Cryptocurrency Trading In 2023? {Brokerages, Wallets & Much More}

If you’re considering cryptocurrency trading in 2023, you’ll need to be well-informed about the ins and outs of the industry. Cryptocurrencies have taken the world by storm over the past few years, with Bitcoin becoming a household name.

And while there’s no denying that cryptocurrencies are volatile investments, they also offer potentially huge returns.

To help you navigate this complex landscape, we’ve put together a one-stop guide for cryptocurrency trading in 2023. In this guide, we’ll cover everything from understanding cryptocurrencies to selecting the best crypto brokerages and market analysis techniques.

Whether you’re new to cryptocurrency or an experienced trader looking to expand your knowledge, this guide will provide you with all the information you need to succeed in the exciting world of cryptocurrency trading.

Key Takeaways

- Understanding the basics of cryptocurrency trading is crucial for success, including technical analysis and different trading options.

- Choosing a reputable crypto brokerage with good customer support, low fees, and strong security measures is important.

- Risk management strategies, such as managing leverage, can help mitigate potential losses.

- Staying informed about market developments, regulations, and both positive and negative events affecting investments is crucial for making educated trading decisions.

Credits: PWC

Understanding Cryptocurrencies

You may be feeling overwhelmed with all the different cryptocurrencies out there, but don’t worry, understanding crypto basics is as easy as ‘buy low, sell high.’

