In the ever-evolving world of cryptocurrencies, Abra has emerged as a popular platform for trading, lending, and staking digital assets. With over 2 million downloads and a 4-star rating, Abra has gained a significant following in 150 countries. Ironically, while Abra offers a convenient mobile app available on Android and iOS, its signup process requires users to undergo a KYC verification that can take several days.

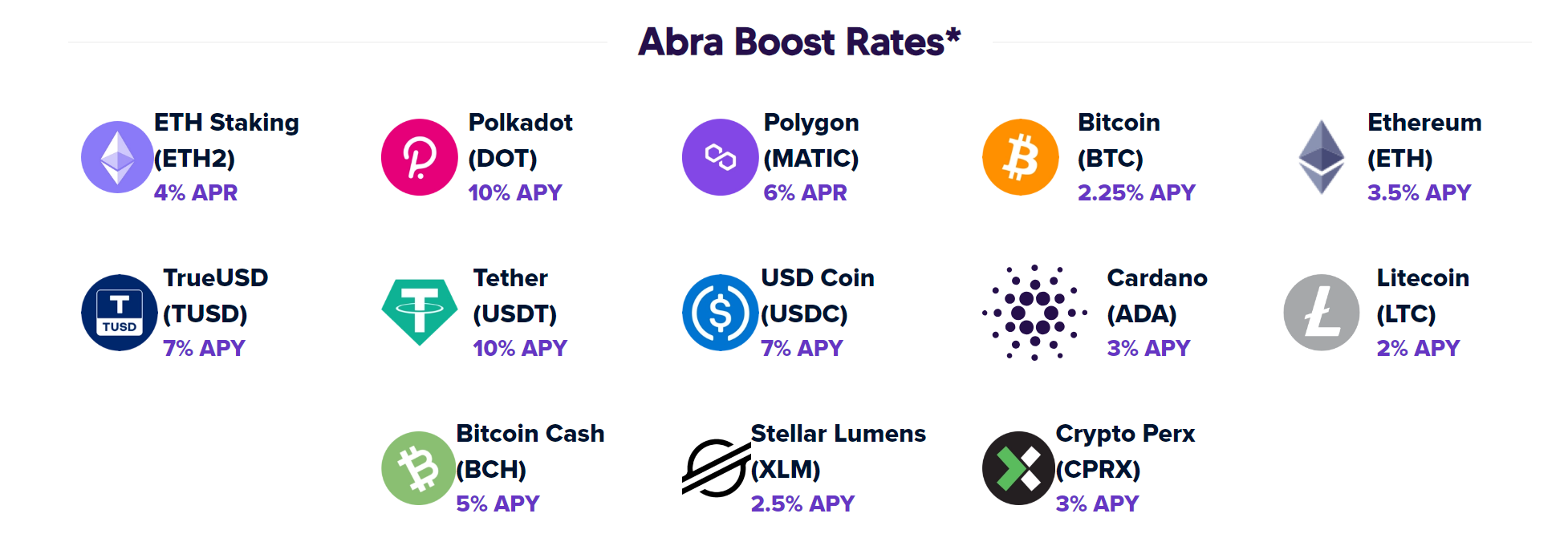

The platform boasts a wide range of features, including the ability to earn interest on crypto holdings, borrow against them, and stake certain cryptocurrencies for rewards. However, it’s important to note that Abra does not provide proof of reserves for user assets. Furthermore, Abra operates differently from traditional exchanges, charging fees for purchasing cryptocurrencies through its third-party integration, MoonPay, and for cryptocurrency withdrawals. This article will delve into the trading fees, pros, and cons of Abra, providing an objective and informative analysis for potential users.

Key Takeaways

- Abra is a cryptocurrency exchange platform founded in 2014 with over 200 employees.

- The Abra app allows users to buy and sell over 100 cryptocurrencies.

- Abra offers various services such as lending, borrowing, and staking cryptocurrencies.

- Abra charges fees for buying cryptocurrencies through MoonPay and has spot fees for trading.

Abra Exchange: Platform Overview

Abra is a cryptocurrency exchange platform that allows users to buy, sell, and trade over 100 cryptocurrencies, including popular options like Bitcoin, Ethereum, and Solana. The platform is available as a mobile app on both Android and iOS, making it easily accessible to users in 150 countries. Abra provides a user-friendly experience, with a simple signup process that requires KYC verification.

However, some users have reported that the verification process can take 2-4 days to complete. In terms of security measures, Abra is registered as a money services business with FinCEN and is also registered in the Philippines and the United States. However, it is important to note that Abra does not offer any proof of reserves of user assets. Overall, Abra offers a convenient platform for cryptocurrency trading with a range of options, but users should be cautious and consider the platform’s limitations.

