CMC Markets is a UK-based financial trading platform that was established in 1989. It offers online trading services to customers around the world, including spread betting, contracts for difference (CFDs), and foreign exchange (Forex). The platform operates on a global scale, with offices in over 15 countries, including Australia, Singapore, and Germany. CMC Markets is regulated by the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC) in Australia.There are several reasons why CMC Markets is worth reviewing as a trading platform. Firstly, the platform offers a wide range of markets to trade, including over 10,000 instruments across multiple asset classes such as stocks, indices, commodities, and cryptocurrencies. This allows traders to diversify their portfolios and potentially increase their profits.Secondly, CMC Markets offers advanced trading tools, including charting software, technical analysis tools, and customizable trading platforms, which allow traders to create and implement their own trading strategies.Thirdly, CMC Markets has a strong reputation for customer service, with support available 24/5 via phone, email, and live chat. The platform also offers a range of educational resources, including webinars, seminars, and trading guides, to help traders improve their skills and knowledge.Related Post: Forex.com Review 2023: Ultimate Trading Platform for Beginners Product Portfolio: CMC Markets offers a broad range of financial products that cater to the diverse needs of traders and investors. The platform offers forex trading, spread betting, contracts for difference (CFDs), and stockbroking services. Additionally, CMC Markets provides access to its award-winning trading platform, Next Generation, which is designed to offer a user-friendly and customizable trading experience.

Product Portfolio: CMC Markets offers a broad range of financial products that cater to the diverse needs of traders and investors. The platform offers forex trading, spread betting, contracts for difference (CFDs), and stockbroking services. Additionally, CMC Markets provides access to its award-winning trading platform, Next Generation, which is designed to offer a user-friendly and customizable trading experience. Asset Classes: The platform provides access to a vast range of asset classes, including forex, stocks, indices, commodities, and cryptocurrencies. Clients can trade over 10,000 financial instruments across all asset classes, making CMC Markets a one-stop-shop for all their trading needs.

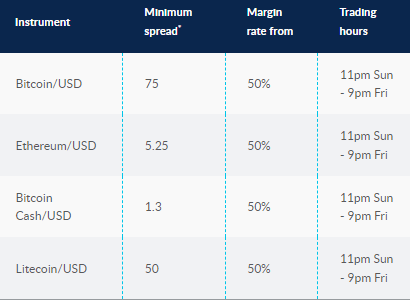

Asset Classes: The platform provides access to a vast range of asset classes, including forex, stocks, indices, commodities, and cryptocurrencies. Clients can trade over 10,000 financial instruments across all asset classes, making CMC Markets a one-stop-shop for all their trading needs. Availability of Tradable Markets: CMC Markets offers access to over 10,000 tradable markets across the globe. Clients can trade on more than 330 forex currency pairs, including majors, minors, and exotic pairs. The platform also offers access to more than 9,000 shares and ETFs, over 100 indices, and commodities such as oil, gold, and silver.

