‘Buy low, sell high’ is a timeless adage that encapsulates the essence of trading. In the world of financial markets, traders are constantly searching for strategies that can help them identify potential trend reversals and profit from market fluctuations.

One such strategy is M and W pattern trading, which harnesses the power of price action to pinpoint entry and exit points. These patterns, resembling the letters M and W on a chart, offer traders the opportunity to capitalize on bullish or bearish setups.

With the advancements in pattern recognition technology, traders now have access to sophisticated tools like the XABCD Pattern Suite software, which accurately identifies these patterns. However, it is important to exercise caution, as false signals and market noise can sometimes cloud the picture.

To navigate these challenges, traders must develop an execution plan, practice risk management, and consider broader market conditions. This article aims to shed light on the world of M and W pattern trading, exploring its benefits, strategies, and the resources available to support traders in their journey.

Key Takeaways

- M and W pattern trading is based on price action forming shapes that resemble the letters M or W on a chart.

- M shaped patterns are bullish and indicate a potential long setup, while W shaped patterns are bearish and indicate a potential short setup.

- M and W patterns provide clear signals for potential trend reversals and have defined entry and exit points.

- The XABCD Pattern Suite software can help identify M and W patterns accurately and promptly.

What are M & W Patterns?

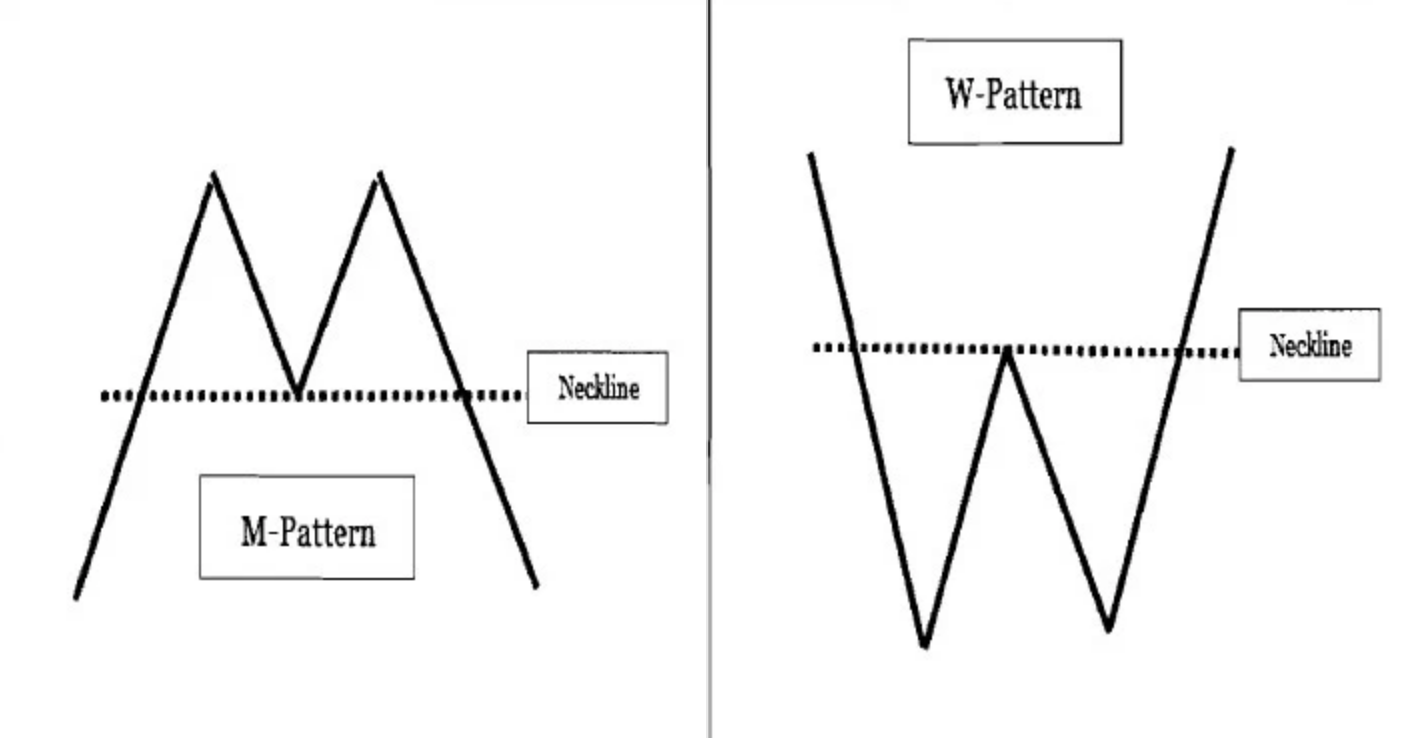

M and W patterns, also known as double tops or double bottoms, are price action formations that resemble the letters M or W on a chart, indicating potential tests of support or resistance levels.

These patterns can be seen as a form of technical analysis and are used by traders to identify potential trend reversals. M shaped patterns are considered bullish and indicate a potential long setup, while W shaped patterns are bearish and suggest a potential short setup.

It is important to note that M and W patterns differ from XABCD patterns, which have specific rules and ratios that need to be met.

To effectively trade M and W patterns, traders need to identify the 5 key points within the pattern and determine the direction of the trade based on the D point.

These patterns can be traded across different markets and timeframes, and can be combined with other indicators and analysis techniques to strengthen trading strategies.

Benefits of M & W Pattern Trading

One advantage of utilizing pattern trading techniques is the ability to identify potential trend reversals through the analysis of price action formations resembling specific shapes on a chart.

Pattern trading offers profit potential as these patterns provide clear signals for entry and exit points, allowing traders to take advantage of favorable risk-reward ratios.

By identifying M and W patterns, traders can anticipate potential long or short setups, depending on the pattern type.

Moreover, pattern trading also has psychological benefits as it helps traders follow a structured approach based on objective rules and ratios. This can help reduce emotional decision-making and increase discipline in trading.

