In the world of trading, finding the holy grail strategy – one that ensures consistent success with minimal risk – has long been the goal of traders. The Nirvana Holy Grail strategy, an innovative approach that combines technical and fundamental analysis, has emerged as a potential game-changer. This strategy leverages advanced algorithms, data analysis, and Agent-Based Modeling (ABM) to make informed trading decisions. By incorporating key indicators, risk management, and stock analysis services, traders using this strategy have achieved remarkable results, with an average return of over 20% in 2020.

However, it is crucial to acknowledge the limitations and risks associated with this approach, such as over-reliance on indicators and emotional trading. Therefore, diversification and a disciplined approach are essential for success. This article aims to provide an updated overview of the Nirvana Holy Grail strategy, discussing its approach, methodology, performance, limitations, and the importance of adaptability in today’s ever-changing market conditions.

Key Takeaways

- The Nirvana Holy Grail strategy combines technical and fundamental analysis to identify high-probability trades with minimal risk.

- Diversification is crucial in reducing risk and increasing returns in trading.

- Agent-Based Modeling (ABM) and key indicators are essential for successful implementation of the strategy.

- Risk management and proper execution of the strategy are important for achieving long-term success in trading.

What is Nirvana Holy Grail Strategy?

The Nirvana Holy Grail strategy is a trading approach that combines advanced algorithms, technical analysis, and fundamental analysis to identify high-probability trades with minimal risk and achieve consistent profits. This strategy leverages the power of data analysis and utilizes indicators such as candlestick charts, moving averages, and the conversion line to identify key trends and patterns in the market. By incorporating these techniques, traders can make more informed trading decisions and potentially increase their returns.

One advantage of the Nirvana Holy Grail strategy is its potential for generating consistent profits. Successful implementation of the strategy has resulted in an average return of over 20% in 2020. Additionally, case studies and success stories, such as Warren Buffett’s investment philosophy, demonstrate the effectiveness of this strategy in real-life scenarios. However, there are also limitations and risks associated with the strategy, including over-reliance on indicators, false signals, and emotional trading. Traders must be aware of these drawbacks and implement risk management techniques to mitigate potential losses.

Approach and Methodology of The Holy Grail Strategy

One approach to trading success involves utilizing a comprehensive and disciplined methodology that incorporates quantitative analysis, diversification, and a focus on long-term profitability. This approach combines the use of advanced algorithms and data analysis to make informed trading decisions. Here are three key elements of this methodology:

- Backtesting benefits: Traders can analyze historical market data to test the effectiveness of their strategies. Backtesting allows traders to identify patterns, trends, and potential pitfalls before implementing their strategies in real-time. It helps traders gain confidence in their approach and make adjustments based on historical performance.

- Psychological aspects of trading: Successful traders understand the importance of managing emotions and maintaining discipline. They develop a trading plan and stick to it, avoiding impulsive decisions based on fear or greed. They also recognize the impact of psychological biases on decision-making and work to mitigate their effects.

- Diversification: By spreading investments across different assets or markets, traders can reduce risk and increase the likelihood of profitable opportunities. Diversification helps to smooth out returns and protect against unexpected market movements. It can also provide the potential for increased profits by taking advantage of various market conditions.

Nirvana Holy Grail: Key Components

Utilizing a comprehensive and disciplined methodology for trading success involves incorporating key components such as backtesting, managing psychological aspects, and implementing diversification strategies. The Nirvana Holy Grail strategy offers several benefits to traders. By leveraging advanced algorithms and data analysis, traders can identify key trends and patterns in the market, leading to consistent profits. Practical tips for implementing the strategy include analyzing candlestick charts, using indicators like moving averages and the conversion line, and monitoring market sentiment with the ABM indicator.

It is important for traders to be aware of the limitations and risks associated with the strategy, such as over-reliance on indicators and emotional trading. Diversification is a crucial aspect of the strategy, as it helps reduce risk and increase returns by spreading investments across different assets or markets. By incorporating these key components, traders can enhance their trading success and achieve long-term profitability.