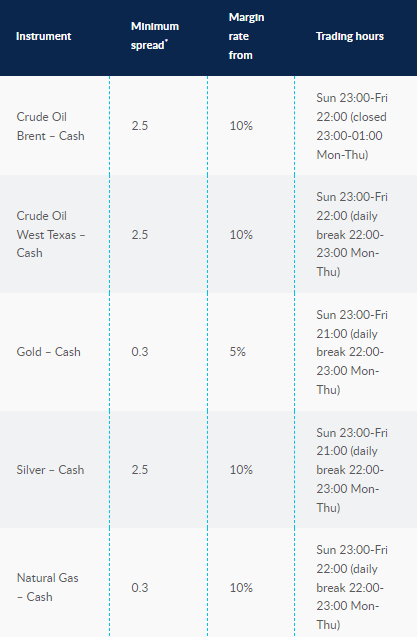

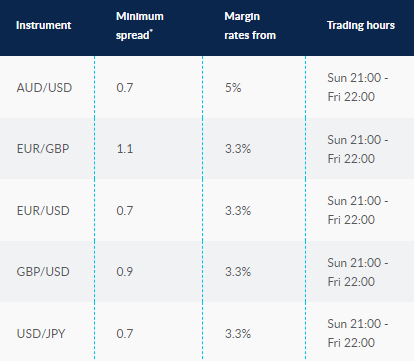

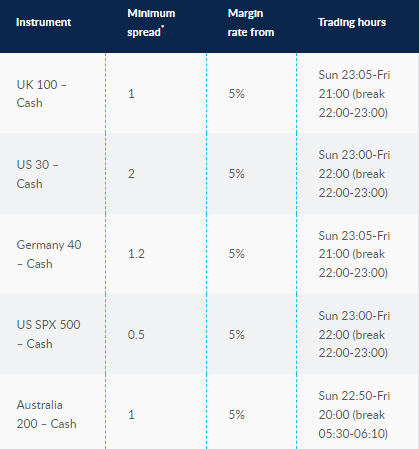

Availability of Tradable Markets: CMC Markets offers access to over 10,000 tradable markets across the globe. Clients can trade on more than 330 forex currency pairs, including majors, minors, and exotic pairs. The platform also offers access to more than 9,000 shares and ETFs, over 100 indices, and commodities such as oil, gold, and silver. Leverage and Margin Requirements: Leverage and margin requirements vary across different asset classes and markets. CMC Markets provides competitive leverage and margin rates to its clients. Forex trading offers up to 30:1 leverage, and clients can trade with a margin requirement as low as 3.3%. The margin requirements for CFDs vary depending on the asset class, with stock CFDs having a margin requirement of 5%.

Leverage and Margin Requirements: Leverage and margin requirements vary across different asset classes and markets. CMC Markets provides competitive leverage and margin rates to its clients. Forex trading offers up to 30:1 leverage, and clients can trade with a margin requirement as low as 3.3%. The margin requirements for CFDs vary depending on the asset class, with stock CFDs having a margin requirement of 5%. Further Reading: Trade Smarter with Trading 212: Pros, Cons, and Features

Further Reading: Trade Smarter with Trading 212: Pros, Cons, and Features

Pricing structure: CMC Markets uses a transparent pricing structure for its trading services, which means that clients can see exactly what they are paying for each trade. The broker offers both variable and fixed spreads, depending on the asset being traded.Commission fees: CMC Markets does not charge commission fees for trading on its platform. Instead, the broker earns its revenue from the spread, which is the difference between the buy and sell price of an asset.Non-trading fees: CMC Markets charges a small monthly inactivity fee of £10 if you don’t trade for two years or more. However, the broker does not charge any account maintenance or platform fees.Deposit and withdrawal fees: CMC Markets does not charge any deposit or withdrawal fees for transactions made via bank transfer, credit/debit card, or PayPal. However, fees may be charged by the payment provider, depending on the transaction method and location.Explore More: Libertex Review 2023: Pros & Cons, Safety, Fees, App & Education Features and functionality: The CMC Markets mobile trading apps come with a range of features and functionalities, including real-time pricing and charting tools, customizable watchlists, news and analysis, and the ability to execute trades directly from the app. Additionally, the apps offer a range of order types, such as stop-loss and limit orders, as well as the ability to set up alerts and notifications.Ease of use and navigation: The CMC Markets mobile trading apps are user-friendly and easy to navigate. The apps are designed with an intuitive interface that allows traders to quickly access the features and functionalities they need. The apps offer a range of customization options, allowing traders to personalize their trading experience and optimize their workflow.Discover: Admiral Markets Review 2023: Platform, Fees & Customer Support

