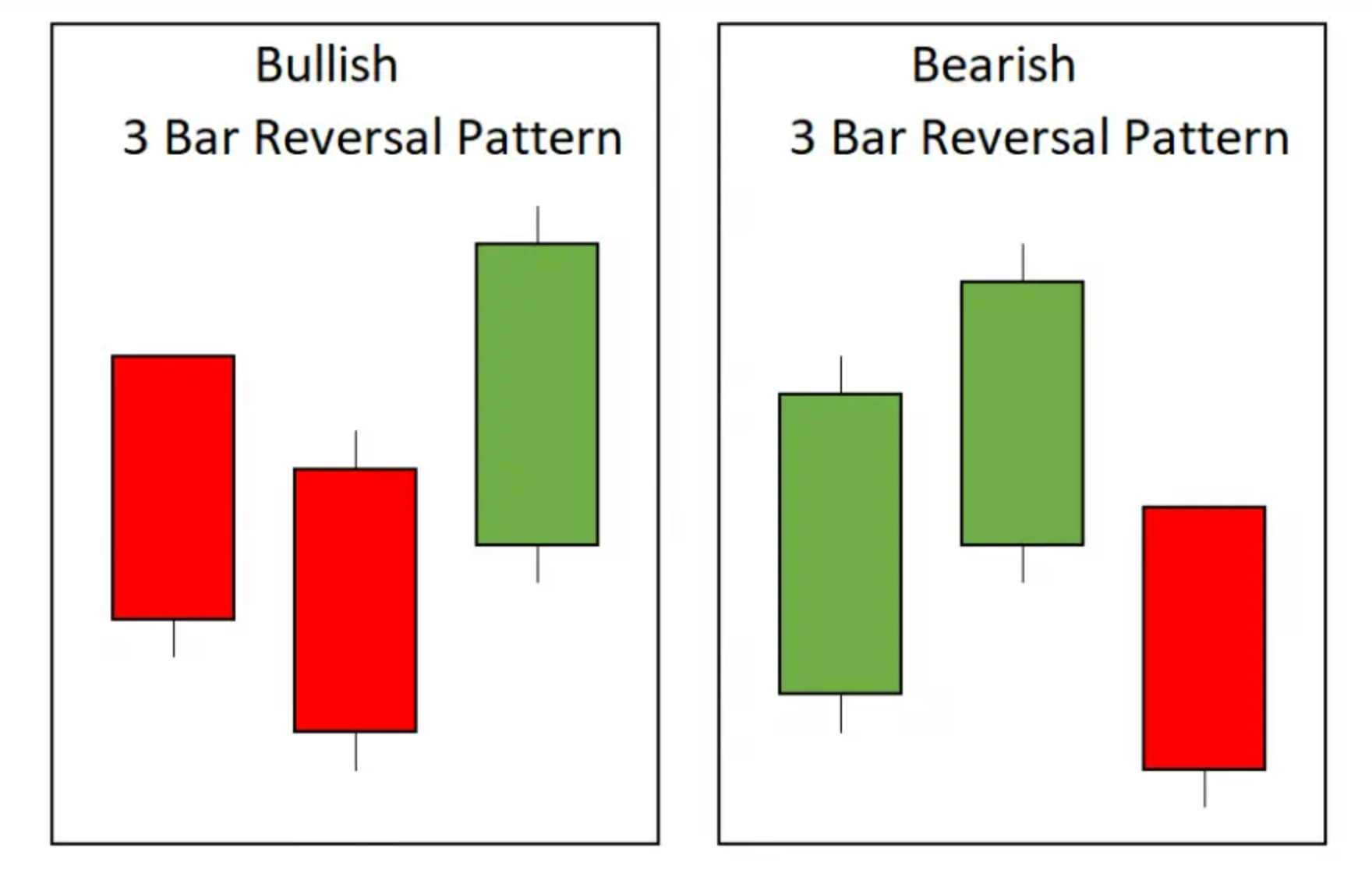

The three-bar reversal pattern for day trading is a trading pattern that can be adapted for day trading and provides an entry point when combined with other analysis. Alton Hill from TradingSim has written about an enhanced version of this pattern, where he prefers the third bar to close above the highs of the first two bars. This pattern can be identified by specific criteria.

