In the fast-paced world of cryptocurrency, AgoraDesk has emerged as a reliable and user-friendly peer-to-peer exchange platform. With over 60 payment methods and support for multiple languages, AgoraDesk offers accessibility to a wide range of users. One of its standout features is its emphasis on user privacy, as it does not require KYC/AML verification. Additionally, the platform provides arbitration protection and an escrow service to ensure secure transactions. AgoraDesk’s affiliate program allows users to earn commissions on referrals, adding to its appeal.

Supported coins include popular options such as Bitcoin, Monero, Litecoin, Ethereum, Dash, and Bitcoin Cash. However, it is important for potential users to exercise caution due to the lack of mandatory verification and legal information. With competitive trading fees and various customer support options, AgoraDesk aims to provide a seamless experience for traders. In this article, we will delve deeper into the platform’s features, supported coins, customer support, payment methods, pros, and cons, allowing readers to make an informed decision.

Key Takeaways

- AgoraDesk is a peer-to-peer cryptocurrency exchange that supports over 60 payment methods and multiple languages.

- The platform prioritizes user privacy and security, with no KYC/AML, phone number, or blocked locations required.

- AgoraDesk offers arbitration protection and an escrow service for secure transactions.

- The lack of reviews and legal information about AgoraDesk makes it challenging to assess its reliability and safety.

