Are you looking for a powerful tool to enhance your trading strategy? Look no further than the Impulse MACD Indicator. This indicator, which stands for Moving Average Convergence Divergence, can help you identify potential trend reversals and pinpoint entry points in the market.

In this article, we will explore the ins and outs of the Impulse MACD Indicator, including how to use it effectively in your trades. Whether you are a seasoned trader or just starting out, adding this indicator to your trading toolbox can greatly improve your chances of success. So, let’s dive in and discover how you can download and utilize the Impulse MACD Indicator to take your trading to the next level.

Understanding the Impulse MACD Indicator

If you want to understand how to use the Impulse MACD Indicator to make profitable trades, you’ll be amazed at how easy it is to grasp its concepts. The Impulse MACD Indicator is a popular technical analysis tool used by traders to identify potential trend reversals and generate buy or sell signals. It is based on the Moving Average Convergence Divergence (MACD) indicator, which measures the relationship between two moving averages.

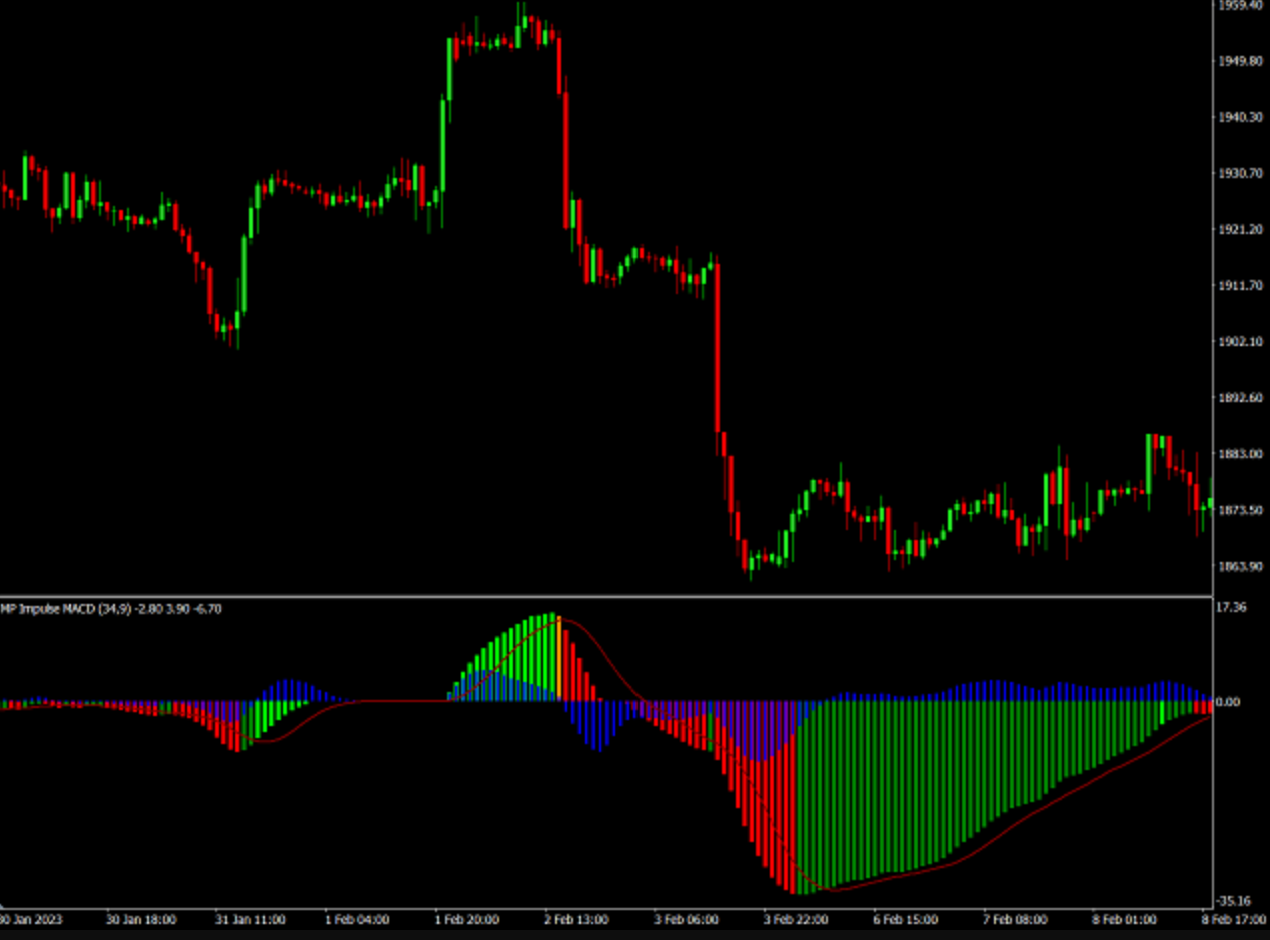

The Impulse MACD Indicator adds a histogram to the MACD line, making it easier to spot changes in momentum. When the histogram bars are positive, it indicates bullish momentum, while negative bars suggest bearish momentum. Traders can use the Impulse MACD Indicator to enter trades when the histogram bars change from negative to positive or vice versa, confirming a potential trend reversal.

