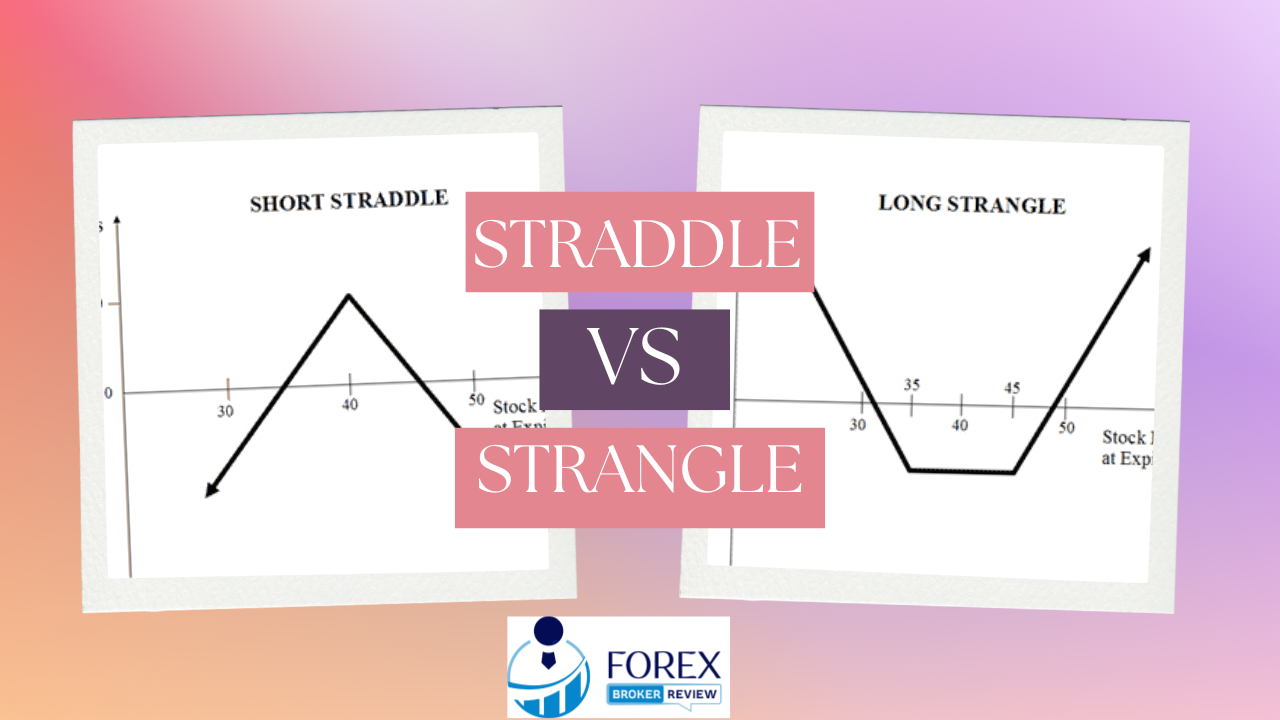

Options trading strategies can be complex and nuanced, requiring a deep understanding of market dynamics and risk management. Among these strategies, the straddle and strangle stand out as popular choices for traders looking to capitalize on volatility and uncertain market conditions. Both strategies offer the potential for significant profits, but they differ in their strike price structure and risk profiles.

