Overview Of Services

Fineco Bank is a trading platform that offers a range of services to its customers. It provides a wide range of financial products and services including online banking, trading, and other financial services. Customers can access the bank’s products and services through its website or mobile app. The bank also offers customer support in multiple languages.The bank has been in operation since 2023 and has seen considerable growth since then. It has an impressive portfolio of products and services that make it one of the most popular online trading platforms in Europe. Customers can trade stocks, exchange-traded funds (ETFs), bonds, options, futures, and forex with ease. The platform also provides sophisticated tools for technical analysis such as charting tools and automated trading systems to help traders make informed decisions about their investments. Customers can also benefit from the bank’s extensive research capabilities which include real-time market data and analysis on markets around the world. This allows investors to stay up-to-date with current market trends and make better investment decisions. All these features combined make Fineco Bank an attractive choice for traders looking for a reliable online trading platform.Overall, Fineco Bank is a trusted trading platform offering customers a wide selection of features to ensure they get the best out of their investments. Its advanced tools, research capabilities, and competitive fees are just some of the reasons why this is one of the top choices among European traders today.You May Also Like: VT Markets Review 2023: A Detailed Look at This Forex Broker

Customers can also benefit from the bank’s extensive research capabilities which include real-time market data and analysis on markets around the world. This allows investors to stay up-to-date with current market trends and make better investment decisions. All these features combined make Fineco Bank an attractive choice for traders looking for a reliable online trading platform.Overall, Fineco Bank is a trusted trading platform offering customers a wide selection of features to ensure they get the best out of their investments. Its advanced tools, research capabilities, and competitive fees are just some of the reasons why this is one of the top choices among European traders today.You May Also Like: VT Markets Review 2023: A Detailed Look at This Forex BrokerPros And Cons

Pros

- Offers a range of trading instruments, including forex, stocks, options, futures, and ETFs.

- Provides low commissions and fees for trading, which can be beneficial for traders looking to minimize trading costs.

- Offers access to its own proprietary trading platform, which includes advanced charting tools and analysis features.

- Provides access to a wide range of educational resources, including webinars and trading guides.

- Regulated by top-tier authorities, such as the FCA and the Bank of Italy.

Cons

- Higher minimum deposit requirements than some other brokers.

- Limited availability of customer support outside of regular trading hours.

- No social trading options.

- Limited availability of payment methods for deposits and withdrawals.

- Limited availability of research tools and market analysis compared to some other brokers.

Account Types

Fineco Bank offers a variety of account types for trading, which makes it suitable for different kinds of investors. The most popular account is the Standard Account, which provides access to all the features and services of the online platform. Through this account, customers can easily open and manage their trades with no minimum balance requirements. Moreover, they can enjoy low commission fees and competitive spreads.The Advanced Account is another popular account type at Fineco Bank. This type of account is suitable for experienced traders who need more advanced features such as real-time market data analysis, automated trading systems, and higher leverage levels. This account also has higher commissions but lower spreads than the Standard Account. Finally, Fineco Bank also offers a Professional Account for professional traders. This type of account offers a range of advanced features such as portfolio management tools and hedging strategies. Customers will have to meet certain criteria to get this type of account with Fineco Bank.Overall, Fineco Bank has something to offer every type of trader with its various accounts options that come with different fees and features depending on their needs and experience level in trading.Further Reading: GKFX Prime Review 2023: Pros, Cons, and Everything in Between

Finally, Fineco Bank also offers a Professional Account for professional traders. This type of account offers a range of advanced features such as portfolio management tools and hedging strategies. Customers will have to meet certain criteria to get this type of account with Fineco Bank.Overall, Fineco Bank has something to offer every type of trader with its various accounts options that come with different fees and features depending on their needs and experience level in trading.Further Reading: GKFX Prime Review 2023: Pros, Cons, and Everything in BetweenUser Experience