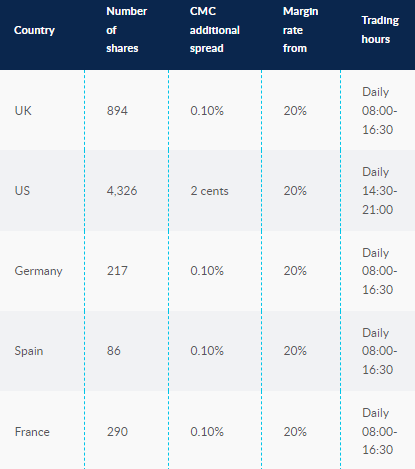

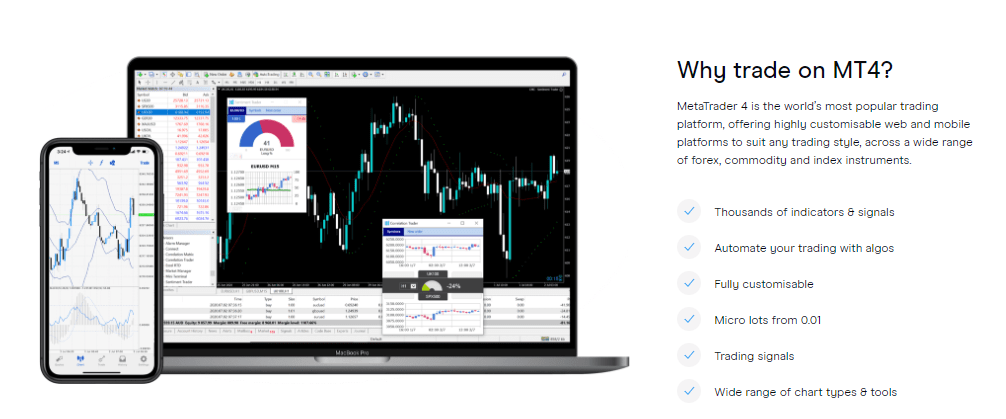

Features and functionality: The CMC Markets mobile trading apps come with a range of features and functionalities, including real-time pricing and charting tools, customizable watchlists, news and analysis, and the ability to execute trades directly from the app. Additionally, the apps offer a range of order types, such as stop-loss and limit orders, as well as the ability to set up alerts and notifications.Ease of use and navigation: The CMC Markets mobile trading apps are user-friendly and easy to navigate. The apps are designed with an intuitive interface that allows traders to quickly access the features and functionalities they need. The apps offer a range of customization options, allowing traders to personalize their trading experience and optimize their workflow.Discover: Admiral Markets Review 2023: Platform, Fees & Customer Support Compatibility: CMC Markets’ trading platform is also compatible with a range of third-party platforms, including MetaTrader 4 and 5, allowing traders to access a range of additional features and tools. This makes it easy for traders to integrate their existing trading strategies and tools into the CMC Markets platform, giving them access to even more trading opportunities.Features: The CMC Markets trading platform is known for its advanced features and tools, including a range of order types, customizable charting tools, and advanced risk management tools. The platform also offers real-time news and analysis, allowing traders to stay up-to-date with the latest market developments and make informed trading decisions. Additionally, the platform offers a range of educational resources and trading tools, making it a great choice for both new and experienced traders.Check out: IG Markets Review 2023: Platform, Trading, Commission & Support

Compatibility: CMC Markets’ trading platform is also compatible with a range of third-party platforms, including MetaTrader 4 and 5, allowing traders to access a range of additional features and tools. This makes it easy for traders to integrate their existing trading strategies and tools into the CMC Markets platform, giving them access to even more trading opportunities.Features: The CMC Markets trading platform is known for its advanced features and tools, including a range of order types, customizable charting tools, and advanced risk management tools. The platform also offers real-time news and analysis, allowing traders to stay up-to-date with the latest market developments and make informed trading decisions. Additionally, the platform offers a range of educational resources and trading tools, making it a great choice for both new and experienced traders.Check out: IG Markets Review 2023: Platform, Trading, Commission & Support Quality and Depth of Research: CMC Markets is known for providing high-quality market research that is insightful, relevant, and up-to-date. The company’s research team is composed of experienced analysts who are experts in their respective fields. Their research reports are well-researched, well-written, and offer a comprehensive analysis of the markets. They also provide regular updates to ensure traders stay up-to-date with the latest market developments.

