In the fast-paced world of financial markets, traders and investors are constantly seeking tools to help them navigate the complexities of price movements. Chart patterns have emerged as a valuable technique for analyzing market trends, reversals, and potential trading opportunities. These visual representations of price movements provide a concise and informative snapshot of market dynamics.

Mastering chart patterns is essential for any trader looking to gain an edge in the market. This comprehensive guide aims to provide traders with the necessary knowledge and skills to effectively interpret and utilize chart patterns. By understanding the different types of chart patterns, their applications in analysis, and their benefits and limitations, traders can make informed decisions and enhance their trading strategies.

Furthermore, this guide will explore the specific relevance of chart patterns in cryptocurrency trading, considering the unique characteristics and volatility of this market. By combining chart patterns with other technical indicators and risk management principles, traders can elevate their trading game and potentially achieve greater success in the cryptocurrency market.

Key Takeaways

- Chart pattern cheat sheets are a valuable tool for traders and investors interested in trading.

- Cheat sheets provide a convenient reference guide to the most common chart patterns in financial markets.

- Chart patterns can be used to analyze potential trends, reversals, and trading opportunities.

- It is important to understand the basics of technical analysis and use cheat sheets in combination with other tools for better trading decisions.

What are chart patterns?

Chart patterns, as discussed in the pre-existing knowledge, are visual representations of price movements on a chart that can be used to analyze potential trends, reversals, and trading opportunities in financial markets. Traders and investors use chart patterns as a tool for identifying and interpreting patterns on a chart.

By recognizing specific patterns, traders can gain insights into potential market behavior and make informed trading decisions. The ability to identify chart patterns accurately is crucial as it allows traders to anticipate market movements and take advantage of profitable opportunities.

Interpreting chart patterns involves analyzing the formation, duration, and characteristics of the pattern to determine its potential implications for future price movements. Traders often combine chart patterns with other technical indicators to confirm their analysis and improve their trading strategies.

Types of chart patterns

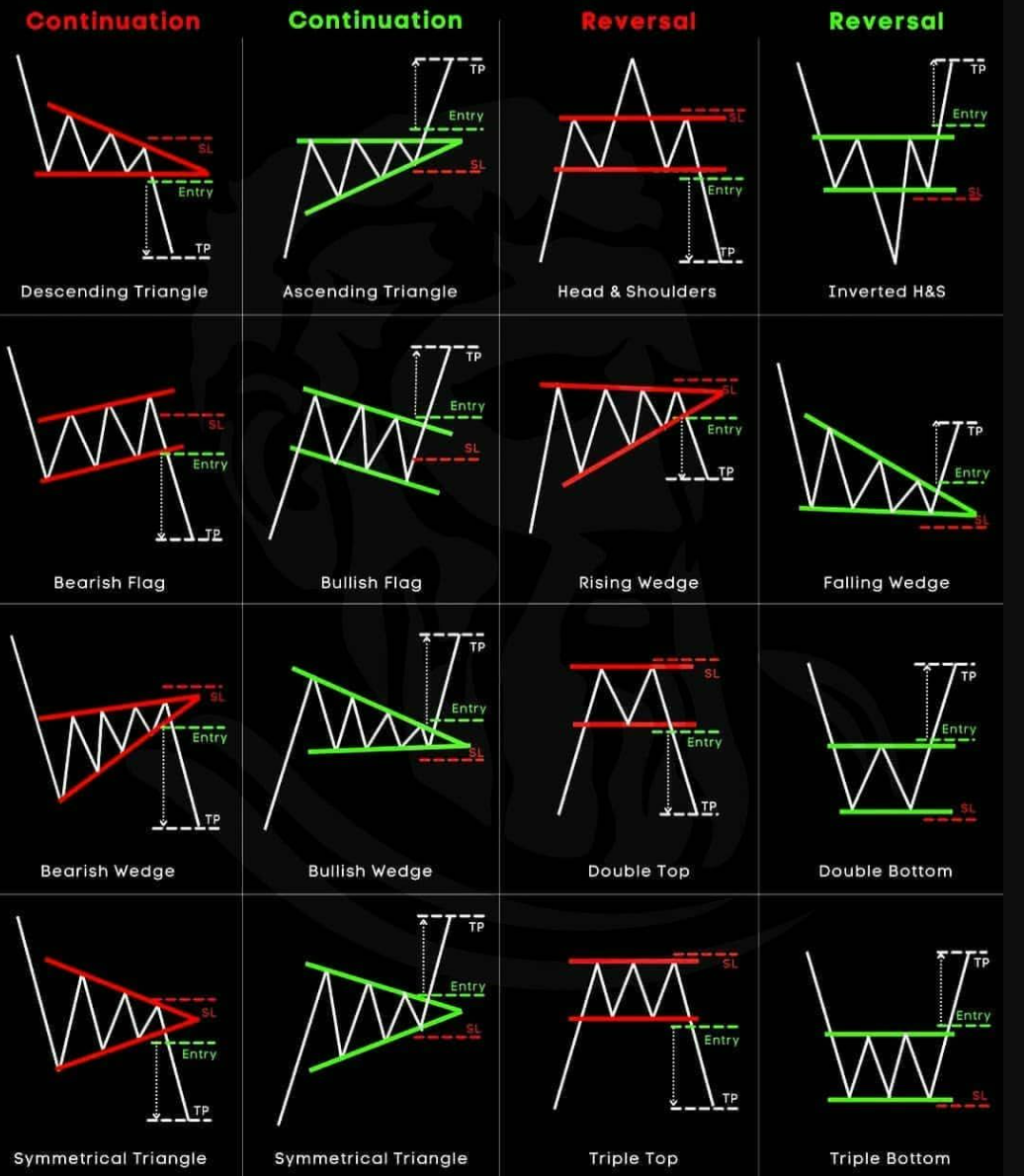

There are three distinct categories of chart patterns that traders commonly use for analyzing potential trends, reversals, and trading opportunities in financial markets.

