In the vast realm of financial markets, traders are constantly in search of tools that can provide valuable insights into market dynamics. Like a seasoned detective, they seek indicators that can unravel the mysteries of price movements and help them make informed trading decisions. One such tool that has gained popularity among traders is the Relative Vigor Index (RVI). This indicator, akin to a magnifying glass, allows traders to size up the market’s pep by measuring the strength behind price moves.

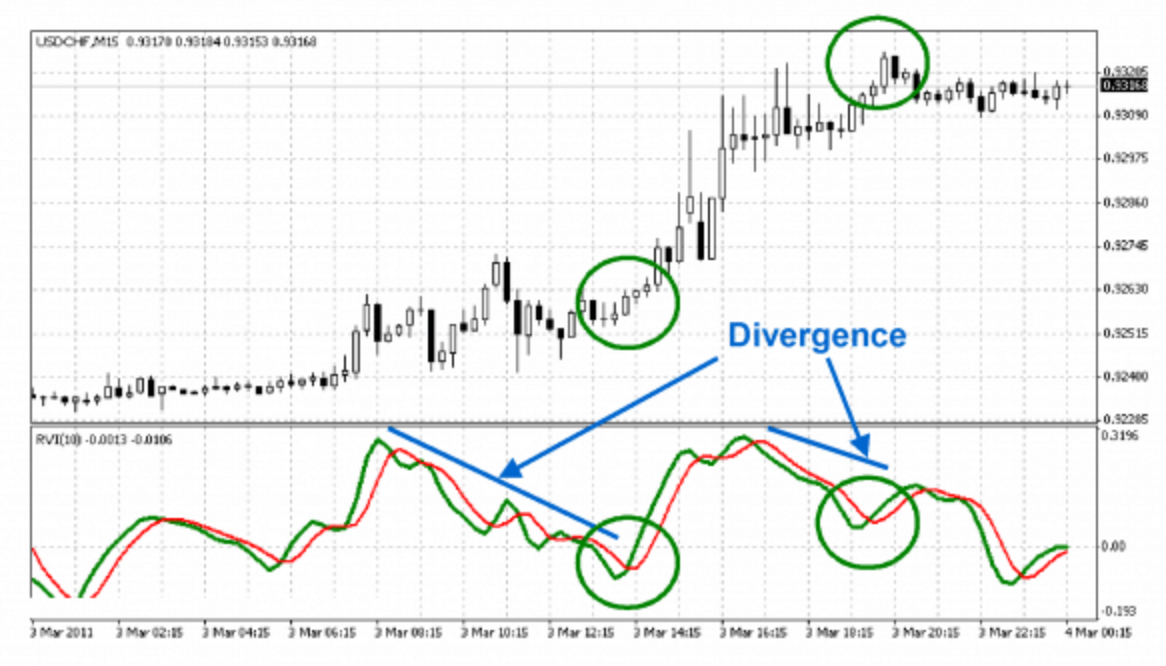

The RVI is a leading indicator that compares the closing and opening prices, shedding light on the market’s bullish or bearish character. By calculating the difference between these prices and normalizing them to the trading range, the RVI provides a smoothed value using a Simple Moving Average (SMA). Additionally, a signal line is created using a FIR filter, allowing traders to identify market changes through crossovers between the green and red lines.

While the RVI can be a powerful tool, it is not without its limitations. False signals can occur, making it imperative for traders to combine the RVI with other indicators to increase confidence in their trading decisions. By doing so, traders can harness the enhanced features of MetaTrader Supreme Edition, offered by Admirals, an award-winning broker, to gain real-time market data and insights from trading experts. With the RVI as their ally, traders can navigate the market with a heightened sense of awareness and precision.

Key Takeaways

- The Relative Vigor Index (RVI) is an oscillator that measures the strength behind a price move.

- RVI predicts the market’s tendency to continue in the same direction or reverse.

- RVI is a leading indicator that helps predict market movement.

- RVI values are calculated by finding the difference between closing and opening prices, normalized to the trading range.

What is RVI (Relative Vigor Index)?

The Relative Vigor Index (RVI) is a leading oscillator that measures the strength behind price movements and predicts the market’s tendency to continue in the same direction or reverse, based on the comparison of closing and opening prices to determine bullish or bearish market character. One of the pros of using RVI in trading is that it provides clear signals for trading through its signal line, making it easier for traders to identify potential entry and exit points.

Additionally, RVI is a leading indicator, which means it can provide early signals of potential market reversals or continuations. However, there are also some cons to consider. RVI may provide false signals, so it is recommended to combine it with other indicators to increase confidence. Furthermore, when comparing RVI to other leading indicators, it is important to consider factors such as the specific market being traded, the time frame of the chart, and the trader’s individual trading strategy.

Relative Vigor Index: Calculation and Interpretation

Calculation and interpretation of the RVI involves analyzing the relationship between closing and opening prices, providing valuable insights into market momentum and potential reversals. The RVI calculation method is similar to the Stochastic Oscillator, as it compares the closing price to the opening price and normalizes it to the trading range. This allows traders to gauge the strength behind a price move and predict whether the market will continue in the same direction or reverse.

In trading, RVI values are smoothed using a Simple Moving Average (SMA), and a signal line is created by applying a FIR filter to the RVI values. Crossovers between the green and red lines indicate market changes, providing clear signals for trading. However, it is important to note that RVI may provide false signals, so combining it with other indicators can increase confidence in trading decisions.

