Table of Contents

ToggleAre you looking for a reliable, trustworthy Forex broker? Then XM Broker Review 2023 is here to help. With the rapid growth of the Forex market in recent years, traders need to make sure they’re making informed decisions when choosing their broker. That’s why this review will provide an honest assessment of XM Broker, so you can decide if it’s the right choice for you.

In this comprehensive review of XM Broker, we’ll cover everything from its trading conditions and fees to customer service and account types. We’ll also look at XM’s reputation among its clients and other traders in the industry. So if you want to know more about XM before investing your hard-earned money, read on!

Our team has spent countless hours researching and comparing different Forex brokers. We’ve done all the hard work so that you don’t have to. By reading this review, you’ll be able to easily decide whether XM is a good option for your trading needs or not. So let’s dive into our detailed analysis of XM Broker Review 2023!

Recommended: In-Depth Analysis of IC Markets | Is IC Markets a Good Broker?

Overview Of XM Broker

XM Broker is an online broker offering forex, CFDs and commodities trading services. The company was founded in 2009 and has grown to become one of the largest brokers in the world, with over two million clients from 196 countries. XM offers a variety of features such as tight spreads, no commissions, a wide range of trading instruments and platforms, negative balance protection and 24/7 customer support. Additionally, XM offers a range of bonuses and promotions for new and existing clients.

