Have you ever wanted to know how trading works? Are you interested in entering the world of finance and investing but don’t know where to start? Supply and Demand Trading is a great way to begin understanding market dynamics. This article will provide an easy-to-follow guide on how supply and demand affects trading, helping beginners gain insight into this complex field.

Have you ever wondered why stocks go up or down in value? The answer lies within the concept of supply and demand. When there is more demand for a stock than supply, prices increase as investors compete for the few available shares. On the other hand, when there are more sellers than buyers, prices drop due to lack of competition among buyers. Understanding these dynamics can help traders make educated decisions on which stocks to buy or sell.

With knowledge about how supply and demand impacts trading, one can become a master investor! By reading our beginner’s guide to understanding market dynamics through Supply and Demand Trading, you can become well-informed about what goes into making successful trades. So get ready—it’s time to learn all about the fascinating world of money management!

Definition of Supply And Demand Trading

Supply-demand trading is an essential concept to understand when it comes to market dynamics. It’s a method of evaluating market sentiment and analyzing price movements in the financial markets. Supply and demand trading takes into account both buyers and sellers, along with their respective prices at which they are willing to transact. This type of analysis can provide traders with insight on potential entry or exit points for trades, as well as how much risk should be taken in order to maximize profits.

Stop loss orders are also important parts of supply-demand trading. They help protect traders from undesirable losses by setting predetermined levels at which positions will be closed if the market moves against them. These orders allow traders to keep their risks under control while still allowing them to take advantage of profitable opportunities that may arise during periods of high volatility.

Understanding supply-demand trading provides investors with a powerful tool for making informed decisions about their investments. By learning more about this technique, investors can better manage their portfolios and make smarter decisions when it comes to entering or exiting the markets.

Basic Principles Of Supply And Demand Trading

Supply and demand trading is a popular strategy used by many traders to understand market dynamics. This type of trading relies on the basic principles of economics – that prices are determined by supply and demand, or how much buyers and sellers are willing to pay for an asset at any given time. By understanding these principles, traders can capitalize on opportunities in the markets when they arise.

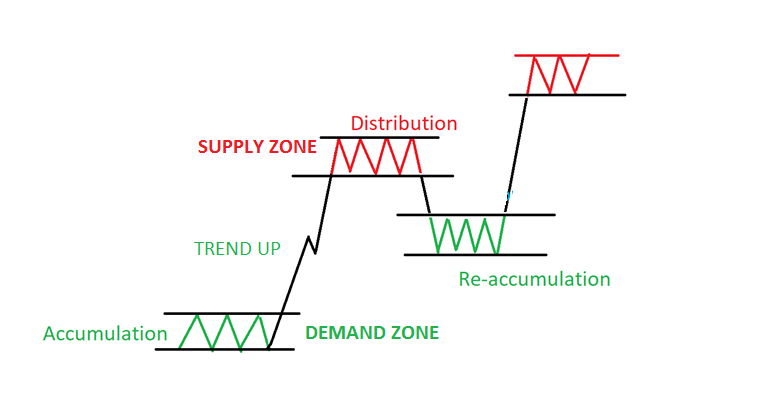

The key concept behind supply-demand trading is identifying areas where there is either an excess of supply or too little demand. For example, if the price of a stock suddenly drops due to news reports or other factors, this could create an opportunity for buying as there may be more potential buyers than sellers at that moment. Similarly, if a stock starts to rise rapidly due to some positive news about the company, it might be wise to sell as soon as possible before oversupply causes prices to fall again.

| Principles of Supply and Demand Trading |

|---|

| – Prices move in trends |

| – Supply and demand are the key factors that move markets |

| – Price action reflects market psychology |

| – Support and resistance levels indicate areas of supply and demand |

| – Trends can be confirmed by price action and volume |

| – Trading with the trend increases the chances of success |

| – Risk management is essential to long-term profitability |

| – A trading plan is necessary for consistent results |

Traders also use different types of trading strategies such as trend following and scalping which involve analyzing charts and making decisions based on trends in order to take advantage of short-term movements in the markets. Additionally, traders must also consider fundamental elements such as economic indicators, geopolitical events and earnings releases when developing their own unique trading strategies. These all play important roles in determining price action within specific markets as well as overall market sentiment. By taking into account all available information related to a particular asset or currency pair, successful traders can make informed decisions regarding when it’s best buy/sell assets or currencies.

In summary, understanding the basics of supply-demand trading can help you gain insights into market dynamics so that you can develop profitable trading strategies with greater confidence.

