In the vast landscape of cryptocurrency exchanges, AidosMarket emerges as a distinctive player. Like a hidden gem amidst the clutter, it offers a centralized platform for trading in ADK and Bitcoin, while also accepting fiat currency deposits. However, the exchange’s location remains ambiguous, necessitating caution for US investors who must navigate potential legal obstacles.

AidosMarket sets itself apart with its simplistic trading view, offering just an order box for seamless transactions. Taker fees of 0.20% and maker fees of 0.18% apply, ensuring a fair marketplace. Withdrawal fees vary based on the specific cryptocurrency, with a 0.001 BTC fee for Bitcoin withdrawals. Notably, AidosMarket stands alongside notable exchanges such as Bybit, PrimeXBT, Binance, MEXC, and Phemex, each carving their niches in the cryptocurrency realm. As this article delves into the intricacies of AidosMarket, a comprehensive comparison will shed light on its unique features and potential benefits.

Key Takeaways

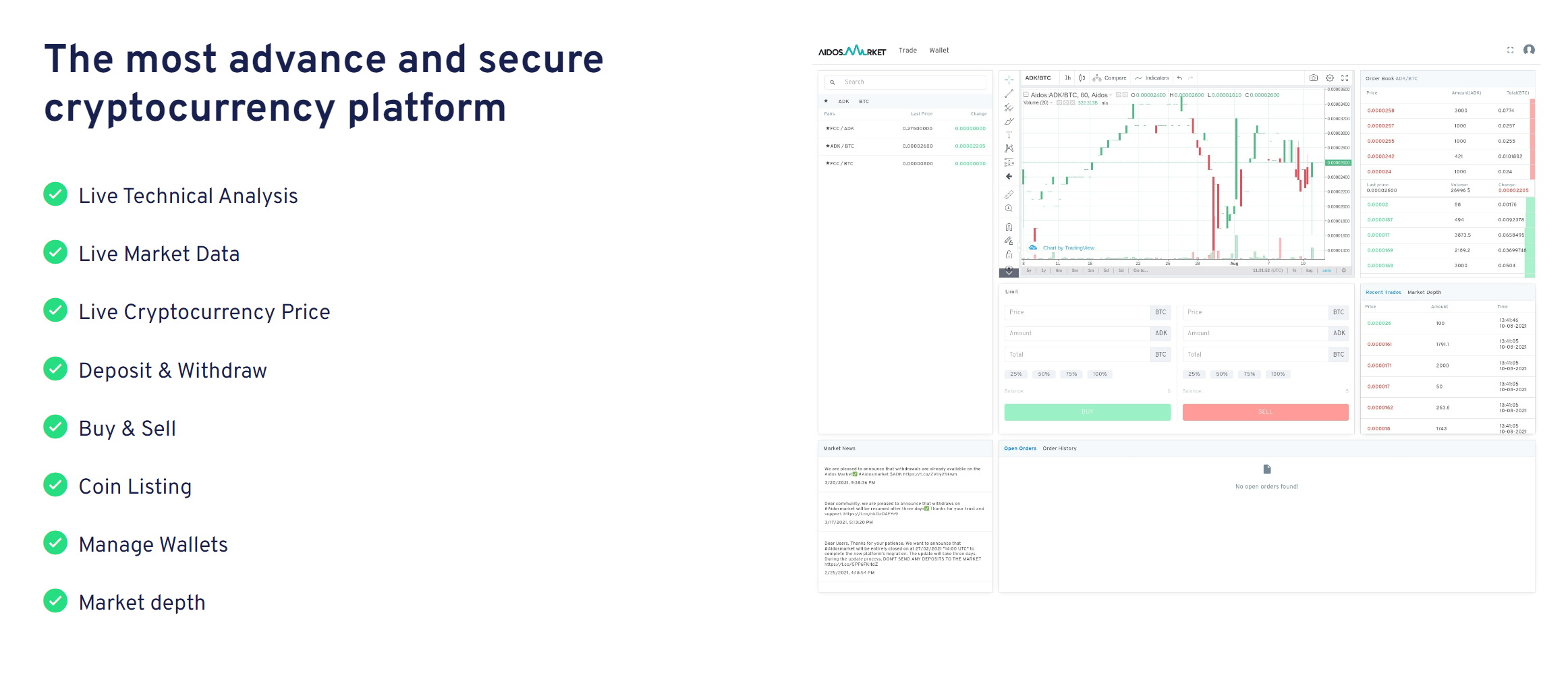

- AidosMarket is a centralized cryptocurrency exchange with a simple trading view and order box interface.

- It offers trading in ADK and Bitcoin, accepts fiat currency deposits, and allows users to deposit and withdraw funds using wire transfer.

- The exchange charges taker fees of 0.20% and maker fees of 0.18%, and withdrawal fees vary based on the specific cryptocurrency.

- AidosMarket’s location is ambiguous, which may pose legal obstacles for US investors, and its BTC withdrawal fee is 60% above the industry average.