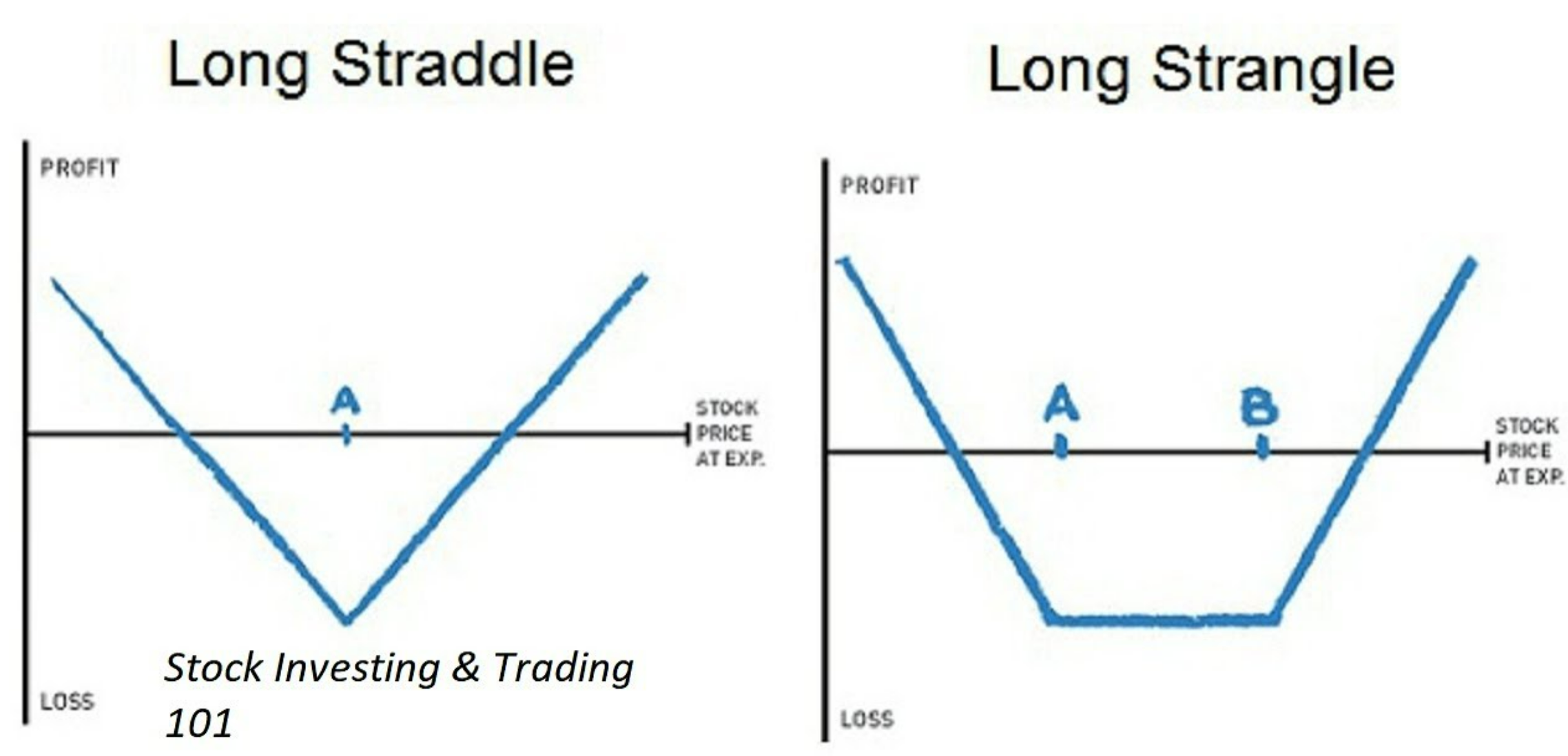

The straddle strategy involves simultaneously buying or selling an at-the-money call option and an at-the-money put option with the same strike price and expiration. This allows investors to profit from large moves in the underlying security, regardless of the direction of the price movement. On the other hand, the strangle strategy involves buying or selling an out-of-the-money call option and an out-of-the-money put option with different strike prices. This strategy also profits from volatility but at a lower cost due to the use of cheaper out-of-the-money options.

In this article, we will delve into the differences between straddles and strangles, examining their strike price structure, profit potential, risk profiles, and time decay. By understanding the nuances of these strategies, traders can make informed decisions about which approach best suits their trading objectives and market conditions.

Key Takeaways

- Straddle and strangle options trading strategies are similar in nature.

- The difference between the two lies in the strike price structure, with straddle using one strike price and strangle using two strike prices.

- Straddle has a higher degree of risk than strangle.

- Short straddles and strangles benefit from time decay (theta), while theta works against long straddles and strangles.

