The best stochastic settings for a 1-minute chart are 14,3,3.

The stochastic oscillator is a popular momentum indicator used by traders to identify overbought and oversold levels in the market.

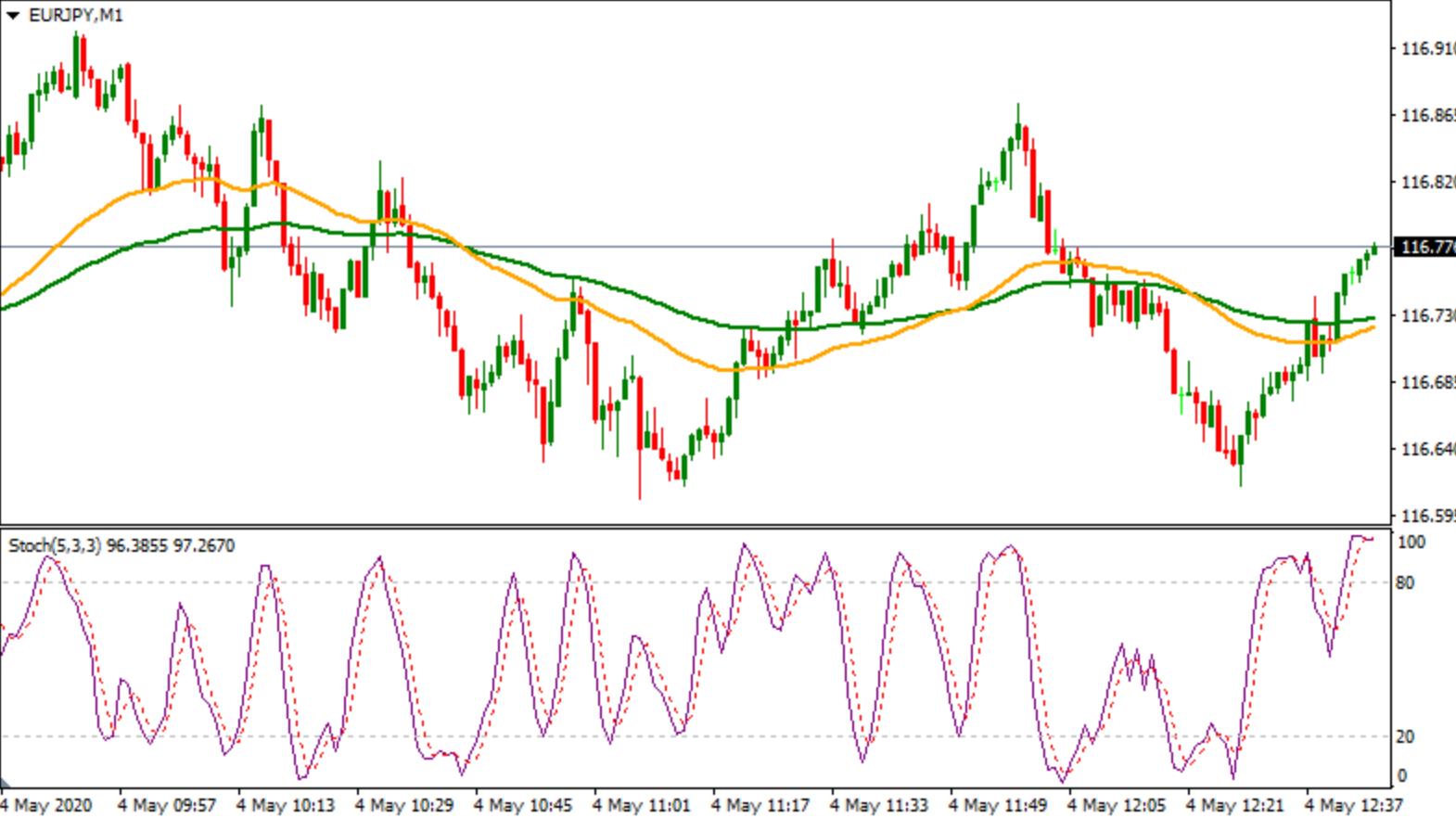

It consists of two components, %K and %D, which are calculated using specific periods.

The %K line represents the current price relative to the highest and lowest prices over a specified period, while the %D line is a moving average of the %K line.