For a long setup, the first bar should close down, the low of the second bar should be below the low of the first bar and the third bar, and the third bar should close above the high of the first and second bars. For a short setup, the first bar should close up, the high of the second bar should be above the high of the first bar and the third bar, and the third bar should close below the low of the first and second bars. The benefits of using this pattern include providing a clear entry point and the potential for high probability trade setups when combined with other indicators or price patterns.

Entry and Exit Points in Three Bar Reversal Pattern

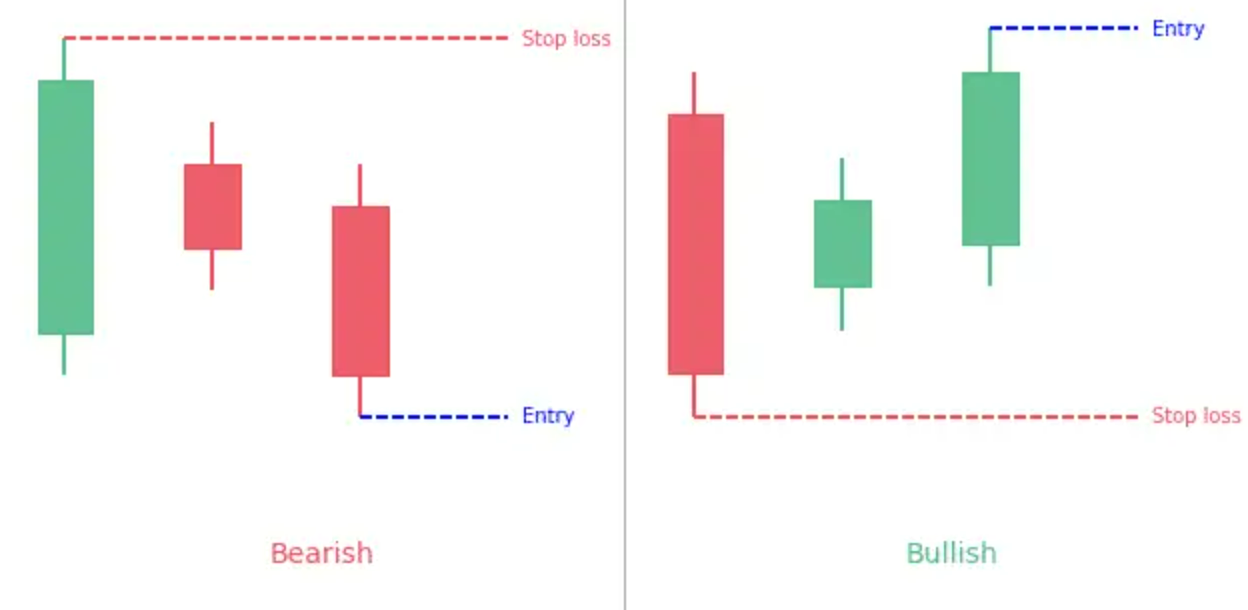

When considering the entry and exit points for the three-bar reversal pattern, it is important to carefully analyze the price action and observe the key levels where the market reverses its direction, allowing traders to enter or exit their positions at opportune moments. Trading strategies using the three-bar reversal pattern involve identifying specific criteria for entry and exit. In a long setup, traders would look for a bar that closes down, with the low of the following bar below the lows of both the previous bar and the third bar.

The third bar should then close above the highs of the first two bars, signaling a buy at the close of the third bar. In a short setup, the opposite conditions apply. Risk management techniques for day trading with the three-bar reversal pattern include managing trade size and setting stop losses to control potential losses. By incorporating these strategies and techniques, traders can increase the probability of successful trades using the three-bar reversal pattern.

