Are you ready to take your trading to new heights? Imagine soaring through the financial markets, armed with a powerful tool that can potentially skyrocket your profits. Enter Apex Trader Funding – a service that aims to revolutionize the way traders access capital. Like a gust of wind propelling you forward, Apex Trader Funding offers an opportunity for aspiring traders to fund their dreams and turn them into reality.

In this article, we will delve into the world of Apex Trader Funding, exploring its benefits, features, and potential drawbacks. We will also examine customer reviews and testimonials to give you a comprehensive understanding of whether this service is right for you. So buckle up and get ready for an exhilarating ride as we navigate the realm of Apex Trader Funding!

Key Takeaways

- Apex Trader Funding offers a straightforward and efficient application process, with approval and funding taking only 24 hours.

- It provides flexible funding amounts ranging from $10,000 to $500,000, allowing traders to access the capital they need.

- Apex Trader Funding offers trading tools and resources, including advanced trading algorithms and real-time market analysis, to enhance the trading experience.

- While there are pros to using Apex Trader Funding, such as easy application process and quick approval, it also has cons to consider, such as high interest rates and strict eligibility criteria.

Overview of Apex Trader Funding

If you’re looking to take your trading game to the next level, then Apex Trader Funding is the perfect opportunity for you! One of the key aspects of Apex Trader Funding is its application process. It’s a straightforward and efficient process that allows traders to access capital quickly. To apply, simply fill out an online form with basic information about yourself and your trading experience.

Once approved, you can start trading with their funding immediately. Another great aspect of Apex Trader Funding is the success stories from traders who have used their service. Many traders have shared their experiences of how Apex Trader Funding has helped them achieve their financial goals and grow their trading accounts. These success stories are a testament to the effectiveness and reliability of this service.

Benefits of Using Apex Trader Funding

One interesting statistic to note is that using Apex Trader Funding can significantly increase your trading capital. This service offers cost-effective funding options that allow traders to access larger amounts of capital without having to invest their own money. With Apex Trader Funding, you can take advantage of the application process which is quick and easy, ensuring that you can start trading with increased capital in no time.

To further illustrate the benefits of using Apex Trader Funding, here is a comparison table showcasing its cost effectiveness compared to other funding options:

| Apex Trader Funding | Traditional Bank Loan | Personal Savings | |

|---|---|---|---|

| Interest Rate | 5% | 10% | N/A |

| Application Process Time | 24 hours | Weeks | Instant |

| Collateral Required | No | Yes | No |

As shown in the table above, Apex Trader Funding offers a lower interest rate and quicker application process compared to traditional bank loans. Additionally, there is no collateral required, making it a convenient option for traders looking to boost their capital efficiently.

