In the dynamic world of financial markets, understanding the forces that drive market movement is crucial for traders seeking to navigate the complexities of buying and selling. Auction Market Theory (AMT) provides a comprehensive framework for analyzing market dynamics and identifying opportunities for profit. This article aims to unlock the secrets of Auction Market Theory, shedding light on its key principles and trading strategies.

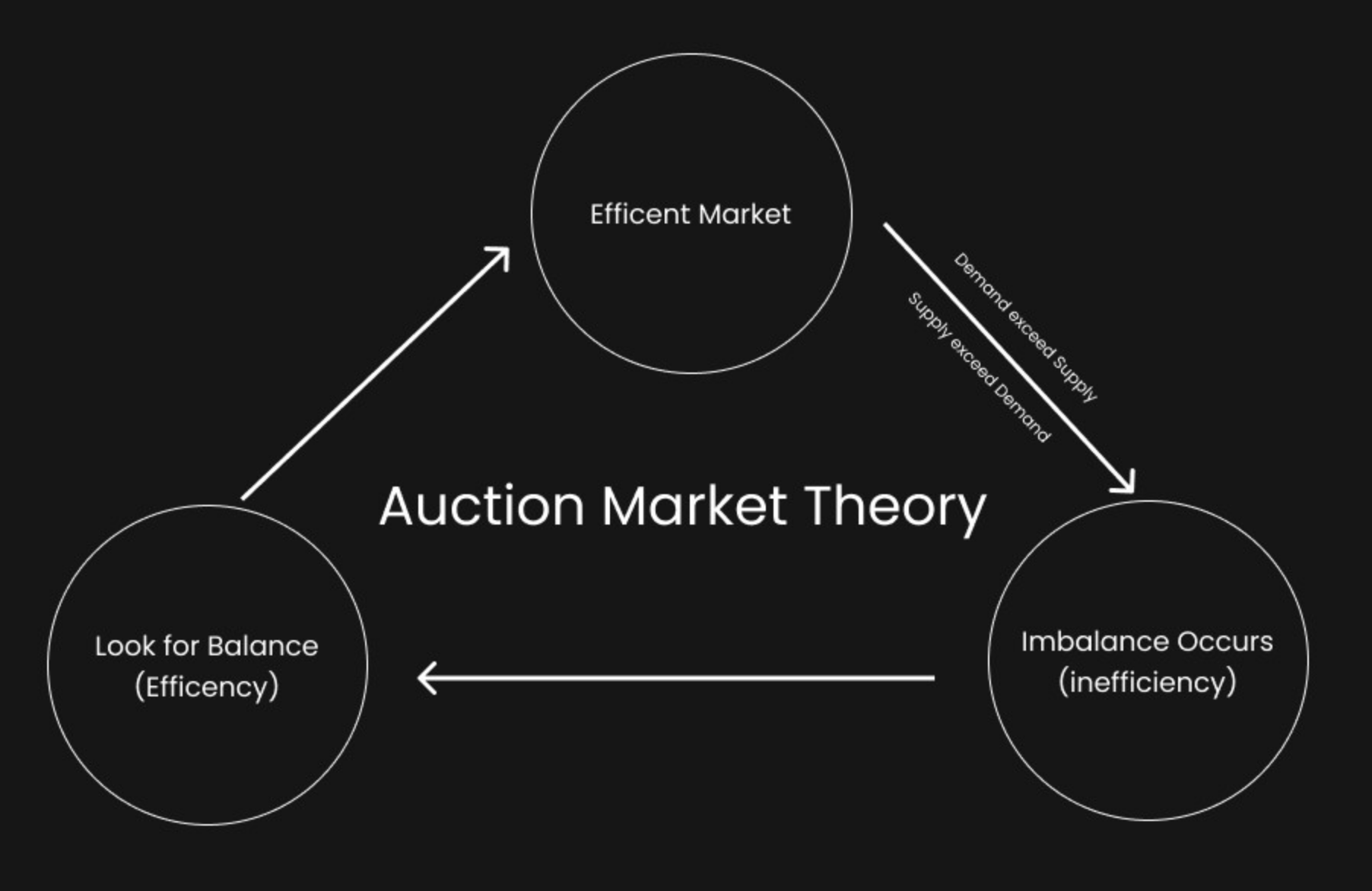

Auction Market Theory is based on the concept of buyer and seller aggression, analyzing the imbalances between these two forces to determine market conditions. By recognizing whether a market is balanced or imbalanced, traders can make informed decisions about when to fade moves away from Fair Value or trade in the direction of the imbalance. Through the constant rotation between balanced and imbalanced states, markets undergo a process of discovery.

