In the fast-paced world of decentralized finance (DeFi), finding the best rates and liquidity can be a daunting task. However, there is one platform that aims to simplify this process and provide users with an optimal trading experience. Enter 1inch Exchange, a leading decentralized exchange (DEX) aggregator that sources liquidity from various exchanges to offer the most favorable rates. Founded in 2019, 1inch Exchange has quickly gained recognition and funding from prominent investors in the crypto space.

With its innovative features and protocols, such as the proprietary API Pathfinder and the Aggregation Protocol v3, users can split transactions across multiple DEXs and enjoy reduced gas fees. The platform’s native governance token, 1INCH, allows holders to participate in the 1inch DAO and stake their tokens for rewards. With its commitment to user-centric design and constant improvement, 1inch Exchange is poised to revolutionize the way we trade in the DeFi landscape.

Key Takeaways (1inch Exchange)

- 1inch Exchange is a decentralized exchange (DEX) aggregator that offers the best rates and sources liquidity from various exchanges.

- The platform does not charge trading, deposit, or withdrawal fees and supports over 188 liquidity sources from 7 blockchains.

- The 1inch Token provides governance for the platform, allowing holders to vote on various parameters and participate in the 1inch DAO.

- Staking 1INCH tokens allows users to earn rewards from swap fees and price impact fees, as well as gain voting rights and governance rewards.

What is 1inch Exchange?