Quality and Depth of Research: CMC Markets is known for providing high-quality market research that is insightful, relevant, and up-to-date. The company’s research team is composed of experienced analysts who are experts in their respective fields. Their research reports are well-researched, well-written, and offer a comprehensive analysis of the markets. They also provide regular updates to ensure traders stay up-to-date with the latest market developments. Tools and Resources: In addition to its research offerings, CMC Markets also provides traders with a range of tools and resources to help them make informed trading decisions. These include advanced charting tools, trading signals, and technical indicators. The company’s trading platform also features a customizable news feed that provides real-time market updates and insights.More Resources: FxPro Review 2023: Trading, Commission, Education & Pros/Cons

Tools and Resources: In addition to its research offerings, CMC Markets also provides traders with a range of tools and resources to help them make informed trading decisions. These include advanced charting tools, trading signals, and technical indicators. The company’s trading platform also features a customizable news feed that provides real-time market updates and insights.More Resources: FxPro Review 2023: Trading, Commission, Education & Pros/Cons Quality and comprehensiveness of educational materials: The quality of the educational materials provided by CMC Markets is high, with content that is informative and easy to understand. The platform provides a comprehensive range of educational resources, which ensures that traders can find resources that are relevant to their trading needs. The interactive courses are particularly useful, as they provide an in-depth understanding of the subject matter.Availability of support and guidance: CMC Markets provides excellent support and guidance to its clients through a range of channels, including email, phone, and live chat. The platform’s customer service team is knowledgeable and responsive, providing traders with prompt answers to their queries. In addition, the platform provides a range of tools and resources to help traders analyze the markets and make informed trading decisions.

Quality and comprehensiveness of educational materials: The quality of the educational materials provided by CMC Markets is high, with content that is informative and easy to understand. The platform provides a comprehensive range of educational resources, which ensures that traders can find resources that are relevant to their trading needs. The interactive courses are particularly useful, as they provide an in-depth understanding of the subject matter.Availability of support and guidance: CMC Markets provides excellent support and guidance to its clients through a range of channels, including email, phone, and live chat. The platform’s customer service team is knowledgeable and responsive, providing traders with prompt answers to their queries. In addition, the platform provides a range of tools and resources to help traders analyze the markets and make informed trading decisions.

CMC Markets Pros & Cons

CMC Markets is a global financial services provider with over 30 years of experience in the industry. It offers an online trading platform that allows traders to access a range of financial instruments, including shares, forex, commodities, and indices. While there are several advantages of trading with CMC Markets, there are also some drawbacks that traders need to be aware of.Pros

- Regulated broker: CMC Markets is regulated by several reputable regulatory bodies, including the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC), which ensures that the broker adheres to strict standards of financial stability and customer protection.

- Wide range of trading instruments: CMC Markets offers access to a wide range of financial instruments, including over 9,000 shares, 330 forex pairs, 90 indices, and 110 commodities.

- User-friendly trading platform: CMC Markets’ Next Generation trading platform is easy to use and offers advanced trading tools such as pattern recognition and technical analysis.

- Competitive pricing: CMC Markets offers competitive pricing, including low spreads, and commissions, making it attractive to traders who want to minimize their trading costs.

Cons

- Limited research tools: While CMC Markets offers some research tools, such as a news feed and economic calendar, it does not offer in-depth research reports or analysis.

- Limited customer support: Customer support is available 24/5 via phone, email, and live chat. However, there have been some reports of slow response times and unhelpful customer service representatives.

- Limited education resources: While CMC Markets offers some educational resources, such as webinars and video tutorials, the resources are limited compared to other brokers.

- Limited payment options: CMC Markets offers limited payment options, with only bank transfer, credit/debit cards, and PayPal available. Some traders may find this limiting.

In conclusion, CMC Markets is a reputable broker with a wide range of financial instruments and a user-friendly trading platform. However, it has some limitations in terms of research tools, customer support, education resources, and payment options, which traders need to consider before opening an account.

Is CMC Markets Safe?

