In a world where overspending has become a prevalent issue, finding effective tools to manage one’s finances has become crucial. Enter PocketGuard, a budgeting app designed specifically for overspenders. Like a guiding light in a sea of financial uncertainty, PocketGuard offers a comprehensive set of features and benefits to help individuals rein in their spending habits and regain control over their finances. With its user-friendly interface and powerful algorithms, this app empowers users to track their income and expenses, visualize their spending patterns, and set realistic savings goals.

While the free version of PocketGuard provides basic budgeting tools, upgrading to PocketGuard Plus unlocks additional features like debt payoff plans and customized spending categories, taking budgeting to a whole new level. With secure data encryption and authentication, PocketGuard ensures the utmost security for its users’ financial information. By incorporating PocketGuard into their lives, overspenders can finally break free from the cycle of overspending and pave the way towards financial stability and success.

Key Takeaways

- PocketGuard is a budgeting app that offers basic tools for free, with the option to upgrade for more features.

- It allows users to track income and expenses, and shows how much money they have left to spend each month.

- Connecting bank accounts, credit cards, and loans is recommended for accuracy.

- The free version has limitations, such as limited custom spending categories and savings goals, making the upgrade to PocketGuard Plus necessary for an effective budgeting experience.

What is PocketGuard?

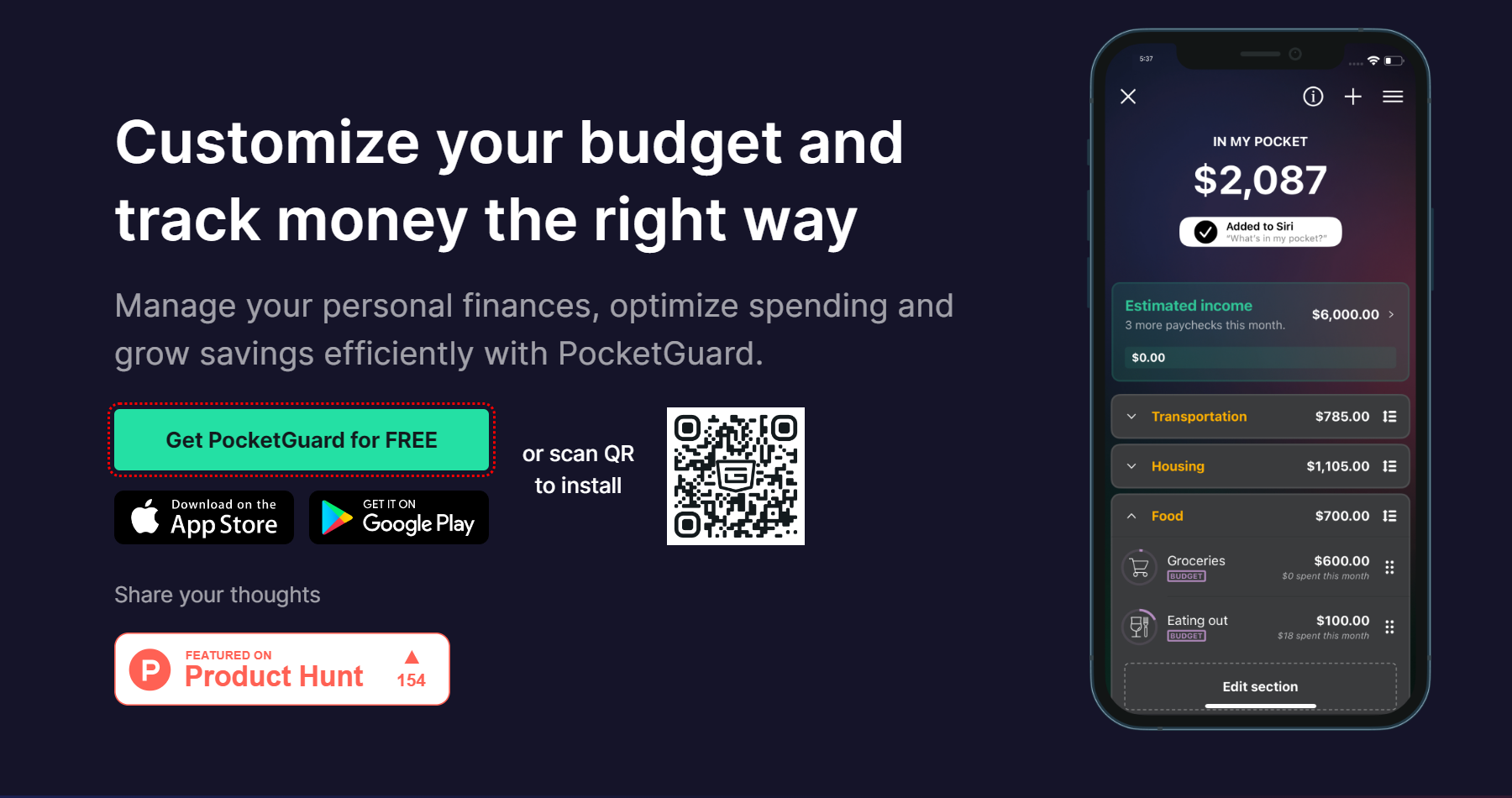

PocketGuard is a budgeting app that offers basic tools for free, with the option to upgrade for more features. It allows users to track their income and expenses, providing them with a clear picture of their financial situation. One of the key features of PocketGuard is its ability to show users how much money they have left to spend each month, which is particularly beneficial for overspenders. By providing this information, PocketGuard helps users manage their finances more effectively and avoid overspending.

However, there are both pros and cons to using PocketGuard for overspenders. On the positive side, the app offers a free version for basic budgeting and allows for direct import of transactions, which adds convenience. On the downside, the free version has limitations in terms of custom spending categories and savings goals, making it less suitable for serious budgeting. To fully benefit from PocketGuard, upgrading to the premium version, PocketGuard Plus, is recommended.

Features and Benefits of PocketGuard

One notable benefit of this budgeting app is its ability to track income and expenses, allowing users to have a clear understanding of their financial situation. Studies have shown that individuals who track their expenses are more likely to achieve their financial goals. PocketGuard offers several features that can be beneficial for users. The app provides a ‘In My Pocket’ algorithm that calculates how much money users have left to spend each month, which helps in monitoring and controlling spending.