However, it is important to note that false signals and market noise can occur, so traders need to be cautious and have a well-defined execution plan.

W & M Pattern: Identification and Validation

Pattern identification and validation involve the process of accurately recognizing and confirming the presence of specific price action formations on a chart, allowing traders to make informed decisions based on these patterns.

It is essential to have experience and practice in pattern trading to effectively identify and validate these patterns. This is because pattern identification can be prone to human error, and it requires a keen eye for detail and familiarity with various market conditions.

Additionally, broader market conditions play a crucial role in pattern trading. Traders need to consider factors such as overall market trends, volatility, and volume when analyzing and validating patterns. By incorporating these elements, traders can enhance their pattern trading strategies and increase their chances of success.

Entry and Exit Strategies (M & W Pattern)

An effective approach to engaging in pattern trading involves the development and implementation of well-defined entry and exit strategies that take into account the specific characteristics and nuances of the identified price action formations. When trading M and W patterns, it is important to have clear entry and exit points to maximize potential profits and minimize losses. Traders can use a combination of indicators, such as moving averages, trendlines, and support/resistance levels, to determine these entry and exit points.

Risk management is also crucial in pattern trading, as it helps traders protect their capital and avoid significant losses. This can be done by setting stop-loss orders at appropriate levels and adjusting them as the trade progresses. Having a predetermined exit strategy, such as taking profits at a certain price level or when a specific target is reached, is also essential in pattern trading. By incorporating these strategies and managing risk effectively, traders can increase their chances of success in pattern trading.

| Entry Strategies | Exit Strategies |

|---|---|

| – Use indicators to determine entry points | – Set stop-loss orders at appropriate levels |

| – Consider moving averages, trendlines, and support/resistance levels | – Adjust stop-loss orders as the trade progresses |

| – Look for confirmation signals before entering a trade | – Have a predetermined exit strategy |

| – Take into account the overall market conditions | – Take profits at a certain price level or when a specific target is reached |

| – Manage risk by setting proper position sizing and stop-loss levels | – Consider trailing stop orders to protect profits |

Combining with Other Indicators

When incorporating M and W patterns into trading strategies, traders can enhance their analysis by combining these patterns with other technical indicators. This allows for a more comprehensive approach to trend analysis and increases the accuracy of trade signals.

Here are three ways traders can combine M and W patterns with other indicators:

- Moving Averages: By using moving averages in conjunction with M and W patterns, traders can identify the overall trend direction and confirm pattern formations. This helps in determining the optimal entry and exit points for swing trading.

