Are you tired of the same old trading strategies that seem to yield minimal returns? Well, prepare to embark on a journey into the fascinating world of chart patterns with the Adam and Eve Pattern. This unique pattern, named after the biblical figures, offers traders a fresh perspective and an opportunity to capitalize on market movements.

The Adam and Eve Pattern is a two-part formation that signals both entry and exit points in the market. By analyzing market trends and price patterns, you can identify these key levels with precision. But don’t worry if this concept seems daunting at first – we will guide you through every step of the process.

In this article, we will delve deep into understanding this intriguing pattern and provide practical tips on how to trade using it effectively. We’ll explore real-life examples, analyze historical data, and showcase case studies to give you a comprehensive understanding of its potential. So get ready to elevate your trading game with the Adam and Eve Pattern – let’s dive in!

Key Takeaways

- The Adam and Eve pattern is a trading pattern that consists of an Adam bottom and an Eve top.

- Traders can identify entry and exit points using historical data and backtest the pattern for reliability and timeframe suitability.

- It is important to spot fake Adam and Eve patterns without proper confirmation and utilize technical indicators for confirmation, such as volume analysis.

- Managing risk and setting stop loss orders, as well as calculating position size accurately, are crucial for proper risk management in trading.

Credits: tradingcampus.in

Understanding the Adam and Eve Pattern

Now, let me show you how you can take advantage of the Adam and Eve pattern to make profitable trades that will leave you feeling confident and empowered. The Adam and Eve pattern is a popular chart formation used in technical analysis, particularly for identifying trading reversals. By understanding this pattern, you can avoid common trading mistakes and develop effective strategies for successful trades.

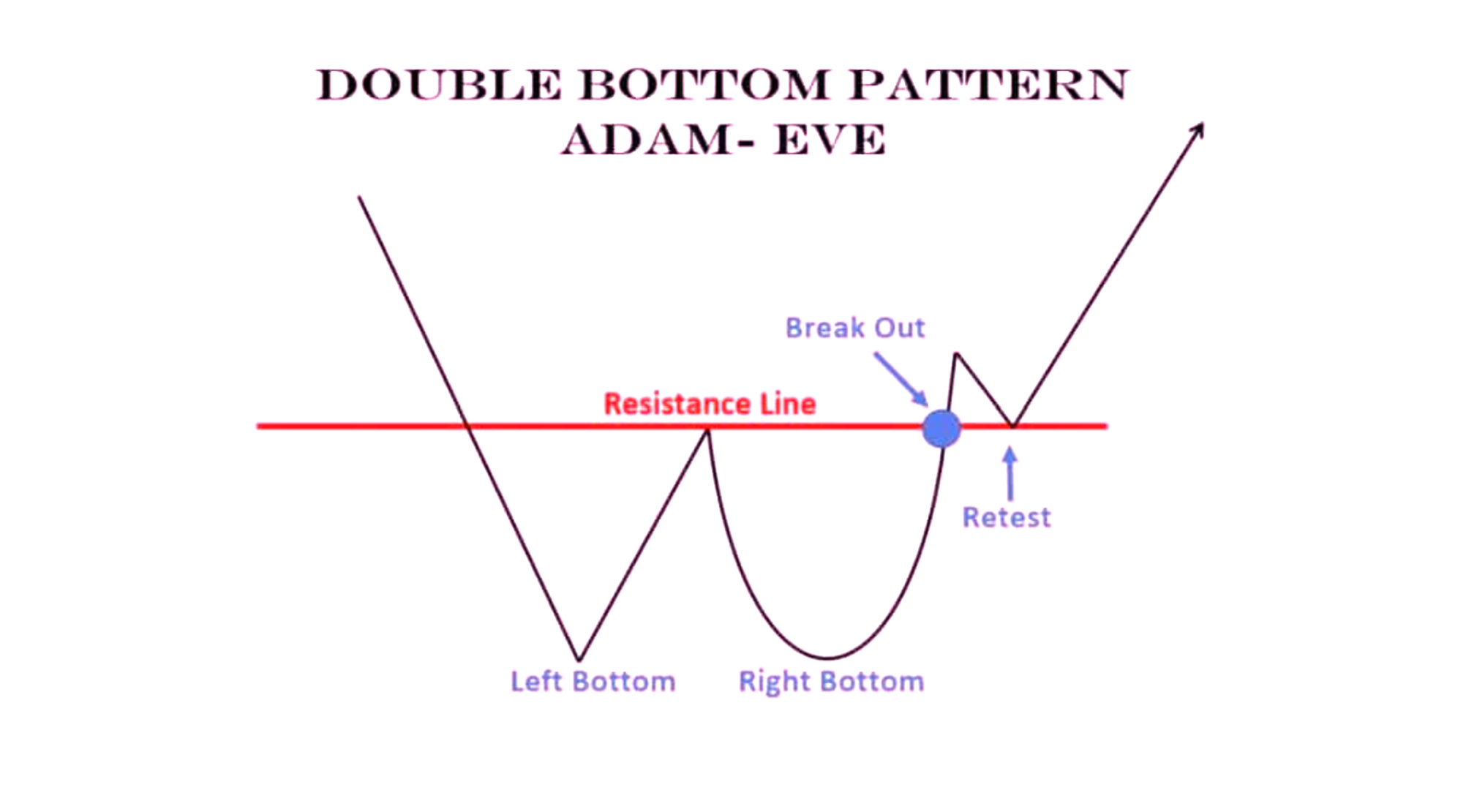

The Adam and Eve pattern consists of two parts: the Adam bottom and the Eve top. The Adam bottom is characterized by a sharp price drop followed by a gradual consolidation phase. This represents a strong selling pressure in the market. The Eve top, on the other hand, is formed when prices rise gradually after the consolidation phase, indicating a shift towards buying pressure.

