Tweezers, the precision tool for trend traders, hold significant value in analyzing and identifying trade signals. These candlestick patterns serve as essential indicators of potential shifts in trend direction, particularly when combined with other technical analysis tools. Depending on whether they occur after an advance or a decline, tweezers can manifest as either topping or bottoming patterns. Their resemblance to reversal candlestick patterns like bearish engulfing or bullish engulfing further enhances their significance.

Trend traders strategically employ tweezers to anticipate impending changes in trend direction and enter trades during pullbacks, aligning with the overall trend. Moreover, the highs or lows of the tweezers can serve as stop-loss levels for topping or bottoming patterns, respectively. However, it is crucial to note that tweezers do not provide a profit target, necessitating the consideration of other factors to determine trading targets. Enhancing the success rate of trades involves confirming tweezers patterns with subsequent candlestick patterns and practicing their identification and utilization before engaging real capital.

Key Takeaways

- Tweezers are a candlestick pattern used by trend traders for analysis and trade signals.

- Tweezers can indicate a shift in trend direction and can be used to anticipate potential changes in trend direction.

- Tweezers are best used to enter trades during pullbacks in alignment with the overall trend.

- The success rate of tweezers patterns improves when used in conjunction with overall trend analysis and other indicators.

What are Tweezers?

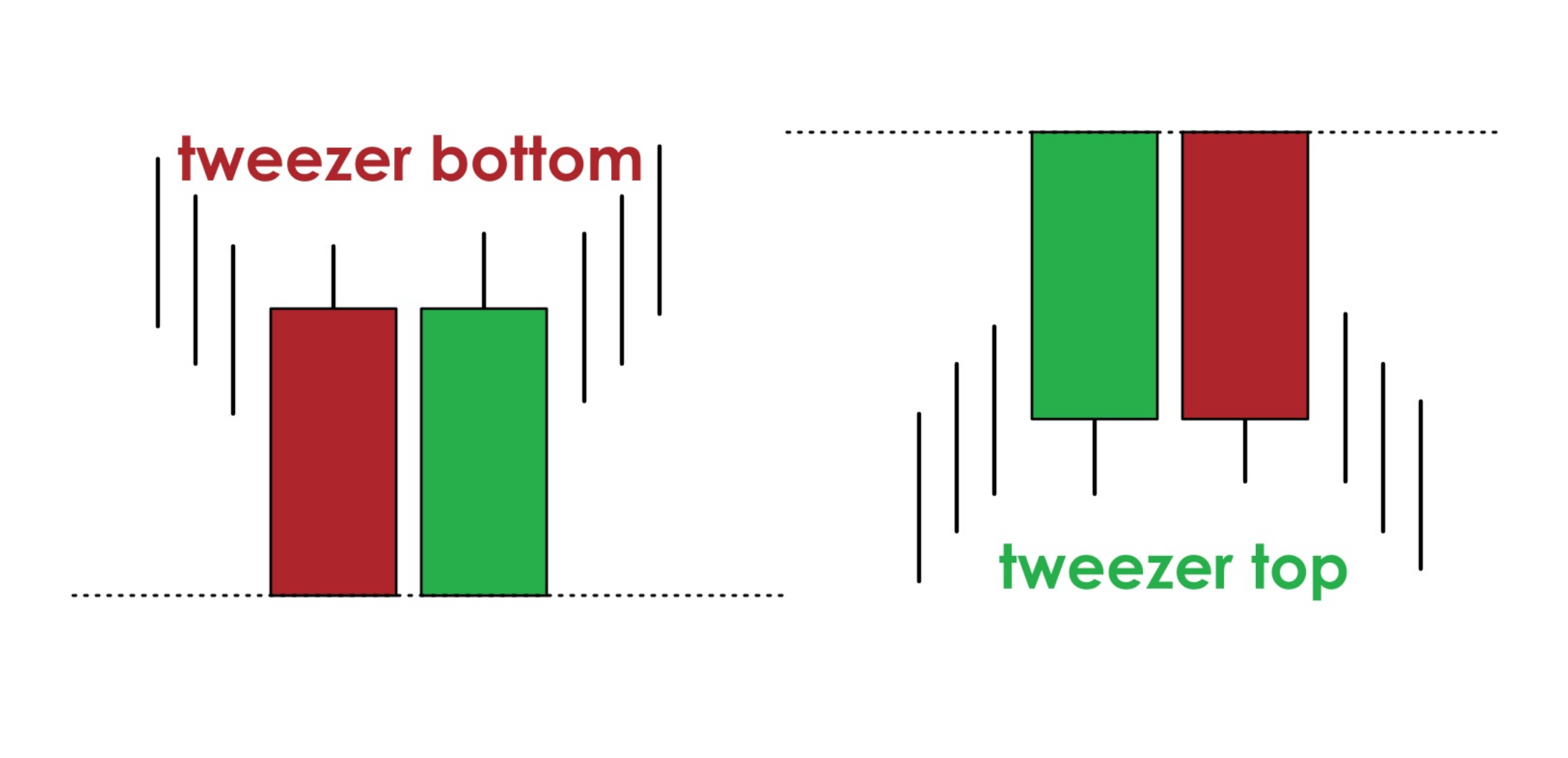

Tweezers, which are frequently observed in candlestick patterns, serve as a valuable tool for trend traders as they can indicate a potential shift in trend direction, and are particularly noteworthy when they resemble other reversal candlestick patterns, such as bearish engulfing or bullish engulfing, offering traders a precise entry point for their trades. Tweezers can take the form of a topping pattern or a bottoming pattern.

Topping patterns occur when the highs of two candlesticks occur at almost the same level following an advance, while bottoming patterns occur when the lows of two candlesticks occur at almost the same level following a decline. By spotting these patterns, trend traders can anticipate potential changes in trend direction and enter trades during pullbacks in alignment with the overall trend. Stop-loss levels can be placed below tweezers lows for bottoming patterns and above tweezers highs for topping patterns. Additionally, tweezers that occur near major support or resistance levels can provide trade signals. Overall, the success rate of tweezers patterns improves when used in conjunction with overall trend analysis and other indicators.

Tweezer Patterns and Signals

Candlestick patterns such as tweezers can offer valuable insights and signals for trend analysis in financial markets. Tweezers patterns can be used to identify potential shifts in trend direction. Topping patterns occur when the highs of two candlesticks are at almost the same level following an advance, while bottoming patterns occur when the lows of two candlesticks are at almost the same level following a decline.

