In the world of decentralized finance (DeFi), Alpha Finance Lab stands out as a shining star, offering innovative solutions to meet the unmet needs of users. Like a well-oiled machine, Alpha Finance Lab operates with precision and efficiency, maximizing returns and minimizing risks for its users. This article serves as a comprehensive review of Alpha Finance Lab, delving into the inner workings of its native token, ALPHA, and exploring its suite of products and features.

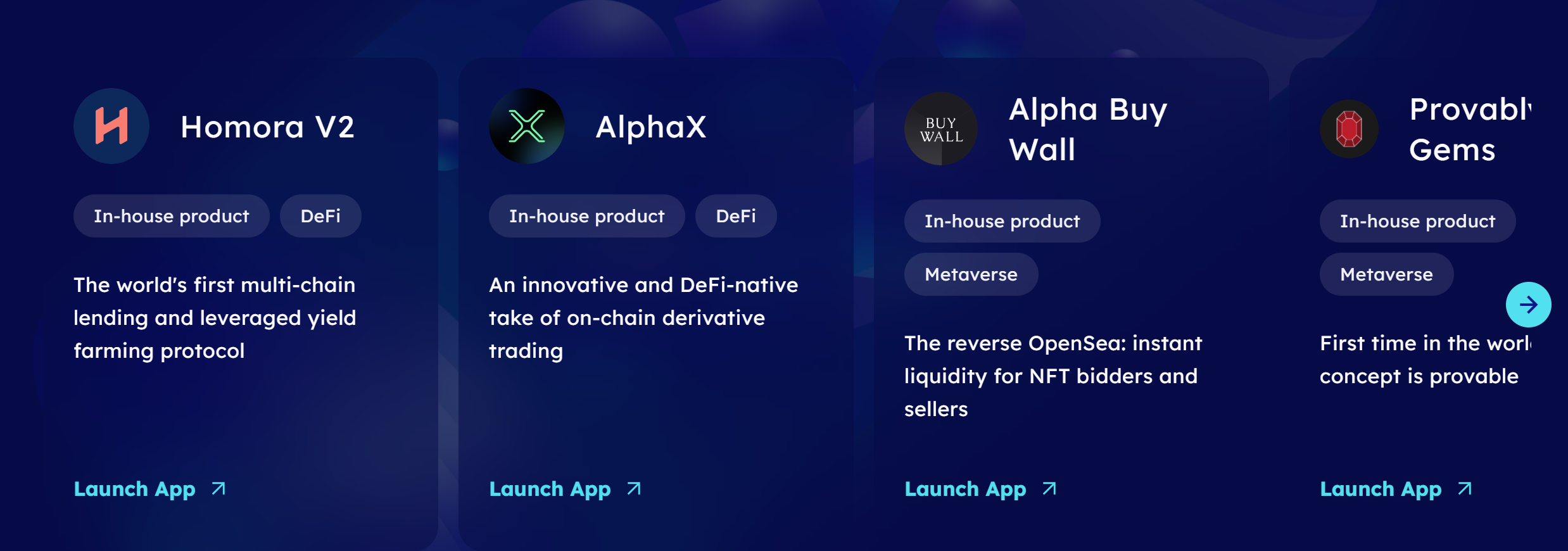

From Alpha Lending, a decentralized lending platform with algorithmically adjusted interest rates, to Alpha Homora, a platform for leveraged yield farming, Alpha Finance Lab offers a range of tools for users to optimize their DeFi strategies. Additionally, the upcoming launch of AlphaX promises to further enhance the platform, allowing users to leverage their positions in yield farming.

With a focus on user-friendly experiences and seamless integration, Alpha Finance Lab offers a synergy within its ecosystem, enabling users to participate as yield farmers, liquidators, or ETH lenders. This article will also delve into the ways in which users can store and obtain ALPHA, as well as its utility in governance and liquidity mining. Join us as we dive deep into the world of Alpha Finance Lab, unlocking the secrets of ALPHA and understanding how it all works.

Key Takeaways

- Alpha Finance Lab offers two main products: Alpha Lending and Alpha Homora.

- Alpha Lending is a decentralized lending platform with algorithmically adjusted interest rates.

- Alpha Homora is a platform for leveraged yield farming.

- Alpha Finance Lab plans to launch its third product, AlphaX, soon.

What is ALPHA?

ALPHA is the native token of Alpha Finance Lab, a cross-chain Defi product that offers Alpha Lending and Alpha Homora, with plans to launch AlphaX in the near future. The purpose of ALPHA is to provide users with maximum returns and reduced risk in the decentralized finance space. Alpha Finance Lab aims to address unmet needs in the DeFi space and create user-friendly products.

ALPHA token holders can receive a share of transaction fees and use it for governance voting or liquidity mining. With a maximum token supply of 1 billion and a current circulating supply of 250,153,035, ALPHA can be obtained by buying them from supported exchanges or by staking assets on the protocol’s website. Overall, ALPHA plays a vital role in the growth and development of the Alpha Finance Lab ecosystem.

