Update May 4, 2023: Shiba Inu burn rate soars beyond imagination at 30,940% in what is considered to be probable trigger for price reversal

Are you an investor looking to explore the Shiba Inu Burn Rate? If so, you’ve come to the right place! This article will provide you with all the information you need to make an informed decision. We’ll look at what Shiba Inu is, how it’s being used, and what investors should consider when evaluating its burn rate. So let’s get started!

The Shiba Inu token is a decentralized cryptocurrency built on the Ethereum blockchain. It was created as part of the Dogecoin project and has since gained a great deal of attention. The token’s popularity comes from its low price and volatile nature, which makes it attractive for speculative investments. However, understanding its burn rate is essential for any investor looking to capitalize on its potential growth.

In this article, we’ll take a closer look at the Shiba Inu burn rate and explore what investors need to know in order to make an informed decision about investing in the token. We’ll provide insights into how the token works, why it has become so popular, and how its burn rate affects its price movements. With that said, let’s dive in!

Overview Of Shiba Inu Cryptocurrency

Shiba Inu is a decentralized cryptocurrency that was created in August 2020 and is built on the Ethereum blockchain. It’s based off of Dogecoin, another popular digital currency, and has gained traction in the crypto community as a result. Shiba Inu has seen tremendous growth since its launch and has become one of the top 10 cryptocurrencies by market capitalization. The coin also has some unique features that make it attractive to investors, such as its low burn rate and its partnership with Crypto.com.

The burn rate of a cryptocurrency is an important metric for investors to consider when investing in digital assets. A coin’s burn rate represents how much of its total supply is removed from circulation over time. This can have a significant impact on the price of a cryptocurrency since it affects supply and demand. Shiba Inu’s low burn rate makes it particularly attractive to investors because it means that the token will remain rarer than other coins and may increase in value over time due to scarcity.

Shiba Inu’s partnership with Crypto.com is also beneficial for investors looking to get involved in the cryptocurrency space. Crypto.com offers users numerous benefits such as access to their DeFi products, zero-fee trading, and more flexible payment options than traditional exchanges provide. This provides both convenience and security for investors who want to purchase or trade Shiba Inu tokens without having to navigate complex exchanges or deal with high transaction fees. With these advantages, Shiba Inu stands out from the competition and could be an attractive investment option for those looking to get into crypto investing.

What Is The Shiba Inu Burn Rate?

Investors in the Shiba Inu (SHIB) cryptocurrency should be aware of its burn rate and how it affects their investments. The burn rate is the rate at which SHIB tokens are destroyed, reducing the total supply in circulation. This article will explore what the Shiba Inu burn rate is and how it impacts investors.