AgoraDesk Exchange: Platform Overview

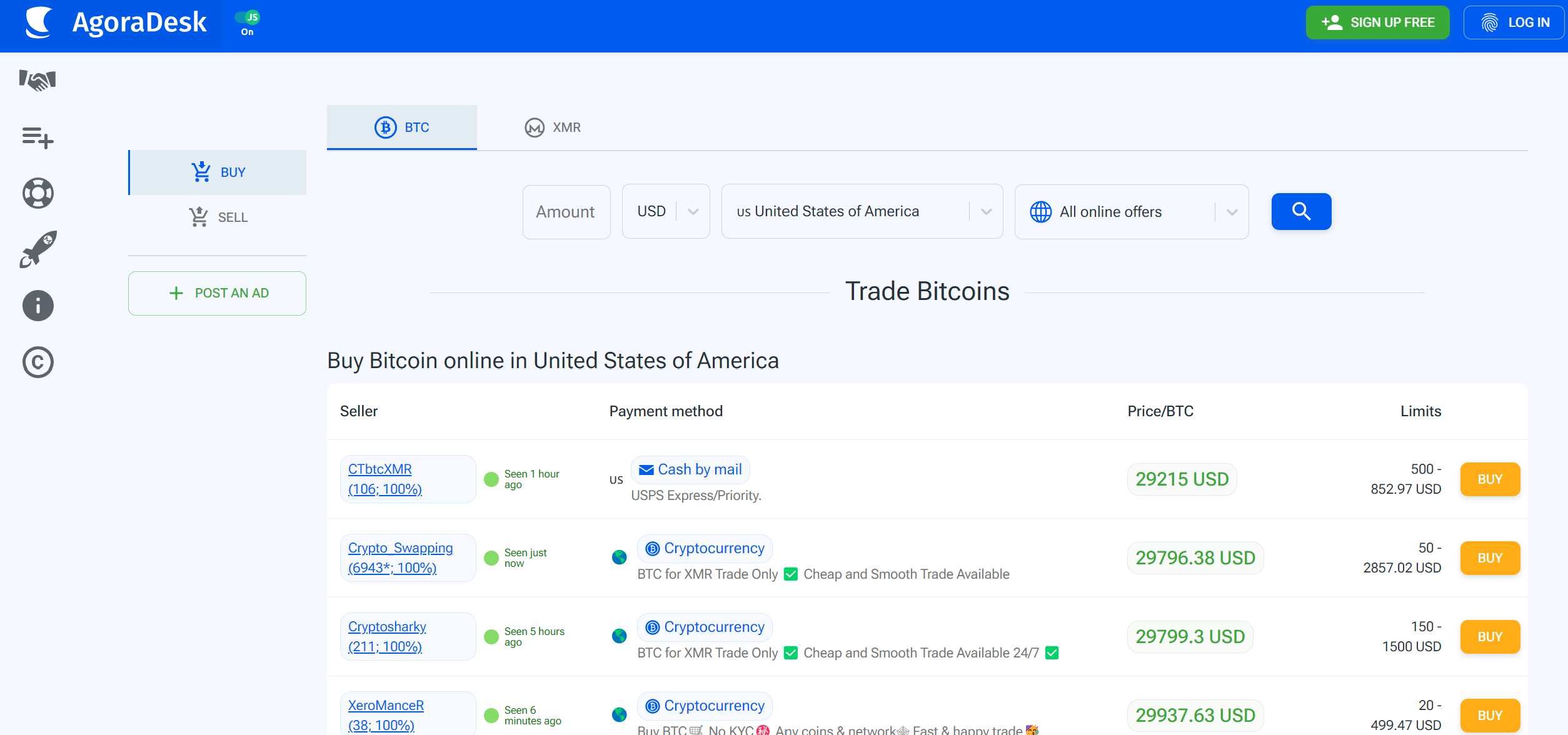

The platform overview of AgoraDesk provides a comprehensive understanding of its features, supported coins, customer support, payment methods, and pros and cons. AgoraDesk is a peer-to-peer cryptocurrency exchange that offers users a variety of features and benefits. One of the main advantages of using AgoraDesk is its support for over 60 payment methods, making it accessible to a wide range of users.

Additionally, AgoraDesk does not require KYC/AML, ensuring user privacy. However, the platform’s reliability and safety are difficult to assess due to the lack of mandatory verification and legal information. When compared to other peer-to-peer exchanges, AgoraDesk stands out for its competitive trading fees and diverse range of supported coins. Overall, AgoraDesk offers a user-friendly platform with strong privacy features, but users should exercise caution and conduct their own research before using the platform.

AgoraDesk: Privacy and Security

Privacy and security are paramount concerns for users of AgoraDesk, as they navigate the potential risks and vulnerabilities associated with peer-to-peer cryptocurrency exchanges. AgoraDesk prioritizes user privacy by not requiring KYC/AML, phone numbers, or blocked locations. This level of anonymity appeals to users who value their privacy.

However, using a peer-to-peer exchange comes with potential risks of fraud and scams. It is important for users to exercise caution, conduct their own due diligence when selecting counterparties, and consider their individual preferences and requirements before deciding to use AgoraDesk.

Pros:

- No KYC/AML required, providing a high level of user privacy.

- Multiple security features, including 2FA, referral program, notifications, and MorphToken integration.

- Arbitration protection and escrow service for secure transactions.

Cons:

- Lack of mandatory verification and legal information makes it difficult to assess the platform’s reliability and safety.

- Limited reviews available, adding to the uncertainty surrounding AgoraDesk.

- Potential risks of fraud and scams associated with peer-to-peer exchanges.

AgoraDesk Crypto Exchange: Payment Options

Payment options on AgoraDesk include a wide range of over 60 methods, allowing users to choose the most convenient and suitable method for their cryptocurrency transactions. AgoraDesk provides multiple payment options, including credit cards and PayPal, which offer flexibility and convenience for users. However, it is important to note that wire transfer limitations may apply depending on the user’s location.

AgoraDesk’s support for various payment methods enables users from different regions to participate in cryptocurrency trading. This diverse range of options caters to the needs of both seasoned investors and beginners. Users should carefully consider the available payment methods and their associated fees before selecting the most suitable option for their transactions on AgoraDesk.

Arbitration Protection

Arbitration protection on AgoraDesk offers users a secure mechanism for resolving disputes and ensuring the completion of transactions. This feature has its pros and cons. On the positive side, arbitration protection provides a neutral third party to mediate in case of conflicts between buyers and sellers. It helps to mitigate the risk of fraud and provides a sense of security for both parties involved.

Additionally, AgoraDesk requires a deposit equal to the transaction amount from the seller, which acts as an incentive for honest behavior. However, there are some potential drawbacks to consider. The requirement of a deposit may deter some users, and the reliance on an independent arbitrator may introduce delays in resolving disputes. Overall, arbitration protection on AgoraDesk adds an extra layer of security to the platform, but users should be aware of its limitations and potential trade-offs.

Escrow Service

The escrow service on AgoraDesk acts as a secure mechanism for holding cryptocurrency until the transaction is completed, ensuring the safety of funds for both buyers and sellers. When a buyer initiates a transaction, the agreed-upon amount of cryptocurrency is held in escrow by AgoraDesk. The seller is then notified to proceed with the transaction. Once the buyer confirms the receipt of the cryptocurrency, the funds are released from escrow and transferred to the seller’s account. This process provides protection against fraudulent transactions, as the funds are held by a third-party until the transaction is successfully completed.