These categories include bilateral patterns, continuation patterns, and reversal patterns.

Bilateral patterns are chart patterns that result in either the continuation or reversal of the current trend. Examples of bilateral patterns include symmetrical triangles and rectangles.

Continuation patterns, on the other hand, indicate a period of stagnation before the price regains its previous momentum. Examples of continuation patterns include flags and pennants, as well as ascending and descending triangles.

Lastly, reversal patterns are used to identify potential direction changes in market trends. Some common reversal patterns include head and shoulders, as well as double top/bottom patterns.

By identifying these chart patterns, traders can gain valuable insights into potential trading opportunities and make informed decisions based on the patterns they observe.

Using Chart Pattern Cheat Sheet in analysis

One notable statistic is that chart patterns can provide valuable insights into potential trading opportunities, with studies showing that traders who effectively utilize chart patterns in their analysis have a higher probability of making profitable trades.

Using chart patterns for technical analysis allows traders to identify potential trends, reversals, and trading opportunities in the financial markets. By recognizing and interpreting chart patterns, traders can make more informed decisions and improve their trading strategies.

Some benefits of using chart patterns include:

- Increased confidence in trading decisions

- Enhanced ability to spot potential entry and exit points

- Improved risk management by identifying potential stop-loss levels

Overall, incorporating chart patterns into technical analysis can be a valuable tool for traders looking to optimize their trading strategies and increase their chances of success.

Benefits and limitations of chart patterns

The use of chart patterns in technical analysis has both benefits and limitations. Chart patterns can provide valuable insights into potential market trends and trading opportunities. By recognizing and interpreting chart patterns, traders can make more informed decisions and save time. They serve as a visual representation of market sentiment and can help identify potential reversals or continuations in price movements.

However, it is important to note that chart patterns are not always reliable indicators and should be used in conjunction with other technical analysis tools. They should also be used with caution and risk management principles, as market conditions and behavior can vary. Overall, chart patterns can be a useful tool in technical analysis, but they should not be the sole basis for trading decisions.

| Pros | Cons |

|---|---|

| – Provide insights into potential trends and trading opportunities | – Not always reliable indicators |

| – Save time by quickly identifying patterns | – Should be used in combination with other technical analysis tools |

| – Visual representation of market sentiment | – Market conditions and behavior can vary |

| – Help identify potential reversals or continuations | – Should be used with caution and risk management principles |

Chart patterns in cryptocurrency trading

Cryptocurrency traders can utilize chart patterns as a technical analysis tool to identify potential trading opportunities and analyze price movements in the highly volatile cryptocurrency market.

Chart patterns can aid traders in formulating effective trading strategies and making informed decisions. These patterns can provide valuable insights into market trends, reversals, and potential entry or exit points.

However, it is important to note that due to the extreme market volatility of cryptocurrencies, chart patterns may not always be as reliable as in traditional markets. Traders should also consider other factors such as technical indicators and the overall state of the market when utilizing chart patterns.

Additionally, different cryptocurrencies may exhibit unique chart patterns that occur more frequently, so it is essential to study and understand the specific patterns relevant to each cryptocurrency.

Overall, chart patterns can be a valuable tool for cryptocurrency traders, but they should be used in conjunction with other analysis techniques and risk management strategies.

Frequently Asked Questions

How can I use chart patterns to determine the best entry and exit points for my trades?

Chart patterns can be used to determine the best entry and exit points for trades. By identifying trend reversals, traders can enter positions at favorable prices. Additionally, chart patterns can be used to set profit targets, allowing traders to take profits at predetermined levels. For example, a trader may use a double top pattern to identify a potential trend reversal and set an exit point near the pattern’s neckline. This approach helps traders make informed decisions and manage their trades effectively.

Are chart patterns more effective in certain types of markets, such as bull or bear markets?

Chart patterns can be effective in both bull and bear markets, as they provide insights into potential trend reversals and trading opportunities. However, their effectiveness may vary depending on market conditions and the behavior of specific assets.

Can I rely solely on chart patterns for my trading decisions, or should I use other indicators as well?

Using chart patterns in conjunction with technical indicators can lead to more accurate trading decisions. Relying solely on chart patterns may have drawbacks, as they are not always reliable indicators and should be used with risk management principles.

Are there any specific chart patterns that are more commonly observed in cryptocurrency trading compared to traditional markets?

Understanding cryptocurrency market dynamics is crucial when analyzing chart patterns. Common mistakes to avoid when applying chart patterns to cryptocurrency trading include relying solely on patterns, ignoring technical indicators, and not considering the volatility and unique behavior of the cryptocurrency market.

How do I incorporate risk management principles when using chart patterns in my trading strategy?

Incorporating risk management principles is crucial when using chart patterns in a trading strategy. Traders should set stop-loss orders, manage position sizes, and diversify their portfolios to minimize potential losses and protect capital.