Picture this: you’re standing on the edge of a vast financial market, filled with opportunities and risks. As you look out, you notice a pattern emerging – an ascending and descending broadening wedge pattern. This powerful formation can provide valuable insights into market trends and help you make informed trading decisions.

In this comprehensive guide, we will delve into the world of the ascending and descending broadening wedge patterns. We’ll explore how to identify these patterns, analyze price movements within them, and use them to your advantage in the market.

Whether you’re a seasoned trader or just starting out, understanding these patterns is crucial for enhancing your trading skills. You’ll discover strategies for effectively trading with the ascending and descending broadening wedge patterns, as well as tips to further refine your techniques.

So get ready to unlock the secrets of these fascinating formations and take your trading game to new heights. Let’s dive in!

Key Takeaways About Broadening Wedge Pattern

- The ascending broadening wedge pattern is a bullish continuation pattern characterized by two upward sloping trendlines that diverge, creating a widening formation.

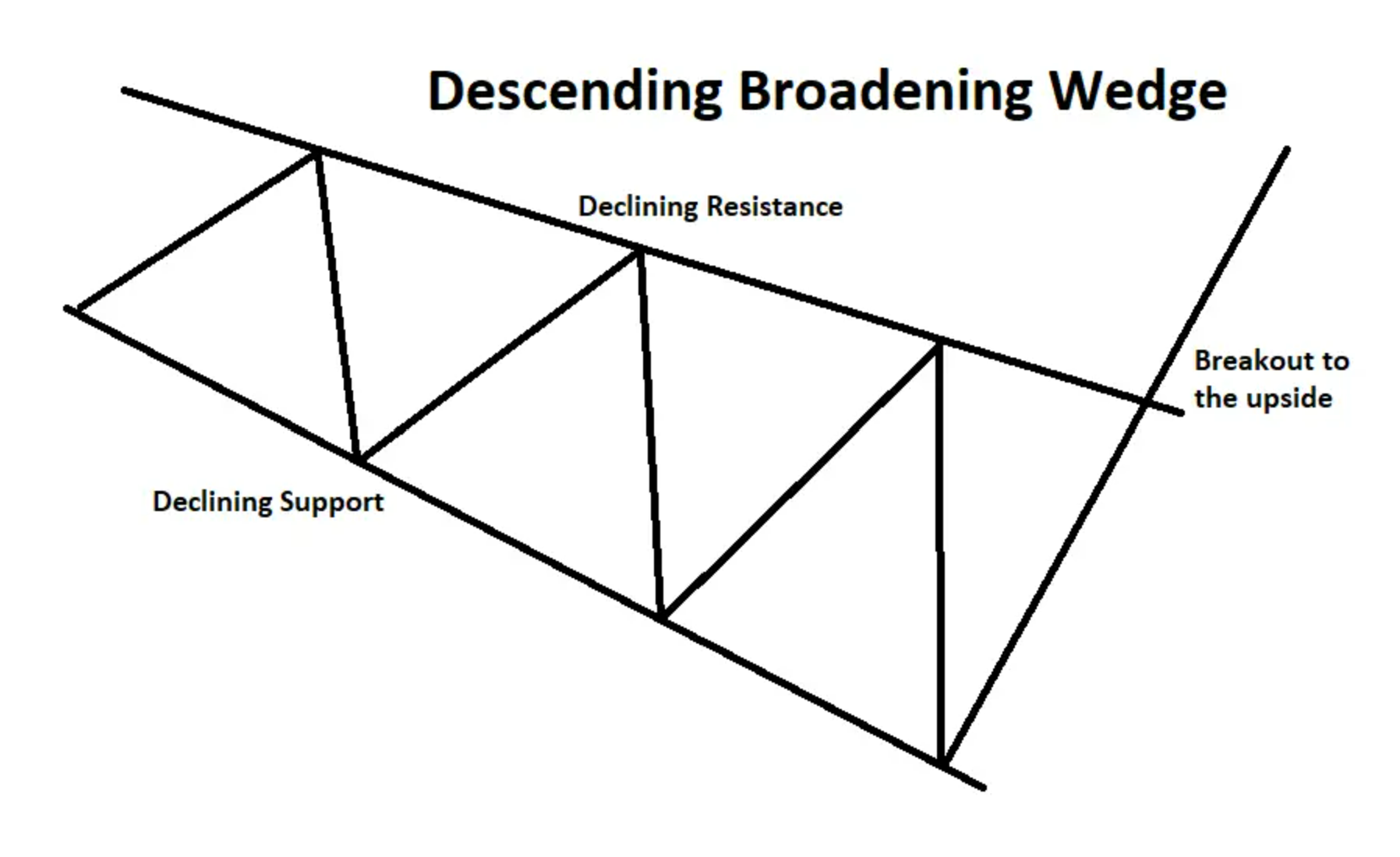

- The descending broadening wedge pattern is a bearish reversal pattern characterized by two converging trendlines that slope downwards.

