The electric vehicle (EV) industry is rapidly evolving, and there’s no better example than Mullen Automotive. Its stock price has skyrocketed in the past year, driving up investor interest. But what does the future hold for this company? Will it continue to be a leader in the EV industry or will its stock price drop? In this article, we will analyze Mullen Automotive’s stock price prediction for 2025 and explore the potential of the EV industry going forward.

The EV sector has seen tremendous growth in recent years, making it one of the most attractive investments on the market. The trend towards green technology, combined with increasing government regulations, have made EVs a viable option for many consumers. As a result, automakers are investing heavily in new models and technologies to keep up with demand.

Mullen Automotive is at the forefront of this revolution. It has been producing high-performance EVs since 2018 and recently announced plans to expand their lineup even further. With their innovative approach and commitment to quality products, it’s no wonder why investors are so bullish on Mullen Automotive’s future prospects. We’ll take a closer look at how these factors could affect their stock price prediction for 2025 and beyond.

Mullen Automotive Stock Price Prediction 2025: Forecasting Models

Forecasting models can be used to predict Mullen’s stock price by 2025. These models are typically based on economic and market data, as well as any other related factors that may influence the company’s performance. For instance, if there is an increase in demand for electric vehicles (EVs), then this could lead to increased investment in Mullen’s EV production and higher stock prices. Additionally, if the EV industry continues its current growth trajectory, then the demand for Mullen’s vehicles could lead to an increase in their stock price.

| Year | Prediction | Change |

|---|---|---|

| 2024 | $0.170906 | 167.05% |

| 2025 | $0.449880 | 604.53% |

| 2026 | $1.205372 | 1,776.08% |

| 2027 | $3.247440 | 5,035.51% |

| 2028 | $8.650288 | 13,381.72% |

| 2029 | $23.047604 | 35,873.52% |

| 2030 | $60.970944 | 96,803.27% |

In order to accurately forecast Mullen’s stock price by 2025, several different types of forecasting models can be employed. These include econometric models such as regression analysis and time series analysis, which use historical data to predict future movements in the stock price. Other types of forecasting models rely on expert opinion or market sentiment surveys to determine how investors feel about the company’s prospects. Finally, financial statement analysis can also be used to assess the company’s financial health and make more accurate predictions about its future performance.

Overall, many different forecasting models can be used to forecast Mullen’s stock price by 2025. Each model has its own strengths and weaknesses and should be carefully evaluated before making a decision about which one is best suited for predicting Mullen’s future performance. By analyzing these various models and taking into account all relevant factors, it is possible to make educated predictions about how much Mullen’s stock will cost in 2025 and beyond.

Current EV Market Overview

The current electric vehicle (EV) market is growing rapidly, with more and more manufacturers investing in the technology. Governments around the world are incentivizing EV adoption, providing tax credits and other financial incentives to consumers who purchase electric cars. As a result, the global EV market is expected to reach $560 billion by 2025. This growth is driven primarily by consumer demand for environmental sustainability and lower operating costs.

