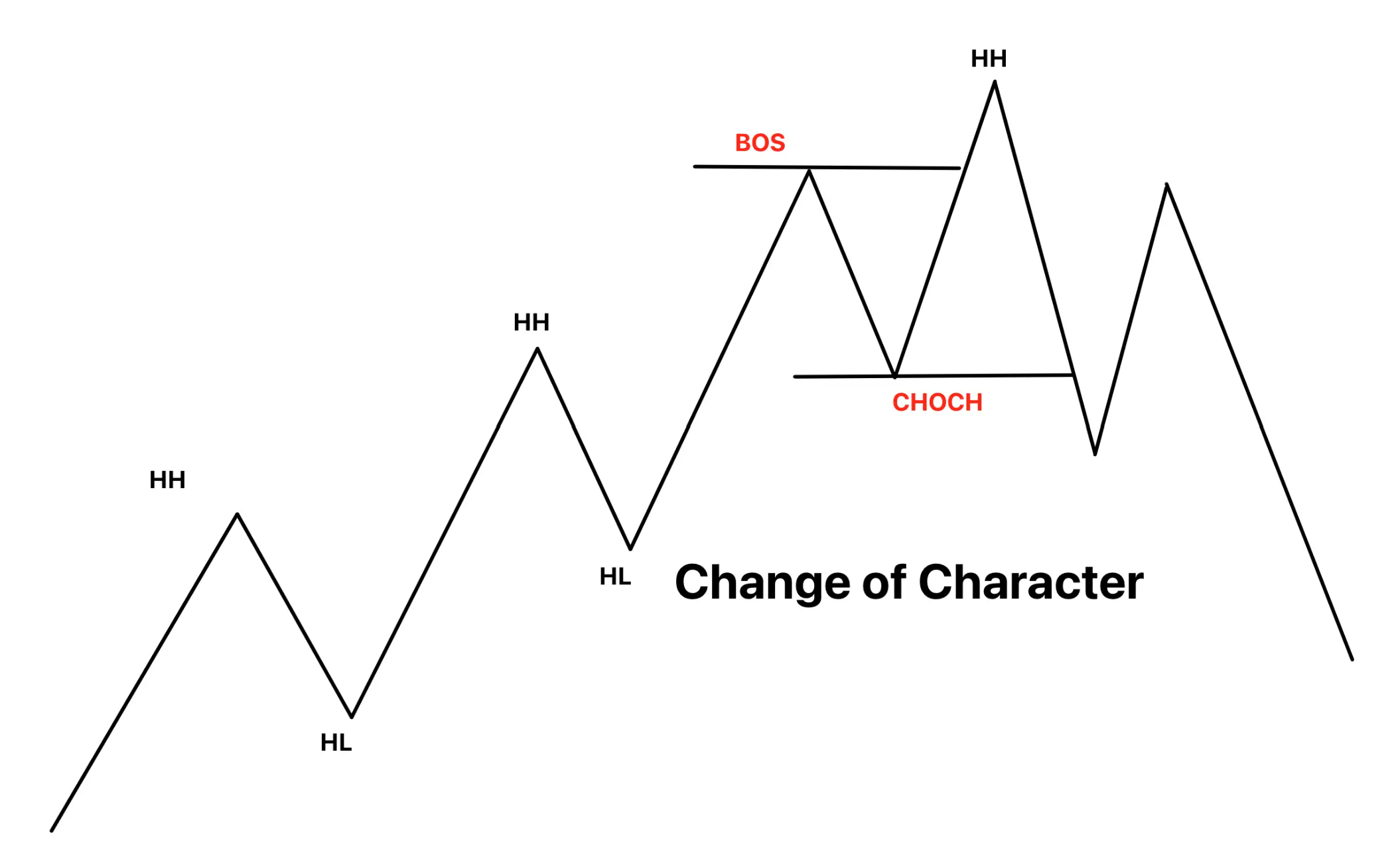

In the world of trading, recognizing patterns and trends is crucial for success. One such pattern that traders can utilize is the Choch pattern, also known as the change of character pattern. This pattern acts as a trend reversal signal and occurs after a break of Highs/Lows in the market. Similar to the Quasimodo pattern, the Choch pattern indicates a shift in market direction. Traders across various markets, including stocks, forex, and cryptocurrency, can employ the Choch trading strategy by combining it with supply and demand zones. By identifying this pattern and marking the relevant zones, traders can open trades and manage risk by placing stop losses accordingly.