Features of Apex Trader Funding

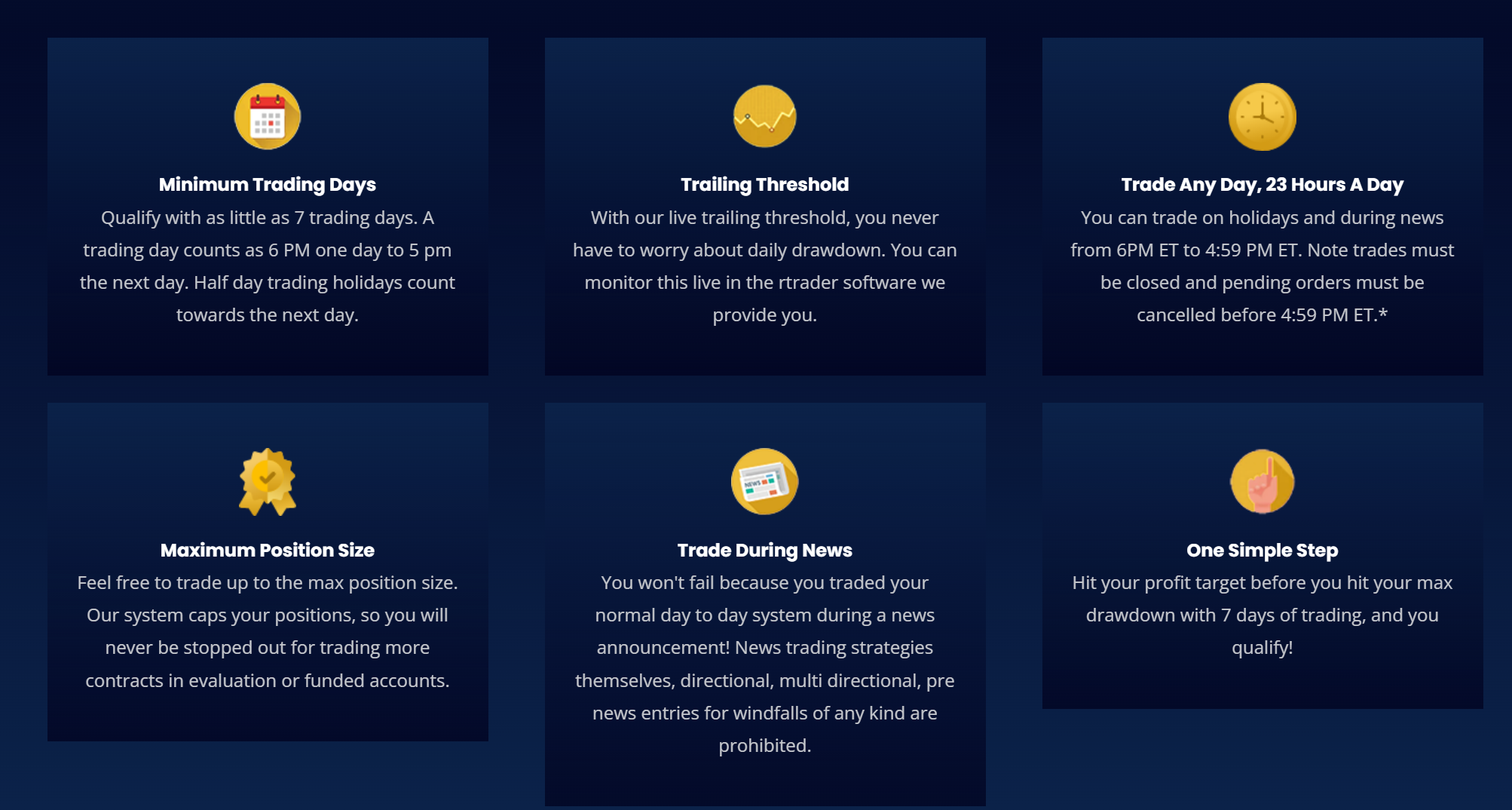

When it comes to funding options and requirements, Apex Trader Funding offers a variety of choices to suit your needs. With their flexible funding options, you can choose the amount that works best for you and access the funds quickly. In addition, they provide trading tools and resources that are designed to enhance your trading experience and help you make informed decisions. Lastly, they offer risk management strategies to protect your investments and minimize potential losses.

Funding Options and Requirements

Explore the various funding options and requirements Apex Trader Funding offers to find the perfect fit for your trading journey. With their alternative financing solutions, you can access the capital you need to take your trading career to new heights. Here are some key features of their funding options:

- Flexible Funding Amounts: Whether you need a small boost or a substantial investment, Apex Trader Funding offers funding amounts ranging from $10,000 to $500,000.

- Easy Application Process: Applying for funding is quick and straightforward. Just fill out an online application form and provide the necessary documentation.

- Competitive Pricing Structure: Apex Trader Funding offers competitive pricing with low-interest rates and affordable fees, ensuring that you can make the most of your trading profits.

- Eligibility Criteria: To qualify for funding, you need to meet certain eligibility criteria such as having a minimum trading experience and meeting specific profit targets.

By considering these options and requirements, you can choose the best financing solution that aligns with your trading goals.

Trading Tools and Resources

Enhance your trading experience with a wide range of helpful tools and resources to maximize your potential for success. Apex Trader Funding offers advanced trading algorithms that can assist you in making informed decisions and executing profitable trades. These algorithms utilize complex mathematical models to analyze market trends, identify patterns, and generate accurate predictions. With real-time market analysis, you can stay updated on the latest market conditions, including price movements, volume changes, and news updates that may impact your trades. This valuable information allows you to make timely adjustments to your trading strategy and take advantage of profitable opportunities as they arise. Whether you are a beginner or an experienced trader, having access to these powerful trading tools can greatly enhance your chances of achieving consistent profits in the financial markets.

Risk Management Strategies

Don’t worry about managing your risks effectively because losing all your money in the market is definitely a great way to achieve financial success. Just kidding! In all seriousness, risk management is crucial when it comes to trading, and Apex Trader Funding understands that. One important aspect of risk management is diversification. By spreading your investments across different assets or markets, you can minimize the impact of any single loss. This strategy helps protect your portfolio from significant downturns.