CMC Markets is a well-established online trading platform that offers clients access to a wide range of financial products such as CFDs, forex, and spread betting. With a history dating back to 1989, CMC Markets has built a strong reputation as a trusted and reliable broker. But is CMC Markets safe to use?Regulatory Oversight: One of the key factors that contribute to CMC Markets’ safety is its strict regulatory oversight. The platform is regulated by several reputable financial authorities such as the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Monetary Authority of Singapore (MAS). These regulatory bodies ensure that CMC Markets adheres to strict standards of financial conduct, client protection, and risk management.Security Measures: CMC Markets takes security seriously and has implemented several measures to ensure the safety of its clients’ data and funds. The platform uses advanced encryption technologies to protect client information, while funds are kept in segregated accounts to prevent them from being used for any other purpose than trading.Client Fund Protection: Another important aspect of CMC Markets’ safety is its client fund protection policy. The platform is a member of the Financial Services Compensation Scheme (FSCS) in the UK, which provides up to £85,000 of compensation per client in the event that CMC Markets becomes insolvent. In addition, CMC Markets has insurance coverage that provides additional protection for client funds.You May Also Like: Saxo Bank Review 2023: Best Broker for Your Trading Needs?Offering of Investments

CMC Markets is a globally renowned online trading and investment platform that offers a wide range of investment products to its clients. The platform has an extensive product portfolio that includes forex, stocks, indices, commodities, and cryptocurrencies. The following is an overview of CMC Markets’ offerings of investments and how they can be traded.

Commodities

Crypto

Forex

Indices

Shares

Commissions & Fees

CMC Markets is a popular online broker that offers its clients a wide range of trading services, including Forex, CFDs, spread betting, and more. As with any broker, it’s important to understand the fees and charges that come with trading on the platform. In this article, we will review CMC Markets commissions and fees.Country/market | Commission charge | Charge currency | Minimum commission charge |

|---|---|---|---|

UK | 0.10% | GBP | GBP 9.00 |

US | 2 cents per unit | USD | USD 10.00 |

Australia | 0.10% | AUD | AUD 7.00 |

Austria | 0.10% | EUR | EUR 9.00 |

Belgium | 0.10% | EUR | EUR 9.00 |

Canada | 2 cents | CAD | CAD 10.00 |

Denmark | 0.10% | DKK | DKK 90.00 |

Finland | 0.10% | EUR | EUR 9.00 |

France | 0.10% | EUR | EUR 9.00 |

Germany | 0.10% | EUR | EUR 9.00 |

Hong Kong | 0.18% | HKD | HKD 50.00 |

Ireland | 0.10% | EUR | EUR 9.00 |

Italy | 0.10% | EUR | EUR 9.00 |

Japan | 0.10% | JPY | JPY 1,000 |

Netherlands | 0.10% | EUR | EUR 9.00 |

New Zealand | 0.10% | NZD | NZD 7.00 |

Norway | 0.10% | NOK | NOK 79.00 |

Poland | 0.18% | PLN | PLN 50.00 |

Portugal | 0.10% | EUR | EUR 9.00 |

Singapore (SGD) | 0.10% | SGD | SGD 10.00 |

Singapore (USD) | 0.10% | USD | USD 10.00 |

Spain | 0.10% | EUR | EUR 9.00 |

Sweden | 0.10% | SEK | SEK 89.00 |

Switzerland | 0.10% | CHF | CHF 9.00 |

Mobile Trading Apps

CMC Markets is a well-known online trading platform that offers mobile apps for its users. These mobile apps provide traders with the flexibility to monitor and manage their trades while on the go. The CMC Markets mobile trading apps are available for both iOS and Android devices and can be downloaded from the App Store or Google Play.Overview of mobile apps: The CMC Markets mobile trading apps are designed to offer traders a comprehensive trading experience. The apps provide access to a wide range of markets, including forex, indices, shares, and commodities. The apps are available in multiple languages, including English, German, Spanish, French, and Italian. Features and functionality: The CMC Markets mobile trading apps come with a range of features and functionalities, including real-time pricing and charting tools, customizable watchlists, news and analysis, and the ability to execute trades directly from the app. Additionally, the apps offer a range of order types, such as stop-loss and limit orders, as well as the ability to set up alerts and notifications.Ease of use and navigation: The CMC Markets mobile trading apps are user-friendly and easy to navigate. The apps are designed with an intuitive interface that allows traders to quickly access the features and functionalities they need. The apps offer a range of customization options, allowing traders to personalize their trading experience and optimize their workflow.Discover: Admiral Markets Review 2023: Platform, Fees & Customer Support