Table: Benefits and Drawbacks of AgoraDesk’s Escrow Service

| Benefits | Drawbacks |

|---|---|

| Secure mechanism for holding cryptocurrency | Potential delays in releasing funds |

| Protection against fraudulent transactions | Dependence on a third-party |

| Safety of funds for both buyers and sellers | Limited control over the release of funds |

| Increased trust and confidence in transactions | Additional fee for escrow service |

Overall, AgoraDesk’s escrow service offers several benefits in terms of security and protection, but it also has some drawbacks, such as potential delays and dependence on a third-party. Users should consider these factors when utilizing the escrow service and weigh them against their individual needs and preferences.

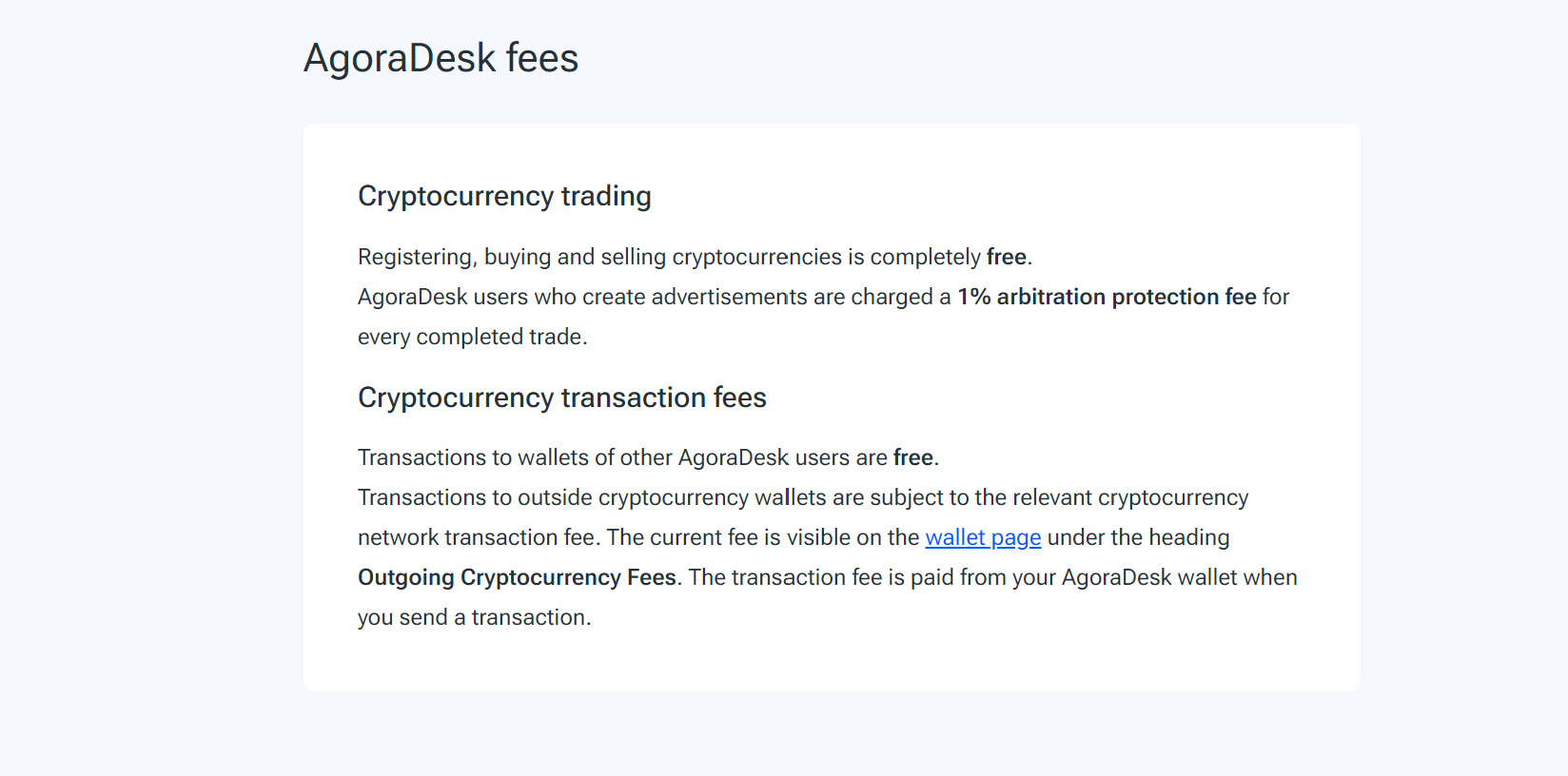

Trading Fees

Trading fees on AgoraDesk are competitive, with a maker fee of 1.00% and a taker fee of 0.00%. These fees are relatively low compared to other exchanges, making AgoraDesk an attractive option for traders. The maker fee of 1.00% is charged when a trader adds liquidity to the order book by placing a limit order that is not immediately matched with an existing order.

On the other hand, the taker fee of 0.00% is charged when a trader removes liquidity from the order book by placing an order that is immediately matched with an existing order. This fee structure benefits traders who provide liquidity to the market. However, it is important to note that the absence of a taker fee may result in higher fees for traders who primarily take liquidity from the market. Overall, AgoraDesk’s trading fees are competitive and can be advantageous for certain trading strategies.

