Overview Of FXOpen Platform

FXOpen is an online Forex trading platform that provides a range of trading services for both novice and experienced traders. It has been operating since 2003 and is regulated by renowned financial institutions such as the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC). Here are a few of the features that make FXOpen stand out:- User-friendly Interface: FXOpen’s user interface is designed with beginners in mind, making it easy to quickly get started trading. The platform also offers advanced features for more experienced traders.

- Variety of Trading Instruments: FXOpen offers a wide variety of Forex pairs, indices, commodities, and cryptocurrencies to trade with. This makes it possible for traders to diversify their portfolio across different asset classes.

- Low Fees & Leverage: FXOpen charges low fees compared to other brokers, with spreads starting from 0.1 pips on major currency pairs. Leverage up to 1:500 is also available on some accounts, enabling traders to take advantage of larger positions without needing large capital investments upfront.

Overall, FXOpen is a reliable and trustworthy broker which has proven itself over the years as a trusted provider of Forex trading services. Its user-friendly interface makes it ideal for beginners while its selection of assets gives experienced traders plenty of opportunities to diversify their portfolios. Additionally, its low fees and leverage make it an attractive option for all types of traders looking to maximize their returns while minimizing risk.Read Next: XTrade Review 2023: In-Depth Look at Its Features & Performance

Overall, FXOpen is a reliable and trustworthy broker which has proven itself over the years as a trusted provider of Forex trading services. Its user-friendly interface makes it ideal for beginners while its selection of assets gives experienced traders plenty of opportunities to diversify their portfolios. Additionally, its low fees and leverage make it an attractive option for all types of traders looking to maximize their returns while minimizing risk.Read Next: XTrade Review 2023: In-Depth Look at Its Features & PerformancePros & Cons Of FXOpen

FXOpen is a reliable Forex trading platform that has been around since 2003. It offers traders a variety of features and services, such as multiple trading platforms, low fees, fast deposit/withdrawal times and more. However, there are some drawbacks to using FXOpen which should be taken into account before signing up.Pros