Features and functionality: The CMC Markets mobile trading apps come with a range of features and functionalities, including real-time pricing and charting tools, customizable watchlists, news and analysis, and the ability to execute trades directly from the app. Additionally, the apps offer a range of order types, such as stop-loss and limit orders, as well as the ability to set up alerts and notifications.Ease of use and navigation: The CMC Markets mobile trading apps are user-friendly and easy to navigate. The apps are designed with an intuitive interface that allows traders to quickly access the features and functionalities they need. The apps offer a range of customization options, allowing traders to personalize their trading experience and optimize their workflow.Discover: Admiral Markets Review 2023: Platform, Fees & Customer SupportOther Trading Platforms

CMC Markets is a leading provider of online trading services, offering access to a wide range of financial instruments across multiple asset classes. In addition to its award-winning mobile app and web-based platform, CMC Markets also offers a proprietary trading platform for advanced traders.Next Generation Trading Platform: CMC Markets’ proprietary trading platform, known as Next Generation, is a powerful and intuitive platform that offers a range of advanced features and tools. It is designed for active traders and provides access to over 10,000 financial instruments across multiple asset classes, including forex, stocks, indices, and commodities. The platform offers a range of charting and technical analysis tools, customizable layouts, and advanced order types, allowing traders to implement complex trading strategies with ease. Compatibility: CMC Markets’ trading platform is also compatible with a range of third-party platforms, including MetaTrader 4 and 5, allowing traders to access a range of additional features and tools. This makes it easy for traders to integrate their existing trading strategies and tools into the CMC Markets platform, giving them access to even more trading opportunities.Features: The CMC Markets trading platform is known for its advanced features and tools, including a range of order types, customizable charting tools, and advanced risk management tools. The platform also offers real-time news and analysis, allowing traders to stay up-to-date with the latest market developments and make informed trading decisions. Additionally, the platform offers a range of educational resources and trading tools, making it a great choice for both new and experienced traders.Check out: IG Markets Review 2023: Platform, Trading, Commission & Support

Compatibility: CMC Markets’ trading platform is also compatible with a range of third-party platforms, including MetaTrader 4 and 5, allowing traders to access a range of additional features and tools. This makes it easy for traders to integrate their existing trading strategies and tools into the CMC Markets platform, giving them access to even more trading opportunities.Features: The CMC Markets trading platform is known for its advanced features and tools, including a range of order types, customizable charting tools, and advanced risk management tools. The platform also offers real-time news and analysis, allowing traders to stay up-to-date with the latest market developments and make informed trading decisions. Additionally, the platform offers a range of educational resources and trading tools, making it a great choice for both new and experienced traders.Check out: IG Markets Review 2023: Platform, Trading, Commission & SupportMarket Research

