Table of Contents

ToggleDiscover Admiral Markets, a well-established online brokerage firm founded in 2001. With its headquarters in Tallinn, Estonia, Admiral Markets is your reliable partner for trading in various financial markets. Rest assured, Admiral Markets is under the stringent supervision of top-tier regulatory bodies including the UK Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC).

Admiral Markets boasts a diverse portfolio of trading instruments, spanning forex, commodities, stocks, and cryptocurrencies, ensuring you have ample choices to diversify your investment portfolio. With a global presence across more than 20 countries, Admiral Markets is committed to serving traders worldwide.

Our objective in this review is to offer a comprehensive overview of Admiral Markets’ services and product offerings. We will delve into crucial aspects such as trading platforms, trading conditions, account types, customer support, and more. By the end of this evaluation, you will gain a comprehensive understanding of what Admiral Markets provides and determine if it aligns with your trading needs. Choose Admiral Markets for a secure and transparent trading experience.

Admiral Markets Pros and Cons

Admiral Markets is a global financial services provider that offers trading services in various markets, including forex, stocks, commodities, and indices. The platform is known for its advanced trading tools, competitive pricing, and excellent customer support. However, like any other trading platform, it has its own advantages and disadvantages.

Pros

- Advanced trading platforms: Admiral Markets offers advanced trading platforms like MetaTrader 4 and 5, which provide traders with access to cutting-edge tools and features that help them make informed trading decisions.

- Competitive pricing: Admiral Markets offers competitive pricing on spreads, making it an attractive option for traders looking for low-cost trading.

- Range of trading instruments: Admiral Markets offers a wide range of trading instruments, including forex, stocks, indices, commodities, and cryptocurrencies, providing traders with numerous trading opportunities.

- Regulated broker: Admiral Markets is regulated by top-tier financial regulators like the FCA, ASIC, and CySEC, which ensures that traders’ funds are safe and secure.

- Excellent customer support: Admiral Markets provides traders with excellent customer support through various channels like email, live chat, and phone.

Cons

- Limited educational resources: Admiral Markets does not provide a lot of educational resources for traders, which can be a disadvantage for beginners.

- High minimum deposit: The minimum deposit required to open an account with Admiral Markets is relatively high compared to other brokers, which may be a disadvantage for small traders.

- Limited payment options: Admiral Markets offers limited payment options, which may be an inconvenience for traders who prefer using certain payment methods.

- No fixed spread accounts: Admiral Markets does not offer fixed spread accounts, which may not be suitable for traders who prefer trading with a fixed spread.

Is Admiral Markets Safe?

Admiral Markets is a reputable financial services provider that offers trading services in various financial markets, including forex, stocks, and commodities. The company operates under strict regulatory oversight to ensure the safety and protection of its clients’ interests. Here are some key aspects of Admiral Markets’ safety and regulation:

Regulatory bodies overseeing Admiral Markets

- Financial Conduct Authority (FCA) in the United Kingdom

- Cyprus Securities and Exchange Commission (CySEC) in Cyprus

- Australian Securities and Investments Commission (ASIC) in Australia

- Estonian Financial Supervision Authority (EFSA) in Estonia

These regulatory bodies ensure that Admiral Markets adheres to strict regulatory standards and procedures.

Security measures for clients’ funds and personal information

Admiral Markets employs various security measures to protect clients’ funds and personal information. The company uses SSL encryption to ensure the confidentiality and integrity of clients’ data, and it keeps clients’ funds in segregated accounts that are separate from its operating funds. Moreover, the company has a robust risk management system that monitors clients’ accounts for any suspicious activities.

Complaints and resolutions

Admiral Markets has a dedicated customer support team that handles client complaints and inquiries. Clients can submit their complaints through various channels, including email, phone, or live chat. The company has a complaints resolution process that is designed to resolve client complaints quickly and fairly. If a client is not satisfied with the outcome, they can escalate their complaint to the relevant regulatory body.

Related Post: IG Markets Review 2023: Platform, Trading, Commission & Support

Investments Options on Admiral Markets

Admiral Markets is an online forex and CFD broker that offers its clients a range of financial instruments for trading. Clients can trade over 4,000 financial instruments, including forex pairs, commodities, indices, shares, ETFs, and bonds.

