Investing in the foreign exchange market isn’t an easy task, especially for those who are just starting out. But with the right broker, you can make the most of your money and succeed in Forex trading. Alpari is one of the leading Forex brokers in the market and their service has been praised by many traders. In this review, we’ll take a look at Alpari and how it stacks up against other popular Forex brokers.

Alpari has become one of the most trusted names in Forex trading since its launch 20 years ago. Based in Russia, this broker offers a wide range of services to individuals and institutions alike. Whether you’re a beginner trader or a seasoned professional, Alpari has something to offer everyone. From low spreads to excellent customer support, Alpari will ensure that you get the best experience when trading with them.

Alpari also provides traders with access to multiple platforms such as MT4, MT5, cTrader and more. This means that you can trade on any platform that suits your needs best. With its competitive pricing structure, Alpari offers some of the lowest spreads in the industry which makes it even more attractive to traders looking for good value-for-money deals. Let’s take a closer look at what else Alpari has to offer in this comprehensive review!

Overview

Alpari is a popular Forex broker that has been operating since 1998. The company has offices in more than 20 countries, and services clients worldwide. It offers a wide range of trading products, including currency pairs, indices, stocks, commodities and cryptocurrencies. Alpari provides both MetaTrader4 (MT4) and MetaTrader5 (MT5) platforms for online trading. It also offers a free demo account with virtual money to help traders practice their strategies without risking real money.

The customer service provided by Alpari is excellent. They have knowledgeable staff who are available 24/7 via email, live chat or phone. Withdrawals and deposits can be made quickly and securely through several payment methods, such as credit cards, e-wallets and bank transfers. The website is well designed and easy to navigate, making it user friendly for all levels of traders. Additionally, the leverage offered by Alpari is high at 1:1000 which allows traders to maximize their profits on trades.

Alpari is a great option for experienced traders looking for an established broker with competitive spreads and fees. Beginner traders will also benefit from its extensive educational resources as well as its demo account feature which allows them to practice trading without risk before committing real funds. All in all, Alpari is an excellent choice when it comes to Forex trading in 2023.

Related Post: IG Review 2023 | Is IG a Top Broker for Investment Needs?

Pros & Cons

Alpari is an online forex and CFD broker that provides trading services to clients worldwide. Here are five pros and cons of using Alpari:

Pros

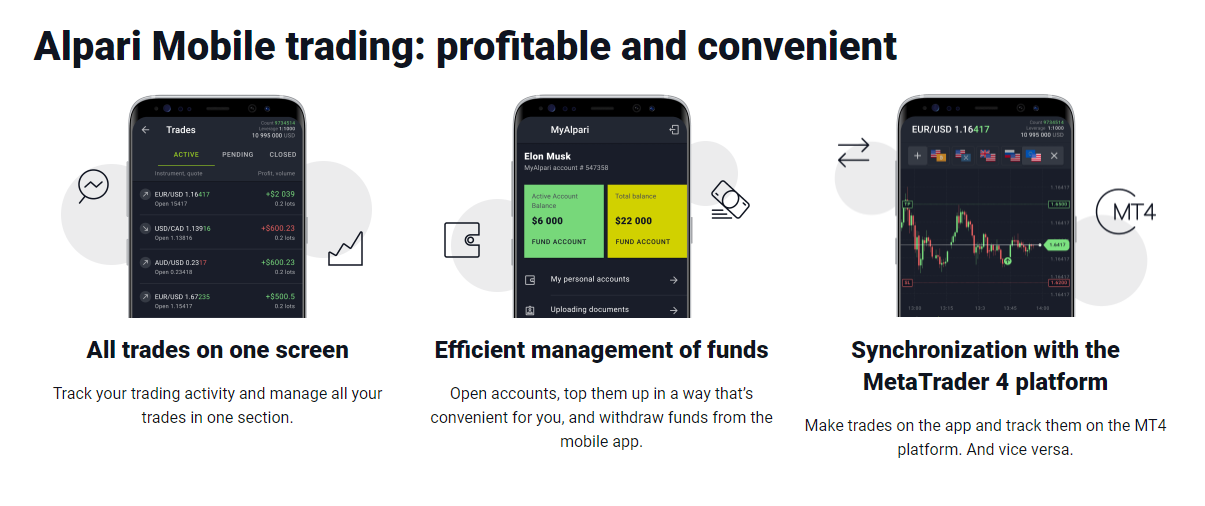

- Multiple trading platforms: Alpari offers multiple trading platforms, including MetaTrader 4, MetaTrader 5, and Alpari Mobile. Each platform has its unique features, enabling traders to choose the one that best suits their trading needs.