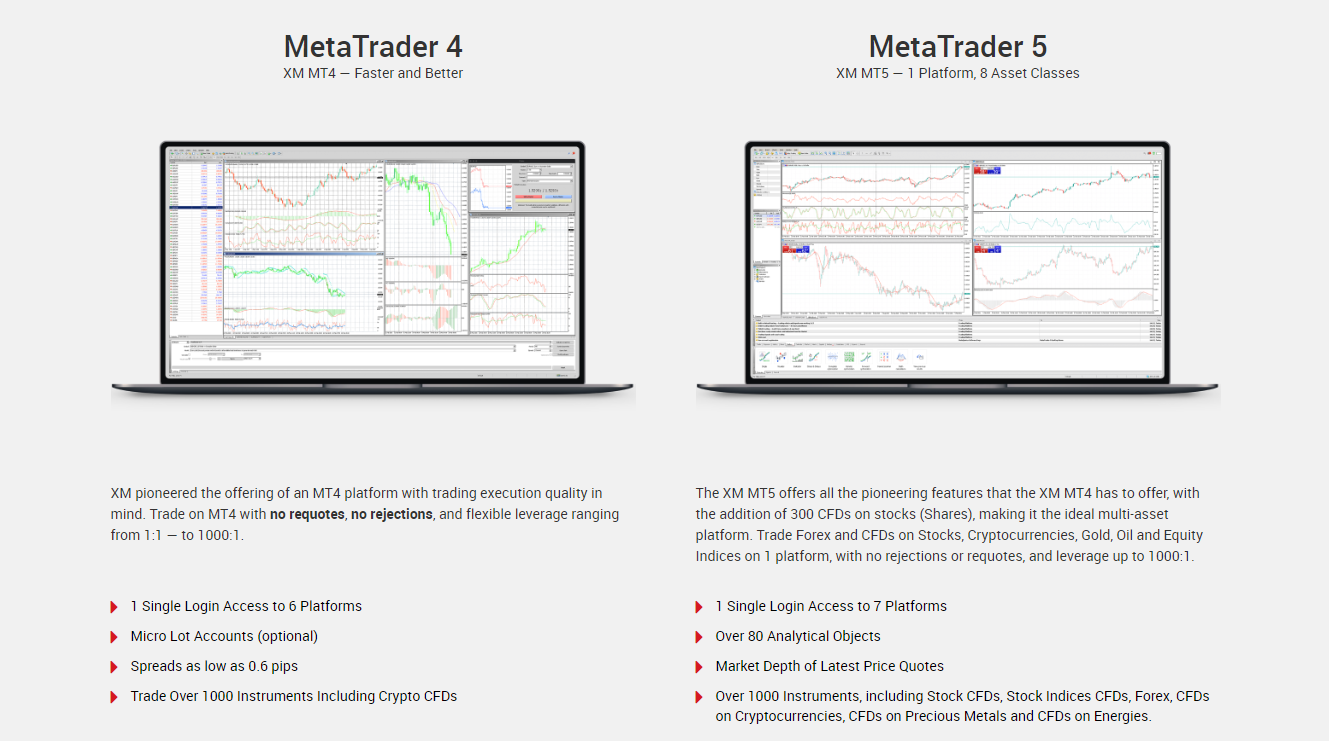

The trading platforms offered by XM are some of the most popular in the industry. These include Metatrader 4 (MT4) for desktop, webtrader for web-based trading, mobile apps for iOS and Android devices as well as multi-terminal which allows traders to manage multiple accounts simultaneously. All these platforms are equipped with advanced charting capabilities as well as automated trading strategies that can be used to help make more profitable decisions when it comes to investing in financial markets.

XM provides its clients with access to over 1000 CFDs including shares, indices, commodities and cryptocurrencies such as Bitcoin, Ethereum, Litecoin and Ripple. The broker also offers competitive spreads across all its asset classes ranging from 0 pips on major currency pairs up to 1 pip on exotic pairs. Furthermore, XM also provides leverage up to 500:1 depending on the instrument being traded which gives traders greater flexibility in managing their risk profile. All in all, XM is an excellent choice for those looking for a reputable broker offering quality services at competitive rates.

Read Next: Tickmill Review 2023 | Is Tickmill a Safe Broker?

Pros And Cons of XM Broker

Pros

- One of the main advantages of using XM is that it has a wide variety of asset classes to choose from, such as stocks, bonds, commodities, currencies and indices. This gives traders a great choice when it comes to deciding what type of trading they want to pursue.

- Another great advantage is that XM offers competitive spreads and fees for all transactions, which helps keep costs low for traders.

- XM has a highly competent team available 24/7 to answer any queries or resolve any issues.

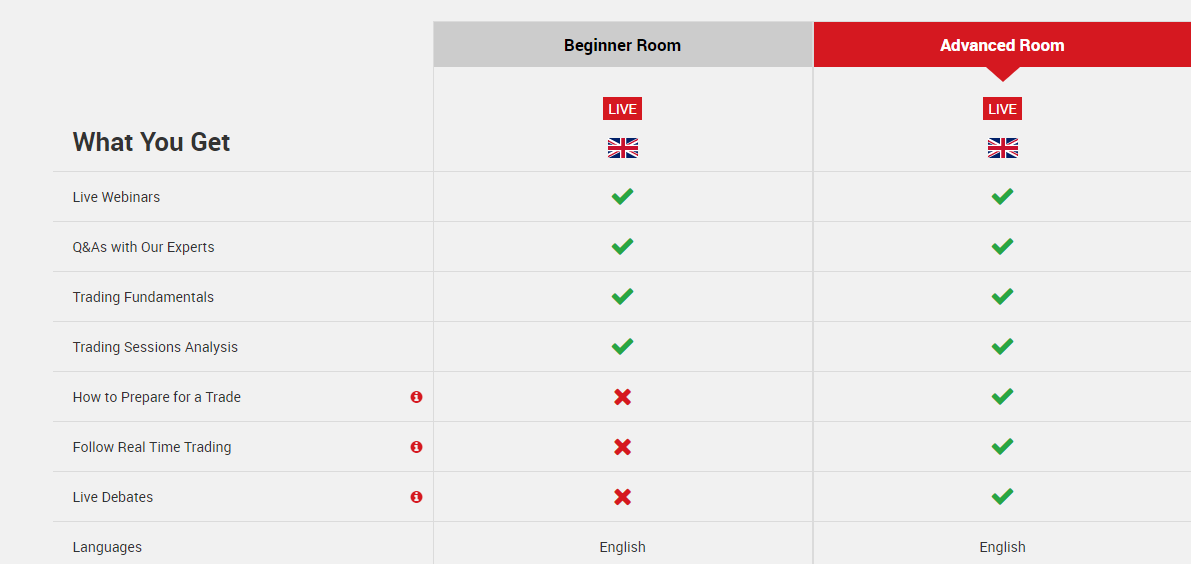

- They also offer educational material in the form of webinars and training videos, which can help traders get up to speed with the markets more quickly.

