Have you ever felt like a fish out of water when it comes to trading? You’re not alone. Price channel trading strategy is an effective way for traders to navigate the stock market and make savvy investments with confidence.

Picture yourself in a boat, gliding through calm waters on a sunny day—it’s much like learning price channel trading strategy. Through this approach, you can easily identify key levels of support and resistance and maximize your profits by taking advantage of swings in prices.

In this article we’ll explain what price channels are, how to use them as part of your trading strategy, the benefits and limitations associated with them, and tips for successful implementation.

So strap in tight; let’s set sail on our journey towards mastering the art of price channel trading!

Key Takeaways

- Price channel trading strategy involves plotting two parallel lines as support and resistance levels.

- Price channels help traders make better trading decisions by providing insight into support and resistance levels.

- Price channels can reduce risk by providing clear boundaries for stop losses and can be used to determine potential breakouts and trend reversals.

- Price channels can be combined with other indicators for better analysis and accuracy in trading.

What is Price Channel Trading Strategy?

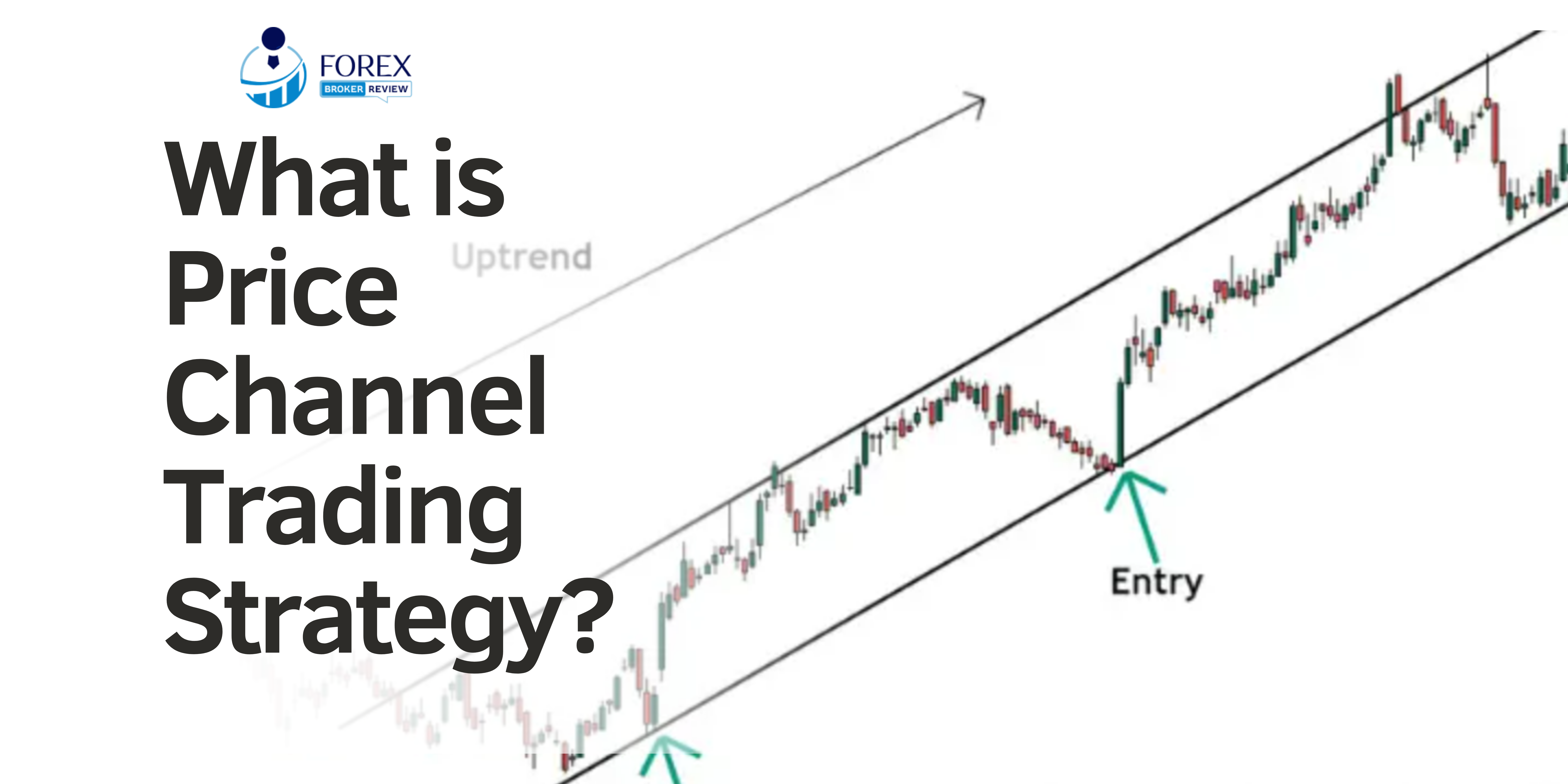

Price Channel Trading Strategy is a technical analysis tool used to identify price trends and provide buy and sell signals. It consists of two parallel lines that act as support and resistance levels.