Analyzing Potential Trend Reversals

When analyzing potential trend reversals, it’s essential to engage the audience by highlighting alternative ways to approach the market and capitalize on emerging opportunities. One effective method is to closely monitor the Impulse MACD Indicator. By observing the convergence or divergence of the MACD line and the signal line, traders can gain insights into possible trend reversals. A bullish trend reversal may occur when the MACD line crosses above the signal line, indicating potential buying opportunities.

Conversely, a bearish trend reversal may be indicated when the MACD line crosses below the signal line, suggesting potential selling opportunities. Additionally, paying attention to the histogram can provide further confirmation of trend reversals. Understanding these signals and incorporating them into trading strategies can help traders make informed decisions and maximize profits. To make use of the Impulse MACD Indicator, it can be downloaded from various online platforms that offer technical analysis tools.

Identifying Entry Points with the Indicator

Take advantage of the powerful insights provided by closely monitoring the convergence or divergence of the MACD line and the signal line, and seize the perfect entry points for maximizing your potential profits. When the MACD line crosses above the signal line, it indicates a bullish signal, suggesting that it may be an opportune time to enter a long position.

Conversely, when the MACD line crosses below the signal line, it signals a bearish trend, indicating that it may be a good time to consider a short position. These crossovers can serve as reliable entry points for traders, providing confirmation of a potential trend reversal. By using the impulse MACD indicator to identify these entry points, traders can enhance their decision-making process and increase their chances of profitable trades.

Steps for Effective Trading with the Impulse MACD Indicator

To effectively trade with the Impulse MACD indicator, follow these steps for better decision-making and increased chances of profitable trades. Firstly, identify the trend by analyzing the MACD line and signal line crossover. A bullish crossover indicates a buy signal, while a bearish crossover suggests a sell signal. Secondly, confirm the trend using the histogram.

Positive values indicate a bullish trend, while negative values suggest a bearish trend. Thirdly, look for divergences between the indicator and price action. Divergences can signal potential reversals or trend continuations. Lastly, consider other technical indicators and price patterns to strengthen your trading decisions. By following these steps and conducting thorough analysis, you can effectively trade with the Impulse MACD indicator and improve your trading outcomes.

Adding the Impulse MACD Indicator to Your Trading Toolbox

Adding the Impulse MACD indicator to your trading toolbox can enhance your decision-making and increase the profitability of your trades. This powerful technical indicator combines the Moving Average Convergence Divergence (MACD) with an impulse line, providing valuable insights into market trends and potential trade opportunities.

By incorporating the Impulse MACD indicator into your trading strategy, you can identify bullish or bearish momentum shifts, spot divergences, and generate buy or sell signals. Additionally, this indicator can help you determine the strength of a trend and identify potential reversals. To add the Impulse MACD indicator to your trading platform, you can download it from various online sources or use built-in tools in popular trading platforms like MetaTrader. Once installed, you can customize the indicator’s settings to suit your trading style and preferences.

Frequently Asked Questions

What are some other popular indicators that can be used in conjunction with the Impulse MACD Indicator?

Some other popular indicators that can be used in conjunction with the Impulse MACD Indicator include the moving average, relative strength index (RSI), Bollinger Bands, and stochastic oscillator. These indicators can provide additional insights and confirm signals generated by the Impulse MACD Indicator.

Can the Impulse MACD Indicator be used in different timeframes?

Yes, the Impulse MACD indicator can be used in different timeframes. It is a versatile tool that can provide insights into market trends and potential trading opportunities across various time periods.

Are there any specific market conditions where the Impulse MACD Indicator is more effective?

There are specific market conditions where the Impulse MACD indicator is more effective. These conditions include trending markets, where the indicator can help identify strong buy or sell signals.

How can the Impulse MACD Indicator be customized to fit individual trading strategies?

The Impulse MACD indicator can be customized to fit individual trading strategies by adjusting the parameters and timeframes to align with specific market conditions and trading preferences. This allows traders to tailor the indicator to their unique trading style and goals.

Are there any common pitfalls or mistakes to avoid when using the Impulse MACD Indicator?

There are common pitfalls and mistakes to avoid when using the impulse MACD indicator. These include relying solely on the indicator, not considering market context, and failing to use proper risk management techniques.

Conclusion

In conclusion, the Impulse MACD Indicator is a valuable tool for traders looking to identify potential trend reversals and entry points in the market. By understanding how to interpret the indicator and effectively incorporate it into your trading strategy, you can improve your chances of making profitable trades. Adding the Impulse MACD Indicator to your trading toolbox can provide you with valuable insights and help you make more informed trading decisions.