What is AidosMarket?

AidosMarket is a centralized cryptocurrency exchange that was founded in 2018 and offers trading in ADK and Bitcoin. It distinguishes itself by accepting fiat currency deposits and having a simple trading view with only an order box. Trading on AidosMarket has its pros and cons. On the positive side, the exchange allows users to trade in ADK and Bitcoin, and it accepts fiat currency deposits, which is not common among all exchanges.

However, there are also some drawbacks. The trading view is simplistic, with only an order box, which may not be suitable for advanced traders. Additionally, the withdrawal fees vary depending on the crypto asset, and the BTC withdrawal fee is 60% above the industry average. To deposit and withdraw funds on AidosMarket, users can use wire transfer as a deposit method but not credit cards. Withdrawal fees may be lowered in the future.

AidosMarket: Trading Options

When considering the trading options available on AidosMarket, investors have the opportunity to engage in the buying and selling of different cryptocurrencies, such as ADK and Bitcoin, within a simple trading view that offers a straightforward order box interface. This allows for ease of use and quick execution of trades. To maximize their trading strategies, investors can analyze the liquidity of the cryptocurrencies on the platform.

Liquidity analysis helps investors determine the ease with which they can enter or exit a trade without significantly impacting the market price. Additionally, investors can explore different trading strategies, such as scalping or swing trading, to take advantage of price movements in the market. AidosMarket provides a platform that enables investors to make informed decisions and execute their trading strategies efficiently.

- High liquidity on AidosMarket provides ample opportunities for investors to enter and exit trades seamlessly.

- The simple trading view and order box interface allow for quick and efficient execution of trades.

- A range of trading strategies, such as scalping and swing trading, can be implemented on the platform.

Aidos Market: Comparison with Other Exchanges

In comparison to other exchanges, AidosMarket distinguishes itself by accepting fiat currency deposits and offers a simple trading view with only an order box interface. This sets it apart from other centralized exchanges such as Bybit, PrimeXBT, Binance, MEXC, and Phemex, which are mentioned as top exchanges.

When choosing a cryptocurrency exchange, there are several factors to consider. Centralized exchanges have pros and cons, with the advantage of providing convenient fiat currency deposits, like AidosMarket, but they also come with the risk of potential hacks and lack of control over users’ funds. Additionally, the trading interface is an important aspect to consider, and AidosMarket’s simple and straightforward order box interface may appeal to traders who prefer a no-frills trading experience.

Frequently Asked Questions

What are the accepted deposit methods on AidosMarket?

Accepted deposit methods on AidosMarket include wire transfer. This method allows users to transfer funds from their bank accounts directly to the exchange. While credit card deposits are not accepted, AidosMarket distinguishes itself by accepting fiat currency deposits. In terms of security measures, AidosMarket employs industry-standard protocols to ensure the safety of deposits. These measures may include multi-factor authentication, encryption, and cold storage for funds.

How do the withdrawal fees on AidosMarket compare to other exchanges?

Comparison of withdrawal fees among cryptocurrency exchanges can vary based on several factors. These factors include the type of cryptocurrency being withdrawn, the exchange’s fee structure, and market competition. It is important to note that withdrawal fees on AidosMarket are not explicitly mentioned in the background information.

However, it is common for exchanges to charge a withdrawal fee, which can vary depending on the platform. To determine how the withdrawal fees on AidosMarket compare to other exchanges, specific information regarding their fee structure would need to be provided.

Are there any geographical restrictions for trading on AidosMarket?

Different cryptocurrency exchanges have varying geographical restrictions and trading restrictions. It is essential for traders to be aware of these limitations before engaging in transactions. Regarding the specific exchange in question, AidosMarket, it is unclear whether there are any geographical restrictions for trading. However, it is advisable for potential traders to conduct further research and consider legal obstacles, especially for US investors, to ensure compliance with relevant regulations.

Does AidosMarket offer any advanced trading features or tools?

Advanced trading features and tools are essential for traders seeking to enhance their trading strategies and optimize their decision-making process. These features and tools can include but are not limited to advanced charting tools, technical indicators, risk management tools, order types, and algorithmic trading options.

These functionalities provide traders with the necessary tools to conduct in-depth analysis, execute complex trading strategies, and manage their portfolio effectively. Incorporating these advanced features and tools can contribute to improved trading outcomes and increased profitability for traders.

Are there any additional fees or charges to be aware of when trading on AidosMarket?

“Hidden charges can often catch traders off guard, causing unexpected financial burdens. When it comes to trading on aidosmarket, it is important to be aware of the trading fees. While the taker fees stand at 0.20% and maker fees at 0.18%, there may be additional withdrawal fees depending on the cryptocurrency being withdrawn. For Bitcoin withdrawals, a fee of 0.001 BTC is charged. It is worth noting that the platform’s BTC withdrawal fee is currently 60% above the industry average, but there is a possibility of this fee being lowered in the future.”