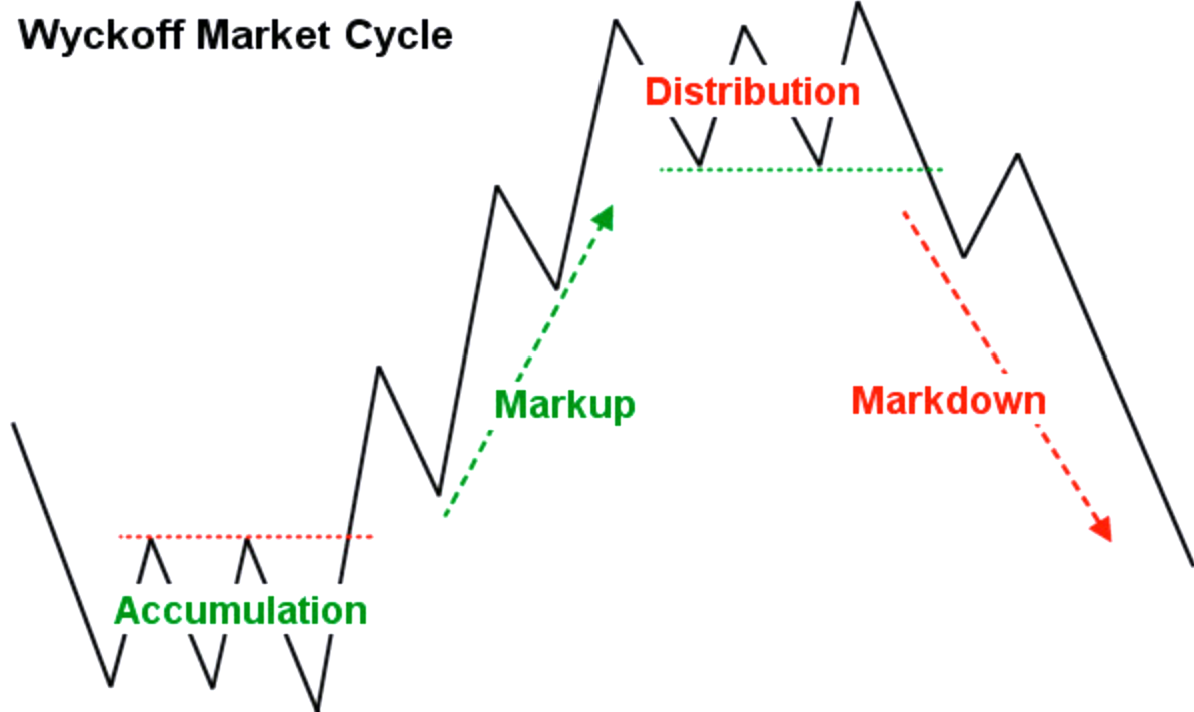

The Wyckoff Method, developed by Richard D. Wyckoff, is a powerful technique utilized by traders to analyze market trends and make informed trading decisions. Based on the fundamental premise that markets are influenced by supply and demand forces, this method encompasses a comprehensive set of tools to examine price and volume, market structure, and liquidity. By understanding the four distinct phases of accumulations, markups, distributions, and markdowns, traders can effectively identify areas where significant players establish positions and subsequently bid prices higher or lower.

The Wyckoff pattern method capitalizes on stop losses and breakout trades to fulfill substantial orders. Key principles such as the Composite Man and the three laws of supply and demand, cause and effect, and effort versus results form the foundation of this approach. By employing Wyckoff chart patterns, traders can successfully identify accumulations and distributions across a range of markets including forex, commodities, crypto, and stocks. Through a systematic and objective application of the Wyckoff Trading Method, traders can gain valuable insights into market dynamics and enhance their trading strategies.

Key Takeaways

- The Wyckoff method is a popular technique for analyzing market trends and making trading decisions.

- It is based on the belief that markets are driven by supply and demand forces.