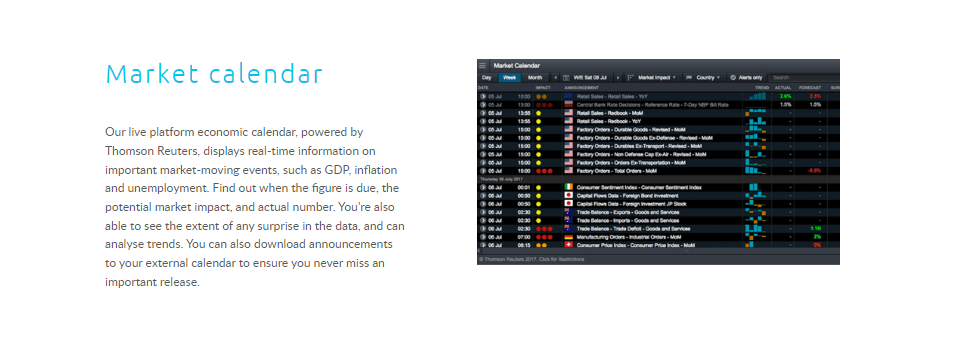

CMC Markets is a well-known financial services provider that offers a range of trading products and services to retail and institutional clients. Among its offerings, CMC Markets is also known for its market research capabilities that are designed to help traders make more informed decisions. Let’s take a closer look at CMC Markets’ market research offerings, quality and depth of research, and tools and resources.Research Offerings: CMC Markets provides a broad range of research services across various asset classes, including equities, commodities, forex, and indices. These research offerings include daily and weekly market analysis reports, economic calendars, trading ideas, and technical analysis. The company also provides access to expert insights from in-house analysts, including live webinars and interactive trading forums. Quality and Depth of Research: CMC Markets is known for providing high-quality market research that is insightful, relevant, and up-to-date. The company’s research team is composed of experienced analysts who are experts in their respective fields. Their research reports are well-researched, well-written, and offer a comprehensive analysis of the markets. They also provide regular updates to ensure traders stay up-to-date with the latest market developments.

Quality and Depth of Research: CMC Markets is known for providing high-quality market research that is insightful, relevant, and up-to-date. The company’s research team is composed of experienced analysts who are experts in their respective fields. Their research reports are well-researched, well-written, and offer a comprehensive analysis of the markets. They also provide regular updates to ensure traders stay up-to-date with the latest market developments. Tools and Resources: In addition to its research offerings, CMC Markets also provides traders with a range of tools and resources to help them make informed trading decisions. These include advanced charting tools, trading signals, and technical indicators. The company’s trading platform also features a customizable news feed that provides real-time market updates and insights.More Resources: FxPro Review 2023: Trading, Commission, Education & Pros/Cons

Tools and Resources: In addition to its research offerings, CMC Markets also provides traders with a range of tools and resources to help them make informed trading decisions. These include advanced charting tools, trading signals, and technical indicators. The company’s trading platform also features a customizable news feed that provides real-time market updates and insights.More Resources: FxPro Review 2023: Trading, Commission, Education & Pros/ConsEducation

CMC Markets is a leading provider of online financial trading and investment services globally. The platform provides educational resources to its clients to help them make informed trading decisions. CMC Markets offers a range of educational materials, including webinars, articles, videos, and interactive courses.Educational offerings: The educational offerings at CMC Markets are designed to cater to traders of all levels, from beginners to advanced traders. The educational resources cover a range of topics, including trading strategies, technical analysis, risk management, and market fundamentals. Quality and comprehensiveness of educational materials: The quality of the educational materials provided by CMC Markets is high, with content that is informative and easy to understand. The platform provides a comprehensive range of educational resources, which ensures that traders can find resources that are relevant to their trading needs. The interactive courses are particularly useful, as they provide an in-depth understanding of the subject matter.Availability of support and guidance: CMC Markets provides excellent support and guidance to its clients through a range of channels, including email, phone, and live chat. The platform’s customer service team is knowledgeable and responsive, providing traders with prompt answers to their queries. In addition, the platform provides a range of tools and resources to help traders analyze the markets and make informed trading decisions.

Quality and comprehensiveness of educational materials: The quality of the educational materials provided by CMC Markets is high, with content that is informative and easy to understand. The platform provides a comprehensive range of educational resources, which ensures that traders can find resources that are relevant to their trading needs. The interactive courses are particularly useful, as they provide an in-depth understanding of the subject matter.Availability of support and guidance: CMC Markets provides excellent support and guidance to its clients through a range of channels, including email, phone, and live chat. The platform’s customer service team is knowledgeable and responsive, providing traders with prompt answers to their queries. In addition, the platform provides a range of tools and resources to help traders analyze the markets and make informed trading decisions.