In the world of trading, finding a trusted prop trading firm with favorable trading conditions can be like discovering a hidden gem. Enter Finotive Funding, a company that stands out from the crowd with its impressive offerings.

Like a beacon of reliability and opportunity, Finotive Funding shines in the trading landscape. With a TU Overall Score of 5.1 out of 10 and a rank of 27th out of 32 in the TU Ranking, the company has proven itself as a trustworthy broker.

Offering multiple account types and a unique profit withdrawal system, Finotive Funding caters to the diverse needs of traders. Access to a wide range of trading instruments, including currency pairs, stocks, indices, cryptocurrencies, and commodities, with a maximum leverage of 1:400, ensures ample opportunities for profit.

With liquidity providers from Deep Liquidity pools, traders can benefit from minimal spreads and low fees. Additionally, the company’s prompt and competent technical support through email and live chat ensures a smooth trading experience.

Experts at Traders Union have evaluated Finotive Funding positively, with a customer satisfaction score of 6.06/10. However, it is important to consider the cautionary words of financial expert and analyst Anton Kharitonov, who advises against working with Finotive Funding due to negative reviews and a low average rating.

Despite differing opinions, the fact remains that Finotive Funding is a prop trading firm worth considering for its favorable trading conditions and trusted reputation.

Key Takeaways

- Finotive Funding is a moderate-risk prop trading firm with a TU Overall Score of 5.1 out of 10 and ranks 27th out of 32 in the TU Ranking.

- The company offers favorable trading conditions, including multiple account types and a unique profit withdrawal system.

- Traders can access a variety of trading options such as currency pairs, stocks, indices, cryptocurrencies, and commodities.

- The maximum leverage offered by Finotive Funding is 1:400, and there are no limitations on trading news, weekends, or the use of advisers.

What is Finotive Funding?

Finotive Funding is a prop trading firm established in 2021 by Oliver Newland, headquartered in Budapest, Hungary, that offers favorable trading conditions and a variety of trading accounts and balances.

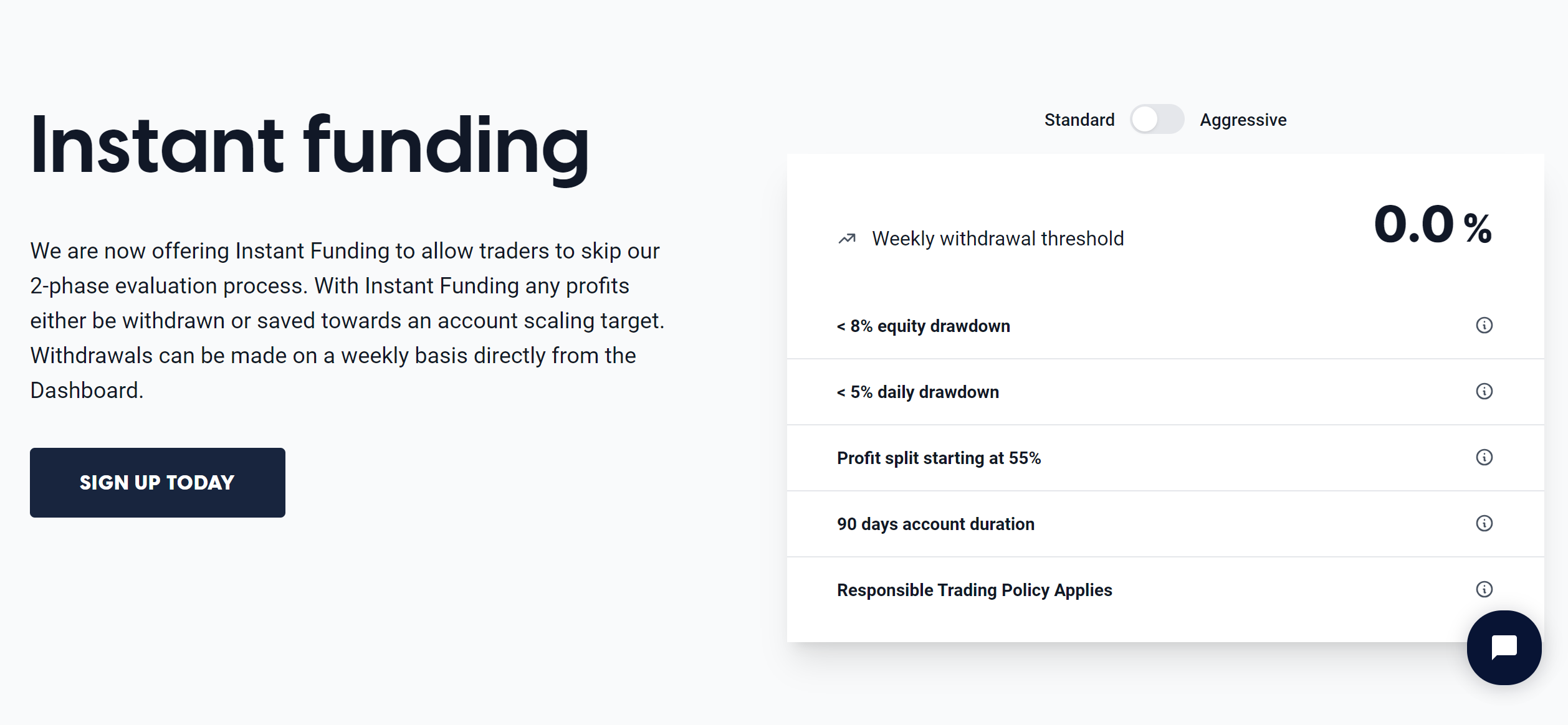

Traders can choose from different account types such as Classic Challenge, One-Step Challenge, Instant Funding (Standard), and Instant Funding (Aggressive). Each account type has its own advantages and disadvantages.