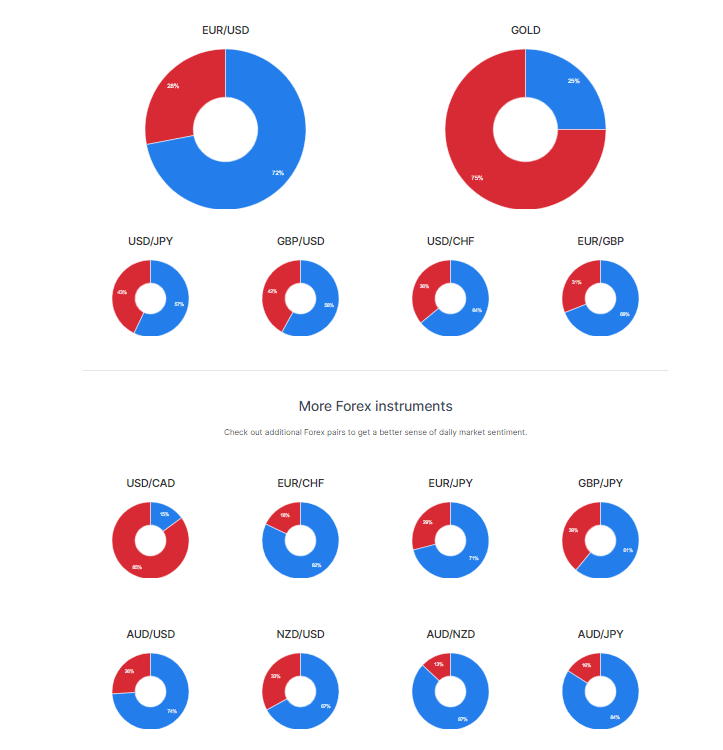

Range of financial instruments available for trading

Admiral Markets provides its clients with access to a diverse range of financial instruments from some of the most popular markets around the world. Clients can trade over 50 currency pairs, including major, minor, and exotic markets. The platform also offers trading in indices from major exchanges, commodities like gold and oil, and a range of individual shares from global markets.

Trading conditions for different account types

Admiral Markets offers several account types, including the Admiral.Markets, Admiral.Prime, and Admiral.MT5 accounts. The Admiral.Markets account offers floating spreads and no commissions, while the Admiral.Prime account provides lower spreads and commission-based trading. The Admiral.MT5 account offers access to the MetaTrader 5 platform and a range of advanced features.

Leverage and margin requirements

The maximum leverage offered by Admiral Markets varies based on the financial instrument and account type. For forex trading, the maximum leverage is 1:30 for retail clients and 1:500 for professional clients. Margin requirements also vary based on the instrument and account type, with the margin required ranging from 1% to 20%.

You May Also Like: FxPro Review 2023: Trading, Commission, Education & Pros/Cons

Admiral Markets Commissions

Admiral Markets is an online broker offering trading services in various financial markets, including forex, stocks, indices, commodities, and cryptocurrencies. This broker operates on a commission-based model, where traders pay a commission on top of the spread for every trade executed.

Spread and commission models: Admiral Markets offers two types of accounts, the Admiral Markets account, and the Admiral Prime account. The Admiral Markets account has higher spreads but does not charge any commission, while the Admiral Prime account has lower spreads but charges a commission per trade. The commission fee varies depending on the asset traded and the volume of the trade.

| Commission per 1.0 lots per side | |||

|---|---|---|---|

| Monthly Volume, USD | |||

| Account currency | Up to 10,000,000 | 10,000,000 – 50,000,000 | Over 50,000,000 |

| USD | 3.0 | 2.4 | 1.8 |

| EUR | 2.6 | 2.1 | 1.6 |

| JOD | 2.2 | 1.7 | 1.3 |

| AED | 11 | 8.8 | 6.6 |

Non-trading fees: Admiral Markets charges various non-trading fees, including withdrawal and inactivity fees. Withdrawal fees vary depending on the method used, while the inactivity fee is charged to accounts that have been inactive for more than 24 months.

Comparison with other brokers in the market: Compared to other brokers in the market, Admiral Markets’ commissions and fees are generally competitive. The broker’s spreads are relatively low, and the commission fees charged on the Admiral Prime account are reasonable. However, the withdrawal fees charged by Admiral Markets are higher compared to some of its competitors. Overall, Admiral Markets’ commission and fee structure is transparent and reasonable, making it a viable option for traders looking for a broker with competitive pricing.

