The world of cryptocurrency has been expanding rapidly, and Ethereum is one of the most popular cryptocurrencies in the market. Ethereum has earned recognition for its smart contract functionality and its ability to support decentralized applications (dApps). Ethereum has experienced significant price movements, and experts have varying predictions about where its value will be in the future.

In this article, we will explore the Ethereum Rainbow Chart and its potential impact on the price of Ethereum by the end of 2023.

What is the Ethereum Rainbow Chart?

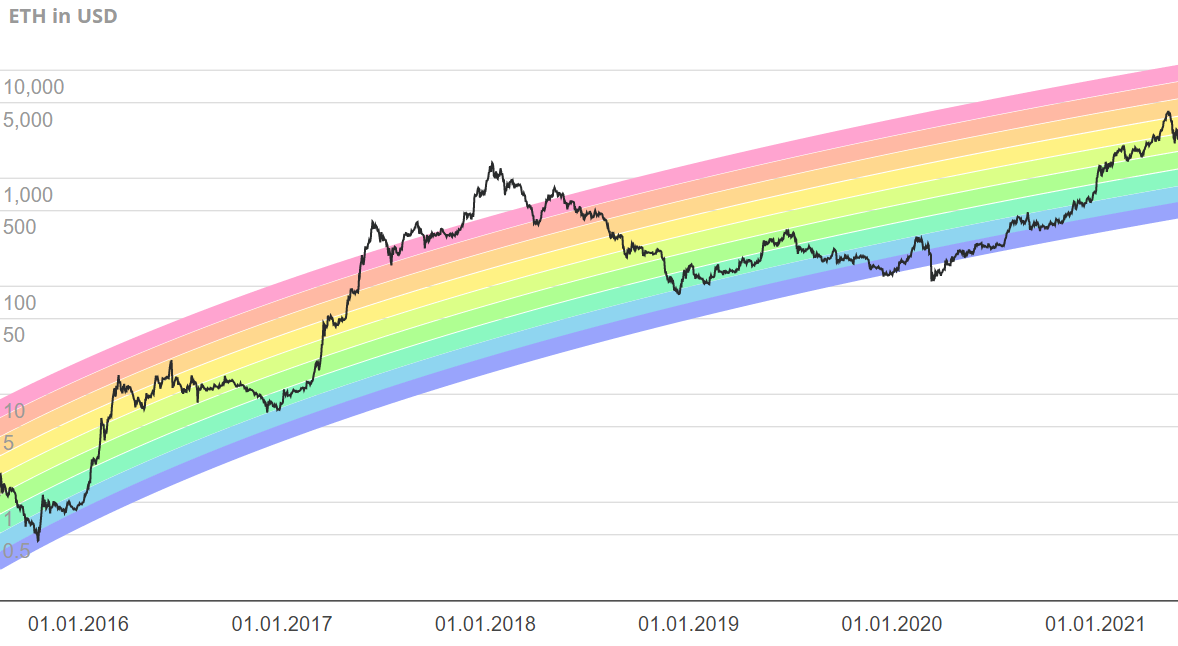

The Ethereum Rainbow Chart is a tool that tracks the price of Ethereum over time, using a logarithmic scale to provide a more accurate representation of its price movements. The chart is based on the stock-to-flow model, which has been used to analyze the value of commodities like gold and silver.

The stock-to-flow model calculates the ratio of the total stock of a commodity to the amount produced each year, providing insight into its scarcity and potential value. This model has been applied to cryptocurrencies to help predict future price movements.

The Ethereum Rainbow Chart was developed by a Twitter user named “Aftab” (@aftab_hossain). It plots the historical price movements of Ethereum and predicts its future value. The chart includes seven color bands, each representing a different phase in Ethereum’s price cycle. The color bands are based on the logarithmic price scale and the number of days between significant price peaks.

Understanding the Color Bands in Ethereum Rainbow Chart

The Ethereum Rainbow Chart consists of seven color bands, each representing a different phase in Ethereum’s price cycle. Let’s take a closer look at each of these color bands.