The Classic Challenge account is recommended for most cases, as it allows traders to start with up to $200,000 and offers scaling options with a maximum balance of $3,200,000. Traders are not limited in their trading strategies as long as they avoid large drawdowns and use stop losses.

It is important for traders to carefully choose the right account type and balance at the start to suit their trading goals and preferences.

Founder and Headquarters of Finotive Funding

Established in 2021 by Oliver Newland, Finotive Funding operates from its headquarters in Budapest, Hungary, serving as a hub for its global partners and clients.

The founder, Oliver Newland, has successfully established the prop trading firm, gaining positive evaluations from experts at Traders Union.

The company has managed to attract a large number of global partners, indicating its growing popularity and trustworthiness in the industry.

The headquarters in Budapest allows Finotive Funding to efficiently manage its operations and provide support to its clients worldwide.

With its favorable trading conditions and a variety of account options, Finotive Funding has positioned itself as a trusted prop trading firm in the market.

The founder’s vision and strategic decisions have contributed to the firm’s success and its ability to cater to the needs of traders from around the world.

Finotive Funding: Account Types

One of the key aspects of Finotive Funding is the availability of multiple account types for traders to choose from. These different account types cater to the varying needs and preferences of traders. The account requirements and features vary across the different types, allowing traders to select the one that best suits their trading style and goals.

Traders can choose from account types such as the Classic Challenge, One-Step Challenge, Instant Funding (Standard), and Instant Funding (Aggressive). These accounts offer different starting balances and profit split options. Additionally, Finotive Funding allows traders to use various trading strategies, giving them the flexibility to implement their preferred approach to trading. This feature enables traders to personalize their trading experience and optimize their chances of success.

| Account Type | Starting Balance | Profit Split |

|---|---|---|

| Classic Challenge | Up to $200,000 | Up to 95% |

| One-Step Challenge | Varies | Up to 95% |

| Instant Funding (Standard) | Varies | Up to 95% |

| Instant Funding (Aggressive) | Varies | Up to 95% |

Table: Different Account Types and their Features at Finotive Funding. Source: Traders Union

Trading Instruments Offered By Finotive Funding

The range of trading instruments available at Finotive Funding is extensive and includes over 60 currency pairs, cryptocurrencies, stocks, indices, and commodities. This allows traders to have a diverse portfolio and the flexibility to trade various assets according to their preferences and strategies.

With such a wide selection of assets, traders can explore different market opportunities and potentially maximize their profit potential. Moreover, the availability of these trading instruments caters to different trading styles and strategies, whether it be short-term scalping or long-term investing.

Traders can utilize technical analysis or fundamental analysis to make informed trading decisions across these assets. The inclusion of cryptocurrencies also reflects the growing popularity and demand for digital assets in the financial markets.

Overall, the variety of trading instruments at Finotive Funding provides traders with ample opportunities to diversify their trading strategies and explore different markets.

Finotive Funding: Leverage and Fees

Leverage plays a crucial role in amplifying potential gains or losses for traders at Finotive Funding, allowing them to have increased exposure to the financial markets and potentially enhance their trading results. With a maximum leverage of 1:400, traders at Finotive Funding have the opportunity to trade larger positions with a smaller amount of capital. This can be advantageous as it allows traders to potentially generate higher profits with a smaller initial investment.

However, it is important for traders to be aware of the risks associated with high leverage, as it can also result in significant losses if trades do not go as anticipated.

Furthermore, fees can impact profitability in prop trading. While Finotive Funding does not charge any additional fees, traders should consider the impact of the non-refundable initial fee when calculating their overall profitability.

It is important for traders to carefully weigh the pros and cons of high leverage and factor in any associated fees when making trading decisions.

Profit Split and Scaling

Moving on to the current subtopic, let’s explore the profit split and scaling options offered by Finotive Funding.

Traders have the opportunity to increase their profit share through scaling, which can reach up to an impressive 95%. This means that as traders successfully grow their account balance, they can earn a larger portion of their profits. Scaling provides a clear incentive for active trading and rewards traders who are able to generate consistent returns.

Additionally, Finotive Funding allows traders to employ various profit split strategies, giving them the flexibility to choose the approach that aligns with their trading style and goals. By offering these options, Finotive Funding aims to motivate and empower traders to maximize their earning potential.