Further Reading: Eightcap Review 2023: Pros and Cons, Trading, Fees & Mobile App

Trading Platforms: Admiral Markets

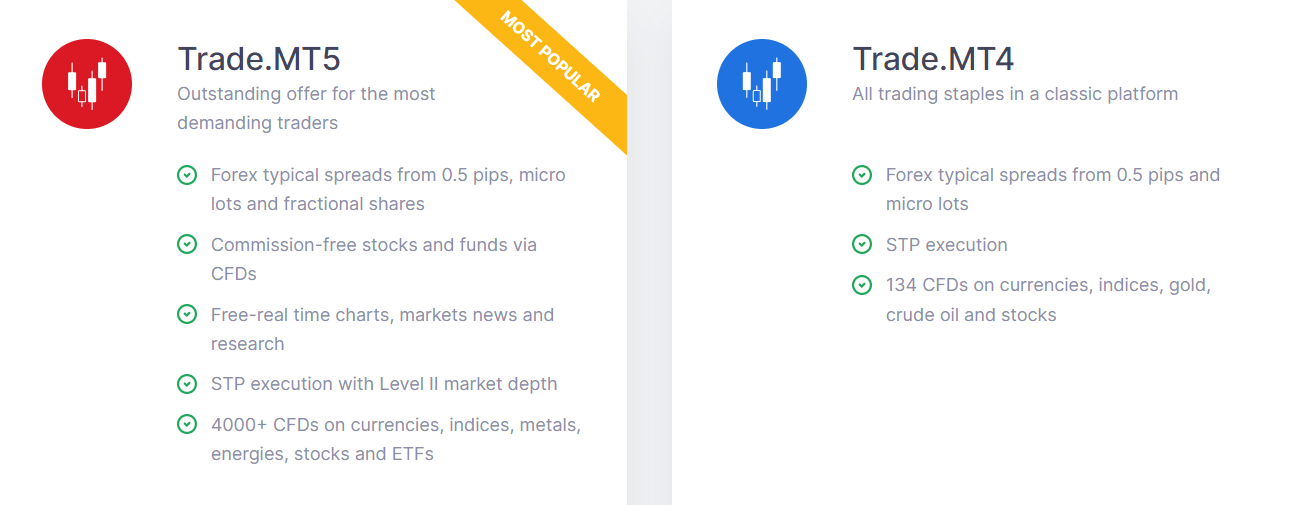

Admiral Markets is a globally renowned trading provider, offering a variety of trading platforms to its clients. Among the different trading platforms, the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms are the most popular ones.

MT4 is the most commonly used trading platform in the forex industry. It is a powerful platform with advanced features such as multiple chart setups, custom indicators, and automated trading. MT4 also offers a wide range of order types, including market, limit, and stop orders. MT5, on the other hand, is the upgraded version of MT4 and offers more advanced features such as improved charting capabilities, more order types, and additional technical indicators.

Admiral Markets also provides mobile trading apps that enable traders to access their trading accounts on-the-go. The Admiral Markets mobile app is available for both iOS and Android devices, and it provides traders with access to real-time market data, charts, and news updates. The app also enables traders to execute trades, manage their positions, and monitor their account balances.

In addition to MT4, MT5, and mobile trading apps, Admiral Markets also provides access to other trading platforms such as the MetaTrader WebTrader and the MetaTrader Supreme Edition. The MetaTrader WebTrader is a browser-based platform that allows traders to access their accounts from any device with an internet connection. The MetaTrader Supreme Edition is an add-on for the MT4 and MT5 platforms that provides traders with additional tools and features, such as the Mini Terminal, which enables traders to place and manage trades directly from the chart.

Explore More: eToro Reviews 2023: Features, Platform, and User Feedback

Admiral Markets: Research and Analysis

Admiral Markets is a reputable financial market brokerage firm that provides in-depth research and analysis to help traders make informed decisions. In addition to offering a variety of trading platforms, Admiral Markets also offers a range of tools and resources to support traders, including daily market commentary and analysis, an economic calendar, news feeds, and technical analysis tools.

Daily market commentary and analysis:

Admiral Markets provides daily market commentary and analysis that covers various financial markets, including forex, stocks, commodities, and indices. Their analysis is conducted by experienced analysts who use fundamental and technical analysis to identify market trends, price action, and potential trading opportunities. Traders can access the analysis through the Admiral Markets website or trading platforms.

Economic calendar and news feeds:

Admiral Markets provides an economic calendar that includes upcoming economic events, such as interest rate decisions, employment reports, and GDP releases. Traders can use this information to anticipate potential market volatility and adjust their trading strategies accordingly. In addition, Admiral Markets offers news feeds that cover global financial news and events, providing traders with up-to-date information that may impact their trades.

Technical analysis tools:

Admiral Markets provides a range of technical analysis tools that traders can use to analyze price action and identify potential trading opportunities. These tools include charting software, technical indicators, and trading signals. Traders can customize the tools to fit their trading style and preferences, and use them to enhance their trading strategies.

Discover: City Index Review 2023: Is it the Best Online Trading Platform?

Admiral Markets’ Educational Resources

Admiral Markets is a leading online trading provider that offers a wide range of educational resources and support services to help traders of all levels succeed in the financial markets. From beginner to advanced traders, Admiral Markets provides a wealth of information, tools, and guidance to help traders make informed trading decisions.