The upper line is the resistance level, while the lower line is the support level. This strategy helps traders identify profitable entry and exit points, based on these levels, as well as predict future price movements.

Importantly, it allows traders to capitalize on short-term price fluctuations in order to maximize their profits.

Definition of Price Channel Trading Strategy

Experience the excitement of price channel trading strategy – a powerful tool to maximize profits! Price channel trading strategy is a technical analysis technique used to identify potential entry and exit points for trades. It involves plotting two parallel lines that act as support and resistance levels. The lines are created by taking the highest high and lowest low of an asset over a certain time period. This allows traders to identify trends and take advantage of price movements within the channel, buying at support levels and selling at resistance levels.

| Keyword | Definition |

|---|---|

| What is price channel trading strategy? | A technical analysis technique used to identify potential entry and exit points for trades. |

| Price Channel Trading Strategy | Involves plotting two parallel lines that act as support and resistance levels, based on taking the highest high and lowest low of an asset over a certain time period. |

Importance of Price Channel Trading Strategy in trading

Gaining insight into support and resistance levels can help you make better trading decisions, so understanding the importance of price channel trading strategy is key!

Price channel trading strategy is an important tool for traders because it allows you to accurately identify entry and exit points based on historical data. It also helps you avoid costly mistakes by providing visual clues about market sentiment. Additionally, it provides a way to create a robust risk management plan that will protect your investments.

Using price channels can be beneficial in terms of reducing risk, as they provide clear boundaries for stop losses. Furthermore, these channels can also be used to determine potential breakouts and trend reversals, allowing you to act quickly when opportunities arise.

As such, price channel trading strategy plays an essential role in helping traders make informed decisions about their investments.

Understanding Price Channels

Price Channels are a trading strategy that involve plotting certain points on a chart to identify the current trend. There are two main types of Price Channels used in trading: Equidistant and Moving Average.

An Equidistant Price Channel is drawn by connecting two parallel lines at equal distance from the price trend, while a Moving Average Price Channel uses moving averages to plot the channel boundaries.

By understanding these different types of price channels, traders can use them to their advantage when making trading decisions.

Explanation of price channels

You’ll quickly discover that price channels are like boundaries that define the highs and lows of a stock’s prices. Price channels can be used to identify potential entry and exit points for trading stocks, as well as provide insight into the current trend of a stock.

Here are 4 key features of price channels:

- They use two lines to show support and resistance levels.nn2. The lines usually represent a period of time or range, such as 20 days or $5 range.nn3. They often move in tandem with each other, providing an indication of where the stock is likely to move next.nn4. When one line is breached, it signals a potential trade opportunity.

By using price channels regularly, traders can gain valuable insights into their investments and make more informed decisions when it comes to buying or selling stocks.

Types of price channels used in trading

When it comes to analyzing the stock market, there are several types of price channels used in trading that can help traders gain an edge.

Three popular ones are Bollinger Bands, Donchian Channels, and Keltner Channels.

Bollinger Bands measure volatility by plotting two bands above and below a moving average line; when prices reach or exceed the outer bands, they indicate a potential trend reversal.

Donchian Channels are based on the highest high and lowest low of the last period; if price breaks out beyond these levels, a trade signal is generated.

Keltner Channels use both high and low prices as well as an exponential moving average to identify trends; when prices move outside of the channel lines, they may indicate either overbought or oversold conditions in the market.

All three tools can provide valuable insights into market direction and sentiment.

Equidistant price channel

Moving on from other types of price channels, the equidistant price channel is a popular technical analysis tool widely used by traders. It consists of two parallel trendlines that are spaced equally apart from each other and form an upper and lower boundary for the asset’s cost.

This type of channel provides a visual representation of the market’s highs and lows over a given period, allowing traders to forecast potential levels for entry or exit points. These lines also act as support and resistance levels, which can be used in conjunction with other indicators such as moving averages to identify trading opportunities.