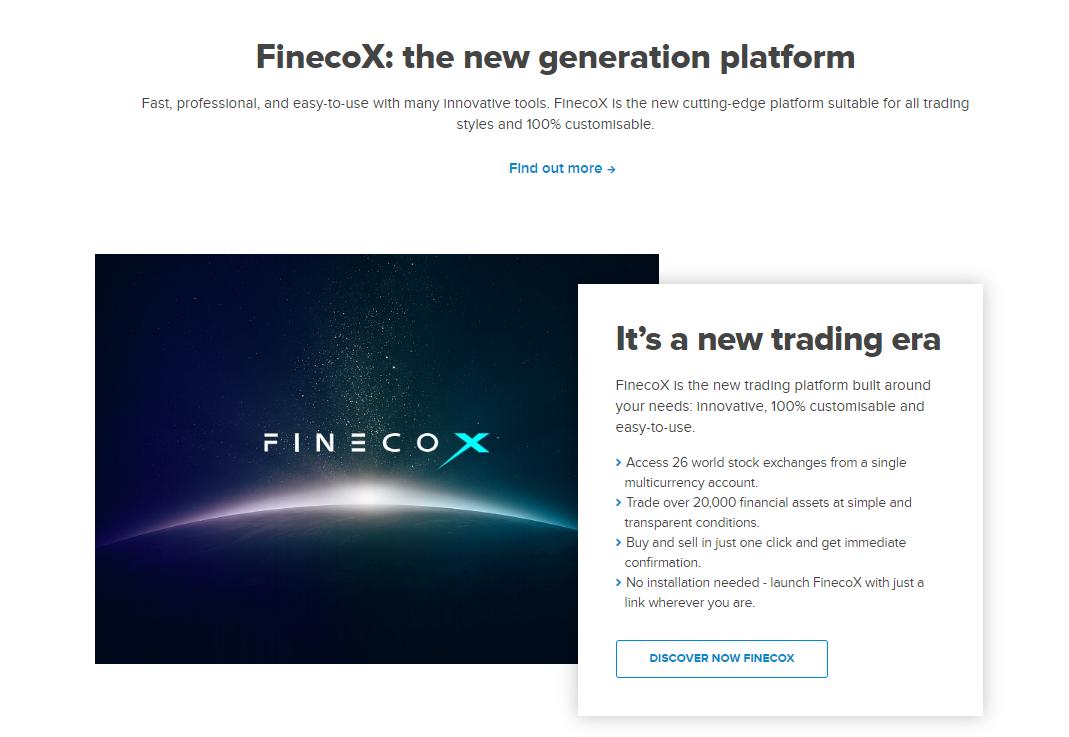

The user experience of Fineco Bank’s trading platform is excellent. The website is easy to navigate, and the interface is intuitive. Customers can easily find the information they need and access the features they want to use with just a few clicks. The site also provides helpful tutorials and tools that make it easier for customers to get started with trading. There are several benefits to using Fineco Bank’s trading platform. The fees are competitive, and there are no hidden costs or charges. Furthermore, customer service is prompt and efficient; users can contact customer service representatives 24/7 via email or live chat. Finally, the online security of Fineco Bank is top-notch; all transactions are securely encrypted and safeguarded against unauthorized access.In summary, Fineco Bank’s trading platform provides an excellent user experience with competitive fees, fast customer service, and robust security measures. It’s definitely one of the best options for traders looking for a reliable trading platform.Explore More: Teletrade Review 2023: Is This Forex Broker a Reliable Choice?

There are several benefits to using Fineco Bank’s trading platform. The fees are competitive, and there are no hidden costs or charges. Furthermore, customer service is prompt and efficient; users can contact customer service representatives 24/7 via email or live chat. Finally, the online security of Fineco Bank is top-notch; all transactions are securely encrypted and safeguarded against unauthorized access.In summary, Fineco Bank’s trading platform provides an excellent user experience with competitive fees, fast customer service, and robust security measures. It’s definitely one of the best options for traders looking for a reliable trading platform.Explore More: Teletrade Review 2023: Is This Forex Broker a Reliable Choice?Pricing And Fees

