Forex.com is a well-established online forex trading platform that offers traders the ability to trade forex and CFDs on a variety of financial instruments. It was founded in 2001 and is currently operated by GAIN Capital, a reputable financial services company based in the United States. The platform is regulated by several financial regulatory bodies, including the Financial Conduct Authority (FCA) in the UK and the Commodity Futures Trading Commission (CFTC) in the US.Forex.com provides a wide range of trading tools and resources to help traders make informed trading decisions. These include real-time market analysis, educational materials, trading signals, and a user-friendly trading platform that can be accessed via desktop, web, or mobile devices. The platform also offers a demo account for traders to practice their trading strategies before risking real money.Forex.com is worth reviewing because of its reputation as a reliable and secure online forex trading platform. The platform offers competitive spreads, fast execution speeds, and a variety of trading tools that can help traders achieve their trading goals. Additionally, Forex.com has won multiple awards over the years, including Best Retail Forex Broker at the Forex Expo Awards and Best Forex Broker at the Online Personal Wealth Awards.Furthermore, Forex.com is regulated by several financial regulatory bodies, which provides traders with added security and peace of mind. The platform also has a strong customer support team that is available 24/7 to assist traders with any questions or concerns they may have. Commission fees: Forex.com’s commission fees range from $5 to $60 per lot traded, depending on the type of account and the currency pair traded. The commission fees are charged on a round-turn basis, meaning both the opening and closing trades are charged.Non-trading fees: Forex.com charges several non-trading fees, including a $15 inactivity fee for accounts that are dormant for more than 12 months. The broker also charges a $25 fee for wire transfers and a $50 fee for account withdrawals via check.Deposit and withdrawal fees: Forex.com does not charge any deposit fees, but some deposit methods may have fees imposed by the payment provider. Withdrawal fees vary depending on the method used. Bank wire withdrawals are charged $25, while credit and debit card withdrawals are charged 1.5% of the withdrawal amount.Further Reading: Libertex Review 2023: Pros & Cons, Safety, Fees, App & Education

Commission fees: Forex.com’s commission fees range from $5 to $60 per lot traded, depending on the type of account and the currency pair traded. The commission fees are charged on a round-turn basis, meaning both the opening and closing trades are charged.Non-trading fees: Forex.com charges several non-trading fees, including a $15 inactivity fee for accounts that are dormant for more than 12 months. The broker also charges a $25 fee for wire transfers and a $50 fee for account withdrawals via check.Deposit and withdrawal fees: Forex.com does not charge any deposit fees, but some deposit methods may have fees imposed by the payment provider. Withdrawal fees vary depending on the method used. Bank wire withdrawals are charged $25, while credit and debit card withdrawals are charged 1.5% of the withdrawal amount.Further Reading: Libertex Review 2023: Pros & Cons, Safety, Fees, App & Education  Features and functionality: The app provides users with a wide range of features and functionalities, including access to real-time market data, advanced charting tools, and customizable trading alerts. Users can also place and manage trades, view account balances and transaction history, and fund their accounts directly from the app.The app also offers a range of educational resources, including daily market analysis, trading insights, and live webinars, to help traders stay informed and make informed trading decisions.

Features and functionality: The app provides users with a wide range of features and functionalities, including access to real-time market data, advanced charting tools, and customizable trading alerts. Users can also place and manage trades, view account balances and transaction history, and fund their accounts directly from the app.The app also offers a range of educational resources, including daily market analysis, trading insights, and live webinars, to help traders stay informed and make informed trading decisions. Ease of use and navigation: The Forex.com mobile app is designed to be user-friendly and easy to navigate. The interface is clean and intuitive, making it easy for users to find what they need and place trades quickly and efficiently. The app is also responsive and fast, allowing traders to react quickly to changing market conditions.Explore More: Admiral Markets Review 2023: Platform, Fees & Customer Support

Ease of use and navigation: The Forex.com mobile app is designed to be user-friendly and easy to navigate. The interface is clean and intuitive, making it easy for users to find what they need and place trades quickly and efficiently. The app is also responsive and fast, allowing traders to react quickly to changing market conditions.Explore More: Admiral Markets Review 2023: Platform, Fees & Customer Support Compatibility with third-party platforms: Forex.com is compatible with a range of third-party platforms, including MetaTrader 4 (MT4) and NinjaTrader. This compatibility allows traders to use their preferred tools and indicators, giving them greater flexibility in their trading strategies.Features and tools: Forex.com offers a range of features and tools that cater to both novice and experienced traders. These include:

Compatibility with third-party platforms: Forex.com is compatible with a range of third-party platforms, including MetaTrader 4 (MT4) and NinjaTrader. This compatibility allows traders to use their preferred tools and indicators, giving them greater flexibility in their trading strategies.Features and tools: Forex.com offers a range of features and tools that cater to both novice and experienced traders. These include: Research Offerings: Forex.com’s market research offerings include daily market analysis, weekly outlook reports, technical analysis, and trading ideas. The broker’s research team analyzes global economic events and their impact on the financial markets, provides fundamental analysis of individual financial instruments, and identifies potential trading opportunities.Quality and Depth of Research: Forex.com’s research team consists of experienced analysts who provide in-depth analysis and insights into the financial markets. The research is well-written, concise, and easily digestible, making it accessible to traders of all levels. The team also provides regular webinars and educational materials, which further demonstrate their commitment to providing high-quality research.

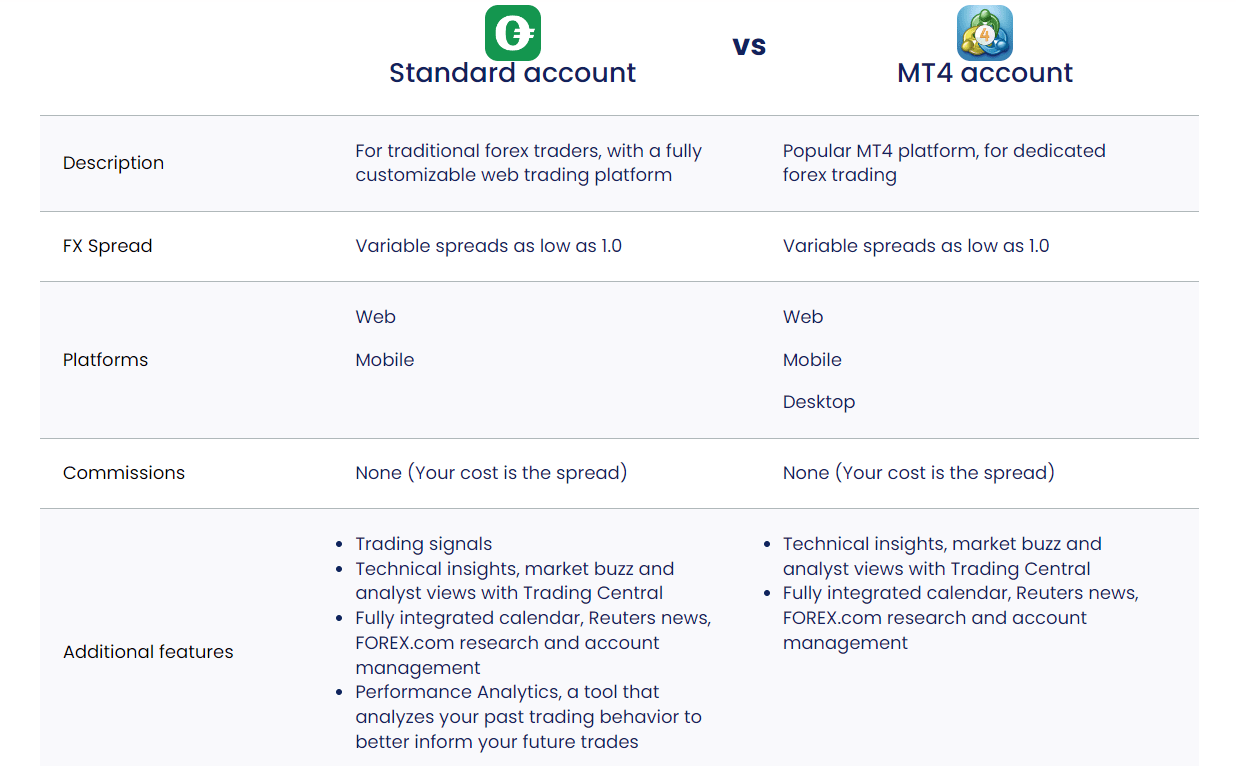

Research Offerings: Forex.com’s market research offerings include daily market analysis, weekly outlook reports, technical analysis, and trading ideas. The broker’s research team analyzes global economic events and their impact on the financial markets, provides fundamental analysis of individual financial instruments, and identifies potential trading opportunities.Quality and Depth of Research: Forex.com’s research team consists of experienced analysts who provide in-depth analysis and insights into the financial markets. The research is well-written, concise, and easily digestible, making it accessible to traders of all levels. The team also provides regular webinars and educational materials, which further demonstrate their commitment to providing high-quality research. Tools and Resources: Forex.com provides a range of tools and resources to help traders make informed trading decisions. The broker’s trading platform includes advanced charting tools, technical indicators, and customizable trading signals. The platform also provides news feeds from leading news providers, such as Reuters and Dow Jones, allowing traders to stay up-to-date with market events.Check out: FxPro Review 2023: Trading, Commission, Education & Pros/Cons