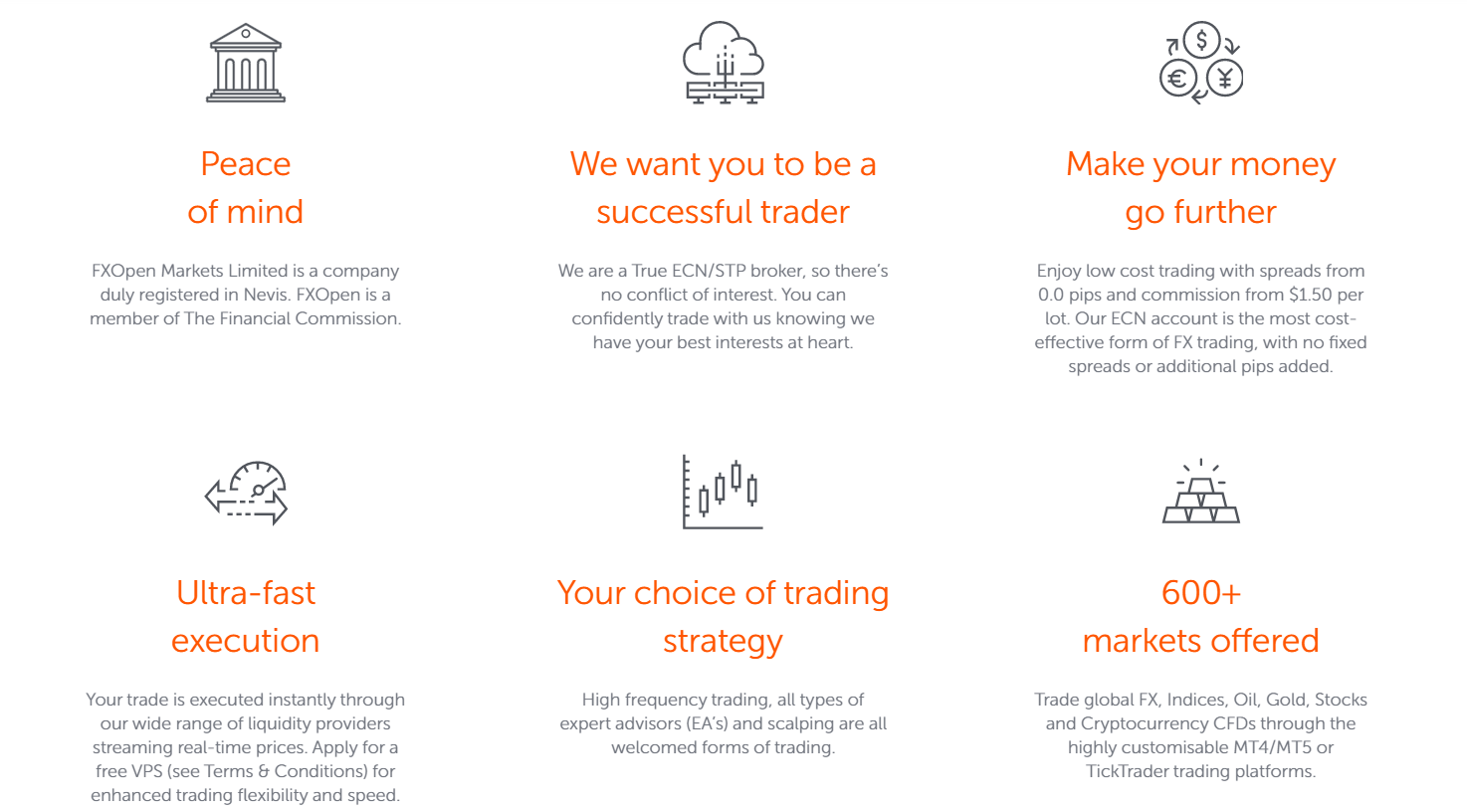

- Provides a range of trading instruments, including forex, cryptocurrencies, and CFDs.

- Offers both ECN and STP execution models, which can be beneficial for traders with different trading styles.

- Supports multiple trading platforms, including MetaTrader 4, MetaTrader 5, and cTrader.

- Provides low spreads and commissions, which can be beneficial for traders looking to minimize trading costs.

- Regulated by top-tier authorities, such as the FCA and ASIC.

Cons

- Limited research tools and market analysis.

- Limited educational resources compared to some other brokers.

- Higher minimum deposit requirements than some other brokers.

- Some users have reported slower customer support response times.

- Limited availability of trading instruments compared to some other brokers.

Fees And Commission Structures

Moving on from the advantages and disadvantages of FXOpen, a closer look at their fees and commission structures is essential to understanding whether this forex trading platform can be trusted. The first matter to consider is their non-trading fees. As a broker, FXOpen does not charge any additional fees or commissions when it comes to making deposits or withdrawing funds. This is great news for traders who don’t want to worry about hidden costs.| ECN | STP | CRYPTO | MICRO | |

| Business Model | ECN | STP | ECN | MM |

| Minimum deposit | from $100 | from $10 | from $10 | from $1 |

| Maximum balance | without limitations | without limitations | without limitations | $3 000 |

| Spread | floating, from 0 pips | floating | floating | floating |

| Commission (per 1 mio) | from $15 | No | 0.5% of trade volume | No |

| round turn | ||||

| Execution | market | market | market | instant |

| Requotes/Slippage | No/Yes | No/Yes | No/Yes | Yes/No |

| Minimum transaction size | 0.01 lots | 0.01 lots | 0.01 lots | 0.01 microlots |

| Maximum transaction size | without limitations | without limitations | without limitations | $1 000 000 |

| Open trades max | not limited* | not limited* | not limited* | up to 100 trades open |

| at the same time | ||||

| Leverage | up to 1:500 | up to 1:500 | 01:03 | up to 1:500 |

| Margin call | 100% | 50% | 30% | 20% |

| Stop Out | 50% | 30% | 15% | 10% |

| Demo accounts | Yes | Yes | Yes | No |

| Islamic accounts | Yes | Yes | No | Yes |

| Instruments | 50+ FX Spot CFDs | 50 currency pairs | 43 pairs with BTC, LTC | 28 currency pairs |