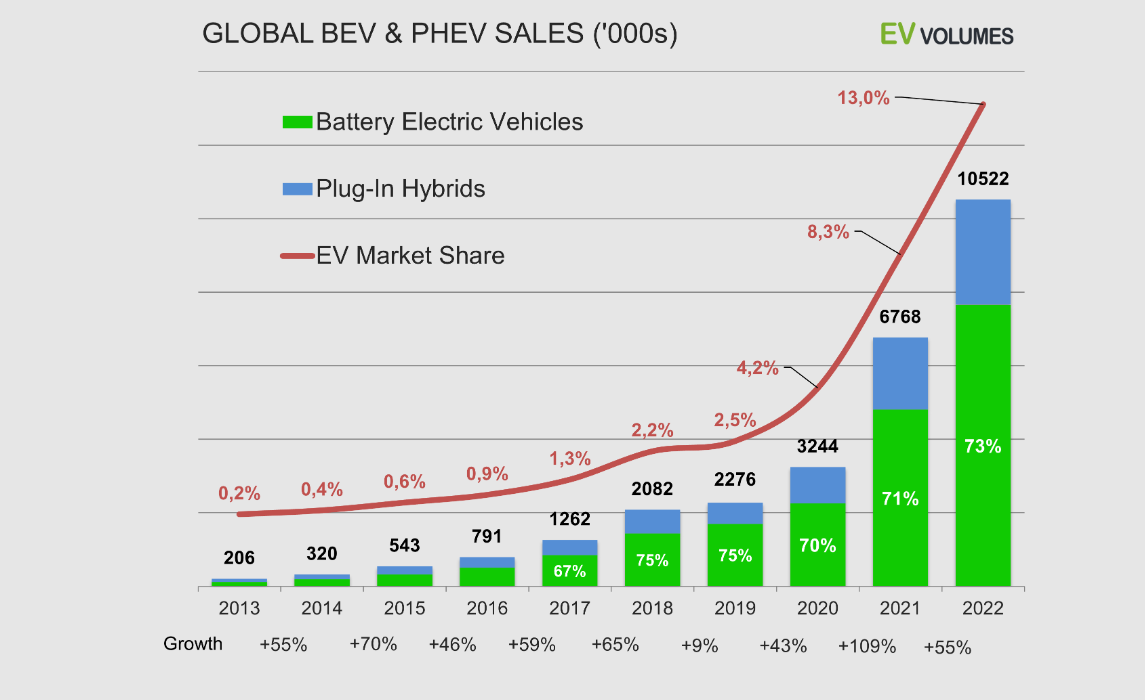

Image Credits: https://www.ev-volumes.com/

At present, battery-electric vehicles (BEVs) constitute the majority of the EV market, followed by plug-in hybrid electric vehicles (PHEVs). BEVs are powered solely by electricity and require a charge from an external power source such as a wall socket or charging station. PHEVs combine both internal combustion engines and electric batteries, allowing drivers to switch between fuel sources depending on their needs. The increasing availability of public charging stations has also helped spur growth in this sector.

In 2020 alone, global sales of EVs grew nearly 50%, despite economic uncertainty due to the pandemic. Models like Tesla’s Model 3 have become especially popular in recent years due to their range capabilities and advanced features such as autopilot. This trend is expected to continue over the next five years as automakers invest more into developing even more efficient models with longer ranges and faster charge times.

The future of EVs looks promising based on current trends, with increased investment from manufacturers resulting in more affordable options for consumers worldwide. More widespread adoption of EVs should contribute significantly to reducing emissions and helping address climate change issues in the long run.

Automotive Industry Trends Impacting Mullen

The automotive industry is undergoing a major transformation, and the future of Mullen Automotive’s stock price depends heavily on the direction of that change. This section will analyze the current trends in the automotive industry and explore how they might influence the future of Mullen.

One major trend in the automotive industry is an increased focus on electric vehicles (EVs). Governments around the world have committed to transitioning away from gasoline-powered cars, creating a booming demand for EVs. This could be beneficial to Mullen as EVs are more expensive to produce than traditional gas-powered cars, meaning higher profit margins. On the other hand, there is also significant competition in this market which could negatively impact Mullen’s earnings if they can’t produce EVs of comparable quality at competitive prices.

| Automotive Industry Trends | Impact on Mullen |

|---|---|

| Electric Vehicle Adoption | Mullen’s focus on electric vehicle production positions it well to benefit from the growing trend of electric vehicle adoption. The company’s all-electric SUV, the MX-05, is set to begin production in 2022. |

| Autonomous Driving | Mullen has invested in autonomous driving technology through a partnership with Florida-based self-driving tech company, Plus.ai. This positions the company to potentially benefit from the growing trend of autonomous driving technology. |

| Supply Chain Disruptions | Like many companies in the automotive industry, Mullen has been impacted by supply chain disruptions related to the COVID-19 pandemic. These disruptions could impact the company’s ability to produce and deliver vehicles in a timely manner. |

| Government Regulations | Government regulations related to emissions standards and vehicle safety could impact Mullen’s production and sales. However, the company’s focus on electric vehicle production could position it well to meet changing regulations. |

| Consumer Demand for Sustainable Transportation | The trend towards sustainable transportation, including electric vehicles, could benefit Mullen’s production and sales if consumer demand for electric vehicles continues to grow. |

| Competition from Established Automakers | Mullen faces competition from established automakers who are also investing in electric and autonomous vehicle production. This could impact the company’s ability to gain market share in the electric vehicle market. |

