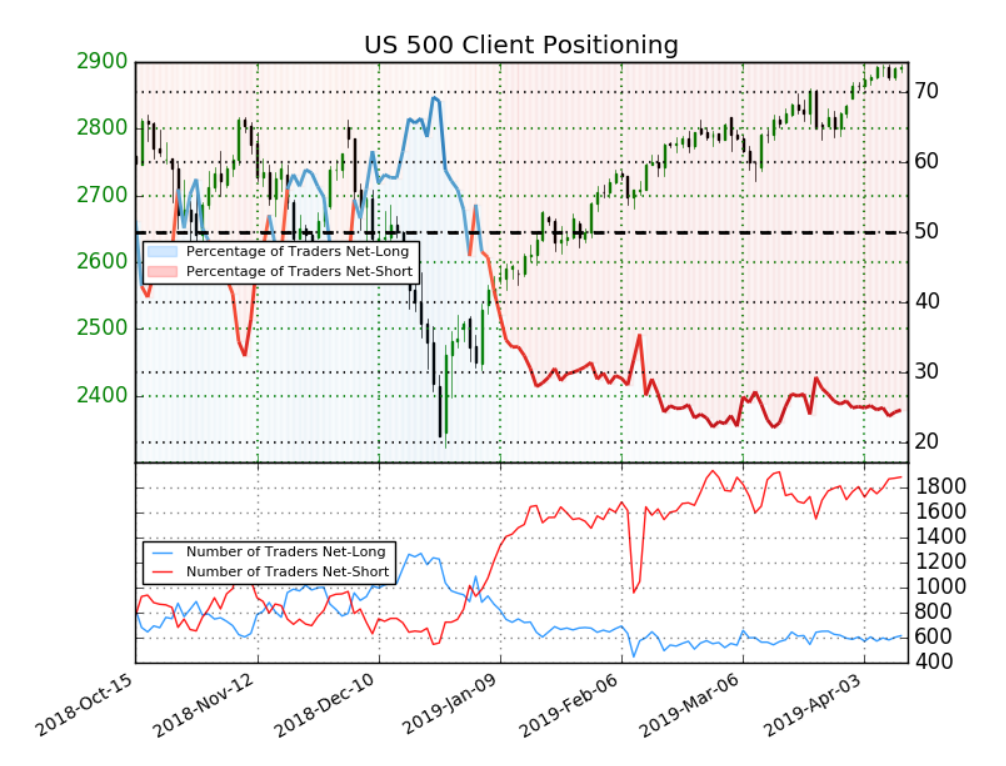

Trading on sentiment involves the utilization of IG client sentiment data as a valuable tool for identifying hidden trends in the market. By analyzing the sentiment data, traders can make informed decisions based on the positioning of retail traders. For instance, let’s consider a hypothetical case where the majority of retail traders are holding long positions on a certain currency pair. This may indicate a strong directional bias towards that currency pair.

However, contrarian traders would view this as an opportunity to trade in the opposite direction, as strong retail trader sentiment often leads to market reversals. To enhance the accuracy of trading decisions, it is crucial to combine sentiment data with technical analysis. This combination allows traders to assess the overall market sentiment and determine the direction of the trend, enabling them to make well-informed trading choices. By understanding both the sentiment data and the technical analysis, traders can effectively navigate the markets and potentially capitalize on profitable opportunities.

Key Takeaways

- Trading on sentiment data can help identify hidden trends in the market.

- IG Client Sentiment acts as a contrarian signal, indicating the opposite direction of strong directional bias.

- Traders should not solely rely on IG Client Sentiment but combine it with technical analysis for a comprehensive trading strategy.

- Changes in long and short positions can indicate a reversal in overall sentiment and help determine the direction of the trend.

How to Trade Sentiment Using IG Client Sentiment Data

To trade sentiment using IG client sentiment data, traders can utilize sentiment to determine the market and trade direction, identify extremes in positioning, and combine it with technical analysis for entry and exit points. Analyzing sentiment indicators involves assessing the prevailing sentiment among retail traders and using it as a contrarian signal.

Traders can look for markets that exhibit significant imbalances in positioning, as readings greater than 2 indicate a meaningful bias among retail traders. Additionally, incorporating sentiment into risk management is crucial. Traders should be cautious when the sentiment is at extreme levels, as it may indicate a potential reversal in overall sentiment. By combining sentiment data with technical analysis, traders can make more informed trading decisions and improve their chances of success.

Interpreting IG Client Sentiment Data

Interpreting sentiment data entails analyzing the prevailing market positioning among retail traders, identifying any significant biases, and combining this information with technical analysis for informed trading decisions. For instance, the NZD/USD example highlights a substantial imbalance in positioning, with 78% of traders being net long, indicating a potential contrarian signal in a trending market.

By using sentiment data, traders can identify market trends and use them as entry and exit points for their trades. It is important to note that sentiment data should not be the sole basis for trading decisions but should be combined with other forms of analysis, such as technical analysis. By incorporating sentiment analysis into their trading strategy, traders can gain valuable insights into market dynamics and enhance their trading performance.

Combining IG Client Sentiment Data with Technical Analysis

Combining sentiment analysis with technical analysis allows traders to gain a comprehensive understanding of market dynamics and make more informed trading decisions. By incorporating sentiment indicators, traders can gauge the overall market sentiment and identify potential market reversals. Analyzing market extremes in sentiment positioning can provide valuable insights into market trends and potential turning points.

Traders can look for markets exhibiting significant imbalances in sentiment, such as a large number of traders holding long or short positions. This information, when combined with technical analysis, can help traders identify entry and exit points with higher probability. By considering both sentiment and technical factors, traders can have a more holistic approach to trading, taking into account both market sentiment and price patterns for more accurate decision-making.

Frequently Asked Questions

How often is the IG client sentiment data updated?

The IG client sentiment data is updated in real time, providing traders with the most current information on market positioning. This frequency of updates allows traders to make informed decisions based on the latest data available.

Can sentiment data be used as the sole basis for making trading decisions?

Sentiment data should not be used as the sole basis for making trading decisions due to emotional biases. Combining sentiment data with technical analysis provides a more objective and data-driven approach, allowing traders to make informed decisions based on market trends and indicators.

Are there any limitations or potential drawbacks to using IG client sentiment data?

The limitations of sentiment data and potential drawbacks include its reliance on retail traders, who often trade against the trend, and the need to combine it with technical analysis. Changes in sentiment may not always indicate a reliable reversal in overall market sentiment.

How can traders determine if a market is exhibiting extremes in positioning?

Traders can determine if a market is exhibiting extremes in positioning by using market sentiment indicators and sentiment analysis techniques. These tools help identify significant biases among retail traders, indicating potential reversal points in overall sentiment.

Is sentiment data more reliable in trending markets or in range-bound markets?

Sentiment data is generally more reliable in trending markets than in range-bound markets. This is because trending markets exhibit stronger directional biases, making it easier to identify and trade against the crowd sentiment. In range-bound markets, sentiment data may be less conclusive due to the lack of a clear trend. Reliability can be enhanced by combining sentiment analysis with technical analysis for market behavior analysis.