The main benefit of this strategy is that it helps traders stay disciplined by focusing on specific trading ranges within the channel boundaries set by their strategy.

Moving average price channel

Discovering the moving average price channel can help you make more informed trading decisions and increase your chances of success. This strategy uses a set of two moving averages, which typically include a faster and slower-moving average.

The idea is that when the faster moving average crosses above the slower one, it indicates an uptrend in price and when it crosses below it signals a downtrend. In addition, traders can look for reversals when there is convergence between both lines.

This technique offers fast entry and exit points with potential for high profits if used correctly. It also helps to reduce risk by limiting losses during times of market uncertainty.

Explaining Price Channel Trading Strategy

Price Channel Trading Strategy is a concept commonly used by traders to identify potential opportunities in the market. This strategy involves plotting two lines on a chart: an upper and lower channel line, which form a “channel” around the price of a security.

By analyzing the relationship between these two lines, traders can identify bullish and bearish signals that may indicate trading opportunities.

Definition and concept of Price Channel Trading Strategy

Uncovering the concept of price channel trading strategy will unlock a world of potential profits for investors!

Price channel trading strategy is an approach to technical analysis that involves analyzing a stock’s price movements over a specified period of time. It relies on identifying patterns and trends in the chart and using them to make informed decisions about future prices.

The key elements of this type of strategy are:

- Analyzing historical data to identify patterns

- Utilizing tools like trend lines, support & resistance levels, and Fibonacci retracements

- Making short-term trades based on market sentiment

- Developing strategies for exiting positions at optimal points.

With these techniques, traders can capitalize on small fluctuations in prices which can produce significant returns over time.

Components involved: upper and lower channel lines

Exploring the components of a price channel trading strategy, one must consider the upper and lower channel lines. These two lines together form an envelope that tracks the prices of a security over time.

The upper channel line marks the highest point of recent price movements, while the lower line marks the lowest point. This range is determined by calculating a certain number of days’ worth of data and then using it to set a maximum and minimum value for each day’s closing price.

By looking at the upper and lower channel lines, traders can identify areas where they may be able to buy or sell at advantageous prices given current market conditions.

Identifying bullish and bearish signals

By examining the upper and lower boundaries of the envelope, traders can uncover bullish and bearish signals that may indicate market opportunities. These signals are important to understand when trading using a price channel strategy.

- Bullish signals occur when the price breaks above the upper line of resistance.

- Bearish signals occur when the price falls below the lower line of support.

- A successful break either way is usually followed by an increase in volume, indicating momentum within the trend change.

- If there’s no follow-through after breaking through either boundary, it could be a false signal and should be monitored closely for confirmation or rejection of the move.

It’s important to remember that these bullish and bearish signals don’t guarantee future success; they simply provide insight into possible market movements that can help inform your trading decisions accordingly.

Price Channel Breakouts

Breaking out of price channels can be a profitable trading opportunity, and it’s important to know how to identify these opportunities. It’s also important to know where to set your entry and exit points for the trade, and how to apply stop-loss and take-profit levels.

You need to learn the best way to spot breakout opportunities within a price channel. This involves using effective entry and exit points when trading breakouts. Additionally, it’s crucial to have strategies in place for setting appropriate stop-loss and take-profit levels.

Identifying breakout opportunities within price channels

Spotting breakout opportunities within price channels is a way to capitalize on market fluctuations. By using technical analysis, traders can identify when the price of an asset breaks above or below its channel. When this happens, it indicates that the trend of the asset has changed and provides potential trading opportunities.

| Positive Breakout | Negative Breakout |

|---|---|

| Buy Signal | Short Opportunity |

| Bullish Trend | Bearish Trend |

| Price Increase | Price Decrease |

Entry and exit points for trading breakouts

Once you’ve identified a potential breakout opportunity, you’ll need to determine the best entry and exit points for your trade – but don’t worry, it’s not rocket science!

To successfully trade breakouts, there are three key elements that need to be considered:

- Timing: Entering the market too soon or too late can significantly impact trading success.

- Risk Management: Properly managing risk is essential to reduce losses and maximize gains.

- Price Action: Monitoring price action is critical in order to identify when a breakout may occur and ensure profitable trades.

By keeping these factors in mind when entering trades, traders can effectively manage their positions and capitalize on any opportunities provided by the price channels trading strategy.