The benefits of scaling and the ability to customize profit split strategies contribute to the overall favorable trading conditions provided by Finotive Funding.

Technical Support offered Finotive Funding

Technical support at Finotive Funding is readily available and offers prompt and competent assistance through live chat and email. Traders can access technical support 24/7, ensuring that any issues or inquiries can be addressed in a timely manner.

The support team at Finotive Funding is known for their competence and expertise, providing traders with the assistance they need to navigate any challenges they may encounter. Whether it is a technical issue with the trading platform or a question about account features and settings, traders can rely on the technical support team to provide accurate and helpful information.

The availability of live chat and email as communication channels ensures that traders can choose the method that is most convenient for them to reach out for assistance.

Overall, Finotive Funding’s technical support is reliable and responsive, contributing to a positive trading experience for its clients.

Evaluation by Experts

In the previous section, we discussed the technical support provided by Finotive Funding. Now, let’s delve into the evaluation of this prop trading firm by experts. Traders Union, a reputable platform, positively evaluates Finotive Funding. They consider various factors, including customer satisfaction and overall performance. Although Finotive Funding has a Customer Satisfaction Score (CSAT) of 6.06/10, indicating a moderate level of satisfaction, there is room for improvement.

Experts at Traders Union thoroughly assess the company’s performance based on several criteria such as regulation and safety, commissions and fees, trading instruments, brand popularity, customer support, and education. While Finotive Funding scores well in some areas, such as commissions and fees (8.29/10) and trading instruments (7.64/10), its scores in customer support (4.62/10) and education (4.01/10) suggest areas for enhancement. The evaluation process conducted by experts provides valuable insights for individuals considering partnering with Finotive Funding.

| Criteria | Score |

|---|---|

| Regulation and Safety | 5.02/10 |

| Commissions and Fees | 8.29/10 |

| Trading Instruments | 7.64/10 |

| Brand Popularity | 7.19/10 |

| Customer Support | 4.62/10 |

| Education | 4.01/10 |

Referral Program

Regarding the referral program, Finotive Funding offers its users the opportunity to earn additional benefits through their extensive network of partners.

Referral programs can have both pros and cons for traders. On the positive side, referral programs can provide traders with a way to earn extra income by referring new clients to the company. This can be especially beneficial for traders who have a large network or following in the trading community.

Additionally, referral programs can help foster a sense of community and collaboration among traders, as they are incentivized to share their positive experiences with others.

However, there are also potential drawbacks to referral programs. Some traders may feel pressured to refer others in order to earn rewards, which could lead to biased or misleading recommendations. Furthermore, referral programs may create conflicts of interest, as traders may prioritize earning rewards over providing unbiased advice.

Overall, referral programs can offer benefits to traders, but it is important for users to approach them with caution and consider the potential drawbacks.

Finotive Funding: Trading Platforms

The availability and compatibility of multiple trading platforms contribute to the versatility and accessibility of Finotive Funding’s services, enhancing traders’ ability to execute their strategies effectively.

- Finotive Funding offers various trading platforms to cater to the diverse needs of traders.

- MetaTrader 5 (MT5) is the primary platform used by Finotive Funding, providing a comprehensive range of tools and features for trading.

- Traders can also choose from other trading platforms, ensuring compatibility with their preferred trading software.

- The choice of trading platform can significantly impact a trader’s performance and overall experience.

- Each platform has its own strengths and weaknesses, and traders should consider their individual requirements and preferences when selecting a platform.

- It is important to weigh the pros and cons of different platforms to make an informed decision that aligns with their trading goals.

Having access to multiple platforms enables traders to find the one that best suits their needs, enhancing their trading experience and potential for success.

Frequently Asked Questions

What is the minimum initial fee required to open an account with Finotive Funding?

The minimum initial fee required to open an account with Finotive Funding depends on the account type and balance chosen. The options include Classic Challenge, One-Step Challenge, and Instant Funding, with fees starting from $50.

Are there any limitations on the trading strategies that can be used with Finotive Funding?

Trading strategies at Finotive Funding are not restricted, allowing traders to utilize a wide range of strategies. The firm does not impose limitations on trading strategies, enabling traders to employ their preferred strategies for optimal trading outcomes.

How many currency pairs are available for trading with Finotive Funding?

Finotive Funding offers traders access to over 60 currency pairs for trading. This wide range of available currency pairs allows traders to diversify their portfolios and take advantage of various market opportunities. The availability of multiple currency pairs enhances the trading conditions provided by Finotive Funding.

Is there a maximum balance limit for the different account types offered by Finotive Funding?

The account types offered by Finotive Funding have different maximum balance limits. Traders can choose from various account types, such as Classic Challenge, One-Step Challenge, and Instant Funding, with a maximum balance ranging up to $3,200,000.

What is the process for withdrawing funds from a Finotive Funding account?

To withdraw funds from a Finotive Funding account, users must first complete the account verification process. This typically involves providing necessary identification documents and fulfilling any additional requirements set by the company. Once the account is verified, users can request a withdrawal through the provided channels, such as email or live chat, and follow the specified procedures to transfer the funds out of their account.