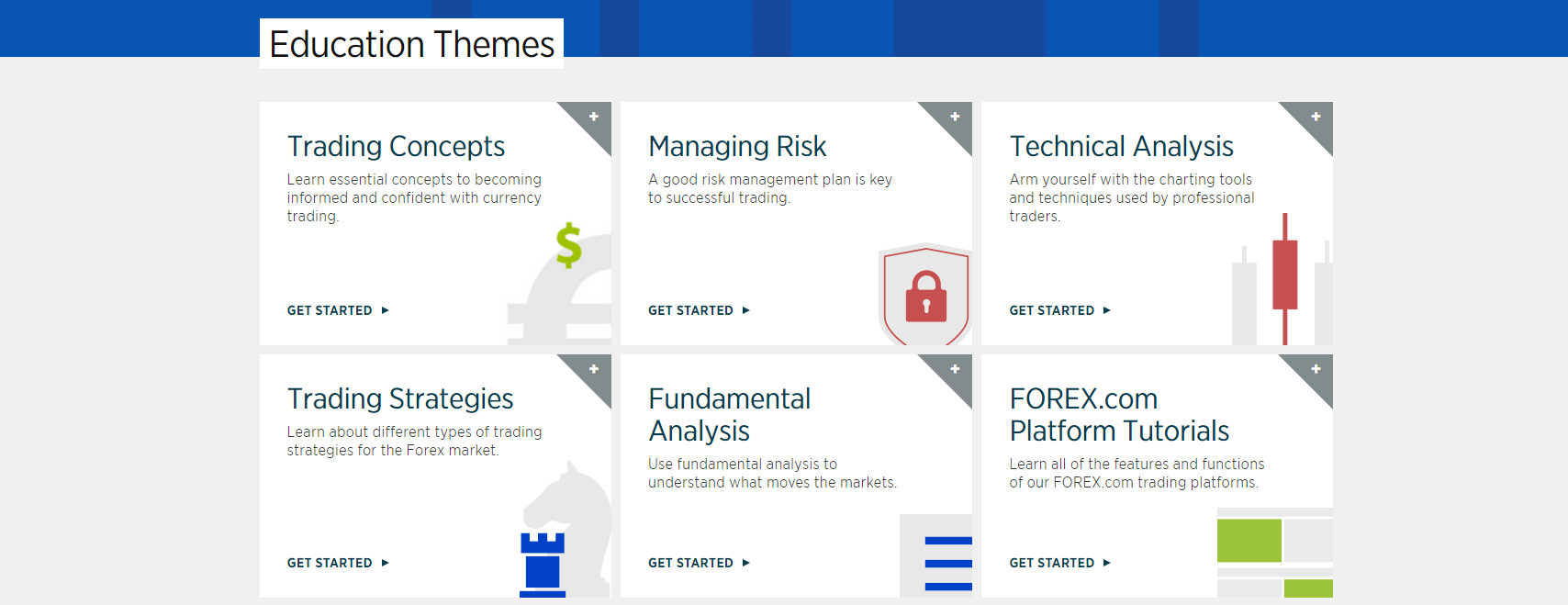

Tools and Resources: Forex.com provides a range of tools and resources to help traders make informed trading decisions. The broker’s trading platform includes advanced charting tools, technical indicators, and customizable trading signals. The platform also provides news feeds from leading news providers, such as Reuters and Dow Jones, allowing traders to stay up-to-date with market events.Check out: FxPro Review 2023: Trading, Commission, Education & Pros/Cons Quality and Comprehensiveness of Educational Materials: The educational materials offered by Forex.com are of high quality and comprehensive. The materials are well-organized and easy to navigate, making it easy for traders to find the information they need. The platform’s video tutorials are particularly helpful, as they provide step-by-step instructions on how to use the platform’s features and tools.Availability of Support and Guidance: Forex.com provides excellent support and guidance to its users. Traders can access a range of support services, including live chat, email support, and phone support. The platform’s customer service team is knowledgeable and helpful, providing traders with quick and effective solutions to their queries.More Resources: Eightcap Review 2023: Pros and Cons, Trading, Fees & Mobile App

Quality and Comprehensiveness of Educational Materials: The educational materials offered by Forex.com are of high quality and comprehensive. The materials are well-organized and easy to navigate, making it easy for traders to find the information they need. The platform’s video tutorials are particularly helpful, as they provide step-by-step instructions on how to use the platform’s features and tools.Availability of Support and Guidance: Forex.com provides excellent support and guidance to its users. Traders can access a range of support services, including live chat, email support, and phone support. The platform’s customer service team is knowledgeable and helpful, providing traders with quick and effective solutions to their queries.More Resources: Eightcap Review 2023: Pros and Cons, Trading, Fees & Mobile App