Alpha Finance Lab: Products and Features

The ecosystem developed by Alpha Finance Lab offers a range of innovative and user-friendly financial products, including a decentralized lending platform called Alpha Lending and a leveraged yield farming platform known as Alpha Homora. These products are built on the Binance Smart Chain and aim to provide users with maximum returns and reduced risk.

Alpha Lending allows users to lend or borrow funds using supported assets as collateral, while Alpha Homora enables users to take leverage on yield farming and offers better rewards for yield farmers. Additionally, Alpha Finance Lab plans to launch AlphaX, a non-custodial decentralized exchange, in the near future. The combination of Alpha Homora and AlphaX maximizes income and minimizes transaction risks. These products offer numerous benefits to users, such as high profits for ETH lenders, higher trading fees and farming APY for yield farmers, and the ability to use ALPHA tokens for governance voting and accessing other product functionalities.

ALPHA: Token Utility and Governance

Token utility and governance within the Alpha Finance Lab ecosystem are essential components that contribute to the overall functionality and growth of the protocol. The ALPHA token serves multiple use cases within the Alpha Finance Lab ecosystem, making it a valuable asset for token holders.

ALPHA token holders can benefit from various advantages. Firstly, they have the opportunity to receive a share of transaction fees generated within the protocol. This provides a passive income stream for token holders. Additionally, ALPHA tokens can be used for governance voting, allowing token holders to participate in the decision-making process of the protocol.

This ensures that the community has a voice in shaping the future direction of Alpha Finance Lab. Furthermore, token holders can also participate in liquidity mining, where they can earn additional ALPHA tokens by providing liquidity to the protocol. These benefits incentivize token holders to actively engage with the Alpha Finance Lab ecosystem and contribute to its growth and development.

The table below summarizes the key use cases and benefits of the ALPHA token:

| Use Cases | Benefits for ALPHA Token Holders |

|---|---|

| Share of Transaction Fees | Passive income stream for token holders |

| Governance Voting | Participate in decision-making process of the protocol |

| Liquidity Mining | Earn additional ALPHA tokens |

The ALPHA token plays a crucial role in the Alpha Finance Lab ecosystem by providing utility and governance opportunities for token holders. These benefits incentivize active participation and contribute to the overall growth and development of the protocol.

Alpha Finance Lab: Founder and Funding

Tascha Punyaneramitdee, the founder of Alpha Finance Lab, successfully raised funds from Spartan Group, MultiCoin Capital, and Defiance Capital to support the development and growth of the protocol. These funding sources have played a vital role in the establishment of Alpha Finance Lab as a prominent player in the decentralized finance (Defi) space.

The support from Spartan Group, MultiCoin Capital, and Defiance Capital has provided the necessary financial backing for the implementation of innovative products such as Alpha Lending, Alpha Homora, and the upcoming AlphaX. This funding has enabled the protocol to attract users and investors, driving the growth and adoption of Alpha Finance Lab within the Defi ecosystem. Tascha Punyaneramitdee’s ability to secure funding from reputable sources demonstrates the confidence in the project’s vision and potential for success.

ALPHA: Lending and Borrowing

Alpha Finance Lab’s lending and borrowing platform offers users the opportunity to engage in decentralized lending and borrowing activities using supported assets as collateral. The platform consists of two main products: Alpha Lending and Alpha Homora. Alpha Lending is a decentralized lending platform that allows users to lend or borrow funds using supported assets as collateral.

The interest rates on Alpha Lending are algorithmically adjusted to ensure optimal returns for users. On the other hand, Alpha Homora is a platform for leveraged yield farming, where users can take leverage on yield farming and earn better rewards. By leveraging their positions, users can receive higher trading fees and farming APY. The combination of Alpha Lending and Alpha Homora maximizes income and minimizes transaction risks, providing users with a comprehensive lending and borrowing experience.

| Alpha Lending | Alpha Homora |

|---|---|

| Decentralized lending platform | Platform for leveraged yield farming |

| Algorithmically adjusted interest rates | Offers better rewards for yield farmers |

| Users can lend or borrow funds using supported assets as collateral | Users can take leverage on yield farming |

| Provides optimal returns for users | Users receive higher trading fees and farming APY |

| Minimizes transaction risks | Maximizes income for users |

Leveraged Yield Farming

Leveraged yield farming allows users to increase their potential returns by borrowing funds to take leveraged positions in yield farming activities. This strategy offers several advantages and disadvantages for users to consider:

- Increased Returns: Leveraging allows users to amplify their profits by multiplying their exposure to yield farming rewards. This can result in higher returns compared to traditional yield farming.

- Risk Management: Leveraged yield farming carries significant risks, including the potential for liquidation if the borrowed funds’ value exceeds the collateral. Users must carefully manage their risk tolerance and monitor their positions to avoid substantial losses.

- Higher Volatility: Leveraged positions are more susceptible to market volatility, which can lead to significant gains or losses. Users must be prepared for price fluctuations and have strategies in place to mitigate risks.