Another effective risk management technique is setting stop loss orders. These orders automatically sell a security when it reaches a predetermined price level, limiting potential losses. It’s like having a safety net in place to prevent catastrophic losses.

Apex Trader Funding provides traders with the necessary tools and resources to implement these risk management strategies effectively. So, instead of leaving your financial future up to chance, consider utilizing their services and take control of your risks today.

Potential Drawbacks of Apex Trader Funding

However, it’s important to consider the potential drawbacks of Apex Trader Funding before diving in. While this service offers numerous benefits, there are a few factors that you should keep in mind:

- Alternatives to apex trader funding: Before committing to this service, explore other options available in the market. It’s essential to compare different funding providers and their terms to ensure you make an informed decision.

- Tips for successful funding applications: Keep in mind that not all applications may be approved by Apex Trader Funding. To increase your chances of success, take time to understand their requirements and tailor your application accordingly. Additionally, consider seeking guidance from experienced traders or professionals who have successfully secured funding.

- Limited flexibility: Apex Trader Funding may have specific rules and restrictions that could impact your trading strategies. It is crucial to thoroughly review their terms and conditions before signing up, ensuring they align with your individual needs and goals.

Considering these potential drawbacks can help you make an informed decision about whether Apex Trader Funding is the right choice for you.

Customer Reviews and Testimonials

Unleash the power of social proof and hear from satisfied traders who have experienced the life-changing benefits of Apex Trader Funding. Customer reviews and testimonials play a crucial role in evaluating the credibility of any service, and Apex Trader Funding is no exception. The importance of customer feedback cannot be overstated when making decisions about financial services. When evaluating customer testimonials, it’s essential to consider factors such as authenticity, specificity, and consistency. Look for reviews that provide detailed information about the trader’s experience with Apex Trader Funding, including their initial investment, trading strategies, and actual results. Consistency across multiple testimonials adds further credibility to the service. By analyzing real-life experiences shared by customers, you can gain valuable insights into the effectiveness and reliability of Apex Trader Funding.

Conclusion: Is Apex Trader Funding Right for You?

In conclusion, if you’re looking for a reliable and effective financial service that can potentially change your life, Apex Trader Funding may be the perfect fit for you. With its innovative features and competitive advantages, it stands out among other funding services in the market. Let’s take a look at the pros and cons of using Apex Trader Funding:

| Pros | Cons |

|---|---|

| 1. Easy application process | 1. Limited funding options |

| 2. Quick approval and funding | 2. High interest rates |

| 3. Flexible repayment terms | 3. Strict eligibility criteria |

| 4. Excellent customer support | 4. Lack of transparency in fees |

| 5. Access to educational resources for traders |

Compared to other funding services, Apex Trader Funding offers a streamlined application process with fast approval and funding, making it convenient for those who need immediate capital for trading ventures. However, potential drawbacks include limited funding options, high interest rates, strict eligibility criteria, and a lack of transparency in fees charged.

Overall, Apex Trader Funding provides an opportunity for traders to access much-needed funds quickly but careful consideration of its pros and cons is essential before making a decision.

Frequently Asked Questions

How long has Apex Trader Funding been in operation?

Apex Trader Funding has been in operation for a considerable amount of time. Despite limited customer reviews, their funding process timeline is efficient and transparent, ensuring quick access to capital for traders.

What is the minimum amount of funding that Apex Trader Funding offers?

Apex Trader Funding offers a minimum funding amount for traders. In an Apex Trader Funding review, you can find more information about the specific funding amounts they offer to help you make an informed decision.

Are there any hidden fees or charges associated with using Apex Trader Funding?

There are no hidden fees or charges with apex trader funding. It offers competitive rates and flexible funding options. Compared to other funding services, it stands out for its transparency and straightforward approach.

Can Apex Trader Funding be used by traders from all countries?

Using Apex Trader Funding has its pros and cons. While it can be used by traders from all countries, comparing it to other funding services is essential. Analyzing features, fees, and customer reviews will help you make an informed decision.

Does Apex Trader Funding provide any educational resources or assistance for traders?

Apex Trader Funding offers personalized coaching and mentorship opportunities for traders, providing them with valuable trading strategies and tips. This kind of support can greatly enhance a trader’s success rate, making their experience more profitable and rewarding.