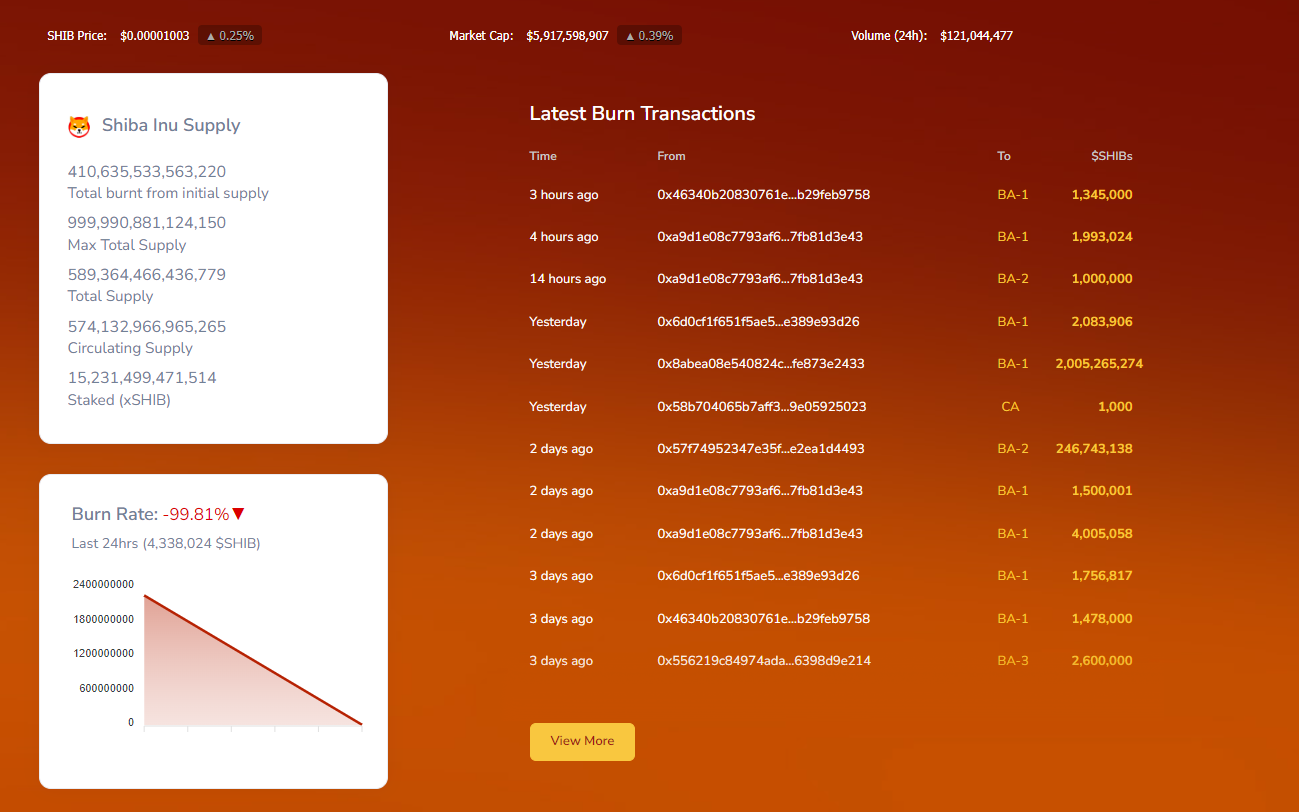

Image Credits: https://www.shibburn.com/

The Shiba Inu burn rate is 50% of all transaction fees, with an additional 10 SHIB destroyed for every transaction that takes place. This means that when a person buys or sells SHIB, 50% of the transaction fee goes toward destroying existing coins, thus reducing the total supply in circulation. This process of burning tokens is designed to reduce inflation and increase scarcity of the token over time.

Investors should be aware that when they buy or sell SHIB, they are contributing to its burn rate. This could have an effect on the price as fewer coins are available, making them more valuable. It’s important to consider this before investing as it could affect your profits or losses from trading in SHIB. Additionally, changes to the burn rate could also affect price movements so it’s important for investors to stay up-to-date on any changes or developments with this process.

Factors Affecting The Burn Rate

The Shiba Inu burn rate can be affected by several factors, some of which investors need to be aware of. Firstly, the amount of liquidity in the market plays a significant role in the burn rate. When there is more liquidity, it is easier for investors to sell their tokens and realize returns. As a result, the burn rate increases due to an increase in the number of tokens burned. Secondly, another factor that affects the burn rate is speculation.

| Factors | Description |

|---|---|

| Supply | The total supply of Shiba Inu tokens in circulation affects the burn rate, as a higher supply can lead to a slower burn rate. |

| Demand | The demand for Shiba Inu tokens can also affect the burn rate, as higher demand can lead to a higher burn rate due to increased trading volume. |

| Tokenomics | The tokenomics of Shiba Inu, such as the burn rate mechanism, the distribution of tokens, and the total supply, can all affect the burn rate. |

| Market Conditions | The overall market conditions, such as the state of the crypto market and investor sentiment, can also affect the burn rate of Shiba Inu. |

| Development Updates | Updates and developments in the Shiba Inu ecosystem, such as new partnerships or product releases, can affect investor interest and thus the burn rate. |

| Competition | Competition from other cryptocurrencies can affect the demand and trading volume of Shiba Inu, which can in turn affect the burn rate. |

| Regulatory Changes | Changes in regulations and legal restrictions can affect the demand and trading volume of Shiba Inu, which can affect the burn rate. |

| Community Support | The level of community support and engagement with the Shiba Inu project can affect investor sentiment and thus the burn rate. |

When speculators enter the market, they tend to buy large amounts of tokens and then quickly sell them when prices rise. This results in more tokens being burned as they are sold off at a faster rate than they are bought into circulation.