Abra Crypto Exchange: Features and Services

The platform offers a range of features and services that cater to users’ cryptocurrency trading and financial needs. Abra’s security measures ensure the protection of user assets and personal information. The platform requires KYC verification during the signup process, establishing a layer of trust and compliance.

Additionally, Abra is registered as a money services business with FinCEN, further ensuring regulatory compliance. In terms of customer support, Abra provides assistance to users through various channels such as email and in-app messaging. Users can reach out to the support team for any queries or issues they may encounter. The prompt and reliable customer support adds to the overall positive user experience on the platform.

Abra Exchange: Deposits and Withdrawals

deposits and withdrawals on the Abra platform provide users with convenient options for transferring traditional currency in and out of their accounts. One advantage of fiat transactions on Abra is the availability of multiple withdrawal methods for fiat currencies. Users can withdraw funds to a US or PH bank account, allowing for easy access to their funds.

Additionally, fiat bank withdrawals from Abra are free of charge, eliminating any additional fees for users. This makes it cost-effective for users to convert their cryptocurrencies into fiat currency and transfer it to their bank accounts. The ability to deposit and withdraw fiat currency adds flexibility to the Abra platform and enhances user experience by providing seamless integration with traditional banking systems.

Fees and Charges

One aspect to consider when using the Abra platform is the fees and charges associated with various transactions and services. Compared to other cryptocurrency exchanges, Abra’s fees for buying cryptocurrencies through MoonPay are considered high. The spot fees for maker trades on Abra range from 0.9-1.2%, while the fees for taker trades range from 0.08-0.10%. For futures trading, the fees are 0.02% for maker trades and 0.05% for taker trades.

These fees can have an impact on trading profitability, as they can eat into potential gains or increase losses. However, it’s important to note that Abra does not charge any additional fees for fiat deposits and fiat bank withdrawals are free of charge. Withdrawals of cryptocurrencies from Abra do come with a fee, such as a 4.9 USDT withdrawal fee for a simple USDT (ERC-20) withdrawal.

Frequently Asked Questions

How does Abra ensure the security of user funds and personal information?

Abra employs robust security measures to protect user funds and personal information. The platform implements encryption protocols and secure storage systems to safeguard sensitive data.

Additionally, Abra’s privacy policy outlines the collection, use, and disclosure of personal information in a transparent manner, adhering to relevant data protection laws. These measures aim to ensure the confidentiality and integrity of user data, instilling confidence in users regarding the security of their funds and personal information.

Does Abra have any limitations on the amount of cryptocurrencies that can be bought or sold?

Abra has limitations on cryptocurrency transactions, which are primarily regulated by its Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance protocols. To ensure compliance with regulatory requirements, Abra enforces KYC verification for all users during the signup process.

This verification process may take 2-4 days to complete. While Abra allows users to buy and sell over 100 cryptocurrencies, it is important to note that there may be certain limitations or restrictions on the amount of cryptocurrencies that can be bought or sold, which could be determined by regulatory guidelines or internal risk assessment measures.

Can users transfer their cryptocurrencies from Abra to other wallets or exchanges?

Wallet transfers are possible on Abra, allowing users to transfer their cryptocurrencies to other wallets or exchanges. However, it is important to note that Abra operates differently from traditional exchanges, as it does not hold user assets in the same way.

While Abra does support the buying and selling of over 100 cryptocurrencies, users should be aware of the fees associated with these transactions compared to other exchanges. It is recommended to compare the fees and features of Abra with other exchanges before deciding to transfer cryptocurrencies.

What are the options for customer support on the Abra platform?

When it comes to customer support options, the Abra platform offers several avenues for users to seek assistance. These include a comprehensive FAQ section on their website, where users can find answers to commonly asked questions.

Additionally, users can submit support tickets through the app or website, allowing them to communicate directly with the Abra support team. The platform also provides a community forum where users can engage with each other and share experiences and knowledge. Overall, Abra strives to provide robust customer support options to ensure a positive user experience.

Does Abra have any restrictions on the countries or regions where it operates?

Abra does not have any explicit country restrictions mentioned in the provided background information. However, it is worth noting that Abra operates in over 150 countries and is used by people worldwide. This suggests that Abra has a global presence and does not restrict its services to specific regions.

It is important to consider that Abra may have compliance requirements and regulations specific to each country it operates in. As for Abra’s expansion plans, the information provided does not mention any specific details about future expansion efforts.