In recent years, eToro has become one of the most popular online trading platforms, attracting millions of users from around the world. The platform offers a range of trading features, including copy trading, social trading, and a variety of asset classes, including stocks, forex, and crypto trading. In this article, we will take an in-depth look at eToro, covering its pros and cons, safety measures, fees, mobile apps, trading platforms, market research, and education resources.

Related Post: City Index Review 2023: Is it the Best Online Trading Platform?

Related Post: City Index Review 2023: Is it the Best Online Trading Platform?

Further Reading: Swissquote Review: Is This the Best Online Broker in 2023?

Further Reading: Swissquote Review: Is This the Best Online Broker in 2023? Explore More: Markets.com Review: Is This the Best Broker for You in 2023?

Explore More: Markets.com Review: Is This the Best Broker for You in 2023? More Resources: IronFX Review 2023: Pros, Cons and Everything You Need to Know

More Resources: IronFX Review 2023: Pros, Cons and Everything You Need to Know

eToro Pros & Cons

eToro is a popular trading platform that offers a range of assets and markets for traders to invest in. Like any platform, eToro has both pros and cons that users should be aware of before using the platform.Pros

- User-Friendly Interface: eToro is known for its user-friendly interface, which makes it easy for traders of all levels to navigate and use the platform. The platform is designed to be intuitive and straightforward, with easy-to-use tools and features.

- Social and Copy Trading Features: eToro offers a unique social and copy trading feature that allows users to follow and copy the trades of successful traders on the platform. This can be a useful tool for new traders who are looking to learn from experienced traders and improve their trading strategies.

- Range of Assets and Markets: eToro offers a wide range of assets and markets for traders to invest in, including stocks, crypto trading, and forex. This can provide users with a diverse range of investment opportunities and the ability to trade in multiple markets.

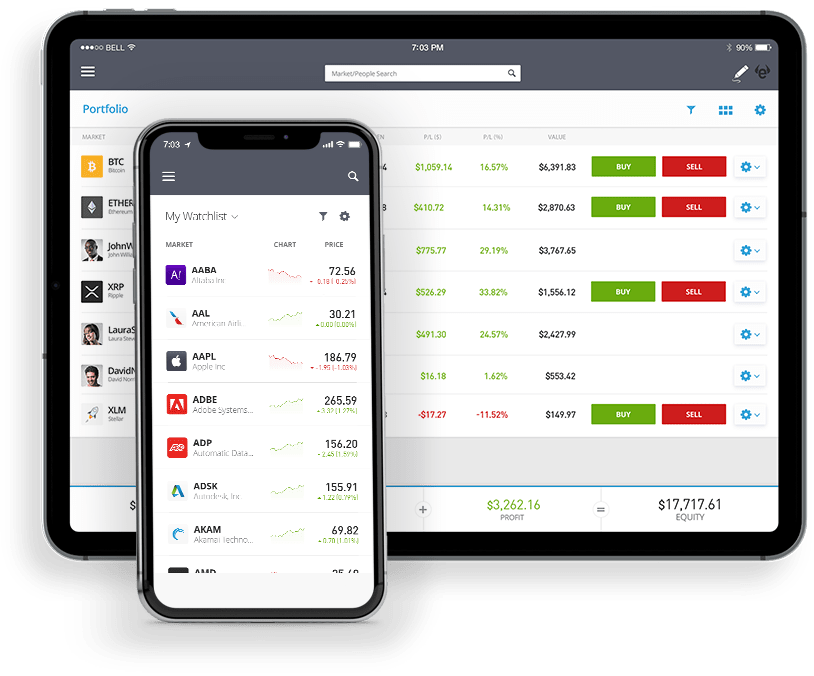

- Mobile Trading Apps: eToro offers mobile trading apps for both iOS and Android devices, which allows users to trade on-the-go. The apps are well-designed and offer all of the same features as the desktop platform.

- Transparent Fee Structure: eToro’s fee structure is transparent, with no hidden fees or commissions. While the fees can be higher compared to some other trading platforms, users know exactly what they’re paying for and can easily calculate their costs.

Cons

- Limited Research and Analysis Tools: While eToro offers basic technical analysis tools, such as charts and indicators, more advanced research and analysis tools are not available on the platform. This can be a drawback for more experienced traders who rely heavily on these tools.

- Higher Fees for Certain Assets: While eToro’s fee structure is transparent, the fees for certain assets, such as crypto trading, can be higher compared to other platforms. This can be a concern for users who trade in these markets.