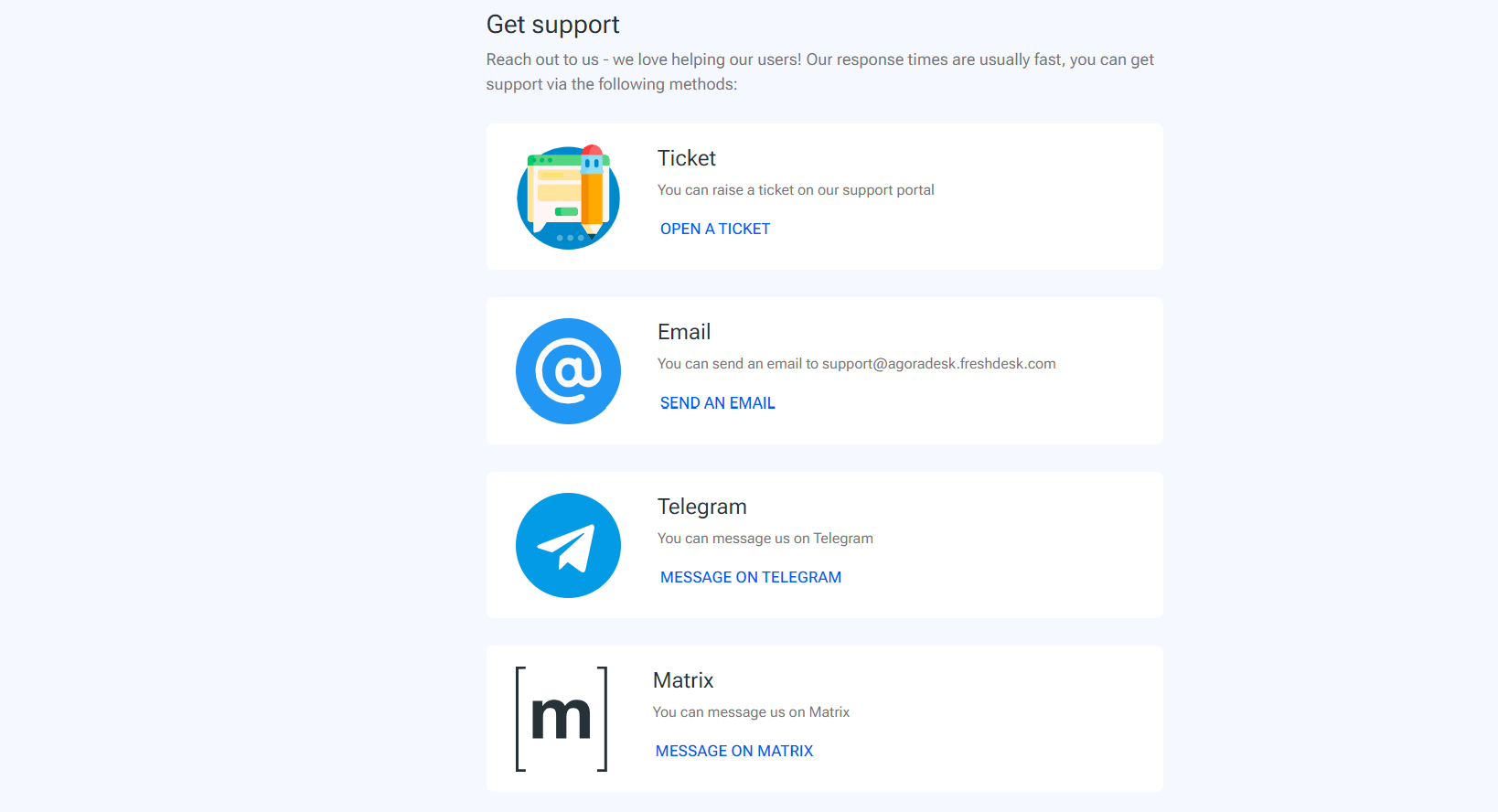

AgoraDesk: Customer Service

Customer service on AgoraDesk is available through various channels such as opening a ticket, sending an email, writing to Telegram, or contacting the company via Twitter. This ensures that users have multiple options to reach out to the support team and get their queries addressed. The customer service team aims to respond to inquiries as quickly as possible, providing a positive user experience.

- Opening a ticket: Users can submit a support ticket directly on the AgoraDesk platform, allowing them to communicate their concerns or issues.

- Sending an email: Users can send an email to the designated support email address to seek assistance or clarifications.

- Writing to Telegram: AgoraDesk also provides a Telegram channel where users can reach out to the support team and receive real-time assistance.

- Contacting the company via Twitter: Users can also contact AgoraDesk through their official Twitter account, enabling them to connect with the support team and get prompt responses.

Through these channels, AgoraDesk aims to provide effective and efficient customer service, ensuring a smooth user experience on their platform.

Reliability and Safety

Assessing the reliability and safety of a cryptocurrency exchange is crucial before making any investment decisions, as the lack of mandatory verification and legal information on AgoraDesk raises concerns about its legitimacy and security. While AgoraDesk prioritizes user privacy and security by not requiring KYC/AML, phone number, or blocked locations, the absence of these verification measures makes it difficult to assess the platform’s reliability.

Additionally, the lack of reviews and information about AgoraDesk further adds to the uncertainty surrounding its safety. It is important for users to exercise caution and carefully evaluate the company’s website and terms of service before engaging in any transactions on AgoraDesk. Due to these factors, investors should consider their individual preferences and requirements before deciding to use AgoraDesk as their preferred cryptocurrency exchange.

Cryptocurrency Options