Another trend that could have an effect on Mullen’s stock price is autonomous driving technology. Autonomous driving technology has been increasing in popularity as it offers drivers improved safety and convenience. Although this technology requires significant investments, it could potentially open up new revenue streams for Mullen if they can develop reliable self-driving systems that appeal to consumers.

Lastly, consumer preferences are constantly shifting towards more sustainable forms of transportation such as hybrids and electric cars. As the demand for environmentally friendly vehicles rises, companies like Mullen that already specialize in EVs will be well positioned to take advantage of this trend and benefit from higher sales figures as a result.

In short, there are numerous trends that may affect Mullen Automotive’s stock price in 2025 and beyond. While some factors may present opportunities for growth, others may lead to decreased profitability over time if not addressed properly. It remains to be seen how these trends will shape both the automotive industry and Mullen itself in the long run.

Factors To Consider When Predicting Mullen Automotive’s Stock Price

When predicting Mullen Automotive’s stock price in 2025, there are several factors to consider. First and foremost, the Electric Vehicle (EV) industry is rapidly evolving. As more countries adopt policies to increase EV adoption and reduce carbon emissions, automakers must develop new technologies to remain competitive. This could have a significant impact on Mullen’s stock price in the future.

| Factors to Consider |

|---|

| Electric vehicle market growth |

| Mullen’s production capacity and sales performance |

| Investment in autonomous driving technology |

| Government regulations and policies |

| Competitor actions and market trends |

| Global economic conditions |

| Consumer demand for sustainable transportation |

| Supply chain disruptions and raw material prices |

Another key factor is the increasing demand for EVs. With manufacturers introducing more models and features that appeal to consumers, sales of electric vehicles are expected to continue growing over the next five years. This could lead to increased profits for Mullen Automotive, which would likely result in a higher stock price.

Finally, investors should consider how other companies in the EV industry will affect Mullen’s performance. Companies such as Tesla, Volkswagen, and General Motors are all developing their own EVs and competing with each other for market share. If one of these companies gains an advantage over Mullen in terms of technology or pricing, it could put pressure on its stock price going forward. Therefore, keeping an eye on EV competition is important when forecasting Mullen’s stock price in 2025.

Mullen Automotive’s Historical Stock Price Analysis

To understand the future of Mullen Automotive’s stock price in 2025, it’s important to look at its historical performance. To get an idea of how the stock has performed over time, analysts can look at the company’s share price and volume data from the past few years. Analyzing these figures will help provide insight into potential trends and fluctuations in Mullen Automotive’s stock price moving forward.

By examining data from 2020, it is clear that Mullen Automotive’s share price was affected by the COVID-19 pandemic. The company saw a drastic decline in their stock price during the first half of 2020 due to the economic downturn caused by the pandemic. However, as news of vaccine distribution began to surface later in the year, there was a surge in investor confidence which resulted in an increase in share prices for many companies including Mullen Automotive.

For 2021, analysts predict that Mullen Automotive’s stock may continue to rise due to increased investment in electric vehicles (EVs). With government regulations and incentives driving consumers towards EVs, this shift has opened up new opportunities for EV manufacturers like Mullen Automotive which could result in higher returns for investors. Investors should also take into consideration uncertainties such as supply chain disruptions or changes in consumer demand when making predictions about Mullen Automotive’s stock performance for 2021 and beyond.

Analyzing historical stock price data can provide insight into potential future trends and fluctuations for any given company. By looking at past performance, investors can make informed decisions about which stocks they want to invest their money into while taking into account both positive and negative indicators.