- Their user interface is very intuitive and easy to use, allowing even beginners to start trading quickly with minimal fuss.

Cons

- Nothing except the loading speed of their website

XM Forex Broker: Commissions And Fees

XM Broker offers competitive commission and fee structures for traders. There are no commissions charged for trading in most of the assets available at XM, such as currencies, commodities, indices and stocks. The only fees charged are the spreads which are fixed and variable depending on the asset being traded. The spreads start from 0 pips (i.e. no spread) for certain currency pairs depending on the account type held with XM Broker.

| Account | Fees, Spreads & Commissions |

| Micro Account | minimum deposit of $5, leverage from 1:1 to 1:1000, spreads from as low as 1 pip, and zero commissions. |

| Standard Account | minimum deposit of $5, leverage from 1:1 to 1:1000, spreads from as low as 1 pip, and zero commissions. |

| XM Ultra-Low Account | minimum deposit of $50, leverage from 1:1 to 1:1000, spreads from 0.6 pips, and zero commissions. |

| Shares Account | minimum deposit of $10,000, no leverage and commissions charges as per the underlying exchange from $1 up to $9. |

For traders who prefer to trade with leverage, XM broker offers leverage up to 1:500. This allows traders to make larger trades than what their capital can normally allow them to do. It should be noted that this comes with an increased risk of potential loss and so traders need to be aware of this when using leverage as part of their trading strategy.

XM also offers a number of other features such as trading signals, automated trading, negative balance protection and access to global markets all through one platform or broker app. These features can help traders save time and maximize their returns while minimizing risk through careful analysis and research within their chosen assets or markets.

Take a Look: Honest and In-Depth Analysis of FXCM | Is FXCM a Good Broker?

XM Broker: Trading Platforms & Tools

XM Broker offers a comprehensive range of trading platforms and tools for their clients. They have a wide variety of options available, from the MetaTrader 4 (MT4) platform to their own proprietary platform, XM WebTrader. The MT4 platform is the most popular platform among traders, as it offers a number of features such as advanced charting capabilities, automated trading systems (EAs), and more. Additionally, XM Broker also offers additional platforms, such as mobile and web-based platforms for on-the-go trading.

The trading tools offered by XM Broker are quite diverse and provide traders with the information they need to make better decisions. These include fundamental analysis with real-time news and economic calendar updates, technical analysis with over 50 technical indicators and drawing tools, sentiment indicators that show how other traders are feeling about the market, plus more. Furthermore, XM Broker offers account managers who can offer personalized advice to help clients in making decisions.

Overall, XM Broker has gone to great lengths to ensure their clients have access to all the necessary resources for successful trading. They offer multiple platforms and a variety of tools that allow traders to be well informed about the markets they’re investing in. With these resources at their disposal, traders can make wiser decisions when investing in financial markets and manage their portfolios more effectively.

Continue Reading: Pepperstone Review 2023 | Is Pepperstone a Reliable Broker

XM Forex: Investment Types Supported

XM Broker offers a wide range of investment types for their clients. These include Forex trading, CFD trading, Stock Trading, Futures Trading and Cryptocurrency Trading. All these investments can be traded in the renowned MetaTrader 4 and MetaTrader 5 platforms.

For Forex traders, XM Broker allows access to over 55 currency pairs with floating spreads as low as 0 pips. Clients have the ability to open trades as small as 0.01 lot and leverage up to 1:888. XM Broker also offers some unique features such as negative balance protection, which helps protect traders from losing more than what they invested.

When it comes to CFDs, XM Broker provides access to over 1200 global markets including indices, commodities and stocks. The minimum trade size is 0.01 lots and leverage up to 1:500 is available for all instruments. With this broker you can use Expert Advisors (EA’s) for automated trading or take advantage of the free VPS hosting services provided.

In short, XM Broker offers a comprehensive range of investment types that are suitable for both experienced traders and beginners alike. Their competitive fees, low spreads and wide range of tools make them an attractive option for any trader looking for a reliable online broker in 2023.

Dig Deeper: Honest and In-Depth Analysis of Octafx | Is Octafx a Good Broker?