Straddle vs Strangle: Overview

The overview of the straddle vs strangle options trading strategies reveals that both strategies allow investors to profit from large moves in an underlying security and neutral markets, with the difference lying in the strike price structure. The straddle strategy involves buying or selling 1 at-the-money (ATM) call option and 1 ATM put option of the same strike price and expiration. On the other hand, the strangle strategy involves buying or selling 1 out-of-the-money (OTM) call option and 1 OTM put option of the same expiry cycle on the same underlying.

When considering the pros and cons of these strategies, factors to consider include the potential for profit and loss, the level of risk involved, and the impact of time decay on the options. Straddles have a higher degree of risk compared to strangles, but they also have the potential for unlimited profit. Strangles, on the other hand, have a lower risk but also a lower potential for profit. Traders should take into account these factors and their expectations for stock movement when deciding between a straddle and a strangle strategy.

Strike Price Structure (Straddle Vs Strangle)

In the realm of options trading, the strike price structure serves as a compass, guiding investors towards different paths that can lead to potential profits in the market. When comparing strike prices, the difference between a straddle and a strangle becomes apparent. A straddle involves using one strike price, while a strangle involves using two strike prices. This distinction allows investors to select optimal strikes based on their expectations for the underlying security.

With a straddle, the strike price is set at the current market price, allowing investors to profit from significant moves in either direction. On the other hand, a strangle has two strike prices, one below and one above the current market price, enabling investors to profit from large moves in either direction. By understanding and comparing the strike price structure, investors can make informed decisions when implementing straddles or strangles in their options trading strategies.

Profit from Upside and Downside

By implementing both the straddle and strangle options trading strategies, investors have the potential to profit from significant moves in both the upside and downside of an underlying security. These strategies serve as effective hedging strategies and volatility strategies, allowing traders to take advantage of market fluctuations.

- Straddles and strangles provide opportunities to profit from large swings in stock prices.

- Straddles involve buying or selling both a call and put option at the same strike price and expiration date, while strangles involve buying or selling both a call and put option at different strike prices.

- Both strategies are directionally agnostic, meaning they can be profitable regardless of whether the stock price goes up or down.

These strategies allow investors to diversify their portfolios and mitigate risk by taking advantage of both bullish and bearish market conditions. Additionally, they can be particularly useful during times of high market volatility or when trading earnings announcements.

Straddle Vs Strangle: Risk Comparison

One key factor to consider when comparing the risk of straddles and strangles is the difference in their strike price structure. In a long straddle, a trader buys one at-the-money (ATM) call option and one ATM put option with the same strike price and expiration. This strategy profits from significant price movements in either direction. On the other hand, a short strangle involves selling one out-of-the-money (OTM) call option and one OTM put option with different strike prices but the same expiration. This strategy benefits from low volatility and limited price movement.

To compare the risk management in these strategies, we can use a table:

| Strategy | Risk | Profit Potential |

|---|---|---|

| Long Straddle | High | Unlimited |

| Short Strangle | High | Limited |

The long straddle has a higher risk because it involves buying options, which have a limited lifespan due to time decay. This means that if the underlying stock price does not move significantly, the trader may experience a loss. On the other hand, the short strangle has a lower risk because it involves selling options, which benefit from time decay. However, the profit potential is limited in the short strangle strategy.

Time Decay and Theta

Time decay, also known as theta, is a significant factor to consider when comparing the risk and profitability of straddles and strangles. In options trading, time decay refers to the reduction in the value of an option as time passes. It affects both long straddles and short strangles differently.

For long straddles, time decay works against the trader. As time passes, the extrinsic value of the options decreases, resulting in a decrease in the overall value of the straddle. This means that the trader needs a larger move in the underlying stock to overcome the loss in value due to time decay.

On the other hand, time decay works in favor of traders who sell short strangles. As time passes, the extrinsic value of the options decreases, leading to a decrease in the overall value of the strangle. This can result in profits for the trader, especially if the stock price remains relatively stable.