The Holy Grail Strategy: Performance and Results

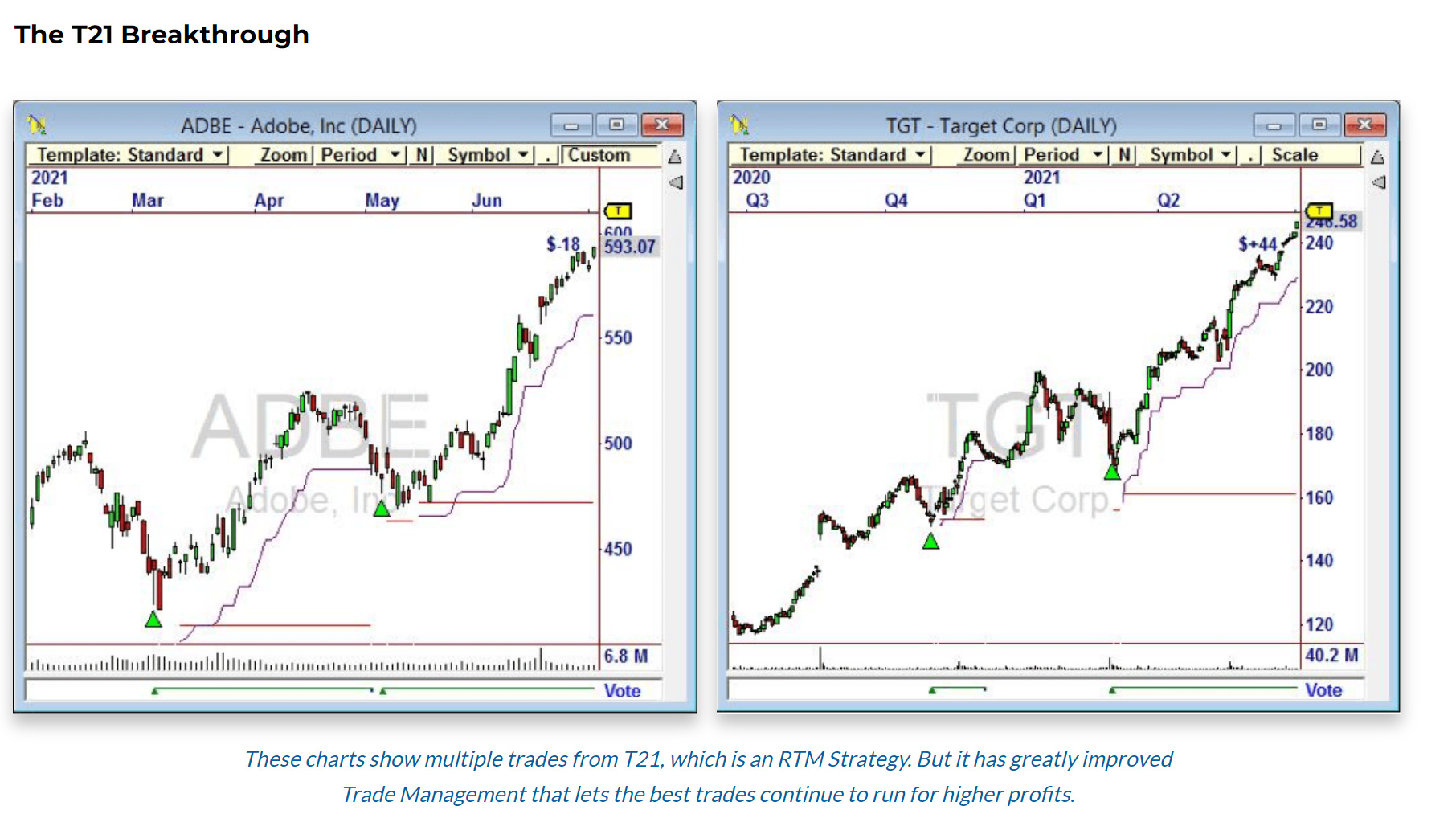

Performance and results of the Nirvana Holy Grail strategy can be evaluated to assess its effectiveness in achieving consistent profits and long-term profitability. Comparing its performance to other trading strategies provides insights into its strengths and weaknesses. The Nirvana Holy Grail strategy has shown impressive performance with an average return of over 20% in 2020. This outperforms many other trading strategies in the market.

Additionally, the Nirvana Holy Grail strategy has proven its ability to generate profits even in volatile market conditions, making it a robust and adaptable approach. Analyzing the impact of market volatility on the strategy can help traders understand its resilience and potential limitations. By considering the strategy’s historical performance and its ability to navigate market fluctuations, traders can make informed decisions about its suitability for their trading goals.

| Performance Metrics | Nirvana Holy Grail Strategy | Other Trading Strategies |

|---|---|---|

| Average Return | 20% | Varies |

| Performance in Volatile Markets | Positive | Varies |

| Adaptability | High | Varies |

| Long-term Profitability | Consistent | Varies |

Limitations and Risks of Nirvana Holy Grail

The Nirvana Holy Grail strategy, like any trading approach, has certain limitations and risks that traders should be aware of. It is important to consider both the pros and cons before implementing this strategy. One of the advantages of the Nirvana Holy Grail strategy is its ability to identify key trends and patterns in the market, which can lead to consistent profits.