The RVI is calculated using the following steps:

- Gather the required data:

- Closing price (CP) for each period (e.g., day, week, hour).

- Opening price (OP) for each period.

- High price (H) for each period.

- Low price (L) for each period.

- Calculate the Typical Price (TP) for each period: TP = (CP + H + L) / 3

- Calculate the Simple Moving Average (SMA) of the Typical Price over a specified period (usually 10 periods): TP_SMA = Sum of TP for last ‘n’ periods / ‘n’

- Calculate the RVI using the formula: RVI = (TP_SMA_today – TP_SMA_n_periods_ago) / (TP_SMA_today + TP_SMA_n_periods_ago) * 100

Where:

- TP_SMA_today is the Simple Moving Average of the Typical Price for the current period.

- TP_SMA_n_periods_ago is the Simple Moving Average of the Typical Price ‘n’ periods ago.

Once you have the RVI value, you can interpret it as follows:

- RVI above 50: Indicates a bullish trend (positive momentum) in the market.

- RVI below 50: Indicates a bearish trend (negative momentum) in the market.

- RVI near 50: Suggests a lack of clear trend or a market in a consolidation phase.

Traders may use the RVI in combination with other technical indicators and chart patterns to make more informed trading decisions. It’s important to note that no indicator is foolproof, and using multiple indicators can help improve overall analysis and reduce false signals.

Here’s a sample table to illustrate the calculation and interpretation of the Relative Vigor Index:

| Period | Closing Price (CP) | High (H) | Low (L) | Typical Price (TP) | Typical Price SMA (10 periods) | RVI |

|---|---|---|---|---|---|---|

| Day 1 | 100 | 105 | 98 | (100 + 105 + 98)/3 | – | – |

| Day 2 | 105 | 110 | 102 | (105 + 110 + 102)/3 | – | – |

| Day 3 | 102 | 108 | 100 | (102 + 108 + 100)/3 | – | – |

| Day 4 | 110 | 115 | 105 | (110 + 115 + 105)/3 | – | – |

| Day 5 | 115 | 120 | 112 | (115 + 120 + 112)/3 | – | – |

| Day 6 | 112 | 118 | 109 | (112 + 118 + 109)/3 | – | – |

| Day 7 | 118 | 122 | 115 | (118 + 122 + 115)/3 | – | – |

| Day 8 | 116 | 120 | 114 | (116 + 120 + 114)/3 | – | – |

| Day 9 | 122 | 126 | 118 | (122 + 126 + 118)/3 | – | – |

| Day 10 | 125 | 130 | 120 | (125 + 130 + 120)/3 | 110.4 | – |

| Day 11 | 130 | 135 | 126 | (130 + 135 + 126)/3 | 113.6 | 9.62 (sample value) |

Trading Strategies With Relative Vigor Index

One effective approach for utilizing the RVI in trading strategies involves combining it with other indicators to enhance trading signals and increase confidence in decision-making. By combining the RVI with other indicators, traders can obtain a more comprehensive view of market conditions and improve the accuracy of their trading signals. For example, the RVI can be used in conjunction with trend-following indicators such as moving averages to confirm the direction of the trend.

Additionally, the RVI can be combined with oscillators like the Stochastic Oscillator or the RSI to identify overbought or oversold conditions in the market. These combinations can help traders filter out false signals and improve the timing of their trades. Ultimately, by combining indicators with the RVI, traders can gain a better understanding of market dynamics and make more informed trading decisions.

Frequently Asked Questions

Can the Relative Vigor Index be used as a standalone indicator for trading decisions?

The Relative Vigor Index (RVI) cannot be used as a standalone indicator for trading decisions. While it provides clear signals, it has limitations such as false signals. Combining RVI with other indicators can improve trading signals and increase confidence. Strategies for optimizing RVI include using it in range-bound markets and testing it with other indicators.

How can the Relative Vigor Index be customized in MetaTrader 4?

The Relative Vigor Index (RVI) in MetaTrader 4 can be customized by changing the period and colors of the lines. This allows traders to adapt the indicator to their preferences. Customization options enhance usability and make it easier to interpret signals. The RVI offers benefits in trading as a leading indicator, helping to predict market movement and providing clear trading signals through its signal line. By incorporating the RVI with other indicators, traders can improve their trading signals and increase confidence in their decisions.

What are some common false signals that the Relative Vigor Index may provide?

Common false signals that the Relative Vigor Index (RVI) may provide include crossovers that do not result in actual market changes, as well as signals that fail to accurately predict the market’s tendency to continue or reverse. These limitations and drawbacks highlight the need for caution when relying solely on RVI for trading decisions.

Are there any limitations or drawbacks to using the Relative Vigor Index?

The Relative Vigor Index (RVI) has some limitations and drawbacks. It may provide false signals, especially in volatile markets. Additionally, RVI is a leading indicator and may not accurately predict market reversals. Traders should consider using other indicators for confirmation.

Can the Relative Vigor Index be used in conjunction with other leading indicators for more accurate trading signals?

Combining the Relative Vigor Index with Moving Averages can enhance trading signals by providing confirmation of market direction. Additionally, the Relative Vigor Index can be used to identify divergence patterns, which can indicate a potential reversal in the market.