XM Broker Account Types

At XM broker, customers can choose from a variety of account options to suit their needs. The Standard Account is the most popular option, offering competitive spreads and no commissions on trades. The Micro Account offers traders with smaller capital balances the ability to trade in small increments, as well as tight spreads and low minimum deposits. For those with more experience, there are also VIP Accounts which offer advanced features such as higher leverage and priority withdrawals.

Broker Type: Market Maker

Minimum Deposit: $5

Spread: As low as 0.0 pips

Scalping: Yes

Hedging: Yes

Free Demo Account: Yes

Traders From USA: No

No matter what type of account you choose, all require a minimum deposit of 500 units of the currency you’re trading in. This ensures that XM broker maintains the highest standards of security while allowing traders to capitalize on market opportunities with minimal risk. Additionally, margin requirements are based on the size and complexity of each individual trade.

XM broker also provides its customers with dedicated customer support and access to educational resources to help them make informed trading decisions. These include webinars, tutorials and live market analysis as well as 24-hour customer service via email or phone if needed. All services are available in multiple languages to accommodate traders from all over the world.

Find Out: Exness Review 2023 | Is Exness a Safe Broker?

Customer Service & Education Resources By XM Broker

Xm Broker’s customer service is top-notch. They provide 24/5 support through live chat, email and phone. Their representatives are highly knowledgeable and friendly, so they’re able to quickly answer any queries you have. They also have a comprehensive FAQ section on their website that covers many topics related to trading and investing.

Moreover, XM Broker offers plenty of educational resources for those looking to learn about the stock market or improve their trading skills. The broker has webinars, video tutorials and ebooks that cover various topics such as technical analysis, risk management, fundamental analysis and more. It also provides access to the MetaTrader 4 platform which is well known for its features and user-friendly interface.

All in all, XM Broker offers great customer service and an extensive range of educational resources that can help traders of all levels get up to speed with the basics of stock trading or refine their strategies for better returns. With its high-quality customer service and education offerings, XM Broker is sure to be a popular choice among investors in 2023.

Learn More: Honest and In-Depth Analysis of FBS | Is FBS a Good Broker?

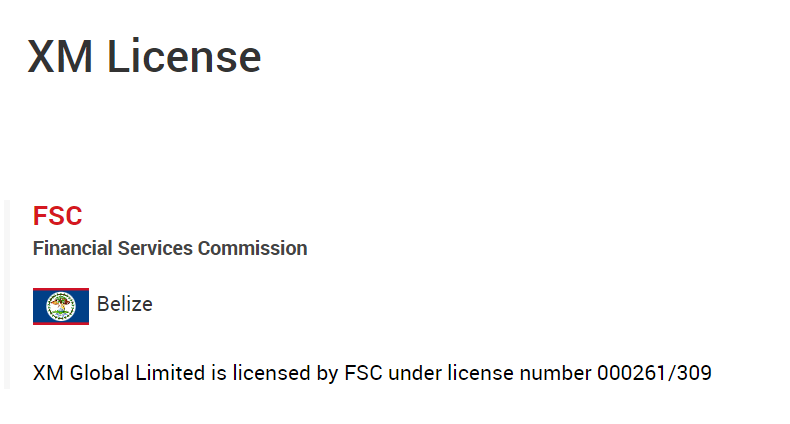

XM Broker: Security & Regulation

When it comes to security and regulation, XM broker review 2023 is a reliable choice. They are regulated by the Cyprus Securities and Exchange Commission (CySEC), one of the most respected regulatory authorities in Europe. They also have an extensive range of internal security measures in place to protect their clients’ funds and data.

All client funds are held in segregated accounts with major European banks, ensuring that they are kept secure at all times. The company also uses encryption technology to ensure all user information is stored securely on their servers. Additionally, their website is protected by the Secure Socket Layer (SSL) protocol which helps keep sensitive customer data safe from hackers.

XM broker review 2023 also has a strict anti-money laundering policy which means that all customers must go through a verification process before they can start trading. This ensures that only legitimate traders are able to use their services and protect clients from any fraudulent activities.

Overall, XM broker review 2023 is a reliable choice for those looking for a secure trading experience with a trusted broker. Their robust security measures and strict regulation make them one of the best brokers available today.

More Resources: Alpari Review 2023 | Is Alpari a Reliable Broker?