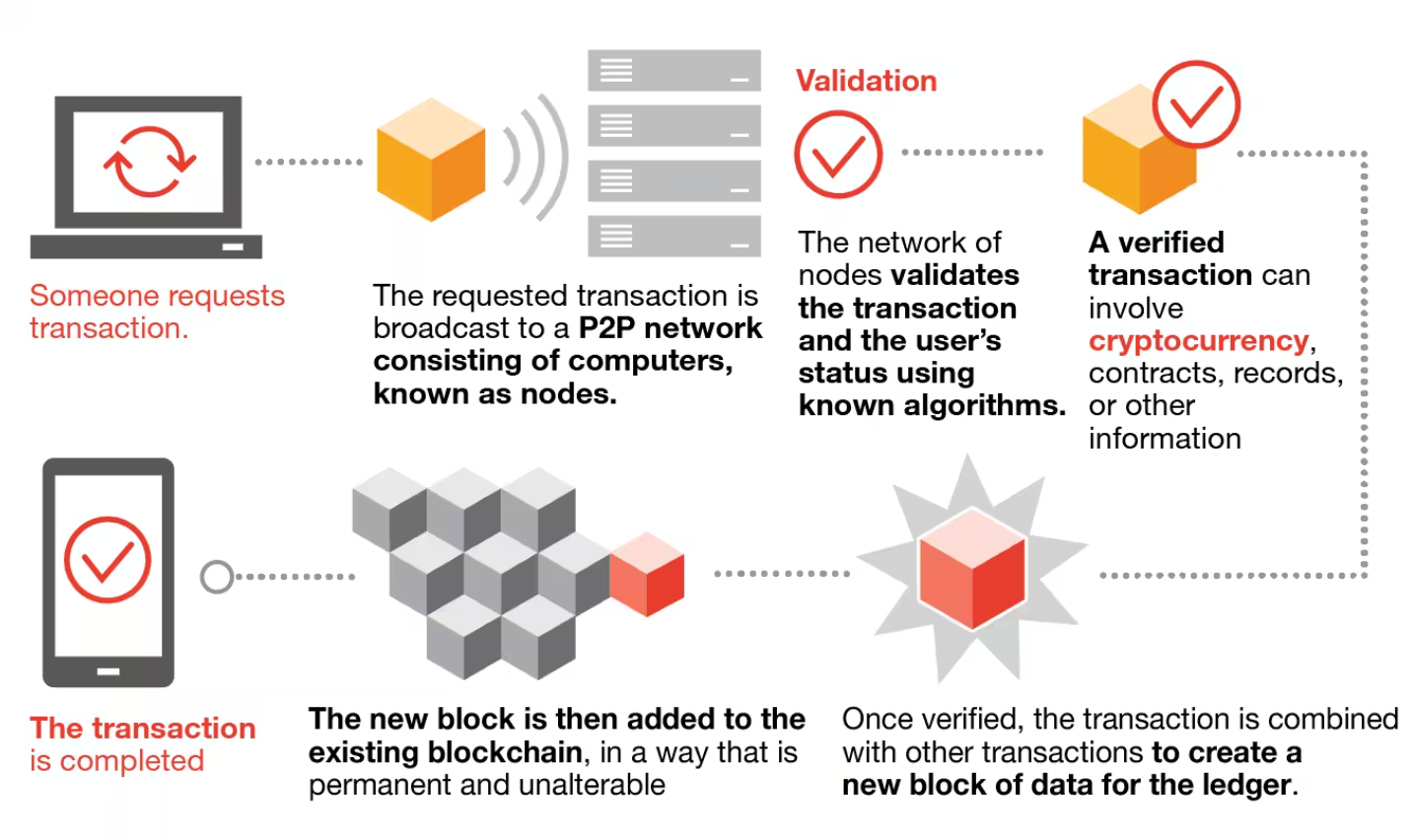

Cryptocurrencies are digital assets that are built on blockchain technology. Blockchain is a decentralized and distributed ledger that records transactions in a secure and transparent way. Bitcoin was the first cryptocurrency to be introduced in 2009, and since then, thousands of other cryptocurrencies have been created.

The crypto market is highly volatile due to its speculative nature and lack of regulation. Therefore, it’s important to have investment strategies in place before trading. Technical analysis can help identify trends in the market and determine when to buy or sell.

Trading platforms provide users with access to different cryptocurrencies and allow them to trade with ease. Decentralized finance (DeFi) is an emerging trend within the crypto industry that aims to create financial applications using blockchain technology without relying on traditional financial institutions.

As the crypto market continues to evolve, staying informed about new developments and regulations will be crucial for successful trading.

Types of Crypto Trading

Differentiating between the various types of trades is crucial for successful cryptocurrency investments. You need to know which type of trading suits your investment goals and risk tolerance.

There are several types of trading options available, including day trading, swing trading, algorithmic trading, margin trading, options trading, futures trading, high frequency trading, position trading, scalping, and arbitrage trading.

- Day traders buy and sell cryptocurrencies within a single day to take advantage of market fluctuations in short periods.

- Swing traders hold their positions for longer periods than day traders but less than trend traders or position traders.

- Algorithmic traders use pre-set instructions to automatically execute trades based on technical analysis signals or market conditions.

- Margin traders borrow money from exchanges or brokerages to increase their buying power and profit potential.

- Options and futures are derivatives that give investors the right to buy or sell an asset at a predetermined price in the future.

- High-frequency traders execute large volumes of trades at rapid speeds using advanced computer algorithms.

- Position traders hold onto their assets for extended periods with the hope that they will appreciate over time while scalpers aim to make small profits through frequent trades during volatile markets.

Finally, arbitrageurs take advantage of price discrepancies across different exchanges by buying low on one exchange and selling high on another simultaneously.

Opening an Account

Before diving into the exciting world of buying and selling digital assets, it’s essential to set up an account with a reputable exchange that fits your needs.

Start by researching different exchanges and their features, such as identity verification requirements, deposit options, account security measures, trading fees, platform interface, customer support availability, trading limits, withdrawal methods offered, and account verification process. Consider these features carefully when selecting an exchange to open an account with.

When setting up your account on the chosen exchange platform, make sure to follow all instructions carefully for identity verification. This may include submitting personal information such as your name, address, date of birth, government-issued identification documents like a passport or driver’s license.

Once verified and approved by the exchange platform provider, you can start funding your new trading account with deposit options such as bank transfers or credit card payments that are accepted by that specific exchange platform provider.

Remember to always keep in mind that security is paramount while trading cryptocurrencies; therefore, it’s important to choose a reliable trading platform provider who offers robust security features like two-factor authentication (2FA), cold storage for funds not in use on the site, and other industry-standard practices that will ensure you have peace of mind while investing in this fast-growing sector.

Credits: antiersolutions.com

Cryptocurrency Wallets

Now that you’ve set up your account, it’s time to learn about cryptocurrency wallets and how they can keep your digital assets secure. There are various types of wallets available for storing cryptocurrencies, each with its own advantages and disadvantages. Here’s a list of the most popular types of wallets:

- Hardware wallets: These are physical devices designed to store your private keys offline. They offer high security and protection against hacking attempts.