Finally, investor sentiment also has an impact on how quickly tokens are burned. If investors become bearish on Shiba Inu coins, they may be less willing to hold onto their tokens and sell them off faster than usual. This could lead to a higher burn rate as more tokens are sold and fewer remain in circulation. All these factors can affect the Shiba Inu burn rate and should be taken into consideration by investors when making their decisions about buying or selling these coins.

Impact On Price Volatility

The impact of the Shiba Inu burn rate on price volatility is of particular interest to investors. With the number of tokens in circulation decreasing over time, it can affect prices significantly. When the burn rate is taken into account, we can see its effect on price movements.

First, when a token is burned, it reduces the supply available for trading. This causes prices to increase because there is less competition for buying and selling tokens. Secondly, the amount of tokens being burned is also important. If a large amount of tokens are burned in a short period of time, this could lead to increased volatility due to traders trying to buy or sell large amounts at once. Finally, if the burn rate affects liquidity in any way, this could also lead to greater volatility as traders may struggle to get their orders filled quickly.

Overall, it’s clear that the Shiba Inu burn rate can have a significant impact on price volatility and should be taken into consideration by investors when making decisions about investing in this cryptocurrency. It’s important to keep an eye on how much and how often tokens are being burned as well as how this impacts liquidity and overall market sentiment so that you can make informed decisions and manage risk appropriately.

Understanding Supply And Demand Dynamics

The supply and demand dynamics of the Shiba Inu burn rate are important for investors to understand. The supply is determined by the number of tokens available on exchanges, while the demand is determined by how many people are looking to buy those tokens. When there is a high demand for Shiba Inu tokens, prices will tend to rise as buyers compete for a limited number of coins. This can create a bullish market where prices increase significantly over time. On the other hand, if there is not enough demand for Shiba Inu tokens, prices may fall due to lack of interest from buyers.

Investors should keep an eye on both the supply and demand dynamics in order to make informed decisions when investing in Shiba Inu tokens. By monitoring the market, investors can identify any potential changes in price before they occur. This can help them decide whether or not to buy or sell their holdings at any given time. Additionally, understanding how these two forces interact with each other can give investors an edge when it comes to predicting future price movements.

Knowing how supply and demand affect the Shiba Inu burn rate can be invaluable information when making investment decisions. It’s important that investors stay up-to-date on market trends so they can remain ahead of the game and capitalize on potential opportunities as they arise. Taking into account this knowledge along with an investor’s own risk tolerance could be key factors in helping them maximize their returns from their investments in Shiba Inu tokens.

How To Analyze Market Data

When it comes to understanding the shiba inu burn rate, investors need to be able to analyze market data. To get a full picture of the current market, investors must consider multiple sources of data. This includes examining the number and value of transactions made by traders over time, as well as market movements and overall sentiment.

Analyzing transactions is one way to determine whether or not the shiba inu burn rate is increasing or decreasing. Investors should look at how many tokens are being transferred from one wallet to another, and the amount of money exchanged during each transaction. This can give insight into how much demand there is for the token. Additionally, analyzing trading volume can help investors understand if there are new buyers entering the market or if existing holders are liquidating their positions.

| Methods | Explanation |

|---|---|

| Technical Analysis | Analyzing historical price and volume data for patterns and trends. |

| Fundamental Analysis | Evaluating the underlying value of the asset based on factors such as technology, team, and competition. |

| Sentiment Analysis | Monitoring public opinion and investor sentiment towards the asset. |

| Trading Volume Analysis | Analyzing the volume of tokens being bought and sold on exchanges. |

| Market Capitalization Analysis | Monitoring the total value of all tokens in circulation. |

| On-chain Analysis | Analyzing blockchain data to gain insight into investor behavior. |

It’s also important for investors to pay attention to news and other factors that could affect the shiba inu burn rate. For example, if a project releases a new feature or product that could make shiba inu more useful or valuable, then this could cause an increase in demand for the token. On the other hand, negative news about a project could lead to investors selling off their holdings and pushing down prices. By keeping an eye on what’s happening with projects related to shiba inu, investors can better anticipate how changes may affect its price over time.