| 25+ Cryptocurrency CFDs | + gold and silver | EOS, PPC, ETH | + gold and silver | |

| Shares CFDs | DASH, EMC | |||

| Index CFDs | ||||

| Spot Metals CFDs | ||||

| Commodity CFDs | ||||

| Bonuses | No | Yes | No | Yes |

| Hedging | Yes | Yes | Yes | Yes |

| Expert Advisors | Yes | Yes | Yes | Yes |

| Scalping | Yes | Yes | Yes | No |

| News trading | Yes | Yes | Yes | No |

| Phone dealing | Yes | Yes | Yes | No |

| Market depth with level 2 quotes | Yes | Yes | Yes | No |

Security And Regulatory Compliance

FXOpen is a highly secure and regulated forex trading platform. It is registered with the Financial Conduct Authority (FCA) in the UK, and complies with MiFID II regulations. Additionally, FXOpen has secured an Australian Financial Services License (AFSL) from the Australian Securities and Investment Commission (ASIC). As such, it offers a safe environment for its customers to conduct their trading activities.The following are some of the security measures that FXOpen provides to protect its users’ funds:- Advanced encryption technology to protect data transmitted over the internet

- Multiple layers of authentication when accessing accounts

- Regular testing of all systems

- Dedicated anti-fraud team monitoring accounts

Overall, FXOpen ensures compliance with regulatory requirements and provides customers with an additional layer of security to ensure the safety of their funds. The platform also maintains strict customer identification procedures in order to prevent money laundering and other financial crimes. This commitment to security and compliance makes FXOpen an ideal choice for traders who prioritize safety when selecting a forex broker.Continue Reading: TMGM Review 2023: Is This Platform Suitable for Your Investment?

Overall, FXOpen ensures compliance with regulatory requirements and provides customers with an additional layer of security to ensure the safety of their funds. The platform also maintains strict customer identification procedures in order to prevent money laundering and other financial crimes. This commitment to security and compliance makes FXOpen an ideal choice for traders who prioritize safety when selecting a forex broker.Continue Reading: TMGM Review 2023: Is This Platform Suitable for Your Investment?Variety Of Account Types Available