Applying stop-loss and take-profit levels

To maximize your profits and minimize losses, you’ll need to apply stop-loss and take-profit levels when trading breakouts.

Stop-loss levels are set at a predetermined price point below the entry price, keeping any potential losses limited.

Take-profit levels are placed at a predetermined level above the entry price, which will lock in profits once they reach that level.

Both of these levels should be determined prior to entering the trade based on an analysis of market conditions and past prices.

Setting both stops and take profit points helps traders manage their risk while also allowing them to secure gains as soon as possible.

By doing so, it allows for a more efficient strategy with less time spent watching the markets for setups or worrying about open positions.

Price Channel Bounces

Bounce trading is a popular strategy amongst traders that utilizes price channel boundaries to identify support and resistance levels. By determining these points, you can set entry and exit points for your trades and increase the likelihood of success.

With careful analysis of market trends, you can use price channel bounce trading to maximize profits while minimizing risk.

Utilizing price channel boundaries for bounce trading

By recognizing the boundaries of a price channel, you can visualize an opportunity for bouncing profits off the walls of the market like a pinball. Utilizing price channel boundaries for bounce trading involves entering a position when prices reach either side of the channel and then exiting as soon as it bounces back inwards.

Here are some key features to consider:

- Look out for periods of low volatility and tight ranges to identify potential entry points.

- Use indicators such as moving averages or envelopes to help confirm entry signals.

- Set stop losses above or below the price channels depending on your trading direction.

- Monitor closely and exit trades early if needed to avoid large drawdowns.

- Try using multiple timeframes for more precise entries and exits.

Determining support and resistance levels

Identifying support and resistance levels is a key skill for any trader looking to maximize their profits. Price channel trading can help by providing traders with clear boundaries that define the range of prices.

Support and resistance levels are determined when prices reach the upper or lower boundary of a price channel. These points indicate where buyers and sellers will most likely enter and exit a trade, respectively.

Traders must be aware that support and resistance levels are not fixed, as they can shift depending on market conditions. To take full advantage of price channels, traders must keep an eye out for changes in the market to ensure they are using the most updated support and resistance levels.

This requires continual monitoring but is essential to successful long-term trading.

Setting entry and exit points for bounce trades

By setting entry and exit points for bounce trades, you can maximize your profits and minimize risk. Knowing when to enter and exit a position is key to successful price channel trading. Here are some things to consider when making these decisions:

- Pay attention to the market trends, as well as fundamental analysis of the stocks and commodities involved in the trade.

- Set stop-loss levels before entering a trade so that losses remain manageable in case of significant price movement against your position.

- Use support and resistance levels identified earlier to set entry and exit points for trades, allowing for a more precise strategy with low risk.

- Trade within the confines of your pre-defined trading plan, sticking with it no matter what news may come out throughout the day or week.

- Monitor open positions regularly, being prepared to adjust entry or exit points if needed due to changing market conditions.

With this careful approach to setting entry and exit points for bounce trades, traders can have confidence they’re taking advantage of their opportunities while reducing risk on each trade.

Advantages and Limitations of Price Channel Trading Strategy

You may be familiar with the Price Channel Trading Strategy, which can be a useful tool for traders who want to identify trends in the market. However, it is important to understand both the potential benefits and drawbacks of using this strategy before you decide whether or not it’s right for your trading goals.

By combining the use of a Price Channel Trading Strategy with other indicators, you can get an even better picture of where the markets are headed – but only if you’re aware of its limitations.

In this discussion, we’ll explore both the advantages and disadvantages of using Price Channel Trading Strategy as well as how best to combine it with other indicators.

Benefits of using Price Channel Trading Strategy

Gaining an edge in trading markets can be difficult, but the Price Channel Trading Strategy provides it – with a win rate of up to 75%!

This strategy has several benefits that make it appealing to traders. Firstly, it uses price channels to identify potential areas for entry and exit points. By using these patterns, traders can gain insight into when they should buy or sell a certain asset.

Secondly, this strategy is more reliable than other forms of technical analysis as it relies on past data rather than predicting future price movements.

Lastly, the Price Channel Trading Strategy makes use of stop-loss orders, which help minimize risk while ensuring maximum returns.

In conclusion, the Price Channel Trading Strategy provides traders with an effective way to analyze the market and gain an edge in trading markets.