- Analyzing price movements within the patterns can help identify market trends, such as wide-ranging swings indicating volatility, decreasing volume suggesting a potential breakout, and converging trendlines indicating equal buying and selling pressures.

- Strategies for trading the patterns include entering long positions near the lower trendline in an ascending pattern and entering short positions near the upper trendline in a descending pattern.

What’s Ascending Broadening Wedge Pattern

Get ready to understand the mind-bending Ascending Broadening Wedge pattern and brace yourself for an emotional rollercoaster! When it comes to identifying breakouts in the market, this pattern can be a game-changer. The Ascending Broadening Wedge is a bullish continuation pattern that signifies uncertainty and volatility. It is characterized by two upward sloping trendlines that are diverging, creating a widening formation.

Traders often refer to this pattern as a megaphone or expanding triangle due to its shape. To effectively utilize this pattern, it’s crucial to consider different timeframes. Patterns in smaller timeframes can provide short-term trading opportunities, while patterns in larger timeframes can give insights into longer-term trends. By analyzing these patterns diligently, you can gain an edge in your trading strategy and make informed decisions based on market dynamics.

What’s Descending Broadening Wedge Pattern

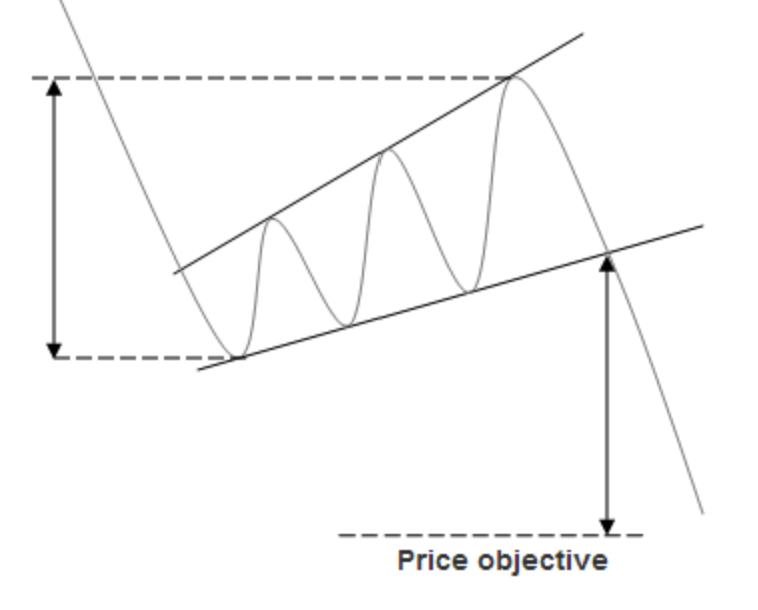

Recognize the telltale signs of this downward-sloping formation and you’ll be on your way to spotting the descending broadening wedge pattern like a pro. When identifying potential reversals, keep an eye out for two converging trendlines that slope downwards. These trendlines should have at least two distinct swing highs and swing lows that are spaced apart, creating a widening pattern.

It’s important to note that the upper trendline is drawn across the swing highs while the lower trendline connects the swing lows. To avoid common mistakes, ensure that both trendlines are valid by touching multiple price points and avoiding outliers. Additionally, remember to wait for confirmation before making any trading decisions as false signals can occur. By mastering these techniques, you’ll have an edge in recognizing and capitalizing on the descending broadening wedge pattern in your trading endeavors.

Analyzing Price Movements within the Pattern

As you delve into the intricacies of the descending broadening wedge, carefully analyze the price movements within the formation to gain a deeper understanding of its dynamics. By analyzing price movements, you can effectively identify market trends and make informed decisions. Here are three key aspects to consider:

- Wide-ranging swings: Notice how prices fluctuate between higher highs and lower lows within the pattern. This wide range indicates increased volatility and uncertainty in the market.