Time decay plays a crucial role in options pricing and can significantly impact the profitability of both long straddles and short strangles. Traders should carefully consider the effect of time decay when deciding which strategy to utilize.

Straddle and Strangle: Volatility Crush

Volatility crush, a phenomenon observed in options trading, can have a significant impact on the profitability of both the long straddle and short strangle strategies. Volatility crush occurs when the implied volatility of options contracts decreases after a major event, such as earnings announcements. This decrease in volatility can lead to a decline in option prices, resulting in a decrease in the value of long straddles and short strangles.

Strategies for trading earnings often involve selling straddles and strangles to take advantage of the expected decrease in implied volatility after the announcement. This is because the decrease in implied volatility can lead to a decrease in the price of options, resulting in a profit for the seller. However, it is important to note that there is still risk involved in these strategies, as unexpected market movements can still lead to losses.

The impact of implied volatility on straddles and strangles can be seen in the table below:

| Strategy | Impact of Implied Volatility |

|---|---|

| Long Straddle | Increase in profitability |

| Short Straddle | Decrease in profitability |

| Long Strangle | Decrease in profitability |

| Short Strangle | Increase in profitability |

Overall, understanding the impact of implied volatility on straddles and strangles is crucial for options traders looking to take advantage of volatility crush and trade earnings effectively.