Deposit & Withdrawal Methods: XM Forex

XM Broker provides a wide range of deposit and withdrawal methods for its customers. Bank wire transfers, credit and debit cards, as well as e-Wallets are accepted by the broker. The minimum deposit requirement is $5 and the processing fees depend on the method used. There is no maximum limit for deposits or withdrawals.

| Options | Currency | Min. amount | Fees | Time |

| VISA | USD, EUR | $5 | None | 2 – 10 days |

| MasterCard | USD, EUR | $5 | None | 2 – 10 days |

| Maestro | USD, EUR | $5 | None | 2 – 10 days |

| WebMoney | USD, EUR | $5 | None | 2 – 10 days |

| NganLuong | USD, EUR | $5 | None | Instantly |

| Neteller | USD, EUR | $5 | None | Instantly |

| Skrill | USD, EUR | $5 | None | Instantly |

| Bank transfer | Any | $150 | Depends | 2 – 10 days |

When it comes to withdrawing funds from XM Broker, it is a fast and secure process. Customers can request a withdrawal directly from their trading account. All requests are processed within 24 hours of submission, unless there is an issue with verification or security checks. It’s also important to note that any profits made via trading must be withdrawn in the same currency as the initial deposit.

Overall, XM Broker makes it easy to manage funds with its extensive selection of deposit and withdrawal options. The process is quick and secure, allowing customers to access their money quickly when needed. Additionally, the low minimum deposit requirement makes it accessible for traders of all levels and budget sizes.

Check out: IG Review 2023 | Is IG a Top Broker for Investment Needs?

Conclusion

After reviewing the features, services and customer support of XM Broker in 2023, it is evident that they have made significant improvements since their launch. Their platform is user-friendly and intuitive, with a wide range of trading tools and instruments. They have great customer service and offer competitive fees and spreads.

Overall, XM Broker provides traders with an excellent experience. They offer a secure environment to trade in, with plenty of options for both beginner and advanced traders. They also provide educational resources to help traders understand the markets better.

XM Broker is one of the best forex brokers available today. Their features, services, customer support and competitive pricing make them a top choice for traders looking for an enjoyable trading experience.

Discover: HFM Review 2023: Honest and In-Depth Analysis of HF Markets

Frequently Asked Questions

Does XM Broker Offer A Mobile Trading App?

Yes, XM Broker does offer a mobile trading app. The app is available for both Android and iOS devices, and it allows users to manage their investments on the go. It is fast and intuitive, giving users all the tools they need to make informed decisions about their investments. The mobile trading app also provides real-time price data and analysis, giving users an edge when making trades.

The mobile trading app from XM Broker offers a range of features that make it a great choice for traders of all levels. For starters, it provides users with access to the full range of asset classes offered by the broker, including stocks, bonds, mutual funds, ETFs and more. Additionally, the app offers advanced charting capabilities and comprehensive research tools which can help traders make better decisions. Furthermore, the app has an intuitive and user-friendly interface which makes it easy to use even for beginners.

XM Broker’s mobile trading app is a great option for those looking to stay up-to-date with their investments while on the go. With its comprehensive features and intuitive design, it gives traders access to powerful tools that can help them achieve success in their investment goals. The ability to manage trades quickly and easily via a smartphone or tablet makes this platform ideal for busy professionals who want to stay in control of their finances wherever they are.

Does XM Broker Offer Any Special Bonuses Or Promotions?

When it comes to online trading, bonuses and promotions are often a deciding factor for many investors. Offering special incentives can be a great way to attract traders, but how does XM Broker fare in this regard? Does XM Broker offer any special bonuses or promotions?

The answer is yes. XM Broker offers several different types of bonuses and promotions for their customers. They have a range of deposit bonuses that vary from $5 to $5000 depending on the size of your deposit. In addition, they also offer No Deposit Bonuses which provide additional funds to trade with without having to make a deposit. Furthermore, XM Broker also offers loyalty rewards in the form of cashback on trades, as well as other promotional campaigns such as contests and giveaways.

All of these bonuses and promotions come with terms and conditions that must be read carefully before taking part in them. For example, some promotions require you to meet certain trading volume requirements before you can withdraw your bonus or winnings from the contest. Additionally, there may be minimum deposit amounts or time limits on when you can take advantage of these offers. It’s also important to note that most of these bonuses are subject to market volatility and changes in currency exchange rates so it’s important to stay up-to-date with the latest news before making any decisions related to these programs.