- Decreasing volume: Pay attention to the decreasing trading volume as price moves towards the apex of the wedge. Lower volume suggests a lack of participation from traders and could be an indication of an upcoming breakout.

- Converging trendlines: Observe how the upper resistance line slopes downward while the lower support line slopes upward. This convergence creates a narrowing triangle shape, signaling that buying and selling pressures are becoming equal.

By closely examining these price movements, you can better understand market dynamics and anticipate potential breakouts or reversals in a descending broadening wedge pattern.

Using the Pattern to Identify Market Trends

Identifying market trends becomes effortless when you observe the evolving shape of the price movements within the formation, as it reveals a clear path for potential breakouts or reversals. Applying the ascending broadening wedge pattern in forex trading can help traders identify bullish market trends. This pattern consists of expanding upper and lower trendlines, which indicates increasing volatility and uncertainty in the market. Traders can look for a breakout above the upper trendline to confirm an upward trend and enter long positions accordingly.

On the other hand, identifying market reversals using the descending broadening wedge pattern can be useful for spotting bearish trends. This pattern features expanding upper and lower trendlines that slope downwards, suggesting increasing selling pressure. A breakout below the lower trendline can indicate a reversal to a downward trend, prompting traders to consider short positions. By recognizing these patterns and their implications, traders can make informed decisions based on market trends revealed by price movements within broadening wedge formations.

Strategies for Trading the Ascending & Descending Broadening Wedge Pattern

Once you’ve got the hang of it, trading the ascending and descending broadening wedge pattern is like riding a wave, allowing you to catch the momentum and ride it all the way to profit town. Identifying entry and exit points in the pattern is crucial for successful trading. When trading an ascending broadening wedge pattern, a common strategy is to enter a long position near the lower trendline as price bounces off it.

Traders often set their exit point at or near the upper trendline when price reaches resistance. Conversely, for a descending broadening wedge pattern, traders may enter a short position near the upper trendline as price reverses downward from resistance. The exit point can be set at or near the lower trendline when price reaches support. Managing risk in trading these patterns involves setting stop-loss orders below or above key levels and adjusting them as price moves in your favor.

Tips for Enhancing Your Trading Skills with the Pattern

Mastering the techniques and tricks for trading the ascending and descending broadening wedge pattern can elevate your trading skills to new heights. Enhancing your trading skills with this pattern involves implementing effective trading strategies. Here are some tips to help you enhance your skills:

- Stay disciplined: Stick to your trading plan and avoid making impulsive decisions based on emotions.

- Practice risk management: Set proper stop-loss orders to limit potential losses and protect your capital.

- Continuously learn and adapt: Keep up with market trends, study different trading strategies, and be open to adjusting your approach as needed.

By enhancing your trading skills and incorporating these tips into your strategy, you can improve your chances of successfully navigating the ascending and descending broadening wedge pattern.

Frequently Asked Questions

How can I differentiate between an ascending broadening wedge pattern and a descending broadening wedge pattern?

To differentiate between an ascending and descending broadening wedge pattern, observe the direction of the wedge’s trendlines. In an ascending pattern, the upper trendline slopes upwards, while in a descending pattern, the lower trendline slopes downwards. Common mistakes when identifying these patterns include misjudging the slope of the trendlines or confusing them with other chart formations.

Are there any specific indicators or tools that can help confirm the validity of the ascending or descending broadening wedge pattern?

To confirm the validity of an ascending or descending broadening wedge pattern, volume analysis is crucial. Higher volumes during breakout confirm the pattern. Trendlines are also important in identifying and validating the pattern’s formation.

Can I apply the ascending and descending broadening wedge pattern to different timeframes, or is it more effective on specific timeframes?

Yes, you can apply the ascending and descending broadening wedge pattern to different timeframes. However, its effectiveness may vary depending on the timeframe. It is important to consider the specific characteristics of each timeframe when analyzing this pattern.

Is there a recommended minimum number of price touches required to confirm the validity of the pattern?

To confirm the validity of the pattern, it is recommended to have a minimum number of price touches. These touches play a significant role in validating the pattern, providing evidence of its reliability and effectiveness.

Are there any specific risk management strategies that should be employed when trading the ascending and descending broadening wedge pattern?

When trading the ascending and descending broadening wedge pattern, it is recommended to use specific risk management strategies. Additionally, there is no set minimum number of price touches required to confirm the validity of the pattern.