Forex.com Pros & Cons

Forex.com is a popular online forex trading platform that provides traders with access to various trading instruments, including currencies, commodities, and indices. As with any trading platform, there are both advantages and disadvantages of using Forex.com.Pros

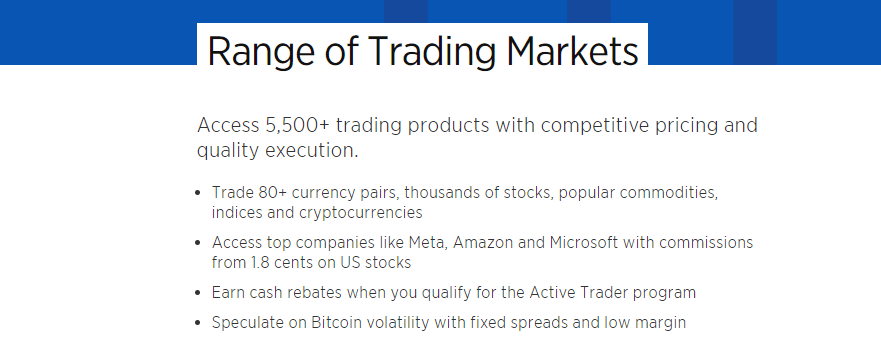

- Wide Range of Trading Instruments: Forex.com provides traders with access to over 80 currency pairs, commodities, indices, and shares from various markets worldwide.

- Low Transaction Costs: The platform offers low transaction costs, including tight spreads, commissions, and low financing rates.

- Multiple Trading Platforms: Forex.com provides various trading platforms, including MetaTrader 4 and its proprietary trading platform, which can be accessed on desktop, web, and mobile devices.

- Educational Resources: Forex.com provides a wide range of educational resources, including webinars, tutorials, and trading guides, to help traders improve their trading knowledge and skills.

- Customer Support: The platform provides excellent customer support, available 24/7 via phone, email, and live chat.

Cons

- Limited Trading Tools: Compared to other trading platforms, Forex.com offers limited trading tools, such as charting and technical analysis.

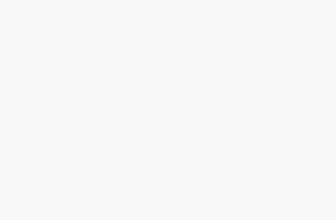

- Restricted Account Options: The platform only offers two account options, the Standard Account and the Commission Account, limiting traders’ choices.

- Limited Payment Options: Forex.com offers limited payment options, with only bank transfer, credit/debit cards, and e-wallets available for deposits and withdrawals.

- Restricted Availability: Forex.com is not available in some countries, limiting its availability to traders worldwide.

Is Forex.com Safe?

Forex.com is a reputable online trading platform that has been in the forex trading industry for over 20 years. With its solid track record and reliable trading platform, many traders are drawn to Forex.com. However, the question of whether Forex.com is safe is a crucial consideration that traders must evaluate before investing their funds.Regulatory oversight: Forex.com is regulated by multiple regulatory bodies across the world, including the US National Futures Association (NFA), the UK Financial Conduct Authority (FCA), and the Australian Securities and Investments Commission (ASIC). The platform operates under strict regulatory oversight, which ensures that it adheres to the highest standards of integrity and transparency.Security measures: Forex.com employs advanced security measures to ensure that its clients’ data and funds are secure. The platform uses industry-standard SSL encryption to protect its clients’ data during transmission. It also uses firewalls, intrusion detection systems, and other security measures to prevent unauthorized access to its servers.Client fund protection: Forex.com segregates its clients’ funds from its operating funds, which means that clients’ funds are not used to pay for Forex.com’s operational expenses. Additionally, Forex.com offers negative balance protection, which ensures that clients’ accounts will not fall below zero, protecting them from any losses that exceed their account balance.Related Post: Saxo Bank Review 2023: Best Broker for Your Trading Needs?Offering of Investments