However, it is important to note that tweezers can sometimes provide false signals, leading to incorrect trade decisions. Common mistakes in using tweezers include relying solely on this pattern without considering other technical analysis tools and failing to confirm the pattern with subsequent candlestick patterns. Therefore, it is crucial to use tweezers in conjunction with overall trend analysis and other indicators to increase the accuracy of trade signals.

How to Use The Tweezer Patterns?

When incorporating tweezers patterns into technical analysis, it is essential to consider other indicators and overall trend analysis to enhance the reliability of trade signals. Just as a skilled chef combines various ingredients and flavors to create a well-balanced dish, traders should use tweezers in conjunction with other tools and analysis techniques to create a comprehensive trading strategy.

- Using tweezers in different market conditions:

- Tweezers can be used in both trending and ranging markets.

- In trending markets, tweezers can help identify potential reversals or pullbacks.

- In ranging markets, tweezers can provide signals for both buying and selling opportunities.

- Tweezers in conjunction with other technical indicators:

- Combining tweezers with indicators like moving averages or oscillators can increase the accuracy of trade signals.

- Looking for confirmation from other candlestick patterns can further validate the reliability of tweezers signals.

- Considering support and resistance levels in conjunction with tweezers can provide additional trade opportunities.

Frequently Asked Questions

What are some common mistakes to avoid when trading with tweezers patterns?

Common mistakes when trading with tweezers patterns include not using other technical analysis tools, ignoring overall trend analysis, failing to confirm with subsequent candlestick patterns, and not practicing with virtual capital.

Can tweezers patterns be used in conjunction with other technical indicators?

Combining tweezers patterns with moving averages can enhance trend analysis. Incorporating tweezers into a breakout strategy involves looking for confirmation from other indicators such as volume, trend lines, and support/resistance levels.

Are there any specific timeframes or chart patterns where tweezers patterns are more effective?

Identifying different types of tweezers patterns involves observing the highs or lows of two candlesticks occurring at almost the same level following an advance or decline. The psychology behind the tweezers pattern suggests potential trend reversal and can impact market sentiment.

How do tweezers patterns differ from other reversal candlestick patterns?

Tweezers patterns differ from other reversal candlestick patterns by their specific characteristics. Understanding the psychology behind tweezers patterns helps traders identify their potential false signals, enhancing their effectiveness in trend analysis.

Are there any recommended resources or tools for learning how to spot and trade tweezers patterns effectively?

Recommended resources for learning how to spot and trade tweezers patterns effectively include online tutorials, educational videos, and trading books. Common mistakes to avoid when trading with tweezers patterns are relying solely on them for trade signals and not confirming them with other candlestick patterns.