By understanding Auction Market Theory, traders can effectively organize their ideas, recognize patterns, and extract essential data from market events. Rather than trying to predict the market, AMT enables traders to react to market information, making informed decisions based on objective analysis. Moreover, knowledge of volume profiles enhances the practicality and logic of Auction Market Theory, providing valuable insights into market movements.

In the following sections of this article, we will delve into the key principles of AMT and explore various trading strategies that can be applied to capitalize on market imbalances. By unraveling the intricacies of Auction Market Theory, traders can unlock a deeper understanding of market movement and position themselves for success in the ever-evolving financial landscape.

Key Takeaways

- Auction Market Theory (AMT) is a philosophy that explains how financial markets move higher and lower due to imbalances between buyer and seller aggression.

- AMT traders aim to determine if the market is balanced or imbalanced and apply the appropriate trading strategy accordingly.

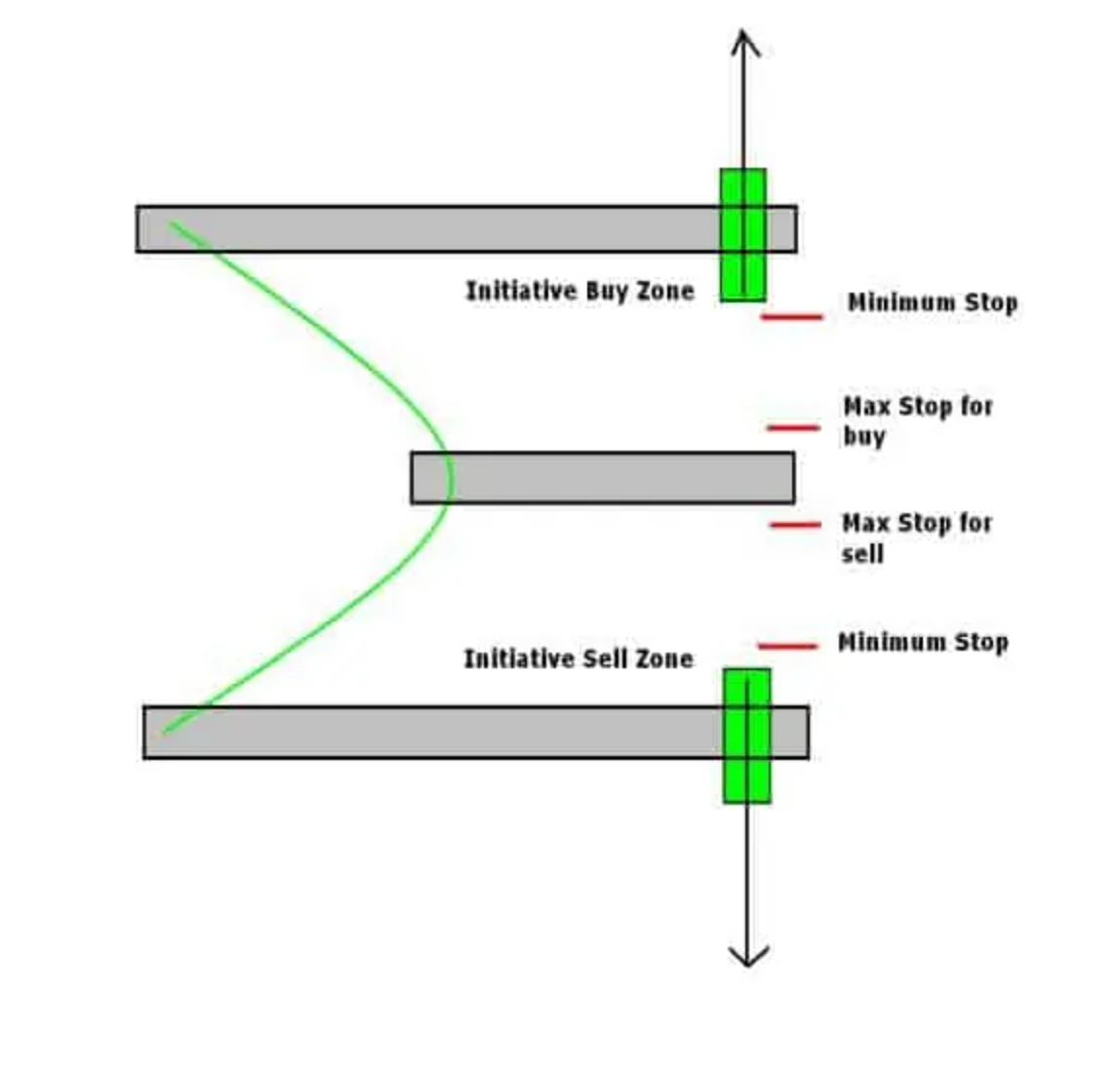

- In balanced markets, AMT traders look to fade moves away from Fair Value, while in imbalanced markets, they trade in the direction of the imbalance.