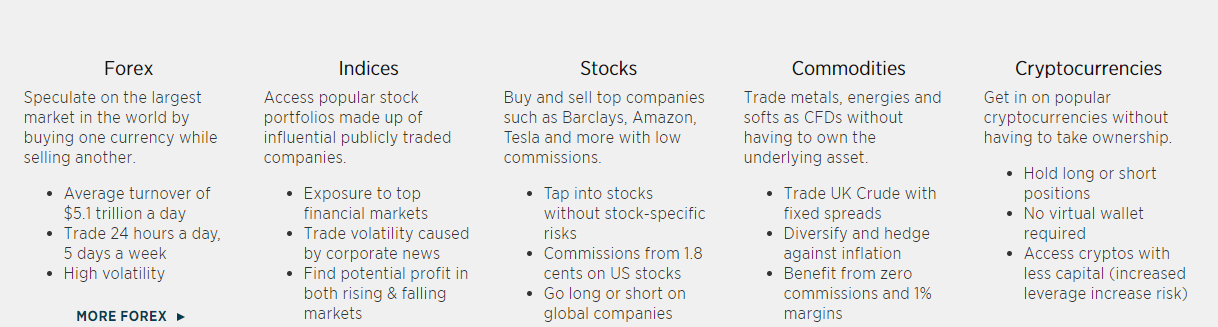

Forex.com is a global leader in online trading, providing clients access to a vast range of markets, instruments, and investment opportunities. The company offers a comprehensive range of products and services, including forex, cryptocurrencies, indices, commodities, and shares.Product portfolio: Forex.com’s product portfolio is extensive, covering various investment products that meet the diverse needs of traders. They offer over 300 forex currency pairs, including majors, minors, and exotics, as well as cryptocurrency pairs. Additionally, the company provides trading opportunities in commodities, such as gold, silver, crude oil, and agricultural products, including coffee, wheat, and corn.Asset classes: Forex.com allows trading across multiple asset classes, including forex, shares, commodities, indices, and cryptocurrencies. This enables traders to diversify their portfolios and access different markets with ease.Availability of tradeable markets: Forex.com provides access to a wide range of markets, including over 80 global shares from some of the world’s largest companies, such as Apple, Amazon, and Google. Additionally, traders can invest in over 25 global indices, including the S&P 500, Nasdaq, and FTSE 100.Leverage and margin requirements: Forex.com offers flexible leverage options, with leverage of up to 200:1 on forex pairs and up to 50:1 on indices and commodities. However, leverage is subject to regulatory restrictions in certain regions. The company also has margin requirements, which vary depending on the instrument being traded and the region where the client is located.You May Also Like: Trade Smarter with Trading 212: Pros, Cons, and FeaturesCommissions & Fees

Forex.com is a leading online forex broker that offers traders access to the global currency markets. As with any broker, traders need to understand the fees and commissions charged by Forex.com before opening an account. In this article, we will review Forex.com’s commissions and fees structure.Pricing structure: Forex.com offers a transparent pricing structure that is based on market conditions and the type of account. The broker offers two account types: Standard and Commission. The Standard account has no commission fees, but spreads are higher. The Commission account charges a commission fee per lot traded, but spreads are lower. Commission fees: Forex.com’s commission fees range from $5 to $60 per lot traded, depending on the type of account and the currency pair traded. The commission fees are charged on a round-turn basis, meaning both the opening and closing trades are charged.Non-trading fees: Forex.com charges several non-trading fees, including a $15 inactivity fee for accounts that are dormant for more than 12 months. The broker also charges a $25 fee for wire transfers and a $50 fee for account withdrawals via check.Deposit and withdrawal fees: Forex.com does not charge any deposit fees, but some deposit methods may have fees imposed by the payment provider. Withdrawal fees vary depending on the method used. Bank wire withdrawals are charged $25, while credit and debit card withdrawals are charged 1.5% of the withdrawal amount.Further Reading: Libertex Review 2023: Pros & Cons, Safety, Fees, App & Education

Commission fees: Forex.com’s commission fees range from $5 to $60 per lot traded, depending on the type of account and the currency pair traded. The commission fees are charged on a round-turn basis, meaning both the opening and closing trades are charged.Non-trading fees: Forex.com charges several non-trading fees, including a $15 inactivity fee for accounts that are dormant for more than 12 months. The broker also charges a $25 fee for wire transfers and a $50 fee for account withdrawals via check.Deposit and withdrawal fees: Forex.com does not charge any deposit fees, but some deposit methods may have fees imposed by the payment provider. Withdrawal fees vary depending on the method used. Bank wire withdrawals are charged $25, while credit and debit card withdrawals are charged 1.5% of the withdrawal amount.Further Reading: Libertex Review 2023: Pros & Cons, Safety, Fees, App & Education Mobile Trading Apps