- Limited Deposit and Withdrawal Options: eToro only allows users to deposit and withdraw funds using a limited range of payment methods, such as bank transfer, credit/debit card, and PayPal. This can be a concern for users who prefer to use other payment methods.

- Limited Educational Resources: While eToro offers a range of educational resources, such as webinars and e-books, some users may find that the platform’s educational offerings are limited compared to other trading platforms.

Overall, eToro is a reputable and safe trading platform that offers a range of features and assets for traders of all levels. However, it’s important for users to carefully consider the platform’s pros and cons before deciding if it’s the right fit for their trading needs and goals.

Is eToro Safe?

when it comes to investing and trading, safety and security are of utmost importance. In this article, we’ll explore the safety measures, investor protection, and user reviews of eToro to help you make an informed decision on whether it’s a safe platform for your trading needs.Security Measures of eToro:

eToro takes security seriously and has implemented a range of measures to protect users’ funds and personal information. The platform uses two-factor authentication (2FA) and SSL encryption to secure user accounts and transactions. In addition, eToro stores user funds in segregated accounts, which means that user funds are separated from the platform’s operating funds.eToro is also regulated by multiple regulatory bodies, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC). Being regulated means that eToro must comply with strict guidelines and standards to ensure the safety and security of its users.

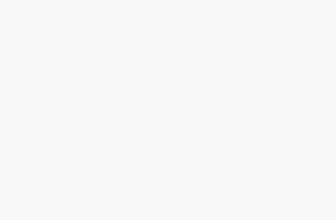

eToro Ratings

Investor Protection:

In addition to security measures and regulation, eToro offers investor protection and insurance to its users. The platform is a member of the Financial Services Compensation Scheme (FSCS) in the UK, which provides up to £85,000 in compensation to eligible investors if eToro were to go bankrupt or become insolvent.eToro also offers negative balance protection, which means that users cannot lose more than the amount they have deposited in their account. This provides an additional layer of protection for users and can help prevent significant losses.User Reviews:

One way to gauge the safety and reliability of a trading platform is to look at user reviews and ratings. Overall, eToro has received positive reviews from users, with many praising the platform’s user-friendly interface and social trading features.However, there have been some negative reviews from users who have experienced issues with deposits and withdrawals, customer support, and fees. It’s important to note that while negative reviews are not uncommon for any trading platform, users should carefully consider these reviews and weigh them against the platform’s overall reputation and safety measures.

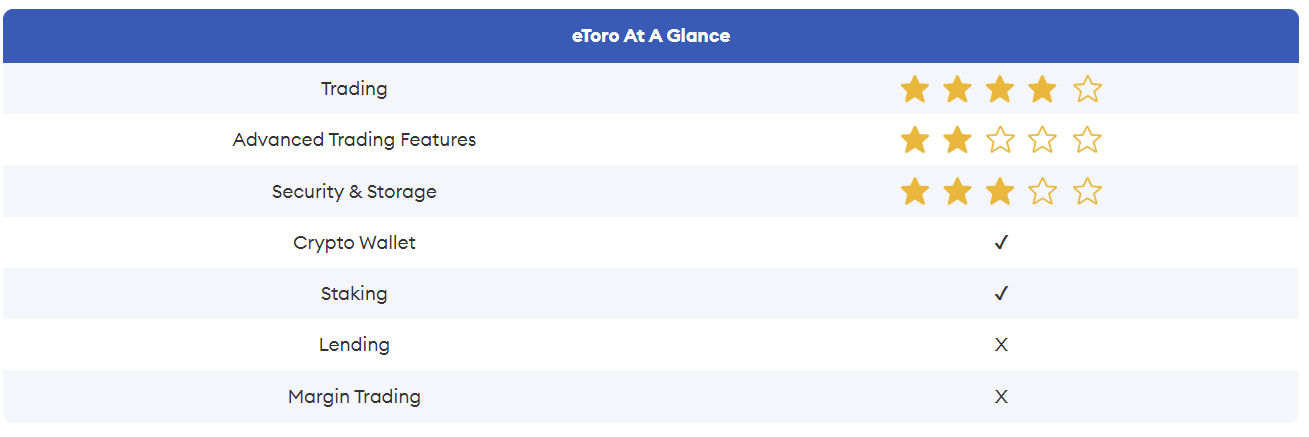

Here’s a list of more popular coins available on eToro

Offering of Investments

eToro is a trading platform that offers a range of investment options to its users. From stocks and ETFs to crypto trading and forex, eToro provides users with a variety of assets to choose from. In this article, we’ll explore eToro’s offering of investments and discuss the trading options, leverage, and margin trading available on the platform.Assets Available on eToro:

eToro offers users access to a wide variety of assets, including stocks, ETFs, crypto trading, forex, and commodities. The platform’s stock offerings include popular companies such as Apple, Amazon, and Tesla, as well as emerging companies from around the world. eToro also offers a range of ETFs, which can provide users with exposure to a diversified portfolio of assets.In addition, eToro provides access to a range of crypto trading, including Bitcoin, Ethereum, and Ripple, among others. For users interested in forex trading, eToro offers a range of currency pairs, including major, minor, and exotic pairs. Finally, eToro offers a selection of commodities such as gold, silver, and oil.Trading Options:

eToro offers a range of trading options to its users. Users can choose to buy and hold assets for the long term or trade on a short-term basis. Additionally, eToro offers social trading features, which allow users to follow and copy the trades of other users on the platform.Users can also take advantage of eToro’s CopyPortfolios, which are pre-set investment portfolios that are managed by eToro’s investment team. These portfolios are designed to provide users with exposure to a range of assets and markets.Margin Trading:

eToro offers leverage and margin trading to its users, which allows them to open positions that are larger than their account balance. The amount of leverage available varies depending on the asset being traded, with higher leverage typically available for more volatile assets such as crypto trading and forex.It’s important to note that while leverage can increase potential profits, it also increases potential losses. Users should carefully consider their risk tolerance and trading strategy before using leverage and margin trading on eToro.You May Also Like: BDSwiss Review 2023: Is it a Reliable Forex and CFD Broker?Commissions

eToro is a popular trading platform that provides users with access to a range of investment options. While the platform offers a variety of features and benefits, it’s important to understand the cost structure and fees associated with trading on eToro. In this article, we’ll explore eToro’s commissions and fees and compare them to other trading platforms.

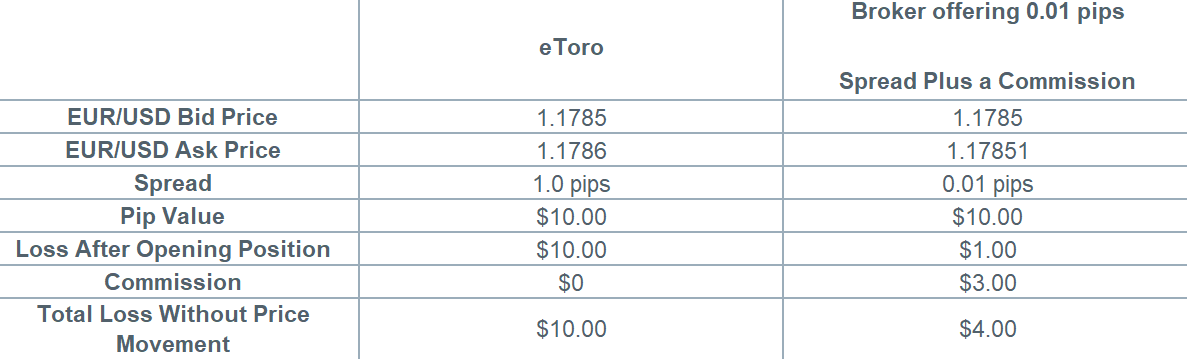

Here’s the eToro Direct Trading Cost Overview and Comparison

Cost Structure:

eToro uses a spread-based pricing model for most of its assets, which means that the difference between the bid and ask price is used to calculate the cost of trading. The spread is a variable fee and can vary depending on the asset being traded and market conditions. For example, the spread for trading Apple stock on eToro is typically around 0.09%.In addition to spreads, eToro charges a small fee for certain types of transactions, such as overnight rollover fees for forex trades. The platform also charges a withdrawal fee of $5 per transaction.Spreads/Markups Charges:

In addition to spreads and transaction fees, eToro may apply markups or other charges to the cost of trading certain assets. For example, eToro may apply a markup to the spread for trading crypto trading, which can increase the cost of trading.It’s important to note that eToro trading platform does not charge commissions for trading stocks, ETFs, or cryptocurrencies. However, users should be aware of the potential impact of spreads and markups on the cost of trading.

Comparison to Other Trading Platforms:

When comparing eToro’s commissions and fees to other trading platforms, it’s important to consider the total cost of trading. While eToro does not charge commissions for trading, the cost of spreads and other fees can add up over time.For example, when trading Apple stock on eToro usa securities inc, the spread is typically around 0.09%. In comparison, some other trading platforms may offer spreads as low as 0.01%. While this may seem like a small difference, it can add up over time, especially for active traders.Additionally, eToro’s withdrawal fee of $5 per transaction may be higher than other trading platforms, which may offer free or lower-cost withdrawals. Further Reading: Swissquote Review: Is This the Best Online Broker in 2023?