By looking at both transactional data and external factors influencing its value, investors can make informed decisions about whether now is a good time to buy or sell their holdings of shiba inu tokens. By staying up-to-date on market trends and news related to shiba inu, they will be able to maximize their returns while minimizing their risks.

Investment Strategies For Shiba Inu

When investing in Shiba Inu, it’s important to have a strategy. To ensure the best return on your investment, you should consider the burn rate of the tokens and how it affects their value. There are several different strategies that potential investors can use to maximize their profits while minimizing their risk.

One strategy is to buy low and sell high. This means buying Shiba Inu tokens when they are at their lowest price and then selling them when the price increases. This allows investors to capitalize on market fluctuations and take advantage of short-term price movements. It’s important to keep an eye on trends in order to make the most out of this strategy.

Another strategy is known as ‘buy and hold’. This involves buying Shiba Inu tokens and holding onto them for an extended period of time in order to benefit from long-term price appreciation. Investors should be aware that this approach carries some risk since market conditions can change quickly, making it difficult for investors to cash out at the right time.

Investing in Shiba Inu requires patience and research but with a well thought-out strategy, investors can potentially make a profit from these digital tokens. It’s important to understand the pros and cons of each investment strategy before deciding which one is right for you. Doing so will help ensure that your investments are successful and profitable.

Key Considerations For Investors

Investing in the Shiba Inu burn rate can be a lucrative opportunity, but it is important to understand the risks involved. Before investing, investors should consider several key factors related to their investment goals and risk tolerance.

First, investors should understand their expected return on investment (ROI). Knowing the potential returns of an investment helps investors determine if the Shiba Inu burn rate is right for them. It’s also essential to make sure that any expected ROI aligns with one’s risk tolerance and long-term financial goals.

Second, investors should consider the liquidity of their investments. The Shiba Inu burn rate is not liquid, meaning funds can’t be withdrawn immediately after investing. Therefore, it is important for investors to have a plan in place for when they will need access to their funds.

Finally, investors should keep tabs on market developments related to the Shiba Inu burn rate. As with all investments, changes in market conditions can significantly affect returns. Staying abreast of news and events related to the Shiba Inu burn rate will help investors stay informed and make more informed decisions about their investments.

Long-Term Outlook For Shiba Inu

The long-term outlook for Shiba Inu is one that should be carefully considered by investors before investing. Although the currency has had a meteoric rise in recent months, its future remains uncertain. The fact that it is a relatively new cryptocurrency means that its value could fluctuate drastically over time. This volatility could potentially make it a riskier investment than more established currencies like Bitcoin or Ethereum.

At the same time, there are some positive signs indicating that Shiba Inu may have staying power in the future. For one, its decentralized nature allows it to operate without the oversight of any single entity, making it more resistant to manipulation and price manipulation. Additionally, the platform’s user base is growing rapidly, with more users joining each day as people become more aware of its potential.

Ultimately, only time will tell if Shiba Inu will remain a viable option for investors in the long-term. With its current rate of growth and increasing awareness among users, there is certainly potential for further success over time. It is important to remember that investing in cryptocurrencies carries inherent risks and investors should do their own research before deciding to invest in any particular currency.

Risks Associated With Investing In Cryptocurrency

Investing in cryptocurrency comes with a certain degree of risk. Cryptocurrency markets are notoriously volatile, and investors should be aware that prices can fluctuate drastically within a short period of time. This means that there is a potential for investors to lose their entire investments. Additionally, there is no guarantee that the digital currency will increase in value or even remain stable over time.

Another risk associated with investing in cryptocurrency is the lack of government oversight. Since cryptocurrencies are decentralized and unregulated, they are not subject to the same laws and regulations as traditional currencies, making them vulnerable to manipulation by malicious actors. Furthermore, many countries have enacted laws and regulations regarding the use of cryptocurrencies which can limit an investor’s ability to trade and convert their holdings into more liquid assets.