- Hot wallets: These are online wallets that can be accessed from any device connected to the internet. They offer convenience but come with a higher risk of being hacked.

- Cold storage: This refers to storing your private keys offline in some form, such as on a USB drive or even written down on paper. It offers maximum security but is less convenient when it comes to accessing your funds.

- Multi-signature wallets: These require multiple signatures (or approvals) before any transaction can take place, making them more secure than single-signature wallets.

When choosing a wallet, it’s important to consider the balance between security and convenience that suits your needs best. Be sure to research each type and the specific wallet options available within each category before making a decision on which one’s right for you.

Best Crypto Brokerages

If you’re looking for the best way to invest in digital assets, you’ll want to check out some of the top crypto brokerages available to you. These brokerages offer a variety of features and tools that can help you trade cryptocurrencies more effectively. Some of the key factors to consider when choosing a brokerage include customer support, trading fees, deposit and withdrawal options, trading platforms, security measures, regulatory compliance, cryptocurrency offerings and user experience.

To help you make an informed decision about which brokerage is right for you, we’ve created a table outlining some of the top options on the market today:

| Brokerage | Features | Customer Support | Trading Fees |

|---|---|---|---|

| Coinbase | Beginner-friendly platform with mobile app | 24/7 phone and email support | Up to 1.49% per transaction |

| Binance | Advanced trading tools and API access | Email support only | As low as 0.1% per transaction |

| Kraken | Strong reputation for security | Live chat and phone support | As low as 0% maker fee |

In addition to these factors, it’s important to consider what type of trader you are and what specific needs or preferences you have. With so many options available on the market today, there’s sure to be a brokerage that meets your unique requirements for cryptocurrency trading.

Risk Management Strategies

To effectively manage risks when investing in digital assets, it’s crucial to have a solid understanding of market trends and utilize proven strategies.

One such strategy is position sizing, which involves determining the appropriate amount of capital to allocate to each trade based on the overall portfolio size and risk tolerance.

- Stop loss orders can also be used to limit potential losses by automatically selling a position at a predetermined price level.

- Hedging techniques can also help mitigate risk by using derivatives or other financial instruments to offset potential losses.

- Diversification strategies involve spreading investments across multiple assets or markets, reducing the impact of any single asset’s volatility on the overall portfolio.

- Managing leverage is another important consideration, as high levels of leverage increase both potential profits and losses.

- Effective risk management also requires careful attention to risk-to-reward ratios, contingency planning for unexpected events, and maintaining trading discipline even during periods of market volatility.

By regularly assessing risks and implementing these strategies, cryptocurrency traders can better protect their investments while still participating in this dynamic and rapidly evolving market.

Market Analysis Techniques

You might be thinking that analyzing the market is too complicated, but using simple techniques like charting and trend analysis can help you make more informed investment decisions.

Here are some key techniques to consider:

- Technical indicators: These are mathematical calculations based on price and/or volume data that can help identify potential buying or selling opportunities.

- Candlestick patterns: These visual representations of price movements can provide insights into market sentiment and potential trend reversals.

- Price action analysis: This involves studying historical price movements to identify patterns that may indicate future price movements.

Other techniques include trend following, Elliott wave theory, Fibonacci retracements, support and resistance levels, volume analysis, sentiment analysis, and algorithmic trading strategies.

By mastering these tools and understanding how they interact with each other, you’ll be well-equipped to navigate the complex world of cryptocurrency trading in 2023.

Fundamental Analysis Factors

Get ready to dive deeper into the world of crypto investing as we explore fundamental analysis factors that can impact your investment decisions.

To make informed trading decisions, it’s important to stay up-to-date with macroeconomic analysis, industry news, and market trends. Technical analysis and news sentiment are also crucial to understand market movements.

Regulation impact and exchange listings are other important factors that can affect the value of cryptocurrencies in which you invest. It’s vital to use trading tools that allow you to track these developments quickly and efficiently.

Additionally, keeping an eye on fundamental data can provide valuable insights into a cryptocurrency’s long-term viability. However, it’s important to be aware of the potential for market manipulation in the volatile world of cryptocurrencies.