Additionally, the strategy incorporates advanced algorithms and data analysis to make informed trades. However, there are also some implementation challenges to consider. Over-reliance on indicators can lead to false signals, and emotional trading can negatively impact decision-making. It is also important to note that the strategy’s performance may vary in different market conditions. Traders should carefully consider these limitations and risks before incorporating the Nirvana Holy Grail strategy into their trading approach.

Diversification Techniques

Diversification, a crucial component of the Nirvana Holy Grail strategy, allows traders to minimize risk and maximize returns by spreading investments across different assets or markets. By diversifying their trading portfolio, traders can reduce the impact of any single loss on their overall investment. This strategy not only helps protect against unexpected market movements but also allows traders to take advantage of profitable opportunities in different markets.

Strategies for diversifying a trading portfolio can include investing in different asset classes such as stocks, bonds, commodities, and currencies. Traders can also diversify by investing in different sectors or industries within the same market. Additionally, geographical diversification can be achieved by investing in markets across different countries or regions. It is important for traders to regularly monitor market conditions and analyze data to identify potential opportunities for diversification. By incorporating diversification techniques, traders can enhance their risk management strategies and increase the potential for long-term trading success.

| Benefits of Diversification | Strategies for Diversifying a Trading Portfolio | Emotional Response |

|---|---|---|

| Reduces risk and maximizes returns | Investing in different asset classes and sectors | Confidence and security in trading |

| Smoother returns with fewer drawdowns | Geographical diversification | Peace of mind |

| Protects against market downturns | Regular monitoring and analysis for opportunities | Flexibility and adaptability |

| Increases profits by up to 50% | Allocation of resources to promising opportunities | Excitement and potential for growth |

Agent-Based Modeling (ABM)

