Since 2013, swing trading signals have emerged as a popular approach to trading, offering a quantified and data-driven strategy for market participants. These signals, which are based on rigorous backtesting, provide traders with a transparent and reliable tool to make informed decisions. Daily signals are conveniently delivered through either a website or email subscription, with the flexibility to cancel anytime. For those interested in exploring the service, a $1 trial option is available.

In contrast, cross trading is a practice that involves buying and selling securities off the public order book, bypassing exchange recording. While it can offer advantages such as executing transactions at desired price points and avoiding spread commissions, there are also legal and regulatory considerations to be aware of. This article will delve into the concept of swing trading signals, explore cross trading, discuss its advantages and disadvantages, and examine the legality and regulations surrounding these practices.

Key Takeaways

- Swing trading signals are a popular and data-driven approach to trading, gaining popularity since 2013.

- These signals provide transparent and reliable tools for decision-making, delivering daily buy and sell recommendations based on rigorous backtesting.

- Swing signals analyze technical indicators like moving averages, price patterns, and volume to identify entry and exit points, taking advantage of short-term price fluctuations.

- Using swing trading signals can potentially lead to higher returns and provide convenience for traders.

What are Swing Trading Signals?

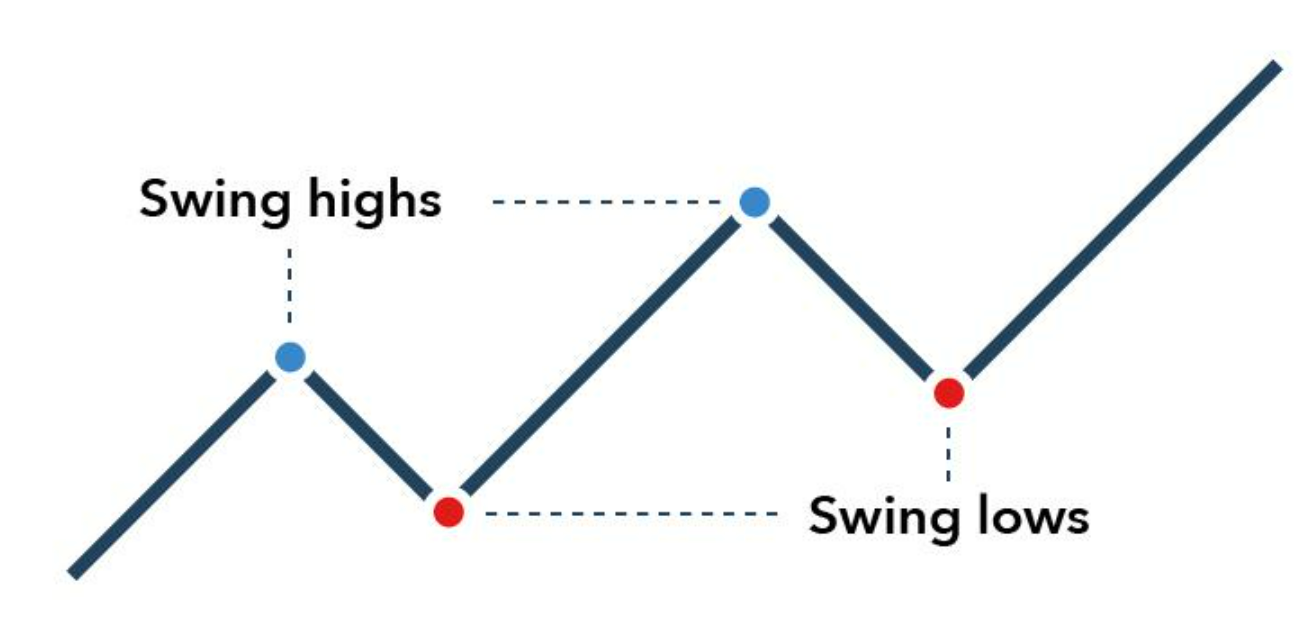

Swing signals refer to quantified and data-driven trading signals that have been developed since 2013 and provide daily buy and sell recommendations for swing trading. These signals are based on rigorous backtesting and are designed to identify short-term price movements in the market. Swing signals work by analyzing various technical indicators, such as moving averages, price patterns, and volume, to identify potential entry and exit points for trades.

Source: IG

By following these signals, traders can take advantage of short-term price fluctuations and potentially make profits. The benefits of using swing signals include the ability to take advantage of short-term trading opportunities, the potential for higher returns compared to long-term investing, and the convenience of receiving daily signals via websites or email. By relying on quantified and data-driven signals, traders can make informed decisions and improve their chances of success in swing trading.

Cross Trading

Cross trading, a method of buying and selling securities off the public order book, is a commonly used practice in the financial industry, particularly in cases involving identical buy and sell orders connected to derivative trades. This type of trading allows investors to execute trades without recording the transaction on an exchange.