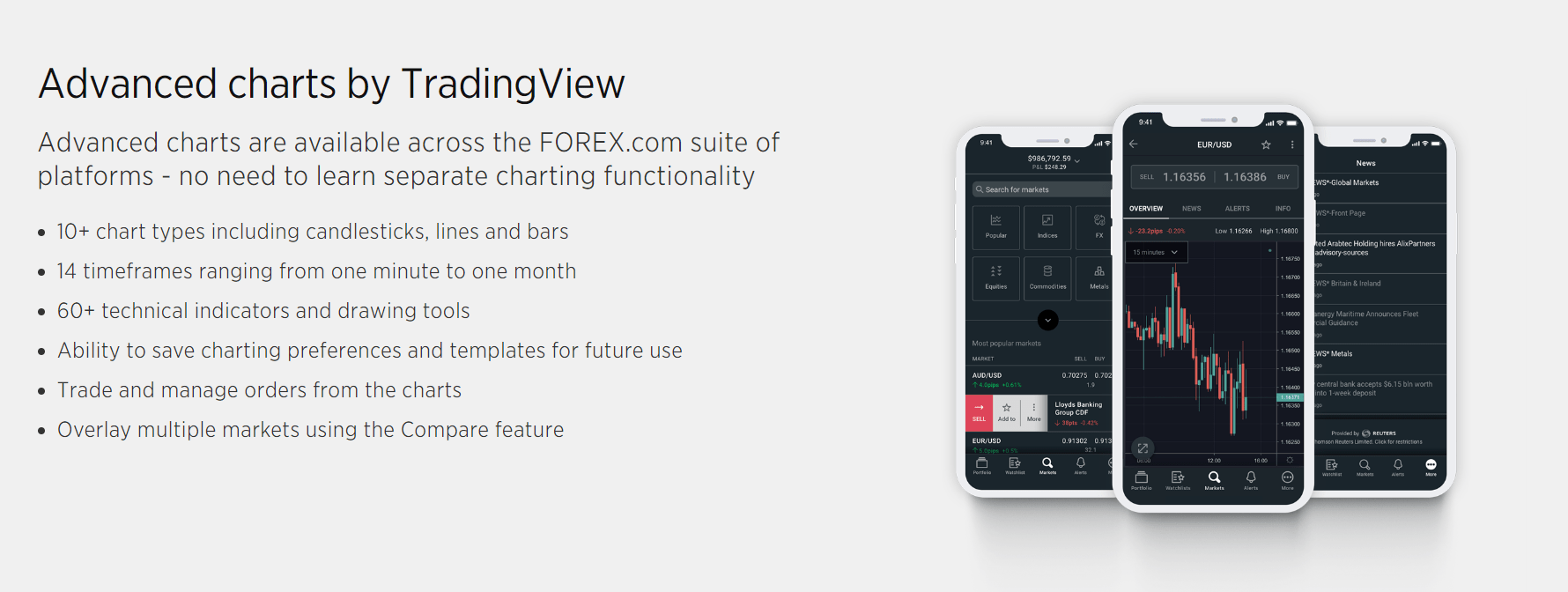

Forex.com is a popular forex trading platform that offers its users a powerful and user-friendly mobile trading app. The Forex.com mobile app is available for both iOS and Android devices, and it allows traders to trade on-the-go with ease and convenience.Overview of mobile apps: The Forex.com mobile app provides a comprehensive trading experience that allows users to access their accounts, place trades, and monitor markets from their mobile devices. It features an intuitive interface that makes it easy to navigate and use. Features and functionality: The app provides users with a wide range of features and functionalities, including access to real-time market data, advanced charting tools, and customizable trading alerts. Users can also place and manage trades, view account balances and transaction history, and fund their accounts directly from the app.The app also offers a range of educational resources, including daily market analysis, trading insights, and live webinars, to help traders stay informed and make informed trading decisions.

Features and functionality: The app provides users with a wide range of features and functionalities, including access to real-time market data, advanced charting tools, and customizable trading alerts. Users can also place and manage trades, view account balances and transaction history, and fund their accounts directly from the app.The app also offers a range of educational resources, including daily market analysis, trading insights, and live webinars, to help traders stay informed and make informed trading decisions. Ease of use and navigation: The Forex.com mobile app is designed to be user-friendly and easy to navigate. The interface is clean and intuitive, making it easy for users to find what they need and place trades quickly and efficiently. The app is also responsive and fast, allowing traders to react quickly to changing market conditions.Explore More: Admiral Markets Review 2023: Platform, Fees & Customer Support

Ease of use and navigation: The Forex.com mobile app is designed to be user-friendly and easy to navigate. The interface is clean and intuitive, making it easy for users to find what they need and place trades quickly and efficiently. The app is also responsive and fast, allowing traders to react quickly to changing market conditions.Explore More: Admiral Markets Review 2023: Platform, Fees & Customer SupportOther Trading Platforms