How To Identify Supply And Demand Levels

Once a trader understands the basics of supply and demand trading, they can move onto learning how to identify supply and demand levels in the market. Identifying these levels is essential for any successful trade strategy. Here are some tips on how to start:

- Observe price behavior – By observing the movement of prices, traders can often spot when there is an imbalance between buyers and sellers which indicates either high demand or oversupply.

- Analyze trendlines – Trendlines provide valuable insight into potential support and resistance levels where trades may enter or exit depending on whether it’s a bullish or bearish market.

- Monitor news events – Paying close attention to economic reports, earnings releases and other important news stories can help traders stay ahead of the curve when trying to anticipate future market movements.

When identifying supply and demand levels, it’s important to remember that all markets will have varying degrees of both at different times. As such, traders should look for patterns that repeat themselves through time in order for them to be profitable with their trading strategies. With enough practice, traders will eventually be able to recognize opportunities before others do so they can capitalize on them quickly and efficiently.

Analyzing Market Sentiment

Analyzing market sentiment is an important part of understanding the dynamics of supply and demand trading. By analyzing market sentiment, traders can gain insight into how others are viewing a particular security or asset class, which can help inform their own trading decisions. Sentiment analysis techniques involve collecting data about the public’s view on a certain security or asset class, such as news reports, social media posts, analyst opinions, and other forms of communication.

Sentiment analysis tools are used to collect this information from various sources in order to analyze it for insights into investor sentiment. There are several types of sentiment analysis indicators that traders use to measure market sentiment. These include volume indicators (such as open interest), price action (such as technical patterns), and fundamental factors (such as economic data). Each type of indicator provides different levels of insight into investor sentiment.

| Analyzing Market Sentiment in Supply and Demand Trading |

|---|

| – Market sentiment is the overall feeling or mood of investors towards a particular asset or market |

| – Sentiment can be bullish (positive), bearish (negative), or neutral |

| – Sentiment can be analyzed using technical analysis, news, social media, and other sources |

| – Positive sentiment can lead to increased demand and higher prices, while negative sentiment can lead to decreased demand and lower prices |

| – It is important to combine sentiment analysis with other factors, such as supply and demand levels, to make informed trading decisions |

| – Sentiment can change quickly, so it is important to stay up-to-date with the latest news and developments in the market |

In addition to these traditional methods, there are also automated sentiment analysis systems available today. These systems utilize machine learning algorithms and natural language processing technology to collect large amounts of data from multiple sources and then process them in order to identify key trends and sentiments related to specific securities or asset classes. This allows traders to gather more detailed insights than they could otherwise get with manual analysis alone.

By utilizing both traditional methods and advanced automation technologies, traders can better understand the current state of the markets so they can make smarter trades accordingly.

Technical Analysis Tools

Now that we’ve discussed the importance of analyzing market sentiment when engaging in supply and demand trading, let’s take a look at some of the technical analysis tools available. Technical analysis involves using charts to identify patterns that may indicate future movements in price or volume. Here are five key technical analysis tools to consider:

- Support & Resistance Levels – This is used to anticipate where prices will find support (buyers) and resistance (sellers).

- Trend Lines – Identifying upward, downward, and sideways trends by connecting highs and lows over time can help traders spot potential entry/exit points for trades.

- Moving Averages – By calculating an average of past data points over a period of time, this tool helps traders understand if current prices are above/below their historical averages.

- Relative Strength Index (RSI) – This measures how quickly prices have changed within a given period and indicates whether they’re overbought or oversold.

- Stop Loss Orders – Placing these orders allows investors to limit their losses on any single trade without having to monitor it constantly.

These technical analysis tools can be used to better understand market dynamics and give traders an edge when making decisions about buying or selling securities based on supply and demand levels. They provide valuable insights into short-term price changes as well as long-term trends, enabling traders to make informed choices about where they should place stop loss orders. With careful consideration of both market sentiment and technical analysis tools, you’ll be well equipped with the knowledge needed to enter the world of supply and demand trading!