Trading Academy and Educational Resources: The Admiral Markets Trading Academy provides traders with comprehensive educational resources to help them develop their trading skills. The academy offers a range of courses, tutorials, and eBooks covering various topics, such as technical analysis, fundamental analysis, risk management, and trading psychology. Additionally, traders can access a range of educational articles, trading ideas, and market analysis tools on the Admiral Markets website.

Webinars and Seminars: Admiral Markets also offers a range of webinars and seminars for traders to learn from experienced professionals. These events cover various topics, such as trading strategies, market analysis, and risk management. Traders can attend these events live or watch the recordings at a later time.

Customer Support and Assistance: Admiral Markets provides traders with excellent customer support and assistance. Traders can contact the support team via phone, email, or live chat, and the team is available 24/5 to assist with any questions or concerns. Additionally, Admiral Markets provides traders with a range of trading tools, such as a demo account, economic calendar, and market analysis tools to help them make informed trading decisions.

Check out: BDSwiss Review 2023: Is it a Reliable Forex and CFD Broker?

Final Thoughts: Admiral Markets

Admiral Markets, the go-to online trading platform, has earned its reputation as a reliable and user-friendly choice for traders across the globe. In this final insights piece, we’ll explore some key takeaways that make Admiral Markets a standout choice.

Admiral Markets excels in providing an extensive array of trading instruments that cater to traders of all stripes. Whether your interest lies in forex, stocks, indices, or commodities, Admiral Markets has a treasure trove of options to satisfy your trading cravings. Furthermore, their MetaTrader suite is celebrated for its advanced charting features and algorithmic trading possibilities.

What truly sets Admiral Markets apart is its commitment to educating its clients. Their educational resources, including webinars and comprehensive articles, span a wide spectrum of topics. Whether you’re a novice or a seasoned trader, you’ll find valuable insights to enhance your trading skills.

Admiral Markets takes your safety seriously. They offer a suite of risk management tools, including stop-loss orders and negative balance protection, to safeguard your investments. Rest easy knowing your trading experience is fortified against unforeseen market fluctuations.

Need assistance? Admiral Markets’ customer support team is at your service 24/5, ready to address any queries or concerns. Their commitment to customer satisfaction ensures you’re never alone on your trading journey.

Admiral Markets is your trusted, user-friendly trading platform that not only offers a diverse range of trading instruments but also provides essential tools for risk management. Whether you’re a seasoned pro or a trading novice, Admiral Markets is a must-visit destination for traders of all levels. Start your trading journey today with Admiral Markets and experience a world of possibilities.

More Resources: Swissquote Review: Is This the Best Online Broker in 2023?

FAQs

What is Admiral Markets, and how long has it been in the trading industry?

Admiral Markets is a well-established online trading platform that has been serving traders worldwide since its founding in 2001. With over two decades of experience, it has gained a strong reputation for reliability and user-friendly services.

Which financial markets can I trade on Admiral Markets?

Admiral Markets offers a diverse range of trading instruments, including forex, stocks, indices, and commodities. This extensive selection ensures there’s something for every trader, regardless of their preference.

What makes Admiral Markets’ MetaTrader suite special?

Admiral Markets is renowned for its MetaTrader suite, praised for advanced charting features and algorithmic trading options. It provides traders with a powerful toolkit to enhance their trading strategies.

How does Admiral Markets support trader education?

Admiral Markets is dedicated to client education, offering an array of resources such as webinars and in-depth articles. These materials cover a wide range of topics, making them accessible to traders of all skill levels.

What risk management tools does Admiral Markets offer?

To protect traders from potential losses, Admiral Markets provides essential risk management tools, including stop-loss orders and negative balance protection. These tools help mitigate the impact of market volatility.

Is Admiral Markets a regulated broker?

Yes, Admiral Markets is regulated by top-tier financial authorities, including the UK Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC). These regulatory bodies ensure the platform adheres to strict industry standards.

Can I access customer support at any time?

Admiral Markets’ customer support team is available 24/5 to assist with any questions or concerns you may have. This ensures you have timely assistance throughout your trading journey.

Are there different account types to choose from?

Yes, Admiral Markets offers various account types to suit different trading needs. These include standard accounts, demo accounts for practice, and more specialized options catering to specific trading styles.

Does Admiral Markets provide mobile trading options?

Absolutely. Admiral Markets offers mobile trading apps, enabling you to trade on the go. Whether you have an iOS or Android device, you can access your account and execute trades anytime, anywhere.

How can I get started with Admiral Markets?

Getting started with Admiral Markets is straightforward. Simply visit their website, open an account, complete the necessary verification steps, deposit funds, and you’ll be ready to start trading in the financial markets with their robust platform and services.