By staying informed about both positive and negative events affecting your investments, you can make more educated choices about when to buy or sell. As you continue your journey in cryptocurrency trading, remember that understanding fundamental analysis factors is critical for making sound investment decisions in 2023 and beyond.

Trading Psychology

Imagine feeling confident and in control as you make trading decisions, trusting your instincts and sticking to a solid strategy that aligns with your goals. This is the kind of mindset that successful traders possess and it can be achieved through emotional discipline, mental resilience, and self-awareness.

To avoid falling prey to cognitive biases such as fear and greed, it is important to cultivate a trading mindset that prioritizes patience and perseverance over impulsive decision making. Consistency and routine are also key factors in maintaining this mindset, which can be supported by regularly journaling your trades to reflect on successes and areas for improvement. By developing these traits, you’ll be better equipped to handle the ups and downs of cryptocurrency trading with a level head.

| KEYWORD | DEFINITION | EXAMPLE |

|---|---|---|

| Emotional discipline | The ability to regulate one’s emotions during trading activities | Staying calm during market downturns |

| Mental resilience | The capacity to bounce back from losses or setbacks without giving up on long-term goals | Continuing to trade after a significant loss |

| Cognitive biases | Systematic errors in decision-making due to personal preferences or beliefs rather than objective analysis of data | Believing that a cryptocurrency will perform well because you like its name |

CFD Trading vs. Exchange Trading

Now that you understand the importance of trading psychology, it’s time to dive deeper into the different types of cryptocurrency trading available.

CFD trading and exchange trading are two popular options in the crypto world, each with its own advantages and disadvantages. CFD (Contract for Difference) trading allows traders to speculate on the price movements of cryptocurrencies without actually owning them. This type of trading offers several advantages such as lower trading fees, higher leverage ratios, and more flexible order execution. However, CFDs are often used for short term trading due to their high-risk nature and lack of ownership rights.

On the other hand, exchange trading involves buying and selling actual cryptocurrencies on a platform. This type of trading is better suited for long term holdings as it provides ownership rights and access to wider liquidity pools. However, exchange trading can come with higher fees and less flexibility in terms of margin trading compared to CFDs.

To help you better understand which option is best for your specific needs, here are some key differences between CFD and exchange trading:

- Trading volumes: Exchange platforms typically have higher volumes than CFD brokers which means there may be more liquidity available when placing orders.

- Margin requirements: CFD brokers offer higher leverage ratios than exchanges but this also comes with greater risk.

- Order execution: CFDs can offer more flexible order execution options including stop-loss orders while exchanges usually only offer limit orders.

Keep these factors in mind when deciding which form of cryptocurrency trading will work best for you in 2023!

Frequently Asked Questions

What is the future of cryptocurrencies in 2023?

In 2023, cryptocurrencies will continue to be influenced by adoption trends, the regulatory environment, and market volatility. Emerging technologies and institutional investment will drive growth in decentralized finance, while global economic impact and blockchain integration will play a role in cryptocurrency mining and user privacy.

Can I use my credit card to purchase cryptocurrencies?

Like a ship navigating through treacherous waters, buying cryptocurrencies with your credit card has limitations. Crypto exchanges charge transaction fees and require card verification, fiat currency conversion, investment limits, payment gateways, and user protection to prevent fraud and purchase restrictions.

What are the tax implications of cryptocurrency trading?

Trading cryptocurrencies can have tax implications. Crypto tax regulations require capital gains to be reported as taxable events. Tax reporting requirements vary by country and may include crypto to crypto trades, tax deductions, and loss harvesting. IRS guidance and tax software solutions can assist with compliance, while international tax implications should also be considered.

How can I ensure the security of my cryptocurrency investments?

To ensure the security of your cryptocurrency investments, use hardware wallets for cold storage, enable multi-factor authentication, and utilize smart contracts. Consider decentralized exchanges and peer-to-peer trading while managing risks and complying with regulations. Additionally, consider privacy coins and token offerings.

What are some common mistakes to avoid when trading cryptocurrencies?

To avoid common mistakes when trading cryptocurrencies, consider risk management and exit strategy. Technical and fundamental analysis are key to developing a successful trading strategy. Beware of liquidity issues, market volatility, and manipulation on trading platforms. Stay aware of your own trading psychology.