When considering cryptocurrency options, users of AgoraDesk have access to a diverse range of cryptocurrencies, including Bitcoin, Monero, Litecoin, Ethereum, Dash, and Bitcoin Cash. This wide selection allows users to choose from some of the most popular and widely traded cryptocurrencies in the market. However, it is important for users to conduct their own risk assessment before engaging in any transactions on AgoraDesk or any other cryptocurrency exchange.

Cryptocurrencies can be highly volatile, and their values can fluctuate greatly within short periods of time. Users should consider factors such as their risk tolerance, investment goals, and market conditions before deciding which cryptocurrencies to trade. Additionally, it is important to stay updated on the latest news and developments in the cryptocurrency space to make informed decisions.

AgoraDesk Exchange: User Experience

The user experience on AgoraDesk is akin to navigating a labyrinth of opportunities, with its user-friendly platform and diverse range of cryptocurrency options. Users report high levels of satisfaction with the ease of use and intuitive navigation of the platform. AgoraDesk offers a well-designed interface that allows users to seamlessly navigate through various features and functionalities.

The platform’s interface design ensures that users can quickly access the information they need and execute trades with ease. Additionally, AgoraDesk provides a variety of helpful resources, including a FAQ section and a guide on how to use the platform, further enhancing the user experience. Overall, the user experience on AgoraDesk is characterized by user satisfaction and a well-designed navigation and interface.

Verification Requirements

Verification requirements on AgoraDesk are not clearly stated, making it difficult to determine the level of verification needed for users to access the platform’s services. This lack of transparency raises concerns about the platform’s legal compliance and user safety. The absence of a clear verification process can potentially attract users who value privacy but may also attract individuals with malicious intent.

The lack of mandatory verification also makes it challenging to assess the reliability and legitimacy of AgoraDesk. Without proper verification measures in place, users may be exposed to fraudulent activities, scams, and money laundering risks. It is crucial for potential users to carefully consider the risks associated with using a platform that does not have clear verification requirements and to exercise caution when engaging in transactions on AgoraDesk.