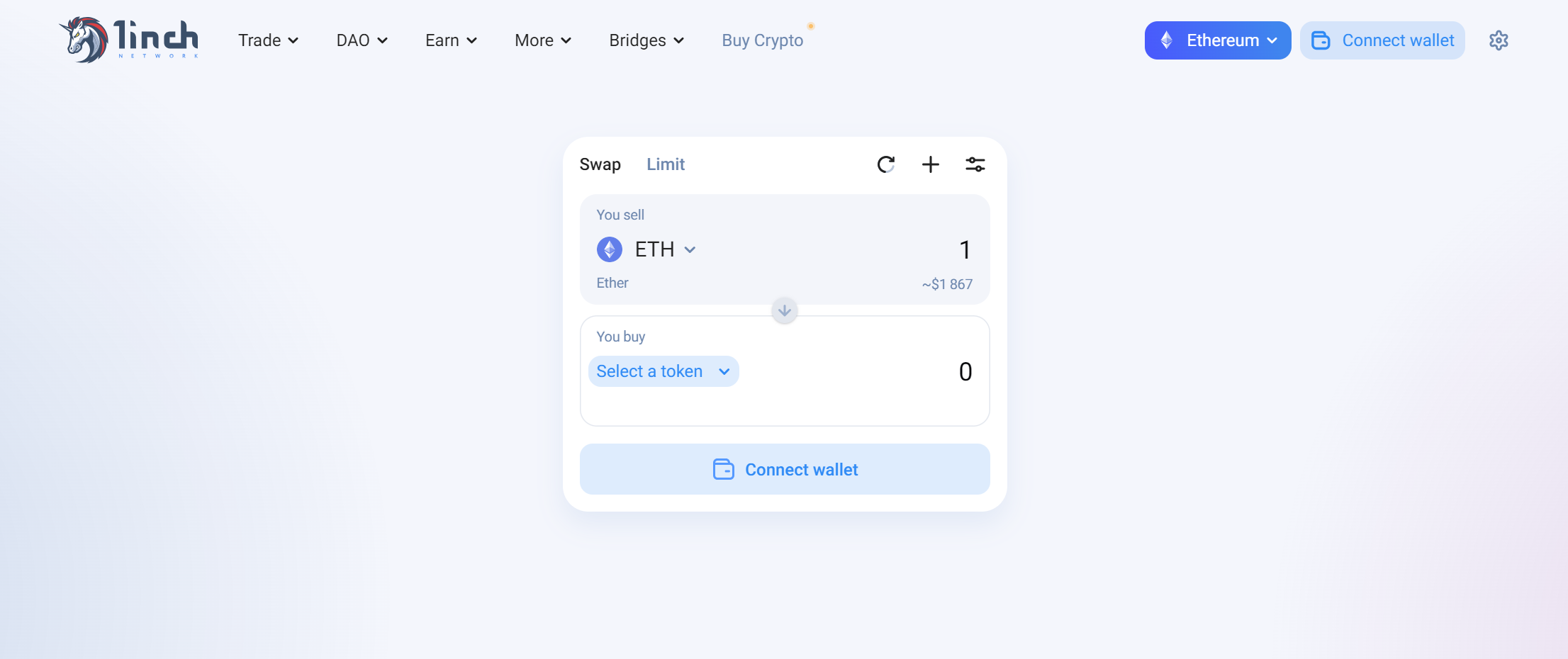

1inch Exchange is like a virtual marketplace that sources liquidity from various decentralized exchanges, offering users the best rates and flexibility in swaps and trades, while also providing a native protocol with no trading, deposit, or withdrawal fees. Compared to other DEX aggregators in the market, 1inch Exchange stands out for its extensive liquidity sources from 7 blockchains and its proprietary API called Pathfinder for order routing.

It also offers advantages such as reduced gas fees through its Aggregation Protocol v3, the ability to split transactions across multiple DEXs for better rates, and the introduction of the Limit Order Protocol V2 for pre-determined price orders. However, beginners may struggle to use the platform, and it does not support fiat currencies. Overall, 1inch Exchange provides a comprehensive and cost-effective solution for decentralized trading, with its unique features and protocols.

1inch Crypto Exchange: Founders and Funding

The founders of the decentralized exchange aggregator secured funding from various investors, including Binance Labs, Pantera Capital, and Amber Group, to support the development and growth of the platform. In 2020, 1inch Exchange raised $2.8 million in a seed round led by Binance Labs. This initial funding allowed the platform to expand its operations and improve its services.

In December 2020, 1inch Exchange raised an additional $12 million in a funding round led by Pantera Capital. This injection of funds enabled the platform to further enhance its technology and attract more liquidity sources. In 2021, 1inch Exchange received a significant investment of $175 million led by Amber Group, further solidifying its position as a leading DEX aggregator. The continuous funding support has been crucial in the platform’s success and ability to provide users with competitive rates and a seamless trading experience.

| Funding Round | Amount Raised | Leading Investor |

|---|---|---|

| Seed Round | $2.8 million | Binance Labs |

| Latest Funding | $12 million | Pantera Capital |

| Round |

Features and Protocols

The platform operates as a combination of a decentralized exchange and liquidity pools, supporting over 188 liquidity sources from 7 blockchains and utilizing a proprietary API called Pathfinder for order routing.

Advantages of using 1inch Exchange over traditional centralized exchanges include:

- Best rates: 1inch Exchange sources liquidity from various exchanges, allowing users to access the most favorable rates for their trades.

- Flexible swaps and trades: The native protocol of 1inch Exchange enables users to execute swaps and trades with ease.

- No trading, deposit, or withdrawal fees: Unlike centralized exchanges, 1inch Exchange does not charge any fees for trading, depositing, or withdrawing funds.

- Reduced gas fees: The Aggregation Protocol v3 of 1inch Exchange offers reduced gas fees, making transactions more cost-effective.

The impact of 1inch Exchange’s aggregation protocol on reducing gas fees is significant. By splitting transactions across multiple DEXs, the protocol ensures better rates for users while minimizing gas fees. This feature makes 1inch Exchange a more efficient and cost-effective option compared to traditional centralized exchanges.

1INCH Token

With a market cap of $648,493,023, the 1INCH token holds the potential to unlock a world of opportunities for long-term holders, offering governance rights, participation in the 1inch DAO, and the chance to earn more tokens through staking. The token provides holders with the ability to vote on various parameters within the 1inch platform, allowing for community-driven decision-making.

Additionally, the 1INCH token has a total supply of 1.5 billion, with 30% allocated to the 1inch community. Holders can participate in the 1inch DAO and vote on governance proposals, ensuring a decentralized and inclusive decision-making process. The token is listed on major exchanges like Coinbase and Kraken, providing liquidity and accessibility to investors.

The table below summarizes the key information about the 1INCH token:

| Token Name | 1INCH |

|---|---|

| Market Cap | $648,493,023 |

| Circulating Supply | 413,777,581 |

| Total Supply | 1.5 billion |

| Governance Rights | Yes |

| Staking Rewards | Yes |

By holding the 1INCH token, investors not only have the potential for future price increases but also actively participate in the governance and decision-making processes of the 1inch platform.

Staking 1INCH Tokens

Staking 1INCH tokens allows holders to earn rewards from swap fees, price impact fees, and governance participation. By staking their tokens, users can acquire voting rights and governance rewards within the 1inch platform. In addition to these benefits, staking also enables holders to navigate to the DAO tab on the 1inch Exchange website and actively participate in decision-making processes.