The buy signal occurs when the %K line crosses above the %D line, indicating a potential upward movement, while the sell signal occurs when the %K line crosses below the %D line, suggesting a possible downward movement.

The 1-minute stochastic indicator is particularly useful for day traders as it can help them identify market turning points and make more informed trading decisions.

By using the optimal stochastic settings, traders can better time their entries and exits, enhancing their overall trading strategy.

Key Takeaways

- The best stochastic settings for a 1-minute chart are 14, 3, 3.

- The stochastic indicator can help traders stay on the right side of the market and better time entries and exits.

- Bullish divergence occurs when price makes a new low but the stochastic indicator does not, indicating a likely reversal.

- Bearish divergence occurs when price makes a new high but the stochastic indicator does not, indicating a likely reversal.

What is it? (Best Stochastic Settings For 1 Minute Chart)

Despite the wide use of the stochastic oscillator as a momentum indicator in the stock market, there is still debate among traders regarding the optimal settings for a 1-minute chart.

The stochastic oscillator consists of two components, %K and %D, with %K being averaged over 14 periods and %D being averaged over 3 periods.

The 1-minute stochastic indicator can provide valuable information in a short period of time, helping traders stay on the right side of the market and better time their entries and exits. However, there are certain limitations to consider.

The %K and %D lines can be choppy on a 1-minute chart, so a slow %K period is often recommended. Additionally, common misconceptions and myths include the belief that the stochastic indicator alone can guarantee accurate predictions, when in reality, it should be used in conjunction with other technical analysis tools.

Components and Calculation

The stochastic oscillator is composed of two components, %K and %D, which are calculated by averaging the %K line over 14 periods and the %D line over 3 periods, respectively.

The %K line represents the current price’s position within the range of the recent high and low prices, while the %D line is a smoothed version of the %K line.

The stochastic oscillator calculation helps to identify overbought and oversold levels in the market. When the %K line is above 80, it suggests the market is overbought, and when it is below 20, it suggests the market is oversold.

Traders interpret stochastic oscillator readings by looking for crossovers and divergences between the %K and %D lines, which can indicate potential bullish or bearish signals.

Trading Signals

Trading signals can be generated by analyzing the crossovers and divergences between the %K and %D lines of the stochastic oscillator. These signals can be used to develop trading strategies and make informed decisions.

When the %K line crosses above the %D line, a buy signal is generated, indicating a potential upward movement. Conversely, when the %K line crosses below the %D line, a sell signal is generated, suggesting a possible downward movement.

Traders can interpret these signals to time their entries and exits in the market. Additionally, the stochastic oscillator can be used to identify bullish and bearish divergences, which can indicate potential reversals in the market.

By analyzing these signals and incorporating them into their trading strategies, traders can increase their chances of making profitable trades.

Frequently Asked Questions

What are the advantages of using the stochastic oscillator on a 1-minute chart?

The advantages of using the stochastic oscillator on a 1-minute chart include providing valuable information in a short period of time, aiding in better timing of entries and exits, and identifying market turning points. However, it’s important to consider the limitations of choppy %K and %D lines on this timeframe.

Are there any limitations or drawbacks to using the stochastic oscillator on a 1-minute chart?

Using the stochastic oscillator on a 1-minute chart has limitations and drawbacks. The fast movement of the chart can result in choppy %K and %D lines, reducing the accuracy of signals. Additionally, false signals may occur due to market noise and short-term fluctuations.

How can traders effectively use the 1-minute stochastic indicator to time their entries and exits?

Traders can effectively use the 1-minute stochastic indicator by considering stochastic indicator strategies for different time frames and following tips for interpreting stochastic indicator signals accurately. This can help them time their entries and exits more effectively.

Can the 1-minute stochastic indicator be used in conjunction with other technical indicators for better trading decisions?

Combining the stochastic indicator with moving averages can improve trading signals by providing additional confirmation. Additionally, exploring the correlation between volume and the stochastic oscillator on a 1-minute chart can offer insights into market trends and potential reversals.

Are there any specific market conditions or scenarios where the 1-minute stochastic indicator tends to be more accurate or reliable?

The accuracy of the 1-minute stochastic indicator may be impacted by high volatility, as extreme price movements can lead to false signals. Additionally, the performance of the indicator may vary in trending and ranging markets,