Setting Stop-Loss Orders

Stop-loss orders are an essential part of any successful trading strategy. Setting stop-loss orders can help you limit your losses and protect your capital in the event that a trade goes against you. Stop-loss orders allow traders to control their risk exposure by establishing predetermined points at which they will close out their position, no matter what the market conditions may be.

| Setting Stop-Loss Orders in Supply and Demand Trading |

|---|

| Principles |

| A stop-loss order is an instruction to automatically sell an asset if it reaches a certain price level |

| Stop-loss orders are used to limit potential losses in case the market moves against a trader’s position |

| Stop-loss orders can be set at key levels of support or resistance to minimize losses |

| Setting stop-loss orders too close to the entry price can result in getting stopped out too soon, while setting them too far can lead to greater losses |

| Traders should use technical analysis to identify key support and resistance levels for setting stop-loss orders |

| Stop-loss orders should be adjusted as the market moves to maintain an appropriate level of risk management |

When setting a stop-loss order, it is important to consider both short term price fluctuations as well as long term trends in the market. Short term volatility should not affect your overall strategy or take precedence over longer term pricing trends. The ideal stop loss level should be based on sound technical analysis and set just outside a key support or resistance level. This way, even if there is temporary movement beyond this point, the trader’s position will still remain protected from major losses due to sudden price swings.

It is also important to keep up with news related to the asset being traded and adjust stop-loss levels accordingly when new information becomes available. A good rule of thumb for traders is to always keep their stops within reasonable proximity of current prices so that sudden movements don’t cause them to lose large amounts of money quickly without having sufficient time for intervention. By following these rules and using effective strategies such as setting stop-loss orders, traders can maximize profits while minimizing potential losses from trades gone wrong.

Risk Management Strategies

Risk management is an essential part of supply and demand trading. It involves taking steps to ensure that your investments are as safe as possible while still providing you with the opportunity for growth. Money-management strategies can help protect against market volatility by ensuring that your investment capital is not exposed to too much risk at any given time. Risk tolerance should also be taken into consideration, which means understanding how much risk you’re comfortable taking on a trade before committing funds.

Stop-loss orders are one way traders manage their risks in volatile markets. A stop-loss order instructs your broker or exchange to automatically close out a position when it reaches a certain price level determined by the trader, protecting them from further losses if prices move unexpectedly. These orders are typically placed just above support levels so that traders don’t have to monitor the market constantly and can sleep soundly knowing they won’t suffer huge losses beyond what they’ve planned for.

It’s important to realize that no amount of risk-management strategy can guarantee success in any type of investing; however, having a plan in place will help minimize potential losses and keep you focused on achieving long-term goals. With proper planning and execution, effective risk management strategies can go a long way towards helping traders stay profitable over time despite market volatility.

Frequently Asked Questions

What Is The Minimum Capital Required For Supply And Demand Trading?

When it comes to supply and demand trading, one of the most important questions is what is the minimum capital required? It’s essential for traders to be aware of the amount of money they need before beginning to trade. This will help them determine which forms of trading are suitable for their financial situation.

The amount of minimum capital needed for supply and demand trading depends on a variety of factors, such as the type of account being opened. Generally speaking, opening a basic trading account requires less capital than other more advanced accounts. The market dynamics also play an important role in determining the amount that needs to be invested. Supply and demand can significantly affect prices; investors should take this into consideration when deciding how much money is necessary for successful trades.

Finally, different types of trading have different requirements regarding the minimum capital needed. Options trading, futures contracts and margin accounts all require various amounts depending on the brokerage firm chosen. Understanding these differences can help ensure that traders enter each form of trading with sufficient funds to succeed financially.

What Is The Best Way To Determine The Entry And Exit Points For A Trade?

Determining the best entry and exit points for a trade is an important part of successful trading. This involves understanding how to identify when it’s time to enter or exit from a position in order to maximize profits and minimize losses. In supply and demand trading, knowing when to buy or sell can be especially tricky due to the volatility of the market. To determine the optimal entry and exit points, traders need to consider factors such as price action, volume, momentum, support/resistance levels, news events, etc.

One way traders can use these elements to their advantage is by opening a trading account with a reputable broker that provides access to real-time data and analysis tools. By doing this, they’ll be able to monitor price movements more closely and make well-informed decisions on when it’s time to enter or exit a trade. Moreover, some brokers also offer automated systems which allow traders to set up their own criteria for entering and exiting trades based on chart patterns or other technical indicators.

Ultimately, the best way for traders to determine their entry and exit points will depend on their individual risk appetite as well as their knowledge of the markets. Those who are new to supply and demand trading should start out by practicing on virtual accounts before investing any real money into live trades. As they gain experience over time, they’ll begin developing their own strategies that work best for them in different market conditions – allowing them to make smarter decisions about when it’s time jump into or out of positions within the market.

How Often Do I Need To Monitor The Market For Supply And Demand Shifts?