Reviews and Reputation

The reputation and reviews of AgoraDesk are crucial factors for users to consider when assessing the platform’s reliability and safety. User feedback plays a significant role in evaluating the trustworthiness of AgoraDesk. However, it is important to note that there is a scarcity of reviews available for AgoraDesk, making it challenging to determine its overall reputation. The lack of reviews raises questions about the platform’s reliability and user satisfaction.

Without a substantial number of reviews, it becomes difficult to gauge the experiences of users and their level of trust in AgoraDesk. Potential users should exercise caution and carefully study the platform’s website, terms of service, and features to make an informed decision. It is advisable to wait for more user reviews and feedback before fully relying on AgoraDesk as a cryptocurrency exchange.

Considerations and Conclusion

Considerations and Conclusion: It is essential for users to assess the reliability and safety measures of cryptocurrency exchanges before making investment decisions, as the lack of reviews and reputation surrounding platforms like AgoraDesk can create uncertainty and potential risks.

| Pros | Cons |

|---|---|

| Supports over 60 payment methods | Lack of mandatory verification and legal information |

| Offers arbitration protection and escrow service | Limited information on reliability and safety |

| No KYC/AML requirements | Lack of reviews |

| Affiliate program with commission opportunities | Potential risks of fraud and scams |

| Competitive trading fees | No mobile app available |

AgoraDesk offers a user-friendly platform with a wide range of payment methods and a focus on user privacy. However, its lack of reviews and limited information on reliability and safety make it important for users to exercise caution and conduct their own due diligence. While the platform has some positive features, such as arbitration protection and competitive trading fees, the potential risks associated with peer-to-peer exchanges should be carefully considered before deciding to use AgoraDesk.

Frequently Asked Questions

How does AgoraDesk ensure the privacy and security of its users?

AgoraDesk ensures the privacy and security of its users through various measures. It employs user data protection protocols to safeguard personal information and transaction details. Encryption protocols are implemented to secure communication and prevent unauthorized access.

The platform’s emphasis on user privacy is reflected in its lack of mandatory KYC/AML requirements and its avoidance of blocked locations. However, it is important for users to exercise caution and conduct their own due diligence to mitigate potential risks associated with peer-to-peer exchanges.

What are the fees for using AgoraDesk’s arbitration protection feature?

The fees for using AgoraDesk’s arbitration protection feature are not explicitly stated in the provided background information. However, it is important to note that AgoraDesk charges a 1% arbitration protection fee for each transaction and requires sellers to post an arbitration deposit equal to the transaction amount. This fee is intended to ensure the security of the transaction and protect both parties involved.

Pros of using AgoraDesk’s arbitration feature include added security and protection against fraud, as well as the involvement of an independent arbitrator. However, a potential con could be the additional cost incurred through the arbitration fee and deposit.

How does AgoraDesk’s escrow service work and how does it provide security for users?

AgoraDesk’s escrow service provides security for users by holding the cryptocurrency in a secure account until the transaction is completed. This ensures that both parties are protected from potential scams or fraud. The platform also offers arbitration protection, which involves an independent arbitrator and a deposit equal to the transaction amount.

However, it is important to note that using a peer-to-peer exchange like AgoraDesk comes with potential risks, such as the possibility of encountering dishonest counterparties. Users should exercise caution and conduct their own due diligence when engaging in transactions.

Are there any limitations on the number of trades users can make in a day on AgoraDesk?

There are no explicit trade limitations on the number of trades users can make in a day on AgoraDesk. However, it is important for users to exercise caution when trading on the platform due to potential risk factors associated with peer-to-peer exchanges. While AgoraDesk takes measures to minimize scams and ensure the security of user funds, users should conduct their own due diligence when selecting counterparties and be aware of the potential risks of fraud and scams.

What are the potential risks associated with using a peer-to-peer exchange like AgoraDesk?

Potential risks associated with using a peer-to-peer exchange like AgoraDesk include the increased likelihood of fraud and scams. Since peer-to-peer exchanges rely on individual users to create and fulfill trades, there is a higher risk of encountering dishonest counterparties.

Additionally, the lack of mandatory verification and legal information on such platforms can make it difficult to assess their legitimacy and security. Users should exercise caution, conduct thorough research, and consider their individual preferences and requirements before engaging in peer-to-peer exchanges.