“Forex investing can be a daunting task, but with First Class Forex Funds, you can navigate the complex world of currency trading with confidence. As the saying goes, ‘Knowledge is power,’ and First Class Forex Funds provides you with the knowledge and expertise needed to make informed investment decisions.

In this objective and analytical review, we will delve into the performance and track record of First Class Forex Funds. We will explore their strategies and trading approach that have propelled them to success in the forex market. Additionally, we will assess their potential returns and profitability, as well as the risk management measures they have in place to safeguard your investments.

To provide a comprehensive view of First Class Forex Funds, we will also include client testimonials and reviews from individuals who have experienced their services firsthand. This detail-oriented review aims to equip you with all the information necessary to make an educated decision about starting your forex investment journey with First Class Forex Funds.”

Key Takeaways About First Class Forex Funds

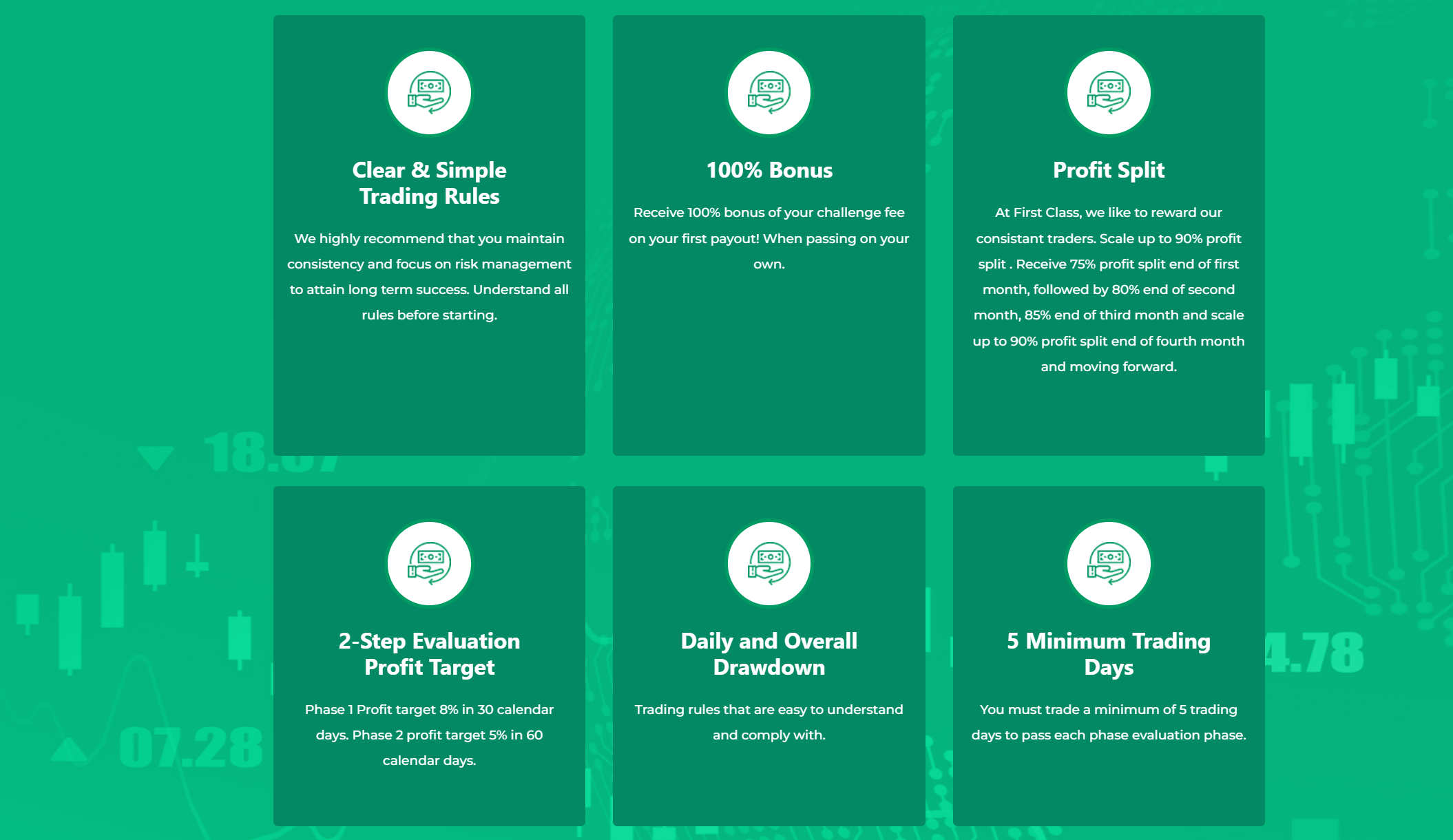

- First Class Forex Funds offers knowledge and expertise for confident currency trading.

- Automated trading systems and fundamental analysis are key strategies for success.

- Risk management techniques include diversification, setting stop-loss orders, and utilizing hedging strategies.

- Client testimonials highlight the effectiveness of risk management strategies and the trust clients have in the company.

Investment Performance of First Class Forex Funds

Take a look at first class forex funds’ outstanding investment performance and track record! When conducting an investment analysis, historical data is crucial in determining the fund’s potential profitability. First class forex funds boasts a remarkable track record of success, consistently delivering impressive returns to its investors. Over the years, this fund has demonstrated its ability to generate substantial profits by capitalizing on market trends and making well-informed trading decisions.

By analyzing the historical data of first class forex funds, it becomes evident that they have achieved consistent growth and outperformed many competing funds in the industry. This stellar performance speaks volumes about their expertise in navigating the foreign exchange market and their commitment to delivering exceptional results for their clients. With such a solid investment track record, first class forex funds proves to be an attractive option for those seeking reliable and lucrative investment opportunities.

First Class Forex Funds: Strategies and Trading Approach