Monitoring the market for supply and demand shifts is an essential part of successful trading. Knowing when to enter and exit trades relies on having a good understanding of how often these shifts can occur in the markets. To be able to make informed decisions, it’s important to know how frequently one needs to monitor the market for changes.

Market analysis provides insight into determining which times are best suited for monitoring the market. Trend analysis, charting, and technical indicators are just some of the tools that traders use to identify opportunities for entering or exiting positions. By looking at historical data, traders can gain an understanding of what kind of frequency is necessary when monitoring the markets for potential supply or demand shifts.

In addition to analyzing past trends, it’s also important to pay attention to current events that could potentially affect liquidity or pricing in certain assets. For example, if there’s news about new regulations coming out related to a particular asset class, this could cause significant fluctuations in its price due to those effects taking place within moments after such news breaks – meaning that frequent monitoring would be needed during these kinds of scenarios.

For short-term traders who aim to capitalize on quick swings in prices with high-frequency strategies, more frequent monitoring may be required than those who hold their positions longer-term and don’t need as much detailed information from shorter time frames. Ultimately, each trader should determine what works best for them based on their individual goals and risk tolerance levels.

What Type Of Trading Account Should I Use For Supply And Demand Trading?

When it comes to supply and demand trading, selecting the right trading account is one of the most important decisions a beginner can make. A good understanding of market dynamics is essential for making an informed decision about which type of trading account works best for your individual needs. In this guide, we’ll explore the different types of trading accounts available and provide some tips on how to choose the perfect one for you.

The first step in choosing a trading account is deciding what kind of features you need. Do you need access to advanced charting tools? Are you looking for low commissions? Each broker offers its own set of features and benefits, so be sure to read through all the fine print before committing to any single provider.

Here are three things you should consider when selecting a supply and demand trading account:

- Commissions: Different brokers will offer varying commission rates, but typically these fees range from 0-3%. Be aware that higher commissions may impact your overall return on investment (ROI).

- Trading Platforms: Most brokers offer their own proprietary platform as well as third-party platforms like MetaTrader or NinjaTrader. It’s important to research each platform thoroughly and determine which one suits your particular style of trading best.

- Research Tools & Resources: Many traders rely heavily on technical analysis tools such as charts and indicators, while others prefer fundamental analysis with news feeds and economic calendars. Make sure the broker you select provides the resources needed to execute successful trades based on your preferred strategy.

It’s also worth researching customer service options offered by potential brokers; after all, if something goes wrong during a trade execution then having reliable support will be invaluable. Ultimately, finding a supply and demand trading account that meets all your needs isn’t always an easy task – but taking the time to do proper due diligence beforehand will pay off in spades over time!

What Are The Advantages And Disadvantages Of Supply And Demand Trading Compared To Other Forms Of Trading?

When it comes to trading, there are many different options and strategies that can be used. One of the most popular is supply and demand trading. This type of trading involves analyzing market trends in order to find potential opportunities for profitability. While this form of trading may offer some advantages compared to other types, there are also disadvantages that should be taken into consideration before investing.

One advantage of supply and demand trading is its ability to identify profitable opportunities quickly. By studying the dynamics between supply and demand, traders can spot areas where prices have moved too far away from their equilibrium levels and take advantage of these shifts by entering trades at certain points. Additionally, since this strategy does not require large capital investments like traditional stock or forex markets do, it can be a great way for beginners to start out with minimal risk.

On the downside, however, there is still an element of risk involved when using this kind of strategy. Since the activity relies heavily on accurate analysis and predictions about future price movements, any incorrect decisions could lead to losses rather than gains. Furthermore, due to the nature of these markets being highly volatile, even those who are experienced in this style of trading may encounter difficulty navigating them without incurring unexpected losses.

In summary, understanding how supply and demand affect each other can help traders make better-informed decisions regarding what positions they should enter into and when they should exit them in order to maximize their profits while minimizing losses as much as possible. It’s important to weigh up both sides carefully before deciding if this type of trading is right for you.

Conclusion

In conclusion, supply and demand trading can be a great way to get started in the market. With an understanding of the basics, including minimum capital requirements and strategies for entry and exit points, traders can gain valuable insight into the dynamics of the market. Monitoring shifts in supply and demand on a regular basis is key to successful trading. Additionally, selecting the right type of trading account is essential for achieving optimal results when engaging in this form of trade. All things considered, there are both advantages and disadvantages associated with this form of trading that one should consider before taking part. With proper planning and preparation, though, you can make smart decisions which will hopefully lead to profitable trades!