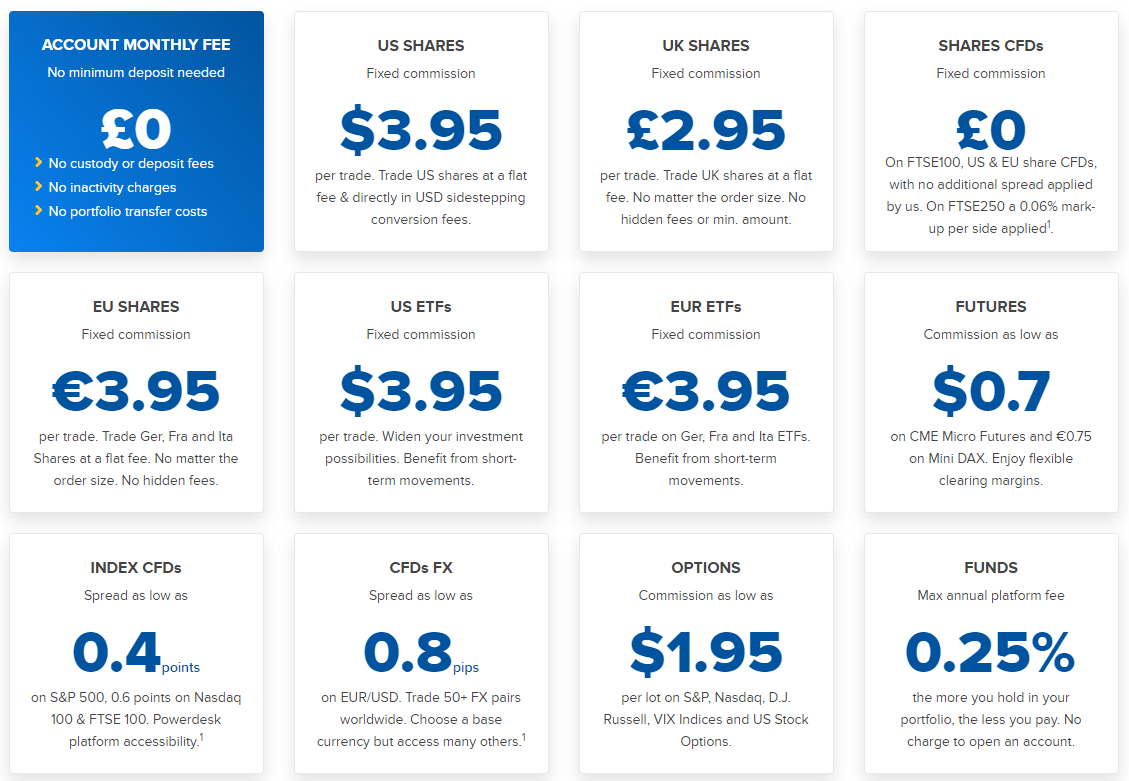

When it comes to pricing and fees, Fineco Bank offers some of the lowest in the industry. They charge a flat fee for all trades and offer free ETFs with no additional charges. On top of these great rates, they also offer a number of other features that make trading with them an even more attractive option. For example, they have sophisticated risk management tools and automated systems that can help traders make better decisions. Additionally, their customer service is top-notch, providing quick responses to any questions or issues you may have. The only downside to Fineco Bank is that their fees are higher than many other brokers. However, if you’re looking for a reliable trading platform with low fees and great features, then this could still be a good option for you. Furthermore, they offer a range of advanced tools such as portfolio analysis and charting capabilities that could give you an edge over other traders in your market.Overall, Fineco Bank is an excellent choice for traders looking for low costs and powerful tools to help them succeed in the stock market. With its competitive pricing structure, comprehensive research tools and excellent customer service, it’s certainly worth considering as one of your top options when it comes to online trading platforms.Discover: FlowBank Review 2023: What Makes This Forex Broker #1?