Overall, XM Broker offers a variety of attractive incentives for traders looking to get started or build their portfolios. These include deposit and no-deposit bonuses, loyalty rewards, promotional campaigns, and more. To ensure that you understand all the rules associated with these offers before taking advantage of them is essential for successful trading with XM Broker.

Does XM Broker Provide Any Form Of Margin Trading?

Margin trading is a type of investment that allows traders to borrow money from their broker or financial institution in order to increase the size of their trades. This can be a great way for traders to maximize their potential profits, but it also comes with certain risks. With margin trading, traders are taking on additional debt and they may be subject to additional fees or penalties if they don’t meet certain requirements. As such, it is important for investors to understand the risks associated with margin trading before engaging in this type of activity.

When it comes to XM Broker, they do offer some forms of margin trading. However, there are a few things that investors should be aware of before getting started. First, XM Broker does not allow investors to open positions larger than 50% of their account balance. This means that investors need to have enough money in their account to cover the full amount of the trade if they want to take advantage of margin trading. Additionally, XM Broker requires investors to maintain a minimum balance in order to continue using margin trading services.

Lastly, it is important for investors to consider all costs when deciding whether or not margin trading is right for them. Margin trading can be beneficial in some circumstances, but investors need to make sure they understand all the risks involved before making any decisions. Additionally, it is important for traders to understand how XM Broker’s fees and penalties work so they can ensure they get the best possible deal when engaging in margin trading activities with this broker.

It is clear that XM Broker does offer some forms of margin trading services; however, understanding all the associated fees and risks involved is key when making any kind of investment decision. It’s important for investors to do their due diligence and fully understand what they’re signing up for before engaging in any form of investing activity with XM Broker or any other broker for that matter.

Are There Any Hidden Fees Associated With Using XM Broker?

Investing in the stock market can be a great way to make money, but there are often hidden fees associated with using any broker. When researching which broker to use, it is important to keep an eye out for these hidden fees. The current question is: are there any hidden fees associated with using XM Broker?

In order to answer this question, it is important to do research into the different fees and charges that XM Broker offers. It is likely that XM Broker has some form of small fee or commission associated with its services. This could include account maintenance fees, trading commissions, and other miscellaneous costs. It’s also possible that they may have additional fees such as withdrawal or deposit charges that you should be aware of before investing your money.

It’s important to take the time to thoroughly investigate any broker’s fee structure before investing your money with them. Doing so will help ensure that you understand what kind of costs you’re dealing with and can help you make an informed decision about whether or not XM Broker is right for you. Additionally, it’s a good idea to read reviews from other customers who have used XM Broker in order to get a better understanding of their service and fees structure.

Overall, researching the hidden fees associated with XM Broker can be beneficial in helping you make an informed decision about investing your money through them. Doing so can help ensure that you’re making a wise investment choice and can save you from unexpected expenses down the line. Taking the time to research now can save you from potential problems later on when investing with XM Broker.

Does XM Broker Provide Access To International Markets?

When it comes to trading, having access to international markets can be a great advantage. People who are interested in investing are likely wondering if XM Broker provides access to these markets. The answer is yes, XM Broker does provide access to international markets for their traders.

XM Broker offers clients access to a range of international markets including major and minor currency pairs, stocks, commodities, indices, and ETFs. Additionally, the broker offers clients a wide selection of instruments and financial products from different global exchanges in more than 20 countries. This means that traders can take advantage of different opportunities while trading in multiple countries.

Moreover, XM Broker provides its clients with an intuitive platform that makes it easy for them to monitor the trends and news of various international markets. This platform also allows traders to make informed decisions when trading in any given market and manage their investments with ease. Furthermore, XM Broker offers its customers several tools such as margin calculators and automated trading strategies that can help them maximize their profits and minimize their losses when trading on the global market.

Overall, XM Broker is an excellent choice for those looking to diversify their portfolios by trading in multiple international markets. The broker offers an intuitive platform as well as numerous tools that can help traders make informed decisions regarding their investments. All these features make XM Broker an ideal option for those who want to take advantage of the various opportunities present on the global market.