Further Reading: Swissquote Review: Is This the Best Online Broker in 2023?Mobile Trading Apps

In today’s fast-paced world, it’s essential for trading platforms to provide users with a seamless mobile experience. eToro usa securities inc has recognized this need and offers mobile trading apps that allow users to access the platform’s features and functionality on the go. In this article, we’ll explore eToro’s mobile trading apps, their features and functionality, availability, and user experience.Features of eToro’s Mobile App:

eToro’s mobile trading apps are designed to provide users with access to the platform’s key features and functionality on their mobile devices. Users can view their portfolios, track performance, and execute trades from anywhere at any time. The apps also offer social trading features that allow users to follow and copy the trades of other successful traders.The mobile apps also provide users with access to real-time market data, news, and analysis, allowing them to stay up to date on market developments and make informed trading decisions. Users can also set up price alerts and notifications to stay on top of market movements and track their investments.Compatibility with Different Devices:

eToro’s mobile trading apps are available for both iOS and Android devices and can be downloaded from the App Store and Google Play Store. The apps are compatible with most smartphones and tablets, providing users with access to eToro’s features on a range of devices.The mobile apps are regularly updated to ensure compatibility with the latest operating systems and devices, providing users with a seamless and reliable trading experience.User Experience:

eToro’s mobile trading apps have received positive feedback from users, who appreciate the convenience and ease of use offered by the apps. The apps are intuitive and user-friendly, allowing users to navigate the platform and execute trades with ease.Users have also praised the social trading features offered by the apps, which allow them to connect with other traders and learn from their strategies and insights. The ability to copy the trades of successful traders has also been a popular feature among users.While there have been occasional reports of technical issues with the apps, eToro’s customer support team is available to assist users with any issues they may encounter.eToro’s mobile trading apps provide users with a convenient and accessible way to access the platform’s features and functionality on the go. The apps offer a range of features and functionality, including social trading features, real-time market data, and analysis.The apps are available for both iOS and Android devices and are regularly updated to ensure compatibility with the latest operating systems and devices. User feedback has been positive, with users praising the ease of use and convenience offered by the apps. Explore More: Markets.com Review: Is This the Best Broker for You in 2023?

Explore More: Markets.com Review: Is This the Best Broker for You in 2023?Other Trading Platforms

eToro offers a range of trading platforms to cater to the diverse needs and preferences of its users. In addition to its mobile trading apps, eToro also provides web-based and desktop platforms that offer advanced trading features and functionality. In this article, we’ll take a closer look at eToro’s other trading platforms, their features, and their integration with social trading networks.Overview of eToro’s Web Platform:

eToro’s web-based and desktop trading platforms offer users a range of advanced trading features and functionality. The platforms provide users with access to real-time market data, news, and analysis, allowing them to stay up to date on market developments and make informed trading decisions.The platforms also offer advanced charting tools and technical indicators, allowing users to perform in-depth analysis of market trends and patterns. Users can also execute trades directly from the platforms and manage their portfolios.eToro’s web-based platform is accessible from any web browser and requires no installation. The platform is intuitive and user-friendly, allowing users to navigate the platform and access its features with ease.eToro’s desktop platform is available for Windows and Mac OS and provides users with additional features and functionality. The desktop platform offers faster execution speeds and enhanced charting capabilities, making it a popular choice among experienced traders.Third-Party Trading Platforms:

In addition to its own web-based and desktop platforms, eToro also supports third-party trading platforms such as MetaTrader 4 (MT4). MT4 is a popular trading platform used by many traders and offers advanced charting tools, technical indicators, and automated trading capabilities.eToro’s integration with MT4 allows users to access the platform’s features and functionality while also benefiting from eToro’s social trading network. Users can copy the trades of successful traders and share their own strategies with the eToro community.Integration with Social Trading Networks:

eToro’s social trading network is a key feature of the platform and allows users to connect with other traders, share insights and strategies, and learn from each other’s experiences. The platform’s web-based and desktop trading platforms are integrated with the social trading network, allowing users to access social features directly from the trading platforms.Users can view the performance of other traders and copy their trades with a few clicks. They can also share their own trades and strategies with the community, building a following and potentially earning additional income through eToro’s Popular Investor program.Discover: FP Markets Review 2023: Is This Broker Worth Your Investment?Market Research