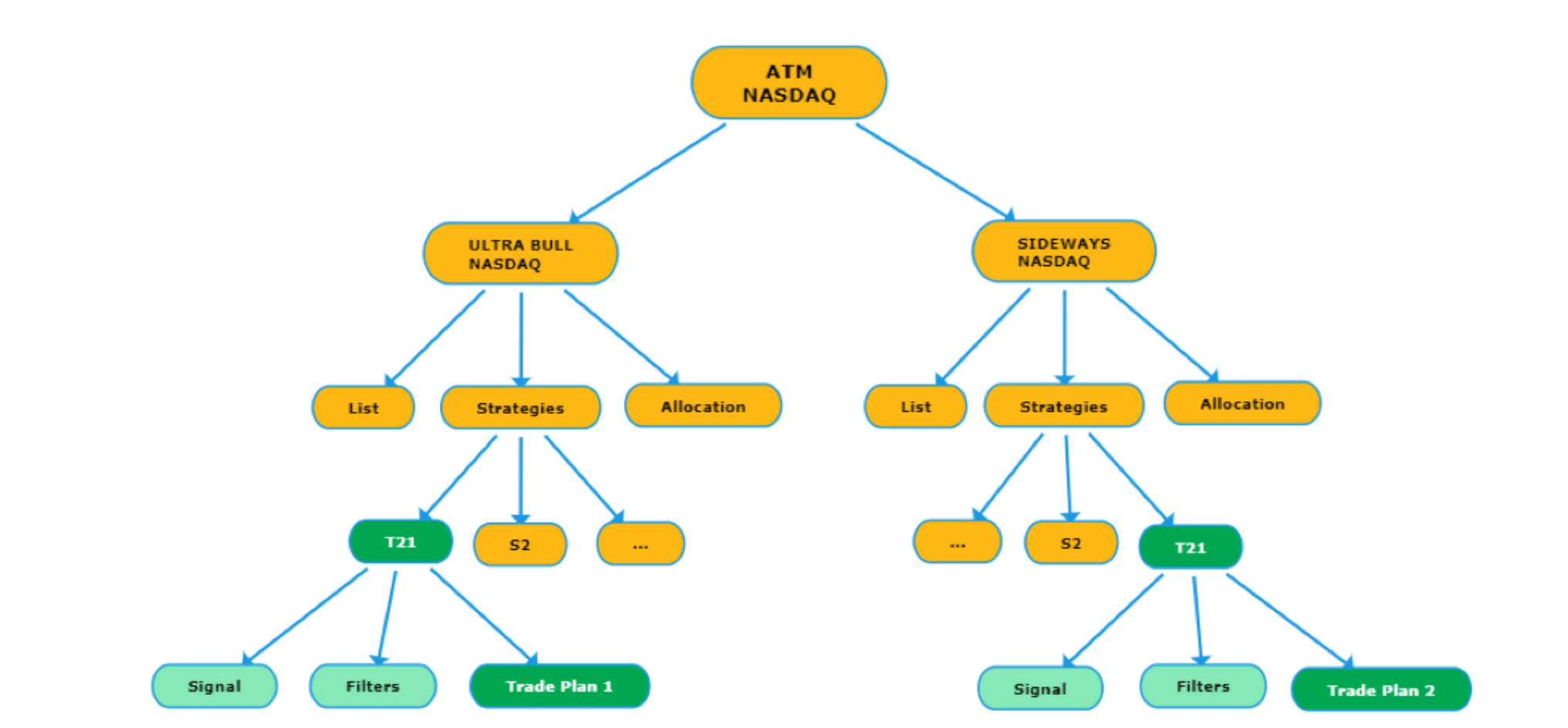

Agent-Based Modeling (ABM) is a powerful tool that allows traders to simulate real-world scenarios and make informed trading decisions based on data-driven insights. ABM finds numerous applications in financial markets. It enables traders to analyze market behaviors, identify patterns, and understand the dynamics of complex systems. By modeling individual agents and their interactions, ABM can capture the emergent properties of markets, such as price movements and trading volumes.

Traders can use ABM to test different trading strategies, evaluate their performance, and optimize their decision-making processes. Furthermore, ABM can help traders adapt to changing market conditions by providing real-time data and insights. By incorporating ABM into their trading approach, traders can gain a deeper understanding of the market and improve their chances of success.

Long-Term Perspective

Taking a long-term perspective in trading allows investors to focus on sustained growth and capitalize on opportunities that may not be immediately apparent. By adopting a long-term approach, traders can benefit from various advantages. Firstly, it helps to reduce the impact of short-term market fluctuations and volatility, allowing investors to ride out temporary price fluctuations and focus on the overall upward trend. Additionally, a long-term perspective enables investors to take advantage of compounding returns by reinvesting profits over time.

This can result in significant growth and wealth accumulation. To maintain a long-term perspective in the market, traders should consider strategies such as diversification, where investments are spread across different asset classes and sectors. This helps to mitigate risk and increase the likelihood of positive returns. Patience and discipline are also essential, as successful long-term traders understand that achieving substantial gains takes time and requires sticking to a well-defined investment plan.

Real-Life Examples of Nirvana Holy Grail Strategy

Warren Buffett’s investment philosophy serves as a real-life example of the long-term perspective advocated by the Nirvana Holy Grail strategy. Buffett, known as one of the most successful investors in history, emphasizes the importance of investing in quality companies with a competitive advantage and holding them for the long term. His approach aligns with the principles of the Nirvana Holy Grail strategy, which also emphasizes long-term investments and diversification.

Buffett’s success stories, such as his investments in companies like Coca-Cola and Apple, demonstrate the effectiveness of his strategy. By focusing on the fundamentals of companies and taking a patient approach, Buffett has achieved remarkable returns over time.

The Nirvana Holy Grail strategy encourages traders to adopt a similar mindset, prioritizing long-term success and seeking out investment opportunities with strong fundamentals and competitive advantages. By learning from successful investors like Warren Buffett, traders can gain valuable insights and enhance their own trading strategies.

Market Implementation

Market implementation of the Nirvana Holy Grail strategy involves applying the principles of long-term investing, diversification, and technical analysis to different asset classes and market conditions. Traders using this strategy analyze market conditions through market analysis techniques and make informed trading decisions based on the identified trends and patterns. They employ various trading strategies, such as momentum, mean reversion, and trend-following techniques, to capitalize on profitable opportunities.

By incorporating technical analysis methods, such as analyzing candlestick charts, using indicators like moving averages and the conversion line, and monitoring market sentiment with the ABM indicator, traders can enhance their understanding of market behavior and make more informed trading decisions. Additionally, they regularly monitor market conditions and adapt their strategies to sudden changes or unexpected news. Through market implementation, traders can effectively utilize the Nirvana Holy Grail strategy to achieve trading success.