The only downside to Fineco Bank is that their fees are higher than many other brokers. However, if you’re looking for a reliable trading platform with low fees and great features, then this could still be a good option for you. Furthermore, they offer a range of advanced tools such as portfolio analysis and charting capabilities that could give you an edge over other traders in your market.Overall, Fineco Bank is an excellent choice for traders looking for low costs and powerful tools to help them succeed in the stock market. With its competitive pricing structure, comprehensive research tools and excellent customer service, it’s certainly worth considering as one of your top options when it comes to online trading platforms.Discover: FlowBank Review 2023: What Makes This Forex Broker #1?Security And Regulations

The security and regulations of Fineco Bank are highly reliable. All accounts are protected by the latest encryption technology, ensuring that all of your data is safe and secure. The Financial Conduct Authority (FCA) regulates their services, and they make sure to comply with all applicable laws and regulations. In addition, Fineco Bank provides a variety of safeguards to protect your money against fraud or theft. They have a zero-tolerance policy for unauthorized access to your accounts, and they monitor all transactions closely so you can be sure your funds are safe at all times.Finally, Fineco Bank also offers customer service that is second to none. They have knowledgeable staff available 24/7 who can offer assistance with any issues you may have related to their services. Overall, Fineco Bank is a secure platform that meets the highest standards of safety and regulation.Check out: Trade Nation Review 2023: Everything You Need to Know

In addition, Fineco Bank provides a variety of safeguards to protect your money against fraud or theft. They have a zero-tolerance policy for unauthorized access to your accounts, and they monitor all transactions closely so you can be sure your funds are safe at all times.Finally, Fineco Bank also offers customer service that is second to none. They have knowledgeable staff available 24/7 who can offer assistance with any issues you may have related to their services. Overall, Fineco Bank is a secure platform that meets the highest standards of safety and regulation.Check out: Trade Nation Review 2023: Everything You Need to KnowCustomer Support

When it comes to customer support, Fineco Bank excels. The support team is knowledgeable and friendly, and they’re always ready to answer any questions you might have. They respond quickly and do their best to provide helpful solutions. For those who prefer self-service options, the website offers detailed tutorials and FAQs that are easy to understand. The platform also provides 24/7 technical assistance in case of a problem. The staff is knowledgeable and experienced, so they can help troubleshoot any issues you may encounter while trading. Additionally, the team can be contacted through email or phone for more immediate assistance.Overall, Fineco Bank provides an excellent customer service experience that makes trading on the platform a breeze. Their knowledgeable staff is always available to help with any issue or question you may have, so you can rest assured that you’re in good hands whenever using the platform.More Resources: FXPrimus 2023 Review: Is This Forex Broker Right For You?

The platform also provides 24/7 technical assistance in case of a problem. The staff is knowledgeable and experienced, so they can help troubleshoot any issues you may encounter while trading. Additionally, the team can be contacted through email or phone for more immediate assistance.Overall, Fineco Bank provides an excellent customer service experience that makes trading on the platform a breeze. Their knowledgeable staff is always available to help with any issue or question you may have, so you can rest assured that you’re in good hands whenever using the platform.More Resources: FXPrimus 2023 Review: Is This Forex Broker Right For You?Research Tools

Fineco Bank offers a variety of research tools for traders. The platform includes market analysis, technical indicators, and alerts to help traders stay informed. It also provides its users with real-time news updates and online learning resources. These tools are beneficial for both beginner and experienced traders alike.The research tools provided by Fineco Bank are comprehensive and easy to use. It has a wide selection of technical indicators such as moving averages, Bollinger bands, Fibonacci retracement levels, and more. Additionally, there are multiple types of alerts which can be set up to notify the user when certain conditions are met. This allows traders to identify opportunities before they arise or get out of losing trades quickly. Overall, Fineco Bank’s research tools make it an excellent choice for trading on the market. Its comprehensive selection of charting tools and alerts makes it easy for traders to find the best opportunities in the market. The platform’s online learning resources also provide helpful tutorials and tips for new investors looking to hone their skills. With these features combined, Fineco Bank is a great choice for anyone looking to make profitable trades on the stock market.Learn More: Forex4You 2023 Review: Is This Forex Broker Right For You?