Finally, investing in cryptocurrency also carries the risk of cybertheft due to its reliance on digital wallets. Digital wallets store private keys which are essential for accessing one’s cryptocurrency holdings, making them targets for hackers and other malicious actors who may attempt to steal or corrupt these keys. As such, it is important for investors to ensure that their digital wallet is secure before investing in any type of cryptocurrency.

Frequently Asked Questions

What Is The Underlying Technology Supporting Shiba Inu Cryptocurrency?

Shiba Inu cryptocurrency is a decentralized cryptocurrency that is built on Ethereum’s blockchain technology. It has many features which make it unique and attractive to investors, including its low transaction costs and the ability to quickly send money across borders. The underlying technology supporting Shiba Inu cryptocurrency is known as ‘Ethereum Smart Contracts.’ These are computer protocols that enable users to securely store and transfer value between two parties.

Smart contracts are used for a variety of applications such as managing digital assets, creating financial derivatives, and executing agreements between multiple parties. They also offer the ability to set up automated payments and enforce contractual obligations without the need for a third-party intermediary. This provides an extra layer of security for both buyers and sellers by reducing the risk of fraud or manipulation.

The Shiba Inu coin itself is an ERC-20 token built on top of Ethereum’s blockchain. This means that it follows all of the same rules and regulations as other ERC-20 tokens like Bitcoin or Litecoin. Transactions made with Shiba Inu coins are secure and quick, making them ideal for both investors looking to make short-term profits as well as those who wish to hold onto their coins in the long term. Additionally, the coin’s low burn rate (the rate at which new coins enter circulation) makes it an attractive investment option for those looking to get in on the ground floor of a rapidly growing market.

Shiba Inu cryptocurrency has become increasingly popular amongst investors due to its unique features and underlying technology which provide users with a secure way to store and transfer value without relying on banks or third-party intermediaries. Its low burn rate also makes it an attractive investment option for those looking to capitalize on its growth potential in the future.

How Secure Is Shiba Inu Cryptocurrency?

Security is of paramount importance in the cryptocurrency space, so when investing in Shiba Inu (SHIB), it’s important to consider how secure the currency really is. By understanding the underlying technology behind SHIB and its security measures, investors can make an informed decision about whether or not SHIB is the right choice for them.

The first step towards understanding the security of a cryptocurrency is to look at its underlying technology. SHIB uses Ethereum’s blockchain protocol to process transactions and store data, meaning that it benefits from Ethereum’s robust security features. For instance, Ethereum utilizes advanced cryptography algorithms such as SHA-256 and ECDSA, which provide strong protection against malicious actors trying to steal funds or tamper with transactions. Additionally, Ethereum also has built-in features such as smart contracts that help automate processes like escrow payments while adding an extra layer of security.

In addition to its underlying technology, SHIB has also taken steps to further protect user funds by implementing measures such as KYC/AML compliance and whitelisting specific addresses. These measures are designed to ensure that only verified users are allowed access to their funds and prevent potential scams or frauds from occurring on the platform. By using these tools, investors can be sure that their money is safe when investing in SHIB tokens.

Investing in any cryptocurrency comes with some risk but by understanding the underlying technology behind SHIB and its additional security measures, investors can be confident that their money will remain safe when trading SHIB tokens. With a combination of robust blockchain protocols and additional features like KYC/AML compliance and whitelisting, investors can be certain they’re making a sound investment decision when investing in SHIB tokens.

What Are The Tax Implications Of Investing In Shiba Inu?

Investing in cryptocurrencies can be a great way to diversify a portfolio, but what many investors overlook is the tax implications of these investments. When it comes to Shiba Inu cryptocurrency, understanding the tax implications is especially important. This article will explore what investors need to know about the tax implications of investing in Shiba Inu.