To trade using this pattern, traders often wait for confirmation signals such as breakouts or trendline breaks before entering into positions. They also utilize indicators like moving averages or oscillators to confirm their analysis.

By recognizing the Adam and Eve pattern and implementing appropriate trading strategies, you can enhance your chances of making profitable trades while avoiding common pitfalls in trading reversals.

Identifying the Entry and Exit Points

First, you’ll want to pinpoint the precise moments to enter and exit the market, capturing those golden opportunities like a master trader. Timing trades is crucial in successfully utilizing the Adam and Eve pattern. To do this, it’s important to use historical data as a guide. Here are some key steps to identify the entry and exit points:

- Analyze previous instances of the Adam and Eve pattern: Look for similarities in price movements and patterns.

- Utilize technical indicators: Combine indicators like moving averages or RSI to confirm your entry and exit points.

- Set stop-loss orders: Protect your positions by setting stop-loss orders at logical levels based on support and resistance levels.

- Monitor market conditions: Stay updated with news releases or events that could impact your trades.

By following these steps, you can effectively identify the entry and exit points using historical data, increasing your chances of trading success.

Analyzing Market Trends and Price Patterns

To truly master the art of trading, it’s essential to delve into the fascinating world of market trends and price patterns. One popular pattern that traders use is the adam and eve pattern. To effectively trade using this pattern, it’s important to backtest it thoroughly. By analyzing historical data, you can determine how reliable the pattern is and identify any potential weaknesses or limitations.

Additionally, it’s crucial to consider different timeframes when using the adam and eve pattern. The pattern may work well in certain timeframes but not in others, so it’s important to experiment and find what works best for you. By incorporating backtesting and considering different timeframes, you can maximize your chances of success when trading with the adam and eve pattern.

Applying Technical Indicators for Confirmation

Utilize technical indicators to validate your trading decisions and enhance your chances of success in the market. One way to confirm the validity of an Adam and Eve pattern is by using volume analysis. By analyzing the volume during the formation of the pattern, you can determine if there is significant buying or selling pressure supporting the pattern.

Additionally, it is crucial to spot fake Adam and Eve patterns. Sometimes, price action may resemble this pattern, but without proper confirmation through other technical indicators, it may not be a reliable signal for trading.

To further increase confidence in trading using the Adam and Eve pattern, backtesting is essential. By reviewing historical data and applying this strategy to past market conditions, you can assess its effectiveness before implementing it in real-time trading.

Incorporating these techniques will help traders make informed decisions when utilizing the Adam and Eve pattern in their trading strategies.

Managing Risk and Setting Stop Loss Orders

One crucial aspect of successful trading is effectively managing risk and setting stop loss orders. When trading using the Adam and Eve pattern, it is important to calculate your position size accurately to ensure that your risk is properly managed. This involves determining the amount of capital you are willing to risk on each trade based on your overall account size and risk tolerance.

Additionally, adjusting stop loss levels is essential in protecting your capital and minimizing potential losses. By placing stop loss orders at strategic levels below or above key support or resistance areas, you can limit your downside risk while still allowing room for the market to move in your favor. It is important to regularly review and adjust these levels as the market conditions change in order to maintain effective risk management throughout your trades.

Reviewing Real-Life Examples and Case Studies

Take a moment to delve into the world of real-life trading examples and case studies, where you can witness firsthand how risk management strategies like setting stop loss orders and calculating position sizes have helped traders navigate the unpredictable market waters. By analyzing stock market trends and evaluating cryptocurrency investments, traders can gain valuable insights into potential opportunities and risks.

For example, let’s consider a case study where a trader identified an Adam and Eve pattern forming in a stock chart. This pattern indicates a potential trend reversal, with the initial drop resembling an Adam’s apple followed by a rounded bottom resembling an Eve’s apple. Through careful analysis of this pattern, the trader could plan their entry and exit points accordingly, managing their risk effectively. Real-life examples like these offer practical lessons on how to trade using the Adam and Eve pattern while considering market dynamics and applying sound risk management strategies.

Frequently Asked Questions

What are the common mistakes to avoid when trading using the Adam and Eve pattern?

To effectively trade using the Adam and Eve pattern, it’s important to avoid common mistakes such as not properly identifying the pattern, ignoring other technical indicators, and failing to set proper stop-loss levels. Stay vigilant and use a systematic approach for successful trading.

How long does it usually take for the Adam and Eve pattern to form?

The formation of the Adam and Eve pattern can vary depending on several factors, such as market conditions and timeframe. Beginners can use trading strategies like identifying key support and resistance levels to trade using this pattern effectively.

Can the Adam and Eve pattern be applied to different timeframes?

Yes, the Adam and Eve pattern can be applied to different timeframes. Trading with patterns, such as the Adam and Eve pattern, can provide benefits like increased accuracy in identifying potential entry and exit points in the market.

Are there any specific market conditions where the Adam and Eve pattern is more effective?

The effectiveness of the Adam and Eve pattern depends on market conditions. It tends to perform better in trending markets, where there is a clear upward or downward movement. It can be applied to different asset classes like stocks and forex.

What are some alternative trading strategies that can be used in conjunction with the Adam and Eve pattern?

To enhance your trading strategy with the Adam and Eve pattern, consider combining it with other chart patterns. Alternative strategies can include using trendlines, Fibonacci retracements, or candlestick patterns to confirm signals provided by the Adam and Eve pattern.