- The method provides tools to analyze price and volume, market structure, and liquidity.

- The markets are framed in four phases: accumulations, markups, distributions, and markdowns.

What is the Wyckoff Pattern of Trading

The Wyckoff Trading Method, developed by Richard D. Wyckoff in the early 20th century, is a popular technique for analyzing market trends and making trading decisions based on the belief that markets are driven by supply and demand forces. This method differentiates itself from other trading methods by providing tools to analyze price and volume, market structure, and liquidity.

It frames the markets in four distinct phases: accumulations, markups, distributions, and markdowns. The Wyckoff method has stood the test of time and continues to be relevant in modern trading strategies. Traders can apply this method to various markets such as forex, commodities, crypto, and stocks. By understanding the principles of the Wyckoff method, traders can identify key market patterns and make informed trading decisions based on supply and demand dynamics.

Key Principles of Wyckoff Method

One fundamental concept of this trading approach involves understanding the intricate relationship between supply and demand forces in the market, akin to the delicate dance between the ebb and flow of tides on a shoreline. The Wyckoff method, developed by Richard D. Wyckoff, is based on this belief and provides tools to analyze price and volume, market structure, and liquidity.

The key principles of the Wyckoff method include the concept of the Composite Man, who represents the actions of large players in the market. Additionally, the method is guided by three laws: supply and demand, cause and effect, and effort vs. results. Wyckoff chart patterns also play a crucial role in this approach, as they can be used to identify accumulations and distributions in the market. Understanding these key principles and utilizing the Wyckoff chart patterns can help traders make informed decisions based on market dynamics.

Wyckoff Method’s Application in Various Markets

Application of the Wyckoff method in diverse markets reveals its versatility and potential for identifying market trends and making informed trading decisions. The Wyckoff method can be effectively applied in cryptocurrency trading and stock market analysis. In cryptocurrency trading, the Wyckoff method provides tools to analyze price and volume, allowing traders to identify accumulation and distribution phases.

This method can help traders spot potential breakouts and trend reversals, leading to profitable trading opportunities. Similarly, in stock market analysis, the Wyckoff method can be utilized to analyze price and volume patterns, providing insights into market trends and potential turning points. By understanding the principles of supply and demand, cause and effect, and effort vs. results, traders can make informed decisions based on the Wyckoff method’s framework. Overall, the Wyckoff method’s application in various markets showcases its adaptability and effectiveness in analyzing and predicting market movements.

Frequently Asked Questions

How does the Wyckoff method identify potential areas of accumulation or distribution in the market?