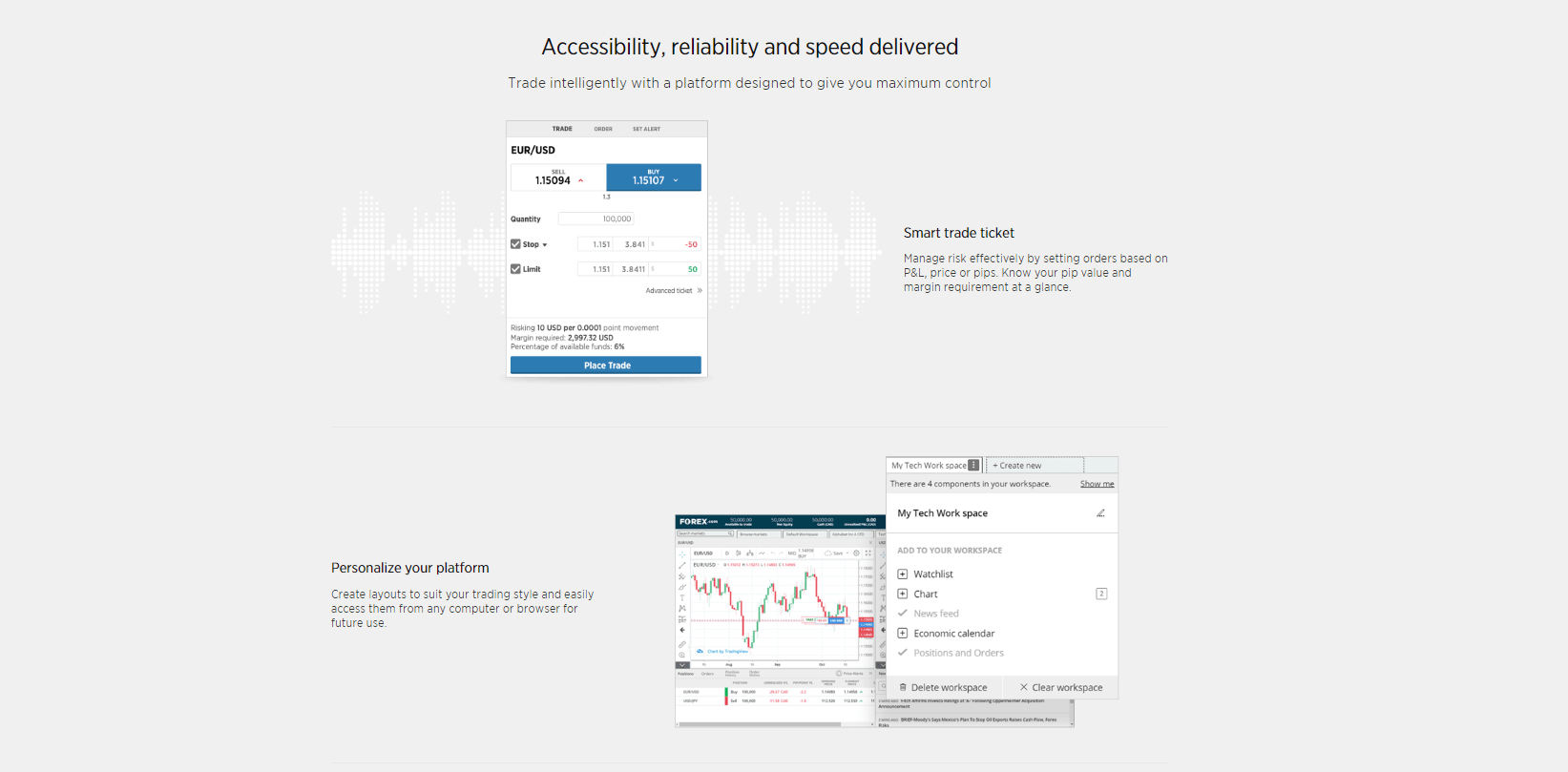

Forex.com is a popular online trading platform that offers access to a range of financial instruments, including forex, stocks, and commodities. The platform is user-friendly and offers a variety of features and tools that cater to both novice and experienced traders. Additionally, Forex.com is compatible with third-party platforms, making it a versatile option for those who prefer to use different tools for trading.Forex.com Trading Platform: Forex.com offers its proprietary trading platform that is available on both desktop and mobile devices. The platform is intuitive and easy to navigate, allowing users to quickly find the information they need to make informed trading decisions. Additionally, the platform offers a range of charting tools and technical indicators, as well as customizable layouts, to help traders create a personalized trading experience. Compatibility with third-party platforms: Forex.com is compatible with a range of third-party platforms, including MetaTrader 4 (MT4) and NinjaTrader. This compatibility allows traders to use their preferred tools and indicators, giving them greater flexibility in their trading strategies.Features and tools: Forex.com offers a range of features and tools that cater to both novice and experienced traders. These include:

Compatibility with third-party platforms: Forex.com is compatible with a range of third-party platforms, including MetaTrader 4 (MT4) and NinjaTrader. This compatibility allows traders to use their preferred tools and indicators, giving them greater flexibility in their trading strategies.Features and tools: Forex.com offers a range of features and tools that cater to both novice and experienced traders. These include:- Educational resources: Forex.com offers a range of educational resources, including webinars, articles, and trading guides, to help traders improve their skills and knowledge.