- Increased Costs: Leveraging typically involves borrowing funds, which incurs interest expenses. Users need to consider the cost of borrowing and ensure that potential gains outweigh these expenses.

Overall, leveraged yield farming offers the potential for increased profits but comes with higher risks and costs. Users must carefully assess their risk appetite and employ risk management strategies to make informed decisions.

AlphaX and Non-Custodial Trading

The introduction of AlphaX into the Alpha Finance Lab ecosystem brings forth a new era of non-custodial trading, offering users the ability to leverage their positions in yield farming while maintaining control of their assets. AlphaX provides several advantages and benefits to users.

Firstly, AlphaX is a non-custodial platform, meaning users have full control over their funds and do not need to trust a centralized authority with their assets. This enhances security and reduces the risk of hacks or theft.

Secondly, AlphaX utilizes prices and funding rates for swapping, ensuring fair and accurate trading. This data-driven approach enhances transparency and reduces the potential for manipulation.

Lastly, AlphaX allows users to leverage their positions in yield farming, maximizing their potential returns. By borrowing liquidity, users can amplify their trading fees and farming APY, increasing their profits.

Overall, AlphaX brings significant advantages to users, combining non-custodial trading, accurate pricing, and leveraged yield farming to maximize income and minimize risk.

| Advantages of AlphaX | Non-Custodial Trading Benefits |

|---|---|

| Enhanced security | Full control over assets |

| Transparent trading | Fair and accurate prices |

| Amplified returns | Maximizing potential profits |

Storing and Obtaining ALPHA

Storing and obtaining the ALPHA token can be facilitated through various methods and platforms. For secure storage, it is recommended to use hardware wallets like Ledger Nano X or Ledger Nano S. These wallets provide an extra layer of protection against potential hacks or thefts. Alternatively, ALPHA tokens can be stored in supported exchanges that offer wallet services, such as Binance or Gate.io.

To obtain ALPHA tokens, users can purchase them from exchanges that support the token. Binance and Gate.io are popular exchanges where users can buy ALPHA tokens. Additionally, ALPHA tokens can be obtained by staking assets on the Alpha Finance Lab protocol’s website. By staking assets, users can earn ALPHA tokens as rewards.

Overall, storing and obtaining ALPHA tokens can be done through trusted wallets or exchanges, ensuring the security and accessibility of the tokens.

Frequently Asked Questions

How does Alpha Finance Lab generate revenue?

Alpha Finance Lab generates revenue through various sources. One of the primary revenue sources is transaction fees, in which ALPHA token holders receive a share. Additionally, the platform offers liquidity mining, where users can stake their assets and earn ALPHA tokens as rewards.

ALPHA token holders can also participate in governance voting, which enhances the platform’s decentralization. Furthermore, Alpha Finance Lab may explore partnerships, collaborations, or additional product offerings to generate revenue and sustain the growth of its ecosystem.

What are the benefits of being an ALPHA token holder?

The benefits of being an ALPHA token holder include participation in the ALPHA token rewards program and access to governance voting and liquidity mining. As part of the rewards program, token holders can receive a share of transaction fees generated by the Alpha Finance Lab ecosystem.

This allows them to earn passive income. Additionally, ALPHA tokens can be used for voting on governance proposals and participating in the decision-making process of the protocol. Holding ALPHA tokens also grants users access to liquidity mining opportunities, further enhancing their potential returns.

How does Alpha Homora determine the interest rates for lending and borrowing?

Determining interest rates in Alpha Homora involves a comprehensive risk assessment process. The platform considers various factors, such as market conditions, asset liquidity, and borrower demand. By analyzing these factors, Alpha Homora aims to strike a balance between attracting lenders and borrowers while managing risk effectively.

The algorithmically adjusted interest rates ensure that lenders are incentivized to provide liquidity, while borrowers can access funds at competitive rates. This approach promotes efficient capital allocation and maximizes returns for users within the Alpha Finance Lab ecosystem.

Can users participate in Alpha Homora without borrowing leverage?

Users can participate in Alpha Homora without borrowing leverage by engaging in alternative ways to earn rewards. In addition to yield farming with leverage, users can also participate as yield farmers, liquidators, or ETH lenders. ETH lenders can earn high profits by lending their ETH to liquidity providers or yield farmers and receive ibETH as interest.

This allows users to earn rewards without taking on the risk and complexity of leverage. These alternative methods provide users with flexibility and options to maximize their earnings within the Alpha Homora ecosystem.

What are the advantages of using a hardware wallet to store ALPHA tokens?

Using a hardware wallet to store alpha tokens provides several advantages. Firstly, hardware wallets offer enhanced security by keeping the private keys offline, reducing the risk of hacking or theft. Additionally, hardware wallets use advanced encryption techniques to protect the tokens from unauthorized access.

Furthermore, these wallets provide a user-friendly interface for managing and accessing the tokens. Overall, using a hardware wallet ensures the secure storage of alpha tokens, safeguarding them from potential vulnerabilities in the digital environment.