When it comes to taxes, most crypto assets are treated as property by the IRS. As such, capital gains taxes will apply if an investor sells their Shiba Inu at a profit. Capital gains are taxed based on how long an investor held the asset before selling it – short-term capital gains are taxed at higher rates than long-term capital gains. Investors should also be aware that they may need to file additional forms depending on where they live and how much money they make from their investments.

It’s also important for investors to remember that any profits made from buying and selling Shiba Inu must be reported on their taxes. The IRS requires all individuals who have earned more than $20,000 in crypto income over the course of a year to file a form 8949 detailing their earnings and losses from cryptocurrency transactions. Additionally, if an individual has received more than $600 worth of cryptocurrency as payment for goods or services, then they must also report that income on their taxes.

Investors should ensure that they understand the tax implications of investing in Shiba Inu before making any decisions about their investments. Understanding taxation laws and filing requirements can help investors maximize their profits while avoiding costly penalties from failing to comply with regulations. By taking the time to research and understand the tax implications of investing in Shiba Inu, investors can make informed decisions about their investments and ensure that they remain compliant with applicable laws and regulations.

Are There Any Custodial Solutions For Shiba Inu?

Investing in cryptocurrencies like Shiba Inu can be a great way to diversify one’s portfolio, but there are some important considerations for investors to take into account. One of the key questions that many investors have is whether or not there are any custodial solutions available for Shiba Inu.

A custodial solution, in this context, refers to a third-party service that stores and safeguards an investor’s cryptocurrency assets. This means that investors don’t need to worry about the safety of their funds as they will be securely stored with a trusted professional. Many exchanges offer custodial solutions for their customers and these services can provide peace of mind when investing in digital assets.

However, it should be noted that not all exchanges offer custodial solutions for Shiba Inu. It is important for investors to do their research and find out which exchanges offer this service before investing. Additionally, it is also important to ensure that the exchange chosen has a good reputation and is properly regulated so that investors can feel confident that their investments are safe and secure.

Investors should also keep in mind that even if an exchange does provide a custodial solution, there may still be risks associated with investing in Shiba Inu due to its volatility. Therefore, it is essential for investors to do their own research before making any investment decisions and make sure they understand the potential risks involved.

How Can I Buy And Sell Shiba Inu?

When it comes to buying and selling Shiba Inu, there are a few options investors can explore. This article will discuss the different ways to purchase and sell this new cryptocurrency, as well as the possible risks associated with investing in it.

The most popular way to buy and sell Shiba Inu is through decentralized exchanges, or DEXs. These allow users to trade Shiba Inu without having to go through a central third party. This means that users don’t have to worry about paying any fees or being subject to any KYC requirements. Additionally, DEXs usually provide access to other cryptocurrencies besides Shiba Inu as well.

Another option for purchasing and selling Shiba Inu is through centralized exchanges. These generally have higher liquidity than DEXs and typically offer more features such as margin trading and stop-loss orders. However, they may also require users to submit verification documents before they can start trading. Additionally, they may charge high fees depending on the exchange used.

Investors should be aware of the potential risks associated with buying and selling Shiba Inu before deciding which option best suits their needs. There is always the possibility of losing money due to price volatility or getting scammed by fraudsters posing as legitimate traders or exchanges. It’s important for investors to research the exchanges they plan on using thoroughly before making any transactions or investments.

In order for investors to make informed decisions when it comes to buying and selling Shiba Inu, it is important for them to understand all of their available options and weigh up the potential risks involved in each one. By doing so, they can ensure that their investments are safe and secure while maximizing their returns at the same time.

Conclusion

In conclusion, it is clear that Shiba Inu cryptocurrency has potential for investors. It’s important to understand the underlying technology, its security features and tax implications before investing. Additionally, investors should consider custodial solutions to protect their investments and be aware of how to buy and sell the currency.

Ultimately, investing in Shiba Inu can be a lucrative opportunity for those who do their research. Its burn rate continues to make it a desirable asset class, but it’s important to remember that investing involves risk. As with any investment decision, investors should weigh the potential rewards against the possible risks before making their final decision.

By understanding the fundamentals of Shiba Inu cryptocurrency and taking into account all aspects of the investment, I’m sure investors will be able to make an informed decision about whether or not this asset class is right for them.