To stake 1INCH tokens, users need to connect their wallet, enter the desired amount of tokens to stake, and unlock them. It is worth mentioning that using CHI gastoken can significantly reduce transaction costs and save up to 42% on gas fees. Overall, staking 1INCH tokens offers holders the opportunity to earn rewards while actively engaging in the governance of the platform.

1inch Exchange and Wallet

Integrated with various platforms and networks, the 1inch Wallet serves as a native wallet for the decentralized exchange, offering additional features such as the DeFi Racer Game and paving the way for the platform’s venture into GameFi and Web3.0. This integration allows users to seamlessly connect their ETH wallets, select tokens to exchange, and choose order parameters. The 1inch Wallet supports popular wallets like MetaMask, TrustWallet, MEW, WalletConnect, and Ledger.

Additionally, it is available on iOS with an Android version coming soon. Furthermore, the 1inch Exchange has expanded its bridges to other blockchain networks such as Gnosis, Polygon, Arbitrum, Optimism, and Avalanche, allowing users to access liquidity and trade on these networks. These user experience improvements and expansion into other blockchain networks demonstrate 1inch Exchange’s commitment to providing a seamless and versatile trading experience for its users.

| User Experience Improvements | Expansion into Other Blockchain Networks |

|---|---|

| Native wallet for the decentralized exchange | Bridges to Gnosis, Polygon, Arbitrum, Optimism, and Avalanche |

| Additional features like the DeFi Racer Game | Access liquidity and trade on these networks |

| Integration with popular wallets | |

| Available on iOS with Android version coming soon |

1inch Liquidity Protocol

The 1inch Liquidity Protocol, formerly known as the Mooniswap portal, allows users to move liquidity from Mooniswap to access various pools with good liquidity and APYs, such as the 1INCH-ETH, 1INCH-USDC, and 1INCH-DAI pools, and earn 1INCH tokens by staking LP tokens.

- Yield farming opportunities:

- Users can stake LP tokens in liquidity pools and earn 1INCH tokens as rewards.

- The protocol offers a range of pools with different token pairs, providing opportunities for diversification and potential higher returns.

- Staking LP tokens allows users to participate in the ecosystem and benefit from the growth of the 1inch platform.

- Benefits of using 1inch Liquidity Protocol:

- The protocol ensures good liquidity in the supported pools, reducing slippage and improving trading efficiency.

- Virtual Rates feature protects against front-running attacks, enhancing security for users.

- Users can estimate their potential earnings when staking LP tokens, providing transparency and helping them make informed decisions.

Security and Support

Moving on from discussing the 1inch Liquidity Protocol, it is important to highlight the security and support measures provided by the 1inch Exchange. As a non-custodial DEX aggregator platform, 1inch has not experienced any hacks or security threats thus far. In terms of customer support, users can rely on various channels for assistance. These include email, live chat, and the Telegram group.

Notably, 1inch has established a partnership with Skynet to further enhance user security. Through Skynet integration, users have access to saved versions of the web app, even in the event of a compromised website. This integration adds an extra layer of protection and reassurance for users engaging with the 1inch Exchange. Overall, the combination of robust security measures and accessible customer support channels contributes to the reliability and trustworthiness of the platform.

Liquidity and Order Execution

Enhancing market depth and ensuring smooth transaction execution, 1inch’s liquidity aggregation approach acts as a magnet, attracting liquidity from various exchanges and pooling it together like a vast ocean, allowing traders to sail smoothly through their desired trades. This unique approach offers several benefits:

- Reduced slippage: By splitting orders across multiple exchanges, 1inch eliminates slippage and ensures traders get the best possible rates.

- Increased liquidity: With access to over 188 liquidity sources from 7 blockchains, 1inch provides traders with a wide range of options and ample liquidity for their trades.

- Efficient order execution: 1inch’s proprietary API, Pathfinder, enables efficient order routing, ensuring quick and seamless execution of trades. This improves the overall trading experience for users.

By combining these features, 1inch Exchange offers a liquidity-rich environment with reduced slippage, increased liquidity, and improved order execution, making it a leading DEX aggregator in the market.

Potential for Future Price Increases

Given the current market conditions and the increasing adoption of decentralized exchanges, 1inch’s native token, 1INCH, has the potential for future price increases as more users engage with the platform and participate in its governance. The price analysis of 1INCH indicates that it has experienced significant growth since its inception. With a circulating supply of 413,777,581 tokens and a market cap of $648,493,023, 1INCH has gained traction among investors.