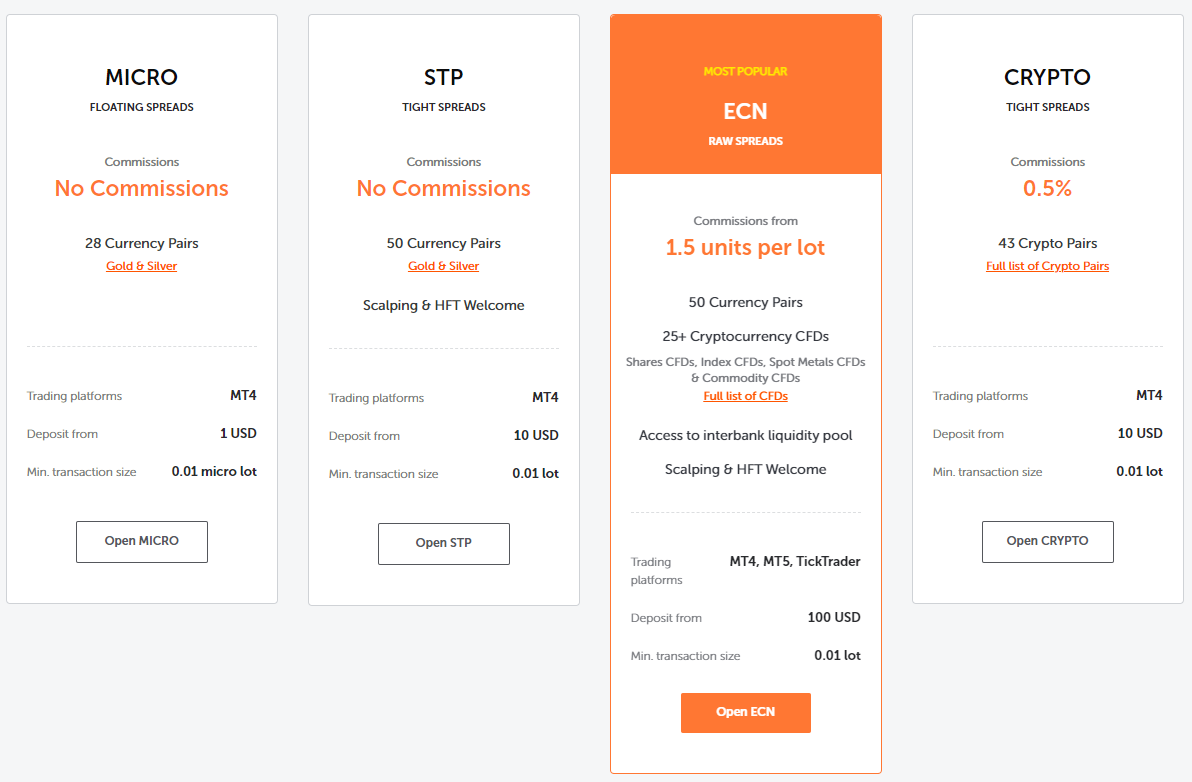

Moving on, FXOpen offers a variety of account types to suit different traders’ needs. These include Standard Accounts, Micro Accounts, STP Accounts, and Crypto Accounts. All accounts can be opened with as little as $1 and offer leverage up to 1:500.The Standard Account is suitable for both novice and experienced traders. It provides access to the MetaTrader4 trading platform which is widely used by traders all over the world. This platform allows for automated trading using Expert Advisors (EAs). The spreads are also competitive when compared to other brokers in the market. The Micro Account is great for those who want to practice their trading strategies without risking too much money. With this account type, you can enjoy lower spreads and commissions than the Standard Account. You can also use EAs and scalping strategies with no restrictions or additional fees.Overall, FXOpen provides a range of account types that cater to different levels of experience and risk appetite. From low cost starter accounts to more sophisticated options, FXOpen has something suitable for everyone looking to make money from forex trading. Whether you’re looking just to try your hand at trading or take things seriously, you can find an account type that fits your needs at FXOpen.Dig Deeper: ThinkMarkets Review 2023: Everything You Need to Know

The Micro Account is great for those who want to practice their trading strategies without risking too much money. With this account type, you can enjoy lower spreads and commissions than the Standard Account. You can also use EAs and scalping strategies with no restrictions or additional fees.Overall, FXOpen provides a range of account types that cater to different levels of experience and risk appetite. From low cost starter accounts to more sophisticated options, FXOpen has something suitable for everyone looking to make money from forex trading. Whether you’re looking just to try your hand at trading or take things seriously, you can find an account type that fits your needs at FXOpen.Dig Deeper: ThinkMarkets Review 2023: Everything You Need to KnowRange Of Currency Pairs Offered

FXOpen offers a wide range of currency pairs for traders to choose from. It has over 60 major, minor and exotic currency pairs, making it one of the most diverse offerings in the industry. The platform also offers a variety of trading tools to help traders make informed decisions. These include market analysis, charting and technical indicators, as well as automated trading systems.| SYMBOL | DESCRIPTION | 1 LOT CONTRACT SIZE | MIN TRADE | STEP | DIGITS | 1 PIP VALUE OF 1 LOT | MARKET ORDER SLIPPAGE CONTROL | STOP ORDER SLIPPAGE CONTROL | LEVERAGE |

|---|---|---|---|---|---|---|---|---|---|

| AUDCAD | Australian Dollar / Canadian Dollar | 100000 AUD | 0.01 lot | 0.01 | 5 | 1 CAD | 1% | 1% | 1:20 |

| AUDCHF | Australian Dollar / Swiss Franc | 100000 AUD | 0.01 lot | 0.01 | 5 | 1 CHF | 2% | 2% | 1:20 |