- Economic calendar: The platform offers an economic calendar that provides real-time information on key economic events and their potential impact on the market.

- Trading signals: Forex.com provides trading signals that can help traders identify potential trading opportunities and make informed trading decisions.

- Market analysis: The platform offers a range of market analysis tools, including daily market commentary and technical analysis, to help traders stay up-to-date with the latest market trends and developments.

Market Research

Forex.com is a leading forex and CFD broker that offers a range of market research resources to help traders make informed decisions. The broker’s research team provides insights on various financial instruments, including forex, commodities, and indices. Research Offerings: Forex.com’s market research offerings include daily market analysis, weekly outlook reports, technical analysis, and trading ideas. The broker’s research team analyzes global economic events and their impact on the financial markets, provides fundamental analysis of individual financial instruments, and identifies potential trading opportunities.Quality and Depth of Research: Forex.com’s research team consists of experienced analysts who provide in-depth analysis and insights into the financial markets. The research is well-written, concise, and easily digestible, making it accessible to traders of all levels. The team also provides regular webinars and educational materials, which further demonstrate their commitment to providing high-quality research.

Research Offerings: Forex.com’s market research offerings include daily market analysis, weekly outlook reports, technical analysis, and trading ideas. The broker’s research team analyzes global economic events and their impact on the financial markets, provides fundamental analysis of individual financial instruments, and identifies potential trading opportunities.Quality and Depth of Research: Forex.com’s research team consists of experienced analysts who provide in-depth analysis and insights into the financial markets. The research is well-written, concise, and easily digestible, making it accessible to traders of all levels. The team also provides regular webinars and educational materials, which further demonstrate their commitment to providing high-quality research. Tools and Resources: Forex.com provides a range of tools and resources to help traders make informed trading decisions. The broker’s trading platform includes advanced charting tools, technical indicators, and customizable trading signals. The platform also provides news feeds from leading news providers, such as Reuters and Dow Jones, allowing traders to stay up-to-date with market events.Check out: FxPro Review 2023: Trading, Commission, Education & Pros/Cons

Tools and Resources: Forex.com provides a range of tools and resources to help traders make informed trading decisions. The broker’s trading platform includes advanced charting tools, technical indicators, and customizable trading signals. The platform also provides news feeds from leading news providers, such as Reuters and Dow Jones, allowing traders to stay up-to-date with market events.Check out: FxPro Review 2023: Trading, Commission, Education & Pros/ConsEducation

Forex.com is a well-established online trading platform that offers a range of educational resources to help traders improve their skills and knowledge of the foreign exchange (forex) market. The platform offers a variety of educational materials to cater to the needs of traders of all levels, from beginners to advanced traders.Educational Offerings: Forex.com offers a range of educational resources, including webinars, video tutorials, e-books, and articles. These resources cover various topics such as forex trading basics, technical and fundamental analysis, risk management, and trading strategies. The platform also offers a demo account, allowing traders to practice trading with virtual funds before committing real money. Quality and Comprehensiveness of Educational Materials: The educational materials offered by Forex.com are of high quality and comprehensive. The materials are well-organized and easy to navigate, making it easy for traders to find the information they need. The platform’s video tutorials are particularly helpful, as they provide step-by-step instructions on how to use the platform’s features and tools.Availability of Support and Guidance: Forex.com provides excellent support and guidance to its users. Traders can access a range of support services, including live chat, email support, and phone support. The platform’s customer service team is knowledgeable and helpful, providing traders with quick and effective solutions to their queries.More Resources: Eightcap Review 2023: Pros and Cons, Trading, Fees & Mobile App

Quality and Comprehensiveness of Educational Materials: The educational materials offered by Forex.com are of high quality and comprehensive. The materials are well-organized and easy to navigate, making it easy for traders to find the information they need. The platform’s video tutorials are particularly helpful, as they provide step-by-step instructions on how to use the platform’s features and tools.Availability of Support and Guidance: Forex.com provides excellent support and guidance to its users. Traders can access a range of support services, including live chat, email support, and phone support. The platform’s customer service team is knowledgeable and helpful, providing traders with quick and effective solutions to their queries.More Resources: Eightcap Review 2023: Pros and Cons, Trading, Fees & Mobile App