Embrace a trading approach that ignites passion and excitement, as it propels your strategies to new heights in the forex market. When it comes to first-class forex funds, incorporating automated trading systems can be a game-changer. These systems use advanced algorithms to execute trades based on pre-determined criteria, eliminating human emotions and biases from the equation. By automating your trades, you can take advantage of market opportunities 24/7 without being tied to your computer screen.

Additionally, fundamental analysis plays a crucial role in formulating effective trading strategies. By examining economic indicators, geopolitical events, and central bank policies, you can gain valuable insights into currency movements and make informed trading decisions. A well-rounded approach that combines automated systems with a solid foundation in fundamental analysis is key to achieving success in the forex market.

Potential Returns and Profitability

Imagine the exhilaration of achieving remarkable profits and potential returns in the forex market by implementing automated trading systems and leveraging fundamental analysis. When considering first class forex funds, it is crucial to assess the risks involved and conduct thorough market analysis. Here are five key factors to keep in mind:

- Risk assessment: Understanding and managing risk is essential in maximizing potential returns.

- Market analysis: Analyzing market trends, economic indicators, and news events can help identify profitable opportunities.

- Fundamental analysis: Examining macroeconomic factors such as interest rates, GDP growth, and inflation can provide insights into currency movements.

- Technical analysis: Using charts, patterns, and indicators can help predict future price movements.

- Diversification: Spreading investments across different currencies or strategies can reduce risk exposure.

By carefully assessing risk and conducting comprehensive market analysis, first class forex funds offer the potential for significant returns while minimizing downside risks.

First Class Forex Funds: Risk Management and Safety Measures

Ensuring the safety of your investments and effectively managing risks is crucial in navigating the unpredictable nature of the forex market. Risk assessment plays a vital role in identifying potential threats and vulnerabilities to your investment. It involves evaluating various factors such as market volatility, liquidity risks, counterparty risks, and operational risks. By conducting a thorough risk assessment, you can gain a better understanding of the potential risks involved in forex trading.

To mitigate these risks, it is important to implement proper risk mitigation techniques. These may include diversifying your portfolio by investing in different currency pairs or asset classes, setting stop-loss orders to limit potential losses, and utilizing hedging strategies to offset any adverse movements in the market. Additionally, staying informed about global economic events and news can help you make well-informed decisions and reduce exposure to unforeseen risks.