- Understanding AMT enhances the capacity to organize ideas, recognize patterns, and extract essential data in order to make informed trading decisions.

What is Auction Market Theory?

Auction Market Theory (AMT) is a philosophical approach to market analysis that recognizes the influence of buyer and seller aggression in moving financial markets higher or lower. It aims to remove noise and doubts in market analysis by focusing on imbalances between buyer and seller aggression.

AMT traders determine if the market is balanced or imbalanced by analyzing factors such as speed of tape, volume, delta, and bid versus offer liquidity. In balanced markets, AMT traders look to fade moves away from Fair Value, while in imbalanced markets, they trade in the direction of the imbalance.

Understanding AMT enhances the capacity to organize ideas, recognize patterns, and extract essential data. The applications of AMT include developing trading strategies based on market imbalances, while the benefits include improved decision-making and avoiding the need to predict the market.

Key Principles of Auction Market Theory

Imbalances between buyer and seller aggression play a pivotal role in determining market movement according to Auction Market Theory (AMT). AMT emphasizes the significance of order flow in understanding market dynamics. Analyzing buyer and seller aggression is essential in AMT to identify imbalances that drive market direction.

Several key principles guide this analysis:

- Speed of tape: The pace at which trades occur can indicate the level of aggression from buyers or sellers.

- Volume: The quantity of shares traded provides insights into the strength of buyer or seller interest.

- Delta: The difference between buyers’ and sellers’ willingness to transact can reveal the dominant force in the market.

- Bid versus offer liquidity: Examining the depth of the order book helps gauge buyer and seller aggression.

By considering these factors, AMT traders can determine if the market is balanced or imbalanced, allowing them to apply appropriate trading strategies. Understanding the role of order flow and analyzing buyer and seller aggression are key components of AMT’s approach to market movement.

Credits: tradingriot.com

Auction Market Theory: Trading Strategies

Traders utilizing Auction Market Theory (AMT) can employ various strategies based on the analysis of order flow indicators such as speed of tape, volume, delta, and bid versus offer liquidity, contributing to a more informed approach to market participation.

One interesting statistic to consider is that high trading volume often indicates increased market activity and potential price volatility.

When it comes to trading strategies within AMT, two common approaches are trend following and mean reversion.

Trend following strategies involve identifying and following the direction of the market trend, aiming to profit from continued price movements in that direction.

On the other hand, mean reversion strategies involve identifying periods of overextension or deviation from the mean, and trading in the opposite direction with the expectation that prices will revert back to their average levels.

These strategies can be implemented using AMT principles to enhance decision-making and increase the effectiveness of trading strategies.

Frequently Asked Questions

How can Auction Market Theory be applied to different financial markets, such as stocks, commodities, or currencies?

Applying AMT to different financial markets involves analyzing buyer and seller aggression through factors such as speed of tape, volume, delta, and bid versus offer liquidity. Understanding the impact of AMT helps traders determine if a market is balanced or imbalanced and apply appropriate trading strategies.

What are some common indicators or tools that traders use to analyze buyer and seller aggression in Auction Market Theory?

Market sentiment analysis and interpreting order flow are key to understanding buyer and seller aggression in Auction Market Theory (AMT). Common indicators and tools used by traders include speed of tape, volume, delta, and bid versus offer liquidity.

Can Auction Market Theory be used to predict short-term market movements or is it more focused on identifying long-term trends?

Auction Market Theory (AMT) is primarily focused on identifying long-term trends rather than predicting short-term market movements. Limitations of using AMT for short-term predictions include the role of psychological factors in market analysis and the difficulty in accurately assessing buyer and seller aggression in real-time.

Are there any specific risk management techniques or guidelines that Auction Market Theory traders follow to protect their capital?

AMT traders employ various risk management techniques and guidelines to safeguard their capital. These may include setting stop-loss orders, using proper position sizing, diversifying their portfolios, implementing hedging strategies, and conducting thorough risk assessments before entering trades.

How does AMT account for external factors or news events that can significantly impact market movement?

The impact of news events on market movement and incorporating external factors in Auction Market Theory is significant. AMT recognizes that market imbalances can be caused by external events and traders analyze various factors such as speed of tape, volume, and bid versus offer liquidity to determine buyer and seller aggression. By understanding these factors, traders can adjust their trading strategies accordingly.