Enhanced 3 Bar Reversal Pattern

An additional rule for confirmation in advance can enhance the modified three-bar reversal pattern. This can be achieved through the application of the candle blending technique, where Bar 3 and Bar 4 are blended together. By incorporating this technique, the pattern becomes more robust and reliable.

Additionally, the modified three-bar reversal pattern can be further improved by combining it with other indicators or price patterns. This allows for the identification of high probability trade setups, increasing the chances of success. However, it is important to note that the trade risk may be higher due to the wider range of the signal bar. To manage this risk, traders can consider cutting their trade size or tightening their stop loss.

Cautions and Considerations

Caution should be exercised when considering the middle bar of the pattern, as it often precedes unpredictable and volatile price action. The three-bar reversal pattern for day trading has its pros and cons. On one hand, it can provide an excellent entry point when combined with other analysis techniques. It offers a clear signal to buy or sell based on the specific criteria of the pattern.

However, there are certain risks that need to be managed. The wide range of the signal bar can increase trade risk, so it is important to adjust trade size or tighten stop loss accordingly. Additionally, the pattern may require confirmation from other indicators or price patterns for higher probability trade setups. Overall, the three-bar reversal pattern can be a useful tool, but careful risk management is essential.

Frequently Asked Questions

What are some common indicators that can be used to identify the Three-Bar Reversal pattern?

Identifying indicators for the three-bar reversal pattern can be helpful in day trading. Some common indicators that can be used to identify this pattern include moving averages, trendlines, and oscillators such as the Relative Strength Index (RSI) or Stochastic Oscillator.

These indicators can assist traders in identifying the setup criteria for the pattern, such as the close of the third bar being above the highs of the first two bars for a long setup, or below the lows for a short setup. Additionally, traders can effectively use the three-bar reversal pattern on different timeframes to capture potential trend reversals.

Can the Three-Bar Reversal pattern be used effectively in intraday trading on different timeframes?

The three-bar reversal pattern can be used effectively in intraday trading on different timeframes, but it has its pros and cons. One interesting statistic is that the pattern has a high success rate of around 70% when combined with other analysis. Pros include providing an excellent entry point and being adaptable for day trading.

However, cons include a higher trade risk due to the wide range of the signal bar and the potential for wild and unpredictable price action. The effectiveness of the pattern may vary on different timeframes, and it is important to consider other indicators or price patterns for high probability trade setups.

Are there any specific price patterns or indicators that can be combined with the Three-Bar Reversal pattern for higher probability trade setups?

Combining other price patterns and using volume analysis can enhance the effectiveness of the three-bar reversal pattern for higher probability trade setups. Traders can look for additional price patterns such as bullish or bearish engulfing patterns, double tops or bottoms, or trendline breaks to confirm the reversal signal.

Additionally, incorporating volume analysis can provide insights into the strength of the reversal, as higher volume during the reversal can indicate increased conviction from market participants. By incorporating these techniques, traders can improve the accuracy of their trades when using the three-bar reversal pattern.

How can traders manage the risk associated with the wide range of the signal bar in the Three-Bar Reversal pattern?

Traders can manage the risk associated with the wide range of the signal bar in the three-bar reversal pattern by employing various techniques for minimizing risk. One approach is to cut trade size or tighten stop loss levels to limit potential losses. Additionally, incorporating other indicators or price patterns can provide confirmation and increase the probability of successful trades. By blending the third and fourth bars using the candle blending technique, traders can enhance the pattern and potentially reduce trade risk.

Can the Three-Bar Reversal pattern be used as a standalone strategy, or is it more effective when combined with other analysis techniques?

The three-bar reversal pattern can be used as a standalone strategy in day trading, but it has both advantages and disadvantages. As an advantage, it provides a clear entry point when the third bar closes above the highs of the first two bars for a long setup or below the lows for a short setup.

However, the wide range of the signal bar can increase trade risk. To improve trading accuracy, traders can combine the pattern with other analysis techniques such as indicators or price patterns. This can enhance the probability of high-quality trade setups.