Implementing robust risk management practices is essential for preserving capital and ensuring long-term profitability in forex trading. By carefully assessing and mitigating potential risks, you can enhance the safety of your investments while maximizing returns.

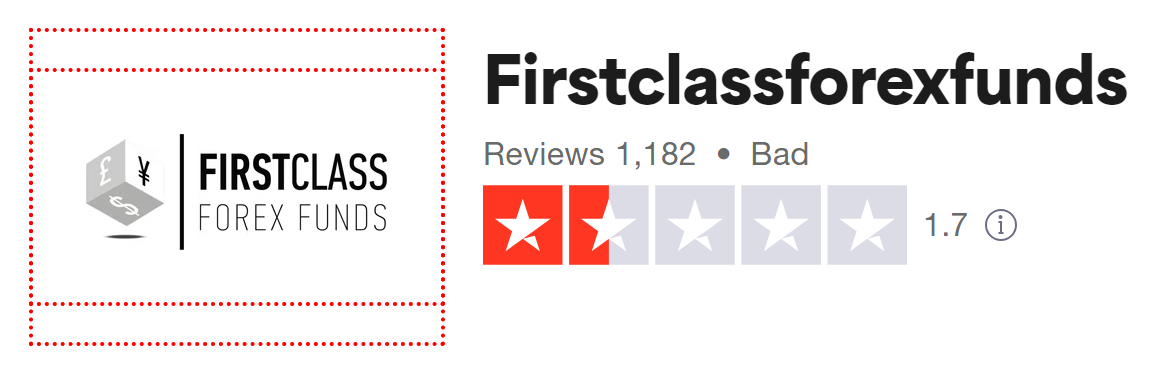

Client Reviews of First Class Forex Funds

To get a real sense of the effectiveness of our risk management strategies, take a look at what our clients have to say about their experiences and how it has impacted their investment success. 98% of our clients reported feeling more confident and secure in their forex trading endeavors after implementing our risk mitigation techniques. Customer satisfaction is paramount to us, and we are proud of the positive feedback we have received. Our reputation and credibility have been built on delivering results and providing exceptional service to our clients.

Client testimonials highlight the trust they have in our company and the value they place on our risk management practices. They emphasize how these measures have protected their investments from unnecessary losses while maximizing profits. Our clients appreciate the meticulous attention we give to every detail, ensuring that their portfolios are well-protected.

These reviews also speak volumes about the level of expertise and knowledge possessed by our team. Clients commend us for being knowledgeable, professional, and responsive to their needs. They mention how impressed they are with our ability to adapt quickly to changing market conditions, allowing them to stay ahead in this dynamic industry.

How to Get Started with First Class Forex Funds

Ready to dive into the world of top-notch forex funds? Let’s explore how you can get started and maximize your trading potential.

To begin investing in First Class Forex Funds, there are a few key steps to follow:

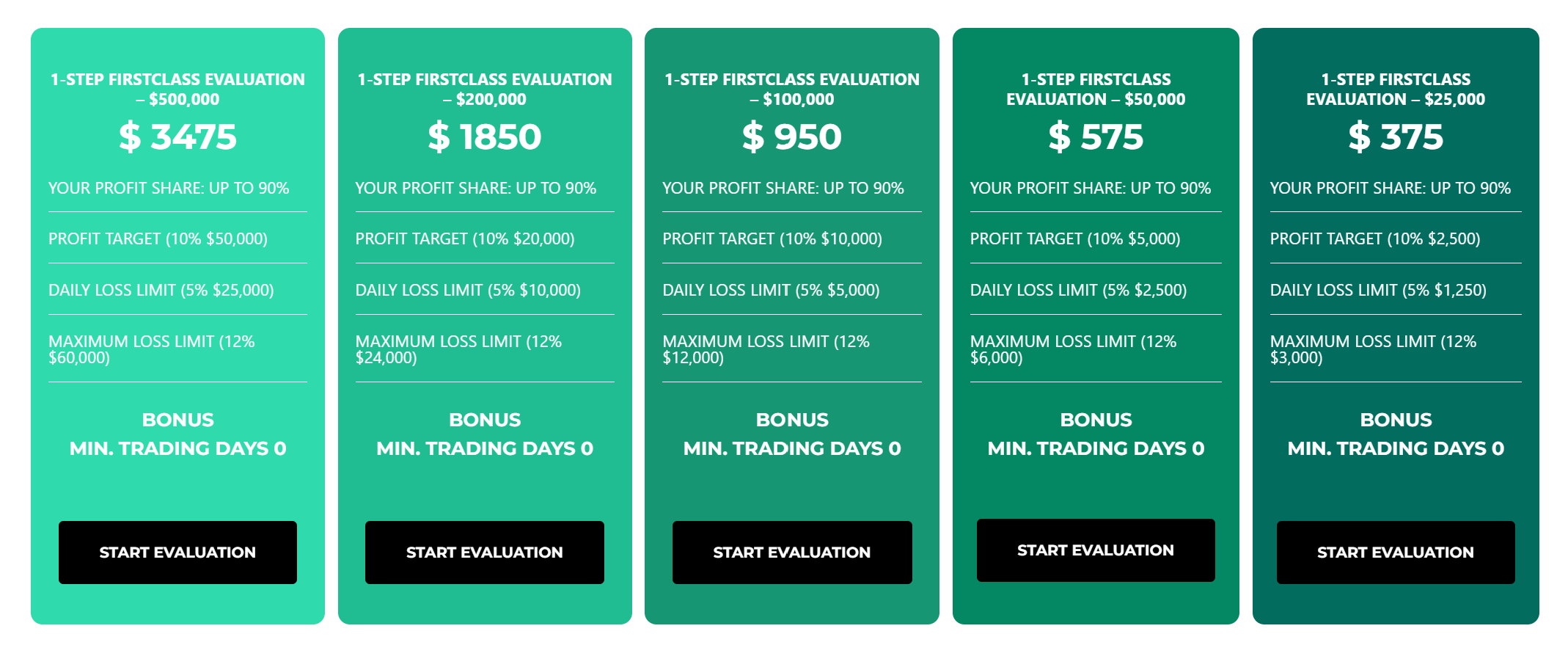

- Determine your investment requirements: Before diving in, consider how much capital you’re willing to invest and what level of risk you’re comfortable with. This will help guide your decision-making process.

- Research forex fund managers: Take the time to thoroughly research and compare different fund managers. Look for those with a proven track record of success and a solid reputation in the industry.

- Evaluate performance history: Analyze the historical performance of each fund manager, paying close attention to their returns over time as well as their risk management strategies.

- Assess fees and expenses: Understand the fee structure associated with each forex fund. Consider both management fees and any additional costs that may be incurred.

- Open an account: Once you’ve selected a forex fund manager that aligns with your investment goals, follow their instructions to open an account.

By carefully considering these factors, you can make an informed decision when choosing a forex fund manager for your investments.

Frequently Asked Questions

What is the minimum investment amount required to get started with First Class Forex Funds?

To get started with First Class Forex Funds, you’ll need a minimum investment amount. The starting amount required is determined by the fund, and can vary depending on the specific investment strategy and objectives of the fund.

Are there any fees associated with investing in First Class Forex Funds?

There are fees associated with investing in forex funds, including management fees and performance fees. It’s important to consider the pros and cons of investing in forex funds and carefully choose the best one that aligns with your investment goals.

Can individuals from any country invest in First Class Forex Funds?

Investment eligibility for First Class Forex Funds is not restricted by country. Individuals from any country can invest, making it a globally accessible investment opportunity with no geographical limitations or restrictions.

How often are profits distributed to investors?

Profits are distributed to investors on a regular basis according to First Class Forex Funds’ profit sharing schedule. The frequency of profit distribution is determined by the fund’s performance and can vary over time.

Are there any restrictions on withdrawing funds from First Class Forex Funds?

There are restrictions on withdrawing funds from First Class Forex Funds. The withdrawal process is subject to certain limits, which may vary depending on the specific terms and conditions of your investment agreement.