| AUDJPY | Australian Dollar / Japanese Yen | 100000 AUD | 0.01 lot | 0.01 | 3 | 100 JPY | 1% | 1% | 1:20 |

| AUDNZD | Australian Dollar / New Zealand Dollar | 100000 AUD | 0.01 lot | 0.01 | 5 | 1 NZD | 1% | 1% | 1:20 |

| AUDUSD | Australian Dollar / US Dollar | 100000 AUD | 0.01 lot | 0.01 | 5 | 1 USD | 1% | 1% | 1:20 |

| CADCHF | Canadian Dollar / Swiss Franc | 100000 CAD | 0.01 lot | 0.01 | 5 | 1 CHF | 2% | 2% | 1:30 |

| CADJPY | Canadian Dollar / Japanese Yen | 100000 CAD | 0.01 lot | 0.01 | 3 | 100 JPY | 1% | 1% | 1:30 |

| CHFJPY | Swiss Franc / Japanese Yen | 100000 CHF | 0.01 lot | 0.01 | 3 | 100 JPY | 1% | 1% | 1:30 |

| EURAUD | Euro / Australian Dollar | 100000 EUR | 0.01 lot | 0.01 | 5 | 1 AUD | 1% | 1% | 1:20 |

| EURCAD | Euro / Canadian Dollar | 100000 EUR | 0.01 lot | 0.01 | 5 | 1 CAD | 1% | 1% | 1:30 |

| EURCHF | Euro / Swiss Franc | 100000 EUR | 0.01 lot | 0.01 | 5 | 1 CHF | 2% | 2% | 1:30 |

| EURDKK | Euro / Danish Krone | 100000 EUR | 0.01 lot | 0.01 | 5 | 1 DKK | 2% | 2% | 1:20 |

| EURGBP | Euro / British Pound | 100000 EUR | 0.01 lot | 0.01 | 5 | 1 GBP | 2% | 2% | 1:30 |

| EURHKD | Euro / Hong Kong Dollar | 100000 EUR | 0.01 lot | 0.01 | 5 | 1 HKD | 1% | 1% | 1:20 |

| EURJPY | Euro / Japanese Yen | 100000 EUR | 0.01 lot | 0.01 | 3 | 100 JPY | 1% | 1% | 1:30 |

| EURNOK | Euro / Norwegian Krone | 100000 EUR | 0.01 lot | 0.01 | 5 | 1 NOK | 1% | 1% | 1:20 |

| EURNZD | Euro / New Zealand Dollar | 100000 EUR | 0.01 lot | 0.01 | 5 | 1 NZD | 1% | 1% | 1:20 |

| EURPLN | Euro / Polish Zloty | 100000 EUR | 0.01 lot | 0.01 | 5 | 1 PLN | 2% | 2% | 1:20 |

| EURSEK | Euro / Swedish Krona | 100000 EUR | 0.01 lot | 0.01 | 5 | 1 SEK | 1% | 1% | 1:20 |

| EURTRY | Euro / Turkish Lira | 100000 EUR | 0.01 lot | 0.01 | 5 | 1 TRY | 3% | 3% | 1:20 |

| EURUSD | Euro / US Dollar | 100000 EUR | 0.01 lot | 0.01 | 5 | 1 USD | 1% | 1% | 1:30 |

| GBPAUD | British Pound / Australian Dollar | 100000 GBP | 0.01 lot | 0.01 | 5 | 1 AUD | 2% | 2% | 1:20 |

| GBPCAD | British Pound / Canadian Dollar | 100000 GBP | 0.01 lot | 0.01 | 5 | 1 CAD | 2% | 2% | 1:30 |

| GBPCHF | British Pound / Swiss Franc | 100000 GBP | 0.01 lot | 0.01 | 5 | 1 CHF | 2% | 2% | 1:30 |

| GBPJPY | British Pound / Japanese Yen | 100000 GBP | 0.01 lot | 0.01 | 3 | 100 JPY | 2% | 2% | 1:30 |

| GBPNZD | British Pound / New Zealand Dollar | 100000 GBP | 0.01 lot | 0.01 | 5 | 1 NZD | 2% | 2% | 1:20 |