While cross trading can offer several advantages, such as allowing traders to buy and sell securities at their own specific price point and eliminating the need to pay commission in the form of a spread, it also carries certain risks. Cross trading can be used as a smokescreen to manipulate the market illegally and is more relevant to investors who trade volatile securities. It is not permitted on most exchanges, but it can be allowed under certain conditions, such as for hedging derivatives trades or for certain block orders.

| Advantages | Risks |

|---|---|

| Allows traders to buy and sell securities at their own price point | Can be used to manipulate the market illegally |

| Eliminates the need to pay commission in the form of a spread | More relevant to investors who trade volatile securities |

| Can be legally executed when a broker matches a buy and sell for two separate client accounts | Not permitted on most exchanges |

| Useful for trades involving identical buy and sell orders connected to derivatives trade | Can be allowed under certain conditions, such as for hedging derivatives trades or certain block orders |

| Provides flexibility in executing trades |

Advantages and Disadvantages of Swing Trading Signals

One advantage of cross trading is that it provides flexibility in executing trades, allowing investors to buy and sell securities at their own specific price point. This eliminates the need to pay commission in the form of a spread, which can be significant for traders dealing with volatile securities. Additionally, cross trading can be permitted as a hedge to derivatives trades or for certain block orders, providing opportunities for risk management and portfolio diversification.

However, it is important to note that cross trading may be used as a smokescreen to manipulate the market illegally, and therefore, it is not permitted on most exchanges. Moreover, the lack of transparency in cross trading raises concerns about price discovery and the potential for conflicts of interest. As such, investors should carefully consider the disadvantages and potential risks associated with cross trading before engaging in such practices.

Swing Trading Indicators: Legality and Regulations

Legality and regulations surrounding the practice of cross trading have been a subject of concern due to its potential for market manipulation and lack of transparency. The regulatory framework for cross trading varies across jurisdictions, with most exchanges not permitting this practice. However, under certain conditions, cross trading can be legally executed when a broker matches a buy and sell for the same security for two separate client accounts and reports it as a cross trade.

The enforcement measures for cross trading regulations aim to prevent market manipulation and ensure fair trading practices. Although cross trading can be allowed as a hedge to derivatives trade or for certain block orders, it is important to note that it may be used as a smokescreen to manipulate the market illegally. Consequently, it is crucial for regulators to monitor and enforce the rules surrounding cross trading to maintain market integrity.

Frequently Asked Questions

How are swing trading signals generated and what is the underlying methodology behind them?

Understanding swing trading techniques involves analyzing swing trading indicators. Traders use various technical analysis tools, such as moving averages, relative strength index (RSI), and Bollinger Bands, to identify potential entry and exit points. These indicators help traders assess market trends, momentum, and overbought or oversold conditions.

By combining these indicators with other analysis methods, such as chart patterns and support/resistance levels, swing trading signals are generated. The underlying methodology behind swing trading signals focuses on capturing short-term price movements and taking advantage of market fluctuations.

Are swing trading signals suitable for all types of investors, or are they more suited for experienced traders?

Swing trading signals may not be suitable for all types of investors, especially inexperienced ones. Relying solely on these signals can have both pros and cons. On the one hand, they provide a data-driven and backtested approach, which can be helpful for decision-making.

However, inexperienced investors may lack the necessary understanding of market trends and the underlying methodology behind these signals. It is important to have a solid grasp of market dynamics and trends before relying on swing trading signals.

Can swing trading signals be used for different asset classes, such as stocks, forex, or commodities?

Swing trading signals can be used for different asset classes, including stocks, forex, and commodities. The advantage of using these signals is that they provide a quantified and data-driven approach to trading, allowing investors to make informed decisions.

However, it is important to consider the specific characteristics and dynamics of each asset class when interpreting these signals. Factors such as market volatility, liquidity, and fundamental analysis should be taken into account to ensure accurate decision making.

How often are swing trading signals generated and how long do they typically last before a new signal is generated?

Swing traders frequently use trading signals to inform their trading decisions. The frequency of signal generation varies depending on the specific trading strategy and market conditions. Some swing traders may generate signals on a daily basis, while others may do so on a weekly or even monthly basis.

The duration of swing trades also varies, with some traders preferring shorter-term trades that last a few days or weeks, while others may hold positions for several months. Ultimately, the preferred duration for swing trades depends on the trader’s individual strategy and risk tolerance.

Are swing trading signals effective in both bull and bear markets, or do they perform better in specific market conditions?

Swing trading signals can be effective in both bull and bear markets, but their performance may vary in volatile market conditions. In bull markets, swing trading signals can help traders capture short-term price movements and generate profits.

However, in bear markets, the effectiveness of swing trading signals may be reduced as the overall market trend is downward. The role of technical analysis is crucial in generating swing trading signals, as it helps identify patterns and trends in price movements, allowing traders to make informed decisions.