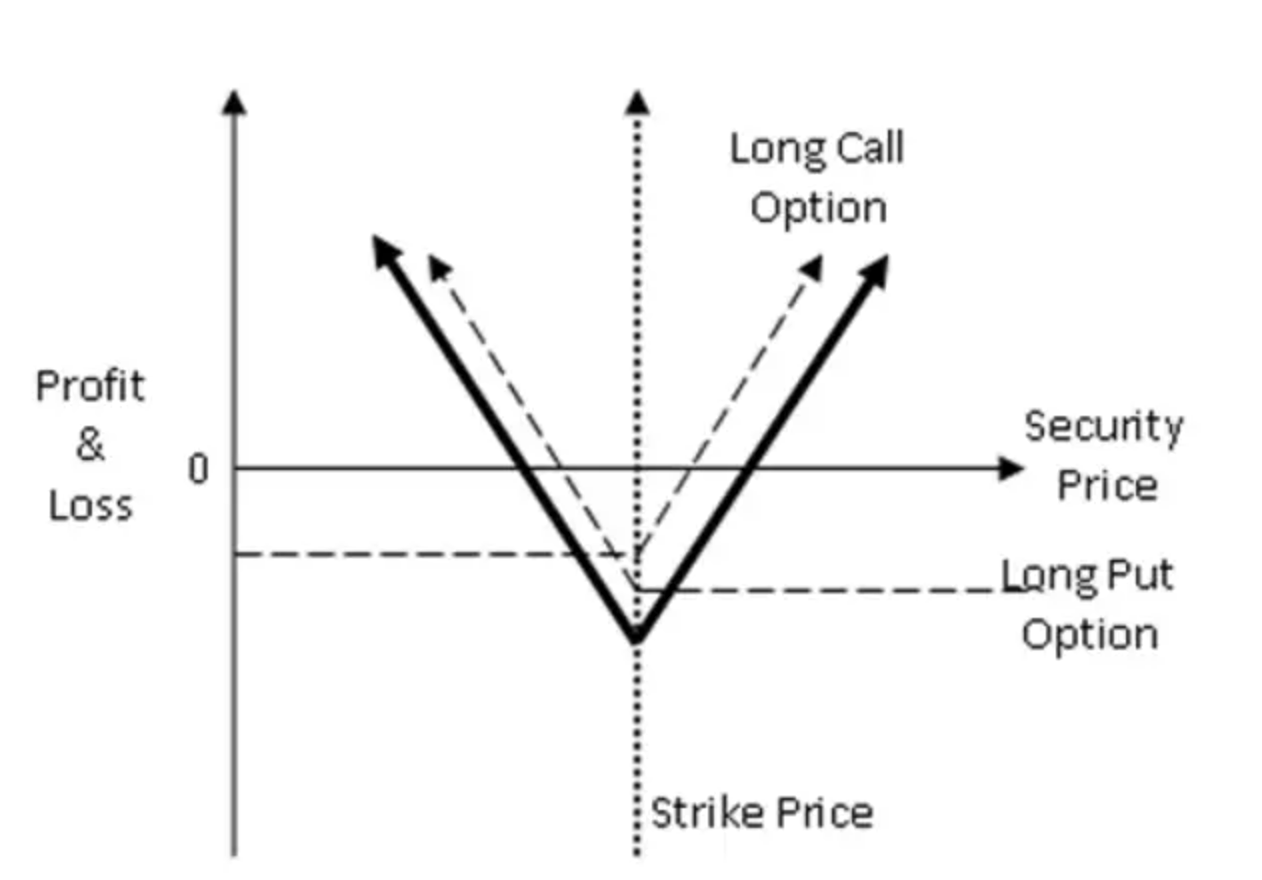

Straddle Components

The components of a straddle strategy include the purchase or sale of an at-the-money call option and an at-the-money put option with the same strike price and expiration date. This combination allows traders to profit from significant price movements in the underlying security, regardless of the direction. Here are four key aspects of a straddle strategy:

- Simultaneous purchase or sale: A straddle involves buying or selling both the call and put options at the same time.

- At-the-money strike price: The strike price of both the call and put options is set at the current market price of the underlying security.

- Same expiration date: Both options in the straddle have the same expiration date, allowing traders to benefit from any significant price movement within a specific time frame.

- Unlimited profit potential: The potential profit from a straddle strategy is unlimited since traders can profit from large upside or downside swings in the underlying security.

By understanding these components, traders can effectively compare and evaluate the differences between a straddle and a strangle strategy.

Straddle Trade Results

One notable result of a straddle trade is the potential for unlimited profit due to the ability to profit from significant price movements in the underlying security. When implementing a straddle trade, the combined value of the put and call options will determine the overall profitability. If the combined value of the put and call options is higher than the initial price, the trade will result in a profit.

On the other hand, if the combined value is lower, the trade will result in a loss. Several factors can affect the profitability of a straddle trade, including the magnitude of the price movement, the volatility of the underlying security, and the time decay of the options. It is important for traders to carefully consider these factors when implementing a straddle strategy.

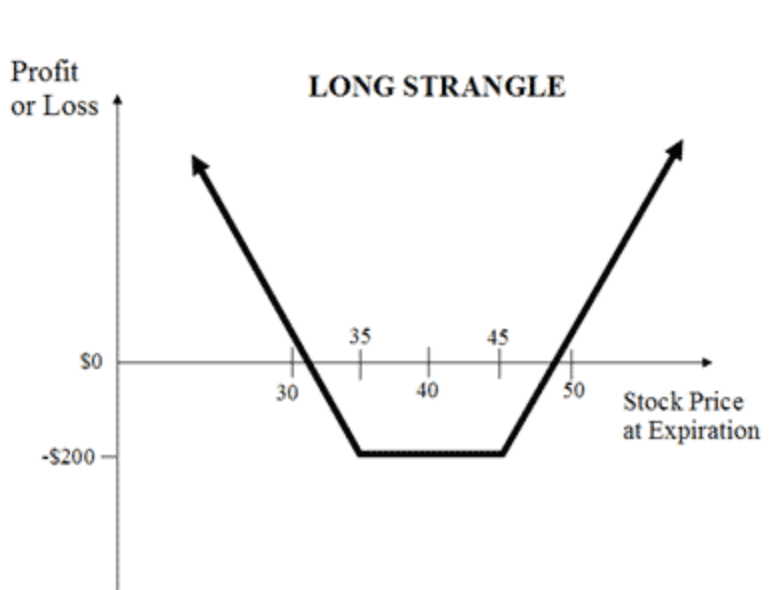

Strangle Components

When implementing a strangle trade, traders must consider the components involved, which include buying or selling one out-of-the-money call option and one out-of-the-money put option with the same expiration cycle on the same underlying security. The out-of-the-money call option has a strike price above the current market price of the security, while the out-of-the-money put option has a strike price below the current market price.