Potential drawbacks and limitations

| Despite its potential benefits, the Price Channel Trading Strategy also has some drawbacks and limitations that traders should be aware of. | Drawback/Limitation | Description |

|---|---|---|

| Time consuming | Requires significant analysis of the markets and more time than other strategies to manage positions correctly. | |

| Risk | Market conditions can change quickly and lead to overtrading or losses. | |

| Inaccurate signals | Price channels are subject to interpretation, so signals may not always be accurate or profitable. | |

| Cost | Data subscriptions for charting software can add up quickly when using this strategy. |

Importance of combining Price Channel Trading Strategy with other indicators

Combining the Price Channel Trading Strategy with other indicators can be like rocket fuel for a trader’s success. It helps to skyrocket profits and minimize losses. Using multiple indicators as part of the trading strategy helps traders make smarter decisions. It provides a more comprehensive view of market conditions.

Combining price channels with moving averages, trend lines, and momentum indicators can increase accuracy in predicting price movements. This allows traders to identify potential entry and exit points with greater confidence. By combining several reliable indicators, traders can also reduce risk by diversifying their strategies.

Ultimately, successful trading requires an effective combination of technical analysis tools. These tools should be tailored to individual markets and trading goals.

Price Channel Trading Strategy: Tips for Successful Implementation

If you’re looking to maximize your returns while minimizing risk using the Price Channel Trading Strategy, there are some best practices you should consider following.

Backtesting and optimizing the parameters of your strategy is essential as it’ll help identify any weak spots so they can be addressed prior to live trading.

Furthermore, it’s important to regularly monitor and adjust your strategy as market conditions change in order to ensure its continued success.

Best practices for using the Price Channel Trading Strategy

To successfully use the Price Channel Trading Strategy, you must stay disciplined and have a clear understanding of how it works. Here are some best practices to ensure success:

- Identify the trend direction before entering a trade.

- Research for potential support and resistance levels.

- Place stop losses above or below the price channel.

- Monitor your trades closely to adjust your position if needed.

Be sure to research multiple time frames when analyzing the market and keep an eye on news events that could affect trading decisions. Utilize risk management tools such as position sizing, trailing stops, and take profits to minimize losses and maximize gains in each trade. Finally, practice patience as this strategy requires waiting for price breakouts from these channels before taking action.

Importance of backtesting and optimizing parameters

It’s crucial to test out different parameters and backtest your trading strategy to see how it performs in various market conditions. To properly execute the Price Channel Trading Strategy, traders must optimize their settings and ensure that they are accurately reflecting current market conditions. Backtesting and optimization of parameters is essential for this as it allows traders to assess the effectiveness of their strategies before putting real money on the line.

| Impact | Example |

|---|---|

| Positive | Increased accuracy in setting up trades, improved returns over time |

| Negative | Takes considerable time & effort to get right, can be costly if done incorrectly |

Regularly monitoring and adjusting the strategy

Regularly keeping tabs on your trading and making adjustments as needed is key to ensuring long-term success with the Price Channel strategy.

It’s important to periodically review your open positions and check for any discrepancies in price movements or technical indicators. Doing so will help you identify any potential issues with the Trade Channel setup, such as a breakdown of support levels or a change in trend direction.

Additionally, it allows you to take advantage of opportunities that may arise while trading within the Price Channel framework.

Finally, by monitoring your trades regularly and adjusting parameters when necessary, you can ensure that your trading strategy remains effective over time.

Frequently Asked Questions

What indicators are used to identify price channels?

You can identify price channels using technical indicators such as Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI), and Bollinger Bands. These are used to measure momentum, volatility, and compare prices against previous trends.

What time frames are best for using a price channel trading strategy?

The best time frames for a price channel trading strategy depend on the trader’s individual goals. Short-term traders may benefit from focusing on hourly or daily charts, while long-term traders should use weekly or monthly charts.

What is the difference between a price channel breakout and a price channel bounce?

You may have heard of a price channel breakout and a price channel bounce. A breakout occurs when the stock or asset’s price moves above or below the lines of the channel, while a bounce is when it quickly reverses back inside the boundaries. Both can be indicators for market sentiment.

What are the risks associated with using a price channel trading strategy?

Risks of using a price channel trading strategy include whipsawing, false breakouts, and missed opportunities. You must be prepared to handle these potential losses.

How do I set up automated alerts to notify me of price channel breakouts or bounces?

Set up automated alerts by subscribing to a trading platform that allows you to customize alert settings for price channel breakouts or bounces. Choose criteria, such as time period and threshold, for your alerts. Monitor market shifts and adjust settings accordingly.