Frequently Asked Questions

What Is The Expected Growth Rate Of The Ev Industry In 2025?

When it comes to predicting the growth of the electric vehicle (EV) industry in 2025, there are many factors to consider. It’s important to look at the current state of the EV industry, as well as potential trends that could influence its future growth rate. In this article, we’ll explore the expected growth rate of the EV industry in 2025 and what trends might affect it.

The current state of the EV industry is encouraging. According to recent research conducted by Navigant Research, global sales of EVs are expected to reach over 22 million vehicles by 2025. This is a significant increase compared to 2020 when only 2 million EVs were sold globally. This high growth rate is a testament to how quickly consumer demand for EVs has grown in recent years, and it demonstrates that the EV industry has a very promising future ahead of it.

When considering what could affect the expected growth rate of the EV industry in 2025, one trend that stands out is the increasing availability of charging infrastructure. The more charging stations available, the more likely people are to switch from traditional fuel-powered vehicles to EVs. Additionally, government incentives such as subsidies and tax credits can also help boost consumer demand for EVs and thus contribute towards their increased sales in 2025. Finally, advancements in battery technology will make EVs more affordable and accessible for consumers who want to drive an environmentally-friendly vehicle without having to compromise on performance or convenience.

These factors all point towards a bright future for the EV industry in 2025 and beyond. With global sales predicted to rise significantly over the next few years, it’s clear that consumers will be increasingly turning towards EVs for their transportation needs and that this trend will continue into 2025 and beyond. As such, there’s no doubt that we can expect robust growth from this sector as we move closer towards 2026 and beyond.

How Will New Technology Impact Mullen’s Stock Price?

Considering the current H2, it’s important to look at how new technology may influence Mullen’s stock price in 2025. As the EV industry continues to grow, so too do the possibilities for innovations that could affect stock prices. It’s important to understand how these advancements in technology could affect Mullen’s share prices and prepare accordingly.

The introduction of new technologies can bring both positive and negative effects on a company’s stock price. Positive effects include increased efficiency, better product offerings, and improved customer satisfaction; all of which can lead to higher share prices. On the other hand, if a company fails to incorporate new technologies into their operations in a timely manner they risk suffering from lower stock prices due to decreased market competitiveness.

Mullen needs to be aware of any potential changes in the EV industry that could affect their stock price and take steps accordingly. This could involve researching new technologies and investing in research and development initiatives that will benefit them in the long run. Additionally, they should consider ways to make sure their products remain competitive with those of their competitors by staying up-to-date on technological advances as well as trends in customer preferences. Ultimately, by being prepared for potential changes in the EV industry Mullen can ensure their stock price remains stable or potentially increases over time.

In order for Mullen to successfully predict their stock price in 2025 they must be aware of how new technologies may impact them positively or negatively and take proactive steps towards addressing those changes now. By monitoring developments within the industry and making informed decisions regarding investments, Mullen can position themselves for success when it comes time for their 2025 predictions.

What Specific Strategies Should Investors Use To Maximize Returns On Mullen Stock?

Investing in the stock of any company is a risky venture, and it can be especially tricky to try and predict future prices. With Mullen Automotive Stock Price Prediction 2025: Analyzing the Future of the EV Industry in mind, investors must consider what strategies they should use to maximize their returns on this particular stock.

One strategy that investors should use when investing in Mullen’s stock is to stay informed about relevant industry news. As electric vehicles become more popular, new technologies are constantly being developed which could have a significant effect on Mullen’s stock price. Keeping up with the latest advancements in this sector will help investors understand how their investments might be affected.

Another strategy investors should use when investing in Mullen’s stock is to diversify their portfolio. This means they shouldn’t put all of their eggs into one basket; instead, they should spread out their investments across multiple stocks from different industries to minimize losses if one of those stocks takes a dip. Additionally, staying diversified helps investors take advantage of sudden shifts in the market or changes in consumer behavior that can cause certain stocks to skyrocket or plummet unexpectedly.