| GBPSGD | British Pound / Singapore Dollar | 100000 GBP | 0.01 lot | 0.01 | 5 | 1 SGD | 2% | 2% | 1:20 |

| GBPUSD | British Pound / US Dollar | 100000 GBP | 0.01 lot | 0.01 | 5 | 1 USD | 2% | 2% | 1:30 |

| HKDJPY | Hong Kong Dollar / Japanese Yen | 100000 HKD | 0.01 lot | 0.01 | 3 | 100 JPY | 1% | 1% | 1:20 |

| NOKJPY | Norwegian Krone / Japanese Yen | 100000 NOK | 0.01 lot | 0.01 | 3 | 100 JPY | 1% | 1% | 1:20 |

| NOKSEK | Norwegian Krone / Swedish Krone | 100000 NOK | 0.01 lot | 0.01 | 5 | 1 SEK | 1% | 1% | 1:20 |

| NZDCAD | New Zealand Dollar / Canadian Dollar | 100000 NZD | 0.01 lot | 0.01 | 5 | 1 CAD | 1% | 1% | 1:20 |

| NZDCHF | New Zealand Dollar / Swiss Franc | 100000 NZD | 0.01 lot | 0.01 | 5 | 1 CHF | 2% | 2% | 1:20 |

| NZDJPY | New Zealand Dollar / Japanese Yen | 100000 NZD | 0.01 lot | 0.01 | 3 | 100 JPY | 1% | 1% | 1:20 |

| NZDSGD | New Zealand Dollar / Singapore Dollar | 100000 NZD | 0.01 lot | 0.01 | 5 | 1 SGD | 2% | 2% | 1:20 |

| NZDUSD | New Zealand Dollar / US Dollar | 100000 NZD | 0.01 lot | 0.01 | 5 | 1 USD | 1% | 1% | 1:20 |

| SGDJPY | Singapore Dollar / Japanese Yen | 100000 SGD | 0.01 lot | 0.01 | 3 | 100 JPY | 1% | 1% | 1:20 |

| USDCAD | US Dollar / Canadian Dollar | 100000 USD | 0.01 lot | 0.01 | 5 | 1 CAD | 1% | 1% | 1:30 |

| USDCHF | US Dollar / Swiss Franc | 100000 USD | 0.01 lot | 0.01 | 5 | 1 CHF | 2% | 2% | 1:30 |

| USDCNH | US Dollar / Chinese Offshore Yuan | 100000 USD | 0.01 lot | 0.01 | 4 | 10 CNH | 2% | 2% | 1:20 |

| USDDKK | US Dollar / Danish Krone | 100000 USD | 0.01 lot | 0.01 | 5 | 1 DKK | 2% | 2% | 1:20 |

| USDHKD | US Dollar / Hong Kong Dollar | 100000 USD | 0.01 lot | 0.01 | 5 | 1 HKD | 1% | 1% | 1:20 |

| USDJPY | US Dollar / Japanese Yen | 100000 USD | 0.01 lot | 0.01 | 3 | 100 JPY | 1% | 1% | 1:30 |

| USDMXN | US Dollar / Mexican Peso | 100000 USD | 0.01 lot | 0.01 | 5 | 1 MXN | 3% | 3% | 1:20 |

| USDNOK | US Dollar / Norwegian Krone | 100000 USD | 0.01 lot | 0.01 | 5 | 1 NOK | 1% | 1% | 1:20 |

| USDPLN | US Dollar / Polish Zloty | 100000 USD | 0.01 lot | 0.01 | 5 | 1 PLN | 2% | 2% | 1:20 |

| USDRUB | US Dollar / Russian Ruble | 100000 USD | 0.01 lot | 0.01 | 4 | 10 RUB | 4% | 4% | 1:20 |

| USDSEK | US Dollar / Swedish Krona | 100000 USD | 0.01 lot | 0.01 | 5 | 1 SEK | 1% | 1% | 1:20 |

| USDSGD | US Dollar / Singapore Dollar | 100000 USD | 0.01 lot | 0.01 | 5 | 1 SGD | 1% | 1% | 1:20 |

| USDTRY | US Dollar / Turkish Lira | 100000 USD | 0.01 lot | 0.01 | 5 | 1 TRY | 3% | 3% | 1:20 |