This strategy allows traders to profit from significant price movements in either direction, as long as the price moves beyond the strike prices of both options. The profitability of a strangle trade depends on the magnitude of the price movement and the premiums paid for the options. Risk management in strangles involves monitoring the price movements closely and adjusting the positions if necessary to limit potential losses.

Strangle Trade Results

Traders can assess the outcome of a strangle trade by considering the price movements of the underlying security in relation to the strike prices of the out-of-the-money call and put options. In a long strangle trade, where an investor buys an out-of-the-money call and put option, the potential profit is unlimited if the stock price moves significantly in either direction.

However, the maximum loss is limited to the total debit paid for the options. On the other hand, in a short strangle trade, where an investor sells an out-of-the-money call and put option, the potential profit is limited to the premium received, but the maximum loss is also limited to the total debit paid. It is important to note that if the combined value of the short put and short call options is zero at expiration, the trader achieves the maximum profit.

Choosing Between Straddle and Strangle

To make an informed decision, investors must carefully consider their risk tolerance, market expectations, and the potential for significant price movements when choosing between the straddle and strangle options trading strategies. Both strategies offer opportunities to profit from large price swings, but they also come with their own set of risks.

The straddle strategy, with its single strike price, is more expensive but has a higher chance of success. It is best suited for traders who expect a significant movement in the stock and are willing to take on more risk. On the other hand, the strangle strategy, with its two strike prices, is cheaper but has a lower chance of success. It is marginally safer than the straddle and may be a better choice for traders who expect moderate price movements. Ultimately, the choice between the two strategies should be based on individual risk management preferences and market conditions.

Frequently Asked Questions

How do straddle and strangle strategies differ in terms of their profit potential?

The profit potential of straddle and strangle strategies in volatile markets can be analyzed based on their pros and cons. Straddles have unlimited profit potential and can benefit from large price swings, but they have a higher degree of risk and are sensitive to time decay.

Strangles, on the other hand, also have unlimited profit potential but require a smaller net debit. To maximize profit potential, traders can consider factors such as strike prices, expiration dates, and option premiums.

What are the main risks associated with short straddles and strangles?

The main risks associated with short straddles and strangles are primarily due to the potential for significant market movement. Short straddles involve selling both a call and put option with the same strike price and expiration.

The risk lies in the possibility of the underlying stock price moving beyond the strike price, resulting in potential losses. Similarly, short strangles involve selling an out-of-the-money call and put option, posing the risk of substantial price movements. These strategies require careful monitoring and management to mitigate potential losses.

Can both straddle and strangle strategies be used during earnings season?

During earnings season, both straddle and strangle strategies can be useful for traders. The advantage of using a straddle strategy is that it allows traders to profit from large price movements in either direction, regardless of the stock’s actual direction.

On the other hand, a strangle strategy can be advantageous because it is typically cheaper to implement than a straddle due to the use of out-of-the-money options. However, it is important to consider the level of volatility expected during earnings season and the associated costs of each strategy.

How does the cost of a strangle compare to the cost of a straddle?

The cost of a strangle is typically lower than the cost of a straddle. This is because a strangle involves buying or selling out-of-the-money options, which are generally cheaper than at-the-money options used in a straddle.

However, it’s important to consider the risk analysis when comparing the two strategies. Strangles have a higher risk due to the potential for larger price moves required for profitability. Traders should carefully assess their risk tolerance and market expectations when choosing between the two strategies.

Are there any additional options strategies that can be used to offset risk in combination with a straddle or strangle?

Hedging techniques and alternative risk mitigation strategies can be employed in combination with a straddle or strangle options strategy to offset risk. One such strategy is the use of options spreads, such as the iron condor or the butterfly spread.

These spreads involve the simultaneous buying and selling of multiple options contracts with different strike prices and expiration dates. By incorporating these additional options positions, traders can limit their potential losses or protect against adverse market movements, while still benefiting from the potential gains of the straddle or strangle strategy.