Additionally, monitoring the formation of counter-trend Choch patterns can help traders determine when to manually close their trades. It is important to note that backtesting the strategy and being mindful of market conditions are essential for successful implementation. By utilizing the Choch pattern and supply-demand zones, traders can increase the likelihood of profitable trade setups, although the probability may decrease in choppy market conditions.

Key Takeaways

- The Choch pattern is a trend reversal signal that occurs after a break of Highs/Lows in the market.

- Traders can combine the Choch pattern with supply and demand zones to identify high probability trade setups.

- Stop losses should be placed above the supply zone or below the demand zone to manage risk.

- Monitoring counter-trend Choch patterns can help determine when to close trades.

What is ChoCh in Trading?

The Choch pattern in trading, also known as the change of character pattern, is a trend reversal signal that occurs after a break of Highs/Lows, indicating a shift in market direction. This pattern is similar to the Quasimodo pattern, but with a different name. The Choch pattern signifies a change in the market trend, with the current trend reversing. Traders often incorporate supply and demand zones along with the Choch pattern to enhance their trading strategy.

It is important to backtest the trading strategy to identify optimal market conditions for this pattern. By doing so, traders can determine the probability of successful trade setups. However, it is crucial to note that the effectiveness of the Choch pattern decreases in choppy market conditions. Overall, the Choch pattern, combined with supply-demand zones, offers high probability trade setups when utilized in appropriate market conditions.

Mechanism and Reversal of ChoCh Forex

Mechanism and Reversal in trading patterns involve a trend reversal in the market after a break of Highs/Lows, indicating a shift in market behavior. The mechanism explanation of the Choch pattern revolves around the identification of reversal signals. Traders look for a change of character pattern, similar to the Quasimodo pattern, to identify potential trend reversals. This pattern works for all markets, including stocks, forex, and cryptocurrency. The Choch trading strategy combines the use of supply and demand zones with the change of character pattern to increase the probability of successful trades.

Traders open a trade when a Choch pattern forms and mark a supply/demand zone. They place the stop loss a few pips above the supply zone or below the demand zone. The trade is closed manually when a counter-trend Choch pattern forms. Backtesting the trading strategy helps in identifying good market conditions and avoiding choppy market conditions with lower probability trading setups. The combination of the Choch pattern and supply-demand zones provides high probability trade setups for traders.

ChoCh Trading Strategy

One key aspect of the trading strategy is the combination of supply and demand zones with the change of character pattern, which significantly increases the probability of successful trades. To identify Choch patterns, traders should look for a break of Highs/Lows followed by a reversal in the market trend. Once a Choch pattern is identified, traders can mark a supply/demand zone and open a trade.

It is important to place the stop loss a few pips above the supply zone or below the demand zone to manage risk. Additionally, traders should consider backtesting the Choch trading strategy to determine its effectiveness in different market conditions. This will help identify optimal market conditions for implementing the strategy and avoid trading in choppy market conditions where the probability of successful trades decreases.

Frequently Asked Questions

How can I identify a Choch pattern in the forex market?

To identify a Choch pattern in the market, traders should look for a trend reversal after a break of Highs/Lows. The success factors for identifying the Choch pattern include analyzing supply and demand zones and backtesting the trading strategy.

What are the key differences between the Choch trading pattern and the Quasimodo pattern?

The key differences between the Choch pattern and the Quasimodo pattern lie in their respective characteristics and trading strategies. The Choch pattern represents a trend reversal, while the Quasimodo pattern signifies a potential breakout. When trading these patterns, incorporating supply and demand zones is crucial for the Choch pattern, whereas the Quasimodo pattern relies on identifying key support and resistance levels.

Are there any specific market conditions where the Choch trading is more likely to be successful?

The success of the Choch pattern in trading depends on specific market conditions. Common mistakes to avoid when trading the Choch pattern include disregarding the importance of backtesting and trading in choppy market conditions.

How do I determine the appropriate placement for the stop loss when trading the Choch?

Determining stop loss placement in trading the Choch pattern involves implementing risk management strategies. Traders should consider placing the stop loss a few pips above the supply zone or below the demand zone to limit potential losses.

Can the Choch pattern be utilized in conjunction with other technical indicators or trading strategies for better results?

The Choch pattern can be utilized in conjunction with other technical indicators and trading strategies to enhance results. Incorporating the Choch pattern into trend analysis and swing trading strategies can provide valuable insights for identifying potential trend reversals and improving trade setups.