- Educational resources: Alpari offers comprehensive educational resources, including video tutorials, webinars, and trading guides. This can be beneficial for traders who are just starting and need to learn more about trading.

- Regulated broker: Alpari is regulated by multiple financial regulators, including the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). This ensures that the broker adheres to strict financial and regulatory requirements, providing traders with a high level of security.

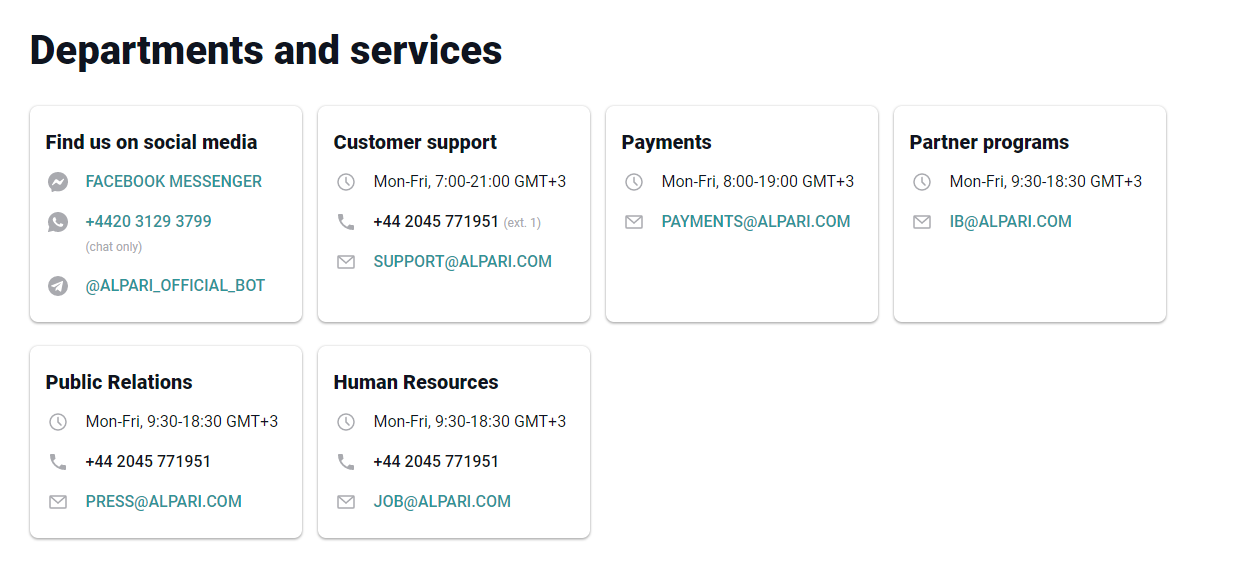

- Good customer support: Alpari offers good customer support, with 24/5 live chat, email, and phone support. Their customer support team is knowledgeable and responsive, providing traders with timely and effective assistance.

- Multiple account types: Alpari offers multiple account types, including standard, pro, and demo accounts. This allows traders to choose the account type that best suits their trading needs.

Cons

- Limited product offerings: Alpari offers a limited range of trading instruments, which may not be sufficient for traders who want to trade a diverse range of assets.

- High trading fees: Alpari charges high trading fees, including spreads and commissions, which can increase the cost of trading.

- Limited payment options: Alpari offers limited payment options, which may not be convenient for traders who prefer to use alternative payment methods.

- No negative balance protection: Alpari does not offer negative balance protection, which means that traders can lose more money than their account balance.

- Limited research tools: Alpari’s research tools are limited, with only a few research reports and market analysis available on their website. This may not be sufficient for traders who require comprehensive research materials to make informed trading decisions.