Market predictions suggest that the demand for decentralized exchanges and DEX aggregators like 1inch will continue to rise, leading to increased utilization of the 1INCH token. Furthermore, the token’s role in the platform’s governance and the potential for long-term holders to participate in the 1inch DAO and vote on governance proposals contribute to its attractiveness as an investment. As such, the future looks promising for 1INCH, with the potential for price appreciation as the platform continues to grow and gain popularity.

Comparison to Other DEX Aggregators

When comparing 1inch to other decentralized exchange aggregators, it is evident that 1inch stands out due to its extensive liquidity sources from multiple blockchains, reduced gas fees through its Aggregation Protocol v3, and the introduction of the Limit Order Protocol V2 for pre-determined price orders.

These features contribute to a more seamless and cost-effective trading experience for users. However, beginners may face challenges in navigating the platform due to its complexity. It is important to note that while 1inch offers numerous advantages, there are also other DEX aggregators available in the market. To provide a clearer comparison, the following table highlights the pros and cons of using 1inch Exchange compared to other DEX aggregators:

| Pros of 1inch Exchange | Cons of 1inch Exchange | Pros of Other DEX Aggregators | Cons of Other DEX Aggregators |

|---|---|---|---|

| Extensive liquidity sources | Complexity for beginners | User-friendly interface | Limited liquidity sources |

| Reduced gas fees | Potential for confusion in navigating the platform | Lower fees | Higher fees |

| Introduction of Limit Order Protocol V2 | Lack of support for fiat currencies | Wide range of supported tokens | Limited token support |

| No trading, deposit, or withdrawal fees | Limited educational resources for beginners | Enhanced security features | Higher slippage |

| Seamless integration with various wallets | Less advanced features |

This table provides a comprehensive overview of the advantages and disadvantages of using 1inch Exchange compared to other DEX aggregators. It is important for users to consider their specific needs and preferences when choosing a platform for decentralized trading.

Frequently Asked Questions

How can users stake 1INCH tokens and what are the benefits of staking?

The staking process for 1inch tokens involves users acquiring tokens and navigating to the DAO tab on the 1inch Exchange website. They can then connect their wallet, enter the amount of tokens they want to stake, and unlock them. By staking 1inch tokens, users can receive rewards in the form of swap fees, price impact fees, voting rights, and governance rewards. Additionally, staking allows users to earn more tokens and potentially benefit from future price increases.

What are the supported wallets for 1inch Exchange and Wallet?

Various wallets are compatible with the 1inch Exchange and Wallet, including MetaMask, TrustWallet, MEW, WalletConnect, and Ledger. These wallets allow users to connect their Ethereum wallets to the platform and engage in token exchanges and other activities. The 1inch Wallet, which is the native wallet of the DEX, offers additional features and is available on iOS, with an Android version coming soon. The platform has also implemented security measures by partnering with Skynet to enhance user security, providing access to saved versions of the web app in case of website compromise.

How does the 1inch Liquidity Protocol work and what are the available liquidity pools?

The 1inch Liquidity Protocol allows liquidity providers to contribute their assets to various pools and earn rewards in the form of 1INCH tokens. By adding liquidity to these pools, providers benefit from the trading fees generated by users. The protocol offers a range of liquidity pools, including pairs like 1INCH-ETH, 1INCH-USDC, and 1INCH-DAI, which users can stake their LP tokens in. Compared to other DEX aggregators, 1inch’s protocol provides enhanced liquidity and reduces slippage by splitting orders across multiple exchanges.

Is there a mobile version of the 1inch Wallet and what additional features does it offer?

The 1inch wallet offers a mobile version that provides users with additional features and convenience. The mobile wallet is currently available on iOS, with an Android version in development. It is integrated with various platforms and networks, allowing users to connect their ETH wallets and easily exchange tokens. Additionally, the 1inch mobile wallet includes the DeFi Racer Game, which allows users to collect in-game coins and participate in tournaments, marking 1inch’s venture into GameFi and Web3.0.

How does the integration with Skynet enhance user security on the 1inch Exchange platform?

The integration of Skynet on the 1inch Exchange platform enhances user security by providing an additional layer of protection. Skynet allows users to access saved versions of the web app, even if the website is compromised. This feature ensures that users can still interact with the platform and their funds, even in the event of a security breach. By integrating Skynet, 1inch Exchange demonstrates its commitment to safeguarding user assets and providing a secure trading environment.