Overall, Fineco Bank’s research tools make it an excellent choice for trading on the market. Its comprehensive selection of charting tools and alerts makes it easy for traders to find the best opportunities in the market. The platform’s online learning resources also provide helpful tutorials and tips for new investors looking to hone their skills. With these features combined, Fineco Bank is a great choice for anyone looking to make profitable trades on the stock market.Learn More: Forex4You 2023 Review: Is This Forex Broker Right For You?Mobile App Performance

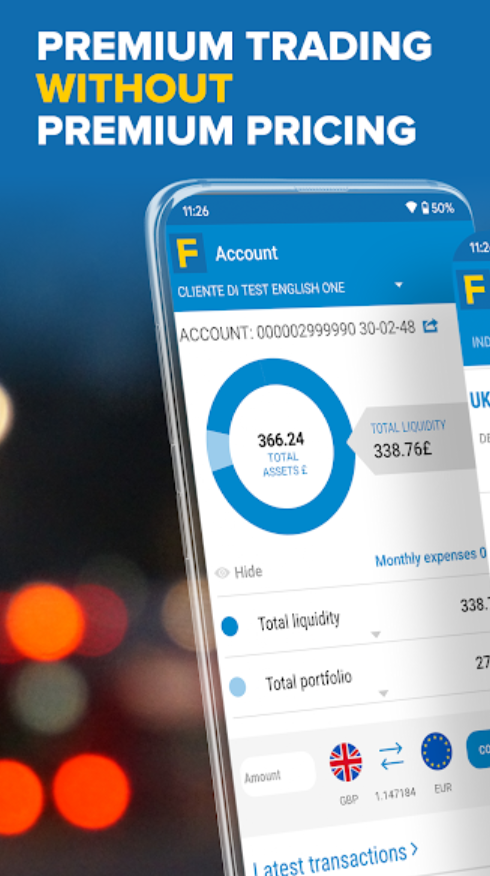

The Fineco Bank review in 2023 assesses the mobile app performance. The app is available for both iOS and Android devices, allowing users to access their accounts on the go. It’s user-friendly and intuitive, making it easy to navigate through all the trading options. The app also offers a range of useful features including notifications, news updates, and real-time price alerts. The security of the app is paramount and the bank has taken several steps to ensure its safety. All data is encrypted and stored securely, so users can be sure that their information won’t be leaked or hacked into. Additionally, two-factor authentication is required in order to log in, which adds an extra layer of protection.Overall, the mobile app offered by Fineco Bank is an excellent way for traders to manage their accounts no matter where they are. It offers a great user experience with plenty of features and protections in place to keep accounts secure.Find Out: Capital.com Review 2023: Everything You Need to Know

The security of the app is paramount and the bank has taken several steps to ensure its safety. All data is encrypted and stored securely, so users can be sure that their information won’t be leaked or hacked into. Additionally, two-factor authentication is required in order to log in, which adds an extra layer of protection.Overall, the mobile app offered by Fineco Bank is an excellent way for traders to manage their accounts no matter where they are. It offers a great user experience with plenty of features and protections in place to keep accounts secure.Find Out: Capital.com Review 2023: Everything You Need to KnowConclusion

Dig Deeper: GBE Brokers Review 2023: An Overview of Trading FeaturesIn conclusion, Fineco Bank is a great trading platform for those looking to get started in the stock market. It offers an easy-to-use interface that’s perfect for beginners, as well as access to international markets and some special incentives when opening an account. The customer support offered by Fineco Bank is also top notch, with knowledgeable staff always available to answer questions.

Overall, the biggest downside of using this platform is that there are some hidden fees associated with it. However, these fees are generally very reasonable and are usually lower than other platforms. As long as you’re aware of them beforehand, they won’t be too much of a problem.

In my opinion, Fineco Bank is one of the best trading platforms out there for new traders in 2023. Not only does it have great features and incentives, but it also has excellent customer support and low fees. I’d definitely recommend it to anyone who’s interested in getting into the stock market!