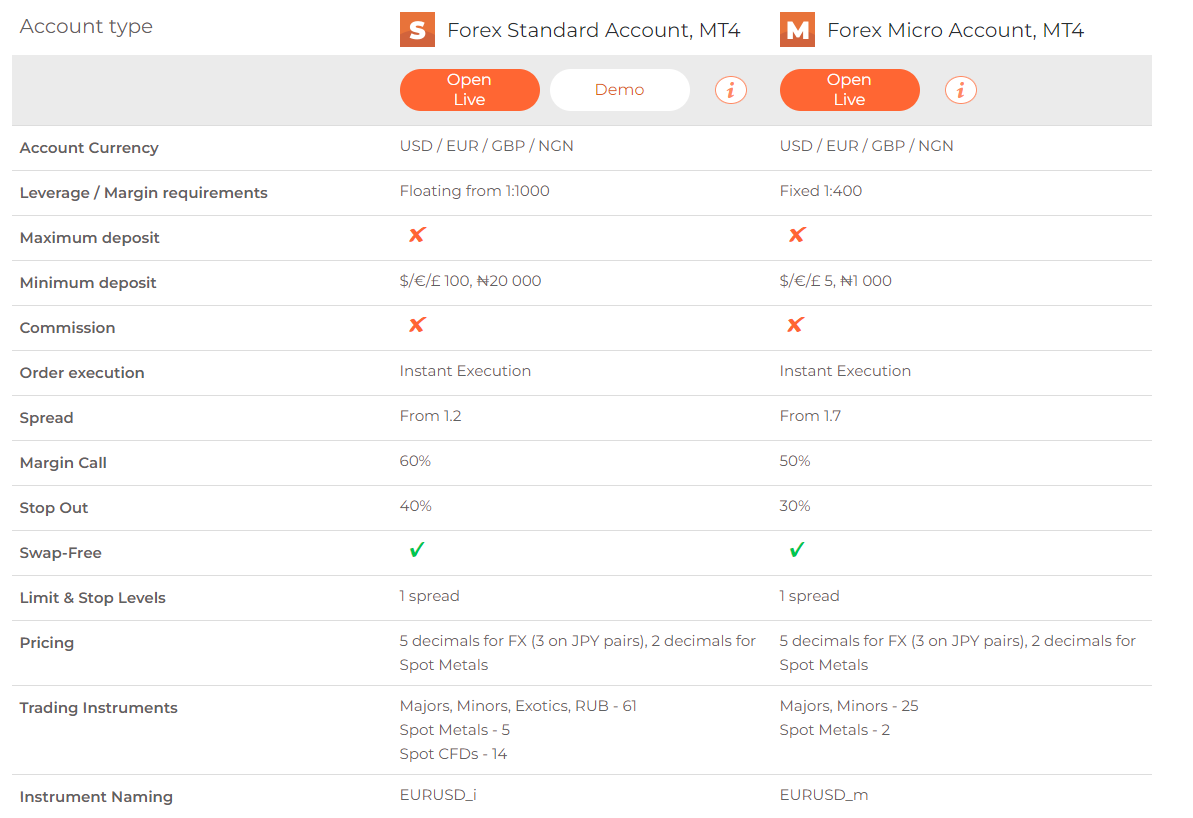

Account Types

Moving on, Alpari offers a variety of different account types to match the needs of its traders. Depending on the level of trading experience, traders can choose between a standard, mini or micro account. All accounts offer competitive spreads and leverage up to 1:1000.

Here are some features that set Alpari apart:

- Low minimum deposits starting from $100

- Access to industry-leading technology for efficient trading

- Tools such as Autochartist and Smart Trader Tools available for all accounts

- Expert advisors with access to high quality technical analysis tools

Alpari also provides an Islamic Account with no swap fees for those who abide by Sharia law. Furthermore, the broker also offers a VIP account for those looking for premium services and additional benefits like free VPS hosting and higher leverage. This is ideal for experienced and professional traders looking to expand their trading opportunities.

You May Also Like: HFM Review 2023: Honest and In-Depth Analysis of HF Markets

Trading Platforms

At Alpari, traders can access the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms. MT4 is a downloadable platform, while MT5 can be accessed through the web or mobile app. Both offer features such as charting tools, technical analysis indicators, automated trading and more.