eToro offers various tools and resources to help its users make informed trading decisions. These include market analysis and research tools, charting and technical analysis features, and news and commentary from industry experts.Tools:

eToro offers a range of tools and resources for market analysis and research, including economic calendars, earnings reports calendars, and market news. The economic calendar provides users with information on upcoming economic events and their potential impact on the markets. The earnings reports calendar helps traders keep track of earnings announcements by companies and their impact on stock prices. Market news is also available on the platform, covering both general market news and company-specific news.Charting Features:

eToro’s charting and technical analysis features are available on both its web-based and mobile platforms. The charting tools allow users to view different time frames and chart types, add technical indicators, and draw trend lines and other annotations. Technical analysis features include indicators such as moving averages, Bollinger Bands, and MACD, as well as chart patterns such as head and shoulders, triangles, and flags.News from industry experts:

eToro also provides news and commentary from industry experts, including market analysts and traders. These insights can help users stay up-to-date on the latest market trends and potential trading opportunities. Users can access these insights directly from the platform or subscribe to eToro’s newsletter for regular updates.Check out: GWtrade Review 2023: Is This Broker Worth Your Investment?Education

eToro offers a range of educational resources and materials to help users improve their trading skills and knowledge. These include trading courses, webinars, tutorials, and trading tools such as demo accounts.eToro provides a range of learning resources and materials for its users, including e-books, blogs, and articles. These materials cover a variety of topics, including trading strategies, market analysis, and risk management. Users can access these resources directly from the eToro platform or through the eToro Academy website.Trading courses, webinars, and tutorials:

eToro offers trading courses, webinars, and tutorials for users who want a more structured approach to learning. These resources cover a wide range of topics, including beginner-level courses on trading basics, as well as more advanced courses on specific trading strategies and market analysis techniques. The webinars and tutorials are presented by experienced traders and industry experts, and users can ask questions and participate in discussions.Trading tools and demo accounts:

eToro account also provides users with a range of trading tools and demo accounts to help them practice their trading skills and test out different strategies. The demo accounts allow users to trade with virtual money, simulating real-world trading conditions without risking any actual funds. This can be a useful tool for novice traders who are just starting and want to learn how to trade without the risk of losing money.

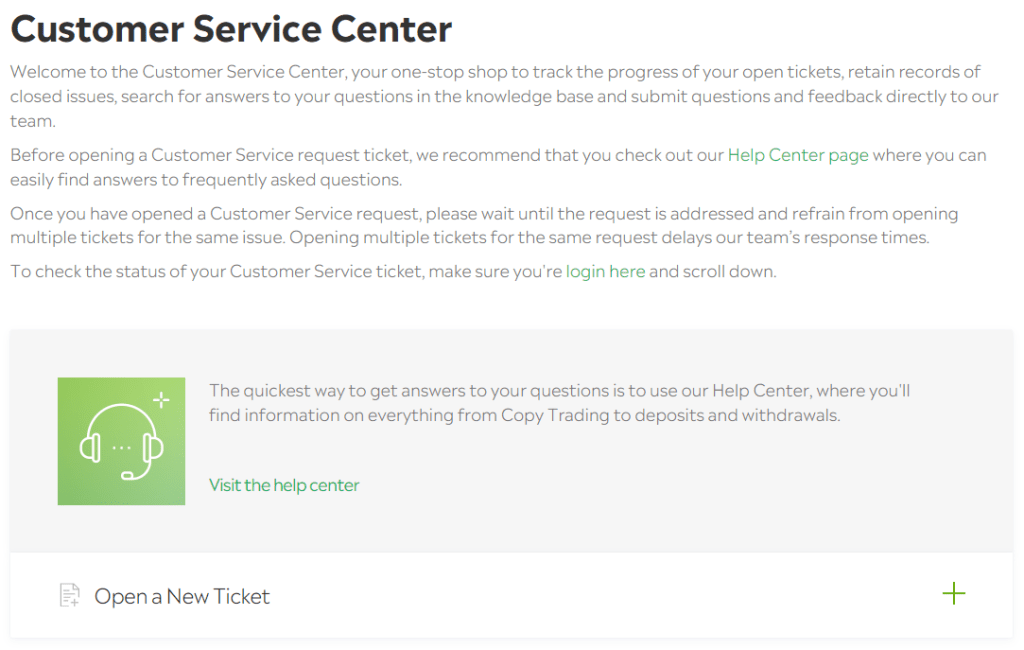

eToro account has a dedicated link for their customer support and support related articles can also be found on their website