Nirvana Holy Grail Strategy: Key Indicators

Key indicators are essential components of the Nirvana Holy Grail strategy, providing valuable information about market conditions and assisting traders in making informed decisions. These indicators play a crucial role in understanding market behavior and identifying profitable trading opportunities. When implementing the strategy, traders should pay attention to the following key indicators:

- ABM and market behavior: Agent-Based Modeling (ABM) is a powerful tool that allows traders to simulate real-world scenarios and gain insights into market behavior. By using ABM, traders can identify patterns, trends, and market behaviors that may not be apparent through traditional analysis methods.

- Risk management techniques: Risk management is a vital aspect of any trading strategy. Traders must be aware of the risks associated with each trade and have a plan in place to minimize those risks. Key indicators such as volume, momentum, volatility, and trend can help traders assess and manage risks effectively.

Incorporating these key indicators into the Nirvana Holy Grail strategy can enhance traders’ ability to make informed decisions and navigate the complexities of the market.

Risk Management

Effective risk management is crucial in maintaining the stability and success of trading strategies such as the Nirvana Holy Grail approach. Implementing effective risk management strategies can provide several benefits in trading. Firstly, it helps to protect against unexpected market movements and potential losses. Secondly, it allows traders to have a clear plan in place for each trade, including predetermined stop-loss levels and profit targets.

This helps to minimize emotional decision-making and ensures disciplined trading. Thirdly, risk management techniques, such as position sizing and diversification, can help to spread risk across different assets or markets and reduce the impact of any single loss on the overall portfolio. Finally, incorporating risk management strategies can provide traders with peace of mind and confidence in their trading approach, knowing that they have a plan in place to manage potential risks.

| Strategies for Effective Risk Management |

|---|

| 1. Set predetermined stop-loss levels |

| 2. Establish profit targets |

| 3. Practice disciplined trading |

| 4. Implement position sizing |

| 5. Diversify portfolio across different assets or markets |

Frequently Asked Questions

How much capital is required to effectively execute the Nirvana Holy Grail strategy across multiple markets and asset classes?

The capital requirements for effectively executing the Nirvana Holy Grail strategy across multiple markets and asset classes depend on several factors. Diversification benefits can be achieved by spreading investments across different assets or markets, which helps minimize the impact of any single loss on the overall portfolio.

The amount of capital required would vary based on the trader’s risk tolerance, investment goals, and the specific assets and markets being traded. It is recommended to have sufficient capital to execute the strategy effectively and manage potential risks.

What are some common traits shared by successful traders who have implemented the Nirvana Holy Grail strategy?

Successful traders who have implemented the Nirvana Holy Grail strategy share common traits that contribute to their trading success. These traits include discipline, patience, and a willingness to learn from mistakes.

By adhering to a comprehensive and disciplined approach, these traders are able to effectively implement the strategy and achieve favorable results. Their disciplined mindset allows them to stay focused on long-term success and make informed trading decisions based on objective analysis rather than emotions.

Can the Nirvana Holy Grail strategy be applied to trading cryptocurrencies?

Applying the Nirvana Holy Grail Strategy to cryptocurrency trading involves analyzing the effectiveness of this strategy in the crypto market. The strategy, which combines technical and fundamental analysis, aims to identify high-probability trades with minimal risk.

However, its applicability to the crypto market may be influenced by the unique characteristics of cryptocurrencies, such as high volatility and lack of regulation. Further research is needed to determine the extent to which the Nirvana Holy Grail Strategy can be successfully implemented in cryptocurrency trading.

Are there any specific timeframes or trading patterns that the Nirvana Holy Grail strategy focuses on?

The Nirvana Holy Grail strategy focuses on analyzing specific timeframes and trading patterns to identify profitable opportunities in the market. Traders using this strategy utilize various technical indicators and tools to identify key trends and patterns.

By analyzing candlestick charts, utilizing indicators like moving averages and the conversion line, and monitoring market sentiment with the ABM indicator, traders can make informed decisions about the specific timeframes and trading patterns to focus on for optimal trading success.

How does the Nirvana Holy Grail strategy handle market volatility and sudden changes in market conditions?

The Nirvana Holy Grail strategy incorporates risk management techniques to handle market volatility and sudden changes in market conditions. Traders using this strategy implement proper diversification techniques to reduce risk and take advantage of profitable opportunities.

They regularly monitor market conditions and analyze data to adapt to sudden changes or unexpected news. Research and analysis play a crucial role in identifying patterns, trends, and market behaviors that are not visible through traditional analysis methods, enabling traders to make informed decisions based on data-driven insights.