Both platforms provide a comprehensive range of order types and execution modes to suit all kinds of trading strategies. The MT4 platform also offers advanced risk management functions including trailing stops and one-click trading. Meanwhile, the MT5 platform allows traders to test out their strategies with its Strategy Tester tool.

Alpari’s platforms are suitable for both beginners and experienced traders alike. The intuitive design makes navigation easy and there are plenty of educational resources available to help traders make informed decisions. All in all, Alpari’s platforms offer an excellent user experience for traders of all levels of experience.

Further Reading: FXCC Review 2023 | Is FXCC a Safe Broker?

Financial Instruments

Moving on to financial instruments, Alpari provides a wide range of assets for traders. From stocks and commodities to cryptocurrencies, Alpari offers an array of options to choose from when trading. Here is a breakdown of the different types of financial instruments offered by Alpari:

- Currencies: Forex pairs, crypto-currency pairs, and CFDs are available for trading on the MetaTrader 5 platform.

- Commodities: Precious metals like gold and silver as well as energies like crude oil can be traded with Alpari.

- Stocks: A variety of stocks from companies around the world can be traded with Alpari, such as Apple Inc., Microsoft Corporation, and Facebook Inc.

- Indices: Major indices like S&P 500 and NASDAQ Composite can also be traded with Alpari’s MetaTrader 5 platform.

Alpari also offers access to various other markets such as bonds and ETFs (Exchange Traded Funds). All these markets are accessible through the same account that clients use for forex trading, making it easy for traders to diversify their portfolios across multiple asset classes. The broker also provides dedicated support in case there are any difficulties navigating these new markets or understanding their nuances. In addition, there are educational resources such as webinars and online courses available to help traders learn more about the different financial instruments available at Alpari.

Overall, Alpari provides a broad selection of financial instruments that can satisfy the needs of both experienced traders and those who are just getting into investing or trading. With its diverse range of products and features available, it is no wonder why this broker has become one of the most popular choices among investors today!

Explore More: easyMarkets Review 2023: Can You Trust This Forex Broker?

Leverage And Margin Requirements

Alpari offers high levels of leverage, allowing traders to open positions with a relatively small capital outlay. The maximum leverage ratio is 1:1000, though traders should note that higher levels of leverage can work against them if the market moves against their position. Margin requirements for Forex trading are low, which means traders can open larger positions with a smaller investment than other types of financial instruments.

The broker also provides an array of tools and resources to help manage risk and control losses. These include guaranteed stop-loss orders, which allow traders to set a predetermined exit point for each trade, as well as negative balance protection, which ensures that a trader’s account cannot move into negative territory due to sudden market movements.

Overall, Alpari provides its clients with a variety of options when it comes to managing risk and leveraging their capital. With competitive margin requirements and access to advanced trading tools, Alpari is an ideal choice for those looking to invest in the Forex markets.

Discover: HYCM Review 2023: Pros, Cons, Fees, Accounts & Features

Fees And Spreads

Alpari offers competitive fees and spreads for clients trading forex. The broker provides ultra-tight fixed spreads, which can go as low as 0 pips on certain pairs, though the exact amount depends on the account type chosen by the trader. Alpari also offers low commissions on some of its accounts, starting from 0.03%. These fees are among the lowest in the industry and make Alpari a great option for traders looking to trade with a minimal cost.

| Account | Standard | Micro | ECN | Pro |

| Min. Deposit | $100 USD | $5 USD | $500 USD | $25 000 USD |

In terms of leverage, Alpari provides up to 1:1000 leverage on selected assets, while other brokers may offer higher levels of leverage. However, this is a great level for traders who want to take advantage of highly leveraged trades without risking too much capital. Additionally, Alpari allows scalping and hedging strategies and doesn’t impose any restrictions on trading strategies or instruments.

Overall, Alpari is a good choice for traders looking for competitive fees and tight spreads. The broker offers low commissions and high leverage that allow traders to maximize their profits with minimal risk. Traders can also benefit from unrestricted trading strategies and instruments.

Check out: FxOpen Review 2023: Reliable Forex Trading Platform or a Scam?