- Fibonacci Retracement: Fibonacci retracement levels can be used to validate M and W pattern formations and identify potential support or resistance levels. Traders can look for confluence between these levels and the pattern’s completion point to increase the probability of a successful trade.

- Oscillators: Oscillators such as the Relative Strength Index (RSI) or Stochastic can be used to confirm overbought or oversold conditions in conjunction with M and W patterns. This can help traders identify potential trend reversals and strengthen their trading strategies.

By combining M and W patterns with trend analysis and utilizing other indicators, traders can improve their decision-making process and increase the effectiveness of their pattern trading strategies.

Risk Management and Execution Plan

Risk management and execution plan are crucial elements in implementing a successful trading strategy. Developing a trading plan helps traders establish clear guidelines for entering and exiting trades, managing risk, and maximizing profits. It involves setting specific goals, determining position sizes, and defining stop-loss and take-profit levels. Traders should also consider their risk tolerance and adjust their position sizes accordingly.

Additionally, managing emotions during trading is essential. Emotions such as fear and greed can cloud judgment and lead to impulsive decision-making. Traders should have strategies in place to control emotions, such as taking breaks, practicing mindfulness, and sticking to their trading plan.

By effectively managing risk and emotions, traders can increase their chances of success and maintain a disciplined approach to trading.

Tools for Accurate M & W Pattern Trading

To accurately identify patterns in trading, utilizing advanced pattern indicators and software can be highly effective. These tools provide traders with a systematic and reliable approach to pattern identification, reducing the chances of human error.

One such advanced pattern indicator is the XABCD Pattern Suite software. This software is specifically designed to identify M and W patterns accurately and promptly. It helps traders map out the 5 points (X-A-B-C-D) within the pattern and determine the direction of the trade based on the D point.

The XABCD Pattern Suite software also offers additional features like the XABCD News indicator, which helps traders stay informed about market developments.

By incorporating these advanced pattern indicators into their trading strategies, traders can enhance their pattern identification process and make more informed trading decisions.

Educational Resources and Community Support

Educational resources and community support play a crucial role in enhancing traders’ understanding of pattern identification and providing a platform for sharing insights and questions. Engaging with a community of like-minded individuals allows traders to gain valuable knowledge and insights from others’ experiences.

Online platforms, such as XABCD Trading, offer a range of learning resources to support traders in their pattern trading journey. These resources include on-demand videos and live streaming sessions, which cover various aspects of pattern identification and trading strategies. Additionally, XABCD Trading provides a comprehensive course on XABCD Patterns, offering in-depth education on the topic.

The community engagement aspect is facilitated through the XABCD Chat Group, where traders can interact with one another, share their insights, and ask questions. This collaborative environment fosters a sense of camaraderie and provides a support system for traders as they navigate the complexities of pattern trading.

Frequently Asked Questions

How do M and W patterns differ from XABCD patterns?

M and W patterns differ from XABCD patterns in their shape and trading implications. M patterns are bullish and indicate a potential long setup, while W patterns are bearish and indicate a potential short setup. XABCD patterns have specific rules and ratios that need to be met.

What is the significance of the D point in M and W pattern trading?

The D point in M and W pattern trading holds significance as it determines the direction of the trade. For M patterns, it indicates a potential long setup, while for W patterns, it indicates a potential short setup. Traders incorporate the D point in their trading strategies to identify entry and exit points and manage risk.

How can traders identify and validate M and W patterns manually?

Identifying M and W patterns in price charts involves visually analyzing the price action to identify shapes resembling the letters M or W. Validation of these patterns can be done by comparing them with historical data and confirming the presence of significant swing highs or lows.

What are some common challenges or limitations in pattern trading?

Common challenges in pattern trading include the risk of false signals and market noise, which can lead to losses. Additionally, pattern identification can be prone to human error, and relying solely on patterns may neglect other important factors in trading.

How can traders effectively combine M and W patterns with other indicators to strengthen their trading strategies?

Combining M & W patterns with trendlines enhances trading strategies by providing additional confirmation. These patterns can be utilized in various timeframes, allowing traders to adapt to different market conditions and increase their trading opportunities.