Blue Phase

The blue phase is the first phase of the Ethereum Rainbow Chart, and it represents a consolidation period. During the blue phase, Ethereum’s price experiences low volatility and gradual price increases. The chart predicts that Ethereum will remain in the blue phase until mid-2022.

Green Phase

The green phase is the second phase of the Ethereum Rainbow Chart, and it is expected to start in June 2022. This phase is characterized by a significant increase in Ethereum’s price, with a target price of around $5,000 by the end of 2022. The green phase is expected to last for approximately 200 days and will be driven by the growing demand for decentralized finance (DeFi) applications and the continued growth of the Ethereum ecosystem.

Yellow Phase

The yellow phase is the third phase of the Ethereum Rainbow Chart, and it represents a significant price correction. The yellow phase is expected to last for approximately 300 days, during which time Ethereum’s price is predicted to decline to around $2,000. This correction is expected to be driven by market consolidation and the resolution of any regulatory uncertainties.

Orange Phase

The orange phase is the fourth phase of the Ethereum Rainbow Chart, and it represents a period of price consolidation. The orange phase is expected to last for approximately 400 days, during which time Ethereum’s price is predicted to remain relatively stable, with minor fluctuations in price.

Red Phase

The red phase is the final phase of the Ethereum Rainbow Chart, and it represents the end of the price cycle. During the red phase, Ethereum’s price is expected to experience a significant increase, reaching a price of around $20,000 by the end of 2023. This increase is expected to be driven by the growing adoption of Ethereum and its increasing use in various industries, such as gaming, supply chain management, and digital identity verification.

Factors that Could Impact Ethereum’s Price

While the Ethereum Rainbow Chart is one prediction of Ethereum’s future price movements, there are various factors that could impact its accuracy. For example, regulatory changes, technological advancements, and market sentiment could all have an impact on Ethereum’s price.

Another factor that could have a significant impact on Ethereum’s price is the success of Ethereum 2.0. Ethereum 2.0 is an upgrade to the current Ethereum blockchain, which aims to improve its scalability, security, and sustainability. The upgrade will introduce a new consensus mechanism known as proof-of-stake (PoS), which is expected to be more energy-efficient than the current proof-of-work (PoW) consensus mechanism.

The success of Ethereum 2.0 could attract more users to the platform, which could increase demand for Ether, the native cryptocurrency of the Ethereum network. This increased demand could drive up the price of Ethereum, potentially impacting the accuracy of the Ethereum Rainbow Chart’s predictions.

However, there are also potential challenges associated with the implementation of Ethereum 2.0, which could impact its success. For example, the migration from the current Ethereum blockchain to Ethereum 2.0 could be complex and require significant coordination between developers, validators, and users. Any delays or technical issues could impact the success of Ethereum 2.0 and its impact on Ethereum’s price.

Other Potential Drivers of Ethereum’s Price

In addition to the factors discussed above, there are several other potential drivers of Ethereum’s price. These include:

- Increased adoption: As more companies and organizations adopt Ethereum for various use cases, demand for Ether could increase, potentially driving up its price.

- Competition from other cryptocurrencies: Ethereum faces competition from other smart contract platforms, such as Cardano, Polkadot, and Solana. The success of these platforms could impact Ethereum’s price.

- Market sentiment: Like all cryptocurrencies, Ethereum’s price is influenced by market sentiment. Positive news and sentiment could drive up its price, while negative news and sentiment could cause it to decline.

- Technical developments: New technical developments, such as upgrades to the Ethereum blockchain or the release of new dApps, could impact demand for Ether and its price.

Conclusion

The Ethereum Rainbow Chart provides one potential prediction of Ethereum’s price movements by the end of 2023. However, as with all price predictions, there are several factors that could impact its accuracy, including regulatory changes, technological developments, and market sentiment. The success of Ethereum 2.0 could also impact the accuracy of the Ethereum Rainbow Chart’s predictions.

Ultimately, the price of Ethereum is influenced by a wide range of factors, and predicting its future value is a challenging task. As with all investments, it is important to do your own research and consider multiple sources of information before making any investment decisions.