Payment Methods

Alpari offers a wide variety of payment methods for traders to deposit and withdraw funds. These options include:

- Bank Wire Transfer

- Credit/Debit Cards

- Skrill

- Neteller

- FasaPay

Bank Wire Transfer is the primary method of depositing and withdrawing funds with Alpari, as it is one of the most secure payment methods. It is also the fastest way to move money into or out of an account. Funds are credited almost immediately, once they are sent from the client’s bank account. There may be fees associated with this type of transaction depending on the amount being transferred.

Credit/Debit Card payments are another option for clients to transfer funds quickly and securely into their accounts. Traders can easily make payments using either Visa or Mastercard, although fees will vary depending on processing times and amounts being transferred. Funds usually appear in their accounts within 1-3 business days.

Skrill, Neteller, and FasaPay offer fast and easy transfers directly through the broker’s website. All three payment processors charge fees for transactions although these tend to be lower than other methods such as Bank Wire Transfer. Additionally, there may be additional charges depending on how much is being transferred as well as processing times. Most deposits should reach traders’ accounts within 24 hours after initiating a transaction through any of these e-wallet services.

In summary, Alpari has several payment options available for its clients – each comes with its own advantages and disadvantages. While Bank Wire Transfers offer quick access to funds but come with higher fees, Credit/Debit Card payments provide fast processing times without charging large transfer fees; however, deposits may not appear in accounts until a few business days later. Skrill, Neteller, and FasaPay are great alternatives for those who need faster access to their funds while still keeping costs low; however, these services may also have additional charges that depend on how much is being transferred along with processing times.

More Resources: ATFX Review 2023: Is This Forex Broker a Good Fit for You?

Customer Service

Alpari offers customer service of the highest quality. Their website is user friendly and highly interactive, allowing customers to ask questions and get answers quickly. There’s also a live chat feature available for those who need help right away, as well as a 24/7 customer support line. Additionally, they offer tutorials and webinars to help new traders learn the ins and outs of trading with Alpari.

Overall, Alpari makes it easy for customers to get support whenever they need it. Their team of knowledgeable professionals are always available to answer any questions or concerns that may arise. They also have an extensive FAQ section where customers can quickly find answers to common queries.

Alpari’s customer service is top notch and is sure to leave customers feeling satisfied with their choice of broker.

Related Post: XTrade Review 2023: In-Depth Look at Its Features & Performance

Security & Regulation

When it comes to security and regulation, Alpari is a reliable and trustworthy broker. They are regulated by the Financial Conduct Authority (FCA) in the UK and have been in operation since 1998. This means that Alpari is held to the highest standards of financial conduct, ensuring that their customers’ funds are safe and secure.

Here are 4 key points about Alpari’s security & regulation:

- Alpari is regulated by the FCA in the UK

- All customer funds must be held securely in segregated accounts

- The broker implements strict KYC (Know Your Client) procedures for all clients

- The company has an excellent track record of over 20 years in the industry

Alpari offers additional security measures such as two-factor authentication (2FA) for added protection of your account information when trading online. They also provide negative balance protection which ensures that you will never lose more than your deposit amount due to market fluctuations. All these measures make Alpari one of the most secure brokers available today, offering unparalleled safety for its customers’ funds.

You May Also Like: BlackBull Markets Review 2023: Honest Feedback from Traders

Conclusion

In conclusion, Alpari is a great Forex broker for those looking to get into trading. They offer a wide range of account types and trading platforms, so there’s something for everyone. Their financial instruments are diverse, and the leverage and margin requirements are reasonable. Payment methods are secure and customer service is excellent. Plus, they’re regulated by some of the most well-known organizations in the industry, so security is guaranteed.

Overall, I think Alpari is an excellent choice for traders at all levels. It’s user friendly, reliable, and offers plenty of support. Plus, their fees are competitive compared to other brokers out there. So if you’re looking to get into Forex trading or just want to switch up your current broker, I highly recommend giving Alpari a look!

All in all, with its reliable services and competitive pricing structure, Alpari makes it easy for anyone to get started with Forex trading. With this 2023 review in mind, I’m sure you’ll be able to make an informed decision about whether or not this broker is right for you.

Further Reading: TMGM Review 2023: Is This Platform Suitable for Your Investment?