Customer Support Services

Moving on, let’s discuss the customer support services offered by FXOpen. They’ve got a range of options available to their customers, which include email and live chat. Their customer service representatives are available 24/7 to help customers with any inquiries they may have.In addition to these options, FXOpen also provides an online knowledge base and other helpful resources for traders who want to learn more about forex trading. The following are some of the benefits that come with using FXOpen’s customer support services:Professional advice:

The following are some of the benefits that come with using FXOpen’s customer support services:Professional advice:- Experienced customer service representatives who can provide valuable insights into trading strategies.

- Access to webinars and educational materials for those interested in learning more about forex trading.

- The response time for emails is usually within 24 hours.

- Live chat support is available around the clock and fast answers can be expected.

- A knowledgeable staff that can answer complex questions related to forex trading or technical issues related to the platform itself.

User Reviews

FXOpen has been around since 2023 and has earned a good reputation amongst traders. Many users have positive experiences with the platform, praising its reliable order execution, competitive spreads, and wide range of trading instruments. The customer service team is also highly praised for their fast response times and helpful attitude. Despite these positive reviews, there are some who claim that FXOpen is a scam and they have lost money while using the platform. These claims are not backed up by any credible evidence and FXOpen denies these allegations. It’s important to take into account that trading in general is risky, so no matter which broker you use, it’s important to understand the risks before investing any money.Overall, FXOpen appears to be a reliable forex trading platform and most users have had positive experiences with it. With its competitive spreads, wide range of instruments and excellent customer support, it can be an ideal choice for experienced traders looking for a trusted broker.More Resources: Multibank Group Review 2023:A Detailed Look at This Forex Broker

Despite these positive reviews, there are some who claim that FXOpen is a scam and they have lost money while using the platform. These claims are not backed up by any credible evidence and FXOpen denies these allegations. It’s important to take into account that trading in general is risky, so no matter which broker you use, it’s important to understand the risks before investing any money.Overall, FXOpen appears to be a reliable forex trading platform and most users have had positive experiences with it. With its competitive spreads, wide range of instruments and excellent customer support, it can be an ideal choice for experienced traders looking for a trusted broker.More Resources: Multibank Group Review 2023:A Detailed Look at This Forex BrokerSummary And Conclusion

After an extensive review of FXOpen, it is clear that it is a reliable Forex trading platform. It offers competitive spreads, low commissions and a variety of trading tools and features to help traders maximize their profits. The customer service team is also friendly and knowledgeable. Additionally, it has strong security measures in place to protect the funds of its customers.Overall, FXOpen provides a safe and secure environment for traders to invest in with confidence. It has been around since 2003 and has earned itself a reputation as one of the most trusted brokers in the industry. Furthermore, its user-friendly interface makes it easy for anyone to get started with Forex trading without any prior experience or knowledge.Check out: VT Markets Review 2023: A Detailed Look at This Forex BrokerIt is safe to say that FXOpen is a reliable forex trading platform that provides all the necessary features for successful trades. With competitive spreads, low commissions and excellent customer service support, traders are sure to have a positive experience when using this broker’s services.In conclusion, FXOpen is a reliable forex trading platform worth considering. It has many advantages that make it attractive to traders: competitive fees and commission structures, a wide range of currency pairs offered, and good customer support services. Security and regulatory compliance are also top-notch. User reviews show that overall most people have had positive experiences with the platform.

Overall, FXOpen seems to be a safe bet for those who are looking for an affordable, reliable forex trading platform. It offers plenty of features that make it suitable for novice and experienced traders alike. With its low fees and robust security systems, FXOpen is certainly worth considering when choosing a trading platform.

If you’re in the market for a forex trading platform, I’d definitely recommend giving FXOpen a try. Its user-friendly interface makes it easy to use even if you’re new to trading. You won’t regret it!