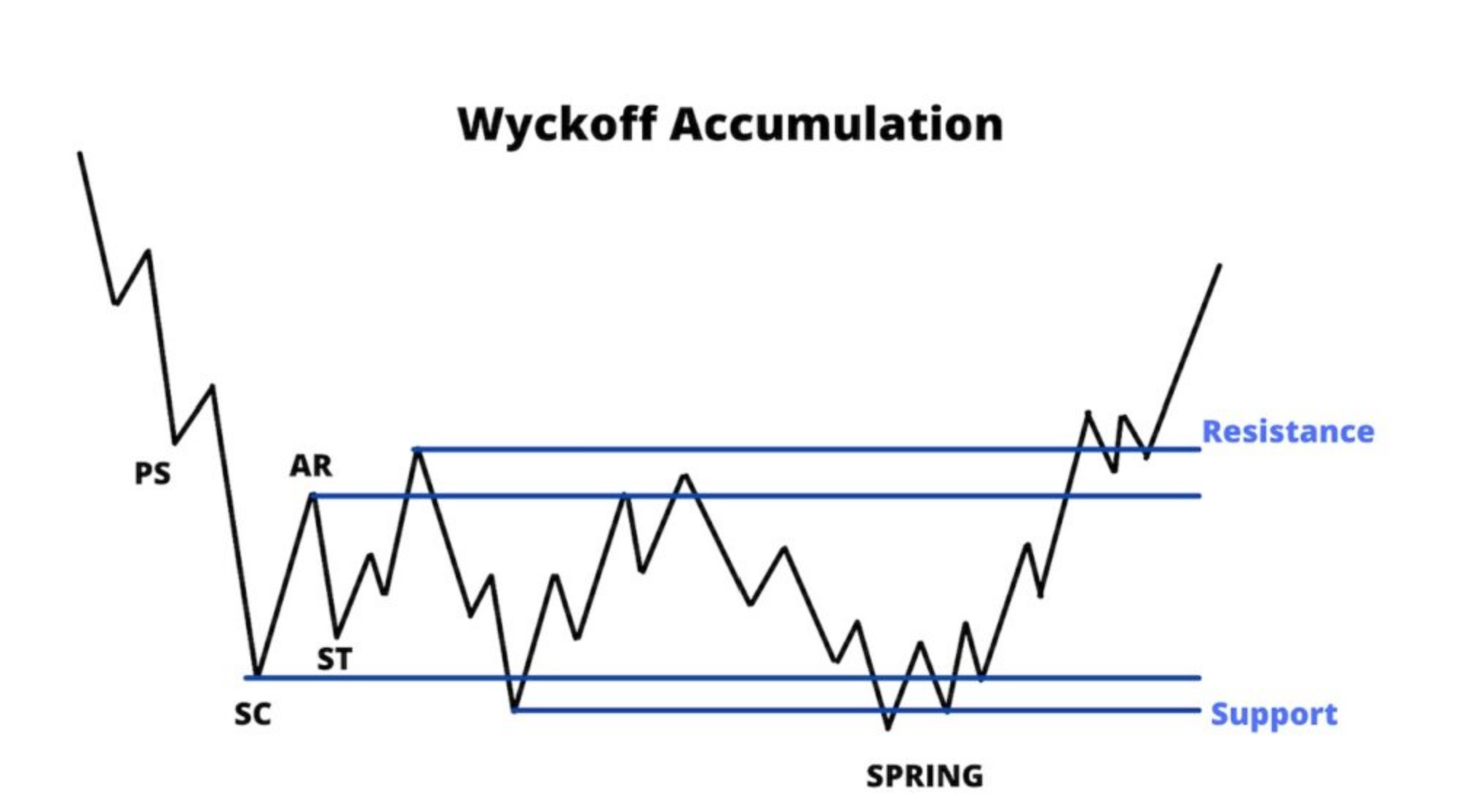

Identifying accumulation or distribution areas in the market involves analyzing market trends. This can be done by examining price and volume, market structure, and liquidity. Various chart patterns, such as preliminary support or supply, can indicate potential areas of accumulation or distribution.

What are some common Wyckoff chart patterns that traders use to spot accumulations and distributions?

Wyckoff chart patterns are visual representations used by traders to identify market trends, including accumulations and distributions. These patterns act as a roadmap, guiding traders to potential areas of interest in the market, much like signposts on a journey.

Can the Wyckoff method be used to predict the duration or timing of market trends?

The Wyckoff method can provide insights into market trends, but it has limitations in predicting their duration or timing. While it offers tools to analyze price and volume, it does not provide specific techniques to accurately forecast the length or timing of market trends.

Are there any specific indicators or tools that are commonly used in conjunction with the Wyckoff method?

Commonly used indicators and tools in conjunction with the Wyckoff method include volume analysis, price action analysis, trendlines, support and resistance levels, moving averages, and oscillators such as the relative strength index (RSI) and the moving average convergence divergence (MACD). These tools help traders identify market trends, confirm price movements, and make informed trading decisions.

How does the Wyckoff method address risk management and the use of stop losses in trading?

Risk management in the Wyckoff method involves the use of stop losses to mitigate potential losses. Stop losses are predetermined price levels at which trades are automatically exited to limit losses and protect capital.