Additionally, PocketGuard offers a direct import feature that allows users to seamlessly import their transactions from their bank accounts, credit cards, and loans. This feature provides convenience and saves time for users. However, it is important to note that the free version of PocketGuard has limitations, such as limited custom spending categories and savings goals. To access advanced features like debt payoff plans and customized categories, users will need to upgrade to PocketGuard Plus. Overall, PocketGuard can be a valuable tool for budgeting and managing expenses, but users should consider the pros and cons of its features and whether it aligns with their specific financial needs.

PocketGuard: Comparison with Other Options

When comparing budgeting options, it is important to consider how PocketGuard stacks up against other available tools. Here are some key points to consider:

- Effectiveness of PocketGuard compared to other budgeting apps:

- PocketGuard offers a free version with basic budgeting tools, but it may not be sufficient for serious budgeting needs.

- The paid version, PocketGuard Plus, provides more features such as debt payoff plans and customized categories, making it a more effective tool for budgeting.

- Pros and cons of PocketGuard compared to competitors:

- Pros: PocketGuard has a user-friendly interface, with direct import of transactions for convenience.

- Cons: The free version has limited customization options and lacks advanced features compared to some competitors.

Overall, while PocketGuard is a valuable tool for budgeting, it is important to compare it with other options to find the best fit for individual needs.

Frequently Asked Questions

How secure is PocketGuard in terms of protecting users’ financial information?

PocketGuard provides secure financial information protection through 256-bit SSL encryption and authentication. Pros include direct import and a free version for basic budgeting. Cons include limited free features and a difficult-to-navigate support website. When compared to other budgeting apps, PocketGuard stands out for its convenience and basic budgeting tools.

Can PocketGuard track investments and retirement accounts?

PocketGuard does not offer investment tracking or retirement planning features. It primarily focuses on budgeting, expense tracking, and savings goals. Users should consider other tools specifically designed for investment tracking and retirement planning.

Does PocketGuard have a feature for setting up automatic bill payments?

PocketGuard does not have a feature for setting up automatic bill payments. However, it offers various budgeting features such as tracking income and expenses, showing available funds, and helping users work towards savings and debt payoff goals.

Can users manually enter transactions in PocketGuard?

Yes, users can manually enter transactions in PocketGuard. This feature allows users to input their expenses and income manually, and then categorize the transactions for accurate tracking and budgeting purposes.

Does PocketGuard offer any tools or resources for improving credit scores?

PocketGuard does not offer tools or resources specifically for improving credit scores. However, users can monitor their credit through Experian’s credit monitoring service, which provides access to credit scores and reports, as well as real-time alerts for changes.