Investors looking for maximum returns on Mullen’s stock should also research and understand the company itself before investing. A thorough understanding of its operations, products, competitors, and financials will help them make better decisions when it comes time to buy or sell shares of the company’s stock. In addition, they may want to look into any potential conflicts of interest between Mullen and other companies within the same industry as these types of relationships can have an impact on the share price as well.

By following these strategies and keeping abreast of industry news, investors can increase their chances of achieving maximum returns on Mullen’s stock price predictions for 2025. It is important for them to remember that even though there are risks associated with any investment opportunity, taking thoughtful steps towards making wise decisions can help them achieve success over time.

How Will Changes In Consumer Preferences Affect Mullen’s Stock Price?

Investing in stock can be a lucrative way to make money, but it also carries risk. Understanding how consumer preferences may affect a company’s stock price is key for investors looking to maximize returns. With this in mind, the question of how changes in consumer preferences could affect Mullen’s stock price is an important one.

By considering what consumers are likely to prefer in the future, investors can better gauge potential changes in Mullen’s stock price. For instance, if electric vehicles (EVs) become increasingly popular, investors will want to pay attention to Mullen’s progress in the EV industry. If Mullen is able to successfully compete with other automakers and produce EVs that are both affordable and popular with customers, then their stock price could increase significantly over time. On the other hand, if Mullen fails to meet consumer demand for EVs or does not produce EVs that are competitively priced compared to those from other automakers, then their stock price could suffer as a result.

At the same time, it is important for investors to consider other factors that may influence consumer preferences in addition to EVs. For example, technological advancements such as autonomous driving or advanced infotainment systems may drive some customers away from traditional vehicles and towards more high-tech alternatives offered by Mullen or its competitors. Understanding these trends and anticipating which ones may have an effect on Mullen’s stock price is key for any investor looking to maximize returns on their investment.

Ultimately, understanding how consumer preferences could impact Mullen’s stock price is essential for any investor looking to make informed decisions about their investments. By keeping an eye on the EV industry and other trends that could influence customer preferences, investors can better position themselves to maximize returns on their investments and prepare for potential changes in Mullen’s stock price.

What Are The Risks Associated With Investing In Companies In The EV Industry?

Investing in companies in the electric vehicle (EV) industry poses a variety of risks for investors. In this article, we’ll explore what these risks are and how they could impact an investment decision.

One risk to consider is the potential for government policy changes that could affect the EV industry. Government regulations can have a major impact on how companies operate in various markets, and if regulations become stricter or more expensive to comply with, this could reduce profits or otherwise make it difficult for companies to remain competitive. Additionally, new incentives or subsidies from governments could spur growth in the sector, creating opportunities for investors.

The second risk associated with investing in EV companies is technological change. As technology advances, new innovations can disrupt existing products and services. Companies must adapt quickly to keep up with changing trends and customer preferences, otherwise they risk being overtaken by competitors who are able to develop better products at lower costs. Furthermore, new technologies may open up entirely new markets or applications that can further increase returns on investment.

Finally, investors should also be aware of the potential for market volatility when it comes to investing in companies within the EV industry. The prices of stocks and other assets may fluctuate significantly due to changes in demand or supply, as well as external events such as natural disasters or political unrest. While careful research and analysis can help mitigate some of these risks, there is still an element of uncertainty involved with any type of stock market investment that should not be ignored.

Conclusion

In conclusion, investing in Mullen Automotive stock for the future is a risky yet potentially rewarding endeavor. As the EV industry grows and new technologies become available, investors should be aware of how those changes will impact Mullen’s stock price. By researching the company, understanding changes in consumer preferences, and implementing strategic investment strategies, investors can maximize returns on Mullen stock. However, it’s important to remember that there are risks associated with investing in companies within the EV industry that could lead to substantial losses. All in all, with proper analysis and research into both the EV industry and Mullen